IST,

IST,

RBI WPS (DEPR): 06/2013: An Empirical Analysis of the Relationship between WPI and PMI-Manufacturing Price Indices in India

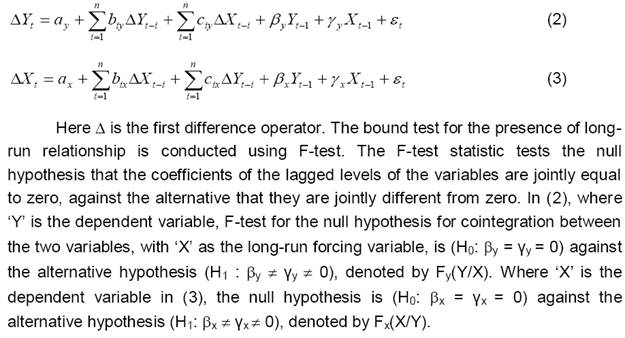

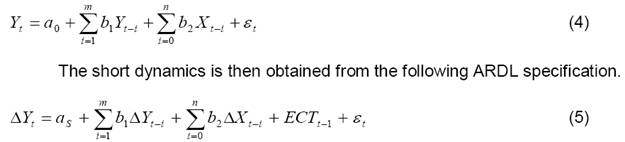

| RBI Working Paper Series No. 06 Abstract *Manufacturing Purchasing Managers Index (PMI) has been increasingly used by various central banks for assessing the direction and strength of economic activity. One of the sub-indices or component level information provided by PMI is that of industrial input and output prices trends as surveyed by firms’ purchasing managers. In this context, the paper tries to examine whether these PMI manufacturer’s price diffusion indices serve as a useful indicator for understanding changes in WPI in India. The analysis was carried out using both OLS estimates and ARDL approach to cointegration for the period April 2005 to October 2012. It is found that both the PMI price indices are good indicators and have significant predictive power of the changes in WPI–All commodities and WPI–Non-food manufactured products. JEL Classification: E31, C22, E37 Key words: PMI, WPI, ARDL, price, forecasting Introduction Manufacturing Purchasing Managers Index (PMI) is a survey based measure of the business conditions among purchasing and supply executives of manufacturing firms constructed in the form of a diffusion index.1 PMI is considered to be a good leading indicator of economic activity for the following reasons. First, it is constructed from the survey of purchasing managers, who, by the very nature of their jobs, are one of the first to spot change in economic conditions and make decisions on purchase and production. Accordingly, a survey of purchasing managers could be considered as a reliable barometer of evolving economic activity. Second, it is released timely on the first business day of every month before the release of official data. Third, once released, they are seldom revised and are able to preserve most of the real-time nature of the data that is crucial for estimation and forecasting exercises (Lahiri and Monokroussos, 2012). PMI, at the same time, suffers from the following disadvantages. First, being a diffusion index, while capturing the spread or dispersion of change in economic activity, it does not capture the intensity of the change. Second, since the responses are not weighted for size difference of firms, it may miss an overall shift in economic conditions arising out of movements in a few large firms (Koenig, 2002; Lahiri and Monokroussos, 2012). These disadvantages, however, do not constrain the use of PMI to gauge the strength and direction of economic activity, as the ultimate criterion is its predictive powers of economic activity vis-à-vis other competing variables (Lahiri and Monokroussos, 2012). In other words, PMI, which measures the diffusion of economic activity at an aggregate level, is expected to have a roughly linear relationship with the change in the corresponding government data (Harris, 1991). Accordingly, PMI has been increasingly used by various central banks as a lead indicator for understanding the strength of economic activity. Several studies have established that PMI serves as a good lead indicator and has forecasting power on the movements in GDP and IIP in the advanced economies (for example, Klein and Moore, 1991; Dasgupta and Lahiri, 1993; Koenig, 2002; Lindsey and Pavur, 2005; Banerjee and Marcellino, 2006; Tsuchiya, 2012; and Lahiri and Monokroussos, 2012). Manufacturing PMI survey also collects information on whether the manufacturing input and output price conditions have changed over the previous month. The survey results are then aggregated and presented in the form of diffusion indices. As the construct and coverage of these two indices are similar to that of PMI non-price indices which are found to be good predictor of GDP and IIP, the PMI price indices similarly could serve as a useful indicator for understanding movements in official price indices. In fact, few studies in the US have successfully used PMI price indices, along with other variables, to forecast inflation (Banerjee and Marcellino, 2006; and Wright, 2008). Hence, in this paper, we attempt to identify the existence of causal relationship between PMI price indices and change in WPI in India. For the purpose, we use two measures of inflation: i) WPI – All commodities; and ii) WPI – Non-food manufactured products for the following reasons. First, in the Indian context, WPI is the headline price index as it has a pan India coverage2. Second, to examine whether PMI price indices have a differential impact on overall WPI and WPI–Non-food manufactured products. In the Indian context, though provisional WPI and PMI price indices are released in the same month, the former is released ahead of the latter by around two weeks. However, while PMI price indices are not subject to revision once released, the provisional official price indices are often subject to significant revisions when the final data is released after a gap of about two months. Thus, in our analysis we consider only the final WPI data. Any significant causal relationship running from PMI price indices to final WPI data would indicate usefulness of PMI prices indices to forecast/nowcast final WPI. The rest of the paper is organized as follows. Section II describes the methodology, while Section III discusses the data and the results. The concluding observations are in Section IV. We considered the first difference in the seasonally adjusted: i) WPI- All Commodities (WPI-AC); and ii) WPI – Non-Food Manufactured Products (WPI-NFMP). This was guided by the fact that PMI data by the nature of its construct depict month-on-month (m-o-m) changes. In the PMI survey, each respondent is asked whether business conditions for a number of variables have improved, deteriorated or stayed the same compared with the previous month. For each of the variables considered in the PMI, a diffusion index is then calculated, where the index varies between 0 and 100, with a level of 50 signaling no change over the previous month. Therefore, meaningful relationships could only be defined between PMI price indices and m-o-m changes in WPI. The existence of a stable relationship between them is examined in two parts. First, by estimating regression equations based on OLS, defined as, In (1), ΔWPI is the m-o-m annualized rate of inflation, PMI is the monthly average value of the PMI and ΔPMI is the change in the PMI’s monthly average value. The logic behind the relationship is that WPI inflation depends on both the level of the PMI and its most recent change (Koenig, 2002). Simple regression equation, however, can suffer from spurious relationship due to variables being non-stationary and integrated of different order. Thus, we also estimate cointegrating long-run relationship and their short-run dynamics using bounds test or ARDL approach to cointegration analysis developed by Pesaran et al. (1999, 2001 and 2009). The advantages of this approach, as mentioned in Khundrakpam and Pattanaik (2010) and Khundrakpam and Ranjan (2010), are the following. First, it is applicable to variables integrated of different order. Second, unlike residual based cointegration analysis, the unrestricted error correction model (UECM) employed in bound testing does not push the short-run dynamics into the residual terms. Third, the bounds test can be applied to small sample size. Fourth, it identifies the exact variable to be normalised in the long-run relationship. A limitation of bounds test, however, is that it is not appropriate in situations where there may be more than one long-run relationship among the variables. In other words, the test is most appropriate only when one variable is explained by the remaining variables and not vice versa. Bounds Test As explained in Khundrakpam and Pattanaik (2010) and Khundrakpam and Ranjan (2010), bounds test involves investigating the existence of a long-run relationship among the variables using UECM. For the two variables, the UECM would take the following form:  The F-test has a non-standard distribution which depends upon: (i) whether variables included in the ARDL model are I(1) or I(0); ii) whether the ARDL model contains an intercept and/or a trend. There are critical bound values of both the statistics set by the properties of the regressors into purely I(1) or I(0), which are provided in Pesaran, Shin and Smith (2001). If the absolute value of the estimated F-statistics : (i) lie in between the critical bounds set by I(1) and I(0), cointegration between the variables is inconclusive; (ii) in absolute value lower than set by I(0), cointegration is rejected; and (iii) in absolute value higher than set by I(1), cointegration is accepted. Once the precise direction of the long-run relationship is confirmed by the above test, the long-run relationship is estimated using the following ARDL specification.  The ECT term in (5) is the error term obtaining from the long-run relationship in (4). For the purpose of analysis, monthly data for the period April 2005 to October 2012 were considered. WPI-AC and WPI-NFMP were culled from the website of Office of the Economic Adviser, Ministry of Commerce and Industry, while PMI input price (PMI-INPR) and PMI output price (PMI-OUTPR) data for India were obtained from HSBC, which, in collaboration with Markit, publishes the PMI for India. OLS Regression Results The regression results of WPI-AC and WPI-NFMP on PMI-INPR and PMI-OUTPR, and their change are given in Table 1. The results indicate that changes in both WPI-AC and WPI-NFMP depend significantly on the levels of the PMI price indices only, and not on their change. The short-run (long-run3) impacts of one point change in PMI-OUTPR to increase in WPI-AC and WPI-NFMP are 0.04 percentage points (0.06 percentage points) and 0.03 percentage points (0.04 percentage points), respectively. The corresponding short-run (long-run) impacts of one point increase in PMI-INPR are 0.03 percentage points (0.05 percentage points) and 0.02 percentage points (0.03 percentage points), respectively. In other words, both the PMI price indices have a larger impact on WPI-AC than WPI-NFMP. However, the impact of PMI-OUTPR is greater than PMI-INPR on both WPI-AC and WPI-NFMP. Further, our estimates suggest that the break-even values of PMI-INPR and PMI-OUTPR (obtained as, constant ÷ coefficient of level of PMI Indices in the regression equations) that signal neither expansion nor contraction are around 44, significantly less than commonly referred value of 50. This implies that when the PMI price indices exceed the value of 44, and not 50, aggregate inflation (m-o-m) measured by WPI-AC and WPI-NFMP would turn positive. The results obtaining from the above regression estimates, however, could be spurious, as unit root tests suggest that the variables are not necessarily integrated of the same order. Both Augmented Dicky Fuller (ADF) and Phillips-Perron (PP) tests show that while WPI-AC, WPI-NFMP and PMI-OUTPR are stationary, PMI-INPR is non-stationary (Table 2). Thus, ARDL approach to cointegration was further carried out. ARDL Cointegration Cointegration Results The bound tests results reported in Table 3 show that in each of the four pair of variables, F-statistics is higher than 95 per cent critical value only when PMI price indices are the long-run forcing (determining) variable. WPI- AC and PMI-OUTPR When WPI-AC is the dependent variable, the estimated F statistics (10.07) is higher than 95 per cent upper critical bound values, while for PMI-OUTPR as the dependent variable, the F- statistic (0.62) is lower than 95 per cent upper critical bound values. Thus, a unique cointegrating long-run relationship is indicated between WPI-AC and PMI-OUTPR, with movements in the former being influenced by the latter. WPI-AC and PMI-INPR The F-statistics (10.84) is significant when WPI-AC is the dependent variable, but is not significant at 0.50 for PMI-INPR as the dependent variable, indicating only the former is influenced by the latter without any reverse relationship. WPI-NFMP and PMI-OUTPR Between WPI-NFMP and PMI-OUTPR, the F-statistics (6.52) is significant when the former is the dependent variable, while for the reverse it is not significant at 0.54, indicating unidirectional relationship flowing from PMI-OUTPR to WPI-NFMP. WPI-NFMP and PMI-INPR Similarly, between WPI-NFMP and PMI-INPR, the F-statistics (5.55) is higher than 95 per cent critical values with the former as the dependent variable, while it is lower for the reverse relationship at 2.36. In other words, PMI-OUTPR and PMI-INPR have unidirectional influence on the movement in WPI-AC and WPI-NFMP without any reverse feedback. Long-run coefficients The estimates were carried for the period April 2005 to June 2012, retaining the last four observations from July 2012 to October 2012 for predictions. Table 4 lists the long-run coefficients of the co-integrating relationships indicated by the Bounds tests. As was found using OLS, the results show that the magnitude of the long-run impact of PMI-OUTPR on movements in WPI-AC and WPI-NFMP are higher than the corresponding impact of PMI-INPR. A one point increase in PMI-OUTPR leads to increase in WPI-AC and WPI-NFMP by 0.07 percentage points and 0.06 percentage points, respectively, while the corresponding impacts of PMI-INPR are 0.04 percentage points and 0.03 percentage points. In other words, both PMI-OUTPR and PMI-INPR have a significant bearing on the long-run movements of both WPI-AC and WPI-NFMP, though the impact of PMI-OUTPR is relatively higher than that of PMI-INPR. Short-run Dynamics The short-run dynamics, based on the specification given in (5), is presented in Table 5. The results show that all the cointegrating relationships considered are stable i.e., they converge to the long-run equilibrium as indicated by the negative sign of the error correction term. The equations are seen to have a fairly good explanatory power and do not suffer from serial correlation problem. In the short-run also, change in both the PMI price indices have positive impact on both WPI-AC and WPI-NFMP measures of inflation. The impacts, as found with OLS estimates, are smaller for PMI-INPR (ranging from 0.02 to 0.03) than the corresponding impacts of PMI-OUTPR (about 0.05). The speed of convergence towards its long-run equilibrium level following a shock, as indicated by the value of ECM terms, is seen to be fairly fast with correction within a month ranging from 55 per cent to about 80 per cent. In order to assess the predictive power of PMI price indices on change in WPI, dynamic forecasts of inflation were generated for the period July 2012 to October 2012 based on the estimated ECM models for April 2005 to June 2012. The forecast results are presented in Table 6. The root mean square errors (RMSEs) of predictions for the forecast period (ranging from 0.14 per cent to 0.30 per cent) are lower than corresponding RMSEs of the estimation period (ranging from 0.29 per cent to 0.33 per cent), indicating that the model forecasts are relatively accurate. The results showing that PMI-INPR has a highly significant bearing on the movements in WPI and share a stable relationship, as shown by fast correction following a shock (error correction) may seem to be a bit surprising. The explanation, however, could be sought from the nature and construct of WPI. In the use-based classification of WPI-Manufactured Products group, basic and intermediate goods account for around 48 per cent of the group weight. Consumer durables and consumer non-durables contribute to around 39 per cent of the WPI-Manufactured Products group weight (Table 7). Thus, the nature of WPI, as a hybrid index, consisting of goods at various stages of production, captured at first point of bulk sale, would result in it having a strong association with both PMI-OUTPR and PMI-INPR. Yet, as shown by the estimates, movements in both WPI-AC and WPI-NFMP are better explained by PMI-OUTPR than PMI-INPR.

The paper sought to understand i) whether there exists any causal relationship between movements in PMI price indices and WPI in India that movements in the former are good indicators to movements in the latter and ii) if a causal relationship exists, whether there could be sustained deviations in movements between the two due to short-term shocks. The analysis has been carried out using both OLS and ARDL approach to cointegration. It is found that both PMI input and output price indices have a significant influence and predict the movements of both WPI–All commodities and WPI–Non-food manufactured products. Expectedly, however, PMI–Output prices has a greater impact on the movements of both WPI–All commodities and WPI–Non-food manufactured products than that of PMI–Input prices. That the PMI input prices influences both measures of WPI inflation can be attributed to the high share of basic and intermediate goods, which have the attributes of both output and inputs prices, in weighting structures in WPI. The estimates of the short-run dynamics also show that any deviations from the equilibrium relationships following shocks are quickly corrected, indicating that the relationships are highly stable. Thus, PMI price indices can be considered as useful variables for the purpose of forecasting/nowcasting movements in final WPI. @ The authors are Director (email) and Assistant Adviser (email) in the Monetary Policy Department, Reserve Bank of India. *These are personal views of the authors and not of the institution they belong. All the usual disclaimers apply. 1 For further details on the construction of PMI, please refer to Annex. 2 For further details on the construction of WPI, please refer to Annex. 3 The long run estimate is defined as short run coefficient ÷ 1 minus coefficient of lagged dependent variable. References: Banerjee, A., and Marcellino, M. (2006), “Are There Any Reliable Leading Indicators for the US Inflation and GDP Growth?”, International Journal of Forecasting, 22, 137-151. Dasgupta, S. and Lahiri, K. (1993), “On the Use of Dispersion Measures from NAPM Surveys in Business Cycle Forecasting”, Journal of Forecasting, 12(3-4), 239-251. Harris, Ethan S. (1991), “Tracking the Economy with the Purchasing Managers’ Index,” Federal Reserve Bank of New York Quarterly Review, 16 (Autumn), 61–69. Khundrakpam J.K. and Rajiv Ranjan (2010), “Saving-Investment Nexus and International Capital Mobility in India: Revisiting Feldstein-Horioka Hypothesis”, Indian Economic Review, Vol. XXXXV, No. 1, 49-66. Khundrakpam J.K. and Sitikantha Pattanaik (2010), “Fiscal Stimulus and Potential Inflationary Risks: An Empirical Assessment of Fiscal and Inflation Relationship in India”, Journal of Economic Integration, Vol. 25(4), 703-721. Klein, P.A., and Moore, G.H. (1991), “Purchasing Management Survey Data: Their Value as Leading Indicators”, in K. Lahiri, and G.H. Moore (eds.), Leading Economic Indicators: New Approach and Forecasting Records, (pp. 403-428), Cambridge University Press. Koenig, Evan F. (2002), “Using the Purchasing Managers’ Index to Assess the Economy’s Strength and the Likely Direction of Monetary Policy”, Economic and Financial Policy Review, Federal Reserve Bank of Dallas, 1(6), 1-14. Lahiri, K. and Monokroussos, G. (2012), “Nowcasting US GDP: The Role of ISM Business Surveys”, International Journal of Forecasting, http://dx.doi.org/10.1016/j.ijforecast.2012.11.002. Lindsey, M.D., and Pavur, R. (2005), “As The PMI Turns: A Tool for Supply Chain Managers”, The Journal of Supply Chain Management, 41(3), 30-39. Pesaran, M. H., and Shin, Y. (1999), “An Autoregressive Distributed Lag Modeling Approach to Cointegration Analysis” in Storm, S. (ed) Econometrics and Economic Theory in the 20th Century-the Ragnar Frisch Centennial Symposium, Cambridge: Cambridge University Press. Pesaran, M.H., Shin, Y., Smith R.J. (2001), “Bound Testing Approaches to the Analysis of Level Relationships”, Journal of Applied Econometrics, 16, 289-326. Pesaran, M. H., and Pesaran, B. (2009), Time Series Econometrics: Using Microfit 5.0, Oxford: Oxford University Press. Wright, Jonathan H. (2009), “Forecasting US Inflation by Bayesian Model Averaging”, Journal of Forecasting, 28, 131-144. Yoichi Tsuchiya, (2012), “Is the Purchasing Managers’ Index Useful for Assessing the Economy’s Strength? A Directional Analysis”, Economics Bulletin, 32(2), 1302-1311. Purchasing Managers Index Purchasing Managers Index (PMI) is constructed by various agencies for manufacturing as well as services. The two most prominent agencies which supply the PMI are Institute for Supply Management (ISM) in case of the US and Markit which provides PMI for around 33 countries including the US. PMI index aggregates the survey responses of the purchasing managers in the form of a diffusion index thereby giving an economy wide index depicting the improvement or deterioration and the strength of it. Diffusion indices which serve as a convenient summary measures showing the prevailing direction of change have the properties for being leading indicators. The PMI report also shows the percentage reporting on each response, the net difference between the number of higher/better responses and lower/worse responses. In the questionnaire, the respondents are asked to state whether business conditions for the variables considered have improved, deteriorated or stayed the same. Further in the questionnaire, the reasons for any changes are also requested from respondents. For each of the indicators, the ‘diffusion’ index is calculated. This index is the sum of the positive responses plus a half of those responding ‘the same’. Hence, these indices vary between 0 and 100 with levels of 50 signaling no change on the previous month. Readings above 50 signal an improvement in business conditions or increase in the variable on the previous month. Readings below 50 signal deterioration in business conditions or decrease in the variable considered on the previous month. The greater the divergence from 50 the greater the rate of change signaled for the variables concerned. The composite PMI diffusion index for Manufacturing as prepared by Markit is a weighted index of five individual indices. The indices and its weights are ‘new orders’ with a weight of 0.3, ‘output’ with a weight of 0.25, employment with a weight of 0.2, suppliers’ delivery times with a weight of 0.15 and ‘stock of items purchased’ with a weight of 0.1. In addition to these five sub-indices as part of the PMI survey, information is also collected on the momentum in manufacturing ‘input prices’ and ‘output prices’. This price information formed the basis for this study. As per the PMI brochure, in order to compile the PMI surveys for manufacturing in India, the questionnaire responses from panels of purchasing executives (or similar) in over 500 companies are collated. The panel is stratified geographically and by Standard Industrial Classification (SIC) group, based on industry contribution to Indian GDP. Further details on PMI are available at: http://www.markiteconomics.com/Survey/Page.mvc/AboutPMIData Wholesale Price Index Historically, Wholesale Price Index (WPI), which has pan-nation coverage, was used by the Reserve Bank as the headline inflation indicator for communicating its assessment on inflation. The Office of the Economic Adviser to the Government of India undertook to publish for the first time, an index number of wholesale prices, with base week ended August 19, 1939 = 100, from the week commencing January 10, 1942. Since 1947, the Office of the Economic Adviser was publishing weekly the Wholesale Price Index numbers for the entire country that continued till mid-January 2012 for two of the three major commodity groups. Since January 2012 it has been published on a monthly basis. The latest revision of WPI series occurred in 2010 with base year 2004-05. As noted in the WPI manual, the concept of wholesale price used for construction of the index comprises, as far as possible, all transactions at first point of bulk sale in the domestic market. The latest WPI series with a base year of 2004-05 comprises of 676 items classified based on National Industrial Classification (NIC) which in turn is comparable to International Standard Industrial Classification (ISIC). Currently WPI at two digit level is classified into primary articles, fuel and power and manufactured products. The choice of commodities, varieties/ grades, market centres and sources of price data in respect of agricultural commodities are as per the recommendations of the Sub-Group on Agricultural Items. As regards the selection of items under Manufactured Products, the Working Group went by the criterion of value of output as per Annual Survey of Industries conducted by CSO for the year 2004-05. At first, all the ASI items are classified into 12 groups under Manufactured Products in WPI. Then, within each group, all the items are ordered in descending order of value of output. Starting from the item with highest value of output and moving downward, items are selected till the cumulative value of output becomes at least 80% of the total output value of the group. The weighting diagram for the latest WPI series with a base year of 2004-05 is derived on the basis of Gross Value of Output (GVO). The output values at current prices, wherever available at appropriate disaggregation, are obtained from the National Accounts Statistics (NAS), 2007 published by the Central Statistical Organization, Ministry of Statistics & Programme Implementation. As per the weighting diagram for the latest WPI (2004-05=100) series, food items constitutes around 24 per cent of the WPI basket, fuel group constitutes around 15 per cent, non-food manufactured products constitutes around 55 per cent of the WPI basket and the remaining, around 6 per cent of the WPI basket, consists of primary non-food articles and minerals. Further details on WPI are available at: http://www.eaindustry.nic.in/WPI_Manual.pdf | ||||||||||||||||||

Page Last Updated on: