IST,

IST,

Report of the Committee to Review the ATM Interchange Fee Structure

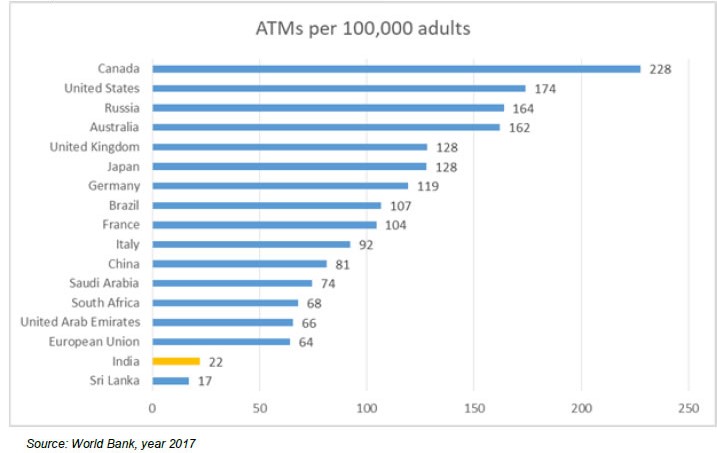

Banks are permitted by Reserve Bank of India (RBI) to set up Automated Teller Machines (ATMs) as extended delivery channels. In year 2012, RBI decided to permit non-bank entities i.e. White Label ATM Operators (WLAOs) to set up, own and operate ATMs in India. The investments in ATMs have been leveraged for delivery of a wide variety of banking services to customers across the banking industry and expanded the scope of banking to anytime, anywhere banking through interoperable platforms provided by the authorised shared ATM Network Operators / Card Payment Network Operators. Usage of ATMs by the public has been growing significantly. However from last 3 years new ATM deployments have been more or less stagnant due to ever increasing cost of operating ATMs and there have been no changes in ATM usage charges and interchange fee. There is persistent demand from the stakeholders to review the ATM charges and interchange. In order to address these, it was announced in the Part ‘B’ of the Second Bi-Monthly Monetary Policy for the year 2019-20 on June 6, 2019 that RBI will constitute a Committee to Review the ATM Interchange Fee Structure with a view to give a fillip to the ATM deployment in the unbanked areas. The Committee was constituted involving all stakeholders, under the chairmanship of the Chief Executive, Indian Banks’ Association (IBA), to examine the entire gamut of ATM charges and fees. Composition and Terms of Reference of the committee is given in Appendix 1. The Committee met several times with the first meeting held on July 17, 2019. Details of Committee meetings held are given in Appendix 2. Presentations and interactions were undertaken with different stakeholders i.e. Banks, WLAOs and managed service operators (Brown Label ATM operators). Presentations were also made by RBI officials conveying the views of RBI on the recent guidelines on ATM related issues including the objectives, security aspects, cost assumptions, etc. The Committee thanks RBI officials for giving their time and valued inputs on recent guidelines issued on ATM security and control measures. The Committee thereafter extensively deliberated all the issues around the cost of operating ATMs, cost impact of recent regulatory guidelines for enhancing ATM security and control measures, changes required in cash management and logistics, interchange fees, ATM usage charges, etc. and have framed the recommendations. It is hoped that the Report will provide inputs for policymakers to address the concerns of banks and WLAOs in specific, and the ATM industry in general. It shall help them to consider the recommendations for reviewing the interchange fees and ATM usage charges, which shall help in making ATM operations viable. This would encourage banks and WLAOs to consider deploying more number of ATMs specifically in semi-urban / rural centers as penetration of digital transactions in semi urban and rural centers is expected to take more time. Govt. / RBI had also set up a committee for Deepening of Digital Payments in the country for strengthening the digital payments. The Committee acknowledges the time spent by Officials of Banks, WLAOs and BLAOs for giving inputs and sharing their views in the said matter. The Committee also acknowledges the time and efforts put in by the Officials of IBA (Mr. K. Ramachandran, Mr. Vikas Srivastava, Ms. Radha Lakshmi S.) and NPCI (Mr. Abhay Parekh, Mr. Anand Iyer) and their valuable contributions for assisting the Committee in completing the assignment. 1.1 ATM is an important channel for customers to access cash anytime and anywhere (any ATM). Ease and ability of withdrawing cash from bank accounts at the time and place of choice / requirement gives confidence to the customer to keep money in the bank accounts thus increasing the money in circulation through formal banking channel. The investments in ATMs have been leveraged for delivery of a wide variety of banking services to customers across the banking industry and expanded the scope of banking to anytime, anywhere banking through interoperable platforms provided by the authorised shared ATM Network Operators / Card Payment Network Operators. 1.2 The usage of ATMs in India by the account holders has gone up considerably over the last decade and half. However, the ATM access in India lags most of the emerging markets and large economies like Russia, Brazil, China, South Africa, US, UK, etc. with only 22 ATMs being available per 100,000 adults in the year 2017. While the overall ATM access in India is low, the ATMs are also unevenly deployed between rural and urban areas. About 69% (2011 census) of population living in rural areas have only 47% of ATMs deployed in semi-urban & rural centers and rest being in metro & urban centers. Thus, there is a huge requirement for ATM deployment in India to make it accessible to masses and make it even more available in semi-urban & rural centers where it is highly underserved. 1.3 The recent regulatory guidelines have impacted the cost of operating ATMs significantly. It is necessary to have safe and secure banking channels including ATMs being one of the main channels for cash transactions. However, Banks and WLAOs need to have a mechanism whereby the incremental cost incurred by them can be recovered over a period of time to ensure viability of operating of ATMs. 1.4 Usage of ATMs by the public has been growing significantly. However, from last 3 years new ATM deployments have been more or less stagnant due to prohibitive costs of operating ATMs making them unviable. There is persistent demand from the stakeholders to review the ATM charges and interchange. 1.5 In order to address these, RBI has constituted a Committee to Review the ATM Interchange Fee Structure involving all stakeholders, under the chairmanship of the Chief Executive, Indian Banks’ Association (IBA), to examine the entire gamut of ATM charges and fees. 1.6 The Committee met on several occasions and had presentations & interactions with different stakeholders i.e. RBI, Banks, WLAOs and managed service operators (Brown Label ATM operators). The Committee extensively deliberated all the issues around the cost of operating ATMs, cost impact of recent regulatory guidelines for enhancing ATM security and control measures, changes required in cash management and logistics, interchange fees, ATM usage charges, etc. and have framed the recommendations. 1.7 There were multiple assumptions by different stakeholders while estimating the average cost of operating ATMs i.e. some included cost of security guard or e-surveillance, while some included certain other assumptions. Average monthly cost of operating an ATM is estimated to be in the range of ₹ 75,000/- to ₹ 80,000/- per ATM, excluding Cassette Swap. The blended estimated cost (financial and non-financial transactions both together in ratio of 75:25) per transaction @ 120 average financial transactions per ATM per day comes in the range of ₹ 15.60 to ₹ 16.70 and @ 130 (avg.fin.txns.) it comes in the range of ₹ 14.50 to ₹ 15.40. This is against the existing blended interchange rate of ₹ 12.50 (₹ 15/- for financial & ₹ 5/- for non-financial). The cost per transaction for WLAOs are higher as their hits per day per ATM are low compared to bank ATMs. The cost of operating ATMs per month may further rise by about 15%, if cassette swap is implemented. 1.8 Summary of the recommendations of the Committee is given below: Given that the cost of operating ATMs has gone up whereas the interchange fees and the cap on customer ATM usage charges has not been reviewed since 2012 and 2008 respectively, the Committee after carefully reviewing various options along with the impact on stakeholders / customers, makes the following recommendations. Further, the Committee also noted with concern the lack of new ATM deployments especially in semi urban and rural centers. 1.8.1 Review of ATM usage charges: 1.8.1.1 Number of mandatory free transaction (inclusive of both financial and non-financial) allowed on other bank and non-bank ATMs –

1.8.1.2 Banks may decide on the number of free transactions for use of own bank ATMs as per appropriate Board approved policy. 1.8.1.3 To increase the upper cap for charging customer for financial transactions, over and above the free transactions allowed, by 20% i.e. from existing cap of ₹ 20/- per transaction to cap of ₹ 24/- per transaction (plus applicable taxes). 1.8.2 Interchange for interoperable domestic ATM transactions 1.8.2.1 To encourage more ATMs to be installed in under penetrated areas which do not have adequate infrastructure for use of alternate payment systems like UPI/ QR CODE/ POS MACHINES/ Online banking a differential Interchange could be considered. 1.8.2.2 For transactions at ATMs in all centres with population of 1 million and above (as per Census 2011 and to be reviewed from time to time) the interchange to be increased by ₹ 2/- i.e. from ₹ 15/- to ₹ 17/- (plus applicable taxes) for financial transactions and from ₹ 5/- to ₹ 7/- (plus applicable taxes) for non-financial transactions. This shall cause an increase of about 16% on a blended basis. 1.8.2.3 For transactions at usage of ATMs in all centers with population of less than 1 million (as per Census 2011 and to be reviewed from time to time) the interchange be increased by ₹ 3/- i.e. from ₹ 15/- to ₹ 18/- (plus applicable taxes) for financial transactions and from ₹ 5/- to ₹ 8/- (plus applicable taxes) for non-financial transactions (restored to the old rate). This shall cause an increase of about 24% on a blended basis. Most of the WLAOs also concentrate in the semi urban and rural areas, and would be encouraged to operate in this space thereby achieving the purpose of increasing ATM penetration in these areas and servicing the customers there.

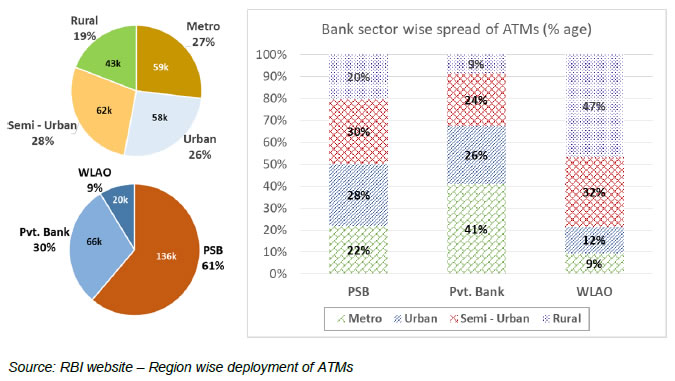

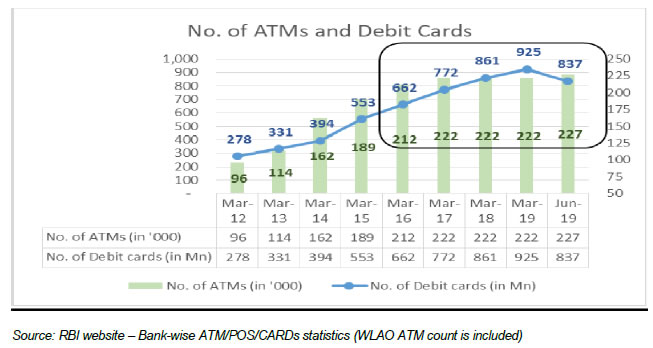

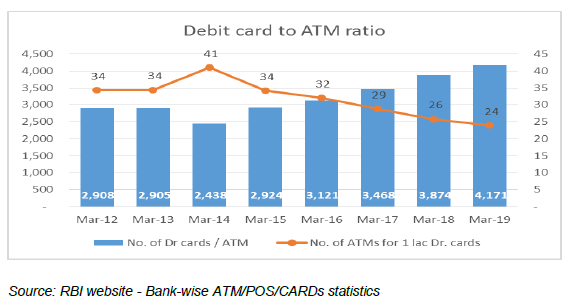

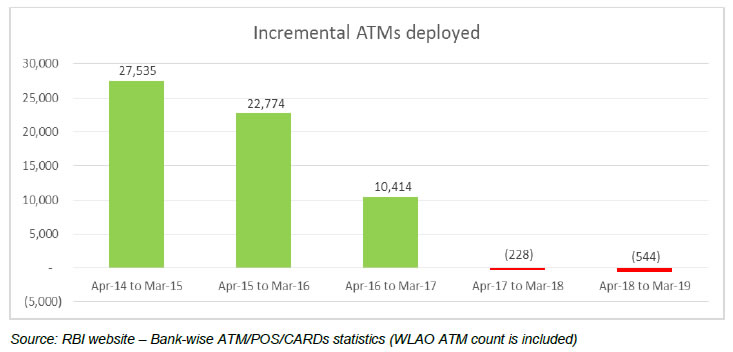

1.8.3 The committee also felt that both the above recommendation i.e. on the interchange and customer ATM usage charges (including free transactions) should be simultaneously implemented so that impact is uniform for all stakeholders while achieving the objective of increased ATM penetration. 1.8.4 The above recommendations have been made without taking into consideration the implementation of the cassette swap (as mentioned elsewhere in the report) which could add another about 15% additional cost. If it is to be implemented, then a commensurate increase in ATM usage charges and ATM interchange should be considered as appropriate. 1.8.5 The Committee also recommends review of interchange and customer ATM usage charges at stipulated intervals to be decided by RBI. 2. Status of ATMs deployed in India 2.1 ATM is an important channel for customers to access cash anytime and anywhere (any ATM). Ease and ability of withdrawing cash from bank accounts at the time and place of choice / requirement gives confidence to the customer to keep money in the bank accounts thus increasing the money in circulation through formal banking channel. 2.2 ATMs are deployed by banks for serving their own customers and also provide services to other banks’ customers as Acquirers where they earn interchange income. WLAOs are given licenses by RBI to primarily set up ATMs in under-served Semi-Urban and Rural areas who depend on interchange fees as the primary revenue source. The ATMs deployment in the country is geographically categorized under Metro, Urban, Semi-Urban and Rural centers. 2.3 Background of ATMs in India 2.3.1 The first ATM in India was set up in 1987 by HSBC in Mumbai. In the following twelve years, about 1500 ATMs were set up in India. In 1997, the Indian Banks' Association (IBA) set up Swadhan, the first network of shared ATMs which allowed interoperable transactions. It was managed by India Switch Company (ISC) for five years (up to 31st Dec.’03), and allowed cardholders to withdraw cash from any ATM in the network. The card holders paid a fee if they did not have an account with the bank that owned the ATM. In 2002, the network connected over 1,000 ATMs of the 53 member banks of the association. Once Swadhan network was non-operational, group of banks formed ATM-sharing networks such as CashTree, etc. 2.3.2 In August 2004, the IDRBT launched National Financial Switch (NFS) to link together the country's ATMs in a single network. The IDRBT then worked towards bringing all major banks in India on board and by December 2009, the network had grown to connect 49,880 ATMs of 37 banks, thereby emerging as the largest network of shared ATMs in the country. 2.3.3 The Reserve Bank of India (RBI) granted authorisation to NPCI to take over the operations of NFS from the IDRBT on an ‘as is where is’ basis in October 2009. NPCI took over the operations of NFS from 14th Dec’09. Over the span of few years, NFS ATM network has grown many folds becoming the leading multilateral ATM network in the country. As on 31st Jul’19, there were 1,140 members (includes 110 Direct members, 966 Sub members, 56 RRBs and 7 WLAOs) using NFS network connected to more than 2.22 Lac ATMs. 2.4 Sector wise – Geographical region wise ATM deployment in India  2.4.1 According to Census 2011, out of the 1.21 billion people, 833 million (69%) live in rural areas while 377 million live in urban areas. Whereas the total ATMs deployed is about 222 K as of March, 2019, 53% of ATMs are in Metro & Urban centers and 47% of ATMs in Semi-Urban & Rural centers. 2.4.2 Public Sector Banks (PSBs) have 61% of total share of ATM deployment, Private Banks (including payment banks, small finance banks and foreign banks) have about 30% ATMs and WLAOs have about 9% ATMs. PSBs have evenly deployed ATMs with 50% of their ATMs in metro/urban centers and 50% ATMs in semi-urban/rural centers. Private Banks have deployed more no. of ATMs in metro/urban centers at 67%, whereas only 33% of ATMs are deployed in semi-urban/rural centers. WLAOs, which have deployed ~20 k ATMs, have majority of their ATMs in semi-urban/rural centers. 2.5 Summary of ATMs deployed year on year and no. of debit cards in force are given below:  2.5.1 The no. of debit cards which was at about 662 Mn. at the end of March, 2016 have increased to about 925 Mn. in March 2019 i.e. increase of about 40% whereas no. of ATMs have grown only by 5% during the period from March, 2016 to March, 2017 and negligible increase since then. 2.5.2 The drop in no. of debit cards in June, 2019 is due to migration of magstripe cards to EMV chip cards and many banks have blocked/closed magstripe only cards. This number is expected to go up again once all the magstripe cards are converted to EMV chip cards and issued to the cardholders. 2.6 Summary of no. of debit cards and credit card financial transactions (Period: Apr-Jun19):

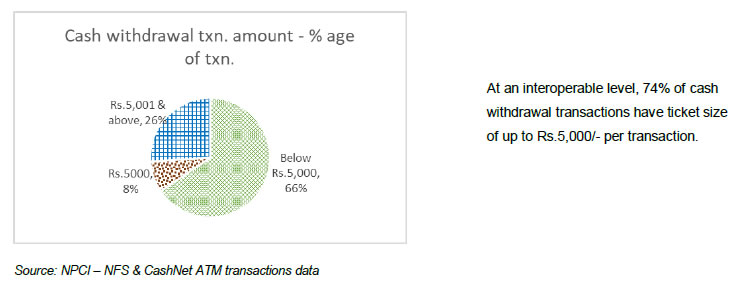

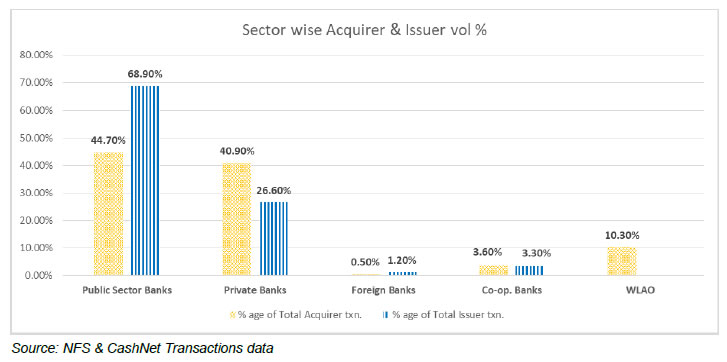

2.6.1 Though PoS / Ecom transactions using debit cards are increasing, 66% of total financial transactions by debit cards continue to be ATM transactions. 2.6.2 On an average 120 to 130 financial transactions are performed at an ATM every day. Total cash withdrawal from ATMs in the country is about ₹ 290,000 Crores every month with average ticket size per cash withdrawal transaction of about ₹3,600/- (Ref: RBI website - Bank-wise ATM/POS/CARDs statistics). 2.7 Domestic Interoperable cash withdrawal transactions - Amount wise slabs Monthly average transactions for 3 months (Period: Apr-Jun19)  2.8 Debit Cards to ATM Ratio  2.8.1 Over the years, while the no. of debit cards is constantly increasing predominantly by PSBs by opening accounts in rural and semi-urban centers using BC network, the growth in no. of ATMs has been particularly low in recent years. There were 2,908 debit cards per ATM in March, 2012 which has increased to 4,171 debit cards per ATM in March, 2019. The high debit card to ATM ratio indicates that there is urgent need for more ATMs in the country. Similarly, for 1 Lac debit cards only 34 ATMs were available in March, 2012, which is now further reduced to only 24 ATMs in March, 2019 (Primarily attributed to the sharp growth in card issued for PMJDY accounts). This emphasizes low ATM coverage to cater to the rapidly growing debit cards issued in the country. 2.9 Summary of ATM access per lac population:  2.9.1 ATM access in India lags most of the emerging markets and large economies like Russia, Brazil, China, South Africa, US, UK, etc. The no. of ATMs per 100,000 adults was 22 in India in year 2017 as per the World Bank data. This is substantially low as compared to China with 81 ATMs, South Africa with 68 ATMs and Brazil & Russia having more than 100 ATMs per 100,000 adults in the same period. 2.10 Summary of no. of incremental ATMs deployed  2.10.1 While the ATM access in India is low, even the new ATM deployment is severely impacted over the recent years due to prohibitive costs of operating ATMs making them unviable. In the last 2 years, the net incremental ATM deployment in the country is negative. 2.11 Summary of Domestic Interoperable ATM transactions a) Acquirer transactions monthly average for 3 months (Apr-Jun19)

b) Issuer transactions monthly average for 3 months (Apr-Jun19)

2.11.1 At an interoperable level, Public Sector Banks acquire 45% of the overall transactions whereas their issuer transactions volume are at 69%. Similarly, the Private Banks acquire 41% of overall transactions and their issuer transactions share is very low at 27%. White Label ATM Operators (WLAOs) acquire 10% of the overall ATM transactions. Co-operative banks and others account for the remaining. 2.11.2 The financial transactions constitute about 79% of overall ATM interoperable transactions, whereas the non-financial transactions (which includes balance inquiry, mini statement, PIN change, etc.) constitute about 21%. Considering ON US transactions, the overall ATM financial and non-financial transactions ratio may be about 75:25. 2.12 Bank sector wise Domestic Interoperable ATM transactions – Acquirer & Issuer (Apr-Jun’19)  2.12.1 The PSBs are mostly net-issuers, whereas the large Private Banks are net-acquirers and WLAOs are only Acquirers. The PSBs remain net Issuers in view of the fact that their rate of ATM deployment lagged behind their rate of debit card issuance. While they have done phenomenal work in acquiring new customers under the Jan Dhan Yojana, however the prohibitive cost of setting up and securing the ATMs have led to virtual stagnation of ATM installation. 3. ATM Usage charges and Interchange 3.1 Summary of customer charges on ATM usage: 3.1.1. ATM Usage charges levied by banks to their customers for usage of own bank and other bank ATMs were not regulated by RBI until the issue of the circular dated 10th Mar’08. 3.1.2. RBI had issued a Draft Approach Paper on Fair Pricing and Enhanced Access of Bank ATMs. As per the Paper, the charges levied by banks for ATM usage were ranging from ‘NIL’ to ₹ 57/- per transaction when their customers use the ATMs of other banks for cash withdrawal and balance inquiry in the country. The charges were dependent on the network relationship between the Bank owning the ATM and the customers’ own Bank. 3.1.3. To establish a fair and transparent framework for levy of service charges for ATMs, such that it would encourage greater financial inclusion and promote enhanced access to ATMs, RBI issued a circular on 10th Mar’08 regulating the customer charges for ATM usage. 3.2 The RBI Circular dated 10th Mar'08 fixed following Customer charges for use of ATMs for cash withdrawal and balance inquiry:

The charge of ₹ 20/- indicated will be all inclusive and no other charges will be levied to the customers under any other head irrespective of the amount of withdrawal. 3.3 IBA Circular dated 22nd Aug’09 (No.CE.RB-1/at/1216) & IBA Circular dated 31st Aug’09 (No.CE.RB-1/atm/1284) on ATM Transactions (with effect from 15th Oct.’09) 3.3.1 The Circular was issued based on the consent received from RBI for capping cash withdrawal from other bank ATMs:

3.4 RBI Circular dated 14th Aug’14 (with effect from 01st Nov.’14) stipulated the free ATM transactions

The ceiling / cap on customer charges of ₹.20/- per transaction (plus service tax, if any) will be applicable. 3.5 In the recent RBI circular dated 14th Aug’19 on usage of ATMs, RBI has stipulated that transactions which fail due to technical reasons shall not be counted as valid ATM transactions for the customer. Consequently, no charges therefor shall be levied. Non-cash withdrawal transactions (such as balance enquiry, cheque book request, payment of taxes, funds transfer, etc.), which constitute ‘on-us’ transactions (i.e., when a card is used at an ATM of the bank which has issued the card) shall also not be part of the number of free ATM transactions. 3.6 Interchange fees levied for interoperable domestic ATM transactions: The interchange fees was reviewed in the Special NFS Steering committee meeting held on 5th July, 2012. As decided in the meeting, the interchange fees were revised with effect from 1st Aug’12 as given below:

Reference: NPCI Circular No. NPCI/NFS/OC No.65/2012-13 dated 14th Jul’12. 4. Recent Regulatory Guidelines 4.1 The recent regulatory guidelines have impacted the cost of operating ATMs significantly. While it is necessary to have safe and secure banking channels and ATMs being one of the main channels for cash transactions, it is also required to understand and appreciate the cost impact of complying with the requirements. Banks and WLAOs should have a mechanism whereby the incremental cost incurred by them can be recovered over a period of time to ensure viability of operating of ATMs. 4.2 List of Regulatory guidelines impacting the cost of operating ATMs and ATM transactions are given below: 4.2.1 RBI circular dated 27th Aug’15 on migration from magnetic strip cards to EMV chip and PIN based transactions Issuing banks were advised to migrate all their magnetic stripe cards to EMV chip and PIN cards by December 31, 2018 4.2.2 RBI circular dated 26th May’16 on enabling EMV chip cards acceptance and processing at ATMs Banks have been advised to ensure that all the existing ATMs (and micro-ATMs) installed / operated by them should be enabled for processing of EMV Chip and PIN cards by 30th September, 2017. However for reasons best known, RBI has not made it mandatory to reject magnetic stripe cards used on the ATM as the cards were to be replaced with EMV Chip cards. 4.2.3 RBI circular dated 6th Apr’18 on cash management activities of the banks Banks shall put in place certain minimum standards in their arrangements with the service providers for cash management related activities. Few of these standards have been given below: 4.2.3.1 Minimum net worth requirement of ₹ 1 billion

4.2.3.2 Should have GPS and monitored live with geo-fencing mapping. Night movement of cash vans should be discouraged 4.2.3.3 Banks are advised to implement it within 90 days of circular. 4.2.4 RBI circular dated 12th Apr’18 on Cassette – Swaps in ATMs It is advised that banks may consider using lockable cassettes in their ATMs which shall be swapped at the time of cash replenishment. Bank shall implement it in a phased manner covering at least one third ATMs every year, such that all ATMs achieve cassette swap by March 31, 2021. 4.2.5 RBI circular dated 20th Jun’18 on Control measures for ATMs Banks and White-Label ATM Operators are advised to initiate action and implement control measures as per prescribed timelines.

4.2.6 Ministry of Home Affairs notification dated 8th Aug’18 Banks and other financial service providers have been advised to consider laying down certain guidelines for standard operating procedures for providing security by the private agencies to cash transportation activities. Few of the guidelines of the said notification is given below: a) Cash van to not carry cash of more than ₹ 5 crores per van b) All ATMs to have one time electronic combination locks c) No cash loading of the ATMs to be carried out - After 9 PM in urban areas, after 6 PM in rural areas and before 9 AM or after 4 PM in the districts notified by the Central Government as Left Wing Extremism (LWE) affected areas d) To use specially designed and fabricated cash van e) The requisite number of trained staff per cash van should be as given below: - Driver – one, armed security guards – two and ATM officer or custodian – two The rules shall come into force on the expiry of 6 months of the publication 4.2.7 RBI circular dated 14th May’19 on Outsourcing of Cash Management – Reconciliation of Transactions

4.2.8 RBI circular dated 14th Jun’19 on Security measures for ATMs

4.3 The impact of all the above regulations on the overall cost of ATM operations is an addition of 25% to 30% and has an impact on the cost of servicing customers and hence it needs to be addressed suitably. 5 Presentations made to the Committee: 5.1 The Committee requested that a presentation be made by RBI officials conveying the views of RBI on the recent RBI guidelines on ATM related issues including the objectives, security aspects, cost assumptions etc. The Dy. Governor was kind enough to agree to the request. 5.2 Details of presentations done by RBI officials are summarized below: Presentation on Security measures in ATMs by Department of Currency Management 5.3 RBI circular dated 12th April, 2018 Banks were advised to consider using lockable cassettes in their ATMs which shall be swapped at the time of cash replenishment. It was advised to be implemented in a phased manner covering at least one third ATMs operated by the banks every year, such that all ATMs achieve cassette swap by March 31, 2021. 5.3.1 Cost of Cassette Swap – Assumptions by RBI

5.3.2 The findings of the Committee on the issue of Cassette Swap: Based on the inputs/feedback received from banks, WLAOs and other stakeholders it is observed that –

5.4 RBI Circular dated June 14, 2019

5.4.1 Cost impact a) Assumption: 40% of ATMs need OTC locks, while the rest already have it and about 10% ATMs are yet to be grouted. Capex cost: Between ₹ 219.36 Cr to ₹ 260.83 Cr - This is considering the cost of OTC lock in the range of ₹ 25,000/- to ₹ 30,000/- installation cost of ₹ 2,000/- per ATM and costing of grouting ATM in the range of ₹ 500/- to ₹ 1,000/- b) Assumption: 90% of ATMs/sites need e-surveillance, while the rest are already covered Opex Cost: Between ₹ 655.12 Cr to ₹ 1,528.60 Cr. - This is considering the cost of implementing CCTV Cameras & Emergency Alarm with QRT shall be in range of ₹ 3,000/- to ₹ 7,000/- per ATM c) While only 10% of ATMs remain to be grouted, the no. of ATMs remaining to be fitted with OTC locks is very high and a lot remains to be done for implementing E-surveillance at all the ATMs. 5.5 RBI officials also made a presentation on following two circulars 5.5.1 RBI circular dated 26th May 2016 on upgradation of ATMs to be EMV compliant and dated 21st June 2018 on Control measures for ATMs.

5.6 Presentations by other stakeholders – Cost of operating ATMs Inputs w.r.t. cost of operating ATMs and their views on ATM usage charges and Interchange were taken from all stakeholders viz. Banks, White Label ATM operators and Brown label ATM operators 5.6.1 Public Sector Banks (PSBs):

5.6.2 Private Banks:

5.6.3 Foreign Banks:

5.6.4 White Label ATM Operators (WLAO):

5.6.5 Brown Label ATM Operators (BLAOs): These are managed service providers which deploy and operate ATMs for banks. They manage about 30% of overall ATMs in the country (excluding WLAO ATMs).

5.7 Summary 5.7.1 There were multiple assumptions by different stakeholders while estimating the average cost of operating ATMs i.e. some including cost of security guard or e- surveillance, while some with certain other assumptions. 5.7.2 Banks should take a call on the need for and number of Security Guards to be deployed, considering e-surveillance being implemented at all the ATMs. Since certain States mandate deployment of security guards at every ATM, based on the inputs received, it is felt that about 30% of ATMs would require Security Guards and thus calculation of cost of operating ATM be arrived at factoring the same. In all other cases e-surveillance has been proposed. 5.7.3 After some normalization, average monthly cost of operating an ATM is estimated to be in the range of ₹ 75,000/- to ₹ 80,000/- per ATM, excluding Cassette Swap. The blended estimated cost (financial and non-financial transactions both together in ratio of 75:25) per transaction @ 120 average financial transactions per ATM per day comes in the range of ₹ 15.60 to ₹ 16.70 and @ 130 (avg.fin.txn.) it comes in the range of ₹ 14.50 to ₹ 15.40. This is against the existing blended interchange rate of ₹ 12.50 (₹ 15/- for financial & ₹ 5/- for non-financial). The cost per transaction for WLAOs is higher as their hits per day per ATM are low compared to bank ATMs. The cost of operating ATMs per month may further rise by about 15%, if cassette swap is implemented. 6 Opportunity for efficiency in ATM operations 6.1 Management of Cash: 6.1.1 For ATM cash replenishment, cash is provided by the banks and cash logistics is handled by the outsourced partners. There is an opportunity to optimize the cash cost for the ATMs by deriving an optimum level of cash required for each ATM based on the historical transaction trends and thereby optimizing the loading for the ATMs. There are chances of imbalance in the cash balances at the ATMs leading to inefficiencies. 6.1.2 Banks can also look at converting their ATMs to Cash Recyclers OR deploy more no. of cash recyclers in locations where cash deposits and cash withdrawals both are equally required and enable Interoperable Cash Deposits (ICD) transactions. 6.1.3 WLAs are authorised by RBI for operating ATMs. Providing access to working capital required for replenishing the cash in ATM at Repo Rates as compared to the current MCLR linked working capital facilities would help them in reducing cost of operating ATMs. In addition retail cash sourcing option from large cash accumulating agencies like Petrol Pumps / super markets may be considered. 6.2 Electricity costs & Connectivity: 6.2.1 Optimizing the monthly electricity bills by switching over to LED lights and timer- controlled lighting in the ATMs. Requirement of air-conditioner at each ATM location can also be re-looked, as the same may not be mandatorily required for the functioning of the ATMs. 6.2.2 Connectivity can be switched from VSAT technology to 4G Modems / CDMA, etc. to reduce cost of maintenance and deliver better availability. 6.2.3 Power (including power sockets) and Telecommunication (Network) cabling carry data or supporting ATM services should be protected from interception or damage. It should be protected from unauthorized access and wire-tapping. 6.3 Security guards: 6.3.1 Physical security guard, wherever not mandatory, can be replaced with e-surveillance system, this can bring cost efficiency in running the ATMs. 6.3.2 It is understood that some region/States mandates deploying of security guards at the ATMs. Doing away with mandatory security guards at all the ATMs across the country where e-surveillance is implemented by banks/WLAOs shall help in reducing cost of operating ATMs in those regions/States. 6.4 Service availability & monitoring: 6.4.1 Real time monitoring of service availability of ATMs and cash out scenarios shall help in raising timely alerts and ensuring high availability of ATMs. This can help increase the ATM footfalls, provide better service to customers and also reduce the per transaction cost. 6.4.2 Monitoring ATM wise customer complaints, transaction failure and suspect transactions at the ATMs shall help in taking preventive measures for reducing customer complaints and cash shortages. 6.5 Reconciliation: 6.5.1 It is important to perform daily reconciliation of ATM transactions considering CBS data, switch data, network files (for interoperable transactions), ATM Electronic Journal (EJ) logs, etc. to have better control over the GLs for ATM transactions. 6.5.2 Cash in ATM reconciliation i.e. tallying physical cash balance at the ATM on the basis of ATM Counters / Cash Balance report (CBR) with ATM GL balance (as per CBS) is important to identify excess cash or shortages at the ATM. Such excess or shortages, as the case may be, must be investigated and appropriate action should be taken immediately. 6.5.3 Failed transactions identified during reconciliation should be proactively reversed to customers account without waiting for customer complaints. This shall also help banks/WLAOs to avoid payment of compensation to customers for delayed credit for failed ATM transactions. 6.6 Innovations and Value Added services on ATMs: Presently, ATMs are mainly seen as a channel for dispensing cash though it can be leveraged for multiple other purposes. More than 900 Mn monthly transactions on ATMs clearly highlights the strong customer acceptance of ATMs across geographies and town classes. With the help of advanced technology, ATMs can be used for additional banking services selectively and can enhance customer experience. 6.6.1 Card-less cash withdrawal at ATMs:

6.6.2 The Nandan Nilekani Committee report on Deeping of Digital Payments has recommended to explore options such as reimagining ATMs as an access point for customer education, awareness, and support. It recommends that features of ATMs should be enhanced merely from cash dispenser to support the gamut of banking facilities including Cash Deposit, Bills Payment, Funds Transfer, Tax Deposits, Mobile Recharge, etc. in addition to customer support and grievance reporting so as to act as a complete Digital facilitation point. 6.6.3 In order to make ATMs further inclusive, ATMs should include user interface support by providing option of more number of local languages in the region of operations. 6.6.4 ATMs can also be used for advertising their financial products such as insurance, mutual funds, loans etc. ATMs could be used to generate leads and capture initial interest of customers, sales fulfilment can happen offline. 7 Conclusion & Recommendations 7.1 ATMs play an important role for customers to access funds in their account anywhere and anytime of the day. This gives them confidence to keep monies in their bank accounts rather than holding cash, as they would have the ability to withdraw cash from ATMs, anytime they need. Now, with many value added services (VAS) being offered through ATMs, it has become like an extension center of a bank branch where customers can fulfil their basic banking needs and also can avail various other services. 7.2 The number of debit cards issued has grown substantially outpacing the growth of ATMs in last 3 years. With more no. of people accessing bank accounts, especially due to various financial inclusion initiatives including PMJDY and DBT transfers, there is an urgent need to have more no. of ATMs, especially in semi-urban and rural centers 7.3 If the increase in no. of ATMs is not commensurate with the increase in no. of debit cards to fulfil basic banking needs of the customers, banks may have high footfalls at the branches. The cost of serving the customer at branch especially for cash transactions is substantially high as compared to per transaction cost at the ATM. Banks should consider the cost saved on Branch OTC transactions and also the cost of setting up of branches, if usage of ATMs and other Alternate channels are not increased. Due to convenience of usage of ATMs the number of withdrawal transactions at ATMs per customer is higher as compared to that at the Branch, hence the comparison of a cost of single ATM transactions with single branch transaction may not be appropriate. 7.4 No. of ATMs in the country over the last 3 years is almost stagnant as operating ATMs have become unviable for banks and WLAOs. The cost of operating ATMs have risen substantially over the last one and half year due to significant investments in implementing EMV, upgrading OS software, anti-skimming devices, etc; and for complying with other regulatory guidelines on ATM security and control measures. The cost shall further increase to comply with recent guidelines on cash management and logistics, and for implementing Cassette Swap. 7.5 Upper cap of ₹ 20/- that bank can levy for ATM cash withdrawal has not been reviewed for over a decade i.e. since March 2008. Number of free transactions allowed were also reviewed last in August 2014 i.e. about 5 years back and have not undergone a change. 7.6 ATM Interchange fees paid by Customer’s Bank (Issuing Bank) to the Bank/WLAO whose ATM is used by the customer (ATM Acquiring Bank/WLAO) has not been reviewed since 1st Aug’12. Interchange has been ₹ 15/- plus applicable taxes for financial transactions and ₹ 5/- plus applicable taxes for non-financial transactions. It is understood that multiple discussions had taken place to review the interchange but no consensus on revision of interchange could be arrived at. However, there is a general consensus amongst the banks that cost of operating ATMs have increased substantially and there is an urgent need to review the ATM usage charges and the interchange for making ATM operations viable. 7.7 Current rate of interchange and cap on ATM usage charges dis-incentivises the Acquirers to invest in deploying new ATMs. Net Issuers prefer paying the existing interchange rather than bearing the cost of operating ATMs which would be much higher, thereby not willing to invest in new ATMs. Possibly, this is the very reason the number of ATMs remains stagnated over the last 3 years and RBI has set up this Committee to examine the entire gamut of ATM charges & fees and to review the ATM interchange fee structure with a view to give a fillip to the ATM deployment in the unbanked areas. The payment of the existing interchange itself is hurting the issuers and any substantial increase in the interchange would hurt them further as explained earlier. 7.8 Recommendations: Given that the cost of operating ATMs has gone up whereas the interchange fees and the cap on customer ATM usage charges has not been reviewed since 2012 and 2008 respectively, the Committee after carefully reviewing various options along with the impact on stakeholders / customers, makes the following recommendations. Further, the Committee also noted with concern the lack of new ATM deployments especially in semi urban and rural centers. 7.8.1 Review of ATM usage charges: 7.8.1.1 Number of mandatory free transaction (inclusive of both financial and non- financial) allowed on other bank and non-bank ATMs –

7.8.1.2 Banks may decide on the number of free transactions for use of own bank ATMs as per appropriate Board approved policy. 7.8.1.3 To increase the upper cap for charging customer for financial transactions, over and above the free transactions allowed, by 20% i.e. from existing cap of ₹ 20/- per transaction to cap of ₹ 24/- per transaction (plus applicable taxes). 7.8.2 Interchange for interoperable domestic ATM transactions 7.8.2.1 To encourage more ATMs to be installed in under penetrated areas which do not have adequate infrastructure for use of alternate payment systems like UPI/ QR CODE/ POS MACHINES/ Online banking a differential Interchange could be considered. 7.8.2.2 For transactions at ATMs in all centers with population of 1 million and above (as per Census 2011 and to be reviewed from time to time) the interchange to be increased by ₹ 2/- i.e. from ₹ 15/- to ₹ 17/- for financial transactions and from ₹ 5/- to ₹ 7/- for non-financial transactions. This shall be an increase of about 16% on a blended basis. 7.8.2.3 For usage of ATMs in all other centers with population of less than 1 million (as per Census 2011 and to be reviewed from time to time) the interchange be increased by ₹ 3/- i.e. from ₹ 15/- to ₹ 18/- for financial transactions and from ₹ 5/- to ₹ 8/- for non-financial transactions (restored to the old rate). This shall be an increase of about 24% on a blended basis. Most of the WLAOs also concentrate in the semi urban and rural areas, and would be encouraged to operate in this space thereby achieving the purpose of increasing ATM penetration in these areas and servicing the customers there.

7.8.3 While the above recommended changes in interchange do not cover the complete cost per transaction, it is felt that given the asymmetry in acquiring and issuing transaction volumes, a via media needs to be arrived at between Issuing banks and Acquiring banks. Hence an ATM interchange increase to cover the full costs of running an ATM is not recommended. Increased transaction volumes are expected to offset the difference in cost per transaction and weighted average interchange recommended. Further, the WLAs also should make effort to increase the number of transactions at their ATMs which will bring unit costs down. 7.8.4 The Committee also felt that both the above recommendations i.e. on the interchange and customer ATM usage charges (including free transactions) should be simultaneously implemented so that impact is uniform for all stakeholders while achieving the objective of increased ATM penetration. 7.8.5 The above recommendations have been made without taking into consideration the implementation of the cassette swap which could add about 15% additional cost. If it is to be implemented, then a commensurate increase in ATM usage charges and ATM interchange should be considered as appropriate. 7.8.6 The Committee requests RBI to consider the above given recommendations favourably and accordingly advise Banks, WLAOs, NPCI & other ATM network Operators and IBA for implementation. 7.8.7 The Committee also recommends review of interchange and customer ATM usage charges at stipulated intervals to be decided by RBI. Appendix 2 – Details of Committee meetings held

Appendix 3 – Cost estimates of operating ATMs by stakeholders A. (i) PSBs (Other than SBI) – Cost estimate of expenses per month per ATM

A. (ii) SBI (all approx. costs per month)

B. Private Banks - Cost estimate of expenses per month per ATM

C. White Label ATM Operators- Cost estimate of expenses per month per ATM

D. Brown Label ATM Operators - Cost estimate of expenses per month per ATM

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

पेज अंतिम अपडेट तारीख: