IST,

IST,

RBI WPS (DEPR): 03/2014: Re-emerging Stress in the Asset Quality of Indian Banks: Macro-Financial Linkages

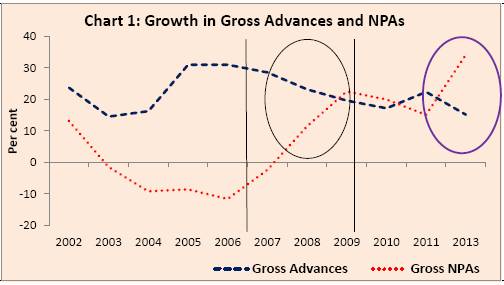

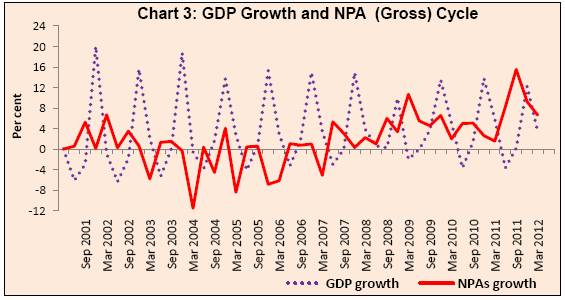

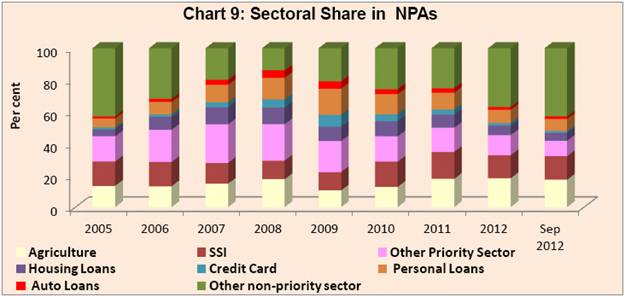

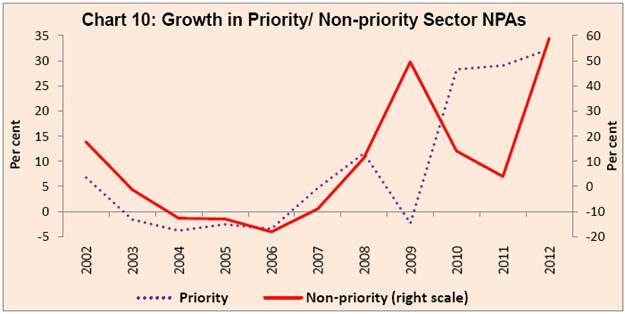

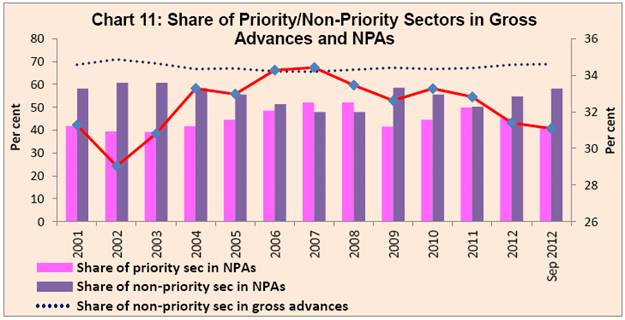

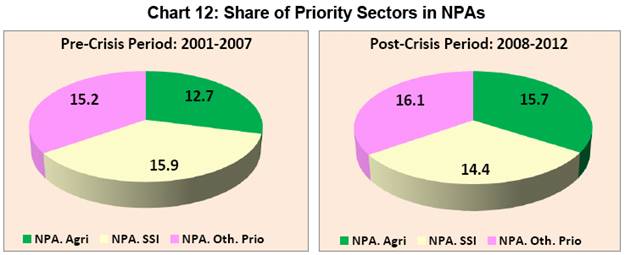

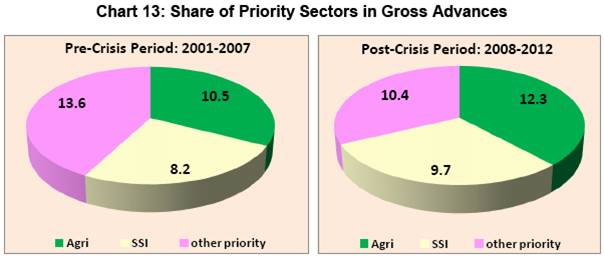

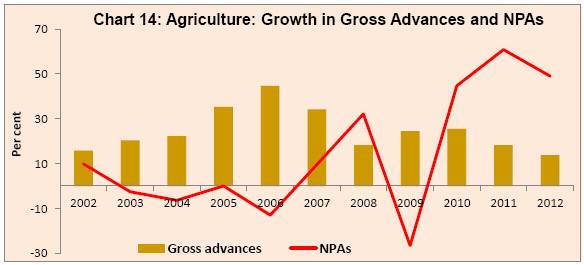

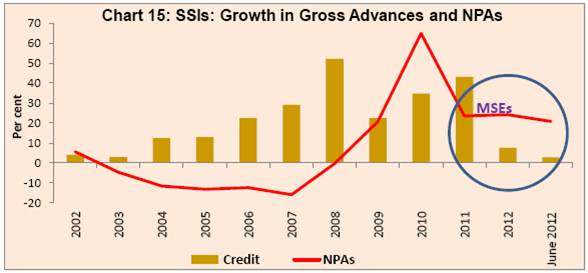

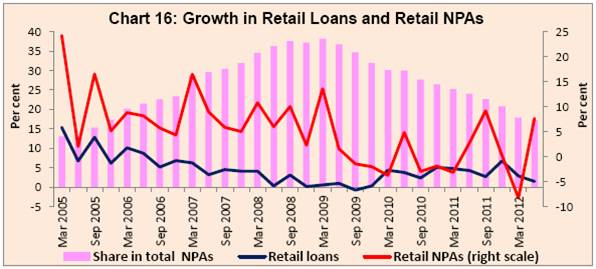

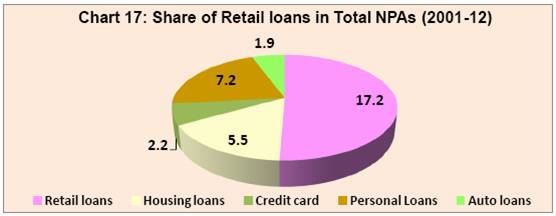

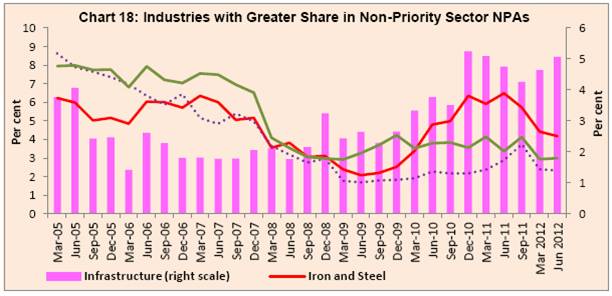

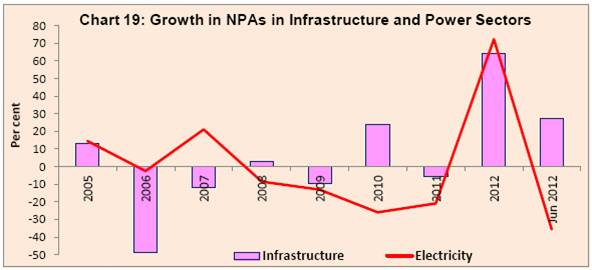

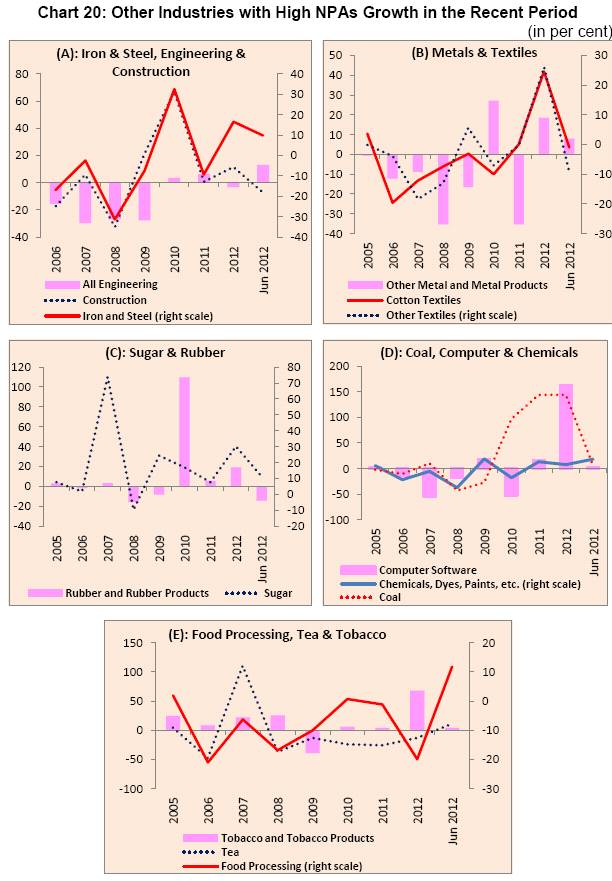

| RBI Working Paper Series No. 03 Abstract 1In a bank-based economy, sound health of the banking system is an imperative for efficient financial intermediation in the context of overall development and financial stability. In the post- global crisis period, the Indian banking system, has suffered growing impairment of asset quality. This paper explores the macro-financial linkages and micro-level sources underlying the asset quality deterioration. In line with the ongoing international intellectual discourse, this paper finds the evidence of procyclicality in the Indian context as reflected in past credit boom-bust episodes as well as economic and interest rate cycles. Anemic external macroeconomic situation post-crisis, high inflation and dwindling asset prices have eroded the debt servicing capacity of borrowers and contributed to the asset quality problems. Sectoral analysis demonstrates rising incidence of loan defaults in infrastructure, particularly power, retail, SSIs and agriculture, across bank groups. Going forward, asset quality could come under greater strains, given the weakening economic backdrop and global headwinds, impinging on the soundness of banks and macro financial stability. JEL Classification: E230, E3, G21 Key words: GDP, business cycles, prices, credit, assets Preface The Indian banking sector accounts for a major portion of financial intermediation and is considered to be the main channel of monetary policy transmission, credit delivery and payment systems. The stability and sound health of the banking system hence is a key pre-requisite for overall economic development and financial stability. The Non-Performing Assets (NPA) is an important prudential indicator to assess the financial health of the banking sector. Besides asset quality, NPAs epitomize the credit risk management and efficacy in the allocation of resources. There is a near unanimity in the literature that asset quality is a critical determinant of sound functioning of the banking system. NPAs affect the operational efficiency, which in turn affects profitability, liquidity and solvency position of banks (Michael, et al, 2006). The consequences of NPAs would be reduction in interest income, high level of provisioning, stress on profitability, gradual decline in ability to meet steady increase in cost, increased pressure on net interest margin (NIM) thereby reducing competitiveness, steady erosion of capital resources and increased difficulty in augmenting capital resources (Batra, 2003). The asset quality problems could be contagious, insidious and they prey on the weak. The contagious nature of loan losses emanates from the fact that their downside impact can quickly transmit to earnings, capital, and liquidity. They are insidious in the sense that it is often difficult to know that there is a problem until it’s too late. Moreover, these problems prey on the weak banks, which are vulnerable and have relatively small amounts of capital to absorb unanticipated losses2. NPAs generate a vicious cycle of effects on the sustainability and growth of the banking system, and if not managed properly could lead to bank failures. Empirical evidence indicates a relationship between bank failures and higher NPAs worldwide (Chijoriga, 2000 and Dash, et al, 2010). The links between financial crises and bank funding may be strongest during banking crises. Such crises tend to arise primarily from deteriorating economic fundamentals, notably declines in asset quality (Borio and Lowe, 2002). The issue is of particular importance after the recent global financial crisis and the failure of some large institutions and bailouts that followed. In the Indian context also empirical research suggests that asset quality is one of the main determining factors of credit, besides time deposits and lending interest rate (RBI, RCF, 2006-08). With the initiation of the reform process in the early 1990s, there has been a paradigm shift in the credit allocation process from micromanagement to a greater role for market forces. The banking sector in India has witnessed significant transformation over the last two decades in terms of type of borrowers/type of instruments and the credit pricing. With enhanced freedom for business operations and increased presence of private/ foreign banks and non-bank credit institutions, the predominance of banking institutions in the credit market has increased and has become increasingly competitive. Rapid credit expansion, particularly since the last decade, was encouraged by improvement in asset quality, which, to some extent reflected the financial deepening process. Robust economic growth during the first half of the last decade also increased the demand for credit (RBI, RCF, 2008). In the period immediately following the global financial crisis, when asset quality of banks in most advanced and emerging economies was impaired, the asset quality of Indian banks was largely maintained (RBI, AR, 2011-12). Nevertheless, in the recent years, particularly since 2012, concerns regarding impairment in asset quality of Indian banks have come to the fore. Against this backdrop, this paper attempts to undertake a critical analysis of asset quality of scheduled commercial banks (SCBs), since they account for more than three-fourths of total credit outstanding in the country. In this endeavour, Section II sets out some stylized facts from literature on the possible causes and impact of asset quality impairment. A brief recap of data and methodology used in this study is outlined in Section III. Section IV examines the trends in gross advances and NPAs at the aggregate level and also undertakes an empirical analysis to understand the macro-financial linkages underlying the asset quality phenomenon. Section V delineates the micro level sources of NPAs at sectoral level. The bank group-wise trends are set out in Section VI. Section VII assesses the recent policy of restructuring of advances and examines its impact in the near to medium term. The concluding remarks are set out in the last Section VIII. Literature on the asset quality of banks brings to the fore several useful perspectives. An asset can turn in to a NPA when the borrower defaults on his repayment of interest and/or principal on agreed terms. In the literature several reasons are cited for asset quality impairment. Business cycle could be a primary reason for banks' non-performing loans (Misra and Dhal, 2010). Sergio (1996) in a study on non-performing loans in Italy found that an increase in the riskiness of loan assets is rooted in a bank’s lending policy adducing to relatively unselective and inadequate assessment of sectoral prospects. The problem of NPAs is related to several internal and external factors confronting the borrowers (Muniappan, 2002). The internal factors are diversion of funds for expansion, diversification and modernisation, taking up new projects, helping/ promoting associate concerns, time/cost overruns during the project implementation stage, business (product, marketing, etc.) failure, inefficient management, strained labour relations, inappropriate technology/technical problems, product obsolescence, etc., while external factors are recession, non-payment in other countries, inputs/power shortage, price escalation, accidents and natural calamities. Kent and D'Arcy (2000), while examining the relationship between cyclical lending behaviour of banks in Australia argued that the potential for banks to experience substantial losses on their loan portfolios increases towards the peak of the expansionary phase of the cycle. However, towards the top of the cycle, banks appear to be relatively healthy; non-performing loans are low and profits are high, reflecting the fact that even the riskiest of borrowers tend to benefit from buoyant economic conditions. While the risk inherent in banks lending portfolios peaks at the top of the cycle, this risk tends to be realized during the contractionary phase of the business cycle. At this time, banks non-performing loans increase, profits decline and substantial losses to capital may become apparent. There are other reasons why credit growth and loan quality are pro-cyclical aside from a financial accelerator. Herd behavior of bank managers can lead to a deterioration of credit standards during economic booms, as credit mistakes are judged more leniently (De Bock and Demyanets, 2012). Gopalakrishnan (2005) classified the causes for NPAs into political, economic, social and technological and observed that neglect of proper credit appraisal, lack of follow-up and supervision, recessional pressures in economy, change in government policies, infrastructural bottlenecks, and diversion of funds are the major causes of NPAs. The problem of NPAs is not mainly because of lack of strict prudential norms, but due to legal impediments and time consuming nature of asset disposal process, postponement of the problem by the banks to show higher returns and manipulation by the debtors using political influence (Reddy, 2002). According to another study, the major reasons for NPAs include improper selection of borrowers’ activities, weak credit appraisal system, industrial problems, inefficient management, slackness in credit management and monitoring, lack of proper follow-up, recessions and natural calamities and other uncertainties (Aggarwal and Mittal, 2012). The clamor for credit risk management can easily be lost in the heat of credit cycles, economic adversity, and intense competition3. In the context of intense competition, focus on market share leads to lax underwriting standards without enough regard for borrowers’ repayment capability4. The opinion over the relationship between inflation and NPAs is divided. Rinaldi and Sanchis Arellano (2006) find a positive relation between the inflation rate and nonperforming loans, while Shu (2002) reports a negative relation. Negative structural shocks to economic growth, the exchange rate, or debt-creating capital inflows tend to bring down private credit while loan quality deteriorates. It is also said that an increase in asset prices pushes up the net worth of firms, households or countries, improving their capacity to borrow. Through general equilibrium effects, this dynamic can then lead to further increases in asset prices. In this way, strong balance sheets in boom periods may lead to excessive lending against inflated values of collateral (De Bock and Demyanets, 2012). In the Indian context, it has been pointed out that though public sector banks recorded improvements in profitability, efficiency (in terms of intermediation costs) and asset quality in the 1990s, they continue to have higher interest rate spreads but at the same time earn lower rates of return, reflecting higher operating costs. Private sector banks, on the other hand, appear to have lower spreads as well as lower operating expenses comparable to the banking system in G3 countries (Table 6). At the same time, asset quality is weaker so that loan loss provisions continue to be higher (Mohan, 2004). In order to explore the macro-financial linkages of the asset quality phenomenon, the key variables used in this paper include credit growth (credit to agriculture and industry separately), GDP growth (in agriculture and industry separately) and interest rate cycles as also inflation, asset prices and world GDP growth. The relationship between these variables and asset quality has been tested in the extant international literature (see Section II). In the Indian context, the quarterly data for scheduled commercial banks spanning from 2001 to 2013 (2012, wherever not available) are used in this paper. Since the disaggregated (component-wise) NPA data are not available prior to 2001, it has not been possible to extend the sample to the earlier decade. Moreover, the industry-wise NPA data are available only from March 2005. To investigate the relationship between the above macro-financial variables and asset quality, the regression of the following form has been estimated using the OLS technique. In addition to other diagnostic tests, LM tests, normality distribution tests and heteroskedasticity tests have been used. Where, GDPG stands for GDP growth, CRGDPR for credit-GDP ratio, MMKTRATE for money market rate (proxy for lending rate), BANKEX for stock prices, WGDP for world GDP growth, WPIINFL for WPI inflation and the dummy variables (D2004Q3, D2005Q3, D2008Q4). The results have been analysed in Section IV. IV. An Overview of Macro Trends (A) Trends in Gross Advances and NPAs An analysis of trends in gross advances and gross NPAs during the last decade brings out the following trends. (1) Deterioration in Asset quality in recent times The period since mid-2000 was marked by a sustained improvement in the asset quality of SCBs. However, with the turn of the decade, the signs of asset quality impairment soon came to the fore with the reversal in the declining trend of NPA ratio. The gross NPA ratio (gross NPAs as a per cent of gross advances) witnessed a sequential decline from 12 per cent as at end March 2001 to 2.4 per cent as at end March 2011. Thereafter, the NPA ratio rose to 3.4 per cent as at end-March 2013 (Table 1 and Chart 1). (2) Growth in NPAs outpaces the growth in credit During the period 2001-2012, three distinct phases are discernible in terms of growth in gross advances and growth in gross NPAs. (a) First Phase: 2001 to 2006: This period was marked by a sharp decline in the growth of gross NPAs and gradual acceleration in the growth of credit (Table 1 and Chart 1). In fact, during the pre-crisis period, bank credit expanded at a robust pace, averaging at over 25 per cent. Several factors, such as increased financial deepening, increased competition, improvement in asset quality of banks and rapid product innovations contributed to the rapid credit expansion. Infrastructure, SMEs, farm credit and retail sectors primarily powered the growth of bank credit during this period (RBI, RCF, 2008). As a result of various reform measures5, there was significant improvement in the asset quality, particularly from the year 2000, partly as a result of expansion of loan volumes and partly on account of write-offs and recovery of past dues. Thus, rapid credit expansion from 2002-03, to an extent, was encouraged by improvement in asset quality as credit intermediation function was impaired in the mid-1990s on account of high level of NPAs (RBI, RCF, 2007). (b) Second Phase: 2006 to 2009: This period witnessed a reversal in the earlier trends with growth in NPAs showing a sharp spurt and growth in credit registering a gradual slowdown. This was also a period when the divergence between the growth in credit and NPAs narrowed down. In the post-crisis period, credit growth averaged at around 19 per cent partly on account of the pressures from global financial crisis. Banks and other financial institutions were impacted by the indirect spillovers of the crisis during 2008-09. Indian banks faced the stress because foreign investors pulled out of the economy and created a liquidity crunch. There was suddenly less money available to borrow or lend. The tight global liquidity situation in the period immediately following the failure of Lehman Brothers in mid-September 2008, coming as it did on top of a turn in the credit cycle, increased the risk aversion of the financial system and made banks cautious about lending (Subbarao, 2009) (c) Third Phase: 2009 to 2012: During this period, growth in credit as well as NPAs slowed down in 2010. However, by end-March 2012, there was a sharp contrast in the movement of both, with credit growth witnessing a sharp contraction and growth in NPAs trending up. NPAs grew at around 46 per cent as at end March 2012, far outpacing credit growth of around 17 per cent. This widening divergence in the growth of credit and NPAs has implications for the asset quality in the near term. The decline in credit growth during this period could be attributed to the general economic slowdown that set in as a result of combination of domestic and global factors. (3) Incremental Accretion to NPAs Accelerate Accretion to NPAs is a critical indicator of efficiency in credit risk management. Banks need to bring down fresh additions to NPAs to improve the quality of their asset portfolio. In consonance with the trends in gross NPAs, the accretions to NPAs was considerably curtailed during the period 2003-2007, but increased significantly thereafter (Chart 2). The incremental NPAs remained negative in most of the years prior to the year 2008. A sharp decline in incremental NPAs reflected significant improvement in credit appraisal, improved risk management and better resource allocation process (RBI, RCF, 2007). The incremental NPAs as percentage of incremental gross advances, which were as low as -0.3 per cent as at end-March 2007 increased significantly thereafter to over 6.6 per cent by end-March 2013. Thus, in the context of financial turmoil, although some slippage in NPAs was expected, it is noteworthy that the growth in NPAs of Indian banks has largely followed a lagged cyclical pattern with regard to credit growth (RBI, RTP, 2009-10). This relationship is examined in greater detail in the following section. (B) Asset Quality Impairment and its Macro-Financial Linkages The asset quality linkages with other macro-financial variables such as credit growth, GDP growth and interest rate cycles as also inflation, asset prices and world GDP growth are examined below. (i) NPAs and Credit Cycle The literature identifies credit cycles as an important determinant of banks’ asset quality. Cyclicality/pro-cyclicality has been defined as “dynamic interactions (positive feedback mechanisms) between the financial and real sectors of the economy” (FSF, 2009). Financial institutions tend to over-stretch their lending portfolio during economic booms and tend to retrench the same during economic downturns. It has been argued that an expansion in credit growth is associated with the deterioration in asset quality because when banks over expand their lending, they tend to lower their credit standards. This behaviour translates itself into greater slippages in asset quality at matured stages of the credit cycle. The literature identifies various reasons for such pro-cyclical risk-taking behaviour of banks, viz., “herd behaviour” (Rajan, 2005), “principal-agent problem” between shareholders and managers (Borio et al, 2001), “disaster myopia” or shortsightedness in underestimating the likelihood of high-loss low-probability events (Guttentag and Herring, 1986), among others. Recent findings, in the Indian context using quarterly data from June 2000, suggested a lagged statistically significant positive relation between deviations from trend in credit to GDP (C-GDP) ratio and growth in gross NPAs (RBI, AR, 2011-12). The deviations from trend in C-GDP ratio has been recommended as a principle guide by the Basel Committee on Banking Supervision (BCBS) for determining economic and financial cycles under its Basel III framework (BIS, 2010). This brings out the cyclicality in the behaviour of asset quality of Indian banks. An empirical analysis of trends in gross advances and gross NPAs since June 2000 carried out in this study indicates that NPA growth follows credit growth with a lag. The results bring out the fact that credit growth fed into growth in NPAs in a lagged manner, i.e., 1 per cent rise in credit- GDP ratio increases NPAs growth by 0.4 percentage points (after 11 quarters). Similarly, the disaggregated analysis suggest that 1 percent increase in agriculture credit results subsequently in 0.7 per cent growth in agriculture NPAs after a lag of 12 quarters. The estimates, though tentative6, are even higher in respect of industrial sector, i.e., 1 per cent increase in industrial credit could increase NPAs by 1.26 per cent after a lag of 9 quarters. This underlines the pro-cyclical behaviour of the banking system, wherein asset quality can get compromised during periods of high credit growth and this can result in the creation of NPAs for banks in the later years (Annex Table 1, 2 and 3). The asset quality of banks plays a significant role in determining the portfolio behaviour of banks. Earlier findings have brought out that asset quality is one of the main determining factors of credit, besides time deposits and lending interest rate (RBI, RCF, 2006-08). In fact, the credit boom in the pre-crisis period was encouraged by the improvement in asset quality. Secondly, the outcome of high credit growth during the pre-crisis period resulted in the rise in NPAs overtime in the post-crisis period, as evident from the empirical analysis above. Hence, pro-cyclicality of credit pattern during the pre-crisis period could be considered as one of the factors responsible for asset quality deterioration during the recent years. Further, it justifies the countercyclical prudential regulatory policy, as pursued by the Reserve Bank, and corroborates the need to further strengthen such a policy by putting it on a more systematic and rule-based footing to effectively address the concerns of asset quality (RBI, AR, 2011-12). (ii) Growth and NPAs Cycle It is often said that general economic slowdown impinges on the performance of banks and financial institutions, since slump in major economic activities results in poor recoveries and consequent deterioration in asset quality. During the pre-crisis period, particularly between 2003-08, the real GDP growth witnessed an impressive turnaround, averaging at 8.9 per cent per annum, which also acted as a strong impetus for credit upturn. However, during the post-crisis period, the real GDP growth decelerated to 6.7 per cent in 2008-09 and to 7.4 per cent in 2009-10. In 2011-12, growth further dropped to 6.2 per cent and further to 5.0 per cent in 2012-13. The slowdown in growth was a result of combination of domestic and global factors. Global macroeconomic and financial uncertainty, weak external demand, elevated level of prices, widening twin deficits combined with weak investment resulted in growth slowdown (RBI, AR, 2011-12). An analysis of growth in nominal GDP and gross NPAs reveals that slowdown in GDP growth is accompanied by rise in NPAs growth (Chart 3). Over the last one decade, growth in NPAs decelerated sharply, following acceleration in GDP growth in 11 quarters, whereas growth in NPAs rose sharply following the deceleration in GDP growth in 12 quarters. The empirical analysis in this regard brings out the following points:

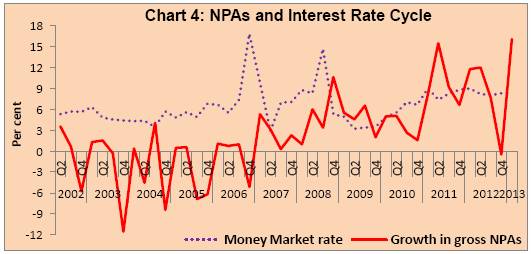

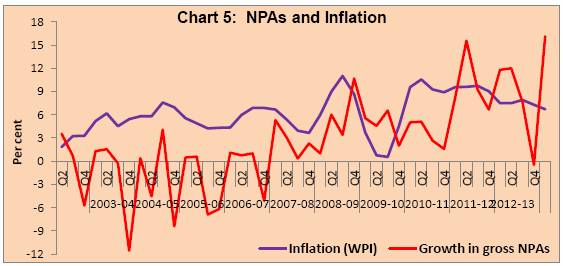

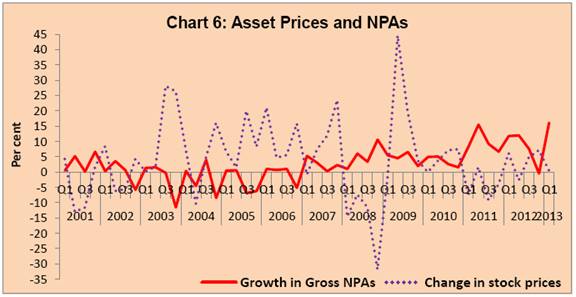

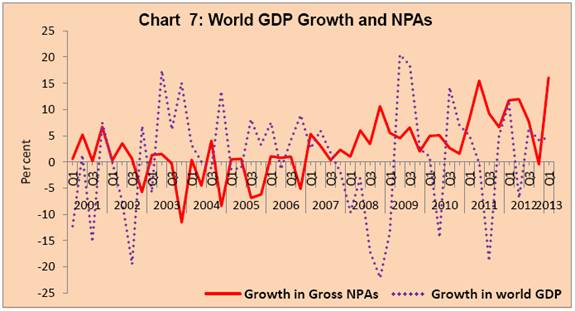

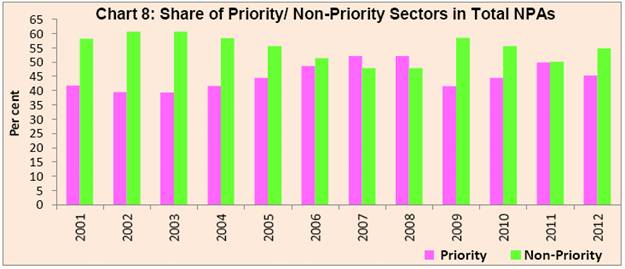

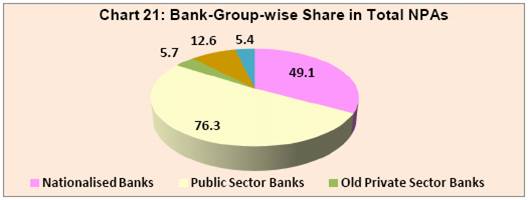

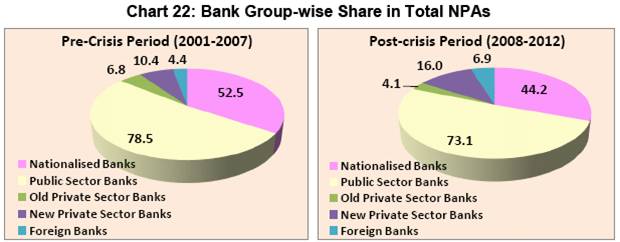

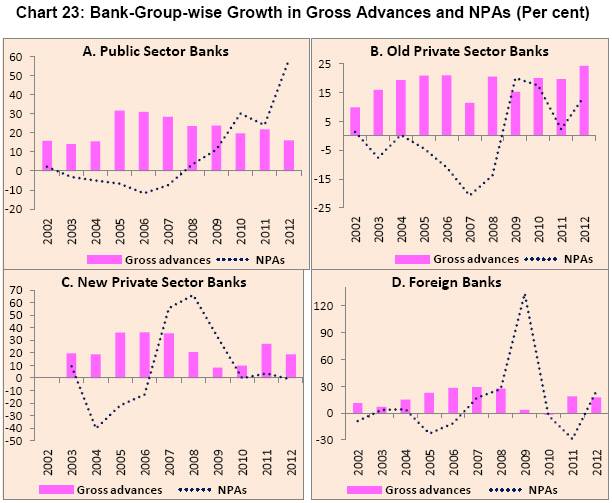

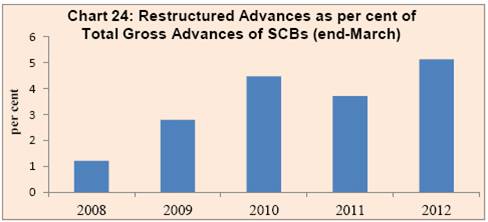

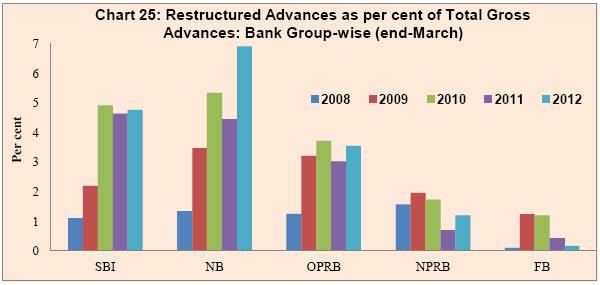

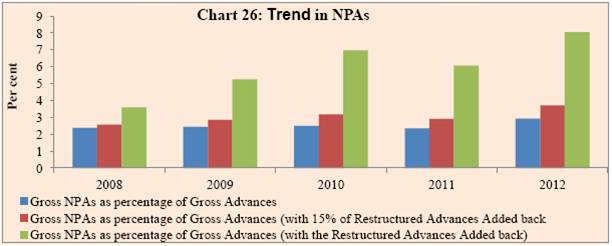

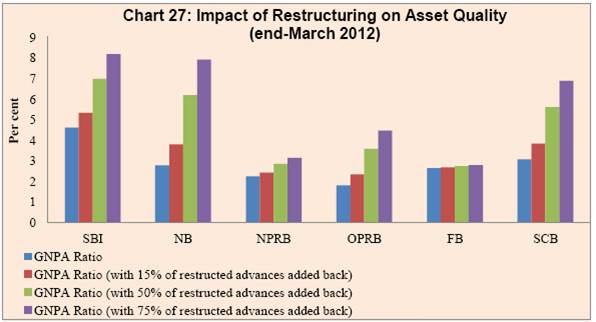

Thus, growth slowdown could be considered as a factor explaining the rise in NPAs in the recent years. (iii) NPAs and Interest Rate Cycle The changes in lending rates of banks may also cause changes in NPA levels. Hardening of interest rates makes repayment of loans difficult for borrowers, particularly those who have availed loans earlier at floating rates. Growth in NPAs also seems to follow a cyclical pattern with lending rate. As a measure of debt servicing cost Bofondi and Ropele (2011) use the short-term money market rate since a large proportion of Italian households' and firms’ outstanding bank debt (about 70 and 90 per cent, respectively) consists of floating rate loans or loans with short maturity. It was found that increases in money market rate worsens the quality of loans as higher debt servicing costs make it harder for borrowers to honour their debt. Furthermore, higher interest rates may result in adverse selection of borrowers, with only the riskier ones left in the market (Stiglitz and Weiss, 1981). In the Indian context, the movement in short-term money market rate and NPAs reveals that growth in NPAs has remained low during the phases of low interest rate, while NPAs growth has increased with the increase in interest rate (Chart 4). The empirical estimates also corroborate the fact that growth in NPAs is likely to go up in the backdrop of elevated interest rate environment, i.e., 100 bps rise in interest rate (money market rate proxy for lending rate) leads to around 0.6 percentage point rise in NPAs growth after a lag of one quarter. Thus, hardening of interest rates in the recent times might have also contributed to increase in NPAs. (iv) NPAs and Inflation The rising prices erode the disposable incomes and impinge on the repaying capacity of borrowers. Moreover, high inflation passes through to nominal interest rates, making debt servicing more onerous. On the other hand, high inflation may help borrowers, whose debt is denominated in nominal terms, as it erodes the real value of debt (Bofondi and Ropele 2011). There is also evidence in the literature that banks’ write‐off ratio increases after increase in retail price inflation and nominal interest rates (Hoggarth et al. 2005) In the three year period before the crisis of 2008, the Indian economy expanded by 9.5 per cent on average and WPI inflation averaged at about 5.2 per cent, despite a positive output gap (i.e. actual GDP growth minus potential growth). The post-crisis period has in fact exhibited phases of both high growth and low growth coexisting with high inflation. In fact, when India recovered quickly from the crisis, inflationary pressures remerged due to supply shocks in the form a deficient monsoon, followed by hardening of global commodity prices. Inflation, as measured by the wholesale price index (WPI), went briefly into negative territory for a few months in 2009 but started rising sharply thereafter, touching a peak rate of 10.9 per cent in April 2010. Average WPI inflation was 9.6 per cent in fiscal year 2010-11, 8.9 per cent in 2011-12 and 7.4 per cent in 2012-13. Both growth in NPAs and inflation display a co-movement (Chart 5). The empirical estimates in this study also suggest that rise in inflation by 1 per cent, results in increase in NPAs by 0.4 percentage points after a lag of 5 quarters. (v) Asset Prices and NPAs A surge in asset prices can push up the net worth of borrowers through wealth effect and help in facilitating debt servicing. There is evidence in the literature about the role of asset prices, particularly stock prices in driving the asset quality of banks (Chen, 2001, Gambacorta, 2005 and Kunt and Detragiache, 1997). High asset prices can cushion borrowers from unexpected shocks by facilitating access to credit and/or helping to service existing debts. Higher asset valuations should, therefore, be associated with lower levels of NPA ratios. A booming stock market reflects a buoyant outlook on firms’ profitability; moreover, an increase in financial wealth is expected to decrease households’ probability of defaulting on loans since it gives them additional means for servicing their debt (Bofondi and Ropele 2011). There is an inverse co-movement between asset prices and NPAs (Chart 6). The empirical evidence in this study points out that increase in stock prices by 1 per cent leads to 0.04 percentage points decline in NPAs, after a lag of 2 quarters. (vi) Global Macroeconomic Situation and Asset Quality External environment also plays a role in the setting of domestic macroeconomic conditions. A buoyant external environment can augur well for the overall profitability and asset quality of banks, since positive externalities flowing from positive external environment can feed into domestic economy performance by way of trade, confidence and financial sector channels. There is inverse relationship between world GDP growth (proxy for external environment) and NPAs (Chart 7). The estimates in this study suggest that a decline in world GDP by 1 per cent brings about 0.1 percentage point increase in NPAs (after a lag of 10 quarters). V. Micro Level Sources of Asset Quality An assessment of trends in gross advances and NPAs in priority and non-priority sectors including the industrial sector are set out below. (1) Non-priority sector has contributed significantly to acceleration in total NPAs in the recent period Since the year 2000, the share of priority sector in total NPAs has averaged at 45 per cent, while the share of non-priority sector averaged at 55 per cent. Prior to the period of 2008, the share of priority sector in total NPAs was expanding, while that of non-priority sector was declining in line with the general decline in total NPAs (Chart 8). Disaggregated analysis reveals that, on an average, retail loans occupy the largest share in total NPAs followed by small scale industries (SSIs), agriculture, personal loans, housing loans, exports, credit cards and auto loans (Chart 9). The growth in NPAs in both priority and non-priority sectors has accelerated since the crisis period of 2008. However, the growth in NPAs of non-priority sector, which averaged at around 32 per cent during the post-crisis period was higher than that of the priority sector (around 22 per cent). Moreover, the growth in the non-priority sector NPAs during 2011-12 was the sharpest in the last one decade (59 per cent as at end-March 2012) (Chart 10). The sharp rise in NPAs of non-priority sector was reflective of the slowdown in the economy and stressed financial conditions of corporates that followed after the global financial crisis. It is noteworthy that the Reserve Bank issued guidelines regarding restructuring of loans, as a one-time measure in view of the extraordinary external factors during the crisis period, for preserving the economic and productive value of assets, which were otherwise viable. (2) Priority sector share in aggregate NPAs not commensurate with its share in total credit Since the last decade, the share of priority sector in gross advances averaged at over 32 per cent, while its share in total NPAs remained much higher, averaging at around 45 per cent (Chart 11 and Table 2). (A) Priority Sector (1) The share of agriculture in total NPAs remains lower than that of other priority sectors The disaggregated analysis of priority sector shows that over the last one decade, the average share of agriculture in total NPAs remains lower than the share of SSIs and other priority sectors. However, the share of agriculture and other priority sectors in aggregate NPAs increased, while that of SSIs declined during the post-crisis period (Chart 12). The recent years have witnessed increased credit flow to agriculture. The share of agriculture in total gross advances increased from 10.5 per cent in the pre-crisis period to 12.3 per cent in the post-crisis period. The increase in credit flow to SSI sector was relatively lower in the post-crisis period. However, in respect of other priority sectors, even while the share in gross advances came down, their share in aggregate NPAs increased during the post-crisis period (Chart 13). (2) Growth in agriculture NPAs has contributed partly to recent rise in NPAs The growth in credit flow to agriculture accelerated significantly during 2002-2006, averaging at around 28 per cent per annum, before decelerating thereafter to over 22 per cent per annum, during 2007-2012. The high growth in agriculture credit during the pre-crisis period could be attributed to the programme of doubling of credit flow to agriculture that was launched by the Government for the period 2004-05 to 2006-07. The growth in NPAs in agriculture, which was negative up to the year 2006, rose significantly by end-March 2008. The growth in NPAs in agriculture declined sharply in 2009 due to the implementation of the Agriculture Debt Waiver and Relief Scheme, 2008 (RBI, RTP, 2010). In the recent years, however, the growth in NPAs in agriculture has been high, averaging at over 28 per cent during 2007-2012. In fact, the growth in NPAs in agriculture was as high as 61 per cent by end-March 2011, although it decelerated subsequently to 49 per cent by end-March 2012. The high growth in credit to agricultural sector during the pre-crisis period might have contributed to the growth in agricultural NPAs in the subsequent years owing to the deterioration in credit quality (Chart 14). Thus, among the priority sectors, the recent rise in NPAs could partly be attributed to increasing NPAs in the agriculture sector. (3) NPAs growth in SSI sector has accelerated sharply in recent years The credit growth to SSIs sector witnessed a marked acceleration, before the crisis period of 2008, averaging at over 19 per cent. This period also saw negative growth in NPAs in SSI sector. In the post-crisis period, the credit growth to SSIs sector decelerated, but remained higher than the pre-crisis period, averaging at over 22 per cent. However, the growth in NPAs, which was negative before 2008, increased significantly thereafter, averaging at around 31 per cent. Even the data for Micro and Small Enterprises (MSEs)7 for 2011 and 2012, show that the NPAs grew sharply at 24 per cent. The rise in the growth of NPAs in the SSI sector was partly a reflection of the impact of the financial crisis and the economic slowdown that had set in thereafter (See section IV). Thus, NPAs in SSIs sector have also contributed to rise in aggregate NPAs in the recent years (Chart 15). (B) Non-Priority Sector (1) NPAs in the retail loan segment decline overtime, but their share in total NPAs still remains high The growth in credit flow to retail segment has declined overtime. This is also accompanied by fall in the growth of NPAs in the retail loans sector. When compared with pre-crisis period, there was a marked deceleration in the growth of retail loans during the post-crisis period, from 7.5 per cent during 2001-2007 to 2.6 per cent during 2008-2012. This could partly be due to risk aversion that generally followed after the crisis. The deceleration in NPAs in retail loan segment has been even sharper from 9.3 per cent to 2.5 per cent during the above period. Though the share of NPAs in retail loan segment in the total NPAs has come down from 38 per cent as at end-March 2009 to 18 per cent by end-March 2012, it still continues to be high and above the levels of key priority sectors like agriculture. As at end-June 2012, there was a sharp acceleration in the growth of retail loan NPAs, partly due to the base effect (Chart 16 and Table 3). (2) In the retail loan segment, personal loans account for the largest share Over the last decade, retail loan segment, on an average, accounted for over 17 per cent of total NPAs, which is higher than its share in total gross advances (15 per cent). Among the retail loan segment, the share of personal loans is the highest in the total NPAs (7.2 per cent), followed by housing loans (5.5 per cent), credit card loans (2.2 per cent) and auto loans (1.9 per cent). However, the share of personal loans and credit card loans in total gross advances is lower than their share in total NPAs (Chart 17). It is noteworthy that retail credit growth including personal loan portfolio of banks had shown a spurt in the pre-crisis period, particularly between 2004-05 and 2005-06. Until the early 1990s, there were several restrictions for granting of personal loans. All these conditions/restrictions were gradually removed in the early 1990s and banks were given freedom to decide the quantum, rate of interest, margin requirement, repayment period and other related conditions. These relaxations had a positive impact on the growth of personal loans. Household or personal loans, on an average, registered a rise of over 38 per cent during the five-year period ended March 2006 as compared with 23 per cent in the 1990s. Housing loans grew at an average annual rate of 47 per cent during the five year period ending 2006 (RBI, RCF, 2007). The sharp increase in bank credit to the household sector was contributed by several factors RBI. The range of loan products offered by banks widened considerably, especially in the case of personal loan segment. Buoyant economic growth and “wealth effect” of surging capital markets were the major triggers for growth in consumer loans (Nitsure, 2007). The rapid growth in the housing market, in particular, was supported, inter alia, by the emergence of a number of second tier cities as upcoming business centres and increase in IT and IT-related activities, which have had a positive impact on household’s demand for housing. Increasing demand, rising income levels, probability of low default and comfortable liquidity in the banking system created huge potential for housing finance business (RBI, RCF, 2007). Thus, high growth in household credit, particularly personal loans and housing loans in the pre-crisis period could have resulted in NPAs in these sectors. High interest rate environment in the recent period might have also contributed to the situation as repayment of loans become difficult for borrowers who have contracted their loans in the low interest rate regime at floating rates, particularly in respect of housing loans, which have the second highest share in retail loans. (C) Industrial Sector (1) The share of infrastructure in non-priority sector NPAs has accelerated in the recent times An analysis of industry-wise share in non-priority sector NPAs in the recent times brings out the fact that infrastructure occupies the largest share (over 5 per cent), followed by iron and steel (over 4 per cent) and chemicals/dyes/ paints industry (3 per cent) as at end-June 2012. The share of these industries in NPAs declined during the crisis period, before inching up gradually in the subsequent period. The increase was highest in respect of infrastructure (Chart 18). However, gross NPAs as percentage of gross advances accounted for around 1 per cent in respect of infrastructure, while it was higher in the case of iron and steel (3 per cent) and chemicals/dyes/ paints industry (4 per cent). It may be noted that given the importance of infrastructural development for economic growth, infrastructural financing has been an important area of concern for both the Government and the Reserve Bank. Accordingly, a number of regulatory measures and concessions were provided to banks including take out financing, relaxed asset classification norms and enhanced exposure ceilings for infrastructural lending. Infrastructural financing has been a growing component in banks’ credit portfolio in the recent years partly on account of such policy initiatives. Banks have been increasing their exposure to the infrastructure sectors such as road and urban infrastructure, power and utilities, oil and gas, other natural resources, ports and airports, telecommunications, among others. Infrastructural credit as per cent of total non-food gross bank credit as well as total industrial credit has shown a steady increase from 2007-08 onwards (RBI, RTP, 2009-10). (2) Coal and textiles, among others, have contributed substantially to recent deterioration in asset quality in respect of industrial sector. In terms of gross NPA ratio (gross NPAs as a percentage of gross advances), asset quality in respect of certain segments of industries has deteriorated significantly in recent times. The coal industry was the worst performer, with its NPA ratio standing highest among all industries. After a sustained improvement, its NPA ratio witnessed a steep increase from 0.2 per cent as at end-March 2011 to 8.2 per cent by June 2012. The other industries that contributed to rising NPAs during the recent period include other textiles, jute textiles, cotton textiles, computer software, leather and leather products, vegetable oils and vansapati industry (Table 4). (3) Power and infrastructure have witnessed sharp growth in NPAs in the recent period Certain sectors like power and infrastructure have seen significant increase in impairments in the asset quality in the recent period. After a period of sustained improvement during crisis and post-crisis period, the growth in NPAs in respect of power sector rose sharply by end-March 2012 (over 72 per cent), partly due to the base effect of negative growth in the previous years. The growth, however, dipped substantially by end-June 2012. Similarly, infrastructure also displayed a sharp uptrend in its NPAs growth by end-March 2012 (over 64 per cent), partly reflecting the base effect (Chart 19). In this context, it may be recalled that the risks faced by banks on their exposure to the power sector due to rising losses and debt levels in state electricity boards (SEBs) and the shortage of fuel availability for power generation were brought out in the Financial Stability Report for December 2011 (RBI, 2011). Potential pressures on asset quality have intensified with restructuring in bank credit to power sector registering a sharp increase, especially in the last quarter of 2011-12. Meanwhile, the losses of SEBs were mounting overtime, adding to the concerns about asset quality in the sector. In fact, credit to the power sector, as at end June 2011, constituted the major share of bank credit to infrastructure segment (55 per cent). In case of banks' exposure to power sector, the public sector banks (PSBs) accounted for the maximum share followed by new private sector banks. In addition, concentration is discernible in credit to power sector as projects for power generation garnered 55 per cent share, while SEBs/corporatised distribution companies (Discoms) accounted for 25 per cent. As per the draft approach to the 12th Five Year Plan (August 2011), the losses of distribution utilities before accounting for state subsidy stood at approximately Rs.70,000 crore. The accumulated losses of SEBs indirectly impact the power producers since SEBs are the largest buyers of power in the country. Apart from poor financial health of SEBs, coal supply issues plague the power sector. Further, some projects are stalled due to environmental hurdles. Thus, growing NPAs in power sector could be due to two reasons: rising losses and debt levels in SEBs, and the shortage of fuel availability for power generation. With losses among SEBs and coal / delay issues of power projects, high concentration of bank credit in power generation and distribution is a matter of concern. (4) Other industries like coal and computer software have also seen sharp spurt in NPAs growth in the recent times Other industries witnessing increase in NPAs growth by end-March 2012 were computer software industry (162 per cent) followed by coal industry (144 per cent in the two consecutive years), tobacco (68 per cent), cotton textiles (42 per cent), sugar (30 per cent), other textiles (19 per cent), rubber (19 per cent), metals (18 per cent), iron and steel (17 per cent) and construction (11 per cent) (Chart 20). In this context, it may be mentioned that the impact of global financial crisis on India, as in the case of many EMEs, spilled over from the real sector to the financial sector. Industry and businesses, especially the small and medium enterprise (SME) sector, had to grapple with a host of problems, such as delays in payment of bills from overseas buyers as also domestic buyers affected by the global slowdown; increase in stocks of finished goods; fall in the value of inventories, especially raw material which, in many cases, were acquired at higher prices such as metal and crude oil-based products; slowing of capacity expansion due to a fall in investment demand; and demand compression for employment-intensive industries, such as gems and jewellery, construction and allied activities, textiles, auto and auto components and other export-oriented industries (Thorat, 2009). The growth in the index of industrial production (IIP) turned negative and continued at sub-zero levels for more than two quarters in 2008-09, exports continued to contract in the second half, and capital market activities dwindled significantly. The slowdown in all the economic activities spilled over to the financial market and bank credit growth fell sharply. Therefore, the pro-cyclical behavior by banks became more evident during the crisis (RBI, RCF, 2008-09).These developments got reflected in growing deterioration in the asset quality in respect of many industries in the post-crisis period. The examination of trends in gross advances and NPAs at bank group level brings out the following points (1) Though public sector banks contribute to the bulk of NPAs, the share of new private sector banks and foreign banks in the total NPAs has gone up in the post-crisis period. In consonance with their share in total gross advances, public sector banks, on an average, account for more than three fourth of the share in total NPAs (over 76 per cent), followed by new private sector banks (around 13 per cent), old private sector banks (around 6 per cent) and foreign banks (over 5 per cent) (Chart 21). However, the share pattern in NPAs is distinct when viewed separately in the pre and post-crisis period. The share of public sector banks in total NPAs has declined during the post-crisis period (around 73 per cent), as compared to the pre-crisis period (around 79 per cent). Similarly, the old private sector banks account for lesser NPAs during the post-crisis period (with a share of around 4 per cent), compared with the pre-crisis period (around 7 per cent). However, the share of new private sector banks and foreign banks has gone up significantly in the post-crisis period from over 10 per cent to 16 per cent and from over 4 per cent to 7 per cent, respectively (Chart 22). (2) Public sector banks and foreign banks have mainly contributed to the recent rise in NPAs. An analysis of the growth rate in gross advances vis-à-vis NPAs among different bank-groups reveals that the growth in NPAs was negative among all the bank-groups during the pre-crisis period (2002-2007). However, the trend has been reversed in respect of all bank-groups during the post-crisis period (2008-2012). Foreign banks witnessed a greater deterioration in their asset quality as their NPAs grew by around 31 per cent during the post-crisis period (Chart 23). Public sector banks were second in this category with a growth of over 25 per cent in their gross NPAs, followed by new private sector banks (over 20 per cent) and old private sector banks (8 per cent) in the post-crisis period. Moreover, during the crisis period, particularly in 2009, foreign banks witnessed the highest growth in NPAs (134 per cent). During 2012, public sector banks witnessed a sharp acceleration in the growth of NPAs (over 58 per cent), followed by foreign banks (over 24 per cent) and old private sector banks (around 14 per cent); new private sector banks, on the contrary, witnessed negative growth. Thus, NPAs have been on the rise, notwithstanding the fact that the credit growth has decelerated in respect of all the bank-groups barring old private sector banks during the post-crisis period. (3) Public sector banks and old private sector banks have witnessed greater deterioration in their asset quality in the case of priority sector, while it is vice-versa in the case of foreign banks and new private sector banks The bank group-wise and sector-wise gross NPAs as a per cent of gross advances reveal that, public sector banks and old private sector banks have recorded higher increase in their NPAs in the priority sector than in the case of non-priority sector in the recent period (end-September, 2012). Conversely, foreign banks and new private sector banks have witnessed greater increase in non-priority sector NPAs as compared to the priority sector (Table 5). VII. Restructuring of Advances and its Likely Impact Restructuring of loans and advances is a procedure to modify the terms and conditions of an existing loan in order to alleviate the difficulties in repayment by the borrower due to temporary cash flow problems or general economic downturn. The Reserve Bank’s prudential guidelines on restructuring define a restructured account as one where the bank, for economic or legal reasons relating to the borrower's financial difficulty, grants to the borrower concessions that the bank would not otherwise consider. Restructuring would normally involve modification of terms of the advances/securities, which would generally include, among others, alteration of repayment period/repayable amount/the amount of instalments/rate of interest (due to reasons other than competitive reasons) (Mahapatra Committee, 2012). The Reserve Bank revised its prudential guidelines regarding restructuring of advances by banks from time to time, mainly in the light of international best practices and the Basel Committee on Banking Supervision (BCBS) guidelines issued in the matter. The modifications in the guidelines for restructuring of advances announced in August 2008 was one of the proactive steps taken by the Reserve Bank in order to arrest the downward spiral in the economy in the aftermath of the global financial turmoil of 2007. The guidelines on restructuring of advances by banks issued in August 2008 allowed banks to restructure accounts of viable entities classified as standard, sub-standard and doubtful. It was prescribed in the August 2008 guidelines that accounts of borrowers engaged in important business activities and classified as standard assets may retain their standard asset classification on restructuring subject to certain conditions. Assessment of the Implementation of Restructuring Advances: Immediate and Medium Term Impact Data on restructured advances for the time period 2007-2012 showed that due to the special dispensation given to the banks regarding restructuring of advances in 2008, total amount of restructured advances increased substantially during 2008-09. Following the slowdown observed in the domestic economy as well as the sluggish recovery of the global market, total amount of non-performing assets (NPAs) as well as restructured advances witnessed accelerated growth during 2011-12. During 2011-12, total restructured advances grew at a rate of 63 per cent, significantly higher than the corresponding growth rate of 2 per cent during 2010-11. Restructured advances as percentage of standard advances shot up significantly at end-March 2012, as compared with the corresponding period of the previous year (Chart 24). During 2011-12, restructuring of advances has been one of the important channels used by banks to contain the deterioration in asset quality caused by burgeoning NPAs. Bank group wise analysis of restructured advances revealed that the increase in restructured advances of banks during 2011-12 was mainly attributable to SBI group and nationalised banks (Chart 25). As at end-March 2012, total amount of restructured advances exceeded total amount of NPAs outstanding, which was in continuation with the trend observed during 2009-2012. Without restructuring, the gross NPAs at system level would have been higher; the exact amount of NPA, however, being dependent of the proportion of restructured advances falling back into NPA category. According to the Financial Stability Report (FSR), June 2012, roughly 15 per cent of the restructured advances could fall back into the NPA category. With 15 per cent of restructured advances added back, the total amount of NPA at system level would have been approximately 1.5 times higher than its actual amount at end-March 2012. However, without restructuring, the gross NPAs as percentages of gross advances would have been more than 2.5 times of its actual value, as at end-March 2012 (Chart 26). An analysis of the impact of restructuring advances on the asset quality of banking sector was carried out using stress test across bank groups. Three different scenarios were assumed under which 15 per cent, 50 per cent and 75 per cent of the restructured advances were turning into NPAs. The impact of these shocks was found to be more significant in case of public sector banks, which constituted more than 80 per cent of total gross NPAs of the system, as at end-March 2012 (Chart 27). Is it desirable to continue restructuring of advances? During 2011-12, banks aggressively resorted to restructuring of advances in order to contain the level of NPAs in their balance sheet. Without restructuring, gross NPAs at system level would have been substantially higher. However, though restructuring of advances was helpful in containing the effect of rising bad loan in banks’ balance sheet, in the long-run, it could have implications for asset quality, in case significant proportion of these restructured advances turn out to be bad loans. In addition, the October 2012 Global Financial Stability Report (IMF) noted that India, together with other emerging markets, is in the late stages of the credit cycle, suggesting NPAs and debt restructurings are likely to continue rising. With growth likely to be weaker for a longer period than after 2008-09 and the loan composition of banks more skewed toward large loans, more restructured advances are likely to slip into NPAs compared to the historical average of 15 percent. The Financial Stability Report, December 2012, has also noted that the spurt in restructuring of advances is a matter of concern, though it may not have systemic dimension. Hence, there is a need to carefully monitor the impact of restructuring on asset quality of banks in the medium to long run. The Mahapatra Committee has recommended that in order to prudently recognise the inherent risks in assets classified as standard on restructuring, the provision requirement on such accounts should be increased from 2 per cent to 5 per cent. In a bank dominated economy like India, the stability and sound health of the banking system is imperative for overall economic development and financial stability. The Indian banking sector overtime has witnessed significant transformation and has proved to be sound and resilient, even in the face of one of the worst financial crisis that hit the world economy during 2008. Nevertheless, of late, the asset quality of Indian banks has come under growing pressure. Asset quality exhibits increasing signs of stress The first half of the last decade turned out to be a good period for Indian banks, with credit growth witnessing a sharp upturn on the back of high economic growth and NPAs growth trending down quite significantly. The second half of the last decade encountered a period of slowdown in credit growth accompanied by gradual deterioration in asset quality, particularly by the turn of the decade. Accretion to NPAs, a critical indicator of efficiency in credit risk management, remained negative in most of the years prior to the year 2008 but expanded quite rapidly thereafter. Pro-cyclical evidence: credit boom in the pre-crisis period, partly driving the asset quality impairment It has been argued in the literature that an expansion in credit growth is associated with the deterioration in asset quality because when banks over expand their lending, they tend to lower their credit standards. In the Indian context, the empirical analysis indicates that NPAs growth follows credit growth with a lag. This underlined the pro-cyclical behaviour of the banking system, wherein asset quality can get compromised during periods of high credit growth and this can result in NPAs in the later years. Thus, high credit growth during the pre-crisis period resulted in the rise in NPAs overtime in the post-crisis period. Hence, pro-cyclicality of credit pattern during the pre-crisis period could be considered as one of the factors responsible for asset quality deterioration during the recent years. Growth slowdown adding to the stress on asset quality While examining the macro-financial linkages of this phenomenon, it is found from the empirical exercise that NPAs growth is inversely related to the GDP growth. In case of agriculture too, NPAs growth was found to be inversely associated with growth in agricultural GDP with a lag. The relationship between credit growth, NPAs and business cycle was broadly of the same nature in case of industries. The cyclical slowdown exerts strain on the performance of various sectors of the economy and adversely affects the cash flows of borrowers, thereby leading to defaults in loan repayments. Therefore, economic slowdown in recent years has contributed to the increasing stress on the asset quality of Indian banks. Hardening of lending rates contribute partially to growing NPAs The changes in lending rates of banks may also cause changes in NPA levels. Hardening of interest rates makes repayment of loans difficult for borrowers, particularly those who have contracted their loans earlier at floating rates, for instance in the case of housing loans. The empirical investigation in this paper corroborates the fact that growth in NPAs is likely to go up in the backdrop of elevated interest rate environment. Thus, hardening of interest rates in the recent times seems to have contributed partially to growing NPAs. Rising inflation adding to asset quality problems It is not only that high inflation feeds into nominal interest rates, making debt servicing more onerous, it also erodes the disposable incomes and impinges on the repaying capacity of borrowers. The evidence in the literature, as seen earlier, corroborates the fact that banks’ write‐off ratio increases after increase in retail price inflation and nominal interest rates. The empirical exercise in this paper confirms that rising prices in the recent years are contributing to the asset quality problems. Dwindling asset prices exerting pressure on asset quality Asset prices as reflected in stock prices can influence the net worth of borrowers through wealth effect and in turn affect the debt servicing capacity. This fact is evident both from the extant empirical literature and empirical exercise carried out in the Indian context in this paper. Higher asset valuations are associated with lower levels of NPA ratios and vice-versa. The dwindling asset prices in an uncertain financial market environment, particularly in the aftermath of crisis are contributing to the asset quality deterioration. Subdued global macroeconomic situation adding to the asset quality woes A buoyant external macroeconomic environment matters for the overall profitability and asset quality of banks, since positive externalities flowing from positive external environment can feed into domestic macroeconomic performance through trade, confidence and financial sector channels. The exploration of relationship between world GDP growth and NPAs growth in this study corroborates the above fact. The subdued world economic growth has a bearing on asset quality impairment. Non-priority sector contributes substantially to weakening asset quality Sectoral analysis reveals that, on an average, retail loans occupy the largest share in total NPAs followed by SSIs, agriculture, personal loans, housing loans, exports, credit cards and auto loans over the last one decade. Arguably, non-priority sector has contributed significantly to acceleration in total NPAs in the recent period. Growing share of agriculture in total NPAs Interestingly, share of agriculture (average) in total NPAs remains lower than that of SSIs and other priority sectors. Nevertheless, the share of agriculture and other priority sectors in aggregate NPAs increased, while that of SSIs declined during the post-crisis period. Nevertheless, NPAs growth in SSI sector has accelerated sharply in recent years, thereby contributing to rise in overall NPAs. Personal loans account for the bulk of retail NPAs In respect of non-priority sector, NPAs in the retail loan segment have declined overtime, but their share in total NPAs remains high. In the retail loan segment, personal loans constitute for the bulk of the share. It is noteworthy that retail credit growth including personal loan portfolio of banks had shown a spurt in the pre-crisis period, partly due to removal of restrictions on personal loans in the early 1990s. Buoyant economic growth and ‘wealth effect’ of surging capital markets were the major triggers for growth in consumer loans. Increasing demand, rising income levels, probability of low default and comfortable liquidity in the banking system created huge potential for housing finance business. Infrastructure and power witness escalation in asset quality impairment The share of infrastructure in non-priority sector NPAs has accelerated in the recent times. The relaxed norms for infrastructure lending and enhancement of exposure limits have resulted in rapid expansion in infrastructure finance in recent years. The power sector has seen a significant increase in impairments in the asset quality in the recent period, owing to rising losses and debt levels in SEBs and the shortage of fuel availability for power generation. With losses among SEBs and coal/ delay issues of power projects, high concentration of bank credit in power generation and distribution is a matter of concern. Spillovers from global crisis and muted performance of industries fed in to the growing deterioration of asset quality The impact of the global financial crisis spilled over to industry and businesses, especially the SME sector, which had to grapple with a host of problems other than fall in investment demand; and demand compression for employment-intensive industries, such as gems and jewellery, construction and allied activities, textiles, auto and auto components and other export-oriented industries. These developments got reflected in growing deterioration in the asset quality in respect of many industries in the post-crisis period. Among the industries, coal and textiles have contributed substantially to recent deterioration in asset quality. The other industries that contributed to rising NPAs include iron and steel, other textiles, jute textiles, cotton textiles, computer software, leather and leather products, sugar, tobacco, rubber, metals, construction and vegetable oils and vansapati industry. Public sector banks and foreign banks mainly contribute to recent acceleration in NPAs The bank group-wise assessment of trends reveals that though public sector banks contribute to the bulk of NPAs, the share of new private sector banks and foreign banks in the total NPAs has gone up in the post-crisis period. Nonetheless, public sector banks and foreign banks have mainly contributed to the recent rise in NPAs. Public sector banks and old private sector banks have witnessed greater deterioration in their asset quality in the case of priority sector, while it is vice-versa in the case of foreign banks and new private sector banks Restructuring provides a transitory respite but needs to be monitored prudently Though restructuring of advances was helpful in containing the effect of rising bad loan in banks’ balance sheet, in the long-run, it could have implications for asset quality of the banks, in case significant proportion of these restructured advances turn out to be bad loans. Hence, there is a need to carefully monitor the impact of restructuring on asset quality of banks in the medium to long run. Inadequate appraisal and lax monitoring resulting in asset quality impairment The spurt in NPAs could also be attributed to the inadequate appraisal and monitoring of credit proposals (RBI, RTP, 2011-12). As noted by the FSR (December 2012), aggressive lending by banks in the past, banks not exercising oversight on diversification into non-core areas by companies, banks not enforcing discipline on companies regarding unhedged forex exposures and delay in disbursements are areas on which banks ought to exercise much better control. Delay in administrative clearances is an equally important reason for pressure on asset quality which needs correction. There is a need to strengthen oversight of financial and corporate risks and policies to incentivize genuine corporate restructuring and improvements to insolvency framework. Further strains on asset quality could emerge given the subdued growth prospects and global uncertainties Going forward, further strains on asset quality could emerge. The macro stress test, as stated in FSR (December 2012), suggests that if the current adverse macroeconomic condition persists, the system level gross NPA ratio could rise from 3.6 per cent as at the end of September 2012 to 4.4 per cent by end March 2014. This ratio could go up to 7.6 per cent under the severe risk scenario. Public sector banks might continue to register highest NPA ratio. The growth prospects in the near- term seem to have subdued. In October 2013, the IMF scaled down its projection of world GDP growth for 2013 to 2.9 per cent. In its First Quarter Review of Monetary Policy 2013-14, the RBI has also revised its growth projection for 2013-14 downwards to 5.5 per cent. Credit growth in the recent period has ebbed and as per the RBI’s indicative projections, the non-food credit growth is likely to be around 15.0 per cent in 2013-14. Thus, notwithstanding the fact that credit growth is not going to be significantly robust, muted economic prospects and global headwinds could lead to further deterioration in asset quality. Need to address the problem in right earnest The stress tests for banks show that even under a scenario in which 30 percent of restructured advances become NPAs, bank stress remains contained and banks sufficiently capitalized. The position is not alarming at the current juncture and some comfort is provided by the sound capital adequacy of banks, which ensure that the banking system remains resilient even in the unlikely contingency of having to absorb the entire existing stock of NPAs. Nevertheless, it is worth to recognise the problem in its early stages and initiate corrective measures in the right earnest. @ Assistant Adviser, Monetary Policy Department, Reserve Bank of India: (email). The paper reflects personal views of the author and should not be ascribed to the institution to which he belongs. 1 The author would like to thank Shri K. U. B. Rao, Adviser and Smt. Rekha Misra, Director of DEPR for instigating this work and their insightful comments. He thanks the Department of Banking Operations and Development and Financial Stability Unit for their comments and Department of Banking Supervision for the data support. Thanks are also due to Kum. Shromona Ganguly for her useful inputs on Section VI of this paper. 2 www.fedpartnership.gov/bank-life-cycle/transcripts/AssetQuality.htm 3 www.fedpartnership.gov/bank-life-cycle/transcripts/AssetQuality.htm. 4 IDFC Securities Research, online: www.idfc.com/capital/pdf/report/Asset-quality-Aug11.pdf 5 It may be recalled that by the mid 1990s, a large magnitude of resources of credit institutions had become locked up in unproductive assets in the form of non-performing loans. Apart from limiting the ability of credit institutions to recycle their funds, this also weakened them by adversely affecting their profitability. The Reserve Bank and the Central Government, therefore, initiated several institutional measures to recover the past dues to banks and FIs and reduce the NPAs. These were Debt Recovery Tribunals (DRTs), Lok Adalats (people’s courts), Asset Reconstruction Companies (ARCs) and the Corporate Debt Restructuring (CDR) mechanism. Settlement Advisory Committees were also formed at regional and head office levels of commercial banks. Furthermore, banks could also issue notices under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 for enforcement of security interest without intervention of courts. Further, banks, Fls and NBFCs (excluding securitisation companies/reconstruction companies) were permitted to undertake sale/purchase of NPAs. Thus, banks and other credit institutions were given a menu of options to resolve their NPA problems. 6 The long period disaggregated NPA data on industries is not available for arriving at conclusive results. 7 The data for SSIs is available only up to 2010. Thereafter, the data for Micro and Small Enterprises, which is available is taken as a proxy for 2011 and 2012 Select References: Adrian van Rixtel and Gabriele Gasperini (2013): “Financial Crises and Bank Funding: Recent Experience in the Euro Area” BIS Working Papers, No 406, March. Aggarwal, S., & Mittal, P. (2012): “Non-Performing Asset: Comparative Position of Public and Private Sector Banks in India”, International Journal of Business and Management Tomorrow, Vol.2 (1). Borio, C, Furfine, C. and Lowe, P. (2001), “Procyclicality of the Financial System and Financial Stability: Issues and Policy Options in Marrying the Macro- and Micro-Prudential Dimensions of Financial Stability”, BIS Papers, 1, March Borio, C and P Lowe (2002): “Assessing the Risk of Banking Crises”, BIS Quarterly Review, December, pp 43–54. Bank for International Settlements (2010), “Countercyclical Capital Buffer”, Consultative Document, July. Batra, S. (2003): “Developing the Asian Markets for Non-Performing Assets; Developments in India”, IIIrd Forum on Asian Insolvency Reform, Seoul, Korea Borbora. (2007): “Management of Non-Performing Assets (NPAs) in the Urban Cooperative Banks (UCBs)”, RBI, CAB, UCB Channel / Mgt. of NPAs of UCBs / Aug. 2007 / Eng. / 5 pgs / Version 1. Bofondi M. and Ropele T (2011): “Macroeconomic determinants of bad loans: evidence from Italian banks” Occasional papers No. 89, March, Banca d'Italia. Chijoriga, M.M. (2000): “The Interrelationship Between Bank Failure and Political Interventions in Tanzania in the Pre-Liberalization Period”, African Journal of Finance and Management, Vol.9(1), 14-30. Chen, Nan-Kuang (2001), “Bank Net Worth, Asset Prices and Economic Activity,” Journal of Monetary Economics, 48, 415-436. De Bock R. and Demyanets A (2012): “Bank Asset Quality in Emerging Markets: Determinants and Spillovers”, IMF Working Paper, Monetary and Capital Markets, No. WP/12/71, March. Dash, MK., and Kabra, G. (2010): “The Determinants of Non-Performing Assets in Indian Commercial Banks: an Econometric Study”, Middle Eastern Finance and Economics, Issue 7 (2010). Financial Stability Forum (2009), Report of the Financial Stability Forum on Addressing Pro-cyclicality in the Financial System, Basel. Guttentag, J. M. and Richard J. Herring (1986), “Disaster Myopia in International Banking”, Essays in International Finance, 164, International Finance section, Princeton University. Gambacorta, Leonardo (2005), “Inside the Bank Lending Channel,” European Economic Review, 49, 1737-1759. Gopalakrishnan, T.V. (2005). “Management of Non Performing Advances”, 1st Revised Edition, Mumbai, Northern Book Centre publication, International Monetary Fund, (2012): Global Financial Stability Report, October IDFC Securities Research, online: www.idfc.com/capital/pdf/report/Asset-quality-Aug11.pdf Demirgüç-Kunt, A., and E. Detragiache. 1997. “The Determinants of Banking Crises: Evidence from Industrial and Developing Countries.” Policy Research Working Paper 1828. World Bank, Washington, D.C. Also forthcoming in IMF Staff Papers. 1998. Karunakar, M., Vasuki, K., and Saravanan, S. (2008): “Are non - Performing Assets Gloomy or Greedy from Indian Perspective?”, Research Journal of Social Sciences, 3: 4-12, 2008. Kent, C and Patrick D'Arcy, (2000): “Cyclical Prudence - Credit Cycles in Australia”, BIS Papers, No 1. Michael, JN., Vasanthi, G., & Selvaraju, R. (2006): “Effect of Non-Performing Assets on Operational Efficiency of Central-Cooperative Banks”, Indian Economic Panorama, Vol. 16(3). 33-39. Misra, B.M. & Dhal, S. (2010): “Procyclical Management of Non-Performing Loans by the Indian Public Sector Banks”, BIS Asian Research Papers. Mohan, Rakesh (2004): “Finance for Industrial Growth”, Reserve Bank of India Bulletin, Speech article, March. Muniappan, G, (2002): “The NPA Overhang, Magnitude, Solutions and Legal reforms”, Reserve Bank of India. Nitsure R.R., (2007): Italian and Indian Banks: Recent Trends and Growth Opportunities”, Icrier, Online: www.icrier.org/pdf/SessionIII-DrRupaReg.pdf Online: www.fedpartnership.gov/bank-life-cycle/transcripts/AssetQuality.htm Panta, R., (2007). Challenges in Banking: A Nepalese Diaspora, Socio-Economic Development Panorama, Vol. 1(2), 9 -22 Reserve Bank of India (2011-12): Annual Report. ……………(2006-08): Report on Currency and Finance. ……………(2005-06): Report on Currency and Finance. ……………(2008-09): Report on Currency and Finance. ……………(2009-10): Report on Trend and Progress of Banking in India. ……………(2010-11): Report on Trend and Progress of Banking in India. ……………(2011-12): Report on Trend and Progress of Banking in India. ……………(2011): Financial Stability Report, December. ……………(2012): Financial Stability Report, June. ……………(2012): Financial Stability Report, December. ……………(2012): Working Group to review the existing prudential guidelines on restructuring of advances by banks/financial institutions (Chairman: B. Mahapatra). Rinaldi L. and A. Sanchis Arellano (2006). “Household debt sustainability: What explains household non‐performing loans? An empirical analysis.” ECB Working Paper, no. 570. Rajan, Raghuram (2005), “The Greenspan Era: Lessons for the Future”, A Symposium of the Federal Reserve Bank of Kansas City, Jackson Hole, August. Reddy, P.K., (2002): “A Comparative study of Non Performing Assets in India in the Global Context- Similarities and dissimilarities, Remedial Measures”, http://unpan1.un.org/intradoc/groups/public/documents/apcity/unpan. Shu C. (2002). “The Impact of Macroeconomic Environment on the Asset Quality of Hong Kong's Banking Sector.” Hong Kong Monetary Authority Research Memorandums. Stiglitz J.E. and A. Weiss (1981). “Credit rationing in markets with imperfect information” American Economic Review, vol. 71, pp. 393–410. Subbarao D (2009): “Impact of the Global Financial Crisis on India – Collateral Damage and Response”- Speech at the Symposium on The Global Economic Crisis and Challenges for the Asian Economy in a Changing World organized by the Institute for International Monetary Affairs, Tokyo, 18 February 2009. Siraj K.K. and Pillai Sudarsanan P (2012): “Study on the Performance of Non-Performing Assets of Indian Banking During Post Millennium Period”, International Journal of Business and Management Tomorrow, Vol. 2, No.3, ISSN: 2249-9962. Sergio, M, (1996): “Non-Performing Bank Loans: Cyclical Patterns and Sectoral Risk’, Review of Economic Conditions in Italy. Rome: Jan-Jun 1996. , Issue. 1. Thorat Usha, (2009): “Impact of Global Financial Crisis on Reserve Bank of India (RBI) as National Regulator”, Presentation made at the 56th EXCOM Meeting and FinPower CEO Forum organised by APRACA at Seoul, Korea Annex: Empirical Results |

Page Last Updated on: