IST,

IST,

Systemic Risk Survey

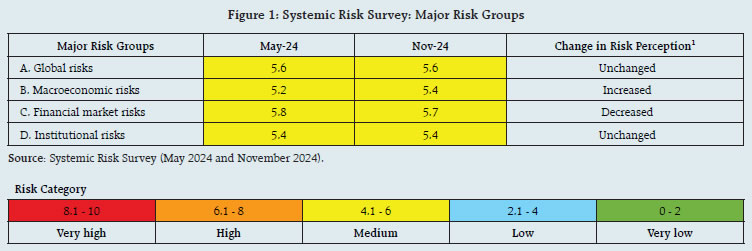

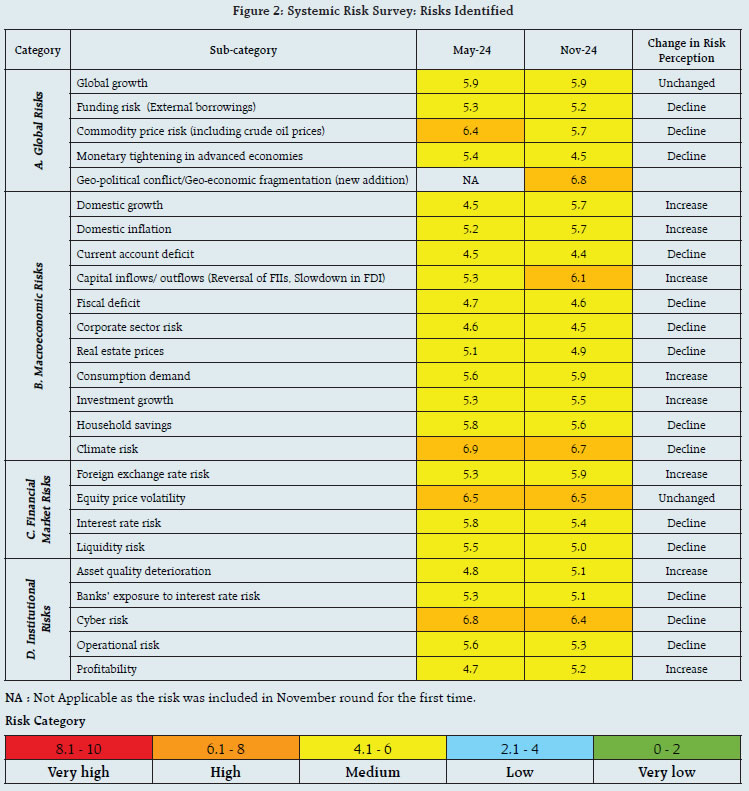

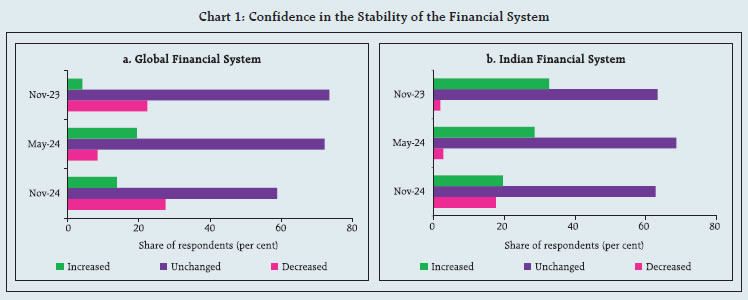

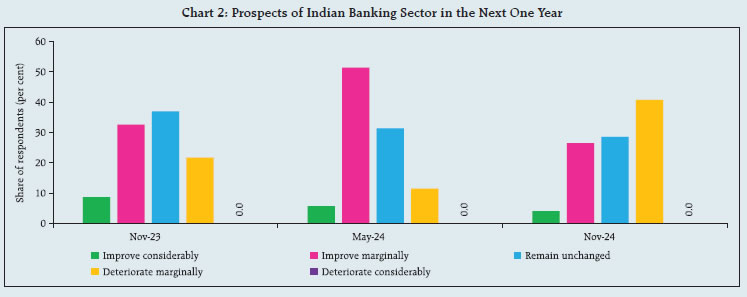

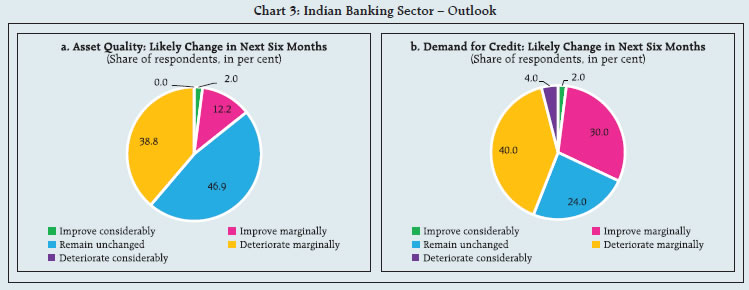

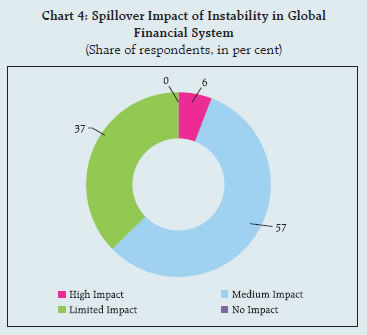

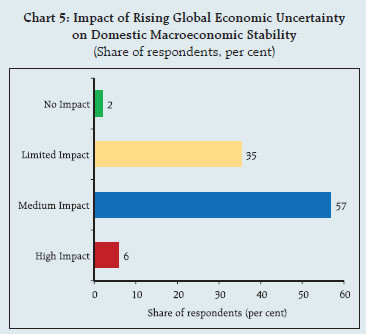

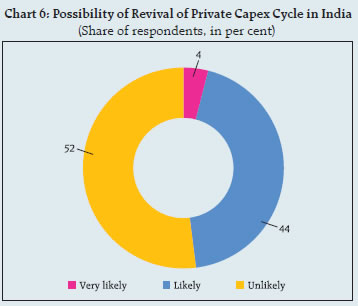

The 27th round of the Reserve Bank’s Systemic Risk Survey (SRS) was conducted in November 2024 to solicit perceptions of experts, including economists and market participants, on major risks faced by the Indian financial system. In addition to key global and macroeconomic factors, the current round of the survey also gauged sentiments on (i) impact of rising global economic uncertainty on India’s macro-financial stability and (ii) revival of private capex cycle. A summary of feedback received from 51 respondents is presented below.

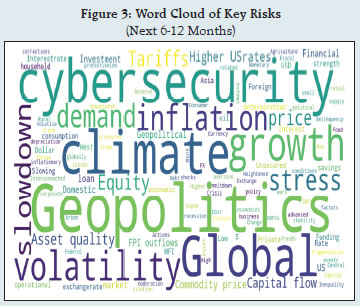

Risks to Financial Stability Going forward, respondents identified the following risks to domestic financial stability (Figure 3):

1 The risk perception, as it emanates from the systemic risk survey conducted at different time periods (on a half-yearly basis in May and November), may shift from one risk category to the other, reflected by the change in colour. However, within the same risk category (boxes with the same colour), the risk perception may also increase/decrease or remain the same, the shift being indicated accordingly through average numeric values. |

Page Last Updated on: