IST,

IST,

Manual on the Compilation of Flow of Funds Accounts of the Indian Economy

1. The objective of this Manual is to provide a comprehensive guide on the extant methodology adopted for the compilation of the Flow of Funds (henceforth, FOF) Accounts for the Indian economy. The Manual is a supplement to the Report of the Working Group on the compilation of FOF Accounts, 2015 (Chairman: Shri Deepak Mohanty). All the recommendations of the Working Group that are implementable at the present juncture have been incorporated in the Manual. 2. The Manual would be updated on a periodic basis taking into account evolving changes in the national accounting framework and new data/data sources in line with the remaining recommendations of the Working Group. In view of this, this Manual and the subsequent revisions would be released as a web version. 3. It may be recalled that the Reserve Bank of India (RBI) is entrusted with the compilation of the annual FOF accounts on a 'from whom-to-whom‘ basis and the RBI has, since 1964, published the FOF accounts for the Indian economy from the year 1951-52 onwards. The FOF accounts for India owe their origin to a suggestion of Sir C.D. Deshmukh, the then Union Finance Minister, in 1955. In 1956, the CSO initiated preparatory work along with the RBI. In 1959, Professor H. W. Arndt of the University of Australia carried out a study in consultation with CSO, Ministry of Finance and RBI, on FOF accounts. The memorandum entitled ''Financial Flows in the Indian Economy 1951-52 – 1957-58'', prepared by Prof. Arndt was discussed by representatives of the CSO and the RBI. They, in turn, referred the issue to a Working Group on Flow of Funds (Chairman: Shri P. C. Mathew) to formulate proposals for further work in this direction. 4. The Mathew Working Group took note of statistics then available and the important work done by Prof. H.W. Arndt and suggested a model set of accounts to be adopted. The compilation of the detailed FOF accounts for the Indian economy was then initiated in 1959 under the joint auspices of the Central Statistics Office (CSO) and the RBI. The Report of the Mathew Working Group, published in 1963, presented a consolidated FOF accounts for the year 1957-58. Subsequently, the RBI developed the work further and published the detailed FOF accounts since December 1964 starting with the data from 1951-52 onwards. The sectoral classification and financial instruments covered were in line with the recommendations of the Mathew Working Group. Since then, these accounts are being published periodically in the monthly RBI Bulletin with the scope of the accounts extended over the years either by way of coverage, i.e., inclusion of additional sub-sectors or by the use of more refined methods of estimation and classification of sub-sectors.2 5. A Manual on the methodology of compilation of the FOF was published as a supplement to the December 1988 issue of the Reserve Bank of India Bulletin (henceforth, the 1988 Manual). This was followed by subsequent changes regarding certain data sources and methodology of estimation which were published along with the FOF articles in the January 1991 and January 1992 issues of the RBI Bulletin. In March 2007, the RBI prepared a 'Manual on Financial and Banking Statistics‘ on the recommendation of the Steering Committee set up by the Ministry of Statistics and Programme Implementation, Government of India. The objective of this reference manual was to provide a methodological framework for compilation of statistical indicators, encompassing various sectors, including the FOF accounts apart from monetary statistics, banking statistics, external sector statistics and fiscal sector statistics,, published by the RBI. Subsequently, the High-Level Committee on the Estimation of Savings and Investment (HLC) (Chairman: Dr. C. Rangarajan), 2009 also made some recommendations for improving the compilation of the FOF accounts. Some of the recommendations of the HLC have already been incorporated in the compilation methodology of FOF in subsequent years. 6. Internationally, the standards for preparing macroeconomic statistics including the detailed flow of funds accounts have evolved over the years with the System of National Accounts (SNA)3 being the internationally agreed standard set of recommendations on how to compile measures of economic activity. The SNA describes a coherent, consistent and integrated set of macroeconomic accounts in the context of a set of internationally agreed concepts, definitions, classifications and accounting rules. The SNA is intended for use by all countries, having been designed to accommodate the needs of countries at different stages of economic development. It also provides an overarching framework for standards in other domains of economic statistics, facilitating the integration of these statistical systems to achieve consistency with the national accounts. 7. The standards for preparing macroeconomic statistics changed significantly following the publication of the 1993 SNA, which set out the overarching conceptual framework for all macroeconomic statistics. The 1993 SNA incorporated two significant enhancements: the full integration of stocks (balance sheets) and flows, and a complete sets of accounts covering production, income, consumption, saving, investment, and financial activities for sectors of the economy as well as for the economy as a whole. The 2008 SNA4 is an update on the 1993 SNA which takes into account new developments in economic activities and analysis since 1993. 8. In the case of the FOF accounts of the Indian economy, it may be mentioned that the sectorisation and the instruments adopted as per the existing methodology partially match with the SNA‘s sectorisation and instruments. However, the Indian FOF accounts, as per the existing methodology, differ from the SNA in some aspects, namely:

9. In this backdrop, the RBI constituted a Working Group on the compilation of Flow of Funds of the Indian Economy chaired by Shri Deepak Mohanty, Executive Director, RBI to review the methodology of compilation of the FOF accounts for the Indian economy. The Working Group reviewed the existing methodology of compilation of the Indian FOF accounts as well as international best practices including the SNA system and examined the feasibility of aligning the Indian FOF accounts with the international best practices to the extent possible at the current juncture taking into account availability of data. As mentioned earlier, this Manual incorporates the recommendations of the Working Group that are currently implementable. 10. The RBI is responsible for preparing the annual FOF accounts for the Indian economy. In the RBI, the National Accounts Analysis Division (NAAD) in the Department of Economic and Policy Research (DEPR) does the compilation of the FOF accounts sourcing the data - from various Government of India agencies, namely the Central Statistics Office (CSO) in the Ministry of Statistics and Programme Implementation (MOSPI), Ministry of Corporate Affairs (MCA), Ministry of Heavy Industries and Public Enterprises (MHIPE), from various financial institutions/market regulators, viz., IRDAI, NABARD, NHB, PFRDA, SEBI, SIDBI, other Departments in RBI, namely DBR, DGBA, DSIM, DNBR, FIDD, DCBR and various regional offices, other Divisions in DEPR [which include the Division of Financial Markets (DFM), Division of International Trade and Finance (DITF), Division of Money and Credit (DMC), and Fiscal Analysis Division (FAD)] as well as from individual corporations, such as State Electricity Boards/Departments/Power Generation, Transmission and Distribution Companies, etc. 11. The methodology for the compilation of the FOF is the responsibility of the RBI which is, however finalised in close coordination with the Central Statistics Office (CSO) in the Ministry of Statistics and Programme Implementation (MOSPI). 12. The new methodology of compilation of FOF accounts for the Indian economy would align the grouping of institutional units into various sectors along the lines of SNA 2008 to the extent feasible (see Chart below). 13. However, coverage of the institutional units would depend upon the availability of data. It may be mentioned that, at the current juncture, consolidated data pertaining to Non-Profit Institutions (NPIs) serving households are not readily available and hence the financial flows of these institutions are not separately reported. 14. As recommended by the Working Group on Compilation of the FOF Accounts of the Indian Economy, 2015, the list of institutional sectors, sub-sectors and the list of institutional units that would be covered in the FoF accounts of the Indian economy are given in the Table 1 below. This sectorisation is generally in line with the 2008 SNA. 6. Financial Assets and Liabilities (Instruments) 15. As recommended by the Working Group on Compilation of the Flow of Funds Accounts of the Indian Economy, 2014, the following financial instruments would be covered in the FOF accounts for the Indian economy to the extent feasible depending on the availability of data (Table 2). 16. The source agencies/source documents for each of the institutional sectors in the FOF accounts are given in the Table below.

a) Consistency between financial and non financial accounts 17. Generally, statistical discrepancies between the financial and non-financial accounts are observed. The reasons for the discrepancies could be on account of the following, inter alia: different scheme of classification of units to a sector (or a sub-sector), use of different sources in compiling the financial and non-financial accounts, difficulties in identifying creditors of some financial assets, and revision of accounts. The FOF accounts attempt to minimise the discrepancy between the financial and non-financial accounts to the extent possible. 18. The 2008SNA/ ESA95 framework presents a full set of accounts so that for any financial instrument and sector, changes between opening and closing balance sheets are divided into financial transactions and "other flows". The "other flows" cover changes in volume not resulting from a transaction between units and changes resulting only from a change in prices of financial assets and liabilities (including change in exchange rate), that is valuation change. 19. As a general rule, the method used for estimating financial transactions is the "changes in stocks adjusted by information on other flows". However, direct data on transactions is used when they are available. It is notably the case for net issuance of securities where market information exists and is reliable, at least for securities traded on an organised market. Purchases and sales of Mutual Fund Shares are frequently available. Balance of Payments transactions are also an example of "direct information". 20. In the Indian context, the financial flows in the FOF accounts of various sectors (except the ROW sector) are and some parts of the Central and State Government Sectors, obtained as the difference between the outstanding financial assets/liabilities in two consecutive end-March positions. At present, the financial flows obtained by differencing the two outstanding positions are not bifurcated into transactions, revaluations (such as capital gains and losses and changes owing to movements in the exchange rate) and other changes in volume account (OCVA) such as write-off of loans. c) Consistency checks/Control Totals 21. In order to maintain consistency in the financial flows across sectors in cases when aggregate numbers are available from two different sources, the data that is firmer is chosen. Furthermore, some aggregate flows, which are available for certain sectors, are used as control totals, so as to ensure consistency with the sum of the constituents, on which data are separately available (Table 3).

22. India‘s FOF accounts categorise the domestic economy into four major sectors, namely, financial corporations, non-financial corporations, the general government, and the 'households and NPISH‘ as is the current practice globally. 23. The FOF accounts will publish both the non-Consolidated Tables wherein the intra-sector transactions are reported and the Consolidated Tables wherein the intra-sector transactions are netted out. 1.1 Non-Financial Corporations 24. This sector comprise of the following institutional units: 1. Non-Government Non-Financial Companies

2. Government departmental and non-departmental Commercial Undertakings

1.1.1. Non-Government non-financial companies 25. This sub- sector comprises all public and private limited companies registered in India under the Indian Companies Act, 2013 (and the earlier Indian Companies Act, 1956) and branches of foreign companies operating in India. Studies on 'Finances of public / private limited companies‘ published periodically in the RBI Bulletin, form the basic source for compilation of the accounts of this sub-sector. 26. These studies cover a sample of operating non-government non-financial public and private limited companies.7 The company finance studies of the Bank cover only a small sample of medium and large public limited companies and private limited companies whose audited Annual Reports and Accounts are received in the Reserve Bank of India [DSIM], 27. The number of companies covered in the Bank‘s studies is revised/enlarged on a quinquennial basis. As the studies include only limited number of companies, the data presented therein are adjusted for the under coverage on the basis of the indicator available for populations of the public and the private limited companies. Total paid-up capital of these companies as on 31st March is used to get global estimates for public and private limited companies. Further, in order to arrive at global estimates, the sample data of each and every item (both financial and nonfinancial) are blown-up using the blow-up factor arrived as the ratio of paid-up capital of the global population to paid-up capital of the sample. The underlying assumption in such blowing–up is that the relationship between the characteristics (estimated) of the population and those of the sample companies is the same as that of the paid-up capital of sample companies to the paid-up capital of the population. 28. In order to ensure accuracy and consistency, after estimating the blown-up numbers for a particular instrument, the number is compared with corresponding flows in other sectors (such as the Commercial Banks sector or the ROW sector). In case of wide variations, the Banking sector or the BOP sector number is used as they are considered to be more firm data. 29. The FOF accounts of the non-government non-financial public and private limited companies, as stated above, are based on the blown-up data of the sample companies. As all the necessary details are not available from these studies, these are supplemented with the information collected from the accounts of other sectors as well as from records of the Bank (DSIM).8 30. Deposits accepted by the companies from public are shown under 'Long term borrowing‘ are 'Short-Term borrowings‘. Further, the deposits are segregated under secured and unsecured. For the purpose of the FOF accounts, these public deposits are treated as deposits raised from the household sector. 31. The company finances information provides data on money raised through bonds/debentures. In the absence of ownership details of these securities, the investments made by other sectors (mainly the financial corporations) in the debt securities of non-financial corporations are used. 32. Long-term borrowings include term loans (including loans from banks), deposits, loan and advances from selected parties, long-term securities of finance lease obligation and from 'others‘. In addition, information relating to short-term borrowings including that from banks is available. 33. The studies on company finances provide information on shareholders‘ funds which include (i) share capital and (ii) reserves and surplus. 34. The total share capital is segregated according to its ownership on the basis of the sectoral accounts which report their investments in the shares of nongovernment non-financial companies. The paid–up capital held by the household sector is obtained as a residual, i.e., by deducting the investments of all identifiable sectors from the total share capital of the companies. Trade payables and other current liabilities 35. Trade payables include companies‘ purchases on deferred payment basis from other non-government companies, government undertakings, partnership firms and proprietorship firms and other business households. However, these ownership details are not available in the Company Finance studies. A similar item, 'trade receivables‘ appears under assets which includes the sale of goods on deferred payments basis to various parties such as, the other non-government companies, government undertakings, partnership and proprietary concerns, the details of which are also not available. In the absence of ownership particulars, the intra-corporate trade transactions are excluded and the residual is taken as the amount received from/paid to the household sector. The 'other current liabilities‘ and classified as 'items not elsewhere classified‘ under the instruments are 'sector unidentified' for the sectoral allocation. 36. Reserves and surplus include different types of reserves, such as, capital reserve, investment allowance reserve, sinking funds and other reserves. Capital reserve includes profit/loss on sale of fixed assets and/ or investments, profits realised on purchase of company‘s own debentures, profit on sale of forfeited shares, capital redemption reserves, revaluation reserves (fixed assets), and premium on shares. Hence, increase in capital reserve does not form part of the saving of the companies. Increase in reserves (other than capital reserve) forms the saving of the companies which is a non-financial transaction. 37. Provisions include provision for taxation, other non-current provisions and other current provisions. The companies also show 'advance income tax paid‘ under current assets. Increase in tax provision net of tax advance over the previous year‘s closing balance forms part of the saving of the companies, whereas other current provisions relate to provisions for contingencies and bonus to staff. They are not included under saving but are shown as other non-financial capital receipts. Cash and cash equivalents 38. Cash on hand are shown against this sub-head. As mentioned earlier for other sectors, cash on hand is split into bank notes and government notes. Deposit 39. Deposits with commercial banks, shown as balances with Banks in the Balance sheets, cover the fixed, current and other deposit accounts. Investments (Debt and equity securities) 40. Companies‘ investments are classified into non-current and current investments. The former includes investment in equity instruments/shares, government or trust securities, debentures/bonds, mutual funds and others. In the absence of any details, the last category 'other investments‘ is shown as sector unidentified. 41. Both long-term and short-term loans and advances are shown under this head. Loans to others are shown as 'sector unidentified‘ as no details are available. Long-term loans and advances include capital advance, security deposits, loans to related parties and 'others‘. 42. These assets which appear under a separate head are classified as other items not elsewhere classified under financial flows. 43. The increase in net fixed assets constitutes the net fixed capital formation of these companies, which is a non-financial transaction. The company finances data provides information relating to gross fixed assets, which include tangible assets (such as land, buildings, plant and machinery, furniture, fixtures and office equipments and others), capital work in progress and intangible assets, but these details are not available on net basis. 44. Inventories include stocks of raw materials and components, stores and spares used by the company for the maintenance of its fixed assets, stocks of finished goods, work-in progress and other inventories. The annual variation in stock is a non-financial transaction. 2.2.2 Power Sector Companies and State Electricity Boards 45. Most of the State Governments have un-bundled the erstwhile State Electricity Boards (SEBs) into one or more Power Generation, Transmission and Distribution Companies. The necessary data for these companies and the existing SEBs are obtained through special returns from these companies and supplemented with their annual reports. The special returns provide the sectoral details of all the financial assets and liabilities. 46. The Annual Reports of the State Power Utilities/electricity boards provide details of deposits (security deposits from contractors, consumers‘ and meter security deposits, retention money and other miscellaneous deposits) received by these firms. As the ownership details of fixed deposits and consumers‘ security deposits, received by these utilities/boards are not available, the amounts are shown as of 'Household Sector‘ for sectoral presentation. Debt securities (bonds and debentures) 47. The Annual Reports of the State Power Utilities/electricity boards provide details of their money raised through bonds and debentures. The category-wise particulars of bonds and debentures, issued by them, are not available in their reports. These details are worked out from the investing sectors‘ accounts. The bonds and debentures are subscribed mainly by the commercial banks, LIC, financial corporations, non-government provident fund authorities and state governments. The state governments‘ investment is derived by deducting other sectors‘ investment in the bonds from the total amount of bonds issued. 48. The Annual Reports of the State Power Utilities/electricity boards provide details of their borrowings from Banks and Others. The borrowings from others include that from state governments, central governments, financial corporations, the LIC and other insurance companies, etc. Other details are worked out from the lending sectors‘ accounts. Trade payables 49. Trade payables include amount due to micro and small enterprises and others including amount payable for purchase of power. The trade credit includes creditors on open account, sundry creditors, dues payable to contractors and suppliers of stores, etc. However, the particulars of the parties, to whom the amounts are payable, are not available. Under assets side, similar items, viz., sundry debtors for electricity supplied, debtors for amount paid on account of contracts in course of completion, debtors for sale and hire purchase, advances against supply of materials, sundry debtors for temporary service connection form trade receivable. The sectoral details of the trade receivables are available which is used to allocate trade payable (net of trade receivables) to government, private corporate sector and households. Other liabilities (current and non-current) 50. The annual reports and accounts of the State Electricity Boards/State power utilities (SEBs/SPUs) present a variety of items under other current liabilities. These items which have the bearing of a liability to others, such as interest, bills payable, etc., are considered as financial transactions. The employees‘ provident fund is also shown under other current liabilities by many of the SEBs/SPUs while a few others show this under the head of provisions. For the compilation of accounts, the provident fund amount is excluded from the liabilities. To the extent possible, the amount of other liabilities (financial part) is shown against different sectors. Reserves, provisions and capital transfers 51. All types of reserves and other funds are non-financial items and represent accumulated saving of the SEBs/SPUs. The increase in taxation provision net of advance tax payments, is the saving of the SEBs/SPUs. Capital transfers comprise revenue subsidy/grant from state governments. Currency and deposits Currency (Cash on hand) 52. Data on cash on hand are available directly in the basic source. Deposits 53. Balances at banks include the deposits in current and fixed deposit accounts with commercial banks and co-operative banks. Loans 54. This item comprises loans and advances to employees, contractors, suppliers and others. Loans to employees are classified as loans to the household sector. Investments (Debt and Equity) 55. The annual reports provide the details of investments of the SEBs/SPUs. Other accounts receivable (Other assets) 56. Other assets include interest accrued, sundry receivable, receivables from state government and other agencies and certain non-financial transactions. Financial items of other assets are identified under different sectors depending upon the availability of details in the annual reports. The non-financial items of other assets are shown as other capital transfer payments under non-financial flow accounts. Non-financial items 57. Net fixed assets, inventories, capital transfers, viz. grants, subsidies, advance of tax payment and other assets (non-financial) appear under non-financial flows. The items such as deferred revenue expenditure and net revenue and appropriation account, appearing under other assets, are deducted from reserve funds to derive the saving of the SEBs/SPUs. Net fixed assets and inventories together form the physical assets and the additions made therein during the year represent the capital formation (net) of the electricity boards/SPUs. 2.2.3 Co-operative non-credit societies 58. The co-operative non-credit societies comprise primary marketing and processing societies, co-operative sugar factories, cotton ginning and pressing societies, milk supply unions and societies, fisheries societies, farming societies, irrigation societies, consumers‘ co-operative stores, housing societies, weavers‘ societies, spinning mills, dairy cooperative societies, poultry union and societies and multiunit societies. 59. The Statistical Statements on the Cooperative Movement in India, which is the primary source for these Cooperatives, is published with a considerable lag. Therefore, the FOF accounts for these societies for the years under review are estimated by applying the same growth rate as observed under the relevant financial instruments of the DCCBs as per the Form IX return of the DCBR, RBI. These estimates are revised as and when the Statistical Statements of the particular year are released by NABARD. 60. The FOF accounts of this sector are prepared by obtaining special returns from the major port trusts, both in the public and private sector. The special returns provides the sectoral details of all the financial assets and liabilities. 61. The major sources of finance of public sector port trusts are in the form of borrowings and other financial liabilities (for example, sundry creditors) which arise in the course of business. Their borrowings are mainly from the central government. 62. Along with the reserves and other funds, the balance sheet of Port Trusts presents provident fund contributions of the employees. Since the nongovernment provident funds(other than state provident funds) is a separate subsector, the provident fund data of the port trusts are excluded from the liabilities side as well as from the assets side and shown in the provident fund sub-sector. 63. The change in reserves and other funds including provisions for depreciation, form the gross saving of the trusts. But, 'net deficit‘, and 'uncovered revenue deficit‘ have been presented under 'other assets‘, which generally indicate accumulated losses. Therefore, these two items are adjusted before deriving the net/gross saving of the port trusts. 64. Under the assets, investments made out of provident funds contributions are shown separately. As stated earlier, this investment account is separated from the assets. In practice, provident fund contributions shown in the liabilities do not match with the investments from the fund given under assets. The difference between these two sets of figures is adjusted under the item 'bank balances‘. 65. Investments made out of general fund and other funds (other than provident fund account) are in the form of securities of financial institutions, private corporate sector and government, and these details are available in the annual reports. The data on cash in hand and their deposits (current and fixed) with banks and other financial assets (such as sundry debtors and accrued interest) are the remaining financial assets of the port trusts. The deposits are treated as deposits with commercial banks. In the case of other financial assets which include interest accrued and such other items, no sectoral details are available. 66. Plant and machinery, premises, furniture and other fixed assets are presented on gross basis inclusive of depreciation in the annual reports. Therefore, rise in these assets would mean gross fixed capital formation of the port trusts. Similarly, the increase in the stores and raw materials maintained by them would be change in inventories. As sated earlier, the 'net deficit‘ and 'uncovered revenue deficit‘ are covered under 'other assets‘ and these are deducted from reserves to derive the saving of the port trusts. 2.2.5 Government Non-departmental non-financial undertakings 67. This sub-sector covers all Government non-departmental non-financial companies owned either singly or jointly by central, state or local governments. In the case of the companies owned by the central government, the data on their assets and liabilities are available in the annual publication titled Public Enterprises Survey (PES) which is published by the Department of Public Enterprises (DPE), Ministry of Heavy Industries and Public Enterprises (MHIPE), Government of India on its website. 68. This publication covers enterprises under construction, and running enterprises, which are promotional, financial and non-financial companies by their activity. However, the financial companies are not included in this sub-sector as they are covered under the 'Financial Corporations‘ sector. 69. The State Public Sector Enterprises are (i) companies under section 617 of companies Act, 1956, (ii) Statutory companies established under the act of state legislature (iii) any other companies not categorised by the state government. 70. The Department of Public Enterprises published the first National survey of State level Public Enterprises (2006-07) in August 2009 and the second survey for 2007-08 in 2012. Due to the time lag in availability of data from the source, the data on SLPEs are compiled from the CAG reports or data disseminated by state governments. The methodology for central and state government companies is given below. (i) Central and State Government Companies Loans (Borrowings) 71. The sectoral borrowing in respect of CPSEs, are drawn from a subsidiary statement on details of short-term and long-term borrowings from (i) central government, (ii) state governments, (iii) holding companies, (iv) banks, (v) foreign parties and (vi) others. Equity (Paid-up capital) 72. In the case of CPSEs, Statement I of the PES, Vol. I, provides the balance sheet data for running enterprises and companies under construction. The ownership details of the paid-up capital are available in subsidiary statement of the PES, Vol. I, against the following heads: (i) central government, (ii) state governments, (iii) holding companies, (iv) financial institutions (Indian), (v) foreign parties, (vi) employees and (vii) others (Indian). The data on financial institutions are not given separately for banking and other financial institutions. Therefore, the equity holding of banks in NDCUs as per the FOF accounts of Scheduled Commercial Banks are shown here. The remaining are shown under non-banking financial institutions. Current and non-current liabilities (other than borrowings) and provisions 73. The current and non-current liabilities (other than short-term borrowings) are further divided into (i) trade payables and, (ii) other long term liabilities, (iii) provisions (long-term and short-term) and deferred tax liability. The taxation provision and other short and long term provisions included under 'provisions‘ appear under non-financial flows. Reserves and Surplus 74. The item 'Reserves and Surplus‘ includes general and other free reserves, specific reserves and balance from profit and loss account. The changes in these funds represent the saving of the companies. While, change in tax provision net of advance tax payments is added, changes in 'deficit‘ and 'deferred revenue expenditure‘ appearing under assets side of central government companies are deducted from change in reserves. Cash and bank balances 75. Cash in hand is the currency held by the companies while bank balances, including fixed deposits with commercial banks, are shown as deposits with commercial banks. In the case of CPSEs, the break-up of cash in hand and balances with commercial banks is not available. The cash Loans (Loans and advances, Trade receivables and other assets) 76. Details of loans and advance extended by the CPSEs are not available. In the absence of any loan details, the total amount under this head, other than loans to subsidiary and holding companies, is shown under unclassified sector. The amount under trade receivables is shown as trade debt and is not allocated to any identifiable sector for want of details. Other assets are shown under 'other items not classified elsewhere‘ for instrument-wise classification and 'unclassified‘ for sectoral presentation. 77. The PSE Survey gives data on inventories and gross fixed assets i.e., fixed assets and inventories inclusive of depreciation. Fixed assets are also shown net of depreciation. The total fixed assets of CPSEs also capital work-in progress, which includes capital advances to suppliers/contractors and intangible assets under development. The PSE Survey provides data on 'deficit‘ (accumulated) and 'deferred revenue expenditure‘ in the case of CPSEs and is shown as other capital transfer payments. Changes in these items are deducted from the change in reserves and surplus to arrive at the net saving of these companies. 78. The Financial Corporations sector would now comprise the institutional units as given in Table 1. 1.2.1 Central Bank – the Reserve Bank of India 79. The Statement of Affairs of the RBI prepared by DGBA and also published in the RBI‘s Handbook of Statistics on the Indian Economy gives the assets and liabilities of the RBI as on March 31st. This data forms the basic source for the compilation of the FOF accounts of the RBI. Currency (Notes issued) 80. This item includes all notes issued by the Government of India up to April 1935 and by the RBI thereafter (referred to as bank notes). One rupee notes and coins issued by the Government of India since July 1940 (referred to as government notes) are considered as rupee coins. These coins are the liabilities of the Government of India and those held by the Reserve Bank are the assets of the Bank. These do not, therefore, form part of 'notes in circulation‘ presented in RBI accounts. Thus, 'notes issued‘ comprise bank notes (i) held in Banking Department of the RBI, and (ii) in circulation (i.e. bank notes outside the RBI). 81. Bank notes and rupee coins in circulation are held by different institutions/subsectors, such as banks, co-operative societies, financial corporations, insurance companies, non-government and government companies, government treasuries, the railways, the posts and telegraphs in the form of petty cash, and households who maintain the cash balances with them for day to day transactions and also as a part of their saving. As there is no single source which gives data on cash holdings of these different institutions/sub-sectors, their cash on hand, as reported in their accounts, is made use of to derive the sectoral distribution of notes and rupee coins in circulation. 82. However, as the cash held by different institutions/sub-sectors includes both the bank notes and the government notes, the break-up of these notes into bank notes and others for each sub-sector is made by assuming that their ratio to one another is the same as indicated in the data on total 'notes in circulation‘ and total 'circulation of rupee coins and small coins as on 31st March of the respective year. The sectoral distribution of bank notes worked out on the above basis is shown under this item. Data on cash holdings of each institution/sub-sector, except the household sector, are obtained from their respective balance sheets/annual reports. Cash holdings of the Household Sector are, however, derived by deducting cash held by different identifiable institutions/sub-sectors from the total currency in circulation excluding government notes. Deposits 83. Deposits with the Bank are shown against the following heads. (a) Government: (i) Central Government, (ii) State Governments, (b) Banks: (i) Scheduled Commercial Banks, (ii) Scheduled State Co-operative Banks, (iii) Other Banks, and (c) Others. 84. The category 'other banks‘ includes deposits of (i) non-scheduled commercial banks, and (ii) central and primary co-operative banks which have been permitted to open accounts with the Bank. In the absence of the availability of separate details for the non-scheduled commercial banks and the co-operative banks, the deposits of the category 'other banks‘, are classified under commercial banks. 85. The last category – 'others‘ – include (i) rupee deposits from Foreign Central Banks and Foreign Financial Institutions, (ii) Deposits from Indian Financial Institutions, (iii) Deposits placed by Mutual Funds, (iv) Accumulated Retirement Benefits – (a) Provident Fund and (b) Gratuity and Superannuation Fund, and (v) Miscellaneous deposits, viz., balances of Clearing Corporation of India Ltd, Primary Dealers, Employee credit societies, etc., and sundry deposits. These deposits are respectively categorized under the sectors ROW, Other Financial Intermediaries, Mutual Funds, and Pension/Provident Funds. After estimating the sectoral figures, the deposits held under Account No. I of IMF with the Bank is deducted from the deposits estimated against the Rest of the World sector and shown separately as loans from the IMF. This modification is made in the accounts of the RBI sub-sector because the above transactions in the Rest of the World sector‘s accounts are shown as loans to the official sector (RBI). Thus, the deposits with the Bank are classified into the various FOF sectors. Equity and investment fund shares Equity Unlisted shares (Paid-up capital) 86. The paid-up capital of the Bank, which is entirely contributed by the Government of India, has remained constant at ₹5 crore since 1948. As there is no change in the amount so far, the flow on this account is nil. Other accounts receivable/payable Bills Payable 87. 'Bills payable‘ include (a) outstanding Demand Drafts (DD) issued between offices of the RBI (b) outstanding payment orders (PO) issued by the RBI for local payments, and (c) outstanding balance in the remittance clearance account, representing the remittances issued as per the erstwhile Remittance Facility Scheme – between (i) treasury agencies, (ii) treasury agencies and banks, (iii) treasury agencies and the RBI, (iv) agency banks and the RBI, etc. A special return as on 31st March from the regional offices of the RBI provides the particulars of bills payable into (1) outstanding balances DDs issued between offices of the RBI and (2) outstanding balances of (a) POs issued by the RBI offices for local payment and outstanding remittances in the Remittance Clearance Account. The amount of 'bills payable, as given in the Statement of Affairs, is allocated to different sectors on the basis of the sectoral pattern derived from the special return. It may be mentioned here that while intra-RBI transactions are shown against category (1), the sectoral details are shown under category (2). While both the categories would be shown in the non-Consolidated Table, only category 2 would be reported in the Consolidated Table. Other liabilities 88. Internal reserves and provisions of the RBI are major components of 'other liabilities‘. While Contingency Reserve (CR) and Asset Development Reserve (ADR) form the RBI‘s internal reserves, having been provided as normally provided by banks, the remaining components of 'Other Liabilities‘, such as, Currency and Gold Revaluation Account (CGRA), Investment Revaluation Account (IRA) and Exchange Equalisation Account (EEA) and provision for outstanding expenses, are in the nature of provisions as they represent unrealised gains/losses. The remaining components of 'other liabilities‘ include surplus transferable to the Government of India and miscellaneous. 89. The CR and the ADR reflected in 'Other Liabilities‘ are in addition to the 'Reserve Fund‘ held by the RBI as a distinct balance sheet head. The Contingency Reserve (CR) represents the amount set aside on a year-to-year basis for meeting unexpected and unforeseen contingencies, including depreciation in the value of securities, and risks arising out of monetary/exchange rate policy operations. In order to meet the needs of internal capital expenditure and make investments in subsidiaries and associate institutions, a further sum is provided and credited to the ADR, which was created in 1997-98. 90. Unrealised gains/losses on valuation of Foreign Currency Assets (FCA) and gold due to movements in the exchange rates and/or price of gold are not taken to the Profit and Loss Account but instead booked under the CGRA. Unlike the CR, which is created by apportioning realised gains, the CGRA is not a reserve account as it represents the accumulated net balance of unrealized gains and losses arising out of valuation of FCA and gold. As CGRA balances mirror the changes in prices of gold and in exchange rate, its balance varies with the size of asset base and volatility in the exchange rate and price of gold. The RBI values foreign dated securities at market prices prevailing on the last business day of each month and the appreciation/depreciation arising there from is transferred to the IRA. The unrealised gains/losses arising from such periodic revaluation are adjusted against the balance in IRA. The balance in the EEA represents provision made for MTM losses on forward commitments mainly arising out of intervention operations. 91. The 'Miscellaneous‘ item is a residual head including sub-accounts such as balances payable on account of leave encashment, reserve for interest earned on securities earmarked for the employee funds, the value of collateral held as margin for repo transactions and medical provisions for employees. 92. For the purpose of the FOF Accounts, only 'Other Liabilities (miscellaneous)‘ would be shown. The extent of financial and non-financial nature of these transactions is, however, not known as the details of these components are not available. However, an attempt is made to exclude the amount of non-financial transactions to the maximum possible extent, by netting similar items on the assets side. 93. The item 'other assets‘ includes (a) certain financial items, such as, housing loans to employees, loans for purchase of cars and motor cycles to employees, (b) nonfinancial items such as adjusting account, charges account, suspense account, demand drafts received for realization account, agency charges account, exchange account and dead stock account. Items under (b) would also include certain financial transactions, for which no data are available. In the absence of the break-up of details of financial and non-financial transactions of the item (b) as well as of other liabilities (miscellaneous), other liabilities (miscellaneous) net of other assets (i.e. categories (b) excluding dead stock account) are shown under financial flows. 94. The reserve funds and other funds of the RBI, namely, the National Industrial Credit (Long-Term Operations) [NIC (LTO)] Fund and National Housing Credit [NHC (LTO)] Fund, form non-financial items under liabilities of the Bank. The original Reserve Fund of ₹0.05 billion was created in terms of section 46 of the RBI Act as contribution from the Central Government for the currency liability of the then sovereign government taken over by the Reserve Bank. Thereafter, ₹64.95 billion was credited to this Fund out of gains on periodic revaluation of gold up to October 1990, taking it to ₹65 billion. The accumulation in the Fund has been static since then and appreciation/depreciation on account of valuation of gold and foreign currency is booked in the Currency and Gold Revaluation Account (CGRA) which is a part of the head 'Other Liabilities‘ in RBI‘s balance sheet. Change in these reserves, namely, reserve fund, NIC (LTO) Fund, NHC (LTO) Fund, CR, and ADR is taken as the saving of the Bank. Monetary gold (Gold coins & Bullion) 95. Stocks of gold held by the Bank in the vault are shown against this head. The gold purchased by the Bank, as a part of its transactions, from the International Monetary Fund (IMF) is also included here. 96. The increase in the value of gold holdings due to revaluation is not shown under the financial flow account. This particular amount due to revaluation is shown against revaluation account under 'Other Liabilities‘ and, therefore, only the increase in the value of gold due to rise in physical stock of gold is shown under financial flow accounts. It is considered as a foreign asset and shown against the 'Rest of the World‘ sector for the sectoral classification. Currency and deposits Currency (Rupee coins, small coins and Bank notes) 97. This item comprises the holdings of the Issue and the Banking Departments of the Bank in the form of one rupee notes/coins and small coins and also any other coins issued by the Government of India. Rupee coins and small coins are shown as the Bank‘s claim on the Government Sector, because one rupee coins/notes and small coins are shown as the currency liability of the government. 98. Bank notes held in the Banking Department of the Bank relate to the notes issued by the Bank and as such form the transactions within the Bank. Deposits 99. Cash balances and fixed deposits with foreign central banks and other major international commercial banks (which form part of the foreign currency assets) are included under this head. Debt securities 100. The Statement of Affairs of the Bank presents data on investments under different heads of assets viz. Government of India (GoI) rupee securities (including treasury bills), foreign securities, Shares in BIS/SWIFT, holdings in Subsidiaries/Associate Institutions (DICGC, NABARD, NHB, BRBNMPL). While the first item is shown under this category, the second item is clubbed with 'foreign assets‘ as explained below. The last two items are shown under the instrument 'equity and investment fund shares‘. 101. The details of investments are obtained from DGBA. The securities of the GoI, treasury bills and rupee securities are shown separately in the FoF accounts. The Bank‘s investments in government treasury bills include rupee treasury bills and bills purchased and discounted, while rupee securities form the Bank‘s investments in government rupee securities. Foreign assets 102. Foreign currency assets (FCA) of the RBI include deposits with other central banks, the Bank for International Settlements (BIS), foreign commercial banks and investments in foreign treasury bills and securities. As these relate to transactions of the Bank with foreign governments/central banks and international institutions, these are classified against the 'Rest of the World‘ sector. While investment in foreign securities is shown under debt securities, cash balances and fixed deposits with foreign central banks and other major international commercial banks are shown under 'deposits‘. Loans (Loans and Advances) 103. The Reserve Bank extends loans and advances to central and state governments, NABARD, scheduled commercial and cooperative banks, EXIM Bank and primary dealers. 104. In addition, certain items such as staff advances, which are shown under 'other assets‘ [Miscellaneous assets] are included under this head. The particulars of these assets are obtained from DGBA as well as through a special return from the regional offices of the Bank, a reference to which was made while discussing 'other liabilities‘. Loans and advances to staff are shown as loans to Households. Equity and investment fund shares Equity 105. The shares of BRBNMPL, DICGC, NABARD and NHB are shown under this instrument. Other accounts receivable/payable (Other Assets) 106. 'Other Assets‘ of Banking Department comprise fixed assets (net of depreciation), gold held abroad (265.49 metric tonnes)9, accrued income (mainly comprising interest income accrued on balance sheet date on the Bank‘s domestic and foreign investments), and miscellaneous assets. Miscellaneous assets comprise mainly loans and advances to staff, amount spent on projects pending completion, the margin offered for reverse repo transactions, security deposit paid, and items in transit representing inter-office transactions (RBI General Account). 107. As explained earlier under 'other liabilities‘, the details of financial and nonfinancial items included in 'other assets‘ are received from the regional offices of the Bank. Besides the exclusion of certain financial items from other assets, the amount under dead stock account, which relates to the fixtures, furniture and premises of the Bank, is also excluded from it before netting with 'other liabilities‘. Increase in dead stock account represents the net capital formation of the Bank. Deposit-taking Corporations, except the Central Bank 108. This sub-sector comprises

109. The financial assets and liabilities data of Scheduled Commercial Banks are available from three sources: Form X return of SCBs (including RRBs) as at end-March, Statistical Tables Relating to Banks in India (STB) based on the audited accounts of the SCBs (excluding RRBs) as at end-March, and Section 42 returns (as on last reporting Friday/last Friday of March). 110. For the compilation of the FOF accounts of SCBs (including RRBs), the Form X returns are primarily used and supplemented with the STB and Section 42 returns. For the RRBs, the consolidated data provided by FIDD is used as supplements. 111. As sectoral details for most of the instruments are not available from these three sources, these details are estimated by making use of the results of different surveys on bank credit, deposits and investments (viz., Basic Statistical Returns (BSR) 1, 4 and 5). The procedure of compilation of the accounts for the sub-sectors is detailed below: Currency and deposits Deposits 112. Data on deposits with SCBs (including RRBs) are obtained from the Form X returns. The total deposits are disaggregated into current, saving and fixed deposits. Further, current and fixed deposits are disaggregated into deposits from Banks and 'Others‘. The sectoral ownership of these deposits is estimated on the basis of the respective shares in the 'Composition and Ownership of deposits with scheduled commercial banks (including RRBs) as on end-March‘; available through the BSR-4 Census10 and published in the STB. Debt Securities 113. Banks are allowed to raise funds through subordinated debt. This data is obtained from the STB. Loans Borrowings and calls received in advance 114. The data relating to banks‘ borrowings furnished in the Form X are classified as borrowings from a. Banks in India

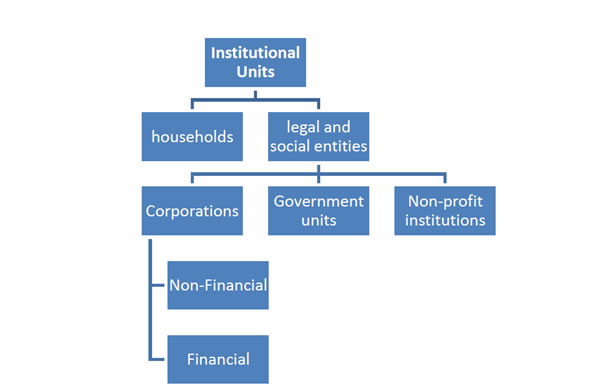

b. From banks outside India c. From financial institutions in India