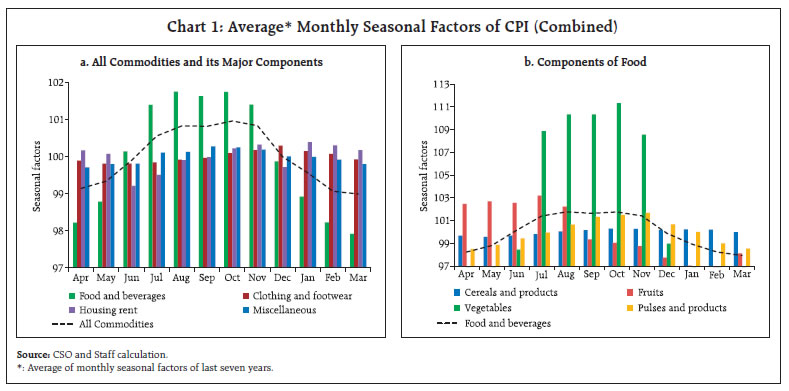

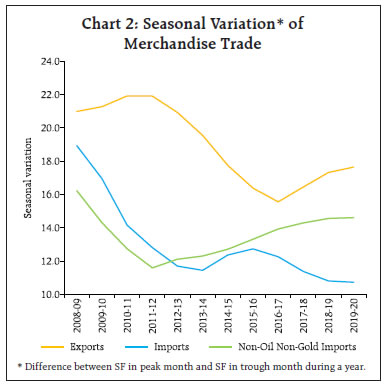

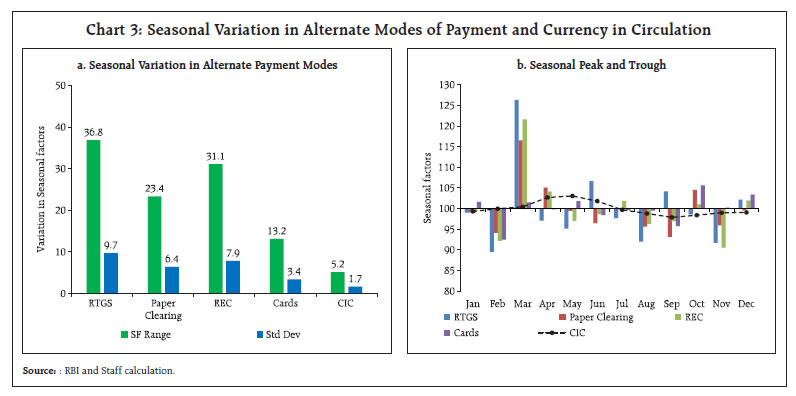

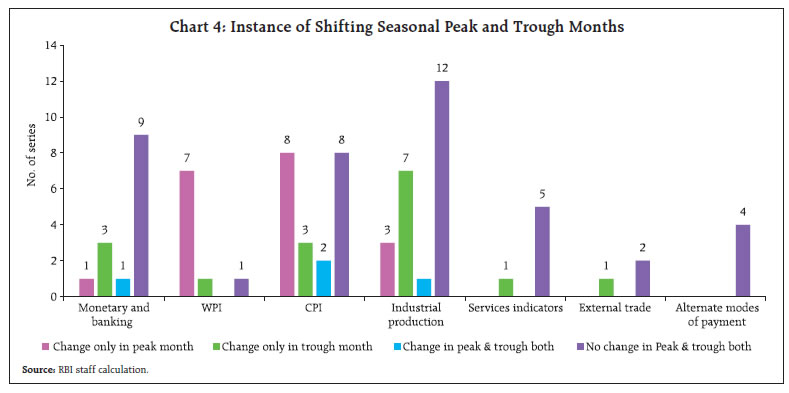

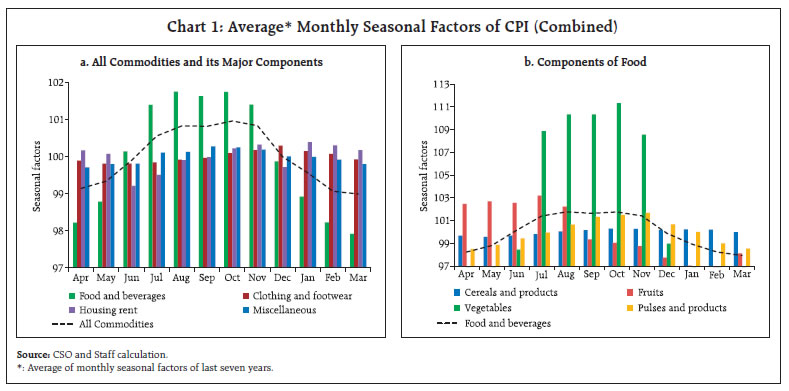

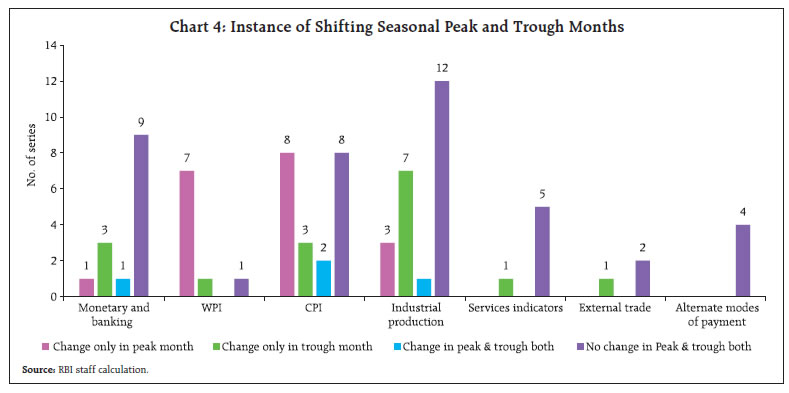

The article presents the seasonal factors of 80 selected economic/financial time series comprising monetary, banking, price statistics, production data, service sector indicators, merchandise trade and alternate modes of payment. This article finds that most of the production-related variables seasonally peak around March and price-related variables record a seasonal trough around the same time. The seasonal variations in the prices of food products and primary articles have become accentuated over the last decade. As regards payment modes, instruments related to bulk transactions tend to peak during March, whereas, in the case of retail payment, seasonality peaks during festivals. Introduction Seasonal variations recurring weekly, monthly or quarterly constitute a behavioural component in economic series and therefore can be predictable. It is intertwined with other time series components, viz., trend, cyclical variations and random fluctuations. The presence of seasonality tends to obscure the true underlying characteristics of the economic variable and its data generating process as well as the inter-relationships between variables. At the same time, correctly understanding seasonal variations helps to accurately foresee behavioural changes. In this context, identification and segregation of seasonal factors of an economic variable is a first step to appropriately use the information for the purposes of modelling and forecasting. Measuring seasonality and undertaking seasonal adjustments has been established as the best practice while modeling time series data. The cross country experience reveals that the USA measures GDP growth in terms of quarter-on-quarter annualised rates of change after adjusting for seasonality. The Inflation Report of the Bank of England generally uses seasonally adjusted data. The Quarterly Financial Report of Bank of Canada publishes assessment of seasonal demand for bank notes. The International Monetary Fund (2016) has advised member countries to report seasonally adjusted broad money data in their ‘Standardised Report Form for Money Aggregates’ in its International Financial and Monetary Statistics. The Reserve Bank has been publishing monthly seasonal factors for important macroeconomic variables since 1980. This article carries forward this endeavor by computing and updating seasonal factors upto 2019-20. The rest of the article is organised as follows. A review of the literature relating to evolution of methodology and global usage of seasonal factors is presented in Section II. The economic variables selected for study and choice of technique for extracting seasonal factors are explained in Section III. Section IV brings out the seasonality patters for various groups of macroeconomic variables based on average monthly seasonal factors in light of data upto 2017-18. Section V presents the results on temporal shifts in seasonality patterns followed by empirical evaluation of seasonal variation. Section VI concludes the article with some policy perspective. II. Review of the Literature In literature, time series are assumed to be composed of orthogonal components, viz., trend, seasonal, cyclical and irregular components. In an additive model, the time series is represented as the sum of the four components mentioned above, whereas in a multiplicative model the time series is the product of the components. Seasonality is the yearly or monthly predictable variation of the time series over and above trend and cycle. Seasonality plays a key role in short-term analysis of macro-economic factors and aids in effective decision-making. The literature refers to unmasking relevant short and long-term movements of economic time series by accounting for the behavioural nature of seasonality (Manna, et al., 2003; HCSO, 2017). Estimates of seasonal factors are observed to have improved the trend-based forecasts of economic variables (Lembke, 2015). Seasonal adjustment has been employed along with various smoothening and filtering techniques to extract the persistent component in economic variables, notably core inflation (Samanta, et al., 2000). The use of non-parametric singular spectrum analysis for extraction of seasonality has been discussed in the context of Global Positioning System (GPS) signal extraction (Chen, et al, 2013) and other related fields. The literature on estimation of seasonal factors has a long history, starting from ratio-to-moving-average method (Macaulay, 1931), further refined as Census Methods by the US Census Bureau in 1954-55. Extensive research on the explicit functional specification of seasonal and trend/cycle components led to development of various versions of seasonal adjustment methods. The X-11 method (US Census Bureau, 1965) provided functional flexibility such as multiplicative as well as additive representation of components, treatment for extreme values and various tests for seasonality (Shiskin, et al., 1967). A major limitation of X-11 method, which is based on moving average or linear smoothing filter, however, was the lack of reliability of estimates for the most recent year because of inability to apply symmetric weights to end points as against central observations. This led to frequent revisions of estimates of most recent observations as more data points get added (Dagum, 1980). Statistics Canada’s X-11-ARIMA method incorporated an Autoregressive Integrated Moving Average (ARIMA) model into the X-11 method to extrapolate original time series data for one year at both ends of the series. This helped to deal with the ‘end points’ problem and to obtain robust estimates of seasonal factors in a scenario when seasonality is moving rapidly in a stochastic way. The US Census Bureau developed X-12-ARIMA as an enhanced version of X-11 and added a feature called RegARIMA, which has an option of built-in or user-defined regressors that enable estimation of stock trading day and holiday effects as well as disruptions in the series such as sudden changes in levels (US Census Bureau, 2011). US Census Bureau’s latest X-13 ARIMA-SEATS (Signal Extraction in ARIMA Time Series) is an enhanced version of the X-11 variant with two additional options, viz., TRAMO (Time series Regression with ARIMA Noise, Missing Values and Outliers) for automatic model selection and Seasonal Extraction in ARIMA Time Series (SEATS) for conducting the seasonal adjustment procedure (Gomez, et al., 1996; 2001a; 2001b; US Census Bureau, 2011). III. Data and Methodology In line with the best country practices and upholding standards set in the past in the Reserve Bank, the macroeconomic indicators covered here are monetary, banking, price statistics, production data, service sector indicators and merchandise trade. In recognition of the rapid proliferation of alternate modes of payment in India, viz., real time gross settlements (RTGS), paper clearing, retail electronic clearing (REC) and card payment, they are also subjected to seasonality analyses. Specifically, 80 monthly macroeconomic variables disaggregated by sector include 14 monetary and banking indicators, 21 categories of indices relating to consumer prices, nine relating to wholesale prices, 23 on industrial production, six on service sector indicators, three on merchandise trade and four series on alternative payment indicators. Seasonal factors are mostly derived from time series dating back to April 1994 (Annex Table 1). Seasonal factors have been estimated under multiplicative model by using the X13-ARIMA-SEATS software of the US Census Bureau, after configuring it to suit Indian conditions, e.g., incorporating Diwali and Indian trading day effects. Seasonal adjustment can be done in two ways; i) direct approach - applying the seasonal adjustment procedure directly to the aggregate series; and ii) indirect approach – first seasonally adjusting each components of the composite series and then summing (aggregating) the components to get seasonally adjusted composite (Manna et al., 2003). The article follows the direct approach. IV. Analysis of Results All the macroeconomic variables considered here exhibit different seasonality (Annex Tables 2 and 3)1. Of the 14 major monetary and banking indicators, 11 recorded seasonal peaks during March or April (around the financial year closure), whereas seasonal troughs for the majority of these series can be located either in August or in December. For example, bank loans registered a seasonal peak in March, whereas banks’ investments register a seasonal trough in the same month. Demand deposits of scheduled commercial banks (SCBs) exhibited the highest seasonal variation (average seasonal factor (SF) range2 at 9.3) followed by reserve money (average SF range at 6.0) and cash in hand and balances with RBI (SCBs) (average SF range at 5.8). On the other hand, time deposits of SCBs, exhibited the smallest seasonal variation (average SF range at 1.3) indicating preference to banks’ deposits as a savings avenue for fixed return and low risk (Annex Table 4). Turning to prices, the Consumer Price Index (CPI) headline experiences seasonal upside pressure between July and November, which is largely due to the prices of food and beverages. CPI-food is driven by the seasonal patterns of prices of vegetables. Prices of fruits peak during the summer (April - August) and those of vegetables around the monsoon (July - November) due to lower availability and persistent demand (Chart 1).  CPI-vegetables showed the highest seasonal variation (nine-year average SF range at 23.0). Among vegetables, prices of tomatoes, onions and potatoes recorded average SF range of 65.6, 40.4 and 35.6, respectively. Seasonal variation in fruits prices was found to be lower (average SF range of 6.3) than those of vegetables. Further, seasonal variations in the prices of cereals and products were found to be lower (average SF range at 0.7) than that of pulses and products (average SF range at 3.2), where mismatches between supply and demand were persistent, possibly caused by production uncertainty and diet shifts linked to the economic development. On the other hand, CPI - non-alcoholic beverages exhibited the smallest seasonal variation (average SF range at 0.3), which could be attributed to rising awareness about healthy lifestyle and wellness among consumers. Seasonality in the aggregate CPI series [CPI-Combined, CPI for Industrial Workers (CPI-IW), CPI for Agricultural Labourers (CPI-AL) and CPI for Rural Labourers (CPI-RL)] is low while it is pronounced in some of the components, mainly food items (Annex Table 4). Seasonal troughs in WPI series were concentrated in only two months (March and December) relative to the distribution of seasonal peaks. Seasonal fluctuations in the WPI-all commodities were largely driven by prices of primary articles, especially food, which have a seasonal pattern similar to CPI-food and beverages. Prices of fuel and power recorded the highest seasonal variation (average SF range at 19.4) and among manufactured products group, manufacture of food products showed the lowest seasonal variation (average SF range at 2.2) (Annex Table 4). As regards seasonality in output, industrial production is highly seasonal. The index of industrial production (IIP) showed an average SF range of 13.0. Among the major sectors, mining had the highest seasonal variation (average SF range at 30.8); under the use-based classification, capital goods had the highest seasonal fluctuation (average SF range at 35.1). Seasonal peaks in the IIP series mostly occurred in March, the last month of the financial year, which could be due to achieving annual targets; seasonal troughs, on the other hand, were scattered. A seasonal moderation in cement production was observed between July to November, which is the monsoon season in major parts of India. Fertiliser production registered a seasonal decline between February to June, which is the harvesting time of rabi crops and a lean season for agricultural activity. Four of the six services sector indicators recorded seasonal peaks in March. Only in the case of domestic and international passenger traffic, the seasonal peak coincided with the holiday seasons in May and January, respectively. The seasonal peaks for merchandise exports remained unchanged in March, coinciding with the peak in the industrial production while non-oil non-gold imports also remained unchanged in December, but the peak in imports shifted to October from March earlier (Chart 2 & Annex Table 2). The analysis of alternate payment modes shows that RTGS, paper clearing and retail electronic clearance recorded high seasonal variations and peak during March, indicating heightened usage of online transfers on annual financial year closing, whereas the seasonal peak of usage of card payments mode was found to be during October, consumption – demand around the festival season. The seasonal troughs, on the other hand, were found to be distributed over February, September and November (Chart 3 and Annex table 2). V. Has Seasonality Changed? A simple way of identifying change in seasonality patterns in 2019-20 would be to compare the outcomes for 2019-20 with the average seasonal factors for the last five years (2014-15 to 2018-19). Out of the 80 selected series, the peak and the trough for 41 series remained unchanged whereas four series recorded shifts in both peaks and troughs (Chart 4 and Annex table 5). This change in seasonality was noticed mainly in the case of CPI. The seasonal peak in CPI-all commodities advanced to November in 2019-20 from October earlier, mainly reflecting change in the prices of vegetables. Seasonal peaks in the prices of CPI-food and beverages also shifted to November from August earlier which got aligned with the seasonal peak in the prices of food articles in the wholesale market. Further, greater convergence in the seasonal peaks of the components of industrial production was found in 2019-20.  In order to explore ‘moving seasonality’- changes in seasonal factors over time - detecting the presence of secular trend is critical. A downward (upward) trend in the seasonal fluctuation of a series shows decline (increase) in seasonal variation over time. While in majority of the cases, seasonal variation/ fluctuations (difference between the maximum and the minimum monthly seasonal factors) in 2019-20 remained similar to the previous five years’ average (Chart 5), empirical evidence indicates that seasonal fluctuations moderated for 35 series over a longer time horizon of last 10 years (Annex table 6). On the other hand, seasonality became more pronounced in another 22 series. Seasonal fluctuations in monetary and banking aggregates either moderated or remained broadly unchanged during last 10 years, arguably reflecting better availability of banking services. Though seasonal fluctuation in general IIP remained unchanged, mining, manufacturing and electricity recorded rise in seasonal variation. The mining activity, especially coal, is adversely affected due to rain and slowdown in railway transport during the monsoon season. Hence, supposedly the higher production during active season to meet rising demand for coal and other minerals explains the rise in seasonal fluctuation over time. Seasonal variation moderated for the majority of CPI-combined elements; retail prices of tomatoes, meat and fish exhibited higher seasonality while potato and onion prices showed lower seasonality. In the wholesale market, WPI-all commodities showed more seasonal variation mainly due to prices of chemicals and chemical products (Chart 6). VI. Conclusion Seasonal adjustment has a crucial role to play in an accurate reading of the economy and in making policy decisions. It is observed that the heightened seasonal demand for currency in circulation around financial year-end and beginning of agricultural season, viz., March and June gives a cue for efficient currency management in the country, similarly, the knowledge of seasonal pattern in banks’ deposits can be used in managing the banks’ resources optimally. Driven by the prices of vegetables, CPI headline inflation exhibited price pressures during the monsoon season. The seasonal peak for general retail prices got advanced to November in 2019-20 from October, aligning with the wholesale market. This calls for efficient supply chain management during such periods. Majority of categories of industrial production peak in March whereas the production of consumer non-durables peak in December. The seasonal peak in the manufacture of textiles had advanced to December, the winter season in the country, from August earlier. Imports and exports experience a peak during March. Further, bank credit peaks in March, apparently to cater to the year-end pressure of target achievements. Well strategizing credit availability by banks and credit institutions, keeping in mind the demand around festivals, will provide stimulus to the productive activities. References: Bank of Canada, (2018). Quarterly Financial Report. June 30, Bank of Canada. Bank of England, (2019). Inflation Report. February, Bank of England. Dagum, E. B., (1980). The X-11-ARIMA Seasonal Adjustment Method. Statistics Canada. Deutsche Bundesbank, (2018). Monthly Report. Vol. 70, No.9, Deutsche Bundesbank, September. Gomez, V. and Maravall, A., (1996). Programs TRAMO and SEATS: Instructions for the User. Bank of Spain. Gomez, V. and Maravall, A., (2001a). Automatic modeling methods for univariate series. In D. Pena, G. C. Tiao, and R. S. Tsay (Eds.), A Course in Time Series Analysis. New York, NY: J. Wiley and Sons. Gomez, V. and Maravall, A., (2001b). Seasonal adjustment and signal extraction in economic time series. In D. Pena, G. C. Tiao, and R. S. Tsay (Eds.), A Course in Time Series Analysis. New York, NY: J. Wiley and Sons. HCSO (2007). Seasonal Adjustments – Methods and Practices. Budapest, July, Hungarian Central Statistics Office. IMF, (2016). Monetary and Financial Statistics Manual and Compilation Guide. International Monetary Fund. Lembke, Ron (2015). Forecasting with Seasonality. Retrieved from http://business.unr.edu/faculty/ronlembke/handouts/Seasonality%20Final17.pdf. Macaulay, F. R. (1931). The Smoothing of Time Series. National Bureau of Economic Research, Inc. Manna, M., Peronaci, R., (2003). Seasonal Adjustment. European Central Bank. Reserve Bank of India (2017). Monthly Seasonal Factors of Selected Economic Time Series. 2016-17, Reserve Bank of India Bulletin, September, Vol. LXXI, No. 9. Samanta, G.P. and Bhattarjee, M., (2000). Are Seasonal Adjustment and HP-Filter Useful in Estimating Core Inflation in India? International Journal of Development Banking, Vol. 18, No. 2, July, pp. 61-75. Shiskin, J., Young, A.H. and Musgrave, J.C., (1967). The X-11 Variant of Census Method II Seasonal Adjustment Programme. Technical Paper No. 15, Bureau of the Census, U.S. Department of Commerce. US Census Bureau (1965). Estimating Trading-Day Seasonal Variation in Monthly Economic Time Series. US Bureau of the Census Technical Paper No. 12. U.S. Census Bureau (2011). X-12-ARIMA Reference Manual, Version 0.3. Time Series Research Staff, Statistical Research Division (https://www.census.gov/ts/x12a/v03/x12adocV03.pdf). U.S. Census Bureau (2017). X-13-ARIMA-SEATS Reference Manual, Version 1.1. Time Series Research Staff, Center for Statistical Research and Methodology (https://www.census.gov/ts/x13as/docX13AS.pdf).

Annex | Table 1: Time Period Used for Estimating Seasonal Factors | | Name of Sectors/Variables | Time Period | Name of Sectors/Variables | Time Period | | Monetary and Banking Indicators (14 series) | | Index of Industrial Production (23 series) | | | A.1.1 Broad Money (M3) | April 1994 to March 2020 | E. IIP (Base 2011-12 = 100) General Index | April 1994 to March 2020 | | A.1.1.1 Net Bank Credit to Government | | A.1.1.2 Bank Credit to Commercial Sector | | A.1.2 Narrow Money (M1) | E.1.1 IIP - Primary goods | April 2012 to March 2020 | | A.1.3 Reserve Money (RM) | E.1.2 IIP - Capital goods | | A.1.3.1 Currency in Circulation | E.1.3 IIP - Intermediate goods | | A.2.1 Aggregate Deposits (SCBs) | E.1.4 IIP - Infrastructure/ construction goods | | E.1.5 IIP - Consumer goods | | A.2.1.1 Demand Deposits (SCBs) | | E.1.5.1 IIP - Consumer durables | | A.2.1.2 Time Deposits (SCBs) | | E.1.5.2 IIP - Consumer non-durables | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | | E.2.1 IIP - Mining | April 1994 to March 2020 | | A.3.2 Bank Credit (SCBs) | | E.2.2 IIP - Manufacturing | | A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs) | | A.3.2.2 Non-Food Credit (SCBs) | E.2.2.1 IIP - Manufacture of food products | April 2012 to March 2020 | | A.3.3 Investments (SCBs) | E.2.2.2 IIP - Manufacture of beverages | | Price Indices[CPI: 21 series and WPI: 9 series] | | E.2.2.3 IIP - Manufacture of textiles | | B. CPI (Base: 2012 = 100) All Commodities | January 2011 to March 2020 | E.2.2.4 IIP - Manufacture of chemicals and chemical products | | B.1 CPI - Food and beverages | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | | B.1 .1 CPI - Cereals and products | | B.1 .2 CPI - Meat and fish | E.2.3 IIP - Electricity | April 1994 to March 2020 | | B.1 .3 CPI – Egg | | B.1 .4 CPI - Milk and products | | B.1 .5 CPI – Fruits | E.3 Cement Production | April 2004 to March 2020 | | B.1 .6 CPI - Vegetables | E.4 Steel Production | | B.1 .6.1 CPI – Potato | E.5 Coal Production | | B.1 .6.2 CPI – Onion | E.6 Crude Oil Production | | B.1 .6.3 CPI – Tomato | E.7 Petroleum Refinery Production | | B.1 .7 CPI - Pulses and products | E.8 Fertiliser Production | | B.1 .8 CPI – Spices | E.9 Natural Gas Production | | Service sector Indicators (6 series) | | B.1 .9 CPI - Non-alcoholic beverages | | F.1 Production of Commercial Motor Vehicles | April 1994 to March 2020 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | | F.2 Cargo handled at Major Ports | | B.2 CPI - Clothing and footwear | | F.3 Railway Freight Traffic | | B.3 CPI – Housing | | F.4 Sales of Commercial Motor Vehicles | | B.4 CPI - Miscellaneous | | F.5 Passenger flown (Km) - Domestic | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | January 2000 to March 2020 | | F.6 Passenger flown (Km) - International | | Merchandise Trade (3 series) | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | | G.1 Exports | April 1994 to March 2020 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | G.2 Imports | | G.3 Non-Oil Non-Gold Imports | | D. WPI (Base: 2011-12=100) All Commodities | April 1994 to March 2020 | Alternate Modes of Payment (4 Series) | | D.1 WPI - Primary Articles | H.1 Real Time Gross Settlement | April 2004 to March 2020 | | D.1.1 WPI - Food Articles | | D.2 WPI - FUEL & POWER | | H.2 Paper Clearing | April 2005 to March 2020 | | D.3 WPI - MANUFACTURED PRODUCTS | | D.3.1 WPI - Manufacture of Food Products | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | H.3 Retail Electronic Clearing | April 2004 to March 2020 | | D.3.3 WPI - Manufacture of Basic Metals Alloys & Metals Products | | H.4 Cards | | D.3.4 WPI - Manufacture of Machinery & Machine Tools | Note:

1. CPI-Combined data is available from January 2011 only.

2. CPI-IW, AL & RL data are broadly aligned with the latest base year of CPI-IW.

3. Data on IIP use-based and disaggregated sectors (NIC-2 digit level) was considered since Apr 2012 as back series could not be computed due to major changes in coverage from previous base year.

4. All the data being used for this study are publically available in the Database on India Economy, Reserve Bank of India. |

| Table 2: No. of Peaks and Trough Observed Over Different Months* | | Sectors/sub-sectors | | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Total | | Monetary and Banking | Peak | 4 | 1 | | 1 | 1 | | | | | | | 7 | 14 | | Trough | | | | | 4 | 1 | 2 | | 4 | 2 | | 1 | 14 | | CPI | Peak | | | 1 | 2 | 1 | 2 | 3 | 8 | 2 | 2 | | | 21 | | Trough | 7 | 4 | 2 | | | | | 1 | | | 3 | 4 | 21 | | WPI | Peak | 2 | 2 | | 2 | 1 | 1 | 1 | | | | | | 9 | | Trough | | | | | | | | | 4 | 1 | 1 | 3 | 9 | | Industrial Production | Peak | | 2 | | 1 | 1 | | 3 | | 2 | | | 14 | 23 | | Trough | 6 | | 1 | | 3 | 5 | | 2 | 1 | | 5 | | 23 | | Services Indicators | Peak | | 1 | | | | | | | | 1 | | 4 | 6 | | Trough | 1 | | 1 | | | 4 | | | | | | | 6 | | External Trade | Peak | | | | | | | 1 | | 1 | | | 1 | 3 | | Trough | | | | | | | | 1 | | | 2 | | 3 | | Alternate Modes of Payment | Peak | | | | | | | 1 | | | | | 3 | 4 | | Trough | | | | | | 1 | | 1 | | | 2 | | 4 | | Total | Peak | 6 | 6 | 1 | 6 | 4 | 3 | 9 | 8 | 5 | 3 | 0 | 29 | 80 | | Trough | 14 | 4 | 4 | 0 | 7 | 11 | 2 | 5 | 9 | 3 | 13 | 8 | 80 | *Note:

1. In general, seasonal peaks and troughs have been decided based on the average seasonal factors of last ten years.

2. Blank cells indicate no peak or trough observed. |

| Table 3: Average* Monthly Seasonal Factors of Selected Economic Time Series (Contd.) | | Series/Month | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 101.2 | 100.8 | 100.0 | 100.1 | 99.8 | 99.6 | 99.9 | 99.6 | 99.2 | 99.5 | 99.6 | 100.7 | | A.1.1.1 Net Bank Credit to Government | 101.2 | 101.1 | 100.8 | 101.8 | 101.2 | 99.7 | 99.8 | 99.7 | 97.9 | 99.1 | 99.1 | 98.7 | | A.1.1.2 Bank Credit to Commercial Sector | 100.9 | 100.3 | 100.2 | 99.5 | 99.1 | 99.3 | 99.4 | 99.2 | 99.7 | 100.0 | 100.4 | 102.2 | | A.1.2 Narrow Money (M1) | 102.0 | 101.4 | 100.6 | 99.2 | 98.8 | 99.1 | 99.0 | 98.7 | 98.8 | 98.7 | 99.9 | 103.7 | | A.1.3 Reserve Money (RM) | 102.0 | 101.7 | 101.1 | 99.7 | 98.9 | 98.4 | 98.2 | 98.9 | 98.8 | 99.0 | 99.2 | 104.1 | | A.1.3.1 Currency in Circulation | 102.7 | 103.0 | 101.8 | 99.7 | 98.8 | 97.9 | 98.4 | 99.0 | 99.0 | 99.3 | 100.0 | 100.4 | | A.2.1 Aggregate Deposits (SCBs) | 100.9 | 100.4 | 99.8 | 100.2 | 99.9 | 99.8 | 100.1 | 99.8 | 99.4 | 99.5 | 99.5 | 100.8 | | A.2.1.1 Demand Deposits (SCBs) | 101.1 | 99.4 | 99.6 | 98.4 | 98.3 | 101.0 | 98.0 | 98.9 | 100.7 | 98.2 | 98.9 | 107.3 | | A.2.1.2 Time Deposits (SCBs) | 100.7 | 100.5 | 99.8 | 100.3 | 100.0 | 99.6 | 100.4 | 100.0 | 99.4 | 99.7 | 99.6 | 100.0 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 101.8 | 99.7 | 101.7 | 99.9 | 100.5 | 101.1 | 98.7 | 101.4 | 101.2 | 96.1 | 99.0 | 99.7 | | A.3.2 Bank Credit (SCBs) | 101.0 | 100.3 | 100.3 | 99.5 | 99.0 | 99.3 | 99.2 | 99.1 | 99.9 | 99.9 | 100.3 | 102.3 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 100.6 | 100.2 | 100.4 | 99.1 | 98.9 | 100.2 | 99.4 | 99.2 | 100.0 | 99.9 | 100.1 | 102.0 | | A.3.2.2 Non-Food Credit (SCBs) | 101.0 | 100.2 | 100.2 | 99.3 | 99.0 | 99.5 | 99.4 | 99.1 | 99.8 | 99.8 | 100.1 | 102.5 | | A.3.3 Investments (SCBs) | 100.1 | 100.4 | 100.2 | 101.0 | 101.6 | 101.0 | 100.8 | 100.5 | 99.0 | 99.1 | 99.1 | 97.6 | | Price Indices [CPI: 21 series and WPI: 9 series] | | B. CPI (Base: 2012 = 100) All Commodities | 99.1 | 99.3 | 99.9 | 100.6 | 100.8 | 100.8 | 101.0 | 100.8 | 100.0 | 99.6 | 99.1 | 99.0 | | B.1 CPI - Food and beverages | 98.2 | 98.8 | 100.1 | 101.4 | 101.8 | 101.6 | 101.7 | 101.4 | 99.9 | 98.9 | 98.2 | 97.9 | | B.1 .1 CPI - Cereals and products | 99.7 | 99.6 | 99.7 | 99.8 | 100.0 | 100.1 | 100.3 | 100.3 | 100.2 | 100.2 | 100.2 | 100.0 | | B.1 .2 CPI - Meat and fish | 99.7 | 100.5 | 101.9 | 101.9 | 100.8 | 100.0 | 99.4 | 98.8 | 98.8 | 99.6 | 99.3 | 99.4 | | B.1 .3 CPI - Egg | 97.0 | 96.9 | 98.4 | 100.2 | 99.3 | 98.9 | 99.1 | 101.2 | 103.0 | 103.8 | 102.1 | 100.0 | | B.1 .4 CPI - Milk and products | 99.6 | 99.9 | 100.0 | 100.2 | 100.2 | 100.2 | 100.1 | 100.2 | 100.1 | 99.9 | 99.9 | 99.7 | | B.1 .5 CPI - Fruits | 102.5 | 102.7 | 102.6 | 103.2 | 102.2 | 99.3 | 99.0 | 98.8 | 97.7 | 97.0 | 96.9 | 98.1 | | B.1 .6 CPI - Vegetables | 89.4 | 92.8 | 98.4 | 108.9 | 110.3 | 110.3 | 111.3 | 108.6 | 99.0 | 93.3 | 89.7 | 88.3 | | B.1 .6.1 CPI - Potato | 86.9 | 96.1 | 103.2 | 109.5 | 113.0 | 112.3 | 114.3 | 115.3 | 102.3 | 86.7 | 79.6 | 80.6 | | B.1 .6.2 CPI - Onion | 80.7 | 79.8 | 85.7 | 98.1 | 109.6 | 115.1 | 118.7 | 120.1 | 110.4 | 102.6 | 94.4 | 84.7 | | B.1 .6.3 CPI - Tomato | 80.7 | 92.1 | 110.6 | 138.4 | 122.6 | 108.7 | 108.8 | 115.8 | 92.1 | 81.4 | 72.8 | 75.7 | | B.1 .7 CPI - Pulses and products | 98.5 | 98.9 | 99.4 | 99.9 | 100.6 | 101.3 | 101.5 | 101.7 | 100.7 | 100.0 | 99.0 | 98.5 | | B.1 .8 CPI - Spices | 99.3 | 99.4 | 99.6 | 99.9 | 100.2 | 100.3 | 100.4 | 100.4 | 100.5 | 100.3 | 99.9 | 99.6 | | B.1 .9 CPI - Non-alcoholic beverages | 99.9 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.1 | 100.1 | 100.0 | 100.0 | 99.9 | 99.8 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 99.8 | 99.7 | 99.8 | 99.9 | 100.0 | 100.1 | 100.1 | 100.3 | 100.2 | 100.1 | 100.1 | 99.9 | | B.2 CPI - Clothing and footwear | 99.9 | 99.8 | 99.8 | 99.8 | 99.9 | 100.0 | 100.1 | 100.2 | 100.3 | 100.1 | 100.1 | 99.9 | | B.3 CPI - Housing | 100.2 | 100.1 | 99.2 | 99.5 | 99.9 | 100.0 | 100.2 | 100.3 | 99.7 | 100.4 | 100.3 | 100.2 | | B.4 CPI - Miscellaneous | 99.7 | 99.8 | 99.8 | 100.1 | 100.1 | 100.3 | 100.3 | 100.2 | 100.0 | 100.0 | 99.9 | 99.8 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 98.8 | 99.2 | 99.4 | 99.8 | 101.0 | 100.9 | 100.7 | 101.1 | 100.8 | 99.8 | 99.5 | 99.0 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 98.9 | 99.1 | 99.5 | 100.1 | 100.6 | 100.8 | 100.8 | 101.0 | 100.6 | 100.1 | 99.6 | 99.0 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 98.9 | 99.2 | 99.5 | 100.2 | 100.4 | 100.8 | 100.8 | 100.9 | 100.5 | 100.1 | 99.6 | 99.1 | | D. WPI (Base: 2011-12=100) All Commodities | 99.6 | 99.7 | 100.1 | 100.2 | 100.2 | 100.2 | 100.3 | 100.1 | 99.9 | 100.0 | 99.9 | 99.6 | | D.1 WPI - PRIMARY ARTICLES | 99.8 | 100.1 | 100.0 | 100.6 | 100.5 | 100.6 | 100.5 | 100.3 | 99.5 | 99.5 | 99.3 | 99.3 | | D.1.1 WPI - Food Articles | 99.1 | 99.5 | 100.4 | 101.5 | 102.0 | 101.4 | 101.2 | 101.3 | 99.3 | 98.6 | 98.0 | 97.6 | | D.2 WPI - FUEL & POWER | 95.2 | 96.8 | 101.7 | 106.0 | 107.5 | 107.3 | 108.1 | 108.1 | 97.2 | 94.2 | 88.7 | 88.9 | | D.3 WPI - MANUFACTURED PRODUCTS | 98.4 | 99.1 | 100.4 | 101.7 | 101.9 | 101.8 | 102.3 | 102.1 | 99.3 | 98.7 | 97.2 | 97.0 | | D.3.1 WPI - Manufacture of Food Products | 98.9 | 99.0 | 99.3 | 100.0 | 100.5 | 100.6 | 101.0 | 101.0 | 100.6 | 100.3 | 99.8 | 99.1 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 99.0 | 99.4 | 99.7 | 100.7 | 101.0 | 101.0 | 101.2 | 100.6 | 99.7 | 99.4 | 99.4 | 98.9 | | D.3.3 WPI - Manufacture of Basic Metals Alloys & Metals Products | 98.9 | 98.0 | 97.7 | 98.5 | 99.4 | 99.4 | 99.6 | 101.0 | 101.6 | 102.6 | 102.3 | 101.0 | | D.3.4 WPI - Manufacture of Machinery & Machine Tools | 97.6 | 98.7 | 99.0 | 100.5 | 101.4 | 101.4 | 103.3 | 102.7 | 101.4 | 99.5 | 97.7 | 97.0 |

| Table 3: Average* Monthly Seasonal Factors of Selected Economic Time Series (Concld.) | | Series/Month | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Index of Industrial Production (23 series) | | E. IIP (Base 2011-12 =A51:A72 100) General Index | 96.6 | 100.1 | 98.6 | 98.0 | 96.8 | 97.9 | 99.5 | 97.8 | 103.2 | 103.2 | 98.7 | 109.6 | | E.1.1 IIP - Primary goods | 97.2 | 102.4 | 99.4 | 97.7 | 97.3 | 94.9 | 100.4 | 98.3 | 103.5 | 104.2 | 96.0 | 108.8 | | E.1.2 IIP - Capital goods | 89.2 | 97.1 | 98.7 | 94.8 | 96.7 | 102.1 | 96.4 | 97.8 | 101.8 | 98.1 | 102.6 | 124.3 | | E.1.3 IIP - Intermediate goods | 98.0 | 100.1 | 98.5 | 100.4 | 100.0 | 99.9 | 99.0 | 97.7 | 101.1 | 100.9 | 97.4 | 107.5 | | E.1.4 IIP - Infrastructure/ construction goods | 99.5 | 104.3 | 101.5 | 99.9 | 97.3 | 96.0 | 97.7 | 94.4 | 100.4 | 103.6 | 99.1 | 107.0 | | E.1.5 IIP - Consumer goods | 95.4 | 98.6 | 96.4 | 97.7 | 97.1 | 100.4 | 101.7 | 99.3 | 103.9 | 103.1 | 100.1 | 106.2 | | E.1.5.1 IIP - Consumer durables | 95.8 | 99.2 | 97.2 | 98.8 | 97.9 | 105.5 | 107.8 | 99.3 | 97.6 | 98.9 | 96.5 | 104.6 | | E.1.5.2 IIP - Consumer non-durables | 94.9 | 99.5 | 95.3 | 95.8 | 95.9 | 96.1 | 96.1 | 100.8 | 108.1 | 106.3 | 102.8 | 108.7 | | E.2.1 IIP - Mining | 97.9 | 100.6 | 96.1 | 91.2 | 89.6 | 88.6 | 97.6 | 100.5 | 107.2 | 109.0 | 103.0 | 119.4 | | E.2.2 IIP - Manufacturing | 96.0 | 99.7 | 98.4 | 98.7 | 97.4 | 99.0 | 99.7 | 97.9 | 103.1 | 102.6 | 98.8 | 108.5 | | E.2.2.1 IIP - Manufacture of food products | 94.2 | 88.2 | 85.8 | 90.3 | 88.4 | 89.0 | 94.6 | 104.2 | 122.5 | 119.9 | 112.8 | 110.0 | | E.2.2.2 IIP - Manufacture of beverages | 119.8 | 130.2 | 108.0 | 88.9 | 85.8 | 89.8 | 91.0 | 85.9 | 90.0 | 95.1 | 98.8 | 118.1 | | E.2.2.3 IIP - Manufacture of textiles | 97.8 | 99.0 | 98.0 | 100.9 | 102.4 | 101.1 | 101.3 | 99.3 | 101.6 | 100.9 | 96.1 | 101.7 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 94.7 | 100.5 | 99.5 | 103.8 | 101.6 | 101.0 | 100.5 | 98.5 | 101.1 | 100.8 | 93.8 | 104.7 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 99.0 | 100.5 | 97.4 | 100.2 | 99.4 | 101.1 | 100.4 | 100.8 | 93.0 | 99.8 | 100.2 | 108.3 | | E.2.3 IIP - Electricity | 100.1 | 105.2 | 100.5 | 102.6 | 102.3 | 99.6 | 102.5 | 94.7 | 97.7 | 99.0 | 92.2 | 102.5 | | E.3 Cement Production | 103.9 | 103.4 | 100.5 | 96.8 | 90.5 | 91.8 | 98.6 | 92.5 | 102.0 | 105.9 | 100.9 | 112.9 | | E.4 Steel Production | 98.5 | 104.2 | 99.3 | 100.1 | 98.8 | 96.6 | 98.9 | 95.7 | 100.4 | 103.7 | 98.1 | 105.7 | | E.5 Coal Production | 91.8 | 94.1 | 89.7 | 83.0 | 81.4 | 81.4 | 95.3 | 103.0 | 113.3 | 117.0 | 112.1 | 138.2 | | E.6 Crude Oil Production | 98.9 | 101.8 | 99.3 | 101.7 | 101.4 | 97.9 | 101.9 | 99.0 | 102.0 | 101.3 | 92.2 | 102.7 | | E.7 Petroleum Refinery Production | 95.8 | 100.9 | 99.3 | 101.3 | 100.5 | 95.5 | 102.2 | 98.6 | 103.2 | 102.8 | 95.2 | 104.6 | | E.8 Fertiliser Production | 82.2 | 95.2 | 99.4 | 104.2 | 106.1 | 104.5 | 107.3 | 104.1 | 105.5 | 102.9 | 93.7 | 95.3 | | E.9 Natural Gas Production | 97.4 | 101.4 | 98.6 | 101.9 | 101.5 | 98.6 | 102.4 | 99.8 | 102.6 | 101.9 | 91.8 | 102.1 | | Service Sector Indicators (6 series) | | F.1 Production of Commercial Motor Vehicles | 95.6 | 96.5 | 92.1 | 95.9 | 96.8 | 98.3 | 101.5 | 99.8 | 92.7 | 106.7 | 107.2 | 116.7 | | F.2 Cargo handled at Major Ports | 100.0 | 103.9 | 97.3 | 99.5 | 98.3 | 93.1 | 98.5 | 98.7 | 102.5 | 104.5 | 94.8 | 108.5 | | F.3 Railway Freight Traffic | 97.3 | 100.9 | 97.1 | 98.1 | 95.2 | 93.5 | 98.4 | 98.4 | 103.5 | 106.5 | 97.7 | 113.2 | | F.4 Sales of Commercial Motor Vehicles | 86.6 | 91.1 | 96.3 | 93.6 | 95.4 | 106.7 | 99.4 | 94.4 | 97.9 | 104.5 | 104.6 | 129.9 | | F.5 Passenger flown (Km) - Domestic | 100.7 | 110.7 | 102.4 | 96.9 | 94.7 | 90.6 | 99.1 | 100.2 | 107.3 | 102.9 | 96.0 | 99.1 | | F.6 Passenger flown (Km) - International | 96.4 | 101.2 | 99.6 | 103.4 | 102.8 | 93.0 | 93.5 | 95.7 | 107.1 | 110.9 | 95.0 | 102.5 | | Merchandise Trade (3 series) | | G.1 Exports | 97.2 | 101.2 | 99.0 | 98.6 | 97.3 | 102.4 | 98.8 | 95.0 | 102.3 | 98.0 | 96.6 | 113.8 | | G.2 Imports | 98.0 | 103.3 | 99.3 | 102.3 | 98.7 | 100.9 | 104.6 | 99.3 | 100.9 | 97.9 | 92.9 | 103.0 | | G.3 Non-Oil Non-Gold Imports | 95.7 | 99.3 | 101.3 | 103.4 | 99.2 | 102.0 | 102.6 | 101.7 | 104.7 | 99.2 | 91.9 | 98.9 | | Alternate modes of Payment (4 series) | | H.1 RTGS | 97.1 | 95.2 | 106.6 | 97.7 | 92.0 | 104.2 | 98.6 | 91.7 | 102.2 | 99.0 | 89.5 | 126.4 | | H.2 Paper Clearing | 105.1 | 99.4 | 96.5 | 100.0 | 95.6 | 93.2 | 104.5 | 95.9 | 99.6 | 99.1 | 94.1 | 116.5 | | H.3 REC | 104.1 | 97.0 | 98.7 | 101.8 | 96.3 | 97.0 | 101.0 | 90.5 | 101.9 | 99.1 | 92.2 | 121.6 | | H.4 Cards | 99.8 | 101.8 | 98.4 | 99.6 | 99.5 | 95.7 | 105.6 | 100.2 | 103.4 | 101.6 | 92.5 | 101.5 | *: Average of last ten years’ monthly seasonal factors, in general. Here, the average monthly seasonal factors have been computed on the basis of last 10 years (i.e., April 2010 to March 2020)

Note:

1. Seasonal factors: Deviation from 100 indicates presence of seasonality. For instance, seasonal factor of IIP-Manufacturing increases during March(108.5) and decreases during April (96.0) indicating that manufacturing production rises during March and declines during February due to seasonal fluctuations.

2. For all CPI indices, the average monthly seasonal factors have been computed on the basis of last 9 years (i.e., January 2011 to March 2019).

3. The average linking factor has been used to compute the back series of IIP (Overall, mining, manufacturing and electricity) and WPI series. The average linking factor was calculated based on IIP/ WPI series for the common period from Apr 2012 to Mar 2020. The back series of IIP, however, was not compiled at further disaggregated level (use based and NIC-2 digit level) due to major changes in coverage.

4. Numbers marked in ‘bold’ are peaks and troughs of respective series. |

| Table 4: Range (Difference Between Peak and Trough) of Seasonal Factors (Contd.) | | Series \ Year | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | Range of Average SF | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 2.3 | 2.1 | 1.9 | 1.8 | 1.7 | 1.8 | 2.0 | 2.1 | 2.1 | 2.1 | 2.0 | | A.1.1.1 Net Bank Credit to Government | 4.6 | 4.1 | 3.8 | 3.6 | 3.5 | 3.6 | 3.7 | 3.9 | 4.0 | 3.9 | 3.8 | | A.1.1.2 Bank Credit to Commercial Sector | 3.7 | 3.3 | 3.0 | 2.8 | 2.7 | 2.8 | 3.0 | 3.1 | 3.2 | 3.2 | 3.1 | | A.1.2 Narrow Money (M1) | 4.7 | 4.1 | 4.0 | 4.2 | 4.4 | 5.3 | 6.1 | 7.0 | 7.8 | 8.2 | 5.0 | | A.1.3 Reserve Money (RM) | 7.1 | 6.8 | 6.4 | 6.1 | 5.7 | 5.4 | 5.2 | 4.9 | 4.8 | 4.7 | 6.0 | | A.1.3.1 Currency in Circulation | 5.9 | 5.6 | 5.2 | 5.0 | 4.8 | 4.7 | 4.7 | 4.7 | 4.8 | 4.9 | 5.2 | | A.2.1 Aggregate Deposits (SCBs) | 2.3 | 2.0 | 1.7 | 1.6 | 1.5 | 1.4 | 1.7 | 1.9 | 2.0 | 2.0 | 1.5 | | A.2.1.1 Demand Deposits (SCBs) | 11.0 | 8.5 | 6.6 | 6.0 | 6.9 | 9.5 | 11.9 | 13.9 | 14.8 | 15.1 | 9.3 | | A.2.1.2 Time Deposits (SCBs) | 2.0 | 1.9 | 1.6 | 1.4 | 1.1 | 1.0 | 0.9 | 0.8 | 0.8 | 0.8 | 1.3 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 10.7 | 9.1 | 7.0 | 5.4 | 4.5 | 4.9 | 5.4 | 5.8 | 6.0 | 6.1 | 5.8 | | A.3.2 Bank Credit (SCBs) | 4.0 | 3.6 | 3.2 | 3.0 | 2.9 | 2.9 | 3.0 | 3.1 | 3.2 | 3.2 | 3.2 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 3.7 | 3.2 | 2.7 | 2.4 | 2.4 | 2.7 | 3.0 | 3.2 | 3.4 | 3.5 | 3.1 | | A.3.2.2 Non-Food Credit (SCBs) | 4.0 | 3.6 | 3.1 | 2.8 | 2.7 | 3.1 | 3.6 | 3.9 | 4.0 | 3.9 | 3.5 | | A.3.3 Investments (SCBs) | 4.8 | 4.6 | 4.4 | 4.1 | 3.7 | 3.5 | 3.5 | 3.4 | 3.4 | 3.3 | 4.0 | | Price Indices [CPI: 21 series and WPI: 9 series] | | B. CPI (Base: 2012 = 100) All Commodities | | 2.3 | 2.2 | 2.1 | 2.0 | 1.9 | 1.8 | 1.7 | 1.7 | 1.7 | 2.0 | | B.1 CPI - Food and beverages | | 4.2 | 4.2 | 4.1 | 4.0 | 3.9 | 3.8 | 3.6 | 3.6 | 3.7 | 3.8 | | B.1 .1 CPI - Cereals and products | | 1.0 | 0.9 | 0.8 | 0.7 | 0.7 | 0.7 | 0.7 | 0.6 | 0.6 | 0.7 | | B.1 .2 CPI - Meat and fish | | 3.1 | 3.1 | 3.2 | 3.2 | 3.2 | 3.2 | 3.2 | 3.3 | 3.3 | 3.1 | | B.1 .3 CPI - Egg | | 8.0 | 7.8 | 7.5 | 7.0 | 6.5 | 6.2 | 5.9 | 5.9 | 5.9 | 6.9 | | B.1 .4 CPI - Milk and products | | 0.9 | 0.8 | 0.8 | 0.7 | 0.6 | 0.5 | 0.4 | 0.4 | 0.3 | 0.6 | | B.1 .5 CPI - Fruits | | 6.5 | 6.5 | 6.4 | 6.3 | 6.2 | 6.2 | 6.2 | 6.4 | 6.5 | 6.3 | | B.1 .6 CPI - Vegetables | | 24.5 | 24.5 | 24.1 | 23.8 | 22.8 | 22.1 | 21.3 | 21.7 | 22.3 | 23.0 | | B.1 .6.1 CPI - Potato | | 38.0 | 37.9 | 37.4 | 36.9 | 36.3 | 35.1 | 33.1 | 31.8 | 30.8 | 35.6 | | B.1 .6.2 CPI - Onion | | 45.0 | 44.7 | 43.3 | 42.0 | 38.8 | 37.4 | 37.0 | 38.0 | 39.1 | 40.4 | | B.1 .6.3 CPI - Tomato | | 63.1 | 63.8 | 65.3 | 66.1 | 66.3 | 66.4 | 66.6 | 66.9 | 67.5 | 65.6 | | B.1 .7 CPI - Pulses and products | | 3.0 | 3.1 | 3.2 | 3.4 | 3.5 | 3.4 | 3.3 | 3.2 | 2.5 | 3.2 | | B.1 .8 CPI - Spices | | 1.8 | 1.7 | 1.5 | 1.2 | 1.1 | 1.1 | 1.1 | 1.0 | 0.8 | 1.3 | | B.1 .9 CPI - Non-alcoholic beverages | | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.3 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | | 0.8 | 0.8 | 0.7 | 0.6 | 0.5 | 0.4 | 0.4 | 0.4 | 0.4 | 0.6 | | B.2 CPI - Clothing and footwear | | 0.7 | 0.7 | 0.6 | 0.5 | 0.5 | 0.4 | 0.3 | 0.3 | 0.3 | 0.5 | | B.3 CPI - Housing | | 1.4 | 1.3 | 1.2 | 1.1 | 1.1 | 1.2 | 1.2 | 1.2 | 1.3 | 1.2 | | B.4 CPI - Miscellaneous | | 0.8 | 0.8 | 0.7 | 0.6 | 0.5 | 0.4 | 0.3 | 0.3 | 0.3 | 0.6 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 2.4 | 2.3 | 2.3 | 2.3 | 2.4 | 2.5 | 2.5 | 2.4 | 2.4 | 2.3 | 2.2 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 2.1 | 2.1 | 2.2 | 2.1 | 2.1 | 2.1 | 2.0 | 1.9 | 1.7 | 1.6 | 2.0 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 2.1 | 2.1 | 2.2 | 2.1 | 2.0 | 2.0 | 2.0 | 1.8 | 1.7 | 1.6 | 2.0 | | D. WPI (Base: 2011-12=100) All Commodities | 1.1 | 1.0 | 1.0 | 0.9 | 0.8 | 0.7 | 0.7 | 0.8 | 0.8 | 0.8 | 0.7 | | D.1 WPI - PRIMARY ARTICLES | 1.4 | 1.3 | 1.5 | 1.6 | 1.7 | 1.6 | 1.5 | 1.4 | 1.4 | 1.4 | 1.3 | | D.1.1 WPI - Food Articles | 3.6 | 3.9 | 4.3 | 4.8 | 5.1 | 5.1 | 4.9 | 4.6 | 4.4 | 4.5 | 4.4 | | D.2 WPI - FUEL & POWER | 17.3 | 17.3 | 18.2 | 19.8 | 21.5 | 22.0 | 22.2 | 22.7 | 23.5 | 23.3 | 19.4 | | D.3 WPI - MANUFACTURED PRODUCTS | 5.2 | 5.2 | 5.2 | 5.3 | 5.6 | 5.6 | 5.5 | 5.5 | 5.6 | 5.6 | 5.3 | | D.3.1 WPI - Manufacture of Food Products | 2.2 | 2.2 | 2.3 | 2.4 | 2.4 | 2.2 | 2.2 | 2.1 | 2.0 | 1.9 | 2.2 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 2.4 | 2.9 | 3.2 | 3.1 | 2.9 | 2.4 | 1.9 | 1.5 | 1.2 | 1.1 | 2.3 | | D.3.3 WPI - Manufacture of Basic Metals Alloys & Metals Products | 4.5 | 4.4 | 4.5 | 4.8 | 5.2 | 5.3 | 5.4 | 5.3 | 5.3 | 5.3 | 4.9 | | D.3.4 WPI - Manufacture of Machinery & Machine Tools | 6.3 | 6.2 | 6.5 | 6.8 | 7.3 | 7.2 | 6.9 | 6.1 | 5.4 | 4.8 | 6.3 |

| Table 4: Range (Difference Between Peak and Trough) of Seasonal Factors (Concld.) | | Series \ Year | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | Range of Average SF | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | Index of Industrial Production (23 series) | | E. IIP (Base 2011-12 = 100) General Index | 14.4 | 14.0 | 13.4 | 12.7 | 12.7 | 12.9 | 13.0 | 13.4 | 13.5 | 13.5 | 13.0 | | E.1.1 IIP - Primary goods | | | 13.5 | 13.7 | 13.8 | 13.9 | 14.0 | 14.1 | 14.3 | 14.5 | 13.9 | | E.1.2 IIP - Capital goods | | | 39.2 | 38.4 | 36.8 | 35.2 | 33.2 | 32.0 | 31.0 | 30.8 | 35.1 | | E.1.3 IIP - Intermediate goods | | | 10.2 | 10.2 | 10.2 | 10.1 | 10.2 | 10.4 | 10.7 | 10.8 | 10.1 | | E.1.4 IIP - Infrastructure/ construction goods | | | 11.6 | 12.0 | 12.3 | 12.7 | 13.1 | 13.6 | 13.8 | 14.2 | 12.7 | | E.1.5 IIP - Consumer goods | | | 12.0 | 11.7 | 11.2 | 10.7 | 10.1 | 9.9 | 10.1 | 10.6 | 10.8 | | E.1.5.1 IIP - Consumer durables | | | 13.9 | 13.8 | 13.3 | 12.5 | 11.3 | 10.3 | 10.0 | 9.6 | 11.9 | | E.1.5.2 IIP - Consumer non-durables | | | 15.4 | 15.1 | 14.3 | 14.0 | 13.7 | 13.9 | 14.6 | 15.3 | 13.8 | | E.2.1 IIP - Mining | 28.0 | 29.0 | 29.7 | 30.5 | 31.2 | 32.1 | 32.9 | 34.2 | 35.1 | 35.6 | 30.8 | | E.2.2 IIP - Manufacturing | 12.6 | 12.2 | 12.0 | 12.3 | 12.4 | 12.6 | 12.7 | 13.1 | 13.2 | 13.4 | 12.5 | | E.2.2.1 IIP - Manufacture of food products | | | 36.3 | 36.3 | 35.9 | 35.9 | 36.6 | 37.6 | 38.5 | 39.3 | 36.7 | | E.2.2.2 IIP - Manufacture of beverages | | | 55.3 | 54.4 | 51.3 | 46.0 | 39.7 | 35.3 | 32.9 | 33.4 | 44.5 | | E.2.2.3 IIP - Manufacture of textiles | | | 8.9 | 8.5 | 7.5 | 6.4 | 5.2 | 5.2 | 5.5 | 5.7 | 6.4 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | | | 11.1 | 10.8 | 10.6 | 10.9 | 11.7 | 12.3 | 12.6 | 12.7 | 10.9 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | | | 13.5 | 13.9 | 14.6 | 15.6 | 16.2 | 16.6 | 16.5 | 16.4 | 15.3 | | E.2.3 IIP - Electricity | 11.3 | 10.7 | 11.2 | 12.0 | 13.1 | 14.2 | 15.5 | 16.7 | 17.9 | 18.4 | 13.0 | | E.3 Cement Production | 23.3 | 23.9 | 23.6 | 23.3 | 22.1 | 21.4 | 20.9 | 21.1 | 21.5 | 22.0 | 22.4 | | E.4 Steel Production | 10.3 | 10.0 | 10.1 | 10.1 | 9.8 | 9.6 | 10.0 | 10.6 | 11.2 | 11.6 | 10.0 | | E.5 Coal Production | 54.6 | 55.2 | 55.1 | 55.0 | 55.4 | 56.6 | 59.1 | 62.4 | 65.3 | 67.1 | 56.8 | | E.6 Crude Oil Production | 10.2 | 10.4 | 10.4 | 10.4 | 10.4 | 10.4 | 10.5 | 10.6 | 10.7 | 10.8 | 10.4 | | E.7 Petroleum Refinery Production | 9.3 | 9.9 | 10.4 | 10.6 | 10.2 | 9.7 | 9.5 | 9.5 | 9.1 | 8.8 | 9.5 | | E.8 Fertiliser Production | 26.7 | 27.0 | 27.4 | 27.3 | 26.4 | 24.6 | 22.8 | 21.9 | 21.4 | 21.9 | 25.1 | | E.9 Natural Gas Production | 11.1 | 10.9 | 10.7 | 10.9 | 10.9 | 11.0 | 10.9 | 10.6 | 10.5 | 10.7 | 10.7 | | Service Sector Indicators (6 series) | | F.1 Production of Commercial Motor Vehicles | 28.6 | 28.7 | 25.6 | 24.0 | 24.1 | 25.8 | 25.9 | 26.2 | 26.1 | 27.5 | 24.7 | | F.2 Cargo handled at Major Ports | 15.9 | 15.9 | 14.8 | 14.6 | 14.8 | 15.3 | 15.6 | 15.7 | 15.5 | 15.4 | 15.4 | | F.3 Railway Freight Traffic | 20.6 | 20.6 | 19.3 | 18.8 | 18.3 | 18.4 | 19.1 | 20.3 | 21.3 | 22.0 | 19.7 | | F.4 Sales of Commercial Motor Vehicles | 41.8 | 41.7 | 40.7 | 41.3 | 41.9 | 43.2 | 44.7 | 46.9 | 48.5 | 49.9 | 43.3 | | F.5 Passenger flown (Km) - Domestic | 25.8 | 25.8 | 24.1 | 22.1 | 19.7 | 17.3 | 15.1 | 13.6 | 12.7 | 12.4 | 20.1 | | F.6 Passenger flown (Km) - International | 15.2 | 16.1 | 16.9 | 18.1 | 18.8 | 19.5 | 20.0 | 20.8 | 21.3 | 22.1 | 17.9 | | Merchandise Trade (3 series) | | G.1 Exports | 21.9 | 21.9 | 20.9 | 19.6 | 17.8 | 16.4 | 15.6 | 16.5 | 17.3 | 17.6 | 18.8 | | G.2 Imports | 14.2 | 12.8 | 11.7 | 11.4 | 12.4 | 12.7 | 12.3 | 11.4 | 10.8 | 10.7 | 11.8 | | G.3 Non-Oil Non-Gold Imports | 12.7 | 11.6 | 12.1 | 12.3 | 12.7 | 13.3 | 13.9 | 14.3 | 14.6 | 14.6 | 12.8 | | Alternate modes of Payment (4 series) | | RTGS | 26.9 | 34.8 | 39.9 | 42.6 | 44.5 | 44.5 | 42.5 | 40.2 | 38.4 | 36.9 | 36.8 | | Paper Clearing | 25.2 | 25.7 | 25.3 | 24.3 | 22.9 | 21.9 | 21.3 | 21.3 | 21.5 | 21.8 | 23.4 | | REC | 23.3 | 29.1 | 33.7 | 35.9 | 36.5 | 36.1 | 34.8 | 33.2 | 31.7 | 30.6 | 31.1 | | Cards | 14.3 | 14.0 | 13.3 | 12.6 | 12.5 | 12.6 | 12.8 | 13.0 | 12.9 | 12.9 | 13.2 | Note:

1. Seasonal adjustment for these series is based on 10 years’ data depending on availability. Guidelines of both the Office of National Statistics (ONS), UK, and the US Census Bureau, however, suggest using more than ten years’ data for estimating stable monthly seasonal factors.

2. Average seasonal factor range is the range of average seasonal factors for last ten years; range is calculated as the difference between maximum and minimum of monthly seasonal factors. |

| Table 5: Change in Seasonal Peaks and Troughs in 2019-20 vis-à-vis previous 5-years (2014-15 to 2018-19) (Contd.) | | Series | Based on SF of 2014-15 to 2018-19 | Based on SF of 2019-20 | | Peak Month | Peak Value | Trough Month | Trough Value | Peak Month | Peak Value | Trough Month | Trough Value | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | Apr | 101.1 | Dec | 99.2 | Apr | 101.1 | Dec | 99.0 | | A.1.1.1 Net Bank Credit to Government | Jul | 101.7 | Mar | 98.0 | Aug | 101.7 | Mar | 97.7 | | A.1.1.2 Bank Credit to Commercial Sector | Mar | 102.0 | Aug | 99.1 | Mar | 102.2 | Aug | 99.0 | | A.1.2 Narrow Money (M1) | Mar | 104.3 | Jan | 98.3 | Mar | 105.8 | Dec | 97.6 | | A.1.3 Reserve Money (RM) | Mar | 103.6 | Oct | 98.4 | Mar | 103.1 | Nov | 98.4 | | A.1.3.1 Currency in Circulation | May | 102.8 | Sep | 98.0 | May | 102.8 | Sep | 97.8 | | A.2.1 Aggregate Deposits (SCBs) | Mar | 101.0 | Feb | 99.3 | Mar | 101.2 | Feb | 99.3 | | A.2.1.1 Demand Deposits (SCBs) | Mar | 108.3 | Jan | 96.9 | Mar | 111.4 | Jan | 96.3 | | A.2.1.2 Time Deposits (SCBs) | Apr | 100.5 | Feb | 99.6 | Apr | 100.3 | Dec | 99.6 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | Dec | 102.3 | Jan | 97.6 | Mar | 104.1 | Jul | 98.0 | | A.3.2 Bank Credit (SCBs) | Mar | 102.1 | Aug | 99.1 | Mar | 102.2 | Aug | 99.0 | | A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs) | Mar | 101.9 | Aug | 99.0 | Mar | 102.3 | Aug | 98.8 | | A.3.2.2 Non-Food Credit (SCBs) | Mar | 102.4 | Aug | 99.0 | Mar | 102.8 | Aug | 98.9 | | A.3.3 Investments (SCBs) | Aug | 101.2 | Mar | 97.7 | Aug | 101.3 | Mar | 98.0 | | Price Indices [CPI: 21 series and WPI: 9 series] | | B. CPI (Base: 2012 = 100) All Commodities | Oct | 100.9 | Mar | 99.1 | Nov | 100.8 | Mar | 99.1 | | B.1 CPI - Food and beverages | Aug | 101.7 | Mar | 98.0 | Nov | 101.7 | Mar | 98.0 | | B.1 .1 CPI - Cereals and products | Nov | 100.3 | May | 99.6 | Nov | 100.3 | May | 99.7 | | B.1 .2 CPI - Meat and fish | Jul | 102.0 | Nov | 98.9 | Jun | 102.1 | Oct | 98.8 | | B.1 .3 CPI - Egg | Jan | 103.3 | May | 97.0 | Jan | 103.1 | May | 97.1 | | B.1 .4 CPI - Milk and products | Nov | 100.2 | Apr | 99.7 | Oct | 100.1 | Apr | 99.8 | | B.1 .5 CPI - Fruits | Jul | 103.0 | Feb | 96.7 | Jul | 102.9 | Jan | 96.4 | | B.1 .6 CPI - Vegetables | Oct | 110.7 | Mar | 88.5 | Nov | 111.3 | Mar | 89.0 | | B.1 .6.1 CPI - Potato | Nov | 115.2 | Feb | 80.5 | Nov | 113.6 | Feb | 82.7 | | B.1 .6.2 CPI - Onion | Nov | 119.5 | May | 81.3 | Nov | 122.9 | May | 83.8 | | B.1 .6.3 CPI - Tomato | Jul | 139.4 | Feb | 73.0 | Jul | 140.7 | Feb | 73.2 | | B.1 .7 CPI - Pulses and products | Nov | 101.7 | Apr | 98.4 | Sep | 101.0 | Apr | 98.6 | | B.1 .8 CPI - Spices | Dec | 100.5 | Apr | 99.4 | Dec | 100.5 | Apr | 99.6 | | B.1 .9 CPI - Non-alcoholic beverages | Sep | 100.1 | Mar | 99.8 | Aug | 100.1 | Mar | 99.9 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | Nov | 100.2 | May | 99.8 | Nov | 100.2 | Jun | 99.9 | | B.2 CPI - Clothing and footwear | Dec | 100.2 | May | 99.8 | Dec | 100.2 | Mar | 99.9 | | B.3 CPI - Housing | Nov | 100.4 | Jun | 99.2 | Nov | 100.4 | Jun | 99.1 | | B.4 CPI - Miscellaneous | Sep | 100.2 | Apr | 99.8 | Nov | 100.2 | Jun | 99.8 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | Aug | 101.2 | Mar | 98.8 | Aug | 101.2 | Mar | 98.9 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | Nov | 100.9 | Apr | 98.9 | Dec | 100.7 | Apr | 99.1 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | Nov | 100.9 | Apr | 98.9 | Dec | 100.7 | Apr | 99.1 | | D. WPI (Base: 2011-12=100) All Commodities | Aug | 100.3 | Mar | 99.7 | Aug | 100.4 | Feb | 99.6 | | D.1 WPI - PRIMARY ARTICLES | Oct | 100.6 | Mar | 99.2 | Nov | 100.7 | Mar | 99.3 | | D.1.1 WPI - Food Articles | Aug | 102.1 | Mar | 97.4 | Nov | 101.9 | Mar | 97.4 | | D.2 WPI - FUEL & POWER | Oct | 109.2 | Mar | 87.6 | Nov | 110.6 | Mar | 87.3 | | D.3 WPI - MANUFACTURED PRODUCTS | Oct | 102.2 | Mar | 96.8 | Nov | 102.5 | Mar | 96.9 | | D.3.1 WPI - Manufacture of Food Products | Nov | 100.9 | Apr | 98.8 | Nov | 100.8 | Apr | 98.9 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | Sep | 101.0 | Mar | 99.0 | Oct | 100.6 | Mar | 99.5 | | D.3.3 WPI - Manufacture of Basic Metals Alloys & Metals Products | Jan | 102.7 | Jun | 97.4 | Feb | 102.6 | Jun | 97.4 | | D.3.4 WPI - Manufacture of Machinery & Machine Tools | Oct | 103.4 | Apr | 97.1 | Nov | 102.4 | Apr | 97.6 |

| Table 5: Change in Seasonal Peaks and Troughs in 2019-20 vis-à-vis previous 5-years (2014-15 to 2018-19) (Concld.) | | Series | Based on SF of 2014-15 to 2018-19 | Based on SF of 2019-20 | | Peak Month | Peak Value | Trough Month | Trough Value | Peak Month | Peak Value | Trough Month | Trough Value | | Industrial Production (23 series) | | E. IIP (Base 2011-12 =A51:A72 100) General Index | Mar | 109.3 | Apr | 96.2 | Mar | 109.7 | Apr | 96.2 | | E.1.1 IIP - Primary goods | Mar | 108.9 | Sep | 94.9 | Mar | 109.3 | Sep | 94.8 | | E.1.2 IIP - Capital goods | Mar | 123.1 | Apr | 89.5 | Mar | 121.5 | Apr | 90.7 | | E.1.3 IIP - Intermediate goods | Mar | 107.8 | Feb | 97.7 | Mar | 108.3 | Apr | 97.5 | | E.1.4 IIP - Infrastructure/ construction goods | Mar | 107.5 | Nov | 94.5 | Mar | 108.9 | Sep | 94.7 | | E.1.5 IIP - Consumer goods | Mar | 105.7 | Apr | 95.4 | Mar | 105.5 | Jun | 94.9 | | E.1.5.1 IIP - Consumer durables | Oct | 107.3 | Apr | 96.1 | Oct | 105.8 | Feb | 96.2 | | E.1.5.2 IIP - Consumer non-durables | Mar | 108.1 | Apr | 94.4 | Dec | 107.9 | Jun | 92.7 | | E.2.1 IIP - Mining | Mar | 121.0 | Sep | 88.2 | Mar | 121.8 | Aug | 86.2 | | E.2.2 IIP - Manufacturing | Mar | 108.3 | Apr | 95.5 | Mar | 108.7 | Apr | 95.3 | | E.2.2.1 IIP - Manufacture of food products | Dec | 122.5 | Jun | 85.6 | Dec | 124.0 | Jun | 84.7 | | E.2.2.2 IIP - Manufacture of beverages | May | 127.7 | Nov | 87.0 | May | 122.3 | Oct | 88.9 | | E.2.2.3 IIP - Manufacture of textiles | Aug | 101.9 | Feb | 96.4 | Dec | 102.8 | Feb | 97.1 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | Mar | 105.4 | Feb | 93.9 | Mar | 107.0 | Feb | 94.4 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | Mar | 108.5 | Dec | 92.6 | Mar | 108.9 | Dec | 92.5 | | E.2.3 IIP - Electricity | May | 106.2 | Feb | 90.8 | May | 108.0 | Feb | 89.6 | | E.3 Cement Production | Mar | 111.9 | Aug | 90.5 | Mar | 112.1 | Aug | 90.1 | | E.4 Steel Production | Mar | 106.7 | Nov | 96.6 | Mar | 108.5 | Sep | 96.9 | | E.5 Coal Production | Mar | 140.1 | Aug | 80.3 | Mar | 144.4 | Aug | 77.3 | | E.6 Crude Oil Production | Mar | 102.7 | Feb | 92.2 | Mar | 103.0 | Feb | 92.1 | | E.7 Petroleum Refinery Production | Mar | 104.4 | Feb | 94.9 | Mar | 103.6 | Feb | 94.8 | | E.8 Fertiliser Production | Oct | 106.3 | Apr | 83.0 | Dec | 105.1 | Apr | 83.3 | | E.9 Natural Gas Production | Oct | 102.7 | Feb | 92.0 | Dec | 103.2 | Feb | 92.6 | | Service Sector Indicators (6 series) | | F.1 Production of Commercial Motor Vehicles | Mar | 116.5 | Dec | 90.9 | Mar | 118.5 | Aug | 91.0 | | F.2 Cargo handled at Major Ports | Mar | 108.9 | Sep | 93.5 | Mar | 108.8 | Sep | 93.4 | | F.3 Railway Freight Traffic | Mar | 113.3 | Sep | 93.8 | Mar | 114.7 | Sep | 92.7 | | F.4 Sales of Commercial Motor Vehicles | Mar | 131.6 | Apr | 86.6 | Mar | 134.9 | Apr | 85.0 | | F.5 Passenger flown (Km) - Domestic | May | 108.7 | Sep | 93.0 | May | 106.7 | Sep | 94.3 | | F.6 Passenger flown (Km) - International | Jan | 112.6 | Sep | 92.6 | Jan | 114.4 | Sep | 92.4 | | Merchandise Trade (3 series) | | G.1 Exports | Mar | 112.8 | Nov | 96.4 | Mar | 113.4 | Jul | 95.8 | | G.2 Imports | Mar | 104.8 | Feb | 92.9 | Mar | 103.7 | Feb | 92.9 | | G.3 Non-Oil Non-Gold Imports | Dec | 104.9 | Feb | 91.1 | Dec | 104.7 | Feb | 90.1 | | Alternate modes of Payment (4 series) | | H.1 RTGS | Mar | 129.9 | Feb | 87.9 | Mar | 125.4 | Feb | 88.4 | | H.2 Paper Clearing | Mar | 115.4 | Sep | 93.6 | Mar | 115.0 | Sep | 93.3 | | H.3 REC | Mar | 125.8 | Nov | 91.4 | Mar | 123.9 | Nov | 93.3 | | H.4 Cards | Oct | 105.4 | Feb | 92.6 | Oct | 106.2 | Feb | 93.4 |

| Table 6: Change in Seasonal Variation in 2019-20 vis-à-vis previous 5-years (2014-15 to 2018-19) | | Name of Variable | 2019-20 | Average Range* | Change | Name of Variable | 2019-20 | Average Range* | Change | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | Monetary and Banking Indicators (14 serties) | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 1.1 | 2.0 | -0.9 | | A.1.1 Broad Money (M3) | 2.1 | 2.0 | 0.2 | | A.1.1.1 Net Bank Credit to Government | 3.9 | 3.7 | 0.3 | D.3.3 WPI - Manufacture of Basic Metals Alloys & Metals Products | 5.3 | 5.3 | 0.0 | | A.1.1.2 Bank Credit to Commercial Sector | 3.2 | 2.9 | 0.2 | | D.3.4 WPI - Manufacture of Machinery & Machine Tools | 4.8 | 6.3 | -1.5 | | A.1.2 Narrow Money (M1) | 8.2 | 6.0 | 2.3 | | A.1.3 Reserve Money (RM) | 4.7 | 5.2 | -0.5 | | Industrial Production (23 series) | | A.1.3.1 Currency in Circulation | 4.9 | 4.7 | 0.2 | | E. IIP (Base 2011-12 = 100) General Index | 13.5 | 13.1 | 0.5 | | A.2.1 Aggregate Deposits (SCBs) | 2.0 | 1.6 | 0.3 | | E.1.1 IIP - Primary goods | 14.5 | 14.0 | 0.5 | | A.2.1.1 Demand Deposits (SCBs) | 15.1 | 11.4 | 3.8 | | E.1.2 IIP - Capital goods | 30.8 | 33.6 | -2.8 | | A.2.1.2 Time Deposits (SCBs) | 0.8 | 0.9 | -0.2 | | E.1.3 IIP - Intermediate goods | 10.8 | 10.1 | 0.7 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 6.1 | 4.7 | 1.3 | | E.1.4 IIP - Infrastructure/ construction goods | 14.2 | 13.0 | 1.2 | | E.1.5 IIP - Consumer goods | 10.6 | 10.4 | 0.2 | | A.3.2 Bank Credit (SCBs) | 3.2 | 3.0 | 0.2 | | E.1.5.1 IIP - Consumer durables | 9.6 | 11.2 | -1.6 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 3.5 | 2.9 | 0.5 | | E.1.5.2 IIP - Consumer non-durables | 15.3 | 13.7 | 1.6 | | A.3.2.2 Non-Food Credit (SCBs) | 3.9 | 3.4 | 0.5 | E.2.1 IIP - Mining | 35.6 | 32.9 | 2.7 | | A.3.3 Investments (SCBs) | 3.3 | 3.5 | -0.2 | E.2.2 IIP - Manufacturing | 13.4 | 12.8 | 0.6 | | Price Indices[CPI: 21 series and WPI: 9 series] | E.2.2.1 IIP - Manufacture of food products | 39.3 | 36.9 | 2.4 | | B. CPI (Base: 2012 = 100) All Commodities | 1.7 | 1.8 | -0.1 | E.2.2.2 IIP - Manufacture of beverages | 33.4 | 40.7 | -7.3 | | B.1 CPI - Food and beverages | 3.7 | 3.8 | -0.1 | E.2.2.3 IIP - Manufacture of textiles | 5.7 | 5.5 | 0.2 | | B.1 .1 CPI - Cereals and products | 0.6 | 0.7 | -0.1 | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 12.7 | 11.5 | 1.2 | | B.1 .2 CPI - Meat and fish | 3.3 | 3.1 | 0.2 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 16.4 | 15.9 | 0.5 | | B.1 .3 CPI - Egg | 5.9 | 6.3 | -0.3 | | B.1 .4 CPI - Milk and products | 0.3 | 0.5 | -0.1 | | E.2.3 IIP - Electricity | 18.4 | 15.5 | 2.9 | | B.1 .5 CPI - Fruits | 6.5 | 6.3 | 0.3 | | E.3 Cement Production | 22.0 | 21.4 | 0.6 | | B.1 .6 CPI - Vegetables | 22.3 | 22.2 | 0.1 | | E.4 Steel Production | 11.6 | 10.1 | 1.6 | | B.1 .6.1 CPI - Potato | 30.8 | 34.7 | -3.8 | | E.5 Coal Production | 67.1 | 59.8 | 7.4 | | B.1 .6.2 CPI - Onion | 39.1 | 38.2 | 0.9 | | E.6 Crude Oil Production | 10.8 | 10.5 | 0.3 | | B.1 .6.3 CPI - Tomato | 67.5 | 66.5 | 1.0 | | E.7 Petroleum Refinery Production | 8.8 | 9.5 | -0.6 | | B.1 .7 CPI - Pulses and products | 2.5 | 3.3 | -0.9 | | E.8 Fertiliser Production | 21.9 | 23.3 | -1.5 | | B.1 .8 CPI - Spices | 0.8 | 1.1 | -0.3 | | E.9 Natural Gas Production | 10.7 | 10.7 | -0.1 | | B.1 .9 CPI - Non-alcoholic beverages | 0.2 | 0.3 | -0.1 | | Service sector Indicators (6 series) | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 0.4 | 0.5 | -0.1 | | F.1 Production of Commercial Motor Vehicles | 27.5 | 25.6 | 2.0 | | B.2 CPI - Clothing and footwear | 0.3 | 0.4 | -0.1 | | F.2 Cargo handled at Major Ports | 15.4 | 15.4 | 0.0 | | B.3 CPI - Housing | 1.3 | 1.2 | 0.1 | | F.3 Railway Freight Traffic | 22.0 | 19.5 | 2.5 | | B.4 CPI - Miscellaneous | 0.3 | 0.4 | -0.1 | | F.4 Sales of Commercial Motor Vehicles | 49.9 | 45.0 | 4.9 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 2.3 | 2.4 | -0.1 | | F.5 Passenger flown (Km) - Domestic | 12.4 | 15.7 | -3.3 | | F.6 Passenger flown (Km) - International | 22.1 | 20.1 | 2.0 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 1.6 | 2.0 | -0.3 | | Merchandise Trade (3 series) | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 1.6 | 1.9 | -0.3 | G.1 Exports | 17.6 | 16.4 | 1.2 | | G.2 Imports | 10.7 | 11.9 | -1.2 | | D. WPI (Base: 2011-12=100) All Commodities | 0.8 | 0.7 | 0.2 | G.3 Non-Oil Non-Gold Imports | 14.6 | 13.8 | 0.8 | | D.1 WPI - PRIMARY ARTICLES | 1.4 | 1.4 | 0.0 | Alternate modes of Payment (4 series) | | D.1.1 WPI - Food Articles | 4.5 | 4.8 | -0.3 | H.1 RTGS | 36.9 | 42.0 | -5.0 | | D.2 WPI - FUEL & POWER | 23.3 | 21.7 | 1.6 | H.2 Paper Clearing | 21.8 | 21.8 | 0.0 | | D.3 WPI - MANUFACTURED PRODUCTS | 5.6 | 5.4 | 0.2 | H.3 REC | 30.6 | 34.5 | -3.9 | | D.3.1 WPI - Manufacture of Food Products | 1.9 | 2.2 | -0.2 | H.4 Cards | 12.9 | 12.8 | 0.1 | | *Average Range of Monthly Seasonal Factors of 5 year ending 2018-19. |

| Table 7: List of Top-Twenty and Bottom-Twenty Series Based on Average Range of Monthly Seasonal Factors During Last Five Years (2015-16 to 2019-20) and Corresponding Peak and Trough Months | | Name of Top-Twenty Series | Average Range | Peak Month | Trough Month | | 1 | 2 | 3 | 4 | | B.1 .6.3 CPI - Tomato | 65.6 | Jul | Feb | | E.5 Coal Production | 56.8 | Mar | Aug | | E.2.2.2 IIP - Manufacture of beverages | 44.5 | May | Aug | | F.4 Sales of Commercial Motor Vehicles | 43.3 | Mar | Apr | | B.1 .6.2 CPI - Onion | 40.4 | Nov | May | | H.1 RTGS | 36.8 | Mar | Feb | | E.2.2.1 IIP - Manufacture of food products | 36.7 | Dec | Jun | | B.1 .6.1 CPI - Potato | 35.6 | Nov | Feb | | E.1.2 IIP - Capital goods | 35.1 | Mar | Apr | | H.3 REC | 31.1 | Mar | Nov | | E.2.1 IIP - Mining | 30.8 | Mar | Sep | | E.8 Fertiliser Production | 25.1 | Oct | Apr | | F.1 Production of Commercial Motor Vehicles | 24.7 | Mar | Jun | | H.2 Paper Clearing | 23.4 | Mar | Sep | | B.1 .6 CPI - Vegetables | 23.0 | Oct | Mar | | E.3 Cement Production | 22.4 | Mar | Aug | | F.5 Passenger flown (Km) - Domestic | 20.1 | May | Sep | | F.3 Railway Freight Traffic | 19.7 | Mar | Sep | | D.2 WPI - FUEL & POWER | 19.4 | Nov | Feb | | G.1 Exports | 18.8 | Mar | Nov | | B.1 .9 CPI - Non-alcoholic beverages | 0.3 | Sep | Mar | | B.2 CPI - Clothing and footwear | 0.5 | Dec | Jun | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 0.6 | Nov | May | | B.4 CPI - Miscellaneous | 0.6 | Sep | Apr | | B.1 .4 CPI - Milk and products | 0.6 | Nov | Apr | | B.1 .1 CPI - Cereals and products | 0.7 | Oct | May | | D. WPI (Base: 2011-12=100) All Commodities | 0.7 | Oct | Mar | | B.3 CPI - Housing | 1.2 | Jan | Jun | | B.1 .8 CPI - Spices | 1.3 | Dec | Apr | | A.2.1.2 Time Deposits (SCBs) | 1.3 | Apr | Dec | | B.1 WPI - Primary Articles | 1.3 | Sep | Feb | | A.2.1 Aggregate Deposits (SCBs) | 1.5 | Apr | Dec | | B. CPI (Base: 2012 = 100) All Commodities | 2.0 | Oct | Mar | | C.3 Consumer Price Index for Rural Labourers (Base: 198687=100) | 2.0 | Nov | Apr | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 2.0 | Nov | Apr | | A.1.1 Broad Money (M3) | 2.0 | Apr | Dec | | D.3.1 WPI - Manufacture of Food Products | 2.2 | Nov | Apr | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 2.2 | Nov | Apr | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 2.3 | Oct | Mar | | A.3.3.1 Loans, Cash, Credits and Overdrafts (SCBs) | 3.1 | Mar | Aug |

|

IST,

IST,