IST,

IST,

Report of the Working Group on Reporting of OTC Interest Rate and Forex Derivatives

May 23, 2011 Smt. Shyamala Gopinath Madam We are glad to submit the Report of the Working Group on reporting of OTC interest rate and forex derivatives. On behalf of the Members of the Working Group, and on my behalf, I sincerely thank you for entrusting us with this responsibility.

The Group is grateful to Shri G Padmanabhan, Shri G Mahalingam, Shri H S Mohanty, Dr Anil Sharma, Dr Nishita Raje, Shri G Seshsayee and Shri Rakesh Tripathy for their valuable suggestions. The Group would like to place on record its appreciation of the research and secretarial assistance provided by Shri Puneet Pancholy of the Financial Markets Department.

In the aftermath of the global financial crisis (GFC), improving transparency of the Over-the-counter (OTC) derivatives market has been a principal theme of discourse concerning the steps to be taken to prevent the recurrence of such a crisis in future. Two major steps in this direction are (a) clearing and settlement of OTC derivative transactions through Central Counterparties (CCP) and (b) incentivising or mandating reporting of OTC derivatives trades to designated trade repositories (TRs). On the second issue, while the details of the framework for reporting are being discussed and debated in various jurisdictions, the need for comprehensive reporting mechanism with unrestricted access to the regulators responsible for financial stability, post-trade processing services to market participants, and dissemination of aggregate volume and price data to the market and public at large is not disputed. 1.2 Although the range of products available and volumes traded in the Indian OTC derivatives market are not comparable to those in the more developed markets and the Indian markets have not seen any upheaval caused by OTC derivatives, the arrangement for reporting of OTC derivative transactions has been existing in India for a long time. While some reports, e.g., those relating to OTC foreign exchange transactions are in summary format, others e.g., reports on OTC interest rate swaps and repo in government bonds captured all details of a transaction and are akin to what is proposed for the repository structure. Nevertheless, the need for consolidation of the reporting arrangements with a view to facilitating a more comprehensive monitoring of the market by the regulator, improving transparency of the market and improving the efficiency of post trade processing infrastructure cannot be overemphasized. 1.3 In this background, it was announced in the Annual Policy statement for the year 2010-11 that a Working Group would be set up comprising officials of the Reserve Bank, representatives from the Clearing Corporation of India Limited (CCIL) and market participants to work out the modalities for an efficient, single point reporting mechanism for all OTC interest rate and forex derivative transactions. 1.4 Accordingly, a Working Group on reporting of OTC derivative transactions was set up under Chairmanship of Shri P Krishnamurthy, the then Chief General Manager, Financial Markets Department, Reserve Bank of India (RBI), with the following terms of reference:

1.5 The constitution of the Working Group was as follows:

1.6 Apart from deliberating on the issue, the Group had requested some members to interact on select issues with other market participants and their clients. After careful analysis of the feedback received and keeping in view the international experience and ongoing debates and discussions on the subject, the Group is pleased to submit its Report organized as follows. 1.7 Chapter two discusses the rationale and urgency for developing comprehensive reporting framework for OTC derivatives and the global experience relating to creation of such arrangements. Chapter three discusses the structure of OTC derivatives market in India. Chapter four discusses the key issues in the reporting of the OTC derivative transactions, and suggests optimal reporting structure in light thereof. Chapter five deals with setting up a trade repository (TR) in India. Chapter six concludes with summary of recommendations. CHAPTER 2 2.1 The financial crisis underscored the importance of a robust and efficient post-trading infrastructure. It is generally believed that the opacity of the over-the-counter (OTC) derivatives market contributed to the seizure of the financial markets and spread of the financial crisis. Among the measures being discussed worldwide to prevent the recurrence of a similar crisis, or, at least to contain the fallout, putting in place an adequately functioning post-trading infrastructure figure prominently. 2.2 Derivatives are financial contracts that derive their value from the price of an underlying commodity, asset, rate, index or the occurrence of an event. As instruments for transfer and dispersal of risk, derivatives facilitate socially useful but risky projects, which would not be undertaken in the absence of such risk management framework. Derivatives may either be standard or customized according to the needs of the participants. While the standardized products mostly trade on exchanges, the customized products are traded over the counter. Major exchanges world over have adopted electronic trading platforms that use order-matching technologies to execute trades in a multilateral environment. Trades on exchanges are characterized by anonymity with the exchange clearing house interposing itself as the central counterparty (CCP) along with associated settlement and risk management protocol. 2.3 On the other hand, OTC derivatives are usually contracted and settled bilaterally. The trading is facilitated through brokers, over an electronically brokered market or over a proprietary trading platform.

2.4 Globally, OTC derivative markets are highly popular and attract a myriad of players. It is estimated that the gross notional outstanding amount of the OTC derivative contracts had reached a peak of USD 684 trillion in June 2008; post-Lehman, contracted to USD 548 trillion in December 2008; and stood at USD 609 trillion in December 20101. The gross notional amount outstanding however does not purvey a sense of the actual exposure, or risk in the market because in case of interest rate swaps (IRS), the principal amount itself is not exchanged and in case of credit default swaps (CDS), the total insured amount is paid out only in case of zero recovery of the underlying debt obligation. ‘Gross market value’ which measures the cost of replacing all OTC contracts better reflects the exposure of the system even though it overlooks legally enforceable bilateral netting arrangements and collateralized counterparty exposures. The gross market values that were at USD 20 trillion in June 2007 peaked to USD 32 trillion in December 2008 and stood at USD 22 trillion at the end of December 20091. 2.5 The OTC derivatives market is reportedly characterized by large exposures between a limited number of market players. When the market is characterized by the existence of a few market makers, most of the activity takes place between these players and disruptions at any major dealer would soon transmit to other financial institutions and spread contagion to the entire market. The risk in the OTC derivative market also emanates from the opacity in the market that constrains the market participants from assessing the quantum of risk held with the counterparty. Further, with increase in volumes and complexities of the OTC derivatives, the non-standardized infrastructure for clearing and settlement also becomes a major impediment in containing risk. 2.6 As a key measure for preventing recurrence of a crisis, major Central Banks and Market regulators have initiated measures to enhance the post-trading infrastructure in the OTC derivative markets. The G-20 Toronto summit declaration of June 26-27, 2010 lays down the future course in this regard.

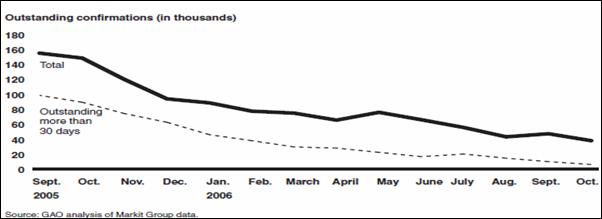

2.7 A CCP is a financial institution that interposes as an intermediary between security (including derivatives) market participants. This reduces the amount of counterparty risk that market participants are exposed to. A sale is contracted between the seller of a security and the central counter party on one hand and the central counterparty and the buyer on the other. This means that no market participant has a direct exposure to another and if one party defaults, the central counterparty absorbs the loss. Settlement through a central counterparty has been progressively used on most major stock and security exchanges. This eliminates both the risk of direct financial loss though a default and the risk of indirect loss through having to unwind/replace a trade. It is therefore a more complete method of reducing counterparty risk than alternatives such as simple DVP. It also tends to enhance liquidity in the market by reducing default risk and facilitating anonymous trading. A caveat is however in order in that a CCP based settlement system leads to concentration of risk with the CCP which needs to be appropriately addressed. Collateral benefits of CCP based settlement system include aggregation of the trade data with the CCP which can be shared with the regulators or disseminated to the market. 2.8 Unlike the CCP infrastructure, the objective of TRs is simply to maintain an authoritative electronic database of all open OTC derivative transactions. It collects data derived from centrally or bilaterally clearable transactions as inputted/verified by both parties to a trade. Depending upon the asset class, a TR may also engage in trade lifecycle event management and downstream trade processing services. However, the principal functionality of a TR is its record keeping and reconciliation of definitive copies of trade data . It may be mentioned that other market infrastructure or service providers that centrally maintain market wide OTC derivative contract information (e.g. CCPs) may also provide the function of the TR. 2.9 Contracts maintained in a TR can be considered the sole ‘official legal record’ (the so called ‘golden copy’) of a transaction depending on legal arrangement in operation in regard to the contract in question. As such, they constitute data usable for various downstream processing. An important attribute of a TR is its ability to interconnect with multiple market participants in support of risk reduction, operational efficiency and cost saving benefits to individual participants and to the market as a whole. 2.10 Since information management is the core functionality of a TR, it would be in order to discuss the hierarchy of information and its usage. The typical drawback of the OTC market is that the information concerning any contract is usually available only to the contracting parties. While expanding the scope of availability of information, it is pertinent to distinguish between information available to regulators, to market participants and to public at large. The law usually gives the regulators the right to call for from the entities they regulate, any information including exposures to any single counterparty or groups of counterparties as well as position and risk implication of any class of contract. Information available to the public is usually limited to aggregate data that excludes trade and position data which are sensitive in nature. Such aggregate data is gathered and published by various agencies according to contract types, geographical coverage, etc. The data requirements of market participants are somewhere between that of the regulators and the public. 2.11 The regulators can obtain detailed and granular information about the individual positions of the entities they regulate. However, they lack a comprehensive picture of market as a whole. In absence of a TR, it is difficult for regulators to assess even the exact size of the various segments of the OTC derivative market as such information is not readily available. Further, even if the information is pieced together using data from various sources, it would be difficult to compile a complete and meaningful picture due to heterogeneity of data. Secondly, the usual regulatory reporting focuses on the risk sensitivity of the positions and does not cover the composition of the positions. In absence of granular composition of positions, it becomes difficult to ascertain the extent of exposure detailed breakdown of the positions of the counterparties. The situation becomes complex when the trades are between entities regulated by different regulators or between entities in different sovereign jurisdictions. Though this problem may partially be addressed by information sharing agreement amongst the regulators, or by having a single TR, there may still be some issues like data privacy issue, quantum and quality of information in the database, etc. 2.12 In absence of a complete picture on the OTC derivative market, the regulators may not be in a position to assess the quantum of risk building up in the system per se. Further, the regulator would be oblivious to the inter-linkages of these positions, thereby limiting its ability to detect the risk to the system and to respond to the evolving scenario. Further, the implication for the market participant is also severe as, in absence of complete information, their positions may remain under-collateralised and more importantly, during the time of stress, the market may become completely illiquid due to lack of trust among participants. 2.13 A TR is an institution that addresses the above concerns by collecting and aggregating information on individual transactions in OTC derivatives. TRs are a relatively new concept in the financial markets. They were unheard of till as late as 2003 and as such they are still evolving and developing over time. One of the underlying causes behind the introduction of TRs was the rapid expansion of volumes both in terms of the value as well as the number of transactions in the financial markets across the globe. When growth in the financial transactions outpaced existing processing capabilities, it led to backlog of confirmations of the financial transactions. As a result of delay in processing capabilities, by the end of September 2005 in the credit derivatives market in US there were about 150,000 unconfirmed trades, with nearly two-thirds of these remaining unconfirmed for more than 30 days2.

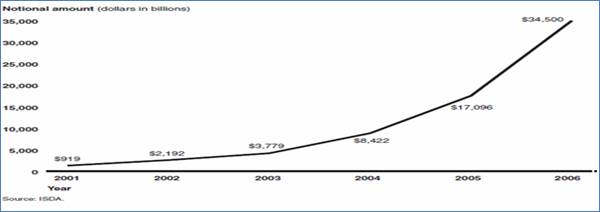

2.14 These backlogs resulted from reliance on inefficient manual confirmation processes that failed to keep up with the rapidly growing volume and because of difficulties in confirming information for trades that end-users transferred to other parties without notifying the original dealer. Although these trades were being entered into the systems that dealers used to manage the risk of loss arising from price changes (market risk) and counterparty defaults (credit risk), the credit derivatives backlogs increased dealers’ operational risk by potentially allowing errors that could lead to losses or other problems to go undetected. The increasing number of deal confirmation backlogs started causing worries for all stakeholders including the regulators. As such the US regulators encouraged electronic trade matching services to handle the increasing volumes and reducing confirmation backlogs. The following charts show the reduction in outstanding confirmations and growth in volume in the CDS market.

2.15 After the electronic trade matching services started making significant difference by bringing down the number of unmatched deals, there was a greater appreciation that for products other than spot market products, say for OTC derivative trades like IRS, only matching services were not of much value unless they are supported by post trade processing services throughout the life cycle of these products. This realization is perhaps the most important driver for the development of TRs and has also resulted in the availability of post trade processing services as an additional functionality provided by such TRs. 2.16 In India, RBI initiated measures for transaction-wise reporting of IRS Trades and mandated reporting of all inter-bank trades to Clearing Corporation of India Limited (CCIL) in August 2007. Incidentally, it may be mentioned that Indian financial market has had a well functioning CCP, viz., CCIL, that has been offering CCP-guaranteed settlement for transactions in government securities, a few money market instruments, and forex i.e. dollar-rupee transactions Impetus for development post-GFC 2.17 During the recent global financial crisis, DTCC Deriv/SERV could provide very valuable information on the actual state of exposures in the CDS market to US Regulators. Similarly, after the Lehman crisis, CCIL too could provide precise information to RBI on the IRS exposures of the Lehman subsidiary in India. 2.18 Post-crisis analysis of the factors contributing to / accentuating the crisis in light of the experience mentioned above prompted the regulators worldwide to start thinking on improving market infrastructure for OTC products - standardizing them, making centralized clearing mandatory for most plain vanilla products and making reporting in TRs mandatory for all other products as brought out in the G-20 declaration mentioned earlier. 2.19 All these developments have provided impetus for rapid development of TRs globally and initiatives are underway in different parts of the world for setting up TRs. Existing Trade Repositories 2.20 Currently the major TRs3 globally are : (in order of their establishment)

DTCC & Markit – CDS Trade Repository 2.22 DTCC started operations as a CDS TR and launched Deriv/SERV as a global trade matching service to automate CDS trade processing in November 2003. In 2004, it expanded to include

2.25 While DTCC contributes its Deriv/SERV matching and confirmation engine, Markit’s data and valuation provides the much needed post trade valuation services. This alliance provides a fully integrated system for processing OTC derivatives across borders and asset classes to provide a service that helps a wide range of market participants achieve greater certainty in their transaction processing. It also addresses the challenges of rapid growth, increased cost and operational risks associated with the OTC derivative markets. TriOptima – IRS Trade Repository 2.26 TriOptima, a Stockholm-based technology company was selected by ISDA to operate as an interest rate derivatives TR. A number of broker-dealers, buy-side firms and industry associations, committed to record all interest rate derivatives trades in this TR. 2.27 The OTC Derivatives Interest Rate Trade Reporting Repository (IR TRR) launched by TriOptima in early 2010 was an important step towards improving transparency in the global OTC derivatives markets. The IR TRR collects data on all transactions in OTC interest rate derivatives from a group of 14 major dealers. It complements the TR for credit default swaps (CDS) run by the DTCC. Interest rate derivative trades worth USD 535 trillion in notional values had been registered with TriOptima's TR by May 20114. Benefits of Trade Repositories 2.28 TRs help in obtaining a clear understanding of :

They also help in the development of tools that allow regulators and other stake holders to have access to more information and thereby identify emerging systemic risks. Global versus Regional trade repositories 2.29 Although development of TRs is in its early stages, there is already a debate on whether the TRs should be global or regional in nature. While global TRs offer the obvious advantage of having all the data at one single place, and are beneficial for global financial players, they have limited flexibility and coverage in terms of regulators and users. The fact that they go by global consensus increases the possibility of legal issues in some parts of the world. For e.g a global TR operating in the US will not accept a trade which is illegal in the US but legal in some other part of the world. These issues make the benefits of establishment of global repositories rather debatable. 2.30 Irrespective of the form and organization of TRs, some of the guiding principles from a regulatory perspective can be briefly mentioned as under.

CHAPTER 3 3.1 OTC derivative markets in India have a long history, though, in an organised manner, exchange traded derivatives take precedence in time. Commodity derivatives in the form of futures in few select commodities date back to the late nineteenth century. After the government ban on options and cash settlement in futures in 1952, the activity in the commodities market moved to informal forward segment. Futures’ trading in several commodities started after the ban was lifted in 2000 and commodity futures exchanges with electronic trading platforms were established. As far as equities are concerned, some form of OTC derivative trading was prevalent in India in the pre-independence days. The Securities Contract Regulation Act, 1956 banned all kinds of derivative trading in equities and it was only in 1999 after the recommendations of two influential committees headed by Shri L C Gupta and Shri J R Varma that a basis was created for amendment to the said Act. As far as foreign exchange markets are concerned, OTC derivatives in the form of forward and swap contracts have been in existence for a long time. The deregulation of interest rates as a part of the financial liberalisation process created a need for interest rate derivatives and the RBI responded by allowing interest rate swaps and forward rate agreements in 1999. The Regulatory framework 3.2 Though the statutes do not define over-the-counter derivatives as such, derivatives have been defined in three separate legislations. The Securities Contract Regulation Act, 1956 (through the Securities Laws ( Second Amendment ) Act,1999 ), Section 2 (ac) defines a derivative as

3.3 The Forward Contracts (Regulation) Act, 1952, does not define the term derivatives but specific contracts ‘forwards’ and ‘options’ (Section 2(c) and Section 2 (g)) as under:

3.4 In the RBI Act, 1934 as amended vide RBI (Amendment) Act 2006, derivatives have been defined in Section 45 (U)(a) as

3.5 Repurchase agreement or repo, a quasi-derivative instrument comprising a simultaneous spot and forward transaction has been separately defined in Section 45 (U)(c) as

3.6 The RBI Act, 1934, however, makes an exception in so far as its regulatory ambit is concerned with regard to instruments falling under its jurisdiction when they are traded and settled on an exchange (Section 45 W).

Global OTC derivatives markets 3.7 Conventionally, OTC derivative contracts are classified based on the underlying into (a) foreign exchange contracts, (b) interest rate contracts, (c) credit linked contracts, (d) equity linked contracts, and (e) commodity linked contracts. According to BIS semi-annual survey (2010), as at the end of 2010, the Interest rate contracts were the most important in terms of notional amount outstanding, accounting for about 77per cent, followed by foreign exchange contracts (10per cent) and credit default swaps(5per cent). The equity linked contracts and commodity contracts were relatively insignificant together accounting for about 1per cent of the gross notional amount. It may be added that the last two classes of contracts are absent in the domestic Indian OTC markets and hence are excluded from the discussion. 3.8 The structure of the OTC derivatives market (excluding equity and commodity linked derivatives) is broadly depicted in the chart below, with instruments in bold face indicating that these are traded in the domestic market at present.

Interest Rate Derivatives in India 3.9 The Indian Financial System witnessed wide discussion on the usefulness of derivatives as instruments of risk management in the late 1990’s. The origin of recent initiatives for development of derivative market in India can be traced to the L C Gupta Committee (set up by SEBI in November 1996). Though the Committee’s main concern was equity based derivatives, it examined the need for financial derivatives in a broader perspective and recommended introduction of interest rate and currency derivatives. The emphasis was on introduction of exchange traded derivatives based on these underlying. It may be recalled that Tarapore Committee on capital account convertibility around the same time had also advocated introduction of currency futures. Recognising the need for interest rate derivatives in a deregulated interest rate regime, the RBI in 1999 permitted banks, primary dealers (PD) and financial institutions (FI) to undertake transactions in interest rate swaps and forward rate agreements. 3.10 A Forward Rate Agreement is (FRA) is a financial contract between two parties to exchange interest payments for a 'notional principal' amount on settlement date, for a specified period from start date to maturity date. An Interest Rate Swap (IRS) is a combination of FRAs in which a fixed interest on a notional principal is exchanged for a floating interest rate equal to the reference rate at periodic intervals over the tenure of the contract. 3.11 Globally, swaps are the dominant instrument among interest rate derivatives; according to the BIS semiannual survey 2010, swaps accounted for more than 78 per cent of all gross notional outstanding of all single currency interest rate derivatives with FRAs and Options accounting for about 11 per cent each. As far as tenor wise activity is concerned, the swap and FRA segment is dominated by contracts with less than one year maturity (41 per cent) followed by 1-5 year (30 per cent) and 5-10 year (29 per cent) maturities.5 3.12 In the Indian markets, four OTC interest rate products are traded, viz., Overnight Index Swap based on overnight MIBOR, a polled rate derived from the overnight unsecured inter-bank market, contracts based on MIFOR6, contracts based on INBMK7, and contracts based on MIOIS8. A typical characteristic of the Indian interest rate market is that unlike in the overseas inter-bank funds markets, there is very little activity in tenors beyond overnight and as such there is no credible interest rate in segments other than overnight. Absence of a liquid 3-month or 6-month funds market has been a hindrance for trading in FRAs as also in swaps based on these benchmarks. Recent emergence of a deep and liquid CD market with significant secondary market trading may perhaps address some of these issues. 3.13 In terms of gross notional outstanding, the OIS based on overnight MIBOR is the most dominant product traded, accounting for about 90per cent of the outstanding followed by MIFOR which accounts for nearly 10per cent and the remaining two products almost insignificant. 3.14 As far as the regulatory regime is concerned, all scheduled commercial banks (SCBs) excluding Regional Rural Banks, primary dealers (PDs) and all-India financial institutions9 have been allowed to use IRS and FRA for their own balance sheet management as also for the purpose of market making. The non-financial corporations have been allowed to use IRS and FRA to hedge their balance sheet exposures, with a caveat that at least one of the parties in any IRS/FRA transaction should be a RBI regulated entity. In addition to the RBI circular of 199910 which lays down principles for accounting and risk management for positions in IRS/FRA, , RBI has, in 2007, released comprehensive guidelines on derivatives comprising general principles for derivatives trading, management of risk and sound corporate governance requirements along with a code of conduct for market makers. 3.15 The reporting arrangement in interest rate derivatives in India follows a two tier system. Since at least one party to an OTC interest rate derivatives transaction is a RBI regulated entity, there has been an elaborate prudential reporting requirement in so far as the risk implication of the derivative positions for the entity is concerned. This includes the PV01 position of IRS contracts including those in the trading book as well as the banking book, notional principal, gross received PV01, gross paid PV01 and net PV01. Regulatory reporting also includes data on benchmark wise details of IRS and credit concentration in derivatives and under the risk based supervision framework, data on credit equivalent, MTM value, and daily VaR. These information however are entity specific and cannot be aggregated and therefore do not convey the interconnectedness and cross-counterparty risk implications for the market as a whole. 3.16 In 2003, an internal Working Group of the RBI on Rupee derivatives had, inter alia, recommended a centralized clearing system for OTC derivatives through CCIL. Preparatory to introduction of centralized clearing as also to get a better understanding of interest rate derivative market in India, RBI, in 2007, made it mandatory for the RBI regulated entities to report inter-bank/PD transactions in interest rate derivatives (FRAs and IRS) on a platform developed by the CCIL. It was mandated that at the inception, the institutions have to report the transaction level details of all outstanding trades on that date. Subsequently, all inter-bank/PD deals were required to be reported by the banks and PDs on the CCIL platform within 30 minutes of initiating the transaction. The information captured through this reporting system is comprehensive: it includes all details to describe a contract, viz., member name and identification, deal time, reporting member and counterparty reference number, type of transaction (new, amended, cancelled, revised), common identification, swap type (fixed-float, float-fixed, float-float), bank and branch, trade date, effective date, termination date, business day convention, notional principal, fist payment and reset dates, date of reversal of trade, reporting member and counterparty identification, gain/loss on reversal and its settlement date, floating rate benchmark, fixed rate and spread. Further, CCIL’s evolution as a repository owed to a regulatory mandate, unlike repositories like DTCC which evolved out of a need to facilitate post trade processing. 3.17 An important innovation in OTC derivative markets introduced during the last few years relates to portfolio compression services offered by TriOptima. Since the only way to exit a position in an OTC derivative is to enter into another with opposite pay off, the gross notional outstanding multiplies manifold as a result. Apart from the fact that this does not capture the economic essence of the portfolios, it increases the demand on capital for the regulated entities. TriOptima’s TriReduce and TriResolve services reportedly offer multilateral netting with bilateral settlement whereby an entity can extinguish its OTC derivative positions without affecting its MTM value or the PV01. In India too, the service has been used by the IRS portfolio holders with significant reduction in the gross notional positions. 3.18 In an attempt to move towards centralised clearing and settlement of IRS transactions, CCIL has introduced a non-guaranteed settlement of these transactions from Nov 27, 2008. It is also in the process of developing TriOptima like trade compression services as also post trade processing services. 3.19 The CCIL reporting platform for IRS and FRA did not cover the transactions that the market makers had with their clients and to this extent there remained a gap in information on the interest rate swap market. Since banks were reluctant to share the details of their client transactions with CCIL without detailed protocol about maintenance of client confidentiality, effective from 2009, RBI started collecting information on market makers transactions with their clients. However unlike the reporting of interbank/PD transactions to CCIL, client transaction reporting to RBI is not granular as to transaction particulars but captures the summary of transactions at fortnightly rests. The information collected includes member identification, outstanding contracts as at the beginning of week, notional amount, number of contracts, interest rate range and outstanding contract at the end of the week. Further, bucket-wise details of contracts accounting for 75per cent of notional amount traded are also collected. Foreign currency derivatives 3.20 The emergence of the modern foreign exchange market owes to the break-down of the Bretton Woods system in the 1970’s and the resultant floating exchange rate regime that came to prevail. The origin of the foreign exchange market in India could be traced to the year 1978 when banks in India were permitted to undertake intra-day tradein foreign exchange. However, it was in the 1990s that the Indian foreign exchange market witnessed far reaching changes along with the shifts in the currency regime in India. The exchange rate of the rupee, that was pegged earlier was floated partially in March 1992 and fully in March 1993 following the recommendations of the Report of the High Level Committee on Balance of Payments (Chairman: Dr.C.Rangarajan). The unification of the exchange rate was instrumental in developing a market-determined exchange rate of the rupee and an important step in the progress towards current account convertibility which was achieved in August 1994. 3.21 Over the last decade or so, the foreign exchange market has acquired depth, liquidity and has witnessed increase in turnover. In the USD-INR segment, the daily average turnover increased from USD 7.83 billion in 2005-06 to USD 18.97 billion in 2009-10. The OTC derivative segment of the forex market includes forwards, forex swaps and forex options. During 2009-10, of the total turnover in the forex market of USD 6.92 trillion, the OTC derivative turnover was USD 3.53 trillion. Of the forex derivatives, the forex swaps are dominant accounting for over 60 per cent of the total turnover during 2009-10. Rupee-forex options, which were allowed in July 2003, have not seen as much trading as the other products. 3.22 The foreign exchange market in India has been subject to by a regulatory framework, salient features of which are as under.

3.23 Broadly three classes of derivatives trade in the foreign exchange market, viz., (outright) forwards, swaps, and options. 3.24 Foreign exchange (outright) Forwards: A foreign exchange forward contract is an agreement to buy a certain amount of a foreign currency against another currency (in our context, Rupee, the domestic currency) at a rate fixed at the time of entering into the contract. It is used to hedge against the exchange risk arising out of an future exposure, eg., export proceeds, import payments, debt servicing or repayment, etc. The intensity of activity in the forward segment expresses a view of the different class of market participants as to the future path of the exchange rate11. A person resident in India may enter into a forward contract with an Authorized Dealer Category-I bank (AD Category I bank) in India to hedge an exposure to exchange risk in respect of a transaction for which sale and/or purchase of foreign exchange is permitted under the Foreign Exchange Management Act, 199912. The forward market turnover during 2009-10 was USD 1.27 trillion. Outright forward contracts are essentially between banks and their merchant clients and these are much less frequent in the interbank markets, globally as well as in Indian markets. After approval by RBI, CCIL is guaranteeing (December 2009 onwards) the forex forward trades from the trade day to the settlement day acting as a central counterparty. The netting done at CCIL virtually eliminates the credit risk, reduces counterparty exposures and frees the capital which otherwise would have been locked till the settlement of trade. 3.25 Swaps: A foreign exchange swap is usually a combination of a spot and a forward transaction, entered into simultaneously. Swaps are mostly inter-bank contracts and are neutral with respect to position as well as impact on the volatility of the exchange rate. Swaps do not have a separate regulatory framework and are covered by the foreign exchange regulations applicable to forward / spot contracts. 3.26 A Foreign currency swap is an agreement between two parties to exchange cash flows (viz., the principal and/or interest payments) of a loan in one currency for equivalent cash flows of an equal (in net present value) loan in another. Globally, foreign currency swaps constitute a large segment of foreign currency derivatives. Resident Indians may enter into foreign currency-rupee swap within regulatory limits. 3.27 Currency options: Forex option is a financial derivative under which the buyer of the option has the right but not the obligation to exchange one currency against another at a given point in time at a predetermined exchange rate. Though introduced in the 1990’s, the OTC forex options market is not yet very liquid in India13. As regards information on the forex options available in the public domain, the Foreign Exchange Dealers’ Association of India (FEDAI) publishes foreign currency option volatility rates including ATM volatility, 25-delta risk reversal and 25-delta strangles. 3.28 Most of the data of foreign currency derivative is collected by the Foreign Exchange Department (FED) of the RBI. It is important to note that most of the data collection by RBI on foreign exchange markets, for historical reasons, has been motivated by the potential impact of foreign exchange transactions on the volatility of the exchange rate. Each of the AD Category-I banks has to submit daily statements of Foreign Exchange Turnover in Form FTD and Gaps, Position and Cash Balances in Form GPB through the Online Returns Filing System (ORFS)14. AD Category-I banks have to consolidate the data on cross currency derivative transactions undertaken by residents and submit half-yearly reports (June and December). AD Category-I banks are required to submit a monthly report (as on the last Friday of every month) on the limits granted and utilized by their constituents under the facility of booking forward contracts on past performance basis. AD Category – I banks are required to submit a quarterly report on the forward contracts booked & cancelled by SMEs and Resident Individuals. Apart from the data collected at FED, forex forwards data is available at CCIL also, but the data set is not complete as all of the banks are not settling their forex forward deals through CCIL.

Under risk based supervision, DBS collects data on currency options including notional principal, credit equivalent, MTM value, PV01 and daily VaR. CHAPTER 4 4.1 The financial crisis has underscored the weaknesses in the OTC derivatives markets which need to be addressed for building a resilient financial system less prone to instabilities. The case for the existence of OTC derivatives to supplement their exchange traded counterpart for better and more effective risk management is well made out and we do not wish to deal with the subject in detail here. The measures that have been suggested to improve the robustness of the OTC derivative markets include the following :

4.2 It is to be appreciated that transparency of the OTC derivative markets underlies all other measures and constitutes the one of the most important step without which other measures cannot achieve the intended results. In order to effectively regulate the OTC derivatives market, prevent risk build-up and ensure pre-emptive corrective action, the regulators need comprehensive and timely information. Similarly, for market discipline to work, market participants must have sufficient knowledge of the position and exposure of the other financial firms in absence of which there would be a secular unwillingness to trade and consequent illiquidity. 4.3 Individual financial and non-financial firms are required to disclose their positions and exposures through their balance sheets but such disclosures may not be enough because firstly, while such disclosures are periodic, markets function on almost real time basis and secondly, balance sheet disclosures are of aggregate nature and lack granularity which is essential to capture risk implications. 4.4 The current discourse on improving transparency is pivoted on the concept of TRs, understandably because of the services that DTCC offered in the aftermath of Lehman Brothers’ bankruptcy. It will be recalled that when Lehman brothers filed for bankruptcy on September 15, 2008, there were widespread but unfounded speculations that Lehman Brothers’ CDS liability would be around USD 400 billion. However DTCC TIW computed and announced that the actual contractual amount was only USD 72 billion and the net settled amount would be only USD 5.2 Billion16. The information transparency of the CDS market has significantly improved since DTCC TIW started disclosing actual CDS market data since October 2008. Thus while there are some differences, particularly between the structures discussed in the US and EU jurisdictions and several practical issues need to be ironed out, a DTCC-like TR constitutes the consensus bulwark for improving OTC derivatives market transparency. It may be noted that ISDA has awarded the contract for developing a TR for interest rate derivatives to TriOptima, a company registered in Sweden and some repositories have started functioning in EU as well. 4.5 In some jurisdictions, notably in India and South Korea, regulatory reporting of OTC derivatives has been in existence for a long time. The reporting arrangement in India for different OTC derivatives has been discussed in the previous chapter. It may be useful to briefly discuss the Korean reporting system. The Korean reporting scheme essentially aims at enabling the financial service regulators to monitor the OTC derivatives market. Currently, there are two reporting schemes for the Korean derivatives markets – derivatives reports based on the Financial Investment Services and Capital Markets Act and forex reporting system based on the Foreign Exchange Transaction Act. 4.6 Financial Investment firms in Korea are required to submit a business report to the Financial Service Commission either monthly (for the firms that hold derivatives dealing license) or quarterly (for firms that do not). The reports cover derivatives transactions, OTC derivatives transactions, credit derivatives and structured/customized product transactions, and securitised derivatives transactions and the contents include outstanding amount by product, by underlying assets, etc. Importantly, the firms are required to report their credit exposure and the results of stress tests. 4.7 The Forex reporting system in Korea, established in 1999, is more elaborate. It involves a Forex information concentration agency, Forex information reporting agencies, Forex information intermediaries and forex information users. The Bank of Korea acts as the Forex information concentration agency and aggregates the information collected from about 380 forex reporting agencies that include banks, security firms, asset management companies, futures companies and Insurance companies. Some Forex reporting agencies are not directly connected to the Reporting System and report their transaction data to the concentration agency through six forex intermediaries. For example, asset management companies report their transactions through the Korea securities depository. Similarly, Life Insurance Association and General Insurance Association of Korea act as reporting intermediaries for the life and non life insurance companies respectively. Forex information users comprise eight institutions including the BOK, the Financial Supervisory Service, the Ministry of Strategy and Finance, which are allowed to use the data collected through the Forex Reporting System17. 4.8 It is to be noted that the data reported through the Forex reporting System covers all transactions denominated in a foreign currency and includes spot as well OTC derivatives transaction. The latter in turn includes forwards contracts, swaps, options as well as interest rate derivatives, equity derivatives, credit derivatives, securitised derivatives, etc., that are denominated in a foreign currency. While all data is to be reported on a daily basis, data related to securitised, customized and credit derivatives can be reported at monthly intervals. 4.9 The advantage of such summary reporting in formats prescribed by the regulatory authorities lies in the fact that the regulators get exact information as they require without any burden of further computation and processing. On the other hand, the disadvantages are many. Firstly, with the change in environment and perspectives of the regulator, the information requirement may undergo change. Therefore, either the information that the regulator receives turns out to be of limited use to in the changed scenario or reporting format has to be revised imposing burden of adjustment on the reporting entities. Secondly, the reports being periodical in nature cannot capture the developments in the market on a real time basis and as the crisis has shown, the illiquidity and credit squeeze can spread pretty rapidly and render regulatory action inadequate. Thirdly, the information submitted to the regulator may not be of much use to the market participants and as such, may not contribute significantly to improving market transparency. Lastly, such information submitted to the regulators shall not be useful for the post trade processing services which contribute to efficiency of the OTC trade infrastructure. 4.10 In the above perspective, the reporting structure for the OTC derivatives in India needs to be looked at afresh. It is true that the OTC derivatives market in India is not comparable to markets in US and EU jurisdictions, either in the range of products available or in the volume of trades. Moreover, with capital accounts restrictions in place and capital inflows and the prospect of any abrupt reversal continuing to be potential destabilizing factors the regulatory perspective on reporting of OTC derivatives transactions is also different from other jurisdictions. 4.11 As mentioned in the earlier chapter, there is a reporting scheme for various OTC derivative products in India and there is no reason to believe that the reporting scheme has not served the objective of the regulators. The objective therefore is to consolidate the existing reporting arrangements so as to make it more robust and efficient in the following sense:

4.12 Another issue which merits consideration is whether the reporting arrangement should cover only the interbank transactions or also the transactions between banks and their clients. Since the current discussions on OTC derivative transactions reporting are in the backdrop of the global financial crisis, it has to be noted that the liquidity dry-up during the crisis has been attributed to the opacity in OTC derivative transactions between the financial firms; and transactions between banks and other non-financial firms have not been in focus. Nevertheless, some of the proposed OTC market reform measures such as CCP clearing are likely to cover non-financial firms’ transactions and this has caused concerns. As mentioned in a FSA/HM Treasury Report, “Non-financial firms typically use OTC derivatives to hedge the risk incurred in the course of their core business. According to the ISDA 2009 Derivatives Usage Survey, 94per cent of the Fortune 500 companies surveyed used OTC derivatives to hedge non-business risks.” It may be noted that the Dodd-Frank Act in the US as well as the draft MIFID largely exempts them from the clearing obligation, unless their business has “systemic” implications and among those who are counted as having systemic implications are the energy companies, airlines, manufacturers, etc., that have large positions in OTC derivatives18. 4.13 The position obtaining in India in respect of OTC derivatives transactions is different from elsewhere in the sense that for all OTC derivative transactions one of the counterparties has to be necessarily a bank, or a Primary Dealer (PD). In terms of Section 3 of Foreign Exchange Management Act 1999, “… no person shall deal in or transfer any foreign exchange or foreign security to any person not being an authorised person”. In terms of Section 45 V of the RBI Act, “… transactions in such derivatives as may be specified by the Bank from time to time, shall be valid, if at least one of the parties to the transaction is the Bank, a scheduled bank, or such other agency falling under regulatory purview of the Bank under the Act, the Banking Regulation Act, 1949(10 of 1949), the Foreign Exchange Management Act, 1999 (42 of 1999), or any other Act or instrument having force of law, as may be specified by the Bank from time to time”. Further, in terms of paragraph 3 of the comprehensive guidelines on derivatives, “… at least one party to a derivative transaction is required to be a market maker” while paragraph 5 (i) ibid. defines market makers as all commercial banks (excluding LABs and RRBs) and PDs. The implications of the above requirements are two-folds. First, when a bank enter into a derivative transaction with a non-financial firm, however systematically important the latter may be and however large the transaction size may be, the bank as a market maker has to do a contra transaction to square its position and as such, the trade between the market makers will in a sense capture the transactions initiated by the non-financial firms. Second, the settlement of trades done by non-financial firms will be between those firms and their banks. Since with a high degree of probability, the OTC derivative trade between a non-financial firm and a bank would be preceded by a bank client relationship between them, such a transaction is unlikely to pose a systemic problem though it might lead to disputes. 4.14 The Indian financial markets are subject to a capital control framework. While the capital accounts transactions of the non-financial sector has been substantially liberalised, the financial sector is subject to a large number of restrictions. On the other hand, increasing globalisation has led to stronger linkages between the domestic and the international sectors by way of multinational firms, foreign exporters with exposure to Indian markets, etc. The Indian financial system has experienced lumpy and uneven capital flows as well as sudden reversals (as witnessed in the aftermath of Lehmann crisis during Oct 2008 to March 2009). In recent times, there has been significant growth in the non-deliverable forwards (NDF) markets19. When the exchange rate is volatile the expectations of the market is expressed through action of non-financial firms (in view of limit on positions of the banks and other financial firms), e.g. cancellation of forward contracts by exporters, increase in booking of forward contracts by importers, etc. As such, it is necessary to have a sense of the activities of the non-financial sector in the OTC derivatives market to take necessary steps to anchor expectations and establish orderly conditions in the market, should there be deviations. 4.15 In light of the discussions above, the rest of this chapter lays down the recommendations/suggestions for consolidating the existing reporting arrangement of the permitted OTC derivatives. Foreign exchange OTC derivatives 4.16 The reporting arrangement in the foreign exchange derivatives so far has been geared to the requirements of the regulator, i.e, the RBI. The prices in the forwards market, the dominant segment, are observable almost on a real time basis, because of the electronic trading platforms. It is true that what is disseminated on the newswires are the quoted rates and there may be some difference between the dealt rates and quoted rates, but nevertheless the newswires do give a realistic sense of the trend and liquidity of the market. Moreover, there is an all-encompassing position limit on the banks in place which substantially mitigates the systemic risk posed by OTC derivatives. 4.17 Clearing of most of the interbank spot foreign exchange transactions is effected through CCIL which interposes as the CCP. The interbank forward transactions20 are also cleared through this arrangement, but only when they enter the spot window. For example a forward contract entered between two banks on October 17, 2010 for delivery on December 31, 2010 has to be reported to CCIL on December 29, 2010 and will settle along with the spot transactions entered into on December 29, 2010, due for settlement on December 31, 2010. CCIL has also put in place a guaranteed settlement for forward transaction right from the date of contract. In such an arrangement, the forward contract mentioned above has to be reported to CCIL on October 17, 2010 itself and the CCP guarantee offered by CCIL will be applicable from that day. 4.18 Considering the importance of the developments in the foreign exchange forward markets as mentioned earlier, it is felt that it would be useful to capture the details of the inter-bank forward transactions which will convey a sense of the market’s view of the future exchange rate trend. It is true that in a liquid market, the prices incorporate all information. However, in case of a heterogeneous market, information on the activity of the market participants would augment the insight of the regulator. As such, it would be appropriate if all inter-bank forex forward transactions are reported to CCIL which already has a platform for clearing and thence, for capturing the data. In absence of any significant post-trade processing benefits, there may not be enough incentive for banks to report their forward transactions to CCIL in absence of regulatory mandate. It may therefore, be necessary for RBI to issue an appropriate direction. 4.19 As mentioned earlier in this chapter, the details of forward contracts entered into between banks and their clients do convey the views of the corporate sector on the exchange rate trend, and as such, it is an important input for policy decisions in capital account management and Reserve Bank’s intervention strategy. It will be useful to have complete information on the volume and price of transactions rather than anecdotal or summary information. While the details of all forward transactions between corporates and their banks may impose considerable burden on reporting and analysis without providing commensurate insight, it is suggested that arrangements may be put in place for reporting of forward transactions between banks and their clients beyond some threshold, say , USD 100,000. 4.20 In the Group’s interactions with market participants and corporates, it was apparent that some of the banks are reluctant to report their client trades to a third party; but they have no reservations against reporting such trades to the RBI. The reason for their reluctance stems from client confidentiality and unwillingness to disclose their pricing strategy to a third party. Fears were also expressed that if it becomes known that a particular bank has entered into a large transaction with a customer and will soon be in the market for covering itself, it may be subject to exploitative squeeze by other market participants. 4.21 It is true that unlike in case of interbank transactions there is no need for post trade processing services in case of transactions between a bank and its client. The settlement of the trade takes place between the bank and its client in the books of the bank. Thus there may not be any incentive for the banks to report their client trades to a repository. 4.22 In the Indian context, it is apparent that the reported client trades are of use only to the Reserve bank (to get a sense of the market and view of the market participants) and that the banks have some reservation about their client trades being known to a third party. From this view, it would follow that the client trades should be reported by the banks only to the regulator. However, it may be feasible if the client trades are reported to an organisation like CCIL with the safeguard that the organisation shall not have any access to these trades and shall only provide the platform for receiving the reports and collating the information into usable formats as decided by RBI from time to time. It may be mentioned that such an arrangement already exists for submission of bids for flotation of government debt through auction which ranks at par with the client trades in terms of confidentiality. 4.23 Since the organisation which receives the report of client trade is not going to provide any service to the reporting banks and thus cannot charge for the services, it may not be a commercially feasible operation. It follows that if reporting of client trades is considered imperative from stability viewpoint, if necessary, some form of compensation to the organization may have to be provided for by the beneficiary of the data. The choice between whether RBI itself receives the client trades reporting and whether a designated organisation receives it, subject, of course, to the safeguards mentioned above, depends on expedience. Forex Option Contracts with Rupee as one of the currencies 4.24 The OTC options market is predominantly between the banks and the end users of the option. The extant regulatory regime distinguishes between banks that are allowed to run an option book and those who are not. The banks that are not allowed to run option book are required to enter into a back to back option contract with another bank for their net options position. Further, corporates are not permitted to write options on a stand alone basis but only as a part of a cost reduction structure, ensuring that there is no net receipt of premium. Unlike in case of linear derivatives where a transaction between a bank and its client usually results in a matching contra transaction in the inter-bank market, in case of options, generally the delta of the option portfolio is reckoned for squaring the position and the squaring is achieved through a spot transaction or a linear derivative. 4.25 In keeping with the objective of reporting of all inter-bank OTC derivatives transactions, it is desirable that all forex options contracts between banks should be reported. If CCIL is entrusted with the responsibility of reporting of forward contracts, the economy of scale and scope would favour reporting arrangement for option contracts with CCIL. Besides CCIL should be in a position to offer post-trade processing services such as valuation and MIS reports. It is understood that CCIL is in a process of developing such platform. 4.26 As mentioned earlier, transactions in the forex options market in India is predominantly between the banks and their clients. Regulatory monitoring of the options markets shall not be complete unless the reports include the client transactions as well. As of now, banks permitted to run an option book are required to report transaction-wise details of their options portfolio (inter-bank as well as client trades) at weekly intervals to the Foreign Exchange Department in physical form (some banks report in soft form as well). However, the utility of these reports is limited partly because the reporting is in physical form requiring further data entry and partly because it is periodic. It is therefore suggested that the reporting of option contracts between banks and their clients may be made in a manner similar to the forex forward contracts discussed in paragraph 4.23 above either to the CCIL with necessary safeguards as to confidentiality or to the Reserve Bank direct. Cross currency options and other derivatives 4.27 While permissible option contracts are limited to the plain vanilla types when rupee is one of the currencies involved, market participants have considerable latitude in case of cross currency options. Apart from the plain vanilla types, various so called exotic options involving two currencies other than the Rupee can also be contracted. It has been observed that corporate are increasingly using such option contracts. Further, these options are rarely transacted in the interbank market except for the purpose of back-to-back-covering. These contracts have little systemic implications in the sense that they do not contribute to or convey any sense of the volatility of the exchange rate of the rupee. Nevertheless, it would be desirable to cover these options as well in the reporting structure to complete regulatory knowledge of the foreign exchange market. Besides, such reporting may also augment the information requirement for prudential oversight. The suggested arrangement may also be considered for other cross-currency derivatives such as forwards, swaps, etc. 4.28 Unlike forex derivatives, the range of OTC interest rate derivatives is rather limited even as the reporting arrangement robust. The only OTC interest rate derivatives permitted are the Forward Rate Agreements (FRA) and Interest Rate Swaps (IRS). IRS is the more actively traded product and at present swaps on three benchmarks – MIBOR, MIFOR and INBMK are traded. Reserve Bank mandated in 2007 that all interbank transactions in FRA and IRS be reported on a platform developed for the purpose by CCIL. The reporting captures all details of the transaction and is on near-real-time basis inasmuch as banks are required to report a transaction within 30 minutes of its conclusion. The data has been available to the Reserve Bank and CCIL has been disseminating some aggregate information on the IRS market. Beyond this, the data bank has so far had no other use as one would expect of a repository arrangement. 4.29 The reporting arrangement for IRS and FRA does not cover transactions between banks and their clients. Client transactions constitute a rather small fraction of the interbank market in IRS. Nevertheless, in absence of client trade reporting, the regulator’s sense of the market remains incomplete. Recognising the need, Financial Markets Department has been collecting information on client trades at weekly intervals in soft (worksheet) form. However, this arrangement is at best ad hoc and needs to be put on a more robust footing. It is suggested that the client trades in IRS may also be reported in the same manner as the forex derivatives discussed earlier. 4.30 A repo essentially comprises a spot sale (purchase) and forward purchase (sale) of any asset. Thus the second leg of the transaction in a linear derivative like any forward or futures contract. However, a repo is usually looked at from its economic essence viewpoint, i.e., a collateralised borrowing arrangement. Although not treated as a separate class of derivatives, repo transactions have assumed importance because of their twin role in funding an asset position as also facilitating short sale in that asset, if permitted. It may be recalled that the repo market faced severe illiquidity during the crisis and making the repo market more robust is engaging the attention of the regulators. 4.31 In Indian markets, there are repo transactions in two assets, viz., the government securities and corporate bonds. A repo-like product, CBLO, operated by the CCIL, where a pool of government securities is created against which units called CBLO are created and allotted to members to be bought (lending of funds) and sold (borrowing of funds) by them is quite popular and commands large volumes. Repos in government securities are partly transacted on an anonymous order matching platform CROMS and partly contracted bilaterally but reported on the RBI’s NDS platform. In case of repo in government securities and CBLO, CCIL acts as the central counterparty and hence all transaction level data are available as would be the case in case of a repository. In case of corporate bonds, the trading as well as settlement is bilateral but the transactions are required to be reported to a platform hosted by the FIMMDA. 4.32 Thus the reporting arrangement in respect of repo transactions is comprehensive and there is little to suggest for making it more comprehensive. The only issue which merits consideration is that there are three agencies involved in the reporting framework. Since CCIL acts as the central counterparty for all repo trades in government securities, it would be optimal if the reporting of repo transactions outside the CROMS are also reported on a CCIL platform rather than RBI NDS. Client trades 4.33 As discussed earlier, the details of a trade reported to a TR is supposed to provide a ‘golden copy’ of the transaction. It should thus serve as a legally binding contract and dispense with such practices as exchange of confirmation. A reported client trade can serve as a ‘golden copy’ of contract between the bank and its client only if the transaction is reported by one and confirmed by the other and matched as such by the TR. Therefore, whether the process of reporting and confirmation is an optimal proposition in case of client trades needs to be examined. In case of forex derivatives, the transaction between a bank and its client is invariably extensively documented because the bank has to fulfill its obligation under FEMA for verifying the underlying. As such clients’ confirmation of trade reported by banks to TRs may be superfluous. Secondly, the trades between a bank and its client settle in the books of the bank and the systemic implication of such a transaction goes little beyond the bank’s credit risk on the client. Thirdly, though technologically feasible, confirmation by numerous and geographically dispersed clients may pose certain problem such as failure of confirmation by clients resulting in unmatched trades. 4.34 If the client trades are not confirmed, the purpose behind reporting of clients trades over TRs as discussed earlier is not necessarily diluted. The onus of correct reporting remains with the reporting banks. 4.35 The objective of the current effort is to provide a framework for consolidation of the reporting arrangements so as to bring in more efficiency and transparency. Thus it is important that future reporting regime with TRs should avoid any duplication of reporting by market participants. Two possible duplications that need to be avoided merit particular mention. First, since the TRs would house comprehensive details of all the transactions of the concerned asset class, any summary report can be constructed from the data and there should not be any case for the regulators calling for same reports from the market participants separately. Secondly, wherever the concerned asset class is cleared and settled through a central counterparty, the market participant should not be required to submit the transaction particulars separately to the TR and CCP. Thus seamless data flow between the TR and the CCP, even when they are separate legal entities, is an imperative and has to form a condition of the charter of the TR. 4.36 The TR shall be storing critical data, including details of transactions between banks and their clients and shall also be offering a wide range of post trade services and inputs to regulators as well as disseminating summary data in the public domain. Besides, they may also be providing data to the CCPs. In such a scenario, the issues of registration, governance and regulation of the TR assume importance. It is felt that the mandate given to regulators to regulate various derivative products will provide the framework for them to deal with these issues. Nevertheless, it will be necessary to formulate comprehensive guidelines for the purpose. 4.37 The Report, in the preceding paragraphs, has discussed about the reporting arrangement for the OTC derivatives permitted to be transacted in the Indian markets as of now. It is recognized that as the market develops, a wider set of derivatives shall be available for the market participants, for instance, plain vanilla as well as interest rate options, exotic options involving INR, etc. The reporting framework proposed here can be extended, with appropriate modifications wherever necessary, to these products. CHAPTER 5 5.1 The role of TRs in improving transparency of the OTC derivatives markets is well recognised. The regulators world over are attempting to set up TRs. As of now, there are three global swap repositories in existence today - one for OTC equity derivatives operated by DTCC in London, one for OTC interest rate derivatives operated by Tri-Optima in Sweden, and one for credit default swaps operated by DTCC in the USA. There have also been some attempts to set up repositories in the Euro jurisdiction. Nevertheless, the issues relating to the setting up of repositories, their governance structures, regulatory jurisdiction, functionalities, etc. have not yet been crystallized and are being widely discussed. Several organisations, including the Financial Stability Board, the IOSCO, the OTC Derivatives Regulators Forum, the European Central Bank, etc., have come up with documents outlining the areas relating to improvement of the OTC market structure. Apart from a mention in the Dodd Frank act to the effect that data repository should be created to provide regulators and the public with the necessary transparency into the global OTC derivatives markets, there does not seem to be any other regulatory mandate for the repositories. 5.2 The issues relating to the repositories fall into two categories. The first covers the structure and organization of the repositories system and the second covers the functionalities of a repository. The pertinent questions regarding the structure of the repository system are (a) whether there should be a single or multiple repository(ies) for each class of OTC derivatives, (b) whether there should be a global repository for each class or multiple repositories across jurisdictions, (c) whether the repository should be a government initiative or private sector initiative and (d) what should be the regulatory regime for the repositories. The second set of issues covers the types, coverage, quality and frequency of transaction data, access to data housed in the TR, services offered by the TRs, and confidentiality of the data. The latter set of issues is universal and the evolving best practices through the efforts of global bodies such as the OTC Derivatives Regulator’s Forum, FSB, IOSCO can provide the guiding principles for any repository in any jurisdiction. Moreover since these issues have been discussed in some detail in chapter 2, the Group does not wish to dwell on it here. Because of their relevance for setting up of a repository in India, the questions in the first set are discussed at length below. 5.3 There is considerable debate on the question whether there should be a single repository across the globe for any given product or there should be several repositories in different jurisdictions for the same product. The problem with more than one repository for a given product lies in data portability and aggregability. The question assumes importance particularly in view of the fact that OTC derivatives are global in nature and the counterparties could be transnational. In such a situation if OTC derivative information about outstanding contracts are fragmented into different repositories in different countries, comprehensive information for the regulator could be elusive. As Don Donahue, Chairman and CEO, DTCC states in a testimony (February 15, 2011) before the US House Committee on financial services,

