IST,

IST,

Report of the Working Group on Import Data Processing and Monitoring System

Chapter 1 1. Introduction The procedure for import trade differs from country to country depending upon the import policy, statutory requirements and customs policies of different countries. In almost all countries of the world, import trade is controlled by the government. The objectives of these controls is ensuring proper use of foreign exchange, protection of indigenous industries etc. In India, the import of goods is governed by the Foreign Trade (Development & Regulation) Act, 1992 and India’s Foreign Trade Policy (FTP). Directorate General of Foreign Trade (DGFT) is the principal governing body entrusted with the responsibility for issuing guidelines on all matters related to Foreign Trade Policy (FTP). Most of the goods are allowed to be freely imported without a special import license whereas certain goods require special permission or licensing for import. Import of Goods and Services into India is being allowed in terms of Section 5 of the Foreign Exchange Management Act 1999 (42 of 1999), read with Notification No. G.S.R. 381(E) dated May 3, 2000 viz. Foreign Exchange Management (Current Account Transaction) Rules, 2000 as amended from time to time. In terms of the extant regulations, remittances against imports should be effected not later than six months from the date of shipment, except in cases where amounts are withheld towards guarantee of performance, etc. AD Category – I banks may permit settlement of import dues delayed due to disputes, financial difficulties, etc. However, interest if any, on such delayed payments, usance bills can be payable only for a period of up to three years from the date of shipment. In case of advance remittance, the good should be imported within a period 3 to 6 months. Recently it has come to our notice that frauds are being perpetrated through imports into India. It has been observed that copies of same Bills of Entry (BoE) were used for multiple remittances using multiple AD banks. In some cases, fake Bill of Entries were used for making outward remittances. Further, a scrutiny report prepared by Department of Banking Supervision has observed that a few entities received large amount of inward remittance as export advance in respect of which they did not submit any evidence of execution of exports. On the other hand, the same entities remitted large sum in the guise of advance payments for imports for which also there was no evidence of actual imports having taken place. Thus, these entities channelized foreign exchange from one country to another country by misusing the Indian banking system and taking advantage of the gaps in the present system of monitoring such outstanding export and import transactions. To some extent, the frauds could be perpetrated due to the absence of any coordinated monitoring mechanism involving various regulatory agencies which were working in a segmented / disjointed manner. The Financial Intelligence Unit, India (FIU-IND) had set up a working group to “Prevent Trade-based Money Laundering”. The working group recommended that an architecture similar to EDPMS should be created for monitoring import transactions including advance payments which could facilitate tracing of any single transaction across various agencies. 1.3 Constitution of Working Group: In order to develop a centralized system for processing and monitoring of import transactions and to overcome shortcomings in the present monitoring system, a working group has been constituted under chairmanship of Shri A.K. Pandey, Chief General Manager of FED, RBI Central Office on August 27, 2015 with the following members: 1. Shri Ajay Shrivastava, ITS, Joint DGFT, Directorate General of Foreign Trade 2. Shri Yogender Singh, IRS, Joint Director ( ICEGATE), Directorate General of Systems, CBEC 3. Shri Rajan Goyal, Director, DITF, DEPR RBI 4. Shri S Gayen, Director, BPSD, DSIM, RBI 5. Shri P.M. Pethe, Foreign Exchange Dealers’ Association of India 6. Shri S V Mhaskar, Foreign Exchange Dealers’ Association of India 7. Shri Jeetesh Bhatia, Director, Citibank N.A. 8. Shri Omesh Puri, DGM, IB- Domestic, State Bank of India 9. Ms. Divya Shetty, Vice President- Trade Finance, HDFC Bank Ltd 10. Shri Pankaj Kumar,GM,FED RBI, Member Secretary Terms and reference of the Working Group The working group was entrusted to look into the following aspects:

The full Group met on three occasions and, in between, the members from RBI and GoI also met separately to arrive at a suitable solution to the problem. The facts observed and tentative solutions were also discussed by the Group with select AD banks in public, private sectors and major foreign banks. The Group acknowledges with gratitude the guidance provided by Shri H.R. Khan, Deputy Governor of RBI and the valuable comments by Shri Chandan Sinha, Executive Director of RBI during the course of the Group’s deliberations. The Group has greatly benefitted by the suggestions received from the FED ROs. Special thanks are due and recorded for Ms Vandana Khare, General Manager, FED, New Delhi and her team for hosting two meetings of the full Group at RBI, New Delhi. The Group also acknowledges the co-operation received from select banks / DGCIS which made invaluable contribution in the deliberations by facilitating clear understanding of issues and processes.The Group also acknowledges the superlative effort of Shri Vivek Kumar, AGM, RBI; Shri Yogender Singh, Joint Director (ICEGATE) and Shri Vijay Gupta, VP, NSDL (SEZ, MOC&I) for successful dissemination of understanding the present position with respect to import reporting and for putting up before the Group various viable and implementable proposals.The group acknowledges the contributions by other members of the RBI team particularly Smt. Anita Mehta, AGM, Ms Sakshi Parihar, Manager, Shri V M Arote and Miss Nighojkar, Ruchita, Assistants for their untiring effort and support to the Group in the various stages of process. Import documentation /reporting/ follow-up: Current procedure 2.1 Procedure Importers have to follow various procedure/formalities before engaging in EXIM activities. They are required to register with the DGFT to obtain an Importer Exporter Code Number (IEC) issued against their Permanent Account Number (PAN). Importer is required to enter in an agreement with overseas exporter, placing an order for import of goods, opening letter of credit etc. Once goods enter the country, they have to follow the Custom formalities for clearance of goods to close the transactions as explained below. 2.1.1 Customs Formalities and Clearing of Goods: Upon arrival of shipment and after receiving the documents of title of the goods, the importer has to take delivery of the goods, to bring them to his place of business. Unless the following mentioned formalities are complied with, the goods lie in the custody of the Custom House. (a) Obtain endorsement for delivery or delivery order: When the ship carrying the goods arrives at the port, the importer, first of all, has to obtain the endorsement on the back of the bill of lading by the shipping company. Sometimes the shipping company, instead of endorsing the bill in his favour, issues a delivery order to him. This endorsement of delivery order will entitle the importer to take delivery of the goods. The shipping company makes this endorsement or issues the delivery order only after the payment of freight. If the exporter has not paid the freight, i.e., when the bill of lading is marked freight forward, the importer has to pay the freight in order to get green signal for the delivery of goods. (b) Pay Dock dues and obtain Port Trust Dues Receipts: The importer has to submit two copies of a form known as ‘Application to import’ duly filled in to the ‘Lading and Shipping Dues Office’. This office levies a charge on all imported goods for services rendered by the Dock authorities in connection with lading of goods. After paying the necessary charges, the importer receives back one copy of the application to import as a receipt ‘Port Trust Dues Receipt’. (c) Bill of Entry: The importer will then fill in a form called Bill of Entry. This is a form prescribed by the customs and is filed electronically. The bill of entry contains particulars regarding the name and address of the importer, the name of the ship, number of packages, marks, quantity, value, description of goods, the name of the country wherefrom goods have been imported and custom duty payable. 2.1.2 Making the Payment: The mode and time of making payment is determined according to the terms and conditions as agreed earlier between the importer and the exporter. In case of a D/P bill, the documents of title are released to the importer only on the payment of the bill in full. If the bill is a D/A bill, the documents of title of the goods are released to the importer on his acceptance of the bill. The bill is retained by the banker till the date of maturity. Usually, 90 to 180 days are allowed to the importer for making the payment of such bills. 2.1.3 Closing the Transactions: The last step in the import trade procedure is closing the transaction. If the goods are to the satisfaction of the importer, the transaction is closed. But if he is not satisfied with the quality of goods or if there is any shortage, he will write to the exporter and settle the matter. In case the goods have been damaged in transit, he will claim compensation from the insurance company. The insurance company will pay him the compensation under advice to the exporter. 2.2 Existing Reporting/Follow up system: Under FEMA 1999, RBI guides the payment mechanism for import through authorized dealers. Rules and regulations to be followed by the AD Category – I banks from the foreign exchange angle while undertaking import payment transactions on behalf of their clients are set out below.

Chapter 3 3.1 In the above backdrop, the Group was convinced that it was imperative to design and implement a robust and foolproof procedure to ensure that (i) all import documents reach the banking channel for settlement against payment made and (ii) a vigorous and effective follow up procedure for monitoring the closure of import transactions i.e. payment as well as BOE is in place. While doing so, the Group identified few limitations in the existing system and deliberated upon the vital facts to be taken into account and the principles forming the basis of the proposed solution. 3.2 Limitations of the present system

Goods are imported in a country by Domestic traffic area (DTA) units and SEZ units. The imported goods are being cleared by customs officials for DTA units and development commissioner of SEZ for SEZ units. Data capturing system at Customs/SEZ I. Customs- Major Ports of customs are Electronic Data Interchange (EDI) ports which are centrally connected with their centralised server. Around 98 percent of import transactions in terms of volume are processed at EDI-enabled ports and 2 percent of import transaction are processed at Non-EDI ports (manual ports). But in terms of value, manual port constituted around 35 percent of imports whereas EDI ports constituted 65 percent.

II. SEZ- Imports by the units in SEZ are being done through the various ports but assessed/ cleared/ certified by the Development Commissioner’s (DC’s) office in the SEZ. Data on import by SEZ units will directly flow from the “SEZ Online System” implemented by the NSDL Database Management Limited (NDML) to the new RBI server electronically as all the ports of SEZ are EDI –enabled and centrally connected with their centralised server. A comprehensive centralised IT-system called Export Data Processing and Monitoring System (EDPMS) is in place through which export transactions are being monitored at each stage right from the shipment stage till realisation of export proceeds. The system facilitates effective monitoring, tracking and follow-up of export transactions and has also resulted in efficiency gains by largely reducing paper based reporting requirements and eliminating several redundant returns. As in the case of exports, Customs is the initial touch point for imports. Through EDPMS, an interface is established with the Customs database as regards export transactions. There is a need to expand this interface to include the import transactions also. A technologically supported interface will help in effective monitoring of export and import transactions separately at each stage for the benefit of all the stakeholders on real time basis. It could also be used to monitor transactions undertaken by any entity (based on IE Code) including the outstanding transactions. Chapter 4 In case of import monitoring system, the focus of the regulator should be on proper use of country’s foreign exchange. There is a dire need for a monitoring system capable of ensuring that goods of equivalent value are imported against forex remittances made abroad. The proposed system should be able to (a) monitor outstanding payment for which imports are not received and (b) outstanding import transactions for which payments are not effected. 4.1 The features of the new system (Import Data Processing & Monitoring System) are as follows:

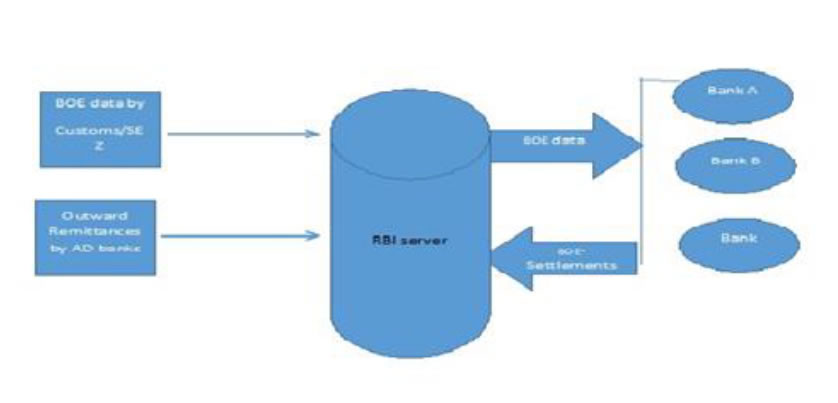

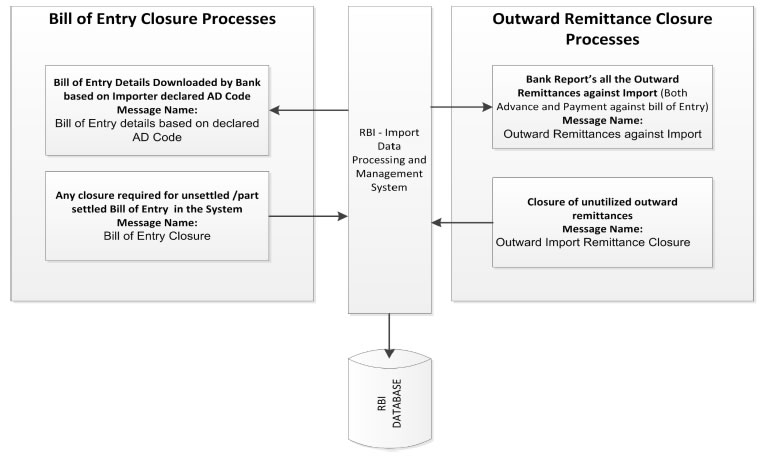

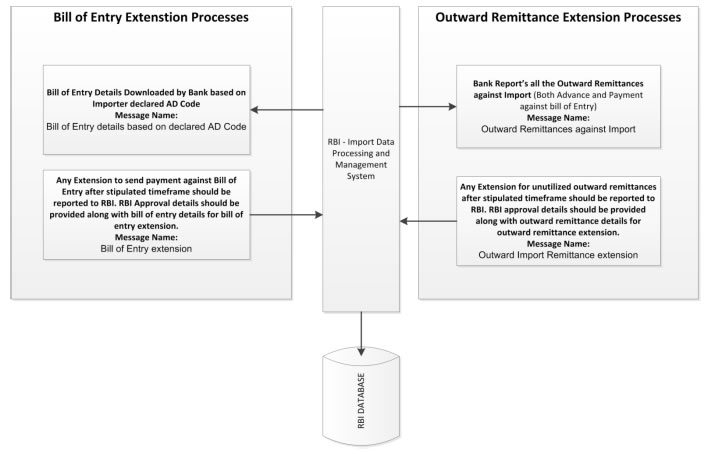

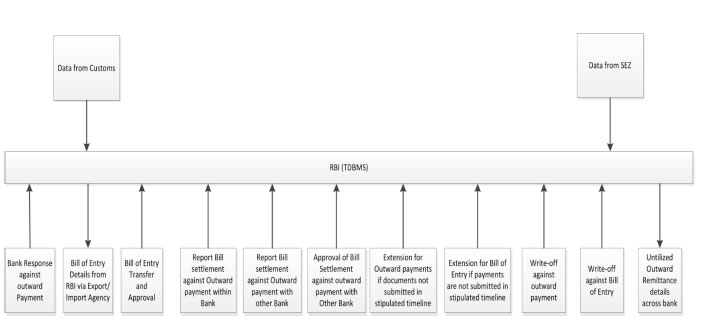

4.2 Work-flow of System 4.2.1 Data Flow  4.2.2 Process flow  4.3 To make the system effective and fool proof, there are some operational issues which need to be addressed before roll out:

Data dissemination to / from ADs and follow-up procedure proposed is as follows:-

4.5 Benefits of the proposed System The benefits of the new system would be as follows:

CHAPTER – 5 Conclusions and Recommendations A. CONCLUSIONS: On a detailed review of the regulatory prescriptions, the challenges faced in the existing system, the volume of transactions, data capture at manual ports, the multiple agencies involved, magnitude of monitoring requirements and the state of technology, the Group has come to the following conclusions:

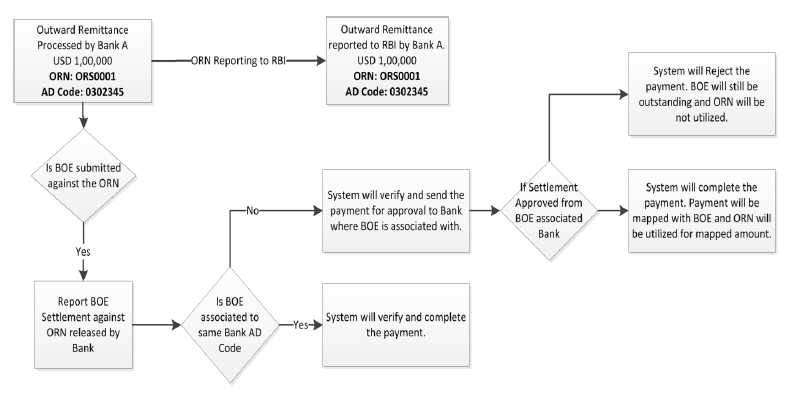

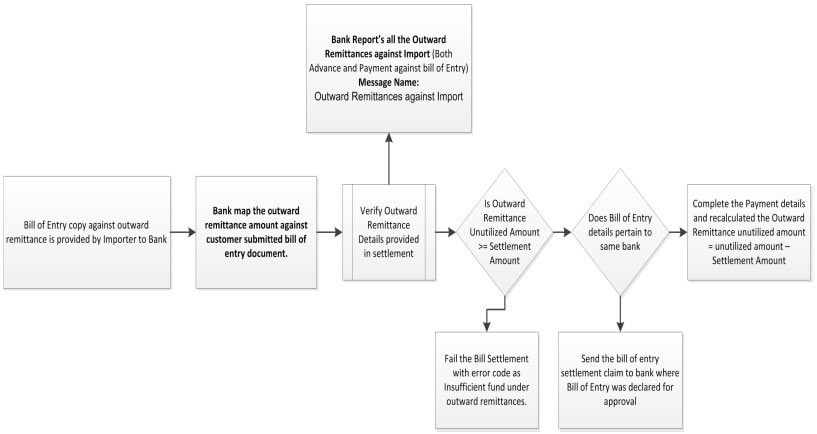

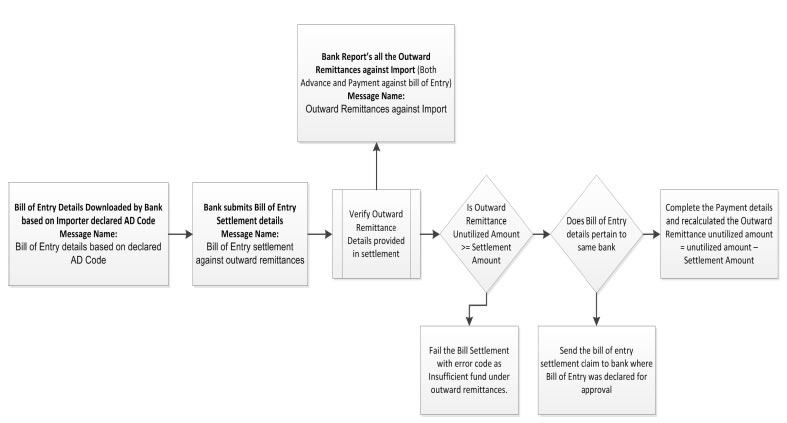

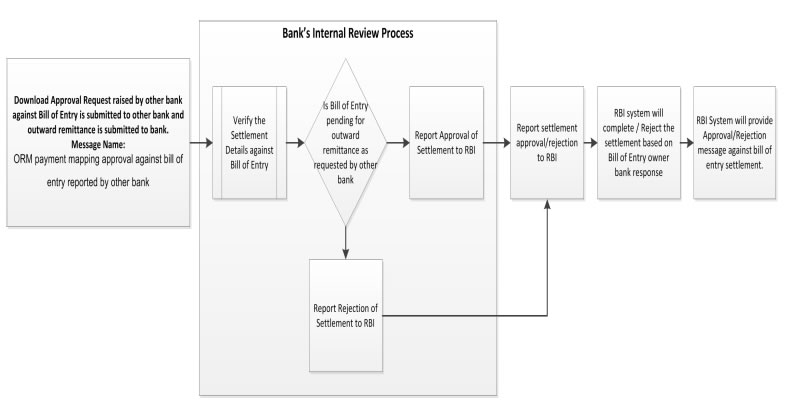

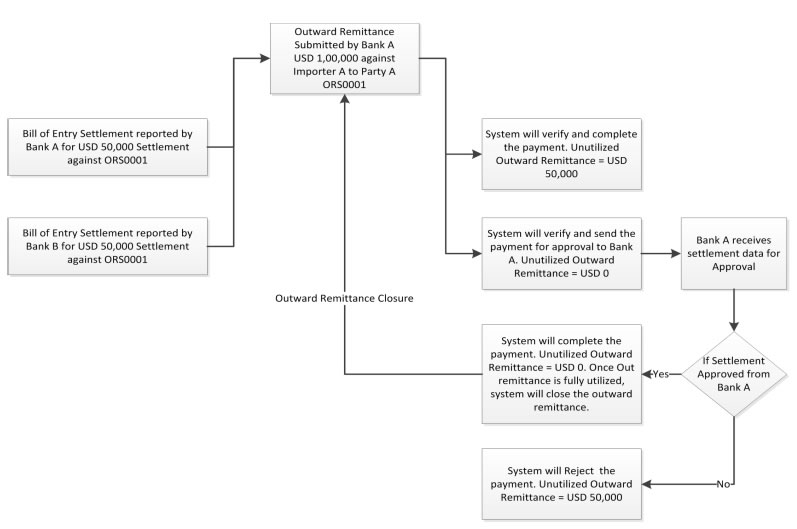

B. RECOMMENDATIONS: Based on the above findings and the systemic requirements, the Group recommends the system (as detailed in Chapter 4) which would involve the following actions: 1. Single data-entry for import transactions should be ensured at initial level at the time of import, and should be entered by the importers electronically with Customs. (Action: Dos, CBEC/ FED, RBI) 2. BOE data or payments for import should be the starting point for transaction monitoring and form the base for import follow-up process at all subsequent levels. RBI may maintain master database for BOE data on goods and payment for imports including advance from the following sources: At Goods level - BOE data at Customs EDI enabled ports (ICEGATE server of CBEC) At Outward remittance level - Banks have to report all the outward remittances against import, this includes advance payments and payment against bill of entry. Bank should upload all the outward remittances before reporting bill of entry settlement to RBI. (Action: FED, RBI/ MoC&I/ DoS (CBEC)/SEZ/NSDL/Banks) 3. The data would be received through the RBI’s secure web-server, which is the RBI platform for receiving data from other agencies. (Action: FED/DIT, RBI) 4. Declaration of a specific AD branch in BOE for handling purpose should be made mandatory. Provisions for subsequent changes in AD banks / branch need to be made. In such cases, the new AD should take responsibility of transaction reporting. Such changes can be effected by RBI’s master database. (Action: FED, RBI) 5. RBI will share the respective BOE data with the nodal office of the concerned AD banks on a daily basis so that they can flag the transactions appropriately. Web-based application should be developed for user interface with RBI server to download/upload data by nodal ADs. (Action:FED,RBI) 6. Similar to exports, a provision should be provided to bank for closure of BOE and outward remittance where remittance amount may vary marginally from the amount mentioned in the bill of entry due to discounts, quality issues, change in amount of freight, insurance, exchange rate fluctuations, etc. (Action: FED, RBI) 7. As available for exports, power may be provided to AD banks for extension of settlement of outward remittances / BOE under specific circumstances. (Action: FED, RBI) 8. As data for each import transaction for value up to USD 1, 00,000 will also be captured and pushed to AD banks / pulled by them and will form a part of the total database, the same also will have to be followed up by the AD banks. (Action: FED, RBI/ AD banks) 9. Electronic data capture is pertinent to ensure 100% coverage, hence the computerization of all manual ports may be undertaken on an urgent basis starting with the 26 ports already identified by Customs on account of high value transactions being routed through them within a year. (Action: CBEC) 10. Once the proposed system is set-up, the erstwhile reporting of BEF statements by the AD banks will be dispensed with and all the BEF data will be captured in IDPMS ab initio. (Action: RBI/Ad banks) 11. The importer wise unutilized advance payments for Imports will be shared to all banks. (Action: RBI/AD banks) 12. The completion report for BOE settlement will be shared on daily basis to Customs/SEZ. (Action: RBI, Customs/SEZ) 13. In case of payments for imports made by bank other than declared on BOE, BOE settlement will be completed based on the approval of bank named in BOE for the request raised by the payee bank. (Action: RBI/ AD banks) 14. A message link will be devised between RBI and DGFT to receive importer / exporter details on daily basis in the same line as the Importer/exporters details shared by DGFT to Customs. (Action: RBI & DGFT) Key Functionalities – Process Flow Outward Remittance Data Flow  Bill of Entry Settlement  Other Bank BOE Settlement Approval  Outward Remittance Utilization Flow  Closure Process  Extension Process  Overall Identified Processes  Objectives The objectives of this document is to provide various File formats identified for RBI- Import Data Processing and Monitoring System. From Import Agencies to RBI

From RBI to Import Agencies

From RBI to Banks

From Banks to RBI

From Import Agencies to RBI 1.1.1 Bill of Entry raised by Customs There will be 3 parts associated to the file,

Following are the fields identified for Control Data at Custom House Code Level

Following are the fields identified for Bill of Entry Header Details

Following are the fields identified for Bill of Entry Invoice Details

A unique bill of entry will be identified based on following fields Bill of Entry Number Invoices against bill of entry will be identified based on following fields Bill of Entry Number Unique Invoice within bill of entry will be based on Invoice Serial Number 1.1.2 Bill of Entry raised by SEZ Following fields are identified at Bill of Entry Level

A unique bill of entry will be identified based on following fields Bill of Entry Number Invoices against bill of entry will be identified based on following fields Bill of Entry Number Unique Invoice within bill of entry will be based on Invoice Serial Number From RBI to Import Agencies 1.1.3 Acknowledgment against the data file provided by Customs This file will be share with Customs as response against Bill of Entry raised by Custom Following fields are identified for acknowledgment sharing

1.1.4 Acknowledgment against the data file provided by SEZ

1.1.5 Bill of Entry Completion Report to Customs This report will be shared on daily basis against the bill of entries with completed settlement Following fields are identified for this report

From RBI to Banks 1.1.6 Bill of Entry details based on declared AD Code This message is intended to share the bill of entry details to bank for reconciliation purposes Following are the fields identified for this message

1.1.7 AD Transfer approval request against Bill of Entry Banks will option to raise AD Transfer Request in RBI-IDBMS system, the raised AD Transfer needs to be approved by declared bill of entry owner bank. System will provide option for the bank user to download the transfer request raised and submit the response (Approval/Rejection) against the raised transfer request Following are the fields identified for downloading the existing raised transfer request from RBI system

1.1.8 Approval for Bill of entry Payment against ORM done from other banks This process is designed to get approval for the bill of entry settlement wherein the bill of entry submission and outward remittance associated to the bill of entry is across banks. This process will ensure the bank who owns the Bill of Entry approves the Outward Remittance settlement associated to banks against Bill of Entry Document. Following are the fields identified for the message

*Payment Reference Number is provided to identify the unique payment reported by bank against bill of entry, bank needs to report it as a unique number within bill of entry. Example: Bank Name + 01 (for the first bill of entry payment) Bank Name + 02 (for the second bill of entry payment) From Bank to RBI 1.1.9 Outward Remittances against Import This message format is identified for banks to report all the outward remittances against import, this includes advance payments and payment against bill of entry. Bank should upload all the outward remittances before reporting bill of entry settlement to RBI. System will reconcile the outward reference details between bill of entry settlement and outward remittance for closing both entities. Following are the fields identified for reporting outward remittance details

Outward Reference Number will be identified uniquely based on following fields across bank

1.1.10 Bill of Entry settlement against outward remittances Bank needs to report the bill of entry settlement against pre uploaded outward remittances, bank can report bill of entry pertaining to any bank where outward remittances is done though the bank, however system will have additional process of approval for the cases where in the owner bank for Bill of Entry is different from owner bank of Outward Remittances. Onus of Outward Remittances settlement lies with the bank form where Outward Remittances is effected against bill of entry by Importer. Following fields are identified for Bill of Entry Settlement Reporting

Each payment will be validated against unutilized amount available under Outward Remittance, Outward Remittance will be identified uniquely based on ORM Number and ORM AD Code. Reported settlement will fail if ORM details are not matching or the unutilized amount is less than the settlement amount. 1.1.11 Bill of Entry Transfer Request System will provide option to the banks to transfer BOE from declared bank to submitted bank.Following fields are identified for this message type

1.1.12 Bill of Entry Transfer Approval System will provide option to the banks to approve the transfer of BOE from declared bank to submitted bank. Declared Bank can Approve / Reject the transfer requested from submitted bank.Following fields are identified for this message type

1.1.13 ORM payment mapping approval against bill of entry reported by other bank System will provide option to Bill of Entry owner bank to report approval/rejection of BOE settlement claim by other bank against the outward remittance send through them.Based on the approval and rejection the actual outward remittance utilization will be calculated against bill of entry and closed.If bank rejects the BOE settlement, the claimed amount in settlement will be reduced from utilized amount and will be added to unutilized amount for tracking the outward remittances. Following fields are identified for approval reporting

1.1.14 Outward Import Remittance extension Outward import remittance extenstion message is designed for the bank to report the extenstions received by RBI on the outward remittance post stipulated timeline. Following are the fields identified for this process

TBD: Do we need to restrict the BOE settlement if the stipulated timeframe for outward remittance is completed/crossed. 1.1.15 Bill of Entry Extension System will provide option to bank wherein they can report any extenstion provided by RBI on late payment against bill of entry. Following fields are identified for reporting Bill of Entry Extension

TBD: Do we need to restrict the BOE settlement if the stipulated timeframe for BOE Settlement is completed/crossed. 1.1.16 Outward Import Remittance Closure System will provide option for the banks for closure of outward import remittance amount in part / full under pre-defined reasons provided by RBI. This will provide banks an option to close the unutilized Outward remittances wherein settlement is not completely matching with outward remittance details. Bank cannot close outward remittances unless settlement/closure against outward remittance matches with Outward payment remittances. Following fields are identified for this message exchange

1.1.17 Bill of Entry Closure System will provide option for the bank to close the bill of entry amount in part/full under pre-defined reasons provided by RBI. This will provide option for the banks to close the bill of entry where the bill of entry amount is not completely matching with invoice amount. Following fields are identified for this message exchange

|

Page Last Updated on: