IST,

IST,

RBI’s OBICUS Survey for Q4:2015-16 reveals Seasonal but not very Robust pick-up in Demand

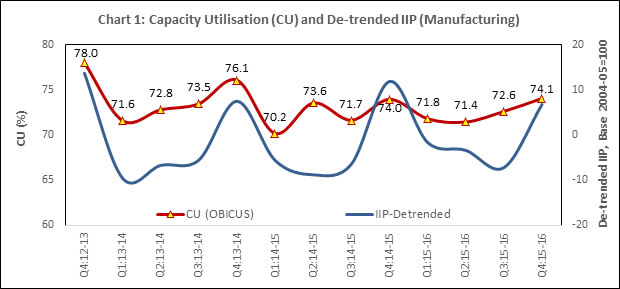

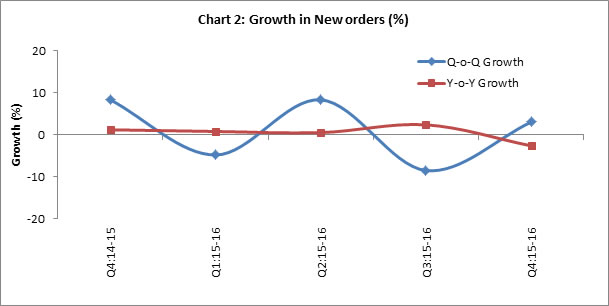

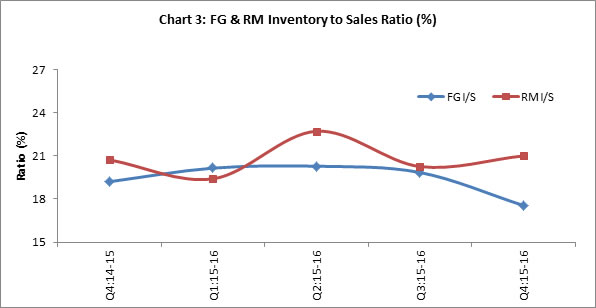

The Reserve Bank of India’s Order Books, Inventories and Capacity Utilisation Survey (OBICUS) for January - March 2016 quarter revealed a seasonal but not very robust pick-up in demand condition. The OBICUS captures actual data from companies in the manufacturing sector. The latest 33rd round of OBICUS, covered data for Q4:2015-16. In all, 926 manufacturing sector companies responded to the survey. The analysis is based on the data on order books, inventory levels for raw materials and finished goods, and capacity utilisation, received from a common set of reporting companies for each of these parameters (Tables 1 - 3). The 32nd round (Q3:2015-16) survey results covering 1058 manufacturing companies were released on April 05, 2016 on the RBI website. The survey results are those of the respondents and are not necessarily shared by the Reserve Bank of India Highlights: 1) Capacity Utilisation (CU): At the aggregate level, CU recorded seasonal pick-up in Q4:2015-16 over the previous quarter and stood at 74.1 per cent - almost unchanged from the level recorded in Q4:2014-15. There is a broad co-movement between capacity utilisation and de-trended Index of Industrial Production1 (IIP) manufacturing, except for some quarters including Q3:2015-16 (Chart 1). 2) Order Books: The average new orders recorded modest growth in Q4:2015-16 over its level in the previous quarter. However, it was lower as compared to the position a year ago (Chart 2). 3) Inventory to Sales Ratio: The finished goods inventory to sales ratio (FGI/S) was lower in Q4:2015-16 as compared to the previous quarter and the same quarter a year ago. Drawdown of FG inventory helped in lowering average pending orders. The raw material inventory to sales ratio (RMI/S) increased in Q4:2015-16 and stood at a marginally higher level as compared to Q4:2014-15 (Chart 3). ANNEX

1 IIP is calculated on a fixed base (currently, 2004-05=100) whereas the denominator (viz. installed capacity) in CU is updated every quarter. For comparison, trend component of IIP is removed. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: