IST,

IST,

Chapter III: Regulatory Initiatives in the Financial Sector

|

Global regulatory initiatives remained focused on strengthening the resilience of the financial system by mitigating risks arising from technological advancements, cyber-security threats and third-party dependencies. Domestically, regulators emphasised upon reinforcing the strength of financial intermediaries, preventing frauds and protecting customers. The Financial Stability and Development Council (FSDC) and its Sub-Committee remain resolute in their commitment to fostering a robust and efficient financial system for the Indian economy. Introduction 3.1 As the global financial system navigates through high uncertainty, regulators remain focused on strengthening the financial system and identification and mitigation of potential vulnerabilities. Policymakers and international standard-setting bodies are prioritising measures to safeguard the resilience of an increasingly complex financial system in an environment of technological advancements and incorporating climate risk through proactive regulatory and supervisory actions. Concurrently, regulatory initiatives are being undertaken to address vulnerabilities in non-bank financial intermediaries, the banking sector and cross-border payment systems. 3.2 Against this backdrop, this chapter reviews the recent regulatory initiatives, both global and domestic, aimed at enhancing the stability and resilience of the financial system. III.1 Global Regulatory Developments III.1.1 Markets and Financial Stability 3.3 The International Organisation of Securities Commissions (IOSCO) published a report1 on “Market Outages”2 in June 2024, proposing measures to enhance market resilience and outlining appropriate response by trading venues and their regulators in case of suspension of trading due to a technical problem. Apart from taking stock of the current legislative and regulatory framework surrounding business continuity plans, a survey was done to gauge organisational requirements and arrangements of trading venues and market participants. The survey found many episodes of market outages on listed trading venues between 2018 and 2022, with ‘Software issues’ and ‘Hardware issues’ cited to be the top reasons behind such incidents. The report enlists several good practices, such as conducting lessons-learned exercises, establishing and publishing an outage plan, methodology for alternative closing prices and communication plans to help ensure business continuity. 3.4 The IOSCO final report3 on “Leveraged Loans and Collateralised Loan Obligations (CLOs)” reviews origination practices in the leveraged loan4 and CLO5 segments, highlighting good practices to ensure adequate investor protection. The report observes that the borrower base has shifted from traditional industrial sectors towards technology and healthcare with the credit profile of corporate borrowers broadly deteriorating. The current investor base majorly consists of non-banks as regulatory oversight has prompted banks to keep less risky and less capital-intensive investments on books. There have been significant developments in market practices including the rise in covenant-lite6 deals, increasing complexity of documentation and highly leveraged transactions. The IOSCO has outlined twelve good practices across five themes, viz., (i) origination and refinancing based on sound business premise; (ii) transparency on EBITDA adjustments and other loan covenants; (iii) strengthening alignment of interest from loan origination to end investors; (iv) addressing interests of different market participants throughout the intermediation chain; and (v) disclosure of information on an ongoing basis. III.1.2 Technology and Financial Stability 3.5 Adoption of artificial intelligence (AI) by companies and service providers can help optimise their operations and resource allocation. The pace at which AI-based technologies have, however, penetrated business operations and front-end consumer services has evoked concerns about the associated risks to wider public interest. The European Union (EU) enacted the European Artificial Intelligence Act (AI Act) in August 20247, pioneering the formulation of comprehensive regulations around the use of AI. The Act provides for ensuring that any AI system8 developed and deployed in the EU is reliable and safeguards people’s fundamental rights while creating a conducive environment for innovation and investment. 3.6 The discussions9 held during the Organisation for Economic Co-operation and Development and the Financial Stability Board (OECD – FSB) Roundtable on AI in Finance noted the rapid adoption of predictive10 AI systems, such as Machine Learning (ML) and Generative AI (GenAI)11, especially by banks and insurance companies and called for policy makers to promote the safe use of AI in financial services. The report notes that the use of AI in finance has increased operational efficiency, risk modelling and fraud detection and the sector is exploring the potential of GenAI for internal applications. There is increasing reliance on data driven models, cloud services and third-party provided AI software, which could amplify existing vulnerabilities in the financial sector. The report states that the policy and regulatory frameworks surrounding the use of AI in financial services should strive to achieve a balance between encouraging innovation and ensuring consumer protection and financial supervisors need to develop necessary expertise, tools and skills for effective oversight of finance-based AI applications. 3.7 Tokenisation12 has permeated the financial sector through crypto-asset markets and the advent of digital tokens created on programmable platforms has provided an ecosystem where multiple issuers, investors, payers and payees may issue, trade and settle transactions with traditional money and other assets. Various projects and experiments resulting in application of tokenisation in financial markets have garnered scrutiny from central banks, given their regulatory ambit over payments system, monetary policy and financial stability. In this context, the Bank for International Settlements (BIS) and the Committee on Payments and Market Infrastructures (CPMI) submitted a joint report13 to the G2014 on “Tokenisation in the context of money and other assets” which, inter alia, concludes that token-based arrangements that provide platform-based intermediation in financial assets have the potential to alter market structures and may lead to network effects. 3.8 The Financial Stability Board’s (FSB) report15 on the ‘Financial Stability Implications of Tokenisation’ focuses on a subset of tokenisation initiatives, viz., tokenised money16 based on distributed ledger technology (DLT), assessed to be the most relevant for financial stability. The report identifies several vulnerabilities associated with DLT-based tokenisation that could impact financial stability, including liquidity and maturity mismatches, leverage, asset pricing and asset quality issues, interconnectedness and operational fragilities. The FSB released a status report17 on the implementation of the “Crypto-Asset Policy Implementation Roadmap”, endorsed by the G20 members in 2023, which highlights that stablecoin issuers are becoming significant holders of mainstream financial assets by virtue of owning them as collateral. Linkages of crypto-assets with core financial markets and institutions, however, appears to remain limited in scale. The report states that nearly all FSB members have either put in place or are developing regulatory frameworks for crypto-assets and stablecoins. Key challenges in regulatory enforcement include deliberate evasion of regulation by entities, lack of compliance culture and data gaps. The FSB also undertook an analysis of cross-border regulatory and supervisory issues of global stablecoin arrangements in EMDEs. The report18 posits that country specific macroeconomic and demographic factors have led to a higher level of interest and activity related to stablecoins in EMDEs as compared to AEs. These developments can undermine the effectiveness of monetary policy, circumvent capital controls, strain fiscal resources and threaten financial stability. Inconsistency in thresholds to identify a systemically important stablecoin (e.g., an advanced economy versus a small open emerging economy) remains a unique cross-border regulatory and supervisory challenge. III.1.3 Banking and Financial Stability 3.9 The 2023 banking turmoil brought to fore a host of issues such as changed depositor behaviour due to technological developments, the advanced pace of bank runs in case of distress, the materiality of additional liquidity risk factors and the role and use of supervisory monitoring tools. The Basel Committee on Banking Supervision (BCBS) progress report19 on “The 2023 banking turmoil and liquidity risk” highlights the challenges in overseeing banks’ liquidity risk due to social media usage, digitalisation of finance and first- and second- round propagation effects of failure of a non-systemic bank. Addressing the same issue, the FSB report20 titled “Depositor Behaviour and Interest Rate and Liquidity Risks in the Financial System” emphasises the need for enhanced operational readiness for resolution, particularly for banks heavily reliant on uninsured deposits. The report further highlights vulnerabilities beyond banks, including life insurers and non-bank real estate investors, whose interest rate-sensitive assets expose them to heightened solvency and liquidity risks in high interest rate environment. 3.10 The BCBS issued a consultative document21 on “Principles for the sound management of third-party risk”. The principles outline the risks arising from banks’ increasing reliance on third-party service providers to access technological expertise, reduce costs, improve efficiency and focus on core activities. The principles establish a common baseline for banks and supervisors for the risk management of such third-party service arrangements and provide the necessary flexibility to accommodate evolving practices and regulatory frameworks across jurisdictions. The BCBS working paper22 on “Novel risks, mitigants and uncertainties with permissionless distributed ledger technologies” highlights that use of such technologies by banks exposes them to operational risk and to a lesser extent liquidity risk and market risk. Potential mitigants include effective business continuity practices and use of adequate safeguards such as allow-listing23 and smart contracts. III.1.4 Non-Banking Financial Intermediation and Financial Stability 3.11 The expansion of non-bank financial intermediation (NBFI), now comprising nearly half of the global financial assets, has not only increased the sector’s role in financing the real economy but also its potential to amplify systemic risks. The FSB has developed a work program to enhance NBFI resilience, aiming to stabilise the demand for liquidity, improve risk monitoring and reduce the need for central bank interventions. The FSB progress report24 in this regard notes that the current design and implementation of NBFI policies has continued to advance at an uneven pace across jurisdictions. The report also outlines work to assess and address systemic risk in NBFI which is structured in three main areas viz., (i) in-depth assessment and ongoing monitoring of vulnerabilities in NBFI; (ii) development of policies to enhance NBFI resilience; and (iii) monitoring the implementation and assessment of the effects of NBFI reforms. The key deliverables for 2024-25 include: (a) closing identified data gaps for monitoring financial stability risks relating to open-ended funds liquidity mismatch and the use of liquidity management tools; (b) issuance of policy recommendations on liquidity preparedness of market participants for margin and collateral calls; and (c) completion of policy work on transparency in centrally cleared markets. 3.12 The FSB’s final report25 on “Liquidity Preparedness for Margin and Collateral Calls” notes that margin and collateral calls are a necessary protection against counterparty risk, but in times of stress they can amplify the demand for liquidity by market participants and have a systemic impact on broader markets. The policy recommendations include, inter alia, (i) establishing contingency funding plans to ensure that liquidity needs can be met in case of increased margin and collateral calls; (ii) regular review of liquidity risk frameworks to ensure ongoing effectiveness; and (iii) tweaking existing liquidity stress tests and scenario designs to cover a range of extreme but plausible scenarios, including both backward-looking and hypothetical scenarios. III.1.5 Cross-Border Payments and Financial Stability 3.13 Following the GFC, the G20 introduced the Legal Entity Identifier (LEI) system to improve transparency and manage financial risk exposures across entities. Initially deployed in the over-the-counter (OTC) derivatives and securities markets, the LEI has since been adopted within the G20 Roadmap to enhance cross-border payment efficiency by supporting ‘Know Your Customer’ (KYC) processes and sanctions screening. The FSB October 2024 progress report26 on “Implementation of the Legal Entity Identifier” underscored the LEI’s role in facilitating cross-border transactions. Since 2019, active LEIs have increased by 84 per cent, with 1.5 million renewed and validated for data quality. However, broader LEI adoption faces challenges including limited perceived incentives for voluntary adoption and high costs, especially for low-income jurisdictions. To address these barriers, the FSB recommends sustained efforts to promote LEI use and urges jurisdictions to fully implement previously issued recommendations. III.1.6 Climate Finance and Financial Stability 3.14 The Network for Greening the Financial System (NGFS) has been playing a pivotal role in addressing the risks associated with climate change across the regulatory, investment and monetary policy fields, and its projects include developing supervisory practices for managing climate-related risks, designing climate scenarios and guiding central banks on nature-related financial risks and implications of climate change on monetary policy. A conceptual framework27 on “Nature-related Financial Risks” was published by the NGFS to help develop a common understanding of such risks among central banks and financial supervisors. The framework and its guiding questions are intended to facilitate identification, assessment, management and disclosure of nature-related financial risks by various stakeholders. 3.15 The NGFS report28 on “Climate change, the macroeconomy and monetary policy” was aimed at identifying the ways in which physical hazards and the transition to net zero can influence variables such as output and inflation. The report also provides guidelines to assist central banks in understanding the macroeconomic impacts of climate-related developments on monetary policy and incorporation of climate related impacts in central banks’ modelling toolkits. 3.16 The FSB progress report29 on “Achieving Consistent and Comparable Climate-Related Disclosures” details the implementation status of sustainability disclosure frameworks and development of global assurance and ethics standards for such disclosures and observes that significant progress has been achieved since 2021 in setting regulations, guidelines or strategic roadmaps for climate-related disclosures. III.2 Domestic Regulatory Developments 3.17 Since the publication of the June 2024 issue of the FSR, the Sub Committee of the Financial Stability and Development Council (FSDC-SC) chaired by the Governor, Reserve Bank of India met once in September 2024. The Sub-Committee reviewed major global and domestic macroeconomic and financial developments alongwith issues relating to inter-regulatory coordination in the Indian financial sector. Members shared their assessments of potential risks to financial stability and discussed various issues that may have financial stability implications. The Sub-Committee also reviewed the activities of various technical groups under its purview and the functioning of State-level Coordination Committees (SLCCs) in States/ Union Territories (UTs). 3.18 The FSDC-SC resolved to continue its focus on improving financial sector resilience through inter-regulatory coordination while remaining watchful of emerging challenges to the economy and the financial system, including those from global spillovers, cyber risks and climate change. III.3 Initiatives from Regulators / Authorities 3.19 During the period under review, financial regulators undertook several initiatives to improve the resilience of the Indian financial system (major measures are listed in Annex 3). III.3.1 Directions on Fraud Risk Management to Regulated Entities 3.20 The RBI issued revised directions on Fraud Risk Management for its regulated entities (REs), outlining a comprehensive framework for prevention, early detection and timely reporting of incidents of fraud to Law Enforcement Agencies (LEAs) and Supervisors. These directions further strengthen the role of the Board in overall governance and oversight of fraud risk management in the REs. The directions emphasise the need for instituting robust internal audit and controls framework in the REs and also provide a revised framework for early warning signals (EWS) and red flagging of accounts (RFA) for early detection of frauds. The directions aim to reduce the number of incidences and the impact of fraudulent activities by better equipping institutions to respond to fraud risks with both preventative and corrective measures. The Reserve Bank’s focus on fraud risk management aligns with its broader efforts to enhance financial stability and resilience in an increasingly digital and interconnected economy thereby enhancing customer trust and protecting the financial sector’s integrity. III.3.2 Prompt Corrective Action (PCA) Framework for Primary (Urban) Co-operative Banks (UCBs) 3.21 On a review of the existing Supervisory Action Framework (SAF) for UCBs, a revised framework under the nomenclature “Prompt Corrective Action (PCA) Framework” has been devised by the RBI to enable early supervisory intervention at an appropriate time, requiring the UCBs to initiate and implement remedial measures in a timely manner, to restore financial health. Under this framework, UCBs that breach certain risk thresholds based on capital adequacy, asset quality and/or profitability are placed under corrective action plan. This plan includes, inter alia, restrictions on expansion of size of the balance sheet and capital investments, reduction in exposure to high risk-bearing assets and other operational constraints to restore financial health. The PCA framework does not preclude RBI from taking any other action as it deems fit at any time in addition to the corrective actions prescribed in the framework. The provisions of the PCA framework will be effective from April 1, 2025. The PCA Framework shall be applicable to all UCBs under Tier 2, Tier 3 and Tier 4 categories except UCBs under All Inclusive Directions. Tier 1 UCBs, though not covered under the PCA Framework as of now, shall be subject to enhanced monitoring under the extant supervisory framework. III.3.3 Treatment of Wilful Defaulters and Large Defaulters 3.22 The RBI has come out with a comprehensive guideline outlining the regulatory framework and procedures for classification of borrowers as wilful defaulters to reinforce the accountability of defaulting borrowers and strengthen risk management frameworks of banks. The directions will play a crucial role in maintaining the integrity of the financial system through transparent mechanism for identification and classification of wilful defaulters, incorporating principles of natural justice, specifying measures and consequences for those borrowers who deliberately default on their financial obligations, reporting and dissemination of credit information on large defaulters and preventive measures through proper credit appraisal and monitoring end use of funds. III.3.4 Cyber Resilience and Digital Payment Security Controls for Non-Bank Payment System Operators 3.23 In order to ensure that the authorised non-bank payment system operators (PSOs) are resilient to existing and emerging information systems and cyber security risks, the RBI issued directions on ‘Cyber Resilience and Payment Security Controls’ for non-bank PSOs that focus on enhancing the security of digital payment systems in the face of growing cyber threats. These directions aim to improve safety and security of the payment systems operated by PSOs by providing a framework for overall information security preparedness covering, inter alia, governance controls, information security measures and digital payment measures, with an emphasis on cyber resilience. 3.24 These directions outline mandatory ‘Cyber Crisis Management Plan’ (CCMP) to detect, contain, respond and recover from cyber threats and cyber attacks. They also specify the minimum information security standards for PSOs in areas, such as identity and access management, network security, vendor risk management, business continuity plan and cloud security. This initiative also addresses the rising reliance on digital payment services, requiring PSOs to adhere to digital payment controls in mobile and card payments. These security measures aim to protect consumers from fraud and ensure trust in digital financial services. III.3.5 Scheme for Trading and Settlement of Sovereign Green Bonds (SGrBs) in the International Financial Services Centre (IFSC) in India 3.25 With a view to facilitate wider non-resident participation in SGrBs, a scheme for investment and trading in SGrBs by eligible foreign investors in IFSC has been notified by the RBI in consultation with the Government and the International Financial Services Centres Authority (IFSCA). This scheme outlines the eligibility of investors, securities eligible for investment, guidelines for participation in primary and secondary markets, trading and settlement procedure and reporting requirements. At present, foreign portfolio investors (FPIs) registered with the SEBI are permitted to invest in SGrBs. This scheme shall facilitate easier access for non-resident investors to invest and trade in SGrBs through the IFSC, thereby enhancing global climate capital flows into India. III.3.6 Irregular Practices in Gold Loans 3.26 To address the non-adherence to prudential guidelines by the supervised entities (SEs) in grant of loans against pledge of gold ornaments and jewellery, the RBI has advised SEs to comprehensively review their policies, identify gaps and implement corrective measures within a specified timeframe. The guidelines assume importance in the wake of the significant growth in the gold portfolio in certain SEs and identified gaps like, inter alia, deficiencies in use of third-parties for outsourcing, discrepancies in gold valuation, inadequate due diligence and insufficient monitoring of the end use of loan funds. III.3.7 Recognition of Central Counterparties by Foreign Regulators 3.27 The issues of extraterritoriality of certain foreign regulations concerning domestic central counterparties (CCPs), the derecognition (or the lack of recognition) of Indian CCPs by foreign regulators and how such regulations can create liquidity inefficiencies and disrupt domestic financial stability have been of concern. To address these issues, the RBI has been engaging with foreign regulatory bodies, including the European Securities and Markets Authority (ESMA). III.3.8 Strengthening of Foreign Portfolio Investors Norms 3.28 To guard against possible circumvention of minimum public shareholding (MPS) norms, the SEBI has mandated disclosure of granular details of all entities holding any ownership, economic interest or control in an FPI, on a full look through basis, without any threshold, by FPIs that fulfil any of the following criteria: (a) holding more than 50 per cent of their Indian equity AUM in a single Indian corporate group, or (b) individually, or along with their investor group (in terms of Regulation 22(3) of the FPI Regulations, 2019), holding more than ₹25,000 crore of equity AUM in the Indian market. III.3.9 Association of Persons Regulated by the SEBI and their Agents with Certain Persons (‘Finfluencers’) 3.29 The significant online presence of ‘finfluencers30’ provides them the ability to influence the financial decisions of their followers. These activities fall within the purview of multiple regulatory bodies, however, most ‘finfluencers’ are neither registered with any of the financial sector regulator nor authorised under the SEBI’s Regulations to offer advice or recommendations regarding securities falling under the purview of the SEBI. 3.30 In this context, the SEBI has recently brought out amendments to the SEBI (Intermediaries) Regulations, 2008, Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations) Regulations, 2018 and the SEBI (Depositories and Participants) Regulations, 2018, which now provide that persons regulated by the SEBI (including recognised stock exchanges, clearing corporations and depositories) and agents of such persons shall not have any direct or indirect association with another person31 who: (a) provides advice or any recommendation, directly or indirectly, in respect of or related to a security or securities, unless the person is registered with or otherwise permitted by the SEBI to provide such advice or recommendation; or (b) makes any claim of returns or performance, expressly or impliedly, in respect of or related to a security or securities, unless the person has been permitted by the SEBI to make such a claim. 3.31 Entities regulated by the SEBI, including recognised stock exchanges, clearing corporations and depositories, must ensure that neither they nor their agents engage in the prohibited activities without the necessary permissions. Additionally, the SEBI registered entities, which are also regarded as ‘finfluencers’, are already subject to the advertisement code established by the SEBI, stock exchanges and the relevant regulatory authorities. III.3.10 Valuation of Additional Tier 1 Bonds (‘AT-1 Bonds’) 3.32 According to the framework for valuation of bonds with multiple call options laid down in the SEBI Master Circular for Mutual Funds, valuation of perpetual bonds held by MFs is required to be done at the lowest of the value obtained by valuing the bond to various call dates and valuing to the maturity date (the deemed maturity of perpetual bonds has been specified as 100 years from the date of issuance of the bond). Additionally, mutual funds have been permitted to value AT-1 bonds held by them on Yield-to-Call basis. For all other purposes, deemed maturity of all perpetual bonds continues to be in line with the SEBI Master Circular. III.3.11 Measures to Strengthen Equity Index Derivatives Framework 3.33 The SEBI introduced several measures to strengthen Equity Index Derivatives Framework for increased investor protection and market stability in October 2024 in view of increased retail participation in equity derivatives and heightened speculative trading volumes in index derivatives on the day of expiry. 3.34 To ensure continued suitability and appropriateness of index derivatives segment for investors, the minimum contract size for index derivatives at the time of introduction has been increased to ₹15 lakh from existing ₹5 lakh. Further, the contract size shall be fixed in such a manner that the value of the derivative contract would be in the range of ₹15 lakh to ₹20 lakh (from existing range of ₹5 lakh to ₹10 lakh). To address heightened activity in index options on expiry day, weekly index derivatives products have been rationalised, tail risk coverage on the day of options expiry has been increased through increase in the margin, calendar spread benefit for options on the expiry day has been discontinued and intraday monitoring of existing position limits at entity level has been stipulated in addition to the existing end of day monitoring. Lastly, upfront collection of option premium from options buyers has been mandated to ensure basic risk hygiene. III.3.12 Review of Eligibility Criteria for Entry/Exit of Stocks in Derivatives Segment 3.35 With an objective to ensure that only high-quality stocks with sufficient market depth are allowed to trade in the equity derivatives segment, the SEBI revised the eligibility criteria for entry/exit of stocks in the segment in August 2024. The stock’s median quarter sigma order size (MQSOS), stock’s market wide position limit (MWPL) and the stock’s average daily delivery value (ADDV) in the cash market, over the previous six months, on a rolling basis, were raised from ₹25 lakh to ₹75 lakh (due to significant rise in the average market turnover), ₹500 crore to ₹1,500 crore (on account of surge in market capitalisation since the last review) and ₹10 crore to ₹35 crore (owing to over 3x increase in average daily delivery value since the last review), respectively. If a stock in derivatives segment fails to meet any of the above criteria for a continuous period of three months, on a rolling basis, based on the data for previous six months, it shall exit from the derivatives segment. Further, an additional criterion of product success framework (PSF) was introduced for evaluating stocks for exit from the derivatives segment. III.3.13 Review of Stress Testing Framework for Equity Derivatives Segment 3.36 New stress testing methodologies were adopted to get a better understanding and measurement of the prevalent tail risk in the equity derivatives segment and accordingly, determine the size of the default fund of clearing corporations in the equity derivatives segment. Additionally, keeping in view the increased funding needs of clearing corporations post adoption of new stress testing methodologies in the equity derivatives segment, provisions were incorporated for inter-segment transfer of SGF from equity cash to equity derivatives segment and staggered contribution to the core SGF of equity derivatives segment. III.3.14 Monitoring of Position Limits for Equity Derivatives Segment 3.37 In October 2024, the SEBI announced an upward revision in the position limits for trading members in the index futures and options contracts, cumulatively for client and proprietary trades, set at ₹7,500 crore or 15 per cent of the total open interest (OI) in the market, whichever is higher, from the earlier mandate of ₹500 crore or 15 per cent of the total OI in the market. The position limits will be applicable for index futures and index options separately and the revised limits are effective immediately. 3.38 The SEBI also decided that in line with the practice in currency derivatives segment, starting April 2025, positions of market participants in the equity derivatives segment (index and stocks) shall be monitored based on the previous day’s open interest of the overall market. III.3.15 Review of Small and Medium Enterprises (SME) framework 3.39 With the objectives of strengthening the framework for public issues by SMEs and to facilitate SMEs having a sound track-record raise funds from the public and get listed on stock exchanges, and to protect the interests of investors in the SMEs, the SEBI has approved amendments to the SEBI (ICDR) Regulations, 2018 and the SEBI (LODR) Regulations, 2015. 3.40 Key changes brought out by the amendments are: a) an SME issuer shall make an IPO, only if the issuer has an operating profit (earnings before interest, depreciation and tax) of ₹1 crore from operations for any two out of the previous three financial years at the time of filing of its draft red herring prospectus; b) offer for sale (OFS) by selling shareholders in SME IPO shall not exceed 20 per cent of the total issue size and selling shareholders cannot sell more than 50 per cent of their holding; c) lock-in on promoters’ holding held in excess of minimum promoter contribution will be released in phased manner after one year; d) allocation methodology for non-institutional investors (NIIs) in SME IPOs has been aligned with methodology used for NIIs in Main Board IPOs; e) amount for General Corporate Purpose in SME IPO shall be capped to 15 per cent of amount being raised by the issuer or ₹10 crore, whichever is lower; f) SME issues shall not be permitted, where objects of the issue consist of repayment of loan from promoter, promoter group or any related party, from the issue proceeds, whether directly or indirectly; and g) related party transaction norms, as applicable to listed entities on Main Board, has been extended to SME listed entities, provided that the threshold for considering related party transactions as material shall be 10 per cent of annual consolidated turnover or ₹50 crore, whichever is lower. III.3.16 Cybersecurity and Cyber Resilience Framework (CSCRF) for the SEBI Regulated Entities 3.41 To ensure robust cybersecurity measures for protection of IT infrastructure and data at its REs, the Cybersecurity and Cyber Resilience Framework (CSCRF) was issued by the SEBI. The primary objectives of CSCRF are to: (a) enhance cybersecurity at REs by establishing cybersecurity standards and guidelines with graded approach; (b) facilitate risk management by providing comprehensive risk assessment guidelines to identify, assess and mitigate cybersecurity risks in a streamlined manner; (c) promote cyber resilience at REs by developing capabilities to not only defend against cyber-attacks but also to recover swiftly from incidents and minimise disruption to securities market operations; (d) enhance efficient audits and compliance; and (e) encourage REs to adopt a culture of continuous improvement and vigilance in cybersecurity practices and to stay updated with evolving cyber threats and technologies. 3.42 The CSCRF has laid down detailed guidelines that outline the responsibilities of REs, including board-level oversight, accountability of REs’ MD/ CEO, appointment of chief information security officer (CISO), composition of IT Committee for REs and other governance measures with operational controls. It also mandates regular cyber audit and risk assessment to identify vulnerabilities and enhance the security posture, including a ‘Cyber Capability Index’ (CCI) to help REs assess their cyber resilience on a periodic basis. Further, the CSCRF has mandated scenario-based cybersecurity drills to handle real world threat scenarios to improve preparedness and strengthen cybersecurity capabilities. III.3.17 Framework of Financial Disincentives for Surveillance Related Lapses at Market Infrastructure Institutions (MIIs) 3.43 MIIs (i.e., stock exchanges, clearing corporations and depositories), which are systemically important institutions in the Indian securities market and are the first level regulators, need to be well equipped to detect market abuse, including new modus operandi that could be adopted by unscrupulous elements, and take prompt preventive and effective action against such activities. 3.44 In view of certain surveillance related lapses observed at MIIs, the SEBI has implemented a framework that would be applicable to surveillance related lapses emanating from non-adherence to (a) the requisite surveillance activities or (b) decisions taken in the surveillance meetings held with the SEBI, and do not involve any subjective discretionary deviations or discretionary value judgments. The number of financial disincentives for such lapses is determined based on total annual revenue of the MII (an indicator of the size and impact of the MII on the market ecosystem) during the previous financial year and the number of instances of surveillance related lapses during the current financial year. The framework is intended to encourage an MII to be proactive in its surveillance related functions and perform the surveillance activities with utmost efficiency and to constantly monitor the performance and efficiency of its surveillance related functions. III.3.18 Upstreaming of Clients’ Funds by Stock Brokers/ Clearing Members to Clearing Corporations 3.45 To protect the funds of investors from being misused by stock brokers (SBs), such as using funds received from their clients to create Fixed Deposit Receipts (FDRs) and place such FDRs with the banks for obtaining Bank Guarantee (BG), the SEBI has introduced a framework under which stock brokers and clearing members (CMs) shall upstream all client funds to clearing corporations (CCs) to ensure that no client funds are retained by SBs/CMs. 3.46 Under this framework, SBs and CMs must upstream all clear credit balances of clients to CCs on an end-of-day basis wherein the client funds which are not required for meeting margin or settlement obligations must be transferred to CCs daily. Upstreaming can be done in three forms: (a) cash; (b) lien on FDRs created out of clients’ funds; and (c) pledge of units of Mutual Fund Overnight Schemes (MFOS) created out of clients’ funds. Any clear credit balance that could not be upstreamed to CCs due to receipt of funds from clients beyond cut-off time shall necessarily remain in Up Streaming Client Nodal Bank Account (USCNBA) until it is upstreamed to CC on the next day. Any FDRs shall be created only with banks which satisfy the CCs’ exposure norms as specified by the CCs/ SEBI from time to time. FDRs shall be created only from USCNBA and tenure of such FDRs shall not be more than one year. Further, every FDR created out of clients’ funds shall necessarily be always lien-marked to one of the CCs. This framework is meant to enhance investor protection, promote market integrity and ensure that client funds are invested in low-risk or risk-free products. III.3.19 Specific Due Diligence of Investors and Investments of Alternative Investment Funds (AIFs) 3.47 AIFs play a crucial role in connecting sophisticated investors, having increased risk appetite, with companies in need of risk capital. AIFs have a relatively light touch regulatory framework vis-à-vis other the SEBI registered investment channels, such as mutual funds (MFs) and portfolio management services (PMS). While this offers flexibility of operations to AIFs, in the past few years, there have been some instances of AIFs facilitating circumvention of extant financial sector regulations, such as (a) facilitating ever-greening of stressed loans of regulated lenders; (b) facilitating investors, who are otherwise ineligible to become Qualified Institutional Buyers, in getting allotments in public offers as QIBs; (c) facilitating investors, who are otherwise ineligible to become Qualified Buyers, in subscribing to Security Receipts as Qualified Buyers in circumvention of SARFAESI Act, 2002; and (d) AIFs with domestic manager/sponsor, investing money received from predominantly foreign investors, to bypass applicable norms governing various routes of foreign investment. 3.48 Accordingly, the SEBI has prescribed a framework to specify the broad principles that AIFs need to adhere to, so as to address the circumventions, under which a set of implementation standards has been formulated to specify the due-diligence checks to be carried out by the specified narrow-based funds. The due diligence is to be carried out with respect to investors and investments of the AIF, prior to making an investment, to prevent facilitation of the identified circumventions. Adherence to these standards by AIFs would result in enhanced trust of investors and all other stakeholders in this asset class in the long run. III.3.20 Institutional Mechanism by Asset Management Companies (AMCs) for Deterrence of Potential Market Abuse 3.49 To address instances of market abuse including front running and fraudulent transactions in securities, the existing regulatory framework, viz., the SEBI (Mutual Funds) Regulations, 1996 has been amended, under which AMCs are required to put in place a structured institutional mechanism for identification and deterrence of potential market abuse in securities. The said amendments aim to a) enhance responsibility and accountability of management of AMCs for such an institutional mechanism; and b) foster transparency by requiring AMCs to have a whistle blower mechanism. 3.50 The SEBI has also specified the broad framework for implementation of the aforesaid institutional mechanism, consisting of enhanced surveillance systems, internal control procedures and escalation processes, such that the overall mechanism is able to identify, monitor and address specific types of misconduct, including front running, insider trading, misuse of sensitive information, among other things. The requirements related to alert generation and monitoring, reporting and periodic review at the end of AMCs have also been specified. To ensure uniform implementation of the institutional mechanism across the industry, the Association of Mutual Funds in India (AMFI) has issued detailed implementation standards, in consultation with the SEBI, which shall mandatorily be followed by all AMCs. III.3.21 Use of Artificial Intelligence in the Financial Sector 3.51 Rapid technological advancements and adoption of new technologies offer benefits and create risks to the financial system. Consequently, financial sector regulators and supervisors are reinforcing their efforts to strengthen regulation and oversight to address potential financial stability risks from emerging technologies. The RBI constituted a Committee in December 2024 to develop a Framework for Responsible and Ethical Enablement of AI (FREE-AI) in the financial sector, comprising of experts from diverse fields. The Committee will assess the current level of adoption of AI in financial services (globally and in India), identify potential risks associated with AI and recommend evaluation, mitigation and monitoring framework for financial institutions. In the securities market, the SEBI has advised market infrastructure institutions and registered intermediaries who use AI tools, either designed by them or procured from third party technology service providers, to take full responsibility for their use of such tools, irrespective of the scale of adoption and ensure privacy, security and integrity of investors’ data. III.4 Other Developments III.4.1 Customer Protection 3.52 The number of complaints received by the Offices of the Reserve Bank of India Ombudsman (ORBIOs) for the previous two quarters indicates that complaints pertaining to loans and advances and payment modes (i.e., complaints pertaining to mobile/ electronic banking, credit card and ATM/ CDM/ debit card) continue to constitute over 70 per cent of the total number of complaints during Q1 and Q2 of 2024-25 (Table 3.1). 3.53 With the rise in digital transactions, the incidents of cyber frauds using novel modus operandi have increased in recent times. Considering the fact that the financial losses and emotional distress caused by these frauds are substantial, it is imperative that REs undertake wide scale preventive awareness initiatives to caution the public about such frauds and intensify efforts to identify mule accounts. III.4.2 Enforcement 3.54 During June 2024 to November 2024, the Reserve Bank imposed monetary penalty on 153 REs (five PSBs; five PVBs; three foreign banks, two RRBs, 116 co-operative banks; 14 NBFCs and eight HFCs) and imposed an aggregate penalty of ₹29.64 crore for non-compliance with/contravention of statutory provisions and/ or directions issued by the Reserve Bank. 3.55 During H1:2024-25, the SEBI has undertaken 461 enforcement actions, which included 452 prohibitive directions (Final and Interim orders), cancellations of certificates of registration of five market intermediaries, prohibition on taking up new assignment/clients on three market intermediaries and one warning issued against an intermediary. Penalties amounting to ₹36.58 crore have been imposed against 297 entities while there have been five cancellations of certification of registration and prohibition on taking up new assignment/ clients on three entities during the period H1:2024-25. III.4.3 Deposit Insurance 3.56 The Deposit Insurance and Credit Guarantee Corporation (DICGC) extends insurance cover to depositors of all the banks operating in India. As on September 30, 2024, the number of banks registered with the DICGC was 1989, comprising 139 commercial banks (including 11 small finance banks, six payment banks, 43 regional rural banks, two local area banks) and 1850 co-operative banks. The Deposit Insurance Fund (DIF) with the Corporation recorded a year-on-year growth of 16.9 per cent to reach ₹2.14 lakh crore at end-September 2024. 3.57 With the present deposit insurance limit of ₹5 lakh, 97.7 per cent of the total number of deposit accounts (293.7 crore) were fully insured and 42.6 per cent of the total value of all assessable deposits (₹227.3 Lakh crore) was insured as on September 30, 2024 (Table 3.2). 3.58 The insured deposits ratio (i.e., the ratio of insured deposits to assessable deposits) was higher for cooperative banks (63.1 per cent), followed by commercial banks (41.5 per cent) (Table 3.3). Within commercial banks, PSBs have higher insured deposit ratio vis-à-vis PVBs. 3.59 Deposit insurance premium received by the DICGC grew by 12.9 per cent (y-o-y) to ₹13,127 crore during H1:2024-25, of which, commercial banks had a share of 94.5 per cent (Table 3.4). 3.60 The DIF with the DICGC is primarily built out of the premium paid by insured banks, investment income and recoveries from settled claims, net of income tax. The DIF recorded a 16.9 per cent year-on-year increase to reach ₹2.14 lakh crore as on September 30, 2024. The reserve ratio (i.e., ratio of DIF to insured deposits) increased to 2.21 per cent from 2.02 per cent a year ago (Table 3.5). III.4.4 Corporate Insolvency Resolution Process (CIRP) 3.61 Since the provisions relating to the corporate insolvency resolution process (CIRP) came into force in December 2016, a total of 8002 CIRPs were initiated till September 2024 (Table 3.6), out of which 6039 (75.5 per cent) have been closed. Of the closed CIRPs, around 20.2 per cent have been closed on appeal or review or settled, 18.5 per cent have been withdrawn, around 43.5 per cent have ended in orders for liquidation and 17.7 per cent have ended in approval of resolution plans (RPs) (Table 3.7). A total of 1963 CIRPs (24.5 per cent) are ongoing. 3.62 The outcome of CIRPs as on September 30, 2024, shows that out of the operational creditor initiated CIRPs that were closed, 52 per cent were closed on appeal, review, or withdrawal (Table 3.8). 3.63 The primary objective of the Insolvency and Bankruptcy Code (hereinafter referred as “Code”) is rescuing corporate debtors in distress. The Code has rescued 3409 corporate debtors (1068 through resolution plans, 1221 through appeal or review or settlement and 1120 through withdrawal) till September 2024. It has referred 2630 corporate debtors for liquidation. Several initiatives are being taken to improve the outcomes of the Code, including monitoring of cases pending for admission and ongoing CIRPs. Further, the IBBI revised its mechanism for real-time information sharing regarding applications for the initiation of CIRP with the Information Utility (IU). These initiatives have had a substantial impact on the IBC process, as evidenced by the increase in the NCLT-approved resolutions and the admission of cases initiated by Financial Creditors (FCs). The number of cases ending with resolution vis-à-vis cases in which liquidation is ordered shows an increasing trend (Chart 3.1). 3.64 Cumulatively till September 30, 2024, creditors have realised ₹3.55 lakh crore under the resolution plans. Creditors have realised around 161 per cent of liquidation value and 86 per cent of fair value. The haircut for creditors relative to the fair value of assets was around 14 per cent, while relative to their admitted claims is around 69 per cent. Furthermore, realisable value through RPs does not include (a) possible realisation through corporate and personal guarantors and recovery against avoidance transactions; (b) the CIRP cost; and (c) other probable future realisations, such as increase in value of diluted equity and funds infused into the corporate debtor, including capital expenditure by the resolution applicants. About 40 per cent of the CIRPs that yielded RPs were defunct companies. In these cases, the claimants have realised 150 per cent of the liquidation value and 19 per cent of their admitted claims.  3.65 As a result of the behavioural change effectuated by the Code, many debtors are settling their dues before the start of insolvency proceedings. Till March 2024, 28,818 applications for initiation of CIRPs of corporate debtors, having underlying default of ₹10.22 lakh crore, were withdrawn before their admission. 3.66 At end-September 2024, the total number of CIRPs ending in liquidation was 2630, of which final reports have been submitted for 1113 CDs. These corporate debtors together had outstanding claims of ₹3.25 lakh crore, but the assets were valued at only ₹0.13 lakh crore. The liquidation of these companies resulted in 87 per cent realisation of the liquidation value. III.4.5 Developments in International Financial Services Centres (IFSC) 3.67 To provide world class regulatory architecture to firms operating from the GIFT-IFSC, many new regulations and frameworks which are aligned to international best practices for regulating financial products, financial services and financial institutions in the IFSC, have been notified by the IFSCA since 2021. The total number of registrations/ authorisations given by the IFSCA reached 687 by the end of September 2024. 3.68 The number of Fund Management Entities (FMEs) registered in the IFSC has almost doubled from 65 in March 2023 to 128 in September 2024. Also, the number of Alternative Investment Funds (AIFs), which have been launched by these FMEs has increased by more than 7 times from 24 in March 2022 to 173 in September 2024 with a total targeted corpus of US$ 40.6 billion. In terms of exchanges at the IFSCA, the monthly turnover on the GIFT-IFSC Exchanges was US$ 102 billion and the average daily turnover of NIFTY derivative contracts on the NSE International Exchange (NSE IX) was US$ 4.8 billion as at end-September 2024. A total of US$ 63.9 billion debt securities had been listed on the IFSC exchanges including US$ 14.8 billion of green bonds, social bonds, sustainable bonds and sustainability-linked bonds till September 2024. 3.69 The banking ecosystem at the GIFT-IFSC comprises 28 banks (IFSC Banking Units), including 12 foreign banks and 16 domestic banks offering a wide spectrum of financial services. These IFSC Banking Units (IBUs) are set up as branches in the GIFT-IFSC and have a whole-stack banking licence. The total banking asset size of 28 IBUs is US$ 70.9 billion as at end September 2024. The cumulative banking transactions have grown from US$ 53 billion in September 2020 to US$ 975.8 billion till end September 2024. 3.70 The India International Bullion Exchange (IIBX) has been formed with the intent of developing India as a vibrant gold trading hub for the national and international markets. Three internationally recognised vault managers have established vaults at the IFSC with capacity of around 450 tonnes for gold and around 3000 tonnes for silver. Furthermore, the import of gold under UAE-India CEPA through IIBX has commenced. 3.71 The IFSCA has developed a Single Window IT System (SWITS) which would contribute to improve the ease of doing business in the GIFT-IFSC, by providing a common application form (CAF), created by merging several existing forms including business-specific annexure forms. The SWITS aims to harmonise and simplify the process of submission of application under various Acts administered by the IFSCA, in addition to the Special Economic Zones (SEZ) Act, 2005. Apart from this, the SWITS also integrates within itself a no objection certificate (NOC) processing module that will ease the process of obtaining NOCs, wherever necessary, from the appropriate regulators, viz., the RBI, the SEBI and the IRDAI. III.4.6 Pension Funds 3.72 The National Pension System (NPS) and the Atal Pension Yojana (APY) have continued to progress in terms of the total number of subscribers and asset under management (AUM). As of September 30, 2024, in terms of number of subscribers, the NPS and the APY have shown a growth of 6.50 per cent since March 2024, whereas the asset under management (AUM) has recorded a growth of 14.06 per cent in the same period. The combined subscriber base under the NPS and the APY has reached 7.83 crore as at end September 2024, with an AUM of ₹13.3 lakh crore (Chart 3.2), which is primarily invested in fixed income instruments (Chart 3.3). 3.73 Points of Presence (PoPs), the distribution channel under the NPS, play an important role in onboarding of subscribers under the NPS/ NPS Vatsalya and providing them various services. There has been a consistent growth in enrolment of new subscribers through PoPs channel as well as strong momentum in corporate sector onboarding. The enrolment under the NPS private sector has seen a growth of more than 55 per cent in the period (April to October 2024) in comparison to the same period in the previous financial year. During this financial year, approximately 2100 new corporates have registered for the NPS until September 30, 2024. Furthermore, the PFRDA organises various campaigns and recognition programs to encourage and honor the efforts of PoPs officials who significantly contribute to the NPS expansion. In the current financial year, the ENRICH ELEVATE ENROL – TRIPLE E campaign has been successfully completed. Moreover, to strengthen the distribution channel of the NPS, the PFRDA is engaging with Fintechs to increase penetration through online mode and with regional rural banks (RRBs) to focus on the rural areas.   3.74 In order to boost the enrolments and expand the coverage under the NPS and the APY, the following initiatives were taken: (a) the NPS Vatsalya has been launched which is a contributory pension scheme exclusively for minors with an objective to create a pensioned society, emanating from the vision of “Viksit Bharat@2047”, and to encourage empowerment of children. All minors who are citizens of India are eligible to participate in the scheme on a voluntary basis. As of end-September 2024, 33,955 subscribers have been enrolled under the scheme; (b) in addition to the existing 3 life cycle funds, i.e., the Conservative Life Cycle Fund (LC-25), the Moderate Life Cycle Fund (LC-50), the Aggressive Life Cycle Fund (LC-75), a new life cycle fund namely the ‘Balanced Life Cycle Fund’ has been launched. This life cycle fund is a predetermined mix of equity and debt that balances the risk of ageing with market risk to maximise the return under which equity allocation up to 50 per cent is maintained until the age of 45. This is currently available to subscribers in the private sector (All-Citizen Model and Corporate); and (c) to expand the coverage under the APY, several outreach programs were conducted across India in collaboration with the State Level Bankers’ Committees (SLBCs), the Lead District Managers (LDMs) and other stakeholders, with 18 programs completed by September 2024. III.4.7 Insurance 3.75 The premium income for life insurance sector has been consistently increasing aided by rising disposable income, regulatory reforms, promoting ease of doing business and rising awareness on the need of insurance, among other factors. The total insurance premium collected by life insurers increased to ₹3.99 lakh crore in April - September 2024 from ₹3.51 lakh crore in April – September 2023, registering a growth rate of 13.7 per cent growth (y-o-y). Similarly, new business premium of life insurance industry grew by 19.5 per cent, reaching ₹1.89 lakh crore in April- September 2024 from ₹1.58 lakh crore vis-à-vis April- September 2023. The general and health insurance sector covers a wide range of non-life insurance products, including motor, health, property, travel and liability insurance. The increased awareness of risk management and the need for financial protection has contributed to significant growth in recent years, with the total premium underwritten by general and health insurers reaching ₹1.54 lakh crore in the current financial year (April - September 2024), exhibiting a 7.0 per cent growth (y-o-y). Among various lines of business, the health insurance segment (the largest among the non-life insurance sector) has reported the highest growth of 8.95 per cent. 3.76 As part of its shift towards principle-based regulations, aimed to create a more flexible and adaptive insurance sector, the IRDAI has issued a comprehensive Master Circular on life insurance business, superseding the provisions of previous circulars. The Master Circular covers the following important areas relating to the products offered and policyholders: (a) insurers are mandated to have in place a stronger product governance framework requiring internal product management committees to closely monitor product development, pricing, and design; (b) introduction of a customer information sheet (CIS) to present the policyholder the gist of the benefits and other terms and conditions in a simplified manner; (c) mandating policy loan facility for savings linked products; option of partial withdrawals for pension plans is introduced with greater flexibility in premium payments; (d) the free-look period to be extended to 30 days, allowing customers more time to review policy terms; (e) grievance redressal mechanisms have been reinforced, prioritising prompt and transparent resolutions; and (f) various measures to strengthen governance viz., initiatives targeted at reducing mis-selling, maintaining fair pricing practices, and strengthening product oversight — all with the goal of increasing insurance penetration and bolstering consumer confidence. 3.77 The IRDAI has also issued a comprehensive Master Circular for the general insurance sector, replacing thirteen previous circulars, to simplify and enhance customer-centric insurance solutions. Key aspects covered in the Master Circular are: (a) stringent timelines for settlement of claims and flexibility in policy cancellations; (b) insurers mandated to provide ‘Pay as you drive’ / ‘Pay as you go’ / ‘Pay as you use’ insurance cover and comprehensive cover including coverage for depreciation; and (c) insurers to ensure fair pricing, robust governance and tech-enabled processes for seamless services. This shift allows customers to have a wide range of tailored options, improving their ability to select products that best fit their needs and preferences, thereby enhancing the overall insurance experience. 3.78 For the health insurance sector, the IRDAI has issued a dedicated Master Circular on health insurance products, consolidating all relevant regulatory norms in one accessible location. This Master Circular, which supersedes 55 Circulars, not only serves as a comprehensive guide for policyholders but also emphasises the need for a smoother, faster and more efficient claims process. Key aspects covered include: (a) broader product choices; (b) a simplified customer information sheet (CIS); (c) flexibility for policyholders to choose products that suit their needs; (d) encouraging insurers to provide seamless and tech-driven services targeting 100 per cent cashless claims and ensure transparency with clear procedures for claims; (e) renewability of policies strengthened, with protections against denial except in cases of fraud or misrepresentation; and (f) enhanced customer safeguards, which include stringent timelines for portability, cashless authorisations and oversight of claim repudiations, ensuring higher service standards and trust in the sector. 3.79 Furthermore, in a broader effort to empower policyholders, the IRDAI has issued a Master Circular on protection of policyholders which supersedes 30 Circulars and provides a consolidated source for policyholders’ rights and entitlements. It stresses the importance of transparent and efficient claims processing aiming to build trust within the sector. The Circular covers two main aspects viz., one for policyholder guidance at various stages of an insurance contract and another outlining regulatory compliance for insurers. Through these reforms, the IRDAI seeks to promote a more consumer-centric insurance environment with emphasis on greater transparency, ease of access and simplified procedures, fostering a climate of trust and ensuring that the insurance sector remains robust and well-aligned with evolving market needs, ultimately promoting a more inclusive and efficient insurance landscape in India. Summary and Outlook 3.80 In the midst of challenges posed by emerging risks, global regulatory bodies have undertaken significant measures to address these challenges and strengthen the stability of the financial system. Key efforts have focused on mitigating the risks posed by technological advancements, including the rise of financial technology, the growing threat of cyberattacks and the increasing reliance on third-party service providers. Furthermore, regulators have prioritised enhancement of frameworks to bolster resilience, ensuring that financial institutions are adequately prepared to manage potential disruptions. As the financial landscape continues to evolve, ongoing collaboration and adaptability will be crucial for maintaining a robust, secure and sustainable global financial ecosystem. 3.81 Domestic regulatory initiatives have concentrated on reinforcing the resilience of financial intermediaries and market infrastructure, preventing fraud and enhancing the protection of customers. Regulators have remained vigilant and responsive, adapting to the changing financial environment to further strengthen the robustness of the financial system. 1 IOSCO (2024), “Market Outages”, June. 2 In the report ibid., “market outage” is used to refer to the disruption of outright/ orderly trading on a trading venue caused by a technical problem or an operational issue, which leads to the suspension of trading. 3 IOSCO (2024), “Leveraged Loans and CLOs Good Practices for Consideration”, June. 4 Loans to highly indebted, non-investment grade, nonfinancial corporate issuers. Such loans usually carry a floating rate of interest and, in contrast to high yield bonds, are secured by the borrower’s assets. 5 A type of securitisation in which a portfolio of loans is bought by a special purpose vehicle that finances the portfolio by the issuance of financial instruments in the form of bonds. 6 Fewer and looser provisions on investor protection. 7 European Commission Press Release IP/24/4123 “European Artificial Intelligence Act comes into force”, August 1, 2024. 8 The Act defines an ‘AI system’ as a machine-based system that is designed to operate with varying levels of autonomy and that may exhibit adaptiveness after deployment and that, for explicit or implicit objectives, infers from the input it receives, how to generate outputs such as predictions, content, recommendations or decisions that can influence physical or virtual environments. 9 OECD – FSB (2024), “Roundtable on Artificial Intelligence (AI) in Finance”, September. 10 IBM defines predictive artificial intelligence as use of statistical analysis and machine learning to identify patterns, anticipate behaviours and forecast upcoming events. 11 IBM defines generative AI as deep-learning models that can generate high-quality text, images, and other content based on the data they were trained on. 12 Tokenisation is the process of generating and recording a digital representation of traditional assets on a programmable platform (BIS, 2024). 13 Bank for International Settlements (BIS) and Committee on Payments and Market Infrastructures (CPMI) (2024), “Tokenisation in the context of money and other assets: concepts and implications for central banks: Report to the G20”, October. 14 The Group of Twenty (G20) is the premier forum for international economic cooperation. It plays an important role in shaping and strengthening global architecture and governance on all major international economic issues. 15 FSB (2024), “The Financial Stability Implications of Tokenisation”, October. 16 Money which can be potentially used as a settlement currency for payments (e.g. commercial bank deposits and central bank deposits) and other financial assets (e.g. securities such as mutual fund shares). The report does not examine initiatives involving central bank digital currencies (CBDCs) or crypto-assets. 17 FSB (2024), “G20 Crypto-asset Policy Implementation Roadmap”, October. 18 FSB (2024), “Report on Cross-border Regulatory and Supervisory Issues of Global Stablecoin Arrangements in Emerging Market and Developing Economies (EMDEs)”, July. 19 BCBS (2024) “The 2023 banking turmoil and liquidity risk: a progress report”, October. 20 FSB (2024), “Depositor Behaviour and Interest Rate and Liquidity Risks in the Financial System”, October. 21 BCBS (2024), “Principles for the sound management of third-party risk”, July. 22 BCBS (2024), “Novel risks, mitigants and uncertainties with permissionless distributed ledger technologies”, August. 23 The consultative document defines ‘allow-listing’ as programming a token to be accessed only by approved addresses on the blockchain. 24 FSB (2024) “Enhancing the Resilience of Non-Bank Financial Intermediation Progress”, July. 25 FSB (2024) “Liquidity Preparedness for Margin and Collateral Calls: Final report”, December. 26 FSB (2024) “Implementation of the Legal Entity Identifier: Progress report”, October. 27 Network for Greening the Financial System (2024), “Nature-related Financial Risks: a Conceptual Framework to guide Action by Central Banks and Supervisors”, July. 28 Network for Greening the Financial system (2024), “Climate change, the macroeconomy and monetary policy”, October. 29 Financial Stability Board (2024) “Achieving Consistent and Comparable Climate-Related Disclosures 2024 Progress Report”, November. 30 Financial influencers, commonly known as ‘finfluencers’, are individuals who provide information, advice, or recommendations on various financial topics, such as investing in securities, personal finance, banking products, insurance and real estate, through engaging content on digital platforms like Instagram, Facebook, YouTube, LinkedIn and X (erstwhile Twitter). 31 The term “another person” does not include those involved in investor education, as long as they do not participate in the specified prohibited activities. |

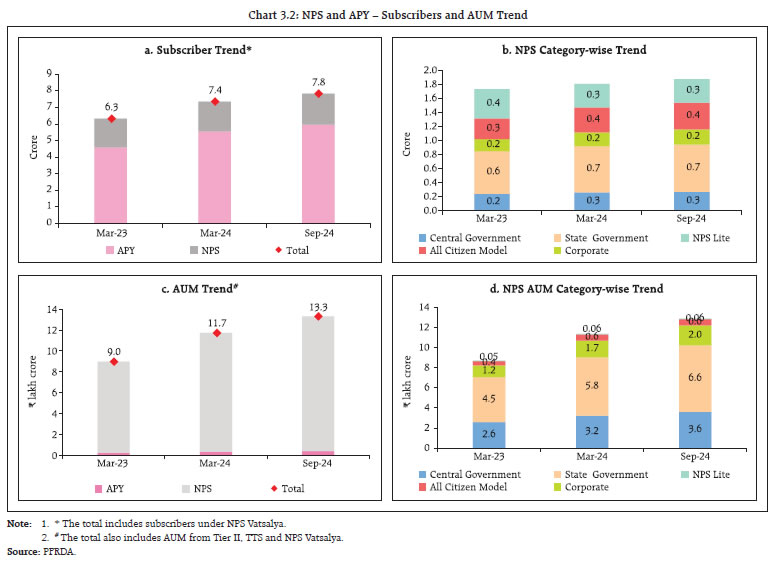

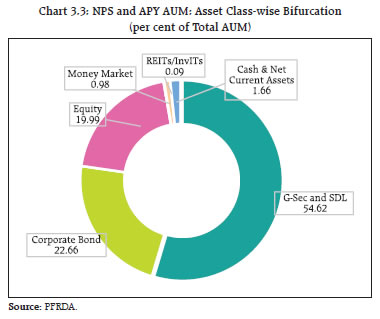

Page Last Updated on: