IST,

IST,

Addendum to the Report of the Internal Study Group to Review the Working of the Marginal Cost of Funds Based Lending Rate System: Some Reflections on the Feedback Received

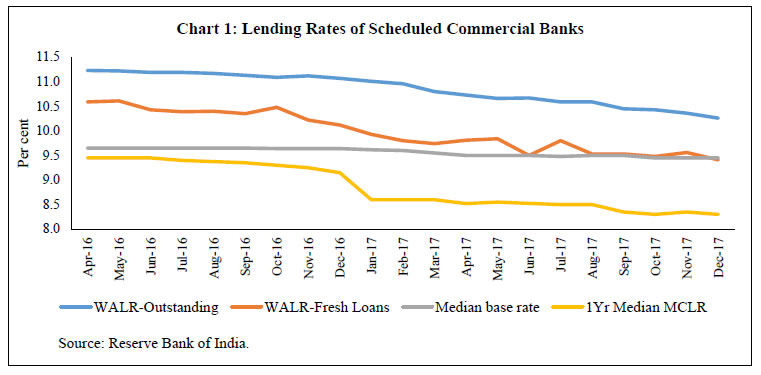

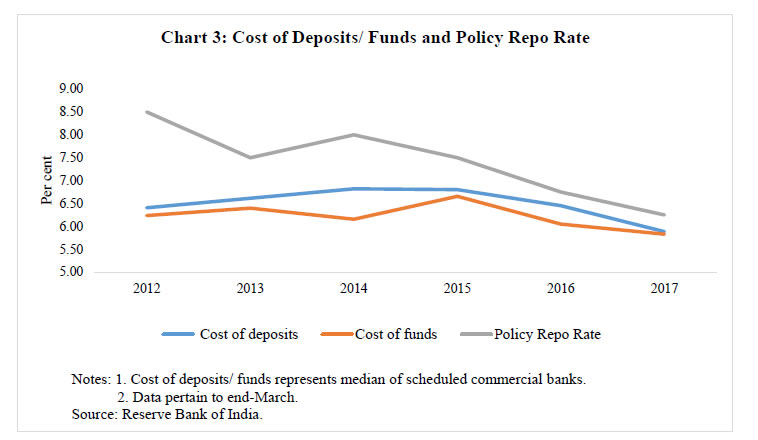

Abstract The system of using internal benchmarks such as the base rate and the marginal cost of funds based lending rate (MCLR) for pricing of loans in the banking system in India has not resulted in satisfactory monetary transmission so far. Hence, the Internal Study Group constituted by the Reserve Bank to review the working of the MCLR system in its report recommended switchover to one of the three external benchmarks, viz., the treasury bill rate, the CD rate and the Reserve Bank’s policy repo rate. This memo covers the major suggestions/comments received from stakeholders in response to the recommendations and sets out our reflections thereon. Introduction The Reserve Bank of India (RBI) released the Report of the Internal Study Group to Review the Working of the Marginal Cost of Funds Based Lending Rate System (Chairman: Dr. Janak Raj) on October 4, 2017 seeking feedback from general public and stakeholders by October 31, 2017. RBI has received feedback from Indian Banks’ Association (IBA), banks, non-bank financial institutions, corporates and members of the public. There have also been several newspaper editorials, research articles and commentary in the media on the recommendations of the report. This memo outlines the major suggestions/comments received on the recommendations of the Internal Study Group and sets out our reflections on the feedback received. The Recent Debate on Monetary Transmission in India: The Context The amended Reserve Bank of India Act, 2016 has mandated the RBI to conduct monetary policy for achieving price stability as its primary objective while being mindful of growth. This mandated objective is difficult to achieve unless supported by a robust transmission mechanism (Acharya, 2017). The policy rate adjustments by the monetary policy committee (MPC) are intended to percolate to the entire spectrum of interest rates, especially bank lending rates, so that the economy stays close to its “steady state”, i.e., inflation close to the target and growth close to its potential path; and, in case of any shock, the economy can be brought back to the steady state by adjusting policy rates. If lending rates of banks do not rise in response to rise in the policy repo rate by the MPC, consumption and investment by households and firms will continue to rise and credit demand of firms and households will continue to grow. As a result, the corresponding aggregate demand conditions in the economy would not allow inflation to drop. Conversely, in an easing cycle of monetary policy, if lower policy repo rate is not followed by reduction in bank lending rates, consumption and investment demand will not pick up to help bring the growth back to the steady state. For more than 20 years after the RBI deregulated banks’ lending rates, the absence of smooth transmission has remained a matter of concern. The first regime of Prime Lending Rate (PLR)1 was introduced in 1994. However, both the PLR and the spread were seen to vary widely across banks and bank-groups. Moreover, PLR continued to be rigid and inflexible in relation to the overall direction of interest rates in the economy. With the aim of introducing transparency and ensuring appropriate pricing of loans – wherein the PLRs truly reflected the actual borrowing costs – the PLR was converted into a reference benchmark rate and banks were advised in 2003 to introduce the Benchmark Prime Lending Rate (BPLR) system. While lending below the BPLR was expected to be at the margin, in practice about 77 per cent of banks’ loan portfolio in March 2007 was at sub-BPLR2. In essence, both PLR and BPLR did not produce adequate monetary transmission to the real economy. This defeated the very purpose for which these benchmarks were introduced. In July 2010, the Reserve Bank replaced the BPLR system with the base rate system. The actual lending rate was the base rate (for which an indicative formula was also prescribed) along with the spread. However, the flexibility accorded to banks in the determination of cost of funds – average, marginal or blended cost – which was a key component of base rate calculation – resulted in opacity in the base rate computed by banks. In particular, the average cost of funds did not move much with monetary policy changes due to the term nature of deposits. Moreover, banks often changed over time the spread over the base rate for some borrowers, even without any change in credit quality of borrowers, while leaving the base rate unchanged. Given these deficiencies, the RBI introduced a new lending rate system for banks in the form of the marginal cost of funds based lending rate (MCLR) in April 2016. Unlike the BPLR and the base rate, the formula for computing the MCLR was prescribed. While some discretion remained with banks, the MCLR has continued to suffer from the same flaw in that transmission to the existing borrowers has remained muted as banks adjust, in many cases in an arbitrary manner, the MCLR and/or spread over MCLR, which has kept overall lending rates high in spite of the monetary policy being accommodative since January 2015 (Table 1 and Chart 1). Recommendations of the Internal Study Group Each of the above mentioned four benchmarks can be considered as “internal” in that banks set it themselves or choose at their discretion many of the factors that get into the prescribed formulae. The task of the Study Group was to evaluate the MCLR system and suggest changes in the lending interest rate system for improving monetary transmission. The key recommendations of the Study Group are summed up below:

The underlying philosophy behind recommendations at (i) and (ii) above was to make the entire process of setting lending rates by banks transparent and to improve monetary transmission. While banks would not have discretion over the benchmark rate, they would have complete freedom to fix the spread over the external benchmark for new borrowers. The fixed spread over the benchmark through the tenure of the loan would limit the scope for any arbitrary adjustment by banks in resetting the spread over time for existing borrowers. The rationale behind the recommendations at (iii), (iv) and (v) above was to enhance flexibility in setting the lending interest rates by banks in response to changing monetary policy signals. Feedback from Stakeholders The Reserve Bank has received extensive comments on the key recommendations of the Study Group, and they reflect the realities of doing banking business in a dynamic and fast changing economy where readiness to embrace change varies across banks as well as customers. Without prejudging the merits, the major comments/suggestions are set out in brief below. Feedback from Banks First, the IBA and banks in general have expressed that the MCLR system is working well and that it should continue. All banks, barring some foreign banks, are of the view that none of the three external benchmarks recommended by the Study Group can be adopted in the near to medium-run since banks’ funding cost is not related directly to any of the proposed external benchmarks. They have presented a case that loans of most Indian banks are funded primarily by retail deposits and not from the wholesale market as is the practice abroad. Therefore, if interest rates on deposits remain sticky, banks cannot lend at rates linked to an external benchmark which may change every day, unless they manage this interest rate risk well. Banks have pointed out that they are currently not in a position to hedge interest rate risk given the absence of a developed Interest Rate Swap (IRS) market. In the absence of such a market, either their profitability will come under pressure or spreads will be higher than necessary as a compensation for interest rate risk. Banks have also highlighted that in the absence of a reliable term money market, use of any benchmark will leave the discretion on pricing of term premium with the banks. To deal with such country-specific challenges, banks have suggested that the more ideal benchmark could be constructed based on deposit rates of the banking system as a whole. Banks have indicated that they experimented with floating rate deposits in the past, but the response was not encouraging. Retail depositors are particularly averse to such products. Even institutional/wholesale depositors prefer fixed rates when they perceive interest rates to have peaked and an easing cycle of monetary policy is about to begin. Second, banks have opined that the reset period cannot be fixed on a quarterly basis always. Currently, by matching the reset period to the tenor of the MCLR (like one year MCLR linked loans having one year reset period), banks address the interest rate risk in the banking book. Moreover, Indian Accounting Standards (Ind AS) and International Financial Reporting Standards (IFRS) also suggest compatibility between tenor of the loan and reset period. Even if an external benchmark is adopted, the reset period should be linked to the tenor of the underlying external benchmark. While longer reset periods increase transmission lags, shorter resets increase interest rate risk for banks. Banks have indicated that retail customers would resist a shorter (quarterly) reset, particularly in a rising interest rate cycle, because of the increase in equated monthly instalments (EMIs) or longer repayment period with uniform EMIs. Third, banks have indicated that in a deregulated interest rate environment, spread over the benchmark – be it internal or external – must be the exclusive domain of commercial banks. Also, for a variety of pure commercial reasons, spread cannot be fixed forever. Credit risk premium is time-varying and expected credit losses do change over time. According to banks, with the switchover to an external benchmark, the spread decisions may get even more complex, because of the uncertainty about managing interest rate risk, which may partly influence spreads. For example, the spread itself could become a function of the interest rate cycle. At times, banks may have to reduce spread just to retain customers; some customers may back their loans with more collateral at a later stage of the loan, requiring a downward adjustment of the spread; for many project loans, as risks decline after the gestation lag and based on repayment track record, the spread may have to be lowered. Therefore, according to banks, market competition alone should lead to convergence of spreads, and regulatory prescriptions on whether the spread should change or remain fixed would not be in sync with the spirit behind deregulation. Banks’ preference, therefore, is to continue with the MCLR regime, which according to the feedback received, should be given more time to enable a fuller assessment of its performance on transmission. One and a half years, according to banks, is too short a period to assess the effectiveness of a new regime, given the normal lags in transmission. Once the base rate linked loans move completely to MCLR, one should expect even better transmission. To facilitate this, banks have suggested that the RBI could indicate a sunset date for the base rate/BPLR regime – say March 31, 2019 only on the basis of mutually agreed terms and conditions. However, banks feel that rendering free switchover would lead to loss of interest earnings for banks. In order to further strengthen the MCLR system, the RBI could institute a governance framework with regard to changes being made by banks to MCLR and spreads. In particular, the RBI could examine the components and methodology adopted by banks under the supervisory review process. Finally, banks have observed that the recommendation of the Study Group to switch over to an external benchmark by April 2018 is too early a time frame, given the many irritants to effective implementation. Feedback from other Stakeholders In contrast to the feedback received from IBA and banks, the feedback received from public, however, in general, suggests that the RBI should move to an external benchmark. Major suggestions received from the general public are set out below:

Comments received through print media – press reports/press articles in particular – covered a broad canvas as mentioned below:

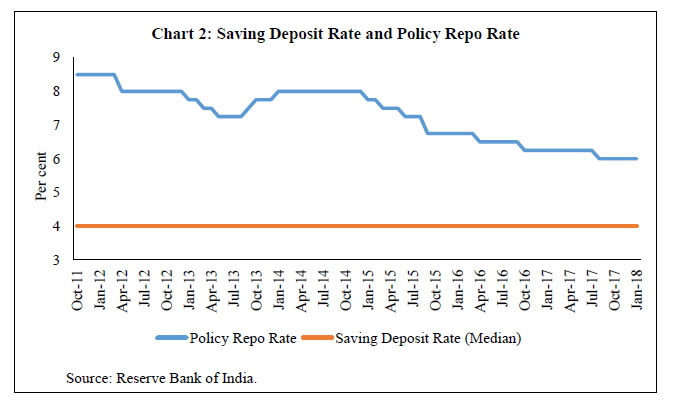

Some Reflections on the Feedback Received Banks have suggested persisting with MCLR, an internal benchmark based on marginal deposit funding cost. While an internal benchmark such as MCLR (or any other equivalent based on deposit funding cost) seems attractive from the standpoint of banks, it suffers from a fundamental flaw in that it makes banks insensitive to policy rate changes. Put simply, banks face no urgency to adjust their deposit rates in response to policy rate changes. And as long as banks do not change deposit interest rates, that would continue to stifle transmission to their lending rates. Otherwise, how could one explain rock steady saving deposit interest rates by banks for six long years from October 2011 to July 2017 even as monetary policy cycles changed in either direction? (Chart 2). It is all the more intriguing as banks were vehemently opposed to deregulation of saving deposit interest rates on the ground that it would lead to a rate war amongst banks.  Banks are of the view that their funding cost is not related to the external benchmark as loans are funded mainly through deposits and not through market borrowings or from the wholesale market. The three external benchmarks, recommended by the Study Group, were selected after a careful analysis of pros and cons of 13 possible options, all of which move closely with the policy repo rate. The cost of deposits/funds of scheduled commercial banks is, in fact, also getting closely aligned with the policy repo rate over the past few years (Chart 3). Hence, the policy repo rate could be taken as a proxy for the cost of deposits/funds of banks. In any case, under the recommended framework by the Study Group, banks would have the freedom to charge the spread to factor in the extra cost of funding (the difference between the external benchmark and the average cost of deposits), term premium or credit risk or any other costs (such as operating costs). Banks have also suggested flexibility in fixing the spread any time during the term of floating rate loans. This goes against the very idea of floating rate loans. The only adjustable element in floating rate loans linked to an internal or external benchmark should be the benchmark and not the spread, unless there is a solid ground to change such as a mutually agreed credit event and attendant outcomes like change in collateralisation of the loan. Without a fixed spread during the life of the floating rate loan, banks can always compensate themselves by changing the spread to offset the floating benchmark movement, in effect rendering it a fixed rate loan. Further, the risk from time-varying credit risk premium can be built into the spread at complete discretion of banks at the time of loan origination, as in floating rate contracts in other parts of the world. Banks are operating in a deregulated environment and, hence, are free to set the overall levels of their lending rates. For instance, banks are allowed to set their interest rates on loans at fixed rate3 even as such loans impede monetary transmission. In the case of fixed interest rate loans, borrowers have the choice to shop around and get the best deal for themselves. The terms of the contract are set at the time of sanction of a loan, which cannot be changed afterwards. However, in the case of floating rate loans, banks can change the interest rate by changing the internal benchmark rate and/or the spread during the term of the loan which could harm the interest of the borrower and also impair monetary transmission. Theoretically, the borrower could refinance the floating rate loan by going to another bank, but in practice, this does not work well. Floating rate loans of different banks with internal benchmarks are not identical even if spreads are identical at loan origination and in future, given that different banks change or reset internal benchmarks differently. The borrower in such a situation is more often left with no choice, but to remain captive to the original bank and pay higher charges on existing loans rather than refinance. For improving monetary transmission, it is imperative that interest rates are set by banks in an absolutely transparent manner. Switching to an external benchmark would be equivalent to the regulator setting an incontrovertible “standard” on the interest rate fluctuations on the loan products. Unlike the MCLR system, where each component of the MCLR and the spread has been prescribed, under the recommended system by the Study Group, the RBI would be moving away from micro managing. Banks will, in fact, have complete freedom to choose the spread over the standardised benchmark. Banks have rightly observed that the interest rate swap (IRS) market is not developed in India. However, the development of any market is demand driven. Hence, once the need for hedging interest rate risk increases after the adoption of an external benchmark, the IRS market could also develop. Creating the demand first could help generate a supply response from those willing to bear interest rate risk in the IRS market. Banks can also introduce more flexibility on their liability side. Monetary policy works by changing the banks’ deposit and lending rates. In the absence of a developed IRS market, flexibility in deposit interest rates is the key for effective monetary transmission. While there is certainly a case for protecting retail depositors from interest rate risk, bulk depositors and corporates should be in a position to manage interest rate risk and deposits from the latter set of savers could be tied to an external benchmark. Further, if the monetary transmission has to be effective, the periodicity of interest rate resets cannot be much different from the periodicity of likely changes in monetary policy. It needs to be recognised that as it is, there are long lags with which monetary policy impacts the ultimate objectives of inflation and growth. It is, therefore, important for the economy that interest rate resets are more or less synchronised with the policy rate changes. A quarterly reset appears just right on this front. Even after more than 21 months of introduction of the MCLR system, quite a sizable loan portfolio of banks continues at the base rate and some loan portfolio is even at the BPLR. The existence of two or three bank lending systems at the same time does not bode well for transparency and monetary transmission. A suggestion has been received for a sunset clause on mutually agreed terms between banks and borrowers. However, some banks have indicated that waiver of conversion fee worries them as it would impact their profitability. While banks may have genuine concerns on their profitability, it is equally important to protect the interests of the borrowers, since transition from base rate to MCLR was kept non-mandatory for banks, taking into account the need for banks to have a calibrated path to manage their profitability during the transition phase. Hence, it is our considered view that there will be a need to work out a middle path, which protects the interests of both banks and borrowers. A suggestion of multiple benchmarks has also been made. The Study Group considered this issue and was of the view that multiple benchmarks may not augur well for the orderly development of a benchmark standard. In the initial stages, it is important that there is a uniformity in the benchmark. Multiple benchmarks for the same market segments could confuse the borrowers as these may be applied differently across customers and sectors. Globally, the practice is for a single benchmark for a specific market segment such as one for the credit market and another for the derivatives market. It is imperative that the chosen external benchmark provides a clear signal to the borrowers of the trend in market interest rates, particularly when the market is at a nascent state of development. Once, however, the market matures and/or there is sufficient liquidity permitting different benchmarks to coexist simultaneously, multiple benchmarks could be an option worth considering. To start with, however, there should be only one external benchmark and the Reserve Bank may need to provide the necessary guidance for its orderly development. The last important suggestion relates to longer timeline for introducing changes in the lending rate system. It is felt that the transition plan needs to accommodate implementation concerns of banks without diluting the overriding goals of stronger monetary policy transmission and consumer protection. Summing Up Monetary policy is a potent tool of macroeconomic management, but transmission impediments can dampen its effectiveness. Since banks are the main conduits through which monetary policy impulses are transmitted in India, it is imperative that their actions help strengthen monetary transmission. Dynamic and fast evolving domestic and global developments often require swift monetary policy responses, which, to be effective, need to be reflected in lending rates set by banks. If policy rate changes by the Reserve Bank are not fully transmitted to the real economy, then the Reserve Bank may have to resort to changes larger than otherwise necessary to achieve the mandated objective. This, in turn, could have ramifications for financial market segments that are sensitive to interest rates, such as G-sec market in which banks are major participants. A key question that needs to be answered is as to who is in a better position to manage the interest rate risk in the economy. Interest rate risk should be managed by those who have the expertise and capacity to do so. Banks, corporates and bulk depositors are certainly in a much better position to manage interest rate risk than retail depositors and borrowers who are currently the repositories of such risk as banks manage the rate-setting process internally. It is time to reflect, revisit and rejig this risk-sharing arrangement. References: Reserve Bank of India (2014), “Report of the Expert Committee to Revise and Strengthen Monetary Policy Framework” (Chairman: Dr. Urjit R. Patel), January, --- (2017), “Report of the Internal Study Group to Review the Working of the Marginal Cost of Funds based Lending Rate (MCLR) System” (Chairman: Dr. Janak Raj), October, Viral V Acharya (2017), “Monetary Transmission in India: Why is it important and why hasn’t it worked well?”, Inaugural Aveek Guha Memorial Lecture, Homi Bhabha Auditorium, Tata Institute of Fundamental Research (TIFR), November 16, 1 In a major initiative in October 1994, the Reserve Bank deregulated lending rates for credit limits over Rs.2 lakh. Banks were required to declare their prime lending rates (PLR), i.e., the interest rate charged for the most creditworthy borrowers. The PLR was to be computed taking into account factors such as cost of funds and transaction costs, and was expected to act as a floor for lending above Rs.2 lakh. 2 Source: Report of the Working Group on Benchmark Prime Lending Rate, Reserve Bank of India (2009). |

Page Last Updated on: