IST,

IST,

Report of the Survey on Climate Risk and Sustainable Finance

Disclaimer: The views in this report are an outcome of the survey and do not necessarily represent the views of the Reserve Bank of India. *The responses of all the participating banks have been aggregated to ensure their confidentiality.

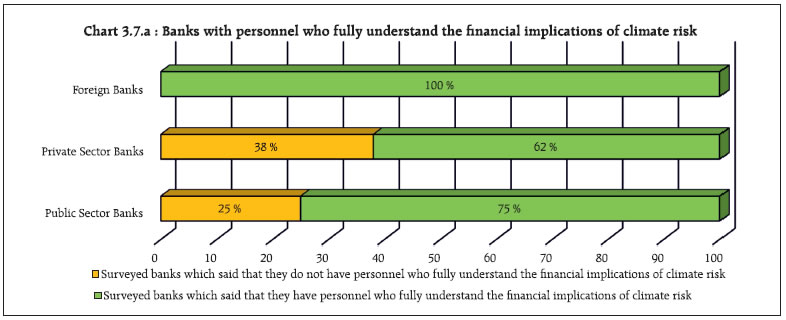

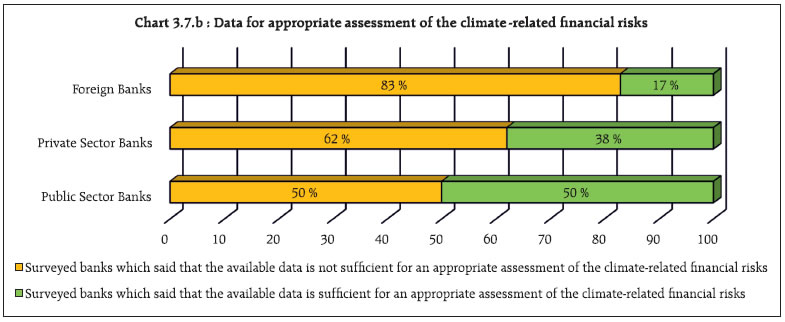

The Sustainable Finance Group in the Department of Regulation, Reserve Bank of India, gratefully acknowledges the support of all the participating banks in submitting the filled-in survey in a timely and comprehensive manner in spite of the disruptions brought about by the COVID-19 pandemic in January 2022. The Sustainable Finance Group (SFG) in the Department of Regulation (DoR), Reserve Bank of India (RBI), carried out a survey1 in January 2022 to assess the status of climate risk and sustainable finance in leading scheduled commercial banks2. The responses indicate that although banks have begun taking steps in the area of climate risk and sustainable finance, there remains a need for concerted effort and further action in this regard. The feedback from the survey will help in shaping the regulatory and supervisory approach of the RBI to climate risk and sustainable finance. Key Observations from the Survey Board-level engagement and responsibility: Board-level engagement on climate risk and sustainable finance is inadequate. In about a third of the banks that were surveyed, responsibility for overseeing initiatives related to climate risk and sustainability was yet to be assigned. Furthermore, only a few banks have included climate risk / sustainability / environmental, social and governance (ESG) related Key Performance Indicators (KPIs) in the performance evaluation of their top management. Strategy: A majority of the banks did not have a separate business unit or vertical for sustainability and ESG-related initiatives. Only a few banks had a strategy for embedding ESG principles in their business, scaling up their sustainable finance portfolio and incorporating climate change risks into their existing risk management framework. Risk management: Almost all the surveyed banks recognized the urgency of the issue, and most of them considered climate-related financial risks to be a material threat to their business. Physical and transition risks were seen as the main sources of climate-related risks3. Some of the banks are not just considering climate and environment-related risks, rather they are also focusing on the social and governance aspects while evaluating credit proposals above a certain amount. A few banks are also attempting to quantify the amount of their loan and investment portfolio that is susceptible to such risks. Transition to low-carbon exposure: Most of the surveyed banks have decided to gradually reduce their exposure to high-carbon emitting/polluting businesses in the coming years. A few banks have either mobilized new capital to scale up green lending and investment or set a target for incremental lending and investment for sustainable finance. Most banks have launched a few loan products to tap the opportunities from climate change. A few banks have also launched green deposits to scale up lending to environment-friendly businesses. Climate-related financial disclosures: A majority of the banks have not aligned their climate-related financial disclosures with any internationally accepted framework. Moving towards a low-carbon environment in banking operations: Most banks have either taken some measures or have plans to decrease the absolute carbon emissions arising from their operations and increase the proportion of renewable energy in their total sourced electricity. A few banks have either announced time-bound plans or plan to come up with a roadmap over the next 12 months to become carbon-neutral. Capacity building and data gaps: Most banks are looking at capacity building to better understand thefinancial implications of climate risk4. Further, most banks felt that the available data was insufficient for an appropriate assessment of climate-related financial risks and the processes and methodologies to measure and monitor climate-related financial risks were also not sufficiently developed. Key Learnings and Suggestions Governance: Banks need to put in place a mechanism at either the Board or top management level for overseeing and scaling up initiatives relating to climate risk and sustainability. They could consider including KPIs on climate risk, sustainability and ESG as a part of the performance evaluation of their top management. Risk management: Banks need to fully grasp the physical, transition and liability risks associated with climate risk and also actively start managing them to make their loan and investment portfoliosmore resilient to such risks5. Further, banks need to develop a strategy for managing climate risk and integrating it into their risk management framework. Climate-related financial disclosures: Banks need to align their climate-related financial disclosureswith an internationally accepted framework6 to improve the comparability and consistency of the disclosures with their counterparts globally. Opportunities from transition to a green future: Banks could consider mobilizing new capital to scale up green lending and investment or set a target for incremental lending and investment for sustainable finance. Human Resources (HR) and capacity building: Banks need to invest significantly in the capacity building of their staff on climate risk, ESG and sustainable finance. Further, banks will require dedicated resources in this area to successfully tap the opportunities arising from climate change, sustainable finance and the growing focus on ESG. Moving towards a low-carbon environment in banking operations: Banks could come out with astrategy to reduce emissions from their own operations7. In line with India’s commitment at the COP26Summit8, banks may also consider working on a timeline to move towards net-zero emissions. 1. Climate risk and sustainable finance has caught the attention of regulators, national authorities and supra-national authorities across the world. The Intergovernmental Panel on Climate Change (IPCC) Report of August 20219 highlighted the changes being observed in the Earth’s climate in every region across the whole climate system. The Report states that emissions of greenhouse gases from human activities are responsible for approximately 1.1°C warming since 1850-1900, and finds that, averaged over the next 20 years, global temperature is expected to reach or exceed 1.5°C warming. Subsequently, the recent Conference of the Parties (COP26) Summit held at Glasgow in November 2021 saw several countries committing to wide-ranging climate action. The recent IPCC Report and the COP26 Summit have, therefore, enhanced the focus on climate change. 2. In order to learn from and contribute to the global effort towards enhancing the role of the financial system to manage risks, and in the broader context of environmentally sustainable development, the RBI joined the Central Banks and Supervisors Network for Greening the Financial System (NGFS)10 as a member in April 2021. Further, the RBI is also represented in the G20 Sustainable Finance Working Group, Financial Stability Board’s Working Group on Climate Risk and Work Stream on Climate-related Disclosures, Task Force on Climate-related Financial Risks set up by the Basel Committee on Banking Supervision (BCBS) and the International Platform on Sustainable Finance. 3. In May 2021, the RBI set up a SFG within its DoR to lead the efforts and regulatory initiatives in the area of climate risk and sustainable finance. The SFG would be instrumental in suggesting strategies and evolving a regulatory framework, including appropriate disclosures, which could be prescribed for banks and other regulated entities (REs) to propagate sustainable practices and mitigate climate-related risks in the Indian context. 4. In order to assess the progress of the regulated entities in managing climate risk, the RBI is coming out with a consultative discussion paper (DP) covering aspects such as (i) governance (ii) strategy (iii) risk management, and (iv) disclosure. Based on feedback from stakeholders and leveraging on the work being done by the NGFS and international standard setting bodies like the BCBS, FSB, etc., RBI would propose appropriate guidelines in this regard. 5. The financial sector11 plays a key role in facilitating the massive reallocation of resources required for the economic transformation. Given the important role played by banks in intermediation and resource allocation across the economy, their strategic decisions would be a key factor in the transition to a sustainable economy. A primary role of the SFG would be to suggest strategies that could be adopted by REs to propagate sustainable practices, mitigate climate-related risks and develop guidelines for the integration of climate risk into their risk management framework. Accordingly, it was decided to conduct a survey among leading banks to understand the prevalent practices and initiatives taken by these banks in the area of climate risk and sustainable finance. 6. The objective of the survey was to assess the approach of these banks, their level of preparedness, etc., with respect to climate risk and sustainable finance. Leading central banks and supervisors in other jurisdictions have also conducted such surveys to fine-tune their regulatory and supervisory approach with respect to climate risk and sustainable finance. In line with these efforts, the SFG conducted a short and focused survey among leading scheduled commercial banks in India. The feedback from this exercise will help in shaping the regulatory and supervisory approach of the RBI to climate risk and sustainable finance. Overview of the Chapters 7. Chapter II of this report focuses on the methodology adopted for the survey. Chapter III discusses the key observations from the survey and Chapter IV looks at the key learnings and suggestions from the survey. Various charts and graphs have been prepared based on the responses of participating banks and are collated in Annex I. The particulars of the banks that participated in the survey, i.e. the number of banks by category, and their total numbers are given in Annex II; the survey questionnaire with an explanatory note is given in Annex III. Coverage of the Survey 1. This chapter discusses the methodology adopted for the survey. In the beginning of January 2022, the survey was sent to 34 scheduled commercial banks comprising public sector banks, private sector banks and foreign banks having a major presence in India. The banks were provided three weeks tofurnish their responses12. The feedback from the survey provides a comprehensive picture of the approach, risk management, level of preparedness, etc., with respect to climate risk and sustainable finance. 2. The survey had 30 questions, covering the following topics:

Barring two questions, all the questions in the survey13 were multiple choice. In 27 of the 30 questions, participants were also asked to elaborate on their chosen response. An explanatory note was provided to assist the participating banks in filling out the questionnaire. Timeliness of the Response 3. All the participating banks need to be complimented for submitting their responses in a timely and comprehensive manner with the approval of their top management in spite of the disruptions on account of the COVID-19 pandemic during January 2022. The questionnaire in the survey was titled ‘Survey by the Reserve Bank of India on Climate Risk and Sustainable Finance’ and covered the following topics.

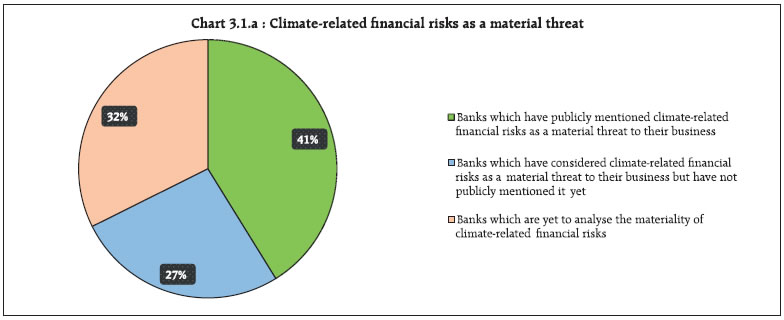

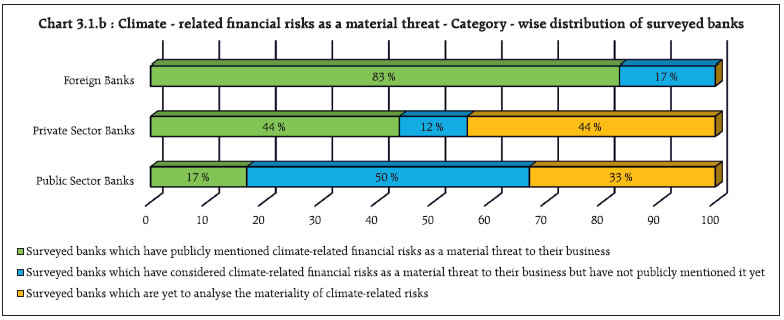

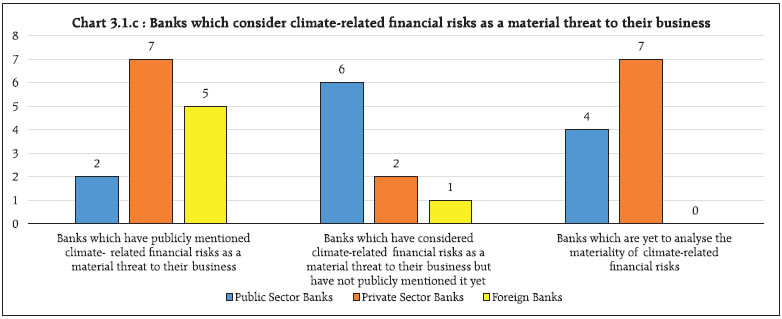

The topic-wise key observations are discussed ahead. Risk Management The economic and financial impact of climate change may give rise to possible losses for banks if the risks are not well managed. Against this backdrop, the questions put to the respondents were designed to gauge the status of climate risk in their current risk management framework. The key observations from a risk management perspective are discussed below. 1. Do you consider climate-related financial risks as a material threat to the bank’s business? Climate-related financial risks are the potential risks that may arise from climate change or from efforts to mitigate climate change, their related impacts, and their economic and financial consequences.14 With regard to this question, the survey showed that:

2. What is/are the source(s) of climate-related risks to the bank? (there could be more than one response) Physical risks, transition risks and liability risks could be the source(s) of climate-related risks to a bank. Physical risks15 refer to the economic costs and financial losses resulting from the increasing severity and frequency of:

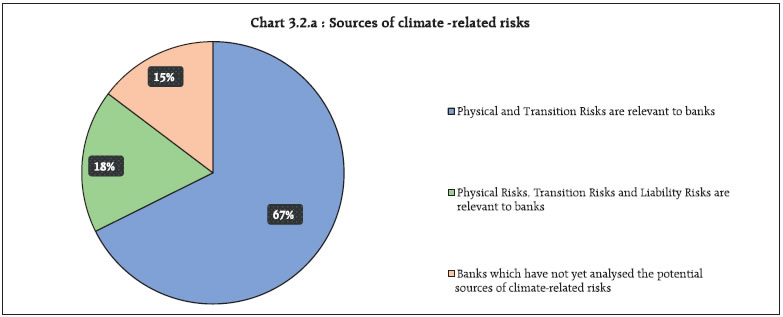

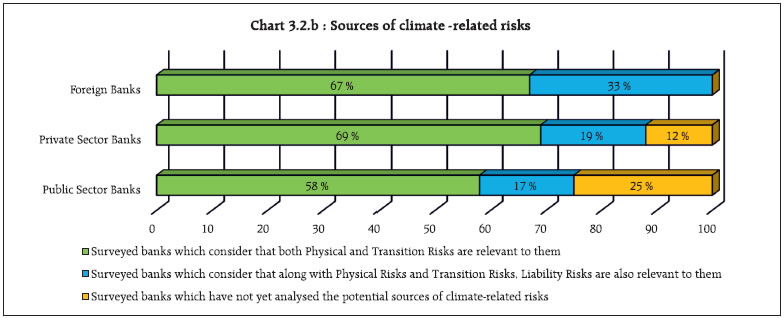

Transition risks are the risks related to the process of adjustment towards a low-carbon economy. Liability risks are the risks arising from people or businesses seeking compensation for losses suffered from physical and transition risks. On being asked what is/are the source(s) of climate-related risks to the banks, the survey showed that:

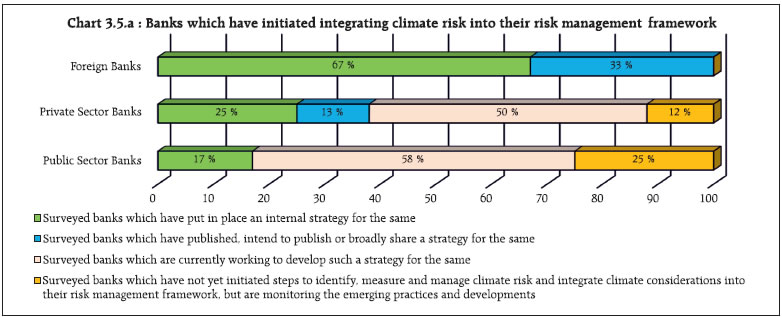

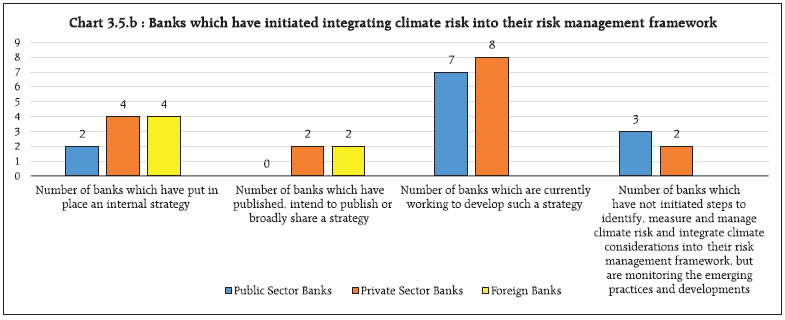

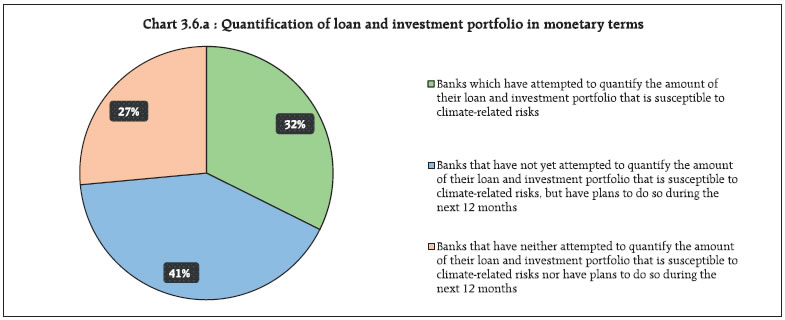

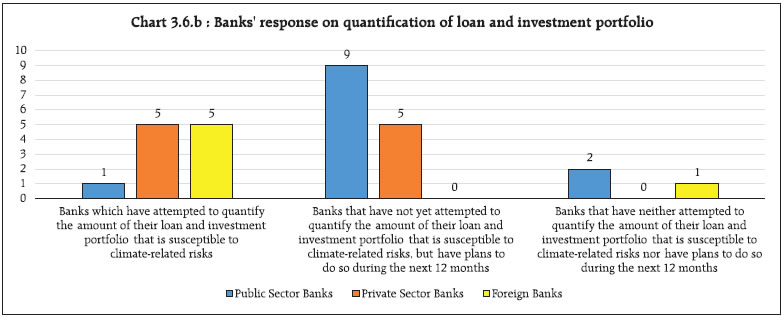

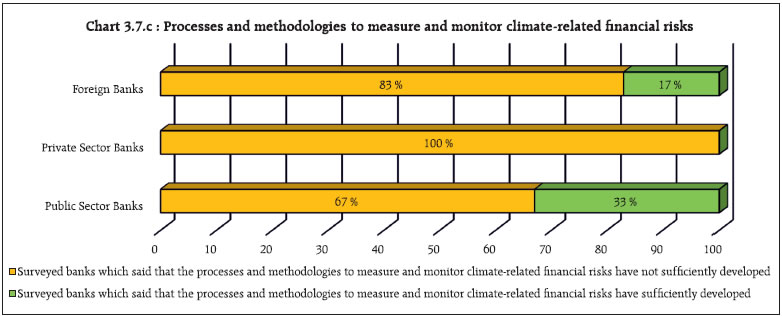

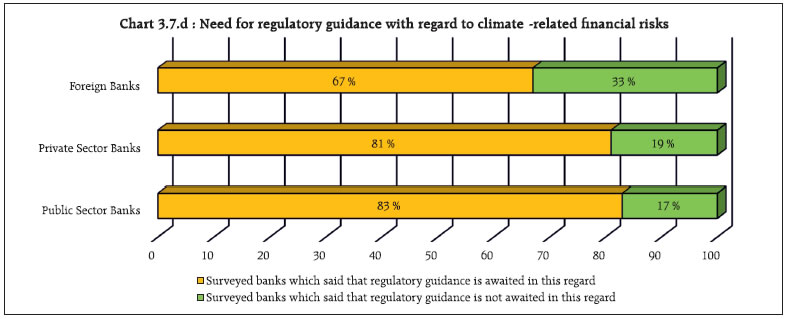

3. How is the bank handling the potential physical and transition risks? Banks’ business models and exposures could increase the severity of climate-related impacts. This is because certain economic sectors will have greater sensitivities to acute climate-related physical risksor to the transition to a low-carbon economy16. In this regard, all the surveyed foreign banks and some of the private sector banks said that they handled potential physical and transition risks by integrating them into their risk management framework. Some of the public sector banks said that they factored the physical and transition risks into their Internal Capital Adequacy Assessment Process (ICAAP), but were yet to integrate climate-related risks into their overall risk management framework.  4. How is the bank handling potential liability risks? Please elaborate. Liability risks might arise when parties are held liable for losses related to environmental damagethat may have been caused by their actions or omissions17. In response to this question, almost all the surveyed foreign banks said that they recognized the potential liability risks arising from climate change into their risk assessment framework. Public sector and private sector banks could also consider factoring in the potential liability risks arising from climate change into their risk assessment framework. 5. Has the bank initiated steps to identify, measure and manage climate risk and integrate climate considerations into its risk management framework? For example, by incorporating ESG/Climate Risk Scores in its credit decisions. Please elaborate. Banks should urgently identify the processes, methodologies and tools they will need to effectively manage climate risk. This entails embedding climate factors into their risk management framework18. Most of the surveyed foreign banks said that they have put in place an internal strategy to integrate climate risk into their risk management framework (Chart 3.5.a). On the other hand, 2 out of 12 public sector banks and 4 out of 16 private sector banks said that they have put in place an internal strategy for managing climate risk and integrating it into their risk management framework (Chart 3.5.b). 6. Has the bank attempted to quantify in monetary terms (i.e. ₹x crore) the amount of its loan and investment portfolio that is susceptible to climate-related risks (separately for physical risks and transition risks)? Please elaborate. In order to address climate-related risks, it is important to quantify the amount of the bank’s loan and investment portfolio that is susceptible to such risks. In this regard, the survey showed that only 1 out of 3 banks have attempted to quantify their loan and investment portfolio that is susceptible to climate-related risks (Chart 3.6.a). Five out of 6 foreign banks, 5 out of 16 private sector banks, and 1 out of 12 public sector banks have attempted to quantify in monetary terms their portfolio which is susceptible to climate-related risks (Chart 3.6.b). 7. What are the main challenges, if any, being faced by the bank with respect to climate-related financial risks? (there could be more than one response) Please elaborate. While addressing climate-related financial risks, banks may face challenges such as availability of skilled human resources, inadequate data, difficulties in measurement of climate risk, etc. In this regard, the observations were:

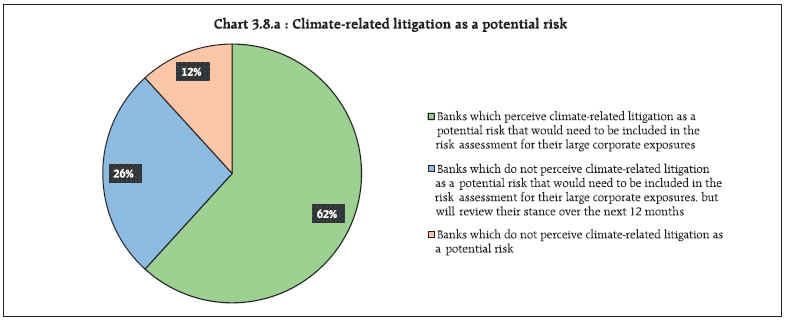

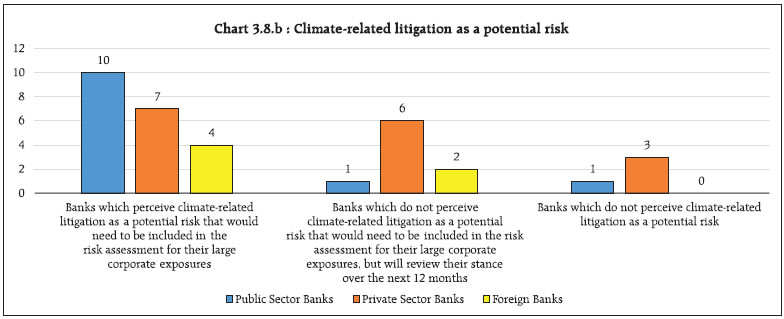

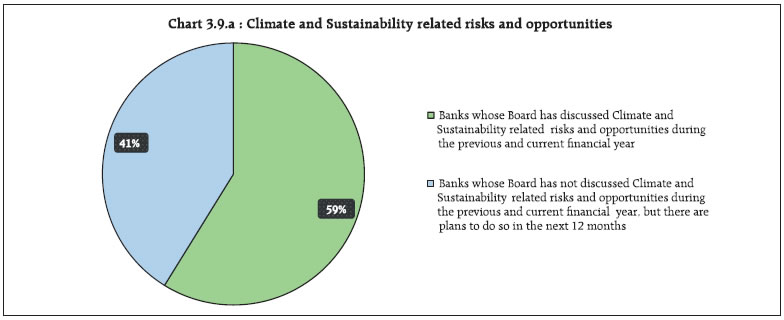

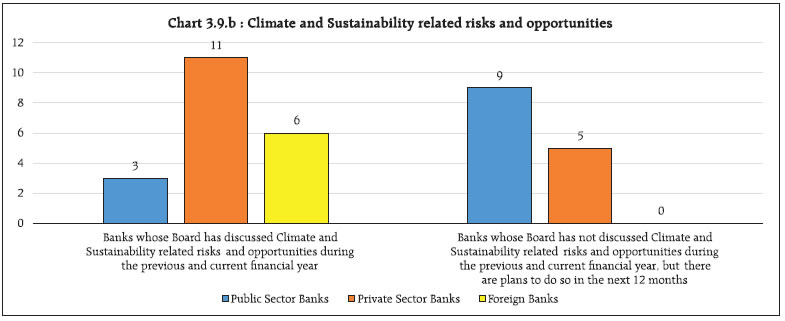

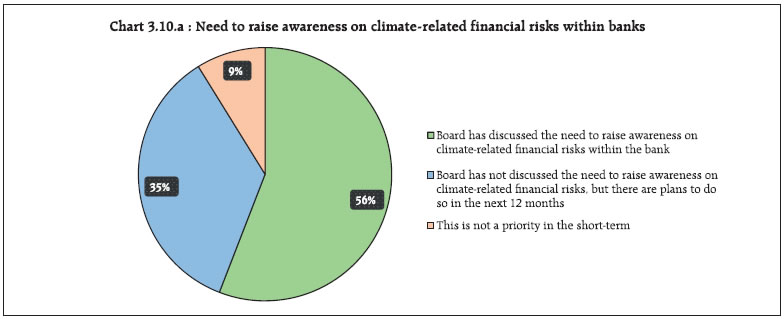

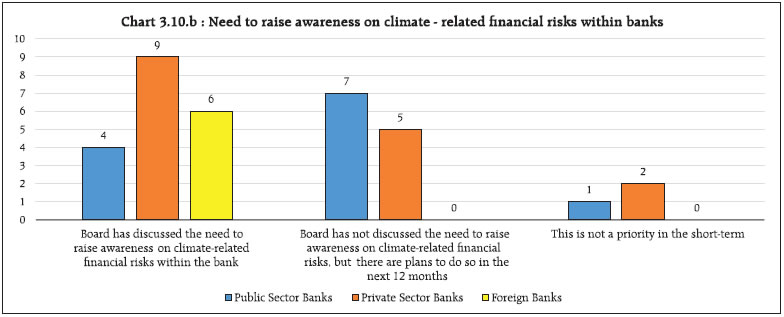

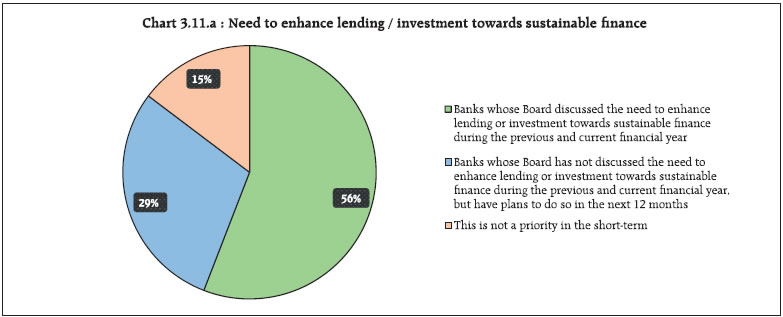

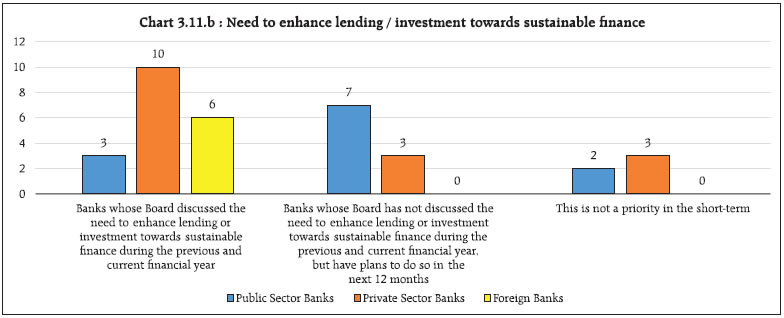

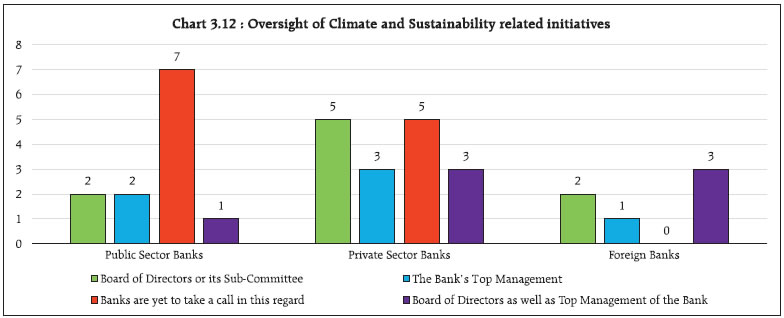

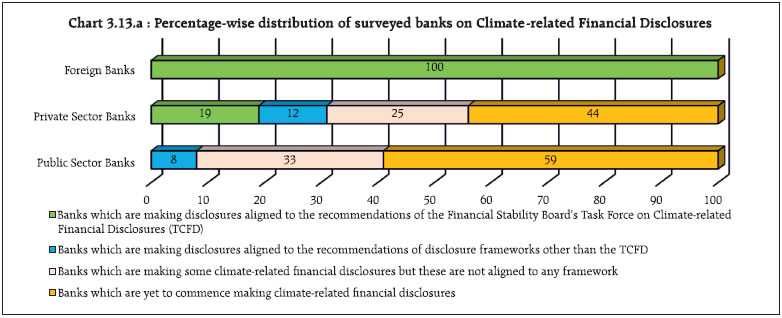

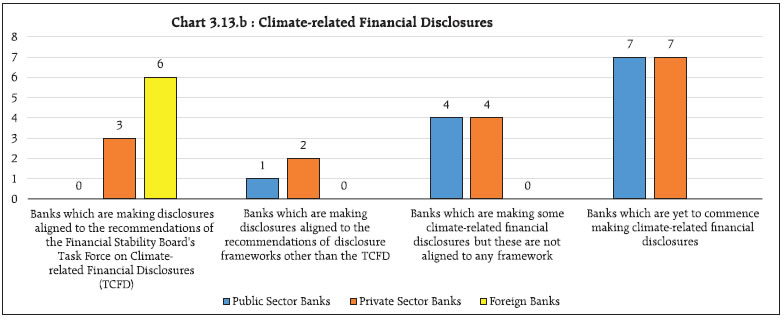

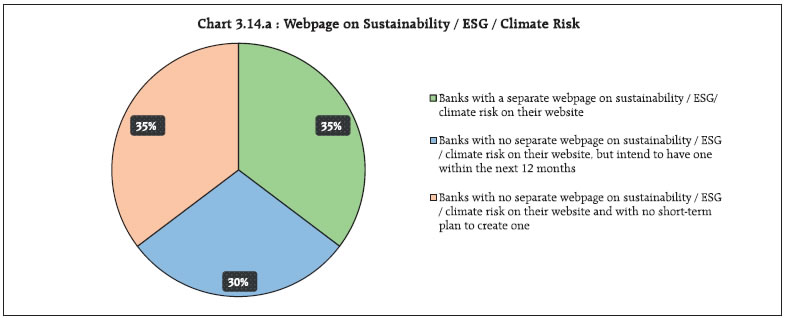

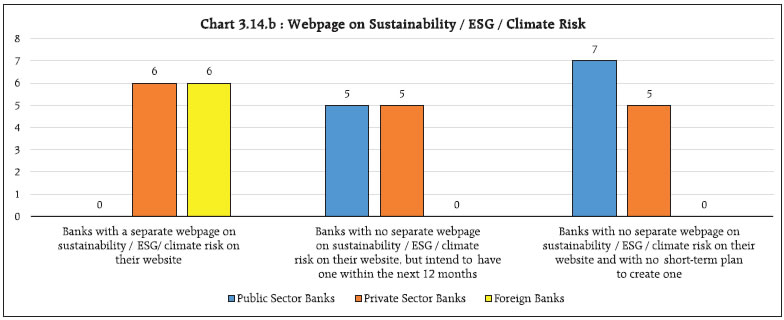

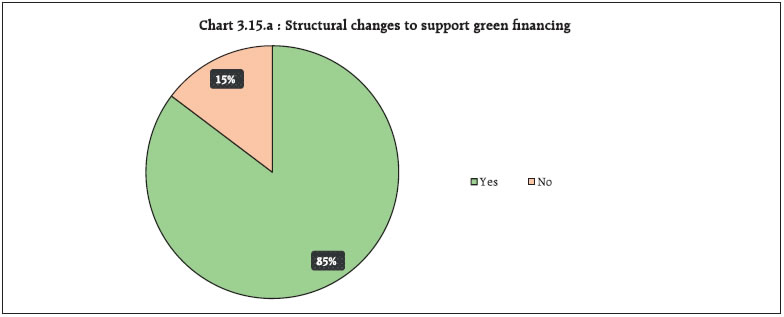

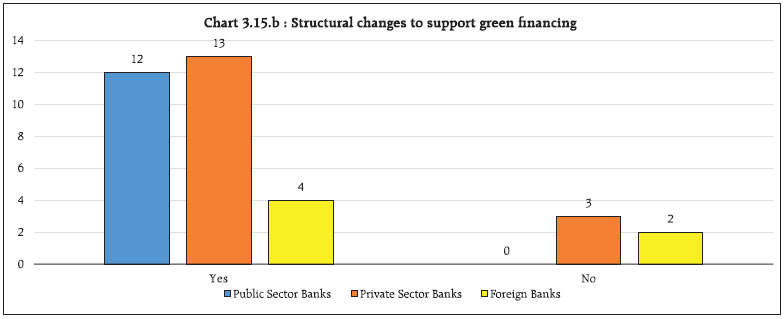

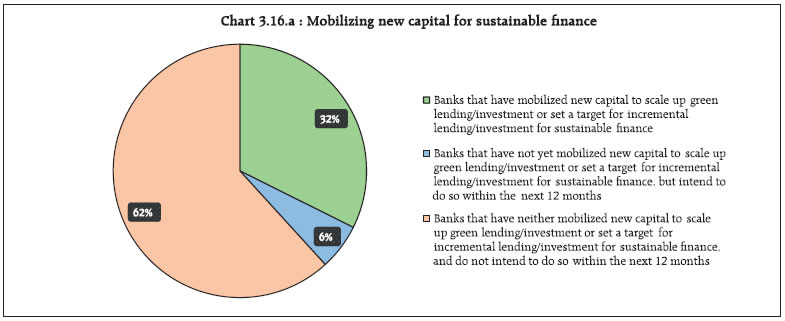

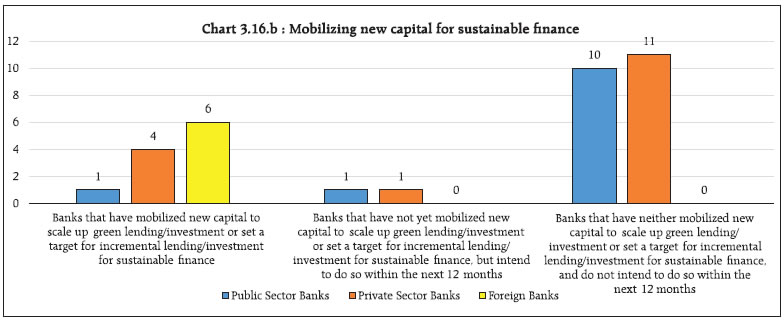

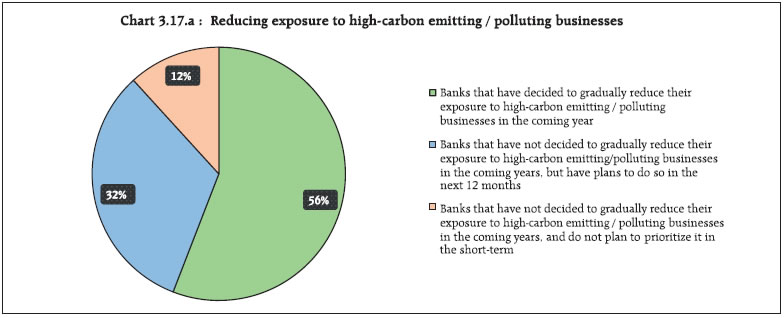

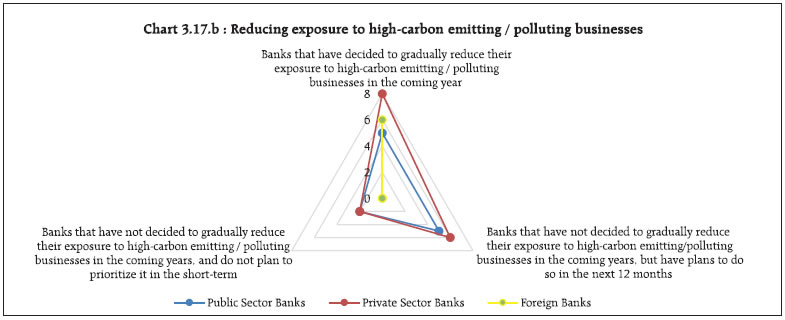

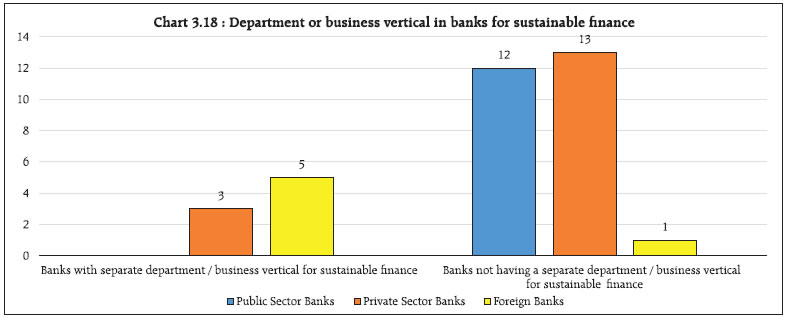

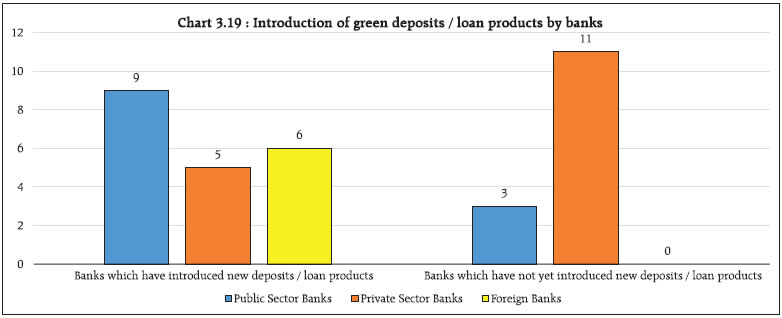

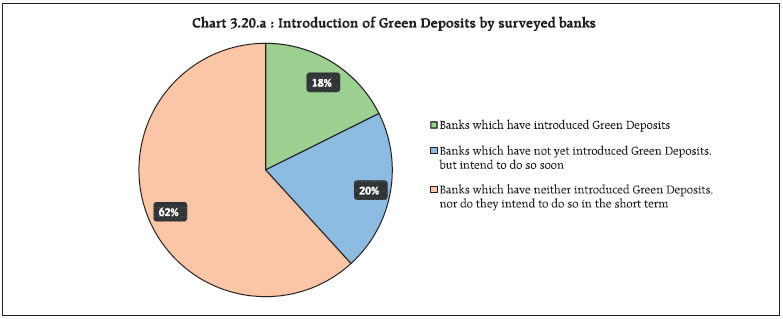

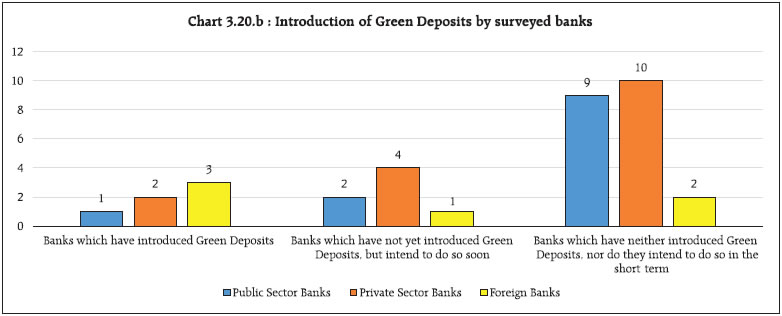

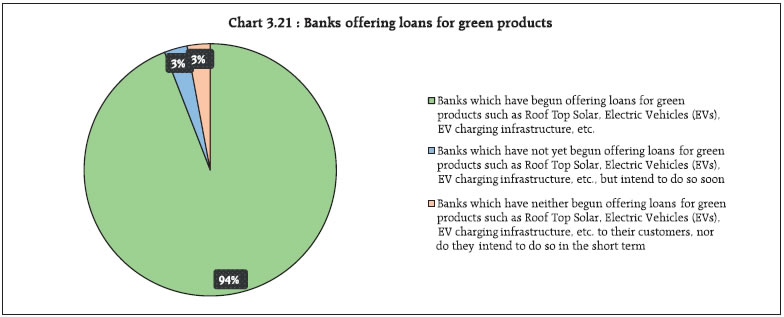

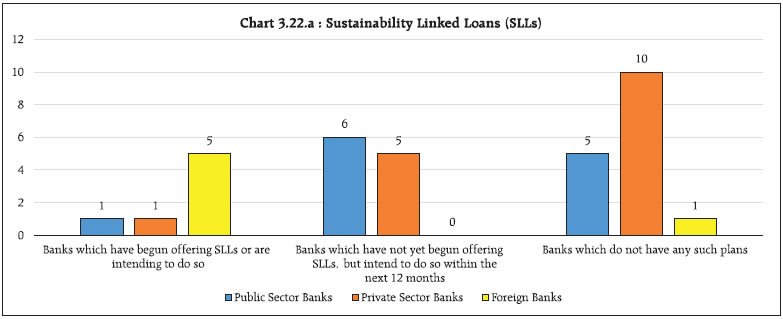

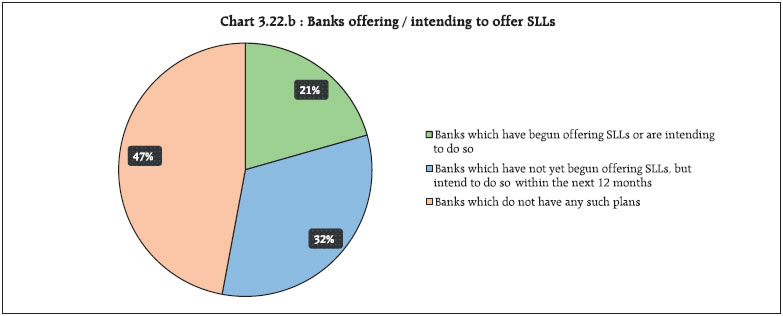

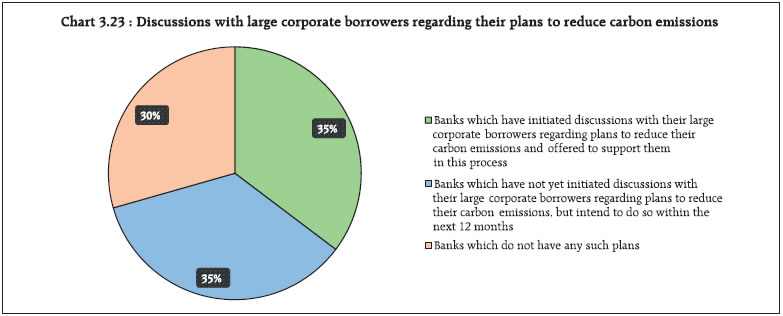

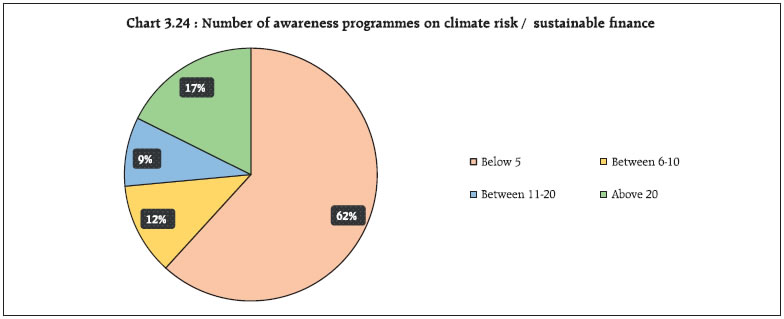

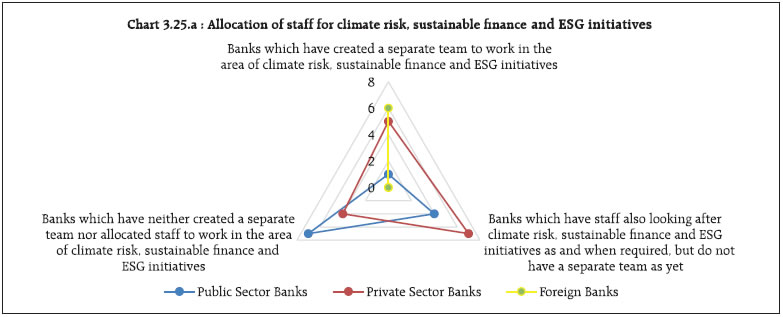

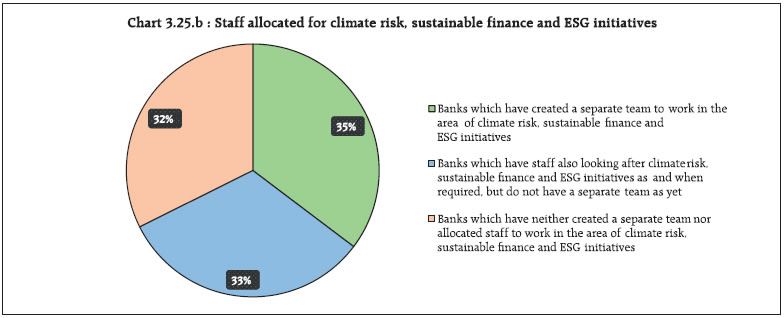

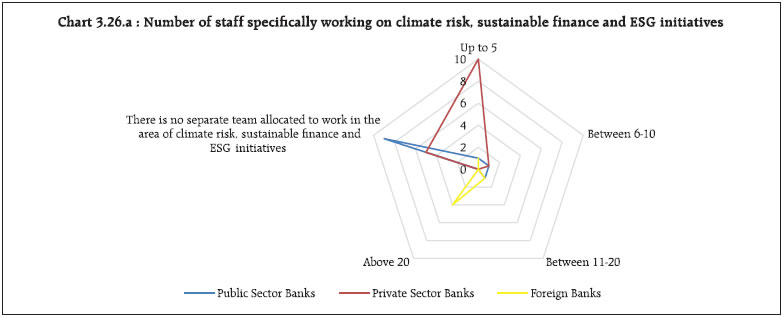

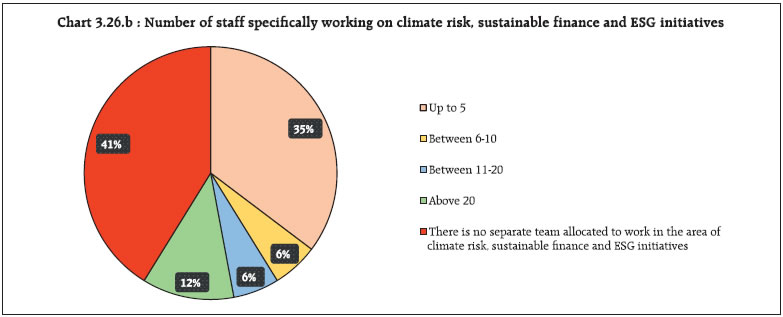

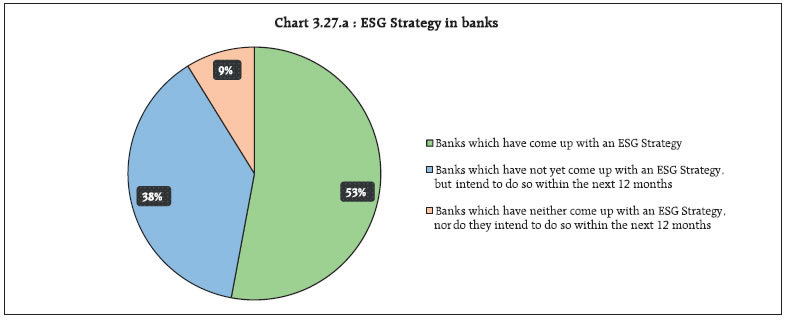

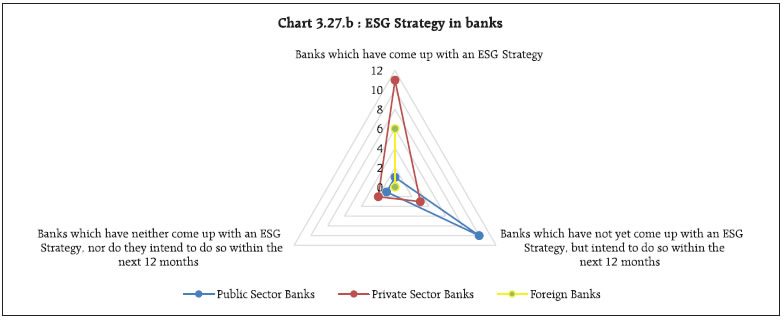

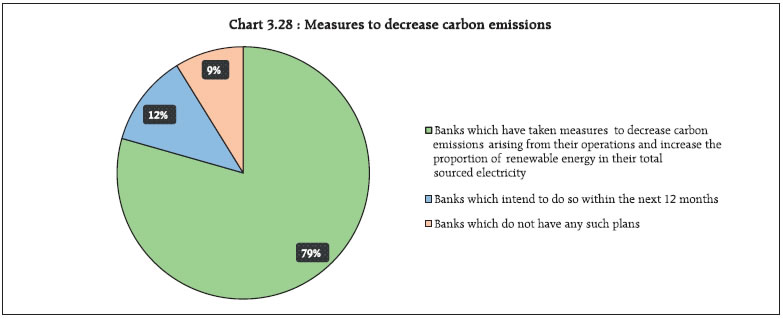

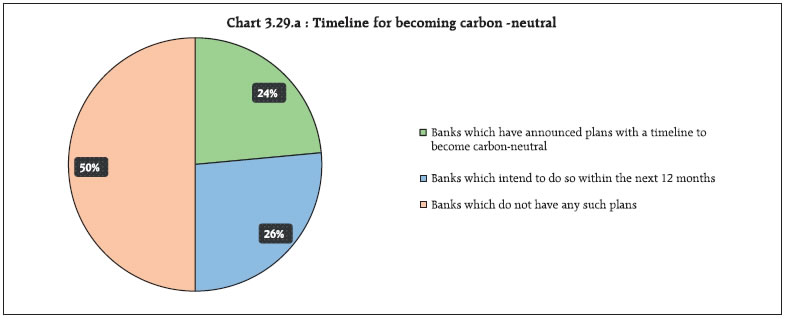

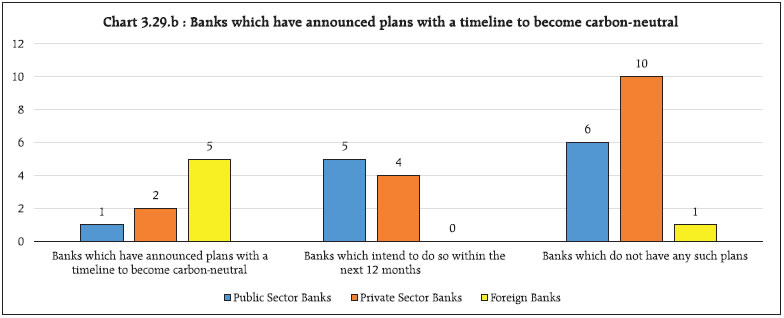

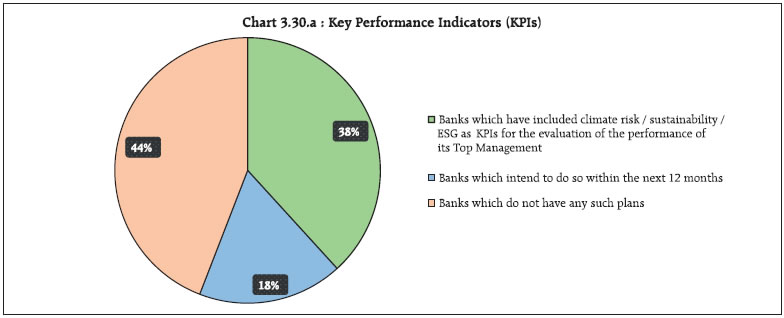

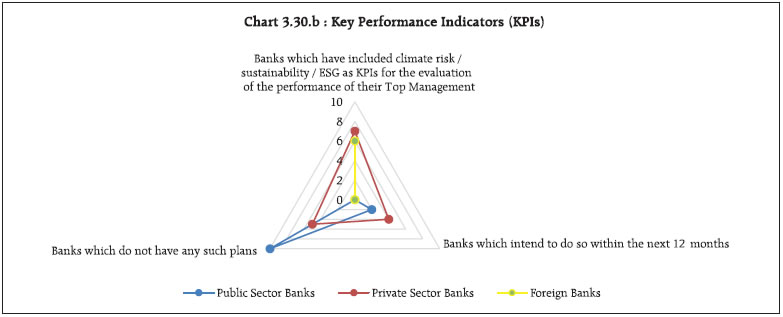

8. Does the bank perceive climate-related litigation as a potential risk that would need to be included in its risk assessment for its large corporate exposures? Please elaborate. Civil society plays an important role in the fight against climate change. One avenue that is increasingly being pursued relates to climate litigation against public and private actors not convincingly supportingthe climate change transition19. In view of the above, banks would also need to factor climate-related litigation as a potential concern in their risk assessment of large corporate exposures. In response to this question, 3 out of the 5 surveyed banks responded in affirmation. One out of 4 banks said that they would review their stance in this regard over the next 12 months (Chart 3.8.a). Ten out of 12 public sector banks, 7 out of 16 private sector banks and 4 out of 6 foreign banks perceived climate-related litigation as a potential risk (Chart 3.8.b). Governance Environmental considerations in governance refer to a set of criteria that play a role in the lending and investment decision-making process or in a company’s operations. Environmental factors consider how an investment or a company contributes to environmental issues such as climate change and sustainability. Governance relates to transparency and legal compliance of an investment or a company’s operations, for instance, in terms of accounting and shareholders’ rights. Key observations from the survey from the perspective of governance are discussed below. 9. Has the bank’s Board discussed climate and sustainability related risks and opportunities during the previous and current financial years? Please elaborate. The survey showed that the Board of Directors in 3 out of 5 banks had discussed risks and opportunities related to climate change and sustainability during the previous and current financial years. This included all the surveyed foreign banks (Chart 3.9.a). The survey also showed that in some of the public sector and a majority of the private sector banks, the Board of Directors had not discussed risks and opportunities related to climate and sustainability either during the previous or current financial years (Chart 3.9.b). 10. Has the bank’s Board discussed the need to raise awareness on climate-related financial risks within the bank? Please elaborate. Among all the respondents, the Board of Directors in about 3 out of 5 banks had discussed the need to raise awareness on climate-related financial risks within the bank, which included all the foreign banks (Chart 3.10.a and 3.10.b). The Board of Directors in 4 out of 12 public sector banks and 9 out of 16 private sector banks discussed the need to raise awareness on climate-related financial risks within the bank (Chart 3.10.b) 11. Has the bank’s Board discussed the need to enhance lending or investing towards sustainable finance during the previous and current financial years? Please elaborate. Climate change would provide opportunities for banks to enhance lending and investment towards sustainable finance. In this regard, the survey showed that the Board of Directors in nearly 3 out of 5 banks had discussed this topic, which included all foreign banks. On the other hand, the Boards of 3 out of 12 public sector banks and 10 out of 16 private sector banks had discussed the need to enhance lending or investment towards sustainable finance during the previous and current financial years (Chart 3.11.a and Chart 3.11.b). 12. Who oversees the climate and sustainability-related initiatives in the bank? Please elaborate. Proper oversight of climate and sustainability-related initiatives is essential in banks to increase the chances of their success. In this context, on being asked who oversees such initiatives in the bank, most public sector banks and some private sector banks said they were yet to take a call in this regard. In all the surveyed foreign banks, the Board of Directors/top management is overseeing these initiatives (Chart 3.12). Climate-related Financial Disclosures Robust climate-related financial disclosures would help provide information needed by stakeholders thereby facilitating effective decision-making. The key observations from the survey in this regard are discussed below. 13. Has the bank commenced making climate-related financial disclosures? Please elaborate. Climate-related financial disclosures by banks would help identify the information needed by investors, lenders and insurance underwriters to appropriately assess and price climate-related risksand opportunities20, and make recommendations for consistent company disclosures that will help thefinancial market participants understand their climate-related risks.21 In this regard, all the surveyed foreign banks have aligned their climate-related financial disclosures with the recommendations of the TCFD framework (Chart 3.13.a). Three out of 16 private sector banks have aligned their climate-related financial disclosures with the recommendations of the TCFD framework. Two private sector banks are making climate-related financial disclosures which are aligned to a framework other than the TCFD framework. (Chart 3.13.b). The survey also showed that public sector banks have not aligned their climate-related financial disclosures with the recommendations of the TCFD framework, although some of them have commenced making such disclosures in a limited manner, but these are not aligned to any framework (Chart 3.13.b). 14. Does the bank have a separate webpage on ‘Sustainability or ESG or Climate Risk’ on its website for single-point dissemination of all its climate-related financial disclosures, ESG and sustainable finance-related initiatives, etc.? Please elaborate. To enable better dissemination of climate-related financial disclosures, ESG and sustainable finance-related initiatives, banks may leverage their websites to reach out to concerned stakeholders. In this regard, 1 in 3 respondents said that they have a separate webpage on ‘Sustainability or ESG or Climate Risk’ on their website (Chart 3.14.a). This included all the surveyed foreign banks. Further, 6 out of 16 private sector banks also had a separate webpage for the same purpose, while the public sector banks did not have one (Chart 3.14.b). Opportunities from Transition to a Green Future Given their dominant role in providing credit in the country, the transition to a green future would provide significant opportunities for banks to grow their business. The key findings from the survey in this regard are discussed below. 15. Would structural changes be needed in the bank’s current lending and investing approach to support green financing? (e.g. evaluation and certification of the green credentials of each project, understanding the corporate road map to achieve net-zero, etc.). Structural changes would be needed in the traditional lending and investment approach to support green financing, including the evaluation and certification of the green credentials of each project, and understanding the corporate road map to achieve net-zero. In this regard, public sector banks and most private sector and foreign banks have indicated the need for structural changes in their lending and investment approach to support green financing (Chart 3.15.a and Chart 3.15.b). 16. Has the bank mobilized new capital for scaling up green lending/investment or set a target for incremental lending/investment for sustainable finance? Please elaborate. Response to climate change would require intensive capital mobilization. Emerging markets need around USD 94.8 trillion to help them transition to a net-zero economy by 2060. India alone would needUSD 17.77 trillion for the above purpose 22. In this regard, 1 out of 3 surveyed banks mentioned that they have mobilized new capital or set a target for incremental lending and investment for sustainable finance (Chart 3.16.a). This includes all the surveyed foreign banks. In contrast, most public and private sector banks said that they are yet to do so (Chart 3.16.b). 17. Has the bank decided to gradually reduce its exposure to high-carbon emitting/polluting businesses in the coming years? Please elaborate. The significant exposure of Indian banks to carbon-intensive sectors exposes them to transition risks23. In this context, most surveyed banks said that they have decided to gradually reduce their exposure to high-carbon emitting/polluting businesses in the coming years. This includes all the surveyed foreign banks, 1 out of 3 public sector and 1 out of 2 private sector banks (Chart 3.17.a and Chart 3.17.b). 18. Does the bank have a dedicated department or business vertical for sustainable finance? Please elaborate. A dedicated department or business vertical would help lead the efforts in scaling up the sustainable finance business in banks. In this regard, 3 out of 4 respondents said that they did not have a separate department/business vertical for sustainable finance. The survey further revealed that almost all the surveyed foreign banks and a few private sector banks had a separate department or business vertical for sustainable finance. In contrast, the public sector banks did not have a separate department or business vertical for sustainable finance (Chart 3.18). 19. Has the bank introduced new deposit and loan products to take advantage of the opportunities arising from climate change by offering green products? Please elaborate. The proceeds from green deposits are deployed to finance environment-friendly businesses such as renewable energy, clean transportation, etc. In this context, 3 out of 5 respondents said that they had introduced green deposit/loan products. Further, 9 out of 12 public sector banks, 5 out of 16private sector banks and all the surveyed foreign banks24 had introduced green deposit/loan products (Chart 3.19). 20. Has the bank introduced green deposits for its customers? Please elaborate. In response to this question, 6 out of the 34 surveyed banks responded in the affirmative. One out of12 public sector banks, 2 out of 16 private sector banks25 and 3 out of 6 foreign banks introduced green deposits for their customers (one foreign bank also introduced green deposits in India) (Chart 3.20.a and Chart 3.20.b). 21. Has the bank begun offering loans for green products such as rooftop solar, electric vehicles (EVs), EV charging infrastructure, etc., to its customers? Please elaborate. Almost all the respondents said they had introduced such products (Chart 3.21). 22. Has the bank begun offering or is intending to look at offering Sustainability Linked Loans (SLLs) to its corporate customers? Please elaborate. In SLLs, the interest rate on the loan is linked to a firm’s achievement of certain sustainability benchmarks to incentivize the borrower to achieve certain sustainability performance objectives.26 In this context, 1 in 5 surveyed banks said that they had begun offering SLLs to their customers (Chart 3.22.b). While 5 out of 6 surveyed foreign banks are offering SLLs, 6 out of 12 public sector banks and 5 out of 16 private sector banks said that they intend to offer SLLs over the next 12 months (Chart 3.22.a) 23. Has the bank initiated discussions with its large corporate borrowers about their plans to reduce their carbon emissions and offered to support them in this process? Please elaborate. Banks would do well to engage with their corporate customers in pursuit of decarbonization and to reduce their financed emissions. In this regard, 1 in 3 banks said that they have initiated discussions with their large corporate borrowers. Further, 5 out of 6 surveyed foreign banks, 7 out of 12 public sector banks and 5 out of 16 private sector banks intend to initiate such discussions within the next 12 months (Chart 3.23). HR and Capacity Building Addressing climate risk in banks would require dedicated human resources and significant investment in capacity building. The findings from the survey in this regard are discussed below. 24. The number of awareness programmes (i.e. classroom, online training programmes and webinars) attended by the bank’s staff on climate risk/sustainable finance during FY 2021-22 so far. Creating awareness on climate risk and sustainable finance would help banks embed climate risk into their operations. In this regard, 3 out of 5 surveyed banks said that they had organized less than five awareness programmes on climate risk or sustainable finance during FY 2021-22 (till December 2021) (Chart 3.24). 25. Has the bank allocated staff to work in the area of climate risk, sustainable finance and ESG-related initiatives? Climate risk, sustainable finance and ESG-related initiatives being multidisciplinary in nature require a separate allocation of staff. One in 3 surveyed banks said that they had allocated staff to work on climate risk, sustainable finance and ESG. This included all the surveyed foreign banks (Chart 3.25.a and Chart 3.25.b). 26. If the answer to Question 25 above is Yes, then please indicate the number of staff specifically allocated to work in the area of climate risk, sustainable finance and ESG-related initiatives? A majority of the foreign banks said that they had a team of over 20 staff for climate risk, sustainable finance and ESG-related initiatives. In contrast, most public sector and some private sector banks were yet to allocate dedicated staff for the same. (Chart 3.26.a and Chart 3.26.b). Green Initiatives (Internal) The key findings with respect to the internal green initiatives of banks are as follows. 27. Does the bank have an ESG strategy or has plans to come out with one (i.e. a strategy for embedding ESG principles into its business)? Banks would do well to develop a robust ESG strategy that is integrated into their overall business strategy to address the risks and also tap the opportunities arising from climate change. Half of the respondents said that they either had an ESG strategy or had plans to come out with one. This included all the surveyed foreign banks. A majority of the private sector banks had a strategy for embedding ESG principles into their business (Chart 3.27.a and Chart 3.27.b). 28. Has the bank taken measures or has plans to decrease the absolute carbon emissions arising from its operations and increase the proportion of renewable energy in its total sourced electricity? Four out of 5 respondents said that they have either taken measures or have plans to decrease the absolute carbon emissions arising from their operations and increase the proportion of renewable energy in their total sourced electricity. This included all the surveyed foreign banks. Some of the public sector and private sector banks are yet to mobilize new capital for scaling up green lending and investment or set a target for incremental lending and investment for sustainable finance (Chart 3.28). 29. Has the bank announced plans, with a timeline, to become carbon-neutral? Becoming carbon-neutral is having or resulting in no net addition of carbon dioxide in the atmosphere. In this context, it means that any carbon dioxide released into the atmosphere from a bank’s activities is balanced by an equivalent amount of carbon dioxide being removed, especially as a result of carbon offsetting. One out of two respondents said that they had either announced time-bound plans to become carbon-neutral or had plan to announce one within the next 12 months. This included almost all foreign banks (Chart 3.29.a). Further, 1 out of 12 public sector banks and 2 out of 16 private sector banks also announced time-bound plans to become carbon-neutral (Chart 3.29.b). 30. Has the bank included ‘climate risks/sustainability/ESG-related’ Key Performance Indicators (KPIs) for the evaluation of its top management? Please elaborate. One out of 3 respondents said that they had included climate risk/sustainability/ESG-related KPIs in the performance evaluation of their top executives (Chart 3.30.a). This included all the surveyed foreign banks and 7 out of 16 private sector banks. None of the public sector banks have included the above KPIs in the performance evaluation of their top management. Further, 2 out of 12 public sector and 4 out of 16 private sector banks intend to do so within the next 12 months (Chart 3.30.b). CHAPTER IV This chapter summarizes the key learnings and suggestions from the survey on climate risk and sustainable finance. These have been listed below under the following topics:

Risk Management 1. A majority of banks consider climate-related financial risks to be a material threat which underscores climate change as an emerging financial risk for them. 2. Some of the surveyed banks have not yet analysed the potential sources of climate-related risks, underscoring the need for building awareness in this regard. 3. Foreign banks have taken the lead by integrating climate-related risks into their overall risk management frameworks. A majority of public and private sector banks also need to take suitable initiatives in this regard to fully grasp the physical and transition risks and actively start managing them, with the aim of making their portfolios more resilient to climate andenvironmental risks27. 4. Foreign banks recognize the potential liability risks arising from climate change. Public and private sector banks also need to factor in such risks into their risk assessment framework. 5. A majority of the surveyed banks have not quantified their portfolio which is susceptible to climate-related risks, underscoring the need to encourage banks to do so. 6. There is a need for capacity building in banks with regard to the financial implications of climate risk and associated aspects. 7. There is a need to scale up data for an appropriate assessment of climate-related financial risks and develop processes and methodologies to measure and monitor the same. Regulatory guidance in this regard has been sought across the board by public sector, private sector and foreign banks28. 8. A majority of the banks perceive climate-related litigation as a potential risk that has to be factored into the risk assessment of their large corporate exposures. Governance 9. In a majority of public and private sector banks, the Board of Directors have not discussed climate and sustainability-related risks and opportunities, underscoring the need for greater attention to this issue at the decision-making level. 10. The Boards of all the surveyed foreign banks discussed the need to raise awareness on climate-related financial risks within their banks. 11. The Boards of all the surveyed foreign banks discussed the need to enhance lending and investment towards sustainable finance. This requires greater attention at the Board level in public sector banks in particular and also in some of the private sector banks. 12. Public and private sector banks could have a mechanism in place at the Board or top management level for overseeing their climate and sustainability-related initiatives and scaling them up. Climate-Related Financial Disclosures 13. Foreign banks have aligned their climate-related financial disclosures with the recommendations of the TCFD framework. Public and private sector banks may consider making their climate-related financial disclosures in line with a widely accepted international framework, to improve the consistency and comparability of such disclosures with their counterparts globally. 14. Banks are beginning to enhance their external communication on sustainability, ESG or climate risk through their websites for single-point information dissemination. All the surveyed foreign banks and some private sector banks had a separate webpage for this purpose. Opportunities from Transition to a Green Future 15. Public sector, private sector and foreign banks have stated that undertaking green financing would require structural changes in their current lending and investing approach. This would help them to better evaluate the green credentials of their potential lending and investment decisions thereby supporting corporate borrowers in their transition to net-zero. 16. All the surveyed foreign banks and select private sector banks have either mobilized new capital to scale up green lending and investment or set a target for incremental lending and investment for sustainable finance. 17. All the surveyed foreign banks are looking to reduce their exposure to high-carbon emitting/ polluting businesses. Public and private sector banks could adopt a gradual and non-disruptive approach to transition away from such businesses, keeping in mind the development imperatives of a growing economy like India. 18. Most of the surveyed foreign banks have a dedicated department or business vertical for sustainable finance to tap the growing business opportunities in this segment. 19. All the surveyed foreign banks have introduced green deposits or loan products to tap opportunities arising from climate change within their overseas markets and selectively in India. Two foreign banks, 1 public sector bank and 3 private sector banks have also introduced green deposits in India. 20. Some of the foreign banks have begun offering SLLs to their corporate customers in India as this product has seen significant growth in other jurisdictions. 21. Foreign banks have initiated discussions with their corporate borrowers on reducing emissions. Public sector and private sector banks could also look at suitable initiatives to help their corporate borrowers transition to net-zero emissions. HR and Capacity Building 22. Foreign banks have been investing significantly in capacity building of staff on climate risk and sustainable finance issues. Public and private sector banks could also scale up their sustainable finance business, integrate climate risks into their risk management framework, incorporate ESG principles in their business, etc. 23. Foreign banks are adequately staffed with dedicated teams working on climate risk, sustainable finance and ESG-related initiatives. Public and private sector banks could do the same so as to better manage climate risk and tap the opportunities arising from sustainable finance and ESG. Green Initiatives (Internal) 24. All the surveyed foreign banks and most private sector banks have developed an ESG strategy. Public sector banks and the remaining private sector banks could do the same. 25. All the surveyed foreign banks and most private sector banks have either taken measures or have plans to decrease the absolute emissions arising from their own operations, increasing the proportion of renewable energy in their total sourced electricity, etc. Public sector banks and the remaining private sector banks could also do the same. 26. In an effort to advance sustainability in their own operations, public and private sector banks could announce definitive plans to reduce greenhouse gas emissions from their own operations—of their buildings, branches and data centres—by taking a suitable year as a baseline and reviewing the progress annually. 27. All the surveyed foreign banks and about half of the private sector banks have included KPIs on climate risk/sustainability/ESG in the performance evaluation of their top management.

1 Taking a cue from the approach adopted by leading central banks and supervisors. 2 The survey covered 34 leading scheduled commercial banks comprising 12 public sector banks, 16 private sector banks and 6 leading foreign banks in India. 3 A majority of the banks perceived climate-related litigation as a potential risk that would need to be included in the risk assessment of their large corporate exposures. 4 Only a few banks had organized more than five in-house awareness programmes on climate risk/sustainable finance during FY 2021-22 (till Q3). 5 For example, by climate-aligning their loan and investment portfolios. 6 For example, the TCFD was set up by the Financial Stability Board (FSB) in December 2015 to develop recommendations on the types of information that companies should disclose to support investors, lenders and insurance underwriters in appropriately assessing and pricing risks related to climate change. In 2017, the TCFD released climate-related financial disclosure recommendations designed to help companies provide better information to support informed capital allocation. The recommendations are structured around four thematic areas that represent core elements of how companies operate: governance, strategy, risk management, and metrics and targets. The recommendations are interrelated and supported by 11 recommended disclosures that build-out the framework with information that should help investors and others understand how reporting organizations think about and assess climate-related risks and opportunities. 7 Banks could decrease emissions from their buildings, branches, data centres, etc., as also their financed emissions (i.e. greenhouse gas emissions associated with a bank’s loans and investments in a reporting year) and review the progress in this regard annually. They could also increase the proportion of renewable energy in their total sourced electricity. 8 The Hon’ble Prime Minister of India, as a part of the National Statement at the COP26 Summit in Glasgow, made the following announcements on November 1, 2021: First, India will reach its non-fossil energy capacity to 500 GW by 2030. Second, India will meet 50 per cent of its energy requirements from renewable energy by 2030. Third, India will reduce the total projected carbon emissions by 1 billion tonnes from now onwards till 2030. Fourth, by 2030, India will reduce the carbon intensity of its economy by less than 45 per cent. Fifth, by the year 2070, India will achieve the target of net zero. Source: https://pib.gov.in/PressReleasePage.aspx?PRID=1768712 9 https://www.ipcc.ch/report/sixth-assessment-report-working-group-i/ and https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr 10 The NGFS is a group of central banks and supervisors willing to share best practices and contribute to the development of environment and climate risk management in the financial sector. The RBI expects to benefit from the membership of NGFS by learning from member central banks and regulators and contributing to the global effort on green finance and the broader context of environmentally sustainable development. Accordingly, the RBI has begun participating in the work streams of the NGFS and would be making use of the NGFS platform to equip its officers with the necessary skills and knowledge on climate-related risks. 11 FSI Briefs No. 16: The Regulatory Response to Climate Risks: Some Challenges authored by Rodrigo Coelho and Fernando Restoy, February 2022 12 The responses of foreign banks include actions taken by them in their overseas operations and in India, wherever applicable. 13 Questions 3 & 4 in the survey. 14 https://www.bis.org/bcbs/publ/d518.pdf 15 https://www.bis.org/bcbs/publ/d518.pdf;Page 5 16 https://www.bis.org/bcbs/publ/d517.pdf;Page 8 17 See Bank of England (September 2015), ‘The impact of climate change on the UK insurance sector’, the three primary lines of argument for establishing liability considered most relevant were: failure to mitigate, failure to adapt and failure to disclose. 18 https://www.mckinsey.com/business-functions/risk-and-resilience/our-insights/banking-imperatives-for-managing-climate-risk 19 NGFS Technical Document on ‘Climate-related litigation: Raising awareness about a growing source of risk’, November 2021 20 https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf 21 https://assets.bbhub.io/company/sites/60/2015/12/12-4-2015-Climate-change-task-force-press-release.pdf 22 https://economictimes.indiatimes.com/industry/renewables/india-needs-17-77-trillion-to-meet-long-term-net-zero-goals-report/articleshow/90670600.cms?from=mdr 23 https://energy.economictimes.indiatimes.com/news/renewable/policy-challenges-will-hinder-indias-net-zero-progress-moodys/90927164 24 Introduced overseas and selectively in India. 25 A private sector bank and a foreign bank have also introduced green deposits on February 22, 2022 and March 15, 2022, respectively, while this survey report was being finalized. 26 https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/LMASustainabilityLinkedLoanPrinciples-270919.pdf 27 Towards an immersive supervisory approach to the management of climate-related and environmental risks in the banking sector’, Keynote speech by Mr Frank Elderson, Member of the Executive Board of the European Central Bank and Vice-Chair of the Supervisory Board of the ECB, at the industry outreach on the thematic review on climate-related and environmental risks, Frankfurt am Main, 18 February 2022. 28 By ensuring that the financial system adequately manages climate-related financial risks, prudential regulation will also contribute to an orderly transition. The main aim of prudential regulation is to ensure the safety and soundness of financial institutions and to safeguard the stability of the financial system. (FSI Briefs No. 16, The regulatory response to climate risks: some challenges, by Rodrigo Coelho and Fernando Restoy, February 2022) |

Page Last Updated on: