Union Budget 2009-10: Review and Assessment* The article undertakes a review and an assessment of the Union Budget 2009-10. The revised estimates of the finances of the Central Government during 2008-09 placed key deficit indicators, viz., revenue deficit and fiscal deficit in relation to GDP substantially higher than the budget estimates. This was mainly on account of deceleration in tax revenue due to moderation in growth rate coupled with tax cuts and higher expenditure to provide a stimulus to the economy in the aftermath of the global financial crisis. With the fiscal stimulus being sustained, the key deficit indicators are slated to widen further during 2009-10. However, the deviation in the key deficit indicators from those mandated under FRBM rules are considered temporary and the Government reiterated its intention to revert back to the path of fiscal consolidation as soon as the negative effects of global financial crisis on growth have been overcome. As a medium-term objective, it has been proposed to initiate institutional reforms encompassing all aspects of Budget such as subsidies, taxes, expenditure and disinvestments. The Union Budget 2009-10 was presented in the backdrop of moderation of growth in the Indian economy and signs of stabilisation in the rate of decline in the global economy. The Budget has aimed to address three important challenges in the short and medium-term, viz., revive the economy to attain a growth of 9.0 per cent per annum at the earliest, deepen and broaden the agenda for inclusive development and re-energise Government and improve delivery mechanisms. The Budget has envisaged a higher allocation for the crucial sectors such as infrastructure in rural and urban areas, education and health, rural employment and empowerment of different segments of population. On taxation front, the changes in the taxes have been envisaged both in direct and indirect taxes to address the concerns of growth and employment. The Budget has emphasised the need to revert back to the path of fiscal consolidation as soon as possible so as to attain sustainability of the finances of the Government in the medium-term. In order to accomplish this, the Government has recognised the importance of institutional reforms encompassing all aspects of the budget such as subsidies, taxes, expenditure and disinvestment.

Thrust of the Budget

Economic Revival, Inclusive Development and Building Accountable Institutions

In the Union Budget 2009-10, the Government has attempted to address three important challenges facing the economy, viz., economic revival, inclusive development and building accountable institutions. To arrest the fall in growth rate in the short-term and sustain it at 9 per cent in the medium-term, the Budget has adopted an expansionary fiscal policy in the short-run. To make development more inclusive there has been substantial increase in the allocation for sectors such as rural employment, health and education. In addition, the Union Budget 2009-10 has for the first time called for creating entitlements backed by legal guarantee to provide basic amenities and opportunities for livelihood to vulnerable sections of society. The Government has also recognised the importance of accountability, transparency and delivery mechanisms of development programmes for high growth and inclusive development.

Fiscal Consolidation

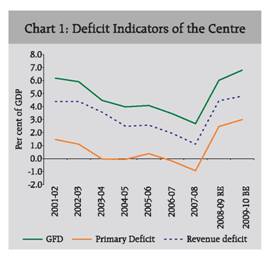

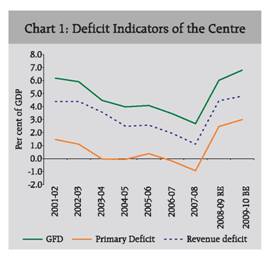

There was substantial deviation from the path of fiscal consolidation in the 2008-09 with key deficit indicators, viz., revenue deficit (RD) and gross fiscal deficit (GFD) turning out to be much higher than the budget estimates. This was on account of economic slowdown, fiscal stimulus measures in terms of tax cuts and additional expenditure to support economic growth. As a result, fiscal deficit increased from 2.7 per cent in 2007-08 to 6.2 per cent of GDP in 2008-09 (provisional accounts). The Central Government has continued to place emphasis on revival of the economy by persisting with fiscal stimulus measures through tax cuts and higher expenditure in 2009-10 as well. Accordingly, the gross fiscal deficit for 2009-10 has been budgeted higher at 6.8 per cent of GDP. However, the Government intends to revert back to the path of fiscal consolidation at the earliest possible. In this context, it has proposed to initiate institutional reform measures in all aspect of the budget such as subsidies, taxes, expenditure and disinvestment. Further, the Thirteenth Finance Commission (ThFC), through an additional Terms of Reference, has been mandated to review the fiscal adjustment and suggest a revised roadmap to maintain the gains from fiscal consolidation through 2010 to 2015. The ThFC has been asked to particularly keep in view the need to bring in the liabilities of the Central Government on account of oil, food and fertiliser bonds into the fiscal accounting, and the impact of various other obligations of the Central Government on the deficit targets. In the medium-term fiscal policy statement, the targets of fiscal deficit during 2010-11 and 2011-12 have been set at 5.5 per cent and 4.0 per cent, respectively.

Tax Proposals

The tax proposals announced in the Budget are in line with broad objectives of taxation policy such as elimination of distortions in the tax structure, moderate levels of taxation and expansion of tax base, rationalisation and simplification of tax structure followed in recent years. Accordingly, the threshold exemption limits on personal income tax (PIT) has been enhanced and surcharge on PIT removed to rationalise the income tax structure. On the indirect tax front, the aim has been to integrate tax on goods (CENVAT) and tax on services and finally move towards Goods and Service Tax (GST) by April 1, 2010. As a part of this initiative, the excise duty rate has been increased from 4 per cent to 8 per cent on certain finished goods and consumer goods to converge it to the mean CENVAT rate. The reduction in excise rate announced on two occasions, from 14 per cent to 10 per cent and from 10 per cent to 8 per cent, to support the manufacturing sector as part of fiscal stimulus was kept unchanged. It has proposed to increase the revenue from service tax by adding four more services under the service tax. Other initiatives included the provision of quality services to taxpayers by re-engineering business processes in the Income- tax department through extensive use of modern technology such as use of e-filling of returns, e-payment of taxes, establishment of a Centralised Processing Centre, issue of refunds through ECS and refund bankers, computer aided selection of cases for scrutiny and effective taxpayer information system. Thus, the strategy of tax policy has aimed to improve voluntary compliance and efficiency of tax administration by using the latest information technology tools.

Against the above backdrop, this article makes an assessment of the Union Budget 2009-10. Section I presents the major policy initiatives announced. The tax proposals announced in the Budget are discussed in Section II. The budgetary outcome in the revised estimates for 2008-09 is discussed in the Section III. Section IV presents an analysis of budget estimates for 2009-10. Section V provides an assessment of the Budget followed by conclusion. Section I

Major Policy Initiatives The major policy announcements in the Budget for 2009-10 are aimed at bringing economy back to the high growth path of 9.0 per cent at the earliest while ensuring inclusive growth and re-energise the Government and improve delivery mechanisms. Towards the objective of economic revival, the Budget has announced several short and medium-term measures for development of infrastructure, agriculture, restoration of export growth, containment of subsidies, improvement in financial access and deepening of markets and improve investment environment. In order to make growth process more inclusive, the allocation of resources for programmes such as National Rural Employment Guarnatee Scheme (NREGS), Bharat Nirman and Pradhan Mantri Gram Sadak Yojana (PMGSY) were substantially enhanced and various schemes were also announced to empower the weaker sections. Measures were also announced to improve the public delivery system and national security.

I.1. Agriculture and Rural Development

Agriculture sector continued to be a priority in the Budget for the purpose of growth and stability. The major thrust areas for sustaining a growth rate of 4 per cent in the sector included: credit, capital formation, debt waiver, debt relief, irrigation and rural infrastructure. a) Agriculture Credit, Debt Waiver and Debt Relief: The targeted credit to agriculture for 2009-10 has been placed at Rs. 3,25,000 crore as against the credit flow of Rs.2,87,000 crore in 2008-09. In order to enable the achievement of the target, the interest subvention scheme for short-term crop loans to farmers for loans up to Rs.3 lakh per farmer at interest rate of 7 per cent per annum was proposed to be continued. An additional subvention of 1 per cent amounting to Rs.411 crore has been provided to those farmers who pay short-term crop loans on schedule. The time given to farmers with more than two hectares of land to pay 75 per cent of their overdues by June 30, 2009 under Agriculture Debt Waiver and Debt Relief Scheme (2008) has been extended to December 31, 2009.

b) Irrigation: The allocation under Accelerated Irrigation Benefit Programme (AIBP) has been increased by 75 per cent over the Interim Budget. Rashtriya Krishi Vikas Yojna (RKVY) has been initiated to increase public investment in agriculture and allied activities like agricultural marketing, agricultural research and education, soil and water conservation agriculture by providing incentive to States. The allocation under the scheme has been raised by 30 per cent over 2008-09 BE.

c) Rural Infrastructure: The progress made in attaining the targets for building rural infrastructure under Bharat Nirman for provision of irrigation, water supply, roads, houses, electrification and telephone facilities in the villages during 2008-09 had been impressive. The allocation for Bharat Nirman has been increased by 45 per cent in 2009-10 over 2008-09 BE. The allocation for the Pradhan Mantri Gram Sadak Yojana (PMGSY) under Bharat Nirman has been increased by 59 per cent in 2009-10 over 2008-09 BE to Rs 12,000 crore. The allocation for the Indira Awaas Yojana (IAY) has been increased by 63 per cent to Rs.8,800 crore in 2009-10 BE. To boost the resource base of Rural Housing Fund of National Housing Bank (NHB) for their refinance operations in rural housing sector, an allocation of Rs.2,000 crore has also been proposed from the shortfall in the priority sector lending of commercial banks.

I.2 Industry and Services

a) Restoring Export Growth: To provide assistance to the exporters to help them overcome the negative fallout of global economic crisis, an adjustment assistance scheme to provide enhanced Export Credit and Guarantee Corporation to badly hit sectors initiated in December 2008 has been extended up to March 2010. The allocation under the Market Development Assistance Scheme which provides support to exporters in developing new markets has been enhanced by 148 per cent over 2008-09 BE to Rs.124 crore. In order to protect the employment-oriented sectors from the global meltdown, the deadline for interest subvention on pre-shipment credit for seven employment oriented sectors has been extended from September 30, 2009 to March 31, 2010.

b) Micro, Small and Medium Enterprises: A special fund of Rs.4,000 crore has been proposed to be provided to Small Industries Development Bank of India (SIDBI) out of Rural Infrastructure Development Fund (RIDF). This fund would incentivise Banks and State Finance Corporations (SFCs) to lend to Micro and Small Enterprises (MSEs) by refinancing 50 per cent of incremental lending to MSEs during 2009-10. I.3 Physical Infrastructure The Budget continued to take measures for the expansion of infrastructure which is vital for growth. In order to ensure that the infrastructure projects do not face financing difficulties, India Infrastructure Finance Company Limited (IIFCL) would refinance 60 per cent of the commercial bank loans for public private partnership (PPP) projects in critical sectors over the next fifteen to eighteen months. The IIFCL and Banks would be able to support a total investment of Rs.100,000 crore in infrastructure.

The allocation to National Highways Authority of India (NHAI) for National Highway Development Programme (NHDP) has been hiked by 23.0 per cent over 2008-09 (BE) while that of Railways by about 46.0 per cent over the Interim Budget 2009-10. The allocation under the Accelerated Power Development and Reform Programme (APDRP) has been increased to Rs.2,080 crore over 2008-09 (BE) to bridge the gap between demand and supply of power. The allocation under Jawaharlal Nehru National Urban Renewal Mission (JNNURM) has been increased by 87 per cent over 2008-09 (BE). The allocation for housing and basic amenities to the urban poor has also been enhanced to Rs 3,973 crore in the Budget 2009-10.

The indigenous production of natural gas is set to double with finding of natural gas in the KG Basin on the Eastern off-shore of the country. In the light of natural gas emerging as an important source of energy, to facilitate transportation of gas across the country, it has been proposed to develop a blueprint for long distance gas highways leading to National Gas Grid.

I.4 Social Infrastructure and Welfare Measures

The higher allocation for the development of social infrastructure are aimed to boost aggregate demand, generate employment and provide support to the vulnerable section of the society. In order to make growth inclusive, the outlays for flagship programmes relating to rural employment, education, health, water supply, women and child development and other welfare has been increased substantially.

a) Education and Health: The allocation for National Rural Health Mission (NRHM) has been increased by Rs 2,057 crore in the Budget over and above Rs.12,070 crore in the Interim Budget. It has been proposed to bring all BPL families under the Rashtriya Swasthya Bima Yojana (RSBY) operationlised in 2008 to empower poor families by giving the freedom of choice for using health care services from private hospital or government hospital. An allocation of Rs.350 crore has been earmarked for this scheme.

b) Employment Generation: The allocation for National Rural Employment Guarantee Act (NREGA) has been budgeted to increase by 144 per cent over 2008-09 (BE) at Rs.39,100 crore for the year 2009-10. In order to increase the productivity of assets and resources under NREGA, convergence with other schemes relating to agriculture, forests, water resources, land resources, and rural roads has been proposed. In the first stage, a total of 115 pilot districts have been selected for such convergence. It has been proposed to launch a new project for modernisation of the Employment Exchanges in public private partnership so that a job seeker can register on-line from anywhere and approach any employment exchange.

c) Other Welfare Measures: In order to enable students from economically weaker sections to access higher education, a scheme to provide full interest subsidy during the period under moratorium has been proposed. The scheme would cover loans taken by the students from scheduled banks to pursue any of the approved courses of study, in technical and professional streams, from recognised institutions in India. A new scheme called Pradhan Mantri Adarsh Gram Yojana (PMAGY) would be launched during 2009-10 on a pilot basis for the integrated development of 1000 villages (with scheduled castes population of above 50 per cent) with an allocation of Rs.100 crore. The Swarna Jayanti Gram Swarozgar Yojna (SGSY) would be restructured as National Rural Livelihood Mission to make it universal in coverage, focused in approach and time bound for poverty eradication by 2014-15. In addition to providing capital subsidy at an enhanced rate, it is proposed to provide interest subsidy to poor households for loans up to Rs. one lakh from banks. In the light of profound transformation brought about by Women’s Self Help Group in rural areas, it has been envisaged to enrol at least 50 per cent of all rural women in India as members of SHGs over the next five years and link these SHGs to banks. The corpus of Rashtriya Mahila Kosh (RMK), which has been the instrument of socio-economic development by facilitating the credit support or microfinance to poor women, would be increased from Rs.100 crore to Rs.500 crore over the next few years. With the objective to reduce the current level of female illiteracy by half in three years, the National Mission for Female Literacy with a focus on minorities, SC, ST and other marginalised groups has been launched. The draft Food Security Bill would be placed on the website of the Department of Food and Public Distribution for public debate and consultations.

1.5 Towards Building Accountable Institutions

A provision of Rs.120 crore has been made for the Unique Identification Authority of India (UIDAI) which was set up for improving governance with regard to delivery of public services.

1.6 Financial Sector

Financial Inclusion: To increase the level of financial inclusion for sustaining long-term equitable development, a subcommittee of State Level Bankers Committee (SLBC) would identify under-banked or un-banked areas and formulate an action plan for providing banking facilities to all these areas in the next 3 years. An amount of Rs.100 crore has been set aside during the current year as one-time grant-in-aid to ensure provision of at least one centre/Point of Sales (POS) for banking services in each of the unbanked blocks in the country. Section II

Tax Proposals The thrust of reforms over the last few years has been to improve the efficiency and equity of tax system. This is sought to be achieved by eliminating distortions in the tax structure, introducing moderate tax rates and expanding the base. As a result, the Centre’s tax- GDP ratio increased to 12.9 per cent in 2007-08 from a low of 9.2 per cent in 2003-04 before sliding to 11.8 per cent in 2008-09. The growth in tax revenue is mainly due to growth in direct tax revenue. Their share in Centre’s tax revenue has increased to 56 per cent in 2008-09 from 41 per cent in 2003-04 resulting in the enhancement of tax equity of tax system. The Income Tax Return Forms are proposed to be made simpler and user-friendly. The Government has proposed to pursue structural changes in direct taxes by releasing the new Direct Taxes Code on August 12, 2009 and also pursue structural changes in indirect taxes by accelerating the process for the smooth introduction of the Goods and Services Tax (GST) with effect from April 1, 2010. A unique computer based Document Identification Number for tracking taxpayer would be introduced to enhance transparency in the functioning of the tax administration. It has been proposed to merge the two Authorities for Advance Rulings on Direct and Indirect Taxes by amending the relevant Acts to further enhance efficiency in tax administration. The Union Budget has sought to provide quality services to taxpayers by re-engineering business processes in the Income-tax department through extensive use of modern technology such as use of e-filling of returns, e-payment of taxes, computer aided selection of cases for scrutiny. Overall, the direct tax measures for the Union Budget 2009-10 would be revenue neutral while indirect taxes would yield a net gain of Rs.2,000 crore. Detailed tax proposals are set out in Annex I. The major tax proposals in the Budget are as follows.

II.1 Direct Taxes

a) Personal Income Tax

Some relief has been provided to small and marginal taxpayers, women and senior citizens in the basic exemption limit. In case of senior citizens above 65 years of age, the exemption limit has been raised by Rs.15,000 to Rs.2,40,000. In the case of women and all other categories of individual taxpayers, the basic exemption limit has been raised by Rs.10,000 each to Rs.1,90,000 and Rs.1.60,000, respectively. The surcharge of 10 per cent on personal income tax has been eliminated. It has also been proposed to increase the deduction under section 80-DD in respect of maintenance, including medical treatment, of a dependent who is a person with severe disability to Rs.1,00,000 from the earlier limit of Rs.75,000.

b) Corporate Tax The corporate tax rates have been kept unchanged in the Budget 2009-10. The Minimum Alternate Tax (MAT) is levied on “Zero Tax Companies” who had book profits and declared dividends to the shareholders but who do not pay any income tax. In order to increase equity in taxation of corporate taxpayers and enhance tax revenue, MAT rate has been increased from 10 per cent of book profits to 15 per cent. However, to give relief to corporate tax payers, the period allowed to carry forward the tax credit under MAT has been extended from seven years to ten years.

Table 1: Income Tax Rates |

Up to Rs. 1,60,000/- |

Nil |

Rs. 1,60,001/- to Rs. 3,00,000 |

10 per cent |

Rs. 3,00,001/- to Rs. 5,00,000/- |

20 per cent |

Above Rs. 5,00,000/- |

30 per cent |

c) Other Taxes

The Fringe Benefit Tax imposed on the value of certain fringe benefits provided by employers to their employees has been abolished in order to reduce the compliance burden. The Commodity Transaction Tax has been also abolished. However, the Securities Transaction Tax (STT) has been kept unchanged.

With a view to tide over the slowdown in exports, the sun-set clauses for tax holiday have been extended by one more year, i.e., for the financial year 2010-11. It has also been proposed to extend the tax holiday under section 80-IB (9) of the Income Tax Act to natural gas sector to facilitate the energy security.

It has been proposed to reduce the distortionary impact of profit linked tax incentives by introducing investment-linked tax exemptions beginning with businesses of setting up and operating ‘cold chain’, warehousing facilities for storing agricultural produce and the business of laying and operating cross country natural gas or crude or petroleum oil pipeline network for distribution on common carrier principle.

In order to facilitate the business operations of all small taxpayers and reduce their compliance burden, it has been proposed to expand the scope of presumptive taxation to all small businesses with a turnover upto Rs.40 lakh. They would have the option to declare their income from business at the rate of 8 per cent of their turnover and simultaneously enjoy exemption from the compliance burden of maintaining books of accounts.

The tax treatment New Pension Scheme (NPS), an important social security system of Government, has been rationalised by exempting the income of the NPS Trust from income tax and any dividend paid to this Trust from Dividend Distribution Tax. All purchases and sales of equity shares and derivatives by the NPS Trust would also be exempted from the Securities Transaction Tax.

In order to incentivise the corporate sector to undertake research and development (R&D) work, it has been proposed to extend the scope of the current provision of weighted deduction of 150 per cent on expenditure incurred on in-house R&D to all manufacturing businesses except for a small negative list.

II.2 Indirect taxes

a) Goods and Services Tax

The dual GST model in which the Centre and the States would each legislate, levy and administer the Central GST and State GST, respectively will be introduced on April 01, 2010.

b) Customs duty

It has been proposed to impose a nominal basic customs duty of 5 per cent on Set Top Boxes to encourage domestic value addition. Since electronic hardware industry has a strong potential for employment especially in the SME sector, the basic customs duty on LCD panels has been reduced from 10 per cent to 5 per cent to support indigenous production. Full exemption from basic customs duty has been provided to rough corals for encouraging value-addition and export. The customs duty has been reduced to 5 per cent from 10 per cent in respect of influenza vaccine and nine specified life saving drugs used for the treatment of breast cancer, hepatitis-B, rheumatic arthritis etc., and on bulk drugs used for the manufacture of such drugs. These would also be totally exempted from excise duty and countervailing duty. On the other hand, customs duty has been increased from Rs. 100 to Rs.200 per ten grams for gold bars and from Rs. 250 to Rs. 500 per ten gram for other forms of gold (excluding jewellery). Customs duty on silver (excluding jewellery) has also been increased from Rs.500 per kg to Rs.1,000 per kg.

c) Excise duty

A differential in excise rates has been maintained between the cotton sector and the manmade fibres sector. It has been proposed to restore the erstwhile optional rate of 4 per cent for cotton textiles beyond the fibre stage. It has been proposed to restore the rate of 8 per cent central excise duty on manmade fibre and yarn on a mandatory basis and on stages beyond fibre and yarn at that rate on optional basis. The basic customs duty on wool waste and cotton waste was reduced to 10 per cent. For further convergence of central excise duty rates to a mean rate of 8 per cent, it has been proposed to increase the rate on many items. The petro-diesel blended with bio-diesel has been fully exempted from excise duty. In addition, it has been proposed to reduce basic customs duty on bio-diesel from 7.5 per cent to 2.5 per cent - at par with petro-diesel to encourage the use of environment friendly fuel.

It has been proposed to exempt the value attributable to the transfer of the right to use packaged software from excise duty and CVD. For construction industry, restoration of full exemption to goods manufactured at site, including pre-fabricated concrete slabs or blocks has been proposed. Excise duty on petrol driven trucks has been reduced from 20 per cent to 8 per cent.

d) Service Tax

The service tax has been kept unchanged at 10 per cent. Keeping in view the growing share of the services sector, four more services have been brought into services taxes net viz., (i) transportation of non-essential goods through railways, (ii) transportation of specified goods through coastal shipping and inland shipping, (iii) legal advice, consultancy or technical assistance provided by a corporate law firm to a corporate, and (iv) cosmetic and plastic surgery.

Services received by exporters from goods transport agents and commission agents, where the liability to pay service tax is ab initio on the exporter, has been exempted from service tax. For other services received by exporters, the exemption would be operated through the existing refund mechanism based on self-certification of the documents where such refund is below 0.25 per cent of fob value and certification of documents by a Chartered Accountant for value of refund exceeding the above limit. The Export Promotion Councils and the Federation of Indian Export Organisations (FIEO) are proposed to be exempted from the levy of service tax on the membership and other fees collected by them till March 31, 2010.

Section III

Revised Estimates 2008-091

III.1 Deficit Indicators

The revised estimates for 2008-09 showed marked deterioration in all the key deficit indicators viz., revenue deficit (RD), gross fiscal deficit (GFD) and primary deficit (PD), relative to GDP over their budgeted levels. The deterioration of the deficit indicators was due to marked deceleration in tax collection as a result of economic slowdown and cut in indirect tax rates on the one hand and substantial hike in expenditure, in particular revenue expenditure, to boost aggregate demand on the other.

The revenue receipts declined by Rs.40,762 crore (6.8 per cent) from the budgeted level while revenue expenditure increased by Rs.1,45,327 crore (22.1 per cent). As a result, RD in the 2008-09 RE at Rs.2,41,273 crore was higher than the BE by 337.2 per cent and constituted 4.4 per cent of the GDP as against the budgeted level of 1.0 per cent. Consequently, GFD was higher by Rs.1,93,228 crore (145.0 per cent) constituting 6.0 per cent of GDP as against the budgeted level of 2.5 per cent. Similarly, primary balance which was budgeted to be a surplus of 1.1 per cent of GDP, turned to a deficit of Rs.1,33,821 crore, constituting 2.5 per cent of GDP in 2008-09 (RE) (Table 2).

III.2 Revenue Receipts

Reflecting the impact of economic slowdown and reduction in tax rates as fiscal stimulus measures to contain the slowdown, the gross tax revenue in the revised estimates for 2008-09 at Rs.6,27,949 crore was lower by Rs.59,766 crore (8.7 per cent) than the budget estimates and constituted 11.6 per cent of GDP. The collections under all the major taxes declined significantly from the budgeted level. Only the recently introduced taxes such as service tax, banking cash transaction tax, fringe benefit tax, constituting a small proportion of the gross taxes, were higher than the budgeted level. Consequently, the net tax revenue [gross tax revenue less States’ share in Central taxes and amount transferred to National Calamity Contingency Fund (NCCF)] was 8.1 per cent lower than the budgeted amount. Non-tax revenue, however, was higher by 0.4 per cent than the budget estimates due to increase in ‘other non-tax revenue’ component (consisting of economic services, social services, etc) by 10.0 per cent. Other major components viz., dividends and profits and interest receipts, however, declined by Rs.3,468 crore and Rs.99 crore, respectively. Reflecting this, the revenue receipts (net) of the Centre in the revised estimated for 2008-09 at Rs.5,62,173 crore fell short of the budgeted level by 6.8 per cent.

Table 2: Major Fiscal Indicators- 2008-09(RE) versus 2008-09(BE) |

(Rupees crore) |

Item |

2008-09 (BE) |

2008-09(RE) |

Variation (3 over 2) |

1 |

2 |

3 |

4 |

5 |

1. |

Revenue Deficit (3-2) |

55,184 |

2,41,273 |

1,86,089 |

337.2 |

2. |

Revenue Receipts |

6,02,935 |

5,62,173 |

-40,762 |

6.8 |

|

i. Tax Revenue |

5,07,150 |

4,65,970 |

-41,180 |

-8.1 |

|

ii. Non-Tax Revenue |

95,785 |

96,203 |

418 |

0.4 |

3. |

Revenue Expenditure |

6,58,119 |

8,03,446 |

1,45,327 |

22.1 |

|

Of which: |

|

|

|

|

|

i. Subsidies |

71,431 |

1,29,243 |

57,812 |

80.9 |

|

ii. Interest Payments |

1,90,807 |

1,92,694 |

1,887 |

1.0 |

4. |

Gross Fiscal Deficit (1-5+6+7) |

1,33,287 |

3,26,515 |

1,93,228 |

145 |

5. |

Other non-debt capital receipts |

10,165 |

2,567 |

-7,598 |

-74.7 |

6. |

Capital Outlay (i+ii) |

84,522 |

83,305 |

-1,217 |

-1.4 |

|

i. Defence |

48,007 |

41,000 |

-7,007 |

-14.6 |

|

ii. Non-defence capital outlay |

36,515 |

42,305 |

5,790 |

15.9 |

7. |

Net Lending (i-ii) |

3,746 |

4,504 |

758 |

20.2 |

|

i. Loans |

8,243 |

14,202 |

5,959 |

72.3 |

|

ii.Recoveries |

4,497 |

9,698 |

5,201 |

115.7 |

8. |

Gross Primary Deficit (4-3(ii)) |

-57,520 |

1,33,821 |

1,91,341 |

-332.7 |

III.3 Non-Debt Capital Receipts

The non-debt capital receipts comprising recoveries of loans and advances and other miscellaneous receipts including disinvestment receipts declined by Rs.2,397 crore (or by 16.3 per cent) in the 2008-09 (RE). This decline was due to non-realisation of the budgeted disinvestment proceeds by the extent of Rs.7,598 crore, despite the recoveries of loans and advances more than doubling to Rs.9,698 in 2008-09 (RE).

III.4 Aggregate Expenditure

With the additional expenditure provided under three supplementary demand for grants, the aggregate expenditure in the revised estimates for 2008-09 was significantly higher by Rs.1,50,069 crore (20.0 per cent) than the budget estimates, with rise in revenue expenditure amounting to Rs.1,45,327 crore. The higher revenue expenditure was mainly on account of subsidies and defence in the non-plan component and rural development under plan component. Subsidies in the RE at Rs.1,29,243 crore were higher by 80.9 per cent, primarily on account of increase in fertiliser subsidies. Rise in defence revenue expenditure was on account of implementation of the Sixth Pay Commission award for defence personnel. With regard to capital expenditure, while the defence capital outlay declined by Rs.7,007 crore, non-defence capital outlay increased by Rs.5,790 crore. The net lending also increased by 20.2 per cent with higher loan disbursements more than off-setting the larger loan recoveries.

Table 3: Plan and Non-Plan Expenditure in 2008-09 |

( Rupees crore) |

Item |

2008-09 (BE) |

2008-09(RE) |

Variation (3 over 2) |

|

|

|

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

Non-Plan |

|

|

|

|

1. |

Interest Payments |

1,90,807 |

1,92,694 |

1,887 |

1.0 |

2. |

Grants to States |

43,294 |

38,421 |

-4,873 |

-11.3 |

3. |

Interest Subsidies |

2,829 |

4,063 |

1,234 |

43.6 |

4. |

Fertiliser Subsidy |

30,986 |

75,849 |

44,863 |

144.8 |

5. |

Defence Services |

1,05,600 |

1,14,600 |

9,000 |

8.5 |

Total Non-Plan Expenditure |

5,07,498 |

6,17,996 |

1,10,498 |

21.8 |

Plan |

2,43,386 |

2,82,957 |

39,571 |

16.3 |

1. |

Central Plan |

1,79,954 |

2,04,129 |

24,175 |

13.4 |

2. |

Central Assistance for State and UT Plans |

63,432 |

78,828 |

15,396 |

24.3 |

Total Plan Expenditure |

2,43,386 |

2,82,957 |

39,571 |

16.3 |

a) Plan and Non-Plan Expenditure

Expenditure pattern indicates that non-plan and plan expenditure increased by 21.8 per cent and 16.3 per cent, respectively from the budgeted levels. Under non-plan expenditure, interest payments, interest subsidies, fertiliser subsidies and defence services increased in the revised estimates over the budgeted level, with fertiliser subsidy alone accounting for 40.6 per cent of the increase in total non-plan expenditure. There was, however, a cutback of Rs.4,873 crore (11.3 per cent) in grants to States from the budgeted level (Table 3). Under plan expenditure, allocation for Central Plan was higher by 13.4 per cent due to substantial hike in rural development. Central assistance for State and UT plans was also higher by 24.3 per cent in the RE mainly due to hike in the allocation for externally aided projects, irrigation and Jawaharlal Nehru National Urban Renewal Mission (JNNURM).

III.5 Financing Pattern of Gross Fiscal Deficit

In view of the increase in GFD by 2.4 times in the revised estimates of 2008-09 over the budgeted level, the net market borrowings (dated securities and 364 days Treasury Bills) was hiked by 2.7 times of the budgeted level to Rs.2,66,539 crore. Net market borrowings would finance 81.6 per cent of the GFD as against 74.3 per cent in the budget estimates (Table 4). There would also be substantial increase in the drawdown of cash balances to finance 9.2 per cent of the GFD as against 5.4 per cent in the budget estimates. Contribution from National Small Savings Fund would also be higher at 3.4 per cent as against negligible amount envisaged in the budget estimates. On the other hand, financing from external assistance in the revised estimates was lower at 2.9 per cent of GFD than the budgeted level of 8.2 per cent. In the public account, deposits and advances would finance 3.9 per cent of GFD against the budgeted level of 6.5 per cent.

Table 4: Financing Pattern of Gross Fiscal Deficit in 2008-09 |

(Rupees crore) |

Item |

2008-09 |

2008-09 |

(BE) |

(RE) |

1 |

2 |

3 |

Gross Fiscal Deficit |

1,33,287 |

3,26,515 |

|

(100) |

(100) |

Financed by |

|

|

Market Borrowings (Market loans |

99,000 |

2,66,539 |

and 364 day T-bills) |

(74.3) |

(81.6) |

Securities against small savings |

9,873 |

1,323 |

|

(7.4) |

(0.4) |

External Assistance |

10,989 |

9,603 |

|

(8.2) |

(2.9) |

State provident fund |

4,800 |

4,800 |

|

(3.6) |

(1.5) |

NSSF |

53 |

11,206 |

|

(0.0) |

(3.4) |

Reserve Funds |

-972 |

-16,808 |

|

-(0.7) |

-(5.1) |

Deposit and Advances |

8,629 |

12,788 |

|

(6.5) |

(3.9) |

Postal Insurance and Life |

4,123 |

2,594 |

Annuity Funds |

(3.1) |

(0.8) |

Draw down of Cash Balances |

7,225 |

29,984 |

|

(5.4) |

(9.2) |

Others |

-10,433 |

4,485 |

|

-(7.8) |

(1.4) |

Note: Figures in parenthesis are percentages to GFD. |

IV. Analysis of Budget Estimates 2009-102

The Union Budget for 2009-10 was presented against the backdrop of persisting global economic slowdown that continues to impact the Indian economy adversely, and the need to revive the growth at the earliest possible while recognising the medium-term concerns. The buoyancy in revenue collection has significantly fallen not only due to the economic slowdown but also due to tax reduction measures undertaken by the Government to provide stimulus to growth. At the same time, enhancement of expenditure to boost the aggregate demand in the economy has been sustained. In this context, there has been an increase in allocation for social sector to create employment and public assets and infrastructure development in both rural and urban areas. With the moderation in economic growth expected to continue well into the fiscal 2009-10, the Budget has envisaged relaxation of the FRBM targets during 2009-10 for continuing with fiscal stimulus measures. IV.1 Deficit Indicators

The Union Interim Budget for 2009-10 has indicated about the sustaining of fiscal stimulus during 2009-10 to provide boost to demand and revive the economy from the slowdown. Consequently, the key deficit indicators, viz., RD, GFD and PD, as per cent of GDP, are budgeted at 4.8 per cent, 6.8 per cent and 3.0 per cent in 2009-10, higher than 4.4 per cent, 6.0 per cent and 2.5 per cent, respectively, during 2008-09 (RE) (Chart 1).

The RD is budgeted to increase by Rs.41,462 crore in 2009-10 due to higher increase in revenue expenditure on account of interest payments, defence and non-plan grants to States and UTs than the increase in revenue receipts arising from non-tax revenue. With capital outlay also increasing substantially, GFD is budgeted to increase by 22.8 per cent to Rs.74,481 crore (Table 5).

Table 5: Major Fiscal Indicators- 2009-10(BE) versus 2008-09 (RE) |

(Rupees crore) |

Item |

2008-09 (RE) |

2009-10(BE) |

Variation (3 over 2) |

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

1. |

Revenue Deficit (3-2) |

2,41,273 |

2,82,735 |

41,462 |

17.2 |

2. |

Revenue Receipts (i+ii) |

5,62,173 |

6,14,497 |

52,324 |

9.3 |

|

i. Tax Revenue |

4,65,970 |

4,74,218 |

8,248 |

1.8 |

|

ii. Non-Tax Revenue |

96,203 |

1,40,279 |

44076 |

45.8 |

3. |

Revenue Expenditure |

8,03,446 |

8,97,232 |

93786 |

11.7 |

|

of which: |

|

|

|

|

|

i. Subsidies |

1,29,243 |

1,11,276 |

-17,967 |

-13.9 |

|

ii. Interest Payments |

1,92,694 |

2,25,511 |

32,817 |

17 |

4. |

Gross Fiscal Deficit (1+6+7-5) |

3,26,515 |

4,00,996 |

74,481 |

22.8 |

5. |

Other non-debt capital receipts |

2,567 |

1,120 |

-1,447 |

-56.4 |

6. |

Capital Outlay (i+ii) |

83,305 |

1,11,267 |

27,962 |

33.6 |

|

i. Defence |

41,000 |

54,824 |

13,824 |

33.7 |

|

ii. Non-defence capital outlay |

42,305 |

56,443 |

14,138 |

33.4 |

7. |

Net lending |

4,504 |

8,114 |

3,610 |

80.2 |

|

i. Loans |

14,202 |

1,23,39 |

-1,863 |

-13.1 |

|

ii. Recoveries |

9,698 |

4,225 |

-5,473 |

-56.4 |

8. |

Gross Primary Deficit (4-3(ii)) |

1,33,821 |

1,75,485 |

41,664 |

31.1 |

The deterioration in deficit indicators has been associated with a distinct deterioration in the quality indicator, i.e., sharp rise in the RD to GFD ratio, indicating pre-emption of resources from borrowings for current consumption. This ratio, which fell continuously from 79.7 per cent in 2003-04 to 41.4 per cent in 2007-08, rose to 73.9 per cent in 2008-09 and is estimated at 70.5 per cent in 2009-10, a level that prevailed in 2001-02 (Chart 2).

IV.2 Revenue Receipts

The continued economic slowdown and moderated rates of indirect taxes would limit the mobilisation of revenue by the Central Government during 2009-10. Though the revenue receipts during 2009-10 are budgeted to increase by 9.3 per cent, improving from 3.7 per cent growth recorded in 2008-09 (RE), gross tax revenue would increase by 2.1 per cent only, decelerating from 5.9 per cent in 2008-09 (RE). Non-tax revenue, however, is expected to grow sharply by 45.8 per cent due to expected receipts from the auction of third-generation (3G) radio spectrum, as against the decline of 6.0 per cent in 2008-09 (RE). The net tax revenue [gross tax revenue less States’ share in Central taxes and amount transferred to National Calamity Contingency Fund (NCCF)] is budgeted to increase by 1.8 per cent over the preceding year.

|

a) Tax Revenue

The gross tax collections, relative to GDP, are budgeted to decline to 10.9 per cent during 2009-10 from 11.6 per cent in 2008-09 (RE). Tax-GDP ratio was moving up steadily from 2001-02 to a peak level of 12.6 per cent in 2007-08. Corporation tax collections are budgeted to increase by 15.6 per cent in 2009-10 compared to 15.1 per cent in 2008-09. The growth in personal income tax, however, is estimated to decline by 1.1 per cent from 5.2 per cent growth in 2008-09 (RE). Collection of indirect taxes would decline with custom duty and union excise duty expected to decline by 9.3 per cent and 1.7 per cent, respectively, during 2009-10. With the proposed abolition of fringe benefit tax (FBT), there would be no collection under this tax. Consequently, the buoyancies (percentage change in tax revenue as a ratio to percentage change in GDP) of major taxes in 2009-10, are budgeted not only to decline, but turn negative in most of them, barring that of corporation tax, which would see some improvement. Tax buoyancies during 2009-10 would thus be far lower than the average recorded during 2004-05 to 2007-08.

b) Non-Tax Revenue

Non-tax revenues (NTR) are budgeted to increase sharply to Rs.1,40,279 crore (45.8 per cent) in 2009-10 from Rs.96,203 crore in 2008-09, reflecting higher revenues from ‘other’ non-tax revenue, which is estimated to grow by 101.8 per cent as a result of expected receipts from the auction of third-generation (3G) radio spectrum. The receipts from dividends and profits, which are other major components of NTR, are also expected to increase to Rs.49,750 crore from Rs.39,736 crore in 2008-09 (RE). Interest receipts are estimated at Rs.19,174 crore as compared with Rs.19,036 crore in 2008-09(RE).

IV.3 Non-Debt Capital Receipts

The recoveries of loans and advances from the State Governments and CPSUs are estimated to decline by 56.4 per cent to Rs.4,225 crore in 2009-10 (BE) from Rs.9,698 crore in 2008-09 (RE). Disinvestment proceeds are also budgeted to decline during 2009-10 to Rs.1,120 crore from Rs.2,567 crore in 2008-09 (RE).

IV.4 Aggregate Expenditure

The Government has envisaged moderating the growth of aggregate expenditure during 2009-10 to 13.3 per cent, as against the sharp rise of 33.1 per cent during 2008-09. This lower growth in aggregate expenditure would mainly emanate from revenue expenditure which is budgeted to grow lower by 11.7 per cent compared to 35.2 per cent growth in 2008-09 (RE). Containment of subsidies, in particular fertiliser subsidy, would be an important contributing factor to the slower growth in revenue expenditure during 2009-10 (Table 6). Consequently, the total subsidies are budgeted to decline by 13.9 per cent in 2009-10 (BE) as against the sharp growth of 82.2 per cent in 2008-09 (RE). Subsidies would account for 1.9 per cent of GDP during 2009-10 compared to 2.4 per cent in the previous year.

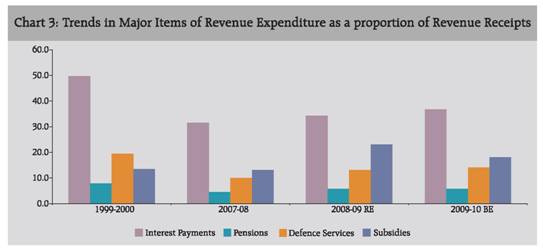

With the rise in fiscal deficit, interest payments during 2009-10 at Rs.2,25,511 crore are estimated to show higher increase of Rs.32,817 crore (17.0 per cent) from Rs.21,664 crore (12.7 per cent) in 2008-09 (RE). Defence expenditure is budgeted to increase substantially by 23.7 per cent due to the implementation of Sixth Central Pay Commission recommendations. The ratios of interest payments and defence to revenue receipts would increase markedly, while that of subsidies would decline during 2009-10 (Chart 3).

Table 6: Major Subsidies |

(Rupees crore) |

Items |

2007-08 |

2008-09

(RE) |

2009-10

(BE) |

1 |

2 |

3 |

4 |

Total Subsidies |

70,926 |

1,29,243 |

1,11,276 |

of which: |

(1.5) |

(2.4) |

(1.9) |

i. Food |

31,328 |

43,627 |

52,490 |

|

(0.7) |

(0.8) |

(0.9) |

ii. Fertiliser |

32,490 |

75,849 |

49,980 |

|

(0.7) |

(1.4) |

(0.9) |

iii. Petroleum |

2,820 |

2,877 |

3,109 |

|

(0.1) |

(0.1) |

(0.1) |

iv. Interest subsidy |

2,311 |

4,063 |

2,601 |

|

(0.0) |

(0.1) |

(0.0) |

v. Other subsidies |

1,977 |

2,827 |

3,096 |

|

(0.0) |

(0.1) |

(0.1) |

Note: Figures in brackets are percentages to GDP. |

The Budget has envisaged stepping up capital expenditure further by 26.8 per cent during 2009-10 from 17.9 per cent increase in 2008-09 (RE). The capital outlay is budgeted to increase by Rs.27,962 crore (33.6 per cent) as against a decline of Rs.23,635 crore (22.1 per cent) in 2008-09. Both the defence and non-defence capital outlay are estimated to increase by Rs.13,824 crore and Rs.14,138 crore, respectively. The defence capital outlay is budgeted to be the largest non-plan capital expenditure.

a) Plan and Non-Plan Expenditure

The expenditure pattern shows that there would be significant moderation in the growth of both non-plan and plan components during 2009-10. The increase in the non-plan expenditures would mainly arise due to interest payments, defence and grants to states and UTs. The increase in interest payments would reflect substantial hike in Government borrowings and special securities issued to Oil Marketing Companies and Food Corporation of India during 2008-09. Sizeable rise in budgeted non-plan expenditure in defence services would arise on account of enhanced provision for pay and allowances, maintenance expenditure and for modernisation of defence services. The budget has also proposed to provide higher non-plan grants t o States and UTs to compensate for the revenue loss incurred on account of phasing out of Central Sales Tax and introduction of Value Added Tax. With regard to plan expenditure, the increase would mainly come about in the central plan component (Table 7). The increase in plan expenditure is mainly accounted for by enhanced allocation to the social sector and urban and rural infrastructure. Most of this additional plan expenditure will go to the schemes like NREGS, PMGSY, RGGVY, NRHM, AIBP, JNNURM, RKVY and TUFS.

Table 7: Plan and Non-Plan Expenditure in 2009-10 |

(Rupees crore) |

Item |

2008-09 (RE) |

2009-10 (BE) |

Amount |

(Per cent) |

1 |

2 |

3 |

4 |

5 |

Interest Payments |

1,92,694 |

2,25,511 |

32,817 |

17.0 |

Food Subsidy |

43,627 |

52,490 |

8,863 |

20.3 |

Interest Subsidies |

4,063 |

2,601 |

-1,462 |

-36.0 |

Police |

20,711 |

25,390 |

4,679 |

22.6 |

Agriculture and allied services |

5,891 |

2,438 |

-3,453 |

-58.6 |

Pensions |

32,690 |

34,980 |

2,290 |

7.0 |

Defence Expenditure |

1,14,600 |

1,41,703 |

27,103 |

23.7 |

Grants to States and UTs |

38,421 |

48,570 |

10,149 |

26.4 |

Other Communication Services |

1,676 |

5,305 |

3,629 |

216.5 |

Capital Outlay |

13,694 |

21,056 |

7,362 |

53.8 |

Other non-plan expenditure |

1,49,929 |

1,35,645 |

-14,284 |

-9.5 |

Total Non-Plan |

6,17,996 |

6,95,689 |

77,693 |

12.6 |

Central Plan |

2,04,129 |

2,39,840 |

35,711 |

17.5 |

Central Assistance for State and |

78,828 |

85,309 |

6,481 |

8.2 |

UT Plans |

|

|

|

|

Total Plan |

2,82,957 |

3,25,149 |

42,192 |

14.9 |

IV.5 Financing of Gross Fiscal Deficit

In contrast to earlier years, the financing pattern of GFD reveals that the Government has envisaged financing almost the entire amount of the deficit during 2009-10 through market borrowings. Net market borrowings would finance 99.2 per cent of the GFD in 2009-10 as against 81.6 per cent in 2008-09 (RE). No drawdown of cash balances has been envisaged during 2009-10, which financed 9.2 per cent of GFD in 2008-09 (RE). External borrowings and securities against small savings would finance 4.0 per cent and 3.3 per cent of GFD in 2009-10, as against 2.9 per cent and 0.4 per cent in 2008-09 (RE), respectively (Table 8).

IV.6 Sectoral Allocation of Expenditure

The sectoral allocation of expenditure under developmental heads like health and education has been increased, while the share of subsidies, agriculture and rural development as a percentage of total expenditure has declined (Table 9).

IV.7 Devolution and Transfer of Resources to States and Union Territories

The devolution pattern of resources to the State Governments and Union Territories shows that net resource transfer would increase by 7.0 per cent to Rs.3,13,751 crore during 2009-10. With the expected slowdown in the gross tax collection, the taxes transferred to the States and Union Territories would increase by only 2.6 per cent to Rs.1,64,361 crore. Grants would increase by 14.3 per cent to Rs.1,46,337 crore, with the non-plan and plan components rising by 26.4 per cent and 9.1 per cent, respectively (Table 10).

Table 8: Financing Pattern of Gross Fiscal Deficit |

(Rupees crore) |

Item |

2008-09

(RE) |

2009-10

(BE) |

1 |

2 |

3 |

Gross Fiscal Deficit |

3,26,515 |

4,00,996 |

Financed by |

|

|

Market Borrowings |

2,66,539 |

3,97,957 |

|

(81.6) |

(99.2) |

Securities issued against |

1,323 |

13,256 |

Small Savings |

(0.4) |

(3.3) |

External Assistance |

9,603 |

16,047 |

|

(2.9) |

(4.0) |

State Provident Fund |

4,800 |

5,000 |

|

(1.5) |

(1.2) |

NSSF |

11,206 |

-103 |

|

(3.4) |

(0.0) |

Reserve Funds |

-16,808 |

-8,428 |

|

-(5.1) |

-(2.1) |

Deposit and Advances |

12,788 |

9,026 |

|

(3.9) |

(2.3) |

Postal Insurance and |

2,594 |

2,672 |

Life Annuity Funds |

(0.8) |

(0.7) |

Draw down of Cash Balances |

29,984 |

0 |

|

(9.2) |

(0.0) |

Others |

4,486 |

-34,431 |

|

(1.4) |

-(8.6) |

Note: Figures in parenthesis are percentages to GFD. |

Table 9: Expenditure on Select Development Heads |

(Rupees crore) |

Item |

2008-09

(RE) |

2009-10

(BE) |

1 |

2 |

3 |

Subsidies |

1,29,243 |

1,11,276 |

|

(14.3) |

(10.9) |

Agriculture |

1,23,038 |

1,07,441 |

|

(13.7) |

(10.5) |

Education |

34,429 |

42,338 |

|

(3.8) |

(4.1) |

Health, family welfare |

16,277 |

22,733 |

and sanitation |

(1.8) |

(2.2) |

Rural Development |

40,799 |

43,554 |

|

(4.5) |

(4.3) |

Irrigation |

579 |

664 |

|

(0.1) |

(0.1) |

Note: Figures in the parenthesis are percentages to total expenditure. |

IV.8 Eleventh Plan Projections vis-avis the Budget Estimates for 2009-10

The projections indicated in the Approach Paper to the Eleventh Plan for the major fiscal indicators vis-a-vis the 2009-10 (BE) are set out in Table 12. It is observed that the total expenditure would substantially exceed the Eleventh Plan projections for 2009-10, primarily due to non-plan expenditure. Though the plan expenditure would also be higher than the projected, it would be solely due to the revenue component as capital component would be lower than the projected. Thus, the large increase in GFD in 2009-10 from the projection in the Eleventh Plan would follow from non-plan expenditure and the revenue component of plan expenditure (Table 11).

Table 10: Resource Transfer to States and Union Territories |

(Amount in Rupees crore) |

Tax |

2008-09 (RE) |

2009-10 (BE) |

Variation

(BE over RE)

(Per cent) |

1 |

2 |

3 |

4 |

States and UTs Share of Taxes and Duties |

1,60,179 |

1,64,361 |

2.6 |

Grants |

1,28,072 |

1,46,337 |

14.3 |

Non-Plan |

38,421 |

48,570 |

26.4 |

Plan |

89,651 |

97,767 |

9.1 |

Loans |

7,118 |

5,714 |

-19.7 |

Non-Plan |

89 |

89 |

0.0 |

Plan |

7,029 |

5,625 |

-20.0 |

Recovery of Loan |

|

|

|

and Advances |

2,008 |

2,661 |

32.5 |

Net Resource |

|

|

|

Transfers |

2,93,361 |

3,13,751 |

7.0 |

Table 11: Eleventh Plan Projections vis-a-vis the Budget Estimates |

(As per cent to GDP) |

Item |

2009-10 |

Eleventh

Plan Projections |

Budget Estimates |

1 |

2 |

3 |

Centre |

|

|

1. Gross Budgetary Support |

|

|

to Plan |

4.97 |

5.55 |

of which |

|

|

(i) Plan revenue |

|

|

Expenditure |

2.87 |

4.75 |

2. Total Non-Plan |

8.86 |

11.88 |

of which |

|

|

(i) Interest Payments |

2.98 |

3.85 |

(ii) Defence |

2.30 |

2.42 |

(iii) Non-Plan grants |

|

|

to States & UTs |

0.62 |

0.83 |

(iv) Subsidies |

0.96 |

1.90 |

3. Total Expenditure |

13.83 |

17.43 |

4. Gross tax revenue |

12.18 |

10.95 |

less: Share of States |

3.32 |

2.81 |

5. Net Tax to Centre |

8.86 |

8.10 |

6. Non-tax Revenue |

1.76 |

2.40 |

7. Total Revenue Receipts |

10.62 |

10.49 |

8. Gross Fiscal Deficit |

3.00 |

6.85 |

9. Revenue Deficit |

0.00 |

4.83 |

V. ASSESSMENT OF THE UNION BUDGET 2009-10

The stance of Union Budget 2009-10 guided by the objectives of keeping the economy on the higher growth trajectory. Consequently, the Government has continued with the policy of increasing public expenditure to boost demand and create infrastructure. It may be noted that without the positive impact of the three fiscal stimulus measures on the economy, GDP growth of 6.7 per cent in India during 2008-09, the second fastest in the World, may not have been achieved. At the same time, it is also important to note that these fiscal stimulus measures undertaken by Government have led to substantial deviation from the fiscal consolidation path mandated under the FRBM Act during 2008-09 and 2009-10. This widening of deficit raises debt sustainability concerns and pre-emption of Government revenue by interest payments in the medium to long-term term. The debt to GDP ratio which had fallen continuously during the FRBM period up to 2007-08 has reversed the trend during 2008-09 and 2009-10. The interest payments to revenue receipts also increased from 31.6 per cent in 2007-08 to 36.7 per cent in 2009-10 (BE). Therefore, there is a need to revert back to the path of fiscal consolidation with emphasis on structural fiscal reforms and prudent fiscal management at the earliest.

V.1 Fiscal Correction and Consolidation

The medium-term fiscal policy statement has placed the rolling targets of major fiscal indicators under FRBM for 2010-11 and 2011-12 at significantly lower levels than in 2008-09 (RE) and 2009-10 (BE). Though these lower deficits may indicate intentions of the Central Government to revert back to the path of fiscal consolidation, the deficit targets would continue to remain significantly higher than those envisaged in FRBMA (Table 12).

Thus, bringing back the key deficit indicators to the level of 2007-08 in the medium-term could be a challenging task. In this context, it may be indicated that the Thirteenth Finance Commission through an additional Terms of Reference was mandated to review the roadmap for fiscal adjustment and suggest a suitably revised roadmap to maintain the gains of fiscal consolidation through 2010 to 2015, particularly keeping in view the need to bring in the liabilities of the Central Government on account of oil, food and fertiliser bonds into the fiscal accounting, and the impact of various other obligations of the Central Government on the deficit targets.

It is imperative that the Government undertake measures to improve the revenue buoyancy once again, which has fallen sharply during the last two years. The tax-GDP ratio had significantly improved from 9.2 per cent in 2003-04 to 12.6 per cent in 2007-08. This has been achieved through rationalisation of the tax structure (moderate levels and a few rates), widening of the tax base, and reduction in compliance costs through improvement in tax administration. The extensive adoption of information technology solutions and re-engineering of business processes has also fostered a less intrusive tax system and encouraged voluntary compliance. These measures have resulted in increased buoyancy in tax revenues till 2007-08 and helped in fiscal consolidation (Table 13).

Table 12: Rolling Targets under FRBM (Per cent to GDP) |

Item |

Revised

Estimates

2008-09 |

Budget

Estimates

2009-10 |

Target for |

|

|

|

2010-11 |

2011-12 |

1 |

2 |

3 |

4 |

5 |

Revenue Deficit |

4.4 |

4.8 |

3.0 |

1.5 |

Gross Fiscal Deficit |

6.0 |

6.8 |

5.5 |

4.0 |

Gross Tax Revenue |

11.6 |

10.9 |

11.9 |

12.4 |

Total outstanding liabilities at end of the year |

59.6 |

61.4 |

60.1 |

57.2 |

Notes: 1. "Total outstanding liabilities" include external public debt at current exchange rates.

2. For projections, constant exchange rates have been assumed. Targets for 2010-11 and 2011-12 will be revisited after the implementation of the 13th Finance Commission recommendations from 2010-11. |

There are several factors, which, however, would facilitate fiscal consolidation process in the medium-term. They include: (a) The Sixth Pay Commission arrears would have been paid out in 2009-10 (60 per cent of the total) with no further liability in 2010-11; (b) most of the farm loan waiver amounts would be paid out in 2009-10 leaving marginal amounts for the next year; (c) much of the decline in business and corporate tax collections is cyclical and would reverse when growth would revive; (d) the expected introduction of the GST in 2010-11 provides an opportunity for setting indirect tax system on the path to producing a sustained increase in revenues; and (e) the Government could also consider reverting back some of the indirect tax cuts when the growth picks up sufficiently. In this regard, the Government has also emphasised the importance of institutional reforms during 2009-10 in order to bring the fiscal deficit under control.

Table 13: Gross Tax Revenue (Per cent to GDP) |

Year |

Budgeted |

Actual |

1 |

2 |

3 |

2002-03 |

9.6 |

8.8 |

2003-04 |

9.2 |

9.2 |

2004-05 |

10.2 |

9.7 |

2005-06 |

10.5 |

10.2 |

2006-07 |

11.2 |

11.5 |

2007-08 |

11.8 |

12.6 |

2008-09 |

12.7 |

11.6* |

* : Revised Estimates. |

V.2 Inflation

The impact of the fiscal deficit, which increased from 6.0 per cent of GDP in 2008-09 (RE) to 6.8 per cent of GDP, on inflation could take place through two channels: (a) increase in aggregate demand, and (b) expansion in money supply through increase in bank credit to the Government including open market operations by the Reserve Bank. Since the higher fiscal deficit has been aimed at off-setting the deceleration in private consumption and investment demand, there may not be inflationary consequences as long as private demand conditions remain subdued. With ample liquidity in the system, increase appetite for government securities and subdued demand for credit from the private sector, the market would be in a position to absorb the large borrowing programme of the Government. However, the large borrowing programme could create inflationary pressures with the recovery in private sector’s demand for credit and return of surges in capital flows.

VI. CONCLUSION

The Union Budget 2009-2010 has been presented in the backdrop of uncertainty in complete economic revival, and consequently, the need to sustain fiscal stimulus measures. Thus, the emphasis was to stimulate the economy by increasing expenditure in the social sector such as education, health, rural employment and investment in infrastructure to boost the aggregate demand, generate income and employment. However, the expansionary fiscal policy has resulted in increase in the revenue and fiscal deficit much above the mandated target mentioned in the FRBM rules. As a result, the debt GDP ratio has increased impairing the debt sustainability conditions.

Though the Government has reiterated its commitment to fiscal consolidation at the earliest, the level of fiscal expansion undertaken and the large Government borrowing to finance the deficit may not be sustainable in the long run. Thus, attaining medium-term sustainability of the finances of the Government remains crucial. The medium-term fiscal policy statement has set the rolling targets of major fiscal indicators under FRBM for 2010-11 and 2011-12 lower than the levels in 2008-09 (RE) and 2009-10 (BE). However, they would remain much higher than the FRBMA targets and the levels achieved during 2007-08. To bring down the deficit indicators to the levels envisaged in FRBMA would require structural fiscal reforms and prudent fiscal management.

In a nutshell, the Union Budget 2009-10 contains elements of continuity and change. The stance of fiscal policy continued to be sustaining high public expenditure programme financed through large market borrowing to boost aggregate demand. The overall tax structure has been retained but many rationalisations have been envisaged. The large market borrowing programme envisaged in the Budget for 2009-10 needs to be managed in a smooth and non-disruptive manner without letting undue upward pressure on interest rates. The fiscal consolidation process has to be resumed at the earliest by initiating institutional reforms encompassing all aspects of budget such as taxes, expenditure, subsidies and disinvestment.

Statement 1: Budget at a Glance |

(Rs. crore) |

Items |

2007-08 (Accounts) |

2008-09

(Budget

Estimates) |

2008-09

(Revised

Estimates) |

2009-10

(Budget

Estimates) |

1 |

2 |

3 |

4 |

5 |

1. |

Revenue Receipts (i+ii) |

5,41,864 |

6,02,935 |

5,62,173 |

6,14,497 |

|

i) |

Tax Revenue (Net to Centre) |

4,39,547 |

5,07,150 |

4,65,970 |

4,74,218 |

|

ii) |

Non-tax Revenue |

1,02,317 |

95,785 |

96,203 |

1,40,279 |

|

|

of which: |

|

|

|

|

|

|

Interest Receipts |

21,060 |

19,135 |

19,036 |

19,174 |

2. |

Capital Receipts |

1,36,498 * |

1,47,949 |

3,38,780 |

4,06,341 |

|

of which: |

|

|

|

|

|

i) |

Market Borrowings |

1,30,600 |

99,000 |

2,66,539 |

3,97,957 |

|

ii) |

Recoveries of Loans |

5,100 |

4,497 |

9,698 |

4,225 |

|

iii) |

Disinvestment of equity in PSUs |

4,486 * |

10,165 |

2,567 |

1,120 |

3. |

Total Receipts (1+2) |

6,78,362 * |

7,50,884 |

9,00,953 |

10,20,838 |

4. |

Revenue Expenditure (i + ii) |

5,94,433 |

6,58,119 |

8,03,446 |

8,97,232 |

|

i) |

Non-Plan |

4,20,861 |

4,48,352 |

5,61,790 |

6,18,834 |

|

ii) |

Plan |

1,73,572 |

2,09,767 |

2,41,656 |

2,78,398 |

5. |

Capital Expenditure (i + ii) |

82,707 # |

92,765 |

97,507 |

1,23,606 |

|

i) |

Non-Plan |

51,197 # |

59,146 |

56,206 |

76,855 |

|

ii) |

Plan |

31,510 |

33,619 |

41,301 |

46,751 |

6. |

Total Non-Plan Expenditure (4i + 5i) |

4,72,058 # |

5,07,498 |

6,17,996 |

6,95,689 |

|

of which: |

|

|

|

|

|

i) |

Interest Payments |

1,71,030 |

1,90,807 |

1,92,694 |

2,25,511 |

|

ii) |

Defence |

91,681 |

1,05,600 |

1,14,600 |

1,41,703 |

|

iii) |

Subsidies |

70,926 |

71,431 |

1,29,243 |

1,11,276 |

7. |

Total Plan Expenditure (4ii + 5ii) |

2,05,082 |

2,43,386 |

2,82,957 |

3,25,149 |

8. |

Total Expenditure (6+7=4+5) |

6,77,140 # |

7,50,884 |

9,00,953 |

10,20,838 |

9. |

Revenue Deficit (4-1) |

52,569 |

55,184 |

2,41,273 |

2,82,735 |

|

|

(1.1) |

(1.0) |

(4.5) |

(4.8) |

10. |

Gross Fiscal Deficit

(8-(1+2ii+2iii)) |

1,25,690 *# |

1,33,287 |

3,26,515 |

4,00,996 |

|

|

(2.7) |

(2.5) |

(6.0) |

(6.8) |

11. |

Gross Primary Deficit (10-6i) |

-45,340 *# |

-57,520 |

1,33,821 |

1,75,485 |

|

|

- (0.9) |

-(1.1) |

(2.5) |

(3.0) |

*: Net of transfer of profit from RBI to the Union Government amounting to Rs.34,309 crore.

# : Net of acquisition cost of RBI’s stake in State Bank of India (SBI) at Rs.35,531 crore.

Notes : 1. Figures in parentheses are percentage to GDP.

2. Capital Receipts are net of repayments.

3. Market borrowings include dated securities and 364 day Treasury Bills.

Source : Budget documents of Government of India, 2009-10. |

Statement 1: Budget at a Glance (Concld.) |

(Rs. crore) |

Items |

Variations |

Col.4 over Col. 3 |

Col.4 over Col. 2 |

Col.5 over Col. 4 |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |

6 |

7 |

8 |

9 |

10 |

11 |

1. |

Revenue Receipts (i+ii) |

-40,762 |

-6.8 |

20,309 |

3.7 |

52,324 |

9.3 |

|

i) Tax Revenue (Net to Centre) |

-41,180 |

-8.1 |

26,423 |

6.0 |

8,248 |

1.8 |

|

ii) Non-tax Revenue |

418 |

0.4 |

-6,114 |

-6.0 |

44,076 |

45.8 |

|

of which: |

|

|

|

|

|

|

|

Interest Receipts |

-99 |

-0.5 |

-2,024 |

-9.6 |

138 |

0.7 |

2. |

Capital Receipts |

1,90,831 |

129.0 |

2,02,282 |

148.2 |

67,561 |

19.9 |

|

of which: |

|

|

|

|

|

|

|

i) Market Borrowings |

1,67,539 |

169.2 |

1,35,939 |

104.1 |

1,31,418 |

49.3 |

|

ii) Recoveries of Loans |

5,201 |

115.7 |

4,598 |

90.2 |

-5,473 |

-56.4 |

|

iii) Disinvestment of equity in PSUs |

-7,598 |

-74.7 |

-1,919 |

-42.8 |

-1,447 |

-56.4 |

3. |

Total Receipts (1+2) |

1,50,069 |

20.0 |

2,22,591 |

32.8 |

1,19,885 |

13.3 |

4. |

Revenue Expenditure (i + ii) |

1,45,327 |

22.1 |

2,09,013 |

35.2 |

93,786 |

11.7 |

|

i) Non-Plan |

1,13,438 |

25.3 |

1,40,929 |

33.5 |

57,044 |

10.2 |

|

ii) Plan |

31,889 |

15.2 |

68,084 |

39.2 |

36,742 |

15.2 |

5. |

Capital Expenditure (i + ii) |

4,742 |

5.1 |

14,800 |

17.9 |

26,099 |

26.8 |

|

i) Non-Plan |

-2,940 |

-5.0 |

5,009 |

9.8 |

20,649 |

36.7 |

|

ii) Plan |

7,682 |

22.9 |

9,791 |

31.1 |

5,450 |

13.2 |

6. |

Total Non-Plan Expenditure (4i + 5i) |

1,10,498 |

21.8 |

1,45,938 |

30.9 |

77,693 |

12.6 |

|

of which: |

|

|

|

|

|

|

|

i) Interest Payments |

1,887 |

1.0 |

21,664 |

12.7 |

32,817 |

17.0 |

|

ii) Defence |

9,000 |

8.5 |

22,919 |

25.0 |

27,103 |

23.7 |

|

iii) Subsidies |

57,812 |

80.9 |

58,317 |

82.2 |

-17,967 |

-13.9 |

7. |

Total Plan Expenditure (4ii + 5ii) |

39,571 |

16.3 |

77,875 |

38.0 |

42,192 |

14.9 |

8. |

Total Expenditure (6+7=4+5) |

1,50,069 |

20.0 |

2,23,813 |

33.1 |

119,885 |

13.3 |

9. |

Revenue Deficit (4-1) |

1,86,089 |

337.2 |

1,88,704 |

359.0 |

41,462 |

17.2 |

10. |

Gross Fiscal Deficit

(8-(1+2ii+2iii)) |

1,93,228 |

145.0 |

2,00,825 |

159.8 |

74,481 |

22.8 |

11. |

Gross Primary Deficit (10-6i) |

1,91,341 |

-332.7 |

1,79,161 |

-395.1 |

41,664 |

31.1 |

Statement 2: Transactions on Revenue Account |

(Rs. crore) |

Items |

2007-08 (Accounts) |

2008-09

(Budget

Estimates) |

2008-09

(Revised

Estimates) |

2009-10

(Budget

Estimates) |

1 |

2 |

3 |

4 |

5 |

I. |

Revenue Receipts (A+B) |

5,41,864 |

6,02,935 |

5,62,173 |

6,14,497 |

|

A. |

Tax Revenue(Net to Centre)(a-b-c) |

4,39,547 |

5,07,150 |

4,65,970 |

4,74,218 |

|

|

a) |

Gross Tax Revenue |

5,93,147 |

6,87,715 |

6,27,949 |

6,41,079 |

|

|

|

of which : |

(12.6) |

(12.9) |

(11.6) |

(10.9) |

|

|

|

1. Corporation Tax |

1,92,911 |

2,26,361 |

2,22,000 |

2,56,725 |

|

|

|

2. Personal IncomeTax |

1,02,644 * |

1,20,604 * |

1,08,000 * |

1,06,800 * |

|

|

|

3. Customs Duty |

1,04,119 |

1,18,930 |

1,08,000 |

98,000 |

|

|

|

4. Union Excise Duty |

1,23,425 |

1,37,874 |

1,08,359 |

1,06,477 |

|

|

|

5. Service Tax |

51,301 |

64,460 |

65,000 |

65,000 |

|

|

|

6. Securities Transaction Tax |

8,576 |

9,000 |

5,500 |

6,000 |

|

|

|

7. Banking Cash Transaction Tax |

586 |

550 |

600 |

50 |

|

|

|

8. Taxes of UTs (Net of Assignments |

|

|

|

|

|

|

|

to Local Bodies) |

1,324 |

1451 |

1,590 |

1,602 |

|

|

|

9. Fringe Benefit Tax |

7,098 |

8160 |

8,500 |

0 |

|

|

|

10. Other Taxes and Duties |

1,163 |

325 |

400 |

425 |

|

|

b) |

States’ Share |

1,51,800 |

1,78,765 |

1,60,179 |

1,64,362 |

|

|

c) |

Surcharge transferred to NCCF# |

1,800 |

1,800 |

1,800 |

2,500 |

|

B. |

Non-Tax Revenue |

1,02,317 |

95,785 |

96,203 |

1,40,279 |

|

|

of |

which : |

|

|

|

|

|

|

1. |

Interest Receipts |

21,060 |

19,135 |

19,036 |

19,174 |

|

|

2. |

Dividends and Profits |

34,499 |

43,204 |

39,736 |

49,750 |

|

|

3. |

External Grants |

2,723 |

1,795 |

2,748 |

2,136 |

|

|

4. |

Non-tax Receipts of UTs |

811 |

815 |

749 |

754 |

|

|

5. |

Other Non-Tax Revenue |

43,224 |

30,836 |

33,934 |

68,465 |

II. |

Revenue Expenditure (A+B) |

5,94,433 |

6,58,119 |

8,03,446 |

8,97,232 |

|

A. |

Non-Plan Expenditure |

4,20,861 |

4,48,352 |

5,61,790 |

6,18,834 |

|

|

of |

which : |

|

|

|

|

|

|

1. |

Interest Payments |

1,71,030 |

1,90,807 |

1,92,694 |

2,25,511 |

|

|

2. |

Defence Revenue Expenditure |

54,219 |

57,593 |

73,600 |

86,879 |

|

|

3. |

Subsidies |

70,926 |

71,431 |

1,29,243 |

1,11,276 |

|

|

4. |

Non-Plan Grants to States and UTs |

35,769 |

43,294 |

38,421 |

48,570 |

|

B. |

Plan Expenditure (1+2) |

1,73,572 |

2,09,767 |

2,41,656 |

2,78,398 |

|

|

1. |

Central Plan |

1,19,666 |

1,51,417 |

1,71,633 |

2,00,290 |

|

|

2. |

Central Assistance for State and UT Plans |

53,906 |

58,350 |

70,023 |

78,108 |

III. |

Revenue Deficit (-)/Surplus(+) [ I-II ] |

-52,569 |

-55,184 |

-2,41,273 |

-2,82,735 |

# : NCCF: National Calamity Contingency Fund.

* Excluding Fringe Benefit Tax.

Note : Figures in the parentheses are gross tax revenue as percentage of GDP.

Source: Budget Documents of the Government of India, 2009-10. |

Statement 2: Transactions on Revenue Account (Concld.) |

(Rs. crore) |

Items |

Variations |

Col.4 over Col. 3 |

Col.4 over Col. 2 |

Col.5 over Col. 4 |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |

6 |

7 |

8 |

9 |

10 |

11 |

I. |

Revenue Receipts (A+B) |

-40,762 |

-6.8 |

20,309 |

3.7 |

52,324 |

9.3 |

|

A. |

Tax Revenue(Net to Centre)(a-b-c) |

-41,180 |

-8.1 |

26,423 |

6.0 |

8,248 |

1.8 |

|

|

a) |

Gross Tax Revenue |

-59,766 |

-8.7 |

34,802 |

5.9 |

13,130 |

2.1 |

|

|

|

of which : |

|

|

|

|

|

|

|

|

|