IST,

IST,

Overview

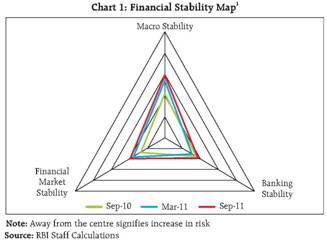

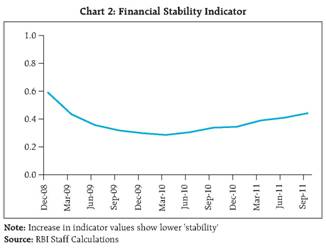

The domestic financial system remains stable even as market participants and stakeholders reposed their confidence in its stability and stringent stress testing certified the resilience of the system. Near term macroeconomic challenges have surfaced while financial markets have experienced heightened volatility. Indian banks remain robust, notwithstanding a decline in CRAR and spurt in NPA levels in the recent past. Increased capital needs and liquidity requirements under Basel III will need to be carefully phased in. The network of the financial sector is found to be closely clustered, leaving major lenders to banks vulnerable to any disturbance in the banking sector. The financial market infrastructure continues to junction without any major disruption. The Indian financial system remains resilient... Stakeholders confident about its stability Macroeconomic environment Risks from the global macroeconomic environment have increased... 2. The European sovereign debt crisis and global slowdown have adversely affected global and domestic conditions since the publication of the last FSR - as is indicated by the Macroeconomic Stability Map and Indicator. The uncertainty in the global macroeconomic environment is expected to continue even as the recovery remains sluggish across regions. The Systemic Risk Survey also reflects the perception that global risks were among the most significant risks facing the Indian economy and financial system. Growth rate of the Indian economy has moderated... 3. In an increasingly integrated global economic and financial system, India's growth performance has been affected through the trade, finance, commodity and confidence channels. Domestic demand has also decelerated, weighed by global factors as well as domestic headwinds including the cumulative impact of interest rate hikes and of elevated inflationary pressures. The slowdown in the industrial sector and deceleration in private consumption may affect the future growth of the services sector as well. Inflationary pressures remain elevated but are easing 4. Inflation in India has remained at high levels. Global commodity prices, including energy prices, are contributing to inflation risks. As expected, however, inflationary pressures have eased in December 2011 and the baseline projection for WPI inflation for March 2012 is 7 per cent. Risks on the external sector front aggravated 5. India's external sector faces risks due to decreasing growth in world trade volumes and weakening global demand. The continued high oil prices and increase in imports of bullion, machinery and electronics by India have partially offset the recent buoyant export growth, resulting in widening of the current account deficit (CAD). Going forward, exports may moderate further if the slowdown in advanced economies persists. Fiscal manoeuvrability remains limited, while corporate performance dips 6. A slowdown in revenue collections and increase in the subsidies expenditure may make the achievement of the budgetary target of a fiscal deficit of 4.6 per cent of GDP for 2011-12 challenging. This reduces fiscal manoeuvrability to address stress in other sectors. Indian sovereign debt, however, is sustainable as it is held mostly by domestic institutions, its average maturity is high and costs less than the rate of growth of GDP. 7. The high costs of inputs, interest rates and deceleration in domestic and external demand is also getting reflected in the declining margins of the corporate sector. Financial Markets Concerns over the sustainability of sovereign debt levels were key drivers of global financial markets 8. The period since the release of the previous FSR was characterised by uncertainty and higher volatility. European debt levels and the rating downgrades have caused some stress in international markets. The European sovereign debt crisis which originated in Greece appears to be spreading to core European sovereigns. The key concerns of market participants were the downward revisions to growth forecasts, leading to corrections in asset prices, especially those sensitive to growth. The movements were exacerbated by the perception of weaker effectiveness of monetary and fiscal backstops. Potential contagion from sovereign credit risks to financial markets and institutions persist 9. The downgrades in sovereign credit ratings of US and in Europe have resulted in a knock-on impact on international banks and their funding markets. Sovereign debt problems affected banks through losses on sovereign bond holdings and lower collateral values for repo and central bank funding. Further, banks derive reduced benefits from implicit and explicit government guarantees. Contagion effects on the markets have been observed in the form of falling turnover, rising costs and decreasing maturity in inter-bank lending markets. Risk aversion dented sentiments for emerging market assets 10. The above developments caused a reversal of capital flows from emerging market assets like equity and debt. Countries like India, with an external deficit, faced a larger currency depreciation than the ones with a current account surplus. The current environment of risk aversion and depreciation of the Indian rupee could complicate the refinancing challenges faced by Indian corporates with regard to their Foreign Currency Convertible Bonds (FCCBs) and External Commercial Borrowings (ECBs). FCCBs raised in pre-crisis years at zero or very low coupons will need to be refinanced through domestic sources at the higher interest rates prevailing currently. Liquidity conditions in the banking system were generally within comfort zone 11. The banking system's liquidity deficit which generally remained within the comfort zone of the Reserve Bank since the publication of the previous FSR, tightened from the second week of November 2011. Consistent with the stance of monetary policy and based on the assessment of prevailing and evolving liquidity conditions, the Reserve Bank started to conduct Open Market Operations for purchase of government securities in November 2011. Evolving equity market microstructure issues warrant monitoring 12. There is a rise in the volume of derivatives trading not accompanied by changes in cash market turnover in equities. The share of proprietary trading in derivatives turnover is also rising. In the cash segment, the share of non-institutional participants, including retail participation, has fallen. There is a need to prevent market dislocations arising from information asymmetry and to ensure that there is adequate disclosure of private pledging of shares by promoters. The evolving microstructure of Indian equity market needs to be watched carefully. Financial Institutions Direct impact of the Euro zone crisis on Indian banks limited, but some funding constraints may emerge 13. Indian banks have negligible exposures to the more affected European countries. Hence, the direct impact of the Euro area sovereign debt crisis on Indian banks is expected to be muted. However, funding constraints in international financial markets could impact both the availability and cost of foreign funding for banks and corporates, some signs of which are already emerging. Banks remain well capitalised though capital adequacy ratios witnessed some decline 14. The Capital to Risk Weighted Assets Ratio (CRAR) and the core CRAR continued with their recent declining trend. The banking system CRAR fell from 14.2 per cent as at end March 2011 to 13.5 per cent as at end September 2011, while the Core CRAR ratio dropped from 10 per cent to 9.6 per cent during the same period. However, both ratios remained well above the regulatory requirement at nine per cent and six per cent respectively. Leverage ratios continued to hover around six per cent as against the Basel III requirement of a minimum of three per cent. Some deterioration in asset quality was evidenced; however, NPA ratios continue to compare favourably with those of other countries 15. Asset quality of banks deteriorated as growth in slippages exceeded credit growth. The gross NPA ratio increased from 2.3 per cent to 2.8 per cent between March and September 2011. The Systemic Risk Survey also identified deterioration in asset quality as one of the most significant risks at the current juncture. A cross country comparison of NPA ratios reveals that, notwithstanding the recent deterioration, Indian banks fared better than banks in other countries. Impaired / restructured power and telecom assets increased even as incremental credit growth to the sectors outpaced aggregate credit growth 16. Restructured and impaired assets in the power and telecom sectors -both important components of banks' credit to the infrastructure sector - increased in recent months. Restructured accounts in these sectors together amounted to 8.5 per cent of total restructured accounts of the banking sector in June 2011 as against 5.0 per cent in March 2011. The fact that incremental credit to these sectors was also high - higher than the aggregate growth in banking sector credit - called for careful monitoring of asset quality in these segments. Profitability of banks under pressure, though efficiency ratios showed some improvement 17. Higher interest expenses and higher provisioning requirements put some pressure on banks' profitability even as efficiency ratios continued to improve. The growth in net interest income (Nil) decreased to 15.5 per cent in September 2011, against 40.7 per cent in September 2010 while growth in PAT decelerated to 2 per cent from 31 per cent a year ago. Operating expenses also grew faster than the non-interest income. Going forward, earnings may be further stressed due to the impact of high deposit rates, potential slowdown in credit growth and deterioration in asset quality. The 'network' of the banking sector is tiered, but limits on interbank exposures mitigate contagion risks 18. The network of the bilateral exposures in the banking sector is 'tiered' rendering it less stable as failure of the most connected banks have a greater contagion impact on the system. Potential contagion risks, if the large borrowers were to fail, have risen, but regulatory limits on interbank exposures help mitigate such risks. Banks resilient but profitability could be affected in severe stress scenarios 19. A series of stress tests assessed the ability of banks to withstand different risks. The banking sector remained resilient even under severe credit risk stress scenarios though a few individual banks could come under duress. Banks' profitability was found to be affected when sectoral NPAs were stressed though the impact on capital adequacy was limited. Interest rate risks in the trading book had a marginal impact; risks in the banking book were higher but manageable. Liquidity risks could pose some concerns, but the SLR portfolio provides comfort. Distress dependencies between banks continue to be low 20. Banking stability measures, which attempt to model the distress dependencies in the banking sector, point to continued low levels of such dependencies though a marginal uptrend is noticeable in case of the Banking Stability Index. The banking system's Expected Shortfall (i.e. the estimated loss of assets in the extreme loss region) has also been declining continuously in recent periods implying that the banking system would be resilient even to the extreme systemic losses derived from the model. Stress testing shows resilience for the NBFC sector though reliance on banks for funding could pose risks 21. NBFCs' profitability improved though there was some deterioration in asset quality. Credit risk stress tests indicate that systemically important non deposit taking NBFCs are in a position to withstand severe stress scenarios. The sector, however, remains significantly reliant on the banking sector for its funding. For the year ended March 2011, the rate of growth of NBFCs' borrowings from banks outstripped the rate of growth of credit extended by the NBFCs. Such dependence could pose risks both for banks and for the NBFCs. NBFCs could face funding strains in case of any disturbances in the banking system. During times of stress, NBFCs tend to deleverage very fast which may, in turn, put strain on banks. Insurance and pension sectors act as 'automatic stabilisers' but remain vulnerable to contagion risks 22. Internationally, the insurance and pension segments are believed to contribute to financial stability because of their typically long term-long-only investment style. The Indian insurance sector is well capitalised but significantly exposed to the banking system leaving it vulnerable to contagion risks, as evidenced by an analysis of the 'network' of the Indian financial system. The ability to raise capital and adequate reinsurance capacity in the sector are observed to be important determinants of its continued stability. Regulatory Infrastructure The FSDC framework for oversight of systemic stability is firmly entrenched Transition to Basel III regime... Indian banks start from a position of strength but many challenges lie ahead 24. The Indian banks' current capital base and liquidity position are comfortable, as a starting point, vis-a-vis the Basel III guidelines. Going forward, there will be increased requirements for capital though precise numbers are yet to be arrived at. Empirical studies indicate that the impact of Basel III, through rise in lending spreads, on growth rate will not be significant. The Reserve Bank is in the process of finalising the guidelines for Indian banks under Basel III - the timelines for implementation will be guided by a need to ensure a non-disruptive transition. Convergence with international accounting standards on track, though IFRS 9 remains a moving target 25. A Reserve Bank Working Group is attempting to facilitate a smooth transition to an IFRS converged environment. But challenges remain as IFRS 9 is yet to be finalised; differences persist between the IFRS and current regulatory guidelines on classification and measurement of financial assets; and there are difficulties in the application of fair values for transactions, where not much guidance is available in India in terms of market practices or benchmarks. Payment and Settlement Systems Network of RTGS system stable but intra-day delays in settling payments could lead to increased risks 26. The network of the Real Time Gross Settlement System (RTGS) is stable with a relatively low level of tiering. However, an analysis of the intra-day pattern of settlement of payments in the RTGS System suggests a certain degree of delay in settlement of transactions by the members. This can increase the liquidity risk in the system and can also magnify the impact of an operational event, leading to credit and systemic risks. Such settlement patterns need to be carefully monitored. Counterparty credit risks in OTC derivative trades need to be closely monitored 27. OTC derivative contracts add to the interconnectedness between Indian banks, especially those which are most active in the derivative markets. This poses challenges for counterparty credit risk management as 'wrong-way risks' in such derivative contracts could assume systemic proportions, especially during stress periods. Revised regulatory norms under Basel III and introduction of central counterparty settlement for OTC derivative transactions mitigate such risks but there remains a need to carefully monitor the risks, for example, through holistic stress tests which include stringent scenarios. CCIL resilient... stress testing needs to reckon interconnectedness and systemic risks 28. A series of stress and back testing exercises reveals that the Clearing Corporation of India Limited (CCIL) is reasonably resilient to shocks in different markets. Going forward, CCIL needs to assess its resilience to situations of generalised market failures and to take cognisance of the impact of interconnectedness in financial markets and amongst banks on its risk management framework. Concluding Remarks 29. There are undoubtedly risks, especially global risks, to the stability of the domestic financial system. Some risks have also intensified since the publication of the previous FSR and these will need careful monitoring. Emerging developments in the macro economy and in the financial soundness indicators of the banking system pose some concerns as do the sharp corrections accompanied by high volatility in financial markets. Overall, however, the system remains robust and well equipped to face the headwinds of instability, including those emanating from developments in the global economy. The market participants also remain confident about the stability of the system. 1 The Financial Stability Map and Indicator depicts the overall stability condition in the Indian financial system. The Financial Stability Indicator (FSI) is based on the three major indicators, viz. Macro Stability Indicator (MSI), Financial Markets Stability Indicator (FMSI) and Banking Stability Indicator (BSI), The FSI was derived using a simple average of MSI, FMSI and BSI, each of which are presented in Chapters I, II and III of this Report respectively, The methodologies are presented in the Annex to this Report. |

Page Last Updated on: