IST,

IST,

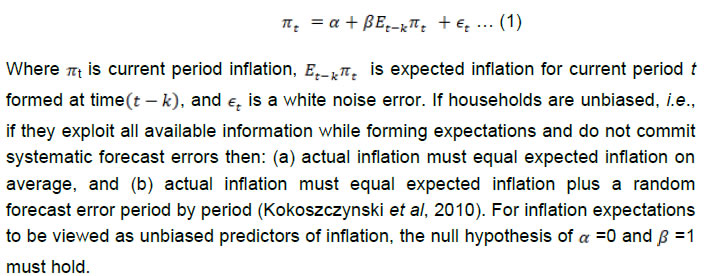

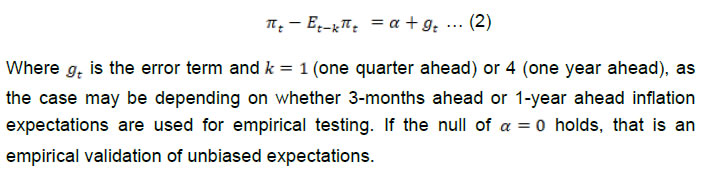

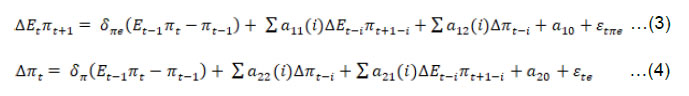

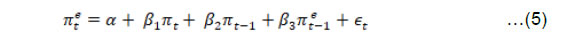

RBI WPS (DEPR): 01/2019: Inflation Expectations of Households: Do They Influence Wage-Price Dynamics in India?