IST,

IST,

RBI WPS (DEPR): 14/2022: Monetary Policy Independence under a Flexible Exchange Rate Regime - The Indian Case

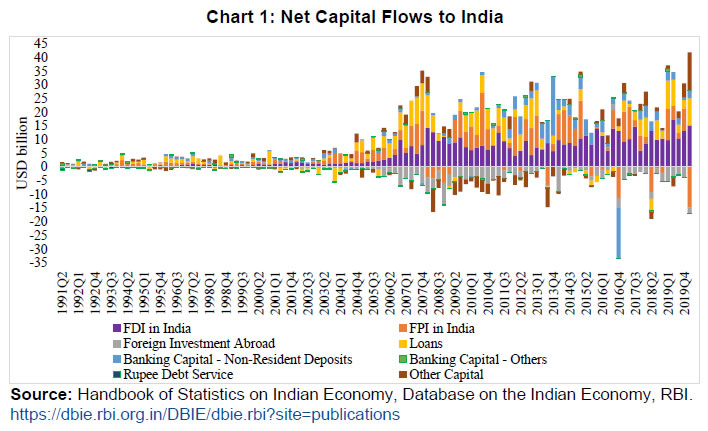

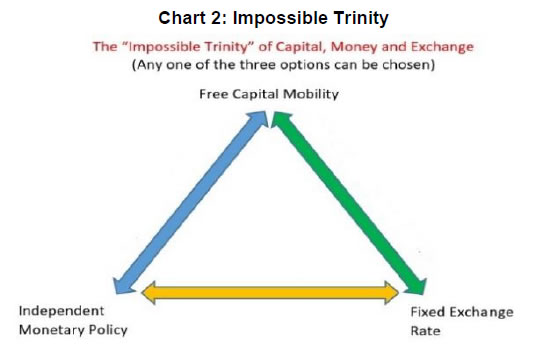

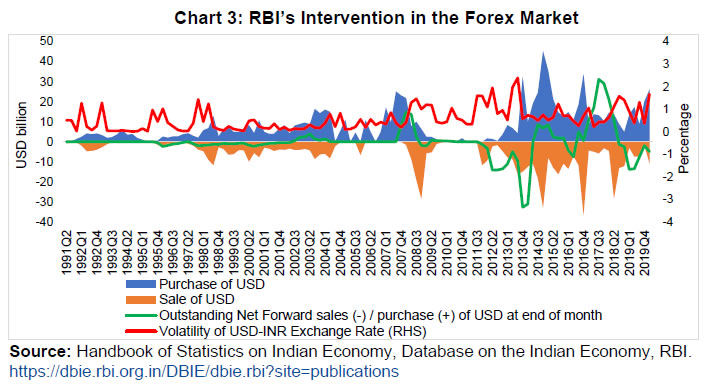

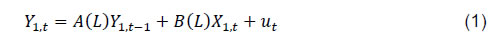

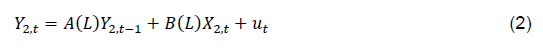

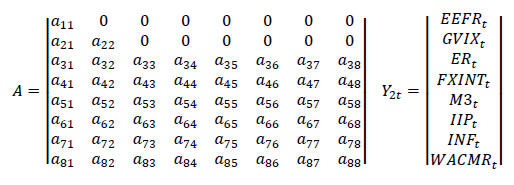

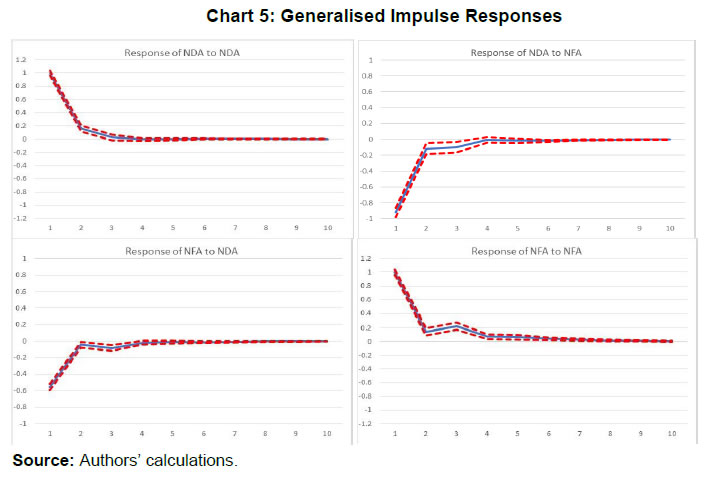

| RBI Working Paper Series No. 14 Monetary Policy Independence under a Flexible Exchange Rate Regime – The Indian Case Harpreet Singh Grewal and Pushpa Trivedi@ Abstract 1The trilemma poses a macroeconomic challenge for policymakers where monetary policy independence, exchange rate stability and capital account openness cannot be achieved simultaneously. While operating with a flexible exchange rate, India intervenes in the foreign exchange market to contain exchange rate volatility arising from surges and ebbs in capital flows. This study employs a range of Vector Autoregressive (VAR) models to assess the quantum and effectiveness of sterilisation in India and the impact of forex market interventions on monetary policy independence in the post-liberalisation era since 1991. The paper finds evidence of effective sterilisation of the money supply impact arising from forex market interventions, and no major constraining influence of forex market interventions on the independence of monetary policy. JEL Classification: E58, F21, F31, F41 Keywords: Capital flows, foreign exchange, impossible trinity, international reserves, monetary policy independence, trilemma Introduction In the age of international capital mobility, it is propounded that monetary policy independence can get constrained under a fixed exchange rate regime, even in the short run. However, under a flexible exchange rate regime, monetary policy is effective (Fleming, 1962; Mundell, 1963). This basic framework has come to be known as the Mundell-Fleming model. The model has gained the popular term “impossible trinity” wherein macroeconomic management is challenged as monetary independence, fixed exchange rate and capital account openness are impossible to be achieved together. The mechanism remains largely unchallenged, though an alternative set of arguments has also emerged. Within this macroeconomic framework, monetary policy independence is defined as the ability of a central bank to set the interest rate in a domestic economy independent of the anchor economy2 (Aizenman, Chinn, and Ito, 2013). Even assuming that the Mundell-Fleming model holds true, a sudden stop or reversal of capital flows requires adjustments that can impact the real economy adversely in terms of output, asset prices and domestic demand (Mohan and Kapur, 2009). This concern, prominently voiced in emerging market economies (EMEs), is the primary reason restraining countries from accepting a completely floating regime, necessitating intervention by central banks during periods of high volatility in the exchange rate or large disruptive movements of capital flows. Further, the response of central banks to use their balance sheets to manage capital flows, both inflows and outflows, can challenge monetary policy, especially in controlling inflation (Sen, 2018). In this context, Calvo and Reinhart (2002) espoused the concept of “fear of floating” driven by high volatility in forex reserves, exchange rates and nominal interest rates, necessitating interventions in the forex market and smoothening of interest rates by central banks. Such effects of exchange rate management on monetary policy independence have tilted the balance towards flexible exchange rate systems; this makes India, with a floating exchange rate, an interesting case for a study of the impact of forex market interventions on the conduct of monetary policy. The paper assesses whether the floating exchange rate in India mimics a fixed exchange rate regime, and whether it allows for monetary policy independence. A more contrarian argument brought forth by Rey (2013) directly questions the relevance of the Mundellian trilemma. The notion that flexible exchange rate regime is a sufficient condition to accord monetary policy independence has been countered with the need for macroprudential policies or capital controls in the wake of a global financial cycle. Despite the opposition to the relevance of the exchange rate regime in maintaining monetary policy independence, the proponents of the trilemma stand their ground (Aizenman, Chinn, and Ito, 2016; Obstfeld, Ostry, and Qureshi, 2019). The Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER), 2020 by the International Monetary Fund (IMF) classifies India as a ‘floating’ exchange rate regime. The interventions in the forex market are undertaken by the Reserve Bank of India (RBI) as part of the stated policy to contain volatility, without aiming for a target level or band. Nevertheless, arguments are also made of asymmetric intervention in the forex market, biased towards counterbalancing an appreciating currency (Sen Gupta and Sengupta, 2013). Notwithstanding the objectives and de facto nature of forex market interventions, as capital inflows have increased in India, especially in the 21st century, forex market interventions to contain volatility might have led to the injection of primary liquidity beyond the needs of the economy. Active liquidity management would then require absorption of the excess liquidity to meet the objectives of monetary policy. However, there could be a challenge to preserve the independence of monetary policy, depending on whether or not such liquidity is sterilised (absorbed). Without active liquidity management, the excess money supply could drive down money market interest rates and the operating target of monetary policy below the policy interest rate. The absorption of excess liquidity through open market operations (by selling government securities) could attract further capital inflows due to a rise in yields, thus making sterilisation ineffective. Capital flow management measures (CFMs) and macroprudential policies, however, can enhance monetary policy independence (Rey, 2013), by putting an effective ceiling to capital inflows, including such flows arising from sterilisation measures. Given the established framework of forex market interventions and challenges to monetary policy, this paper seeks to first assess the quantum and the effectiveness of sterilisation and then test whether forex market interventions in India erode monetary policy independence (impacts the call money rate). The paper provides evidence of effective sterilisation of forex market interventions with adequate space for the conduct of independent monetary policy. Further, monetary policy independence is assessed to have been preserved despite the foreign exchange market interventions. Set against this backdrop, this paper is organised under six sections. In Section II, a review of select literature in the context of monetary independence within the constraint of the ‘impossible trinity’ is presented. The range of policy actions undertaken by the RBI from 1991 to 2020 for the conduct of monetary policy and forex market interventions are analysed in Section III to ascertain whether the constraint is absolute or ‘rounded’. Section IV discusses the methodology and data used to undertake statistical analysis. Section V presents the estimation results, and Section VI concludes the paper. The trilemma of capital account openness, fixed exchange rate, and monetary policy independence is arguably the numero uno macroeconomic challenge facing policymakers. Several studies have found evidence on the existence of the trilemma not just globally (Aizenman, Chinn, and Ito, 2008 and 2010; Aizenman et al., 2013) but also in the Indian context (Aizenman and Sengupta, 2012; Grewal and Trivedi, 2021; Hutchison, Sengupta, and Singh, 2012; Sen Gupta and Sengupta, 2013). However, studies differ on the impact of exchange rate stability, usually brought about by forex market interventions on monetary policy independence and inflation (Aizenman and Sengupta, 2012 and Grewal and Trivedi, 2021). As the pace of financial integration has increased across the globe, the choice is increasingly being seen between a fixed exchange rate regime and monetary policy independence. Under a pegged exchange rate regime, large capital flows first bring with them benefits in the form of credit and investment boom and then bring in pitfalls of high inflation, overheating, real exchange rate misalignments, current account imbalances and financial sector weaknesses, resulting in a financial crisis. Eichengreen (1998), however, argues that pegged exchange rate arrangements alone may not contribute to financial instability. Banking crises have been witnessed in countries having pegged exchange rates (e.g., Argentine, 1980 and Chile, 1981), including countries adopting the gold standard (e.g., Germany, 1901 and the US and Canada, 1914), as well as floating exchange rates (e.g., Japan crisis of the 1990s). Economies not opting for a fixed exchange rate regime have more control over their domestic monetary policy. Shambaugh (2004) finds that the monetary policies of developed and developing economies not pegging their exchange rates have more influence over local interest rates, even after controlling for domestic macroeconomic variables. Frankel, Schmukler, and Servén (2004) provide evidence that industrialised nations in the 1970s and 1980s had a higher association of short-term interest rates in the case of pegged exchange rates. By contrast, Obstfeld, Taylor, and Shambaugh (2005) analysing a long period from 1870 to 2000 for more than 100 countries show that monetary policy independence3 is eroded considerably for countries with the pegged exchange rates. Given the trilemma, developing and emerging market economies have been moving towards floating exchange rates to provide a buffer to the real economy from global shocks through greater monetary policy independence (Obstfeld et al., 2019). Shocks to the banking system, which arise primarily due to foreign disturbances, like a monetary transmission from overseas, are more effectively dealt with through a floating exchange rate system. Keefe (2020) argues that lower exchange rate volatility (less than 1 per cent) in emerging market economies (EMEs) and advanced economies (AEs) contributes towards achieving their inflation targeting commitments whereas Kaltenbrunner and Painceira (2017) argue that EMEs with high capital mobility and inflation-targeting regime along with exchange rate management may be potentially counterproductive. Further, “fear of floating” may arise due to concerns of high exchange rate pass-through to commodity prices, lack of credibility, dollarisation of the domestic financial system, and inflation targeting (Calvo and Reinhart, 2002). There is empirical evidence of monetary independence being compromised even under flexible exchange rates (Edwards, 2015; Hofmann and Takáts, 2015) where the US short and long-term interest rates influence interest rates in financially integrated economies and Latin American economies. There are also arguments that the erosion in monetary policy independence due to forex market interventions under flexible exchange rates can be regained through capital controls or macro-prudential policies (Davis, 2015). This prescription of capital controls and/or macro-prudential policies is also proposed by Rey (2013, 2016) who finds empirical support for credit and risk-taking channel across developed and developing economies suggesting the prevalence of a global financial cycle. Several central bankers and economists have also accepted the existence of monetary policy spillovers, even in economies having flexible exchange rates, which may necessitate the deployment of macroprudential tools and capital flow measures to maintain monetary independence (Draghi, 2014; M. Mohanty, 2014; Rajan, 2015; Volcker, 1978). In the same vein, IMF (2020) recognises that an integrated policy framework with the three pillars of macroprudential measures, foreign exchange market intervention, and capital flow management measures could play an important role in enhancing monetary policy independence, especially for EMEs with financial frictions and balance sheet vulnerabilities. Pandey, Pasricha, Patnaik, and Shah (2021) counterargue that capital controls are not effective in the Indian context. However, the findings are based on data on debt that are presented to be actual flows, but represent only agreement values, and hence, the conclusions thereof may not be reliable. Thus, to manage the financial flows, foreign exchange market interventions by the EMEs play a central role in the independence of monetary policy. Further, monetary policy independence may be weakened or strengthened not only by whether capital controls or macroprudential policies are put in place, but also by the complementary role of the exchange rate channel to compensate for the weakening of the interest rate channel (Georgiadis and Mehl, 2015). These studies bring out the role of flexible exchange rate and forex market interventions in maintaining monetary policy independence, especially in EMEs. Considering the challenges from corner solutions, developing countries, including India, have been opting for the “middle ground” or “rounding” the corners of the trilemma (Aizenman et al., 2013; Mohan and Kapur, 2009), where foreign exchange market intervention can be an important variable. To assess the impact of forex market interventions on monetary policy independence, the following section provides the stylised facts on this issue in the Indian context. III. Intervention in the Foreign Exchange Market and Monetary Independence – A Rounded Corner? Various measures of financial openness have been used in the literature, but none of them is without their fair share of criticism. De jure measures, based on AREAER data, popularly known as Chinn-Ito Index as a (Chinn and Ito, 2006), shows a static value of 0.165 for India’s financial openness for 1991-2018. De jure measures may be misleading because of the differences in the enforcement of the law or evasion of law, limited access to the domestic market due to higher market risk, undeveloped financial market or other economic and institutional reasons. De facto measures, on the other hand, provide more accurate information about capital mobility. De facto measures, based on capital flows or financial assets/ liabilities positions, tend to show an increasing trend, especially for EMEs including India (Aizenman and Sengupta, 2012; Hutchison et al., 2012). However, unless the “push” and “pull” factors are disaggregated, it would be difficult to say whether the flows are due to the opening up of the capital account or simply due to the increased amount of capital flows globally, especially from the early 21st century. III.1 Capital Flows to India Analysing for the 1990s, Patnaik (2003) ascribed “substantial openness” to the capital account in India. Further, the portfolio flows to EMEs have increased after the Global Financial Crisis (GFC), led by global liquidity arising from the unconventional monetary policies of developed countries. Of total flow, the debt flows are higher as compared to equity flows. Looking at the size of capital flows, it is observed that the net capital flows to India increased substantially in the period 2003-2007, mainly driven by Foreign Portfolio Investment (FPI) flows (Chart 1). As Foreign Direct Investment (FDI) policy has been gradually liberalised, inward FDI flows have also played an important role. The importance of capital flows in the management of the exchange rate in India is highlighted from the size of some of their components. Noteworthy, among them, are three instances. The first episode was in Q3 of 2010 with large capital inflows, mostly in the form of FPI flows, that resulted in nominal USD-INR exchange rate moving from 46.59 per USD at the start of the quarter to 44.56 by the end of it. This was equivalent to 4.56 per cent appreciation in one quarter. The second episode was of the taper tantrum of 2013 when the USD-INR exchange rate had depreciated by around 13.82 per cent in a matter of one month from July 29, 2013 to August 28, 2013 due to large capital outflows. To counter sharp depreciation, the RBI adopted extraordinary measures by providing a USD-INR swap facility for banks to attract non-resident deposits and raising the short-term interest rate ceiling by 300 basis points for a certain segments of non-resident deposits4. The policy response of the RBI resulted in more than USD 21 billion inflows in Q4 of 2013 in the form of non-resident deposits.  The third episode was when these deposits matured in Q4 of 2016, that resulted in large capital outflows, which were offset to a large extent by FDI inflows. Due to balancing flows, this episode did not result in any increased volatility of the Indian Rupee. Thus, modulating the overall size of capital flows, through its various components, is an essential part of Indian external sector policies. The volatility of capital flows results in swings in the exchange rate and therefore the former is also an important determinant of the foreign exchange market interventions. To understand this relationship, the period from 1991 to 2018 (April to March) is broken up into five phases, viz., Phase I: 1991-1997 (period of major financial sector reforms in India); Phase II: 1997-2003 (Asian Financial Crisis, dot-com bubble in the US and its aftermath); Phase III: 2003-2008 (high growth phase in India and the world); Phase IV: 2008-2013 (GFC and its aftermath); and Phase V: 2013-2020 (taper tantrum, followed by reduction and termination of asset purchase programme by the US, and ultimately a reversal of the accommodative stance of its monetary policy). The volatility of capital flows, measured in terms of the standard deviation of various components of quarterly flows, shows that FPI flows are the most volatile followed by loans (Table 1). FDI flows and non-resident deposits in banks in India are seen to be quite stable. Hence, to manage capital flows, FPI and loan flows will entail active management of forex markets through changes in capital account policies as have been used by the RBI in the past.

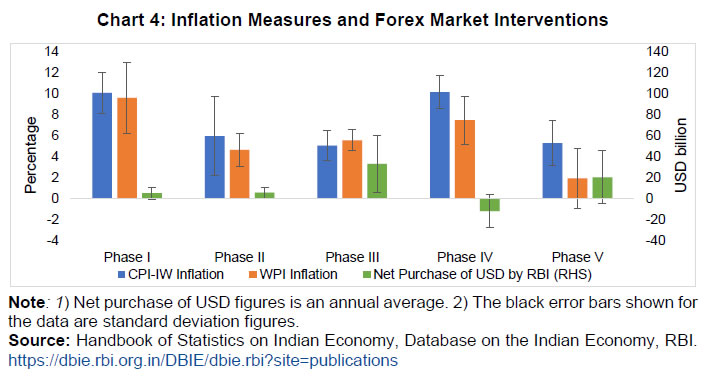

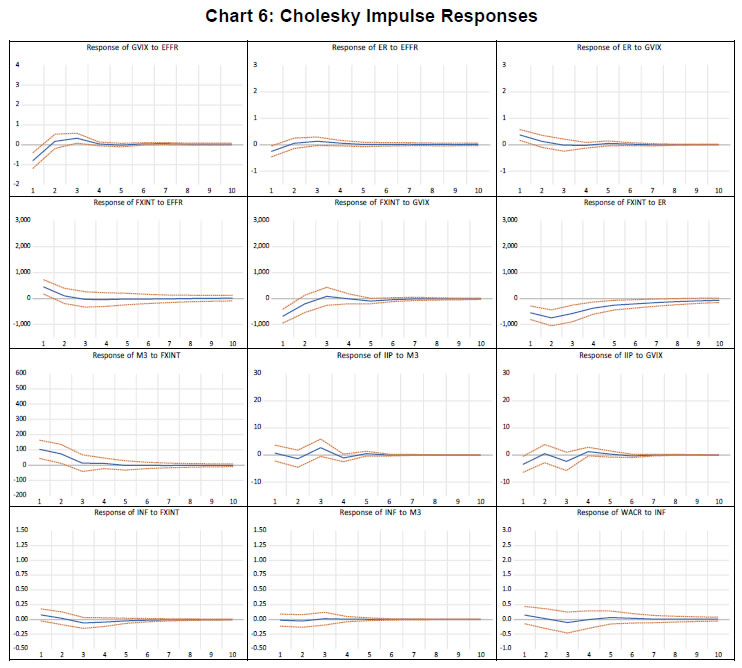

With India’s de facto measures showing a relatively open capital account, the trilemma boils down to whether the exchange rate is fixed or flexible. In a flexible exchange rate system, monetary independence is accorded. Whether interventions in the forex market by the RBI only round the corner of “impossible trinity” (Chart 2) and continue to provide monetary independence or whether the interventions start impinging on monetary independence is a question worth exploring.  III.2 Forex Market Intervention and Monetary Independence Intervention by the RBI in the foreign exchange market by way of purchase of dollars that increases forex reserves and reserve money, if not sterilised, can push down money market interest rates below the policy rate and lead to inflation. Consequently, an increase in the policy rate to address inflationary pressures may invite further yield-seeking capital flows. This may constrain the operation of monetary policy. However, sterilisation is not required if the increase in reserve money aligns with the demand in the economy or an increase in reserve money is less than required.  Theoretically, the increase in money supply can be sterilised by the Reserve Bank through open market operations or market stabilisation scheme5 by selling an equivalent amount of domestic government securities. However, sterilisation has quasi-fiscal costs by driving down seigniorage when higher-yielding assets are replaced by lower-yielding ones. Also, the sale of domestic government securities drives interest rates upward inviting further capital flows. Another option for sterilisation is the use of swaps, which can postpone the impact of excess liquidity but drive up the forward premia. Intervention in the forex market, however, has not been used actively as a means of changing the money supply till Q4 of 2018, especially for augmenting domestic liquidity through forex swaps when the economy is in liquidity deficit mode. Hence, exchange rate management in that sense has been compartmentalised from monetary policy. These outcomes can completely offset the objectives of sterilisation by loosening control over the money supply. However, sterilisation-driven additional capital inflows can be managed if accompanied by capital flow measures or capital controls. As India has gradually liberalised the capital account and not imposed wide-ranging controls even when there have been large capital inflows/outflows, the amount and nature of the intervention (sterilised or unsterilised) in the foreign exchange market by the central bank can influence the term structure of interest rates. This can become a challenge for maintaining monetary policy independence. Forex market interventions involve the use of the balance sheet of the Reserve Bank with concomitant constraints. Sterilisation through the sale of government securities is restricted by the stock availability of such securities with the Reserve Bank. Further, as stated, sterilisation could also invite further yield-seeking flows with a rise in yields. An assessment of sterilisation coefficient and offset coefficient, hence, is important. Change in net domestic assets (quasi fiscal) on the balance sheet of the RBI due to the change in net foreign assets (NFA) arising from forex market interventions gets captured in the sterilisation coefficient (i.e., represents the drain of the NDA from the policy response of sterilisation). On the other hand, the change in NFA due to change in NDA from sterilisation operations gets captured in the offset coefficient – indicating the effectiveness of the sterilisation. Both coefficients have a range between 0 and -1. A move towards a higher negative value reflects higher sterilisation with a value near -1 indicating full sterilisation of excess reserve money from forex market interventions. For offset coefficient, a value near 0 indicates monetary policy independence through effective sterilisation. While a value near -1 for offset coefficient indicates complete ineffectiveness of sterilisation with perfect capital mobility, i.e., monetary policy tightening would induce equal and offsetting foreign inflows thus completely impinging on the independence of monetary policy. A general consensus of available evidence (Table 2) indicates that the RBI sterilises a large proportion of excess money supply generated from forex market interventions. Further, an increase in NFA due to aid receipts, revaluation and the RBI’s income on its foreign assets does not have a monetary impact, commensurately reducing the need for sterilisation. For offset coefficient, RBI (2004, 2005) argued about the unidirectional cause from changes in NFA to NDA and Pattanaik (1997) and RBI (2021) provided evidence of a low offset coefficient. However, Ouyang and Rajan (2008) and RBI (2018) showed the prevalence of a high offset coefficient. Therefore, the impact on monetary policy independence is not clear. Most studies are based on single equation based OLS estimates that may, however, be biased due to the endogeneity issue – the simultaneous relationship between foreign exchange market intervention, NDA and NFA variables. This reduces the reliability of the coefficient values and, therefore, the assessment of monetary independence in the presence of forex interventions. Foreign exchange market intervention can be inflationary if the excess money supply beyond the absorption capacity of the economy is not adequately sterilised. In this regard, different measures of inflation based on Consumer Price Index – Industrial Workers (CPI-IW) and Wholesale Price Index (WPI) are plotted in Chart 4. It can be observed from the Chart that inflation has generally been on a declining trend as shown in different periods, except during Phase IV. However, this period (2008-2013) also witnessed a large decline in the net purchase of foreign exchange by the RBI as compared to the previous period. The 2013-20 period (Phase V) witnessed a decline in inflation despite elevated forex intervention during that period, implying that monetary independence was maintained even in the light of managing the flexibility of the exchange rate. This may be due to sterilised interventions being effective or that increase in money supply was commensurate with growth in income and demand for money or other factors. Hence, a more in-depth analysis on this issue is necessary, as has been attempted in this paper.  The paper follows a two-step approach to find the impact of forex market intervention on monetary policy independence of India for the period 1991-2020 (April-March). First, the level of sterilisation of excess reserve money from forex market interventions (sterilisation coefficient) and its effectiveness in maintaining monetary policy independence (offset coefficient) is estimated. Second, the paper estimates whether forex market interventions have an impact on the weighted average call money rate (WACR) – the operating target of monetary policy in India. The construction of variables is given in Annex 1 and represent monthly data. The following VAR model is used for our empirical analysis, where Y1,t is a vector of endogenous variables and X1,t is a vector of variable(s) to control for exogenous factors. A(L) and B(L) are n x n and n x k coefficient matrix polynomial of the lag operator.  In the first step, sterilisation and offset coefficients are estimated where Y1,t is comprised of Net Domestic Assets (NDA), Net Foreign Assets (NFA), Index of Industrial Production (IIP), Money Multiplier (MM) and Exchange Rate (ER), and X1,t includes Dummy for Global Financial Crisis (DGFC), and DDEM1 and DDEM2 (Dummies for Demonetisation). The endogenous variables are similar to those used in existing studies (RBI, 2018, 2021; Sen Gupta and Sengupta, 2013). IIP is included as NDA may increase with a rise in economic activity and NFA may increase due to capital flows led by higher growth of the economy. The overall impact on NDA/ NFA due to changes in reserve money is captured in MM. ER is included to study the impact of changes in NDA and NFA on the exchange rate. The paper estimates the sterilisation coefficient and the offset coefficient from the impulse responses of the VAR model. For impulse response functions, Pesaran and Shin (1998) is followed to generate generalised impulse responses where the orthogonal set of innovations do not depend on the VAR ordering. In the second step, the impact of forex market interventions on monetary policy independence has been estimated. Common determinants of inflation, viz., monetary policy variables, industrial output and commodity prices have been used in the model (e.g., Mohanty and John, 2015). Further, well-established external factors like Effective Federal Funds Rate of the US (EFFR) and Volatility Index (GVIX) have also been incorporated in the model, which is expected to impact forex market interventions. The paper uses institutional knowledge to impose contemporaneous restrictions (Cholesky) on the responses of the variables. The following VAR model is used, as in equation (1), and order the variables in Y2,t as under: EFFR → GVIX → ER → FXINT → M3 → IIP → INF → WACR  Specifically, the study has estimated the VAR model with linear constraints where the restrictions are imposed to treat EEFR and GVIX like any other exogenous variable. Here, EEFR is restricted to be determined by its own shocks only. GVIX is allowed to be impacted by the shocks of EEFR apart from its own shocks. However, these variables are not impacted by any other domestic endogenous variables. Particularly, the coefficient matrix A and variable vector Y can be presented as follows:  In X2,t CRUDE is used, as it has an important role to play in the Indian economy with crude oil accounting for a large proportion of imports and playing a crucial role in driving India’s fuel price inflation. In the first step, sterilisation and offset coefficients are estimated for the sample period 1991-2020. Using the OLS method, opted by most studies (refer to Table 2), the sterilisation coefficient is found to be -0.88, and the offset coefficient to be -0.73, broadly comparable with the numbers reported in the literature (Annex 2). However, to address the endogeneity problem in OLS estimates, VAR is used, which to the best of our knowledge is used for the first time in the Indian context. The VAR is estimated as in equation (1) with two lags based on the Hannan-Quinn Information criterion. As all the inverse roots of the characteristic autoregressive (AR) polynomial lie inside the unit circle, the estimated AR process is covariance stationary. Using the estimated VAR, the impulse responses of generalised one standard deviation innovations are presented below (Chart 5).  Our variables of interest are NDA and NFA. The response of NDA to one unit shock in NFA is −0.92 and statistically significant up to three lags. This result implies fast and large sterilisation of money supply arising from forex market interventions by the RBI. The estimate is consistent with the findings of Patnaik (2004), RBI (2004) and RBI (2018). Similarly, the response of NFA to NDA is also statistically significant for the first three months. The capital flows driven by monetary policy tightening do not result in equal and offsetting foreign inflows (offset coefficient value of −0.56) thus suggesting that the independence of monetary policy is maintained. The estimate is between the range of values found in other studies (Ouyang and Rajan, 2008; Pattanaik, 1997; RBI, 2018, 2021). Thus, the study finds that a large quantum of the money supply from forex market interventions is sterilised, which is effective as offsetting flows suggest they are not large enough to impinge on monetary policy independence. In the second step, the VAR is estimated as in equation (2) using two lags based on Hannan-Quinn and Akaike Information Criteria. As all the inverse roots of the characteristic AR polynomial lie inside the unit circle, the estimated AR process is covariance stationary. Using the estimated VAR, the impulse response of Cholesky one standard deviation innovations is presented below (Chart 6).   The empirical results suggest that an increase in EFFR concomitant with rising demand has a dampening effect on GVIX. The reversal of global risk aversion due to a reduction in volatility pushes capital flows to EMEs like India. This is also evident from the response of ER to EFFR and GVIX. To limit the effects of a surge in capital inflows on exchange rates, the central bank intervenes as shown by the response of FXINT to changes in EFFR and GVIX. Further, as ER depreciates (appreciates) in response to outflows (inflows), FXINT falls (rises). The increased FXINT by the Reserve Bank leads to an increase in M3, which is statistically significant for up to two months. The increased money supply aids in the growth of IIP, which remains insignificant. This chain is represented directly as well with a rise in GVIX (lowering of GVIX) leading to a fall in the IIP (increase in the IIP), which is found statistically significant in the first month. An increase in FXINT does not lead to an inflationary impact. Further, an expansionary M3 shock does not lead to a rise in INF. This may be seen in the context where M3 increases only in the case of partial sterilisation or the increase in money supply is not commensurate with demand. This does not appear to be the case as brought out by several studies in Section III and our earlier reported empirical results on sterilisation coefficient. Further, as already found, FXINT increases M3 only temporarily for a couple of months. Nevertheless, in case of a jump in INF, the monetary authority responds through an increase in the policy rate, thereby impacting the operating target of monetary policy (WACR) in a typical Taylor type response, which then subdues INF. However, these results are not found statistically significant. Inflation in India (INF) responds asymmetrically when ER depreciates rather than when ER appreciates (on capital inflows), which reflects that imports invoiced in USD, especially petroleum products, with their inelastic demand and high import composition can lead to inflation when the exchange rate depreciates. The monetary authority response is then to increase the policy rate, pushing up WACR to control INF. The temporary impact on M3 due to FXINT insulates monetary policy from external influences. Hence, the paper finds that a shock to FXINT neither leads to an increase in INF nor an increase in WACR (both statistically not significant). Further, the increase in EFFR of the US does not have a statistically significant relationship with the change in WACR up to substantial lags (up to 8 months). This corroborates the independence of monetary policy argument where changes in the monetary policy of the US (EFFR) lead to increased FXINT, but FXINT impacts M3 only temporarily and EFFR does not appear to impact WACR in India. In the era of large global spillovers, the debate continues as to whether exchange rate regime is irrelevant for maintaining monetary independence. The study does not delve into the ‘for’ or ‘against’ strand on fixed vs flexible exchange rate and their impact on monetary independence. However, given that flexible exchange rates are expected to allow for monetary independence, the paper seeks to find whether India’s exchange rate policy – under a flexible exchange rate regime with intervention to contain volatility – constrained monetary policy independence. The preliminary assessment from the stylised facts suggests that even during times of foreign exchange market intervention by RBI, there has been low and stable inflation in India. The study estimates the quantum and effectiveness of sterilisation through a VAR model and then estimates the impact of forex market interventions on the independence of monetary policy (operating target of monetary policy) through another VAR model. The results suggest that there is high degree of sterilisation (-0.92) of the increase in the money supply resulting from forex market interventions, but the offset coefficient of -0.56 highlights that offsetting flows due to decline in net domestic assets and hardening of yields do not constrain monetary policy independence. The study also finds that moderation in global risks leads to higher capital inflows into India. However, the consequent forex intervention to contain volatility of the INR and the resultant increase in M3 is neither inflationary nor elicits a policy rate response. @ Harpreet Singh Grewal is Deputy General Manager, Department of External Investments and Operations, Reserve Bank of India (hsgrewal@rbi.org.in). Pushpa Trivedi is Senior Professor, Shiv Nadar University Chennai and Visiting Professor, Department of Humanities and Social Sciences, IIT Dharwad (trivedip@snuchennai.edu.in). 1 The authors are thankful to Pankaj Kumar, Soumasree Tewari, and seminar participants at the DEPR Study Circle. We are also grateful to Priyanka Upreti, DRG, DEPR. We acknowledge her help in revision of this paper. This paper has also benefitted from the comments of an anonymous external reviewer and authors place on record their sincere thanks for the same. However, we alone are responsible for any errors that may have remained in the paper. The views expressed in the paper are those of the authors and do not necessarily represent those of the institutions to which they belong. 2 Anchor economy is with whom the monetary policy of the home country is closely linked. 3 Monetary policy independence is considered as high when there is low co-movement between domestic and foreign short-term interest rates and vice-versa. 4 The interest ceiling for Foreign Currency Non-Resident (Bank) deposits was raised for three to five-year maturities by 300 bps to Libor-plus 400 bps, which are deposits eligible to be made by non-resident Indians. 5 Market Stabilisation Scheme (MSS), instituted in 2004, gave an additional instrument in the hand of the RBI to absorb liquidity during times of large capital flows, which previously impacted efficacy of monetary policy as it was being done by dated securities and later through reverse repo. MSS Securities were issued specifically for flows of enduring nature, where the funds were sequestered in a separate account to be used for redemption/ buy-back of MSS securities only. References Aizenman, J., Chinn, M., and Ito, H. (2008). Assessing the Emerging Global Financial Architecture: Measuring the Trilemma's Configurations Over Time. NBER Working Paper(14533). Aizenman, J., Chinn, M., and Ito, H. (2010). Surfing the Waves of Globalization: Asia and Financial Globalization in the Context of the Trilemma. NBER Working Paper(15876). https://dx.doi.org/10.3386/w15876 Aizenman, J., Chinn, M., and Ito, H. (2013). The “Impossible Trinity” Hypothesis in an Era of Global Imbalances: Measurement and Testing. Review of International Economics, 21(3), 447-458. https://dx.doi.org/10.2139/ssrn.2071311 Aizenman, J., Chinn, M., and Ito, H. (2016). Monetary Policy Spillovers and the Trilemma in the New Normal: Periphery Country Sensitivity to Core Country Conditions. Journal of International Money and Finance, 68, 298-330. https://dx.doi.org/10.1016/j.jimonfin.2016.02.008 Aizenman, J., and Sengupta, R. (2012). The Financial Trilemma in China and a Comparative Analysis with India. US Santa Cruz Working Paper. Calvo, G., and Reinhart, C. (2002). Fear of Floating. The Quarterly Journal of Economics, 117(2), 379-408. Chinn, M., and Ito, H. (2006). What Matters for Financial Development? Capital Controls, Institutions, and Interactions. Journal of Development Economics, 81(1), 163-192. Davis, S. (2015). The Trilemma in Practice: Monetary Policy Autonomy in an Economy with a Floating Exchange Rate. Annual Report, Globalization and Monetary Policy Institute. Draghi, M. (2014). Monetary Policy Communication in Turbulent Times. Speech at the Conference De Nederlandsche Bank 200 years: Central Banking in the Next Two Decades. Retrieved from https://www.ecb.europa.eu/press/key/date/2014/html/sp140424.en.html Edwards, S. (2015). Monetary Policy Independence under Flexible Exchange Rates: An Illusion? The World Economy, 38(5), 773-787. Eichengreen, B. (1998). Exchange Rate Stability and Financial Stability. Open Economies Review, 9 (569-608). https://dx.doi.org/10.1023/A:1008373022226 Fleming, M. (1962). Domestic Financial Policies under Fixed and under Floating Exchange Rates. IMF Staff Papers, 9(3), 369-380. https://dx.doi.org/10.2307/3866091 Frankel, J., Schmukler, S., and Servén, L. (2004). Global Transmission of Interest Rates: Monetary Independence and the Currency Regime. Journal of International Money and Finance, 23(5), 701-733. https://dx.doi.org/10.1016/j.jimonfin.2004.03.006 Georgiadis, G., and Mehl, A. (2015). Trilemma, Not Dilemma: Financial Globalisation and Monetary Policy Effectiveness. Globalization Institute Working Paper(222). https://dx.doi.org/10.24149/gwp222 Grewal, H. S., and Trivedi, P. (2021). The path of impossible trinity in India: 1991-2018. Global Business and Economics Review, 24(4), 382-408. https://dx.doi.org/10.1504/GBER.2021.115811 Hofmann, B., and Takáts, E. (2015). International Monetary Spillovers. BIS Quarterly Review, September 2015, 105-118. Hutchison, M., Sengupta, R., and Singh, N. (2012). India’s Trilemma: Financial Liberalisation, Exchange Rates and Monetary Policy. The World Economy, 35(1), 3-18. https://dx.doi.org/10.1111/j.1467-9701.2011.01381.x IMF. (2020). Toward an Integrated Policy Framework. IMF Policy Paper. Kaltenbrunner, A., and Painceira, J. P. (2017). The Impossible Trinity: Inflation Targeting, Exchange Rate Management and Open Capital Accounts in Emerging Economies. Development and Change, 48(3), 452-480. https://dx.doi.org/10.1111/dech.12304 Keefe, H. G. (2020). The impact of exchange rate volatility on inflation targeting monetary policy in emerging and advanced economies. International Finance, 23(3), 417-433. https://dx.doi.org/10.1111/infi.12368 Mohan, R., and Kapur, M. (2009). Managing the Impossible Trinity: Volatile Capital Flows and Indian Monetary Policy. SCID Working Paper(401). Mohanty, D., and John, J. (2015). Determinants of Inflation in India. Journal of Asian Economics, 36, 86-96. https://dx.doi.org/10.1016/j.asieco.2014.08.002 Mohanty, M. (2014). The Transmission of Unconventional Monetary Policy to the Emerging Markets - An Overview. BIS Papers, 78, 1-24. Mundell, R. (1963). Capital Mobility and Stabilization Policy under Fixed and Flexible Exchange Rates. The Canadian Journal of Economics and Political Science, 29(4), 475-485. https://dx.doi.org/10.2307/139336 Obstfeld, M., Ostry, J., and Qureshi, M. (2019). A Tie That Binds: Revisiting the Trilemma in Emerging Market Economies. The Review of Economics and Statistics, 101(2), 279-293. https://dx.doi.org/10.1162/REST_a_00740 Obstfeld, M., Taylor, A., and Shambaugh, J. (2005). The Trilemma in History: Tradeoffs Among Exchange Rates, Monetary Policies, and Capital Mobility. The Review of Economics and Statistics, 87, 423-438. https://dx.doi.org/10.1162/0034653054638300 Ouyang, A. Y., and Rajan, R. S. (2008). Reserve stockpiling and managing its monetary consequences: the Indian experience. Macroeconomics and Finance in Emerging Market Economies, 1(1), 75-91. https://dx.doi.org/10.1080/17520840701835021 Pandey, R., Pasricha, G. K., Patnaik, I., and Shah, A. (2021). Motivations for capital controls and their effectiveness. 26(1), 391-415. https://dx.doi.org/10.1002/ijfe.1795 Patnaik, I. (2003). The Consequences of Currency Intervention in India. ICRIER Working Paper(114). Patnaik, I. (2004). India's Experience with a Pegged Exchange Rate. India Policy Forum, 1(1), 189-226. Pattanaik, S. (1997). Targets and Instruments for the External Sector with an Open Capital Account. Economic and Political Weekly, 32(40). Pesaran, H., and Shin, Y. (1998). Generalized Impulse Response Analysis in Linear Multivariate Models. Economics Letters, 58(1), 17-29. https://dx.doi.org/10.1016/S0165-1765(97)00214-0 Rajan, R. (2015). Competitive Monetary Easing: Is it Yesterday Once More? Macroeconomics and Finance in Emerging Market Economies, 8, 1-12. https://dx.doi.org/10.1080/17520843.2014.992451 RBI. (2004). Report on Currency and Finance 2002-03. RBI Report. RBI. (2005). Report on Currency and Finance 2003-2004. RBI Report. RBI. (2018). Forex Market Operations and Liquidity Management. RBI Bulletin, August 2018. RBI. (2021). Report on Currency and Finance 2020-21. RBI Report. Rey, H. (2013). Dilemma not Trilemma: The Global Cycle and Monetary Policy Independence. Paper presented at the Proceedings - Economic Policy Symposium. Rey, H. (2016). International Channels of Transmission of Monetary Policy and the Mundellian Trilemma. IMF Economic Review, 64(1), 6-35. https://dx.doi.org/10.1057/imfer.2016.4 Sen Gupta, A., and Sengupta, R. (2013). Management of Capital Flows in India. ADB South Asia Working Paper (No. 17). Sen, P. (2018, August 23, 2018). Monetary Policy in India: Does the RBI Have a Framework? The Wire. Retrieved from https://thewire.in/banking/rbi-monetary-policy-framework-inflation Shambaugh, J. (2004). The Effect of Fixed Exchange Rates on Monetary Policy. The Quarterly Journal of Economics, 119(1), 301-352. Volcker, P. (1978). The Political Economy of the Dollar. Federal Reserve Bank of New York Quarterly Review, Winter (1978-79), 1-12.

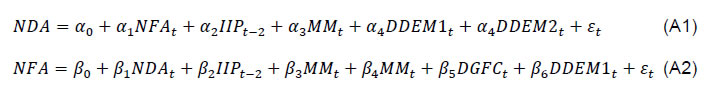

OLS Estimates of Sterilisation and Offset Coefficients As Section 3 explains, NFA and NDA are interdependent with capital inflows (rise in NFA) impacting liquidity conditions leading to the monetary authority response of open market sales (reduction in NDA). This is captured in the sterilisation coefficient. As yields harden due to open market sales, yield-searching flows may increase into the country (rise in NFA). This hamper independent conduct of monetary policy and is reflected in the offset coefficient. The study estimates the sterilisation and offset coefficients by way of the following equations using variables defined in Annex 1 (Table A1):  The results of the estimations are reported in Table A2 below. There is complete sterilisation if α1=−1 and no sterilisation when α1=0. Our empirical results of equation A1 give a sterilisation coefficient value of −0.88, reflecting high levels of sterilisation. Output growth (IIP) with a 2-month lag is positively but insignificantly related to change in NDA. Further, MM is significant but has a negative coefficient, i.e., an increase in MM leads to a fall in NDA. A change in the monetary base can be backed by both NDA and NFA. Hence, an increase in the monetary base lowers MM while increasing NDA. When the offset coefficient (β1)=−1, sterilisation becomes ineffective as equal and offsetting flows (rise in NFA) are received when NDA declines. When β1=0, sterilisation is completely effective. Our estimates of equation A2 indicate the offset coefficient to be −0.73 reflecting that monetary policy relatively maintains its independence. However, persistent flows and sterilisation may start impinging on monetary policy independence. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: