VII. Macroeconomic Outlook - RBI - Reserve Bank of India

VII. Macroeconomic Outlook

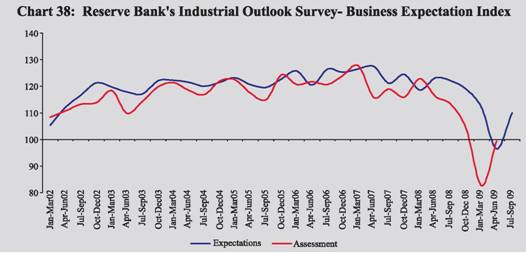

The forecasts of various international agencies continue to point towards persistence of global recessionary conditions during 2009, though some indications, albeit tentative, of a global economic recovery are becoming visible. The IMF revised the growth projection for India upwards on July 8, 2009 from the earlier 4.5 per cent to 5.4 per cent in 2009. Various surveys of economic activity point towards gradual emergence of optimistic sentiment for the outlook of the Indian economy in the coming months. There are visible upside prospects as well as downside possibilities for the near-term growth outlook. Emerging lead information indicate firming up of inflation over time, even though certain possible developments could help in moderating the inflationary pressures. Business Expectations Surveys VII.2 The Business Confidence Index (BCI) of the NCAER (68th round) receded to 81.6 in April 2009 from 91.4 in January 2009. The BCI lost 9.8 points or 10.7 percent in April 2009 over its January 2009 level (Table 56). The decline was recorded in three constituent indices, namely the “overall economic conditions index over the next six months”, “investment climate in the economy now as compared to six months back”, and “expectations of financial position of the firm in next six months”. The index on “current level of capacity utilisation of the firm relative to optimal operations” remained unchanged during the period.

VII.3 The CII Business Confidence Index (CII-BCI) for April-September 2009 at 58.7 increased by 4.3 per cent over the preceding round (i.e., October-March 2008-09) reflecting an improvement in the ensuing business confidence. The business confidence, however, was lower by 3.8 per cent for April-September 2009 as compared to the corresponding period of last year. The Dun and Bradstreet Business Optimism Index for July–September 2009 increased significantly by 40.8 per cent to 132.1 from an all-time low of 93.8 in April-June 2009. On a year-on-year basis, the index, however, recorded a marginal decline of 3.3 per cent over the corresponding quarter of the previous year as compared to a decline of 39.0 per cent in April-June 2009. Five of the six optimism indices, namely volume of sales, net profits, new orders, selling prices, and employee levels recorded an improvement as compared to the previous quarter. Inventory levels, however, registered a decline by 2.0 per cent over the previous quarter. VII.4 The headline Markit India Manufacturing PMI was at 55.3 during June 2009, above the neutral mark of 50.0, indicating recovery in manufacturing for the third straight month after protracted contraction. Production, new orders and manufacturing employment recorded increase during June 2009. Reserve Bank’s Industrial Outlook Survey VII.5 The Industrial Outlook Survey of the Reserve Bank conducted in April-May 2009 also suggests a turnaround in the business sentiment. For the manufacturing companies in the private sector, the business expectations indices based on an “assessment for April-June 2009” and on “expectations for July-September 2009” improved sharply by 20.3 and 14.0 per cent, respectively, over the previous quarter, when these indices had recorded their lowest level since inception of the Survey (Chart 38). VII.7 The industry-wise breakup showed that the net sentiments on ‘overall business situation’ for the sample companies recorded sharp improvement from its lowest level for the quarter April-June 2009. The industry groups, viz., fertilizer, food products, and pharmaceuticals show positive sentiment, with more companies expecting growth than those expecting contraction. The expectations on employment for the July-September 2009 show that the manufacturing sector will be a net hirer. The Business Expectations Index (BEI) for April-June 2009 improved with reference to the previous quarter indicating that the contraction is assessed to be at a much smaller rate. The BEI for July-September 2009 also indicates a turn around and crossed the critical 100 mark into the growth terrain. Survey of Professional Forecasters1 VII.8 The results of eighth round of survey of professional forecasters’ conducted by the Reserve Bank in June 2009 placed overall (median) growth rate for 2009-10 at 6.5 per cent, revised upwards from 5.7 per cent in the earlier survey (Table 58). The sectoral growth rate forecast for the agriculture sector was revised downwards from 3 per cent to 2.5 per cent. The forecasts for industry were revised upwards from 4.1 per cent to 4.8 per cent and for services from 7.5 per cent to 8.3 per cent in the current survey. Median forecasts for different quarters of 2009-10 placed higher growth for industry and services in the third and fourth quarters of 2009-10. Inflation and Growth Outlook VII.10 The outlook for growth has to be assessed in the context of both upside prospects as well as downside possibilities. Certain lead information available for the year 2009-10 that could indicate recovery in growth include: (a) IIP growth remaining positive during April-May 2009 with increasing number of industry groups showing positive trends, (b) the core infrastructure sector showing higher growth of 4.8 per cent in April-June 2009 as against 3.5 per cent in the corresponding period of the previous year, (c) cement production showing significantly higher growth during April-June 2009 over the corresponding period last year, suggesting picking up of activities in the construction sector, (d) some of the forward looking indicators for services sector activities such as tourist arrivals and railway freight earnings imporving in June 2009 and growth in new cell phone connections showing improvements during April-May 2009 being significantly higher than the numbers in the corresponding period of last year, (e) large and sustained fiscal stimulus providing the boost to aggregate demand, (f) Reserve Bank’s Industrial Outlook Survey conducted in April-May 2009 suggesting significant improvement in the respondents’ “assessment for April-June 2009” and “expectations for July-September 2009” by 20.3 per cent and 14.0 per cent, respectively, over the previous survey conducted during January-March 2009, (g) the Reserve Bank’s professional forecasters survey conducted in June 2009 showing a median GDP growth of 6.5 per cent for 2009-10, as against 5.7 per cent as per the previous survey conducted in March 2009, (h) non-food credit growth turning positive since the beginning of June 2009 and the year-on-year deceleration in credit growth showing a modest reversal since the last fortnight of June 2009, (i) capital flows, after two consecutive quarters of net outflows in the second half of 2008-09, showing signs of improvement in the first quarter of 2009-10, (j) early information on the corporate performance for the first quarter of 2009-10 indicating positive growth in both sales and profits over the corresponding period of the previous year, (k) the stock market witnessing significant recovery in the first quarter of 2009-10, indicating signs of improving risk appetite, and (l) primary segment of the capital market, which had virtually dried up since October 2008, witnessing signs of revival with one public issue being over subscribed multiple times. VII.11 Several lead indicators, however, suggest that the dampened growth impulses may continue, which include:(a) significant delay in the arrival of monsoon in certain parts of the country which has already affected the kharif showing, (b) persistence of global recession and the associated weak prospects for recovery in export growth in the near-term, (c) the lagged impact of decline in manufacturing growth in the Q4 of 2008-09 on services demand in early 2009-10, (d) capital goods segment in the IIP showing negative growth during April-May 2009, (e) commercial vehicles production registering a negative growth of 23.1 per cent during April-May 2009, and (f) non-oil import growth declining at an accelerated rate. VII.13 Inflationary pressures may abate if: (a) global recession deepens and persists over a longer period, which could then dampen the commodity prices considerably, (b) despite the delayed progress of monsoon, agricultural growth remains unaffected, (c) administered prices, including MSP do not increase further during the year, and (d) the accommodative monetary stance returns to normal levels at the earliest. 1Introduced by the Reserve Bank from the quarter ended September 2007. The forecasts made in the section are that of professional forecasters and not that of the Reserve Bank. |

||||||||||||||||||||||||||||||||