5.4 As of now, the derivatives market in India is almost entirely domestic and the data aggregability and extra-jurisdictional issues do not apply. Though the non-residents are not allowed in the interest rate swaps market, they have limited access to the foreign exchange derivatives market and are likely to have access to the proposed CDS market. On the other hand, the Indian bank branches abroad do participate in the OTC derivatives markets in the host countries and single named CDS on some of the Indian corporate and banks are also reported to be trading. Even though the domain of the TRs in India would be restricted to products and participants in the domestic markets, it would be desirable to keep in view the data portability and aggregability issues while setting up a repository. 5.5 The argument in favour of a single repository for a given class of product is compelling from another perspective. TRs are not merely warehouse of information but can significantly contribute to market efficiency through post trade processing service and lifetime event management. If the repositories are fragmented, particularly in a nascent market with limited activity, it would not be possible for them to provide any effective post trade service. 5.6 A related question in this context is whether multiple class of products may be reported on a single repository. As such, there is nothing that prevents a single repository from handling multiple products, provided it has the necessary resources and expertise. The global experience suggests that a single repository is catering to a particular class of product, e.g., DTCC is the repository for credit derivatives, whereas TriOptima deals with interest rate derivatives. It may be mentioned here that such a structure has evolved for historical reasons and given the large volumes of transaction in each product class, such specialisation is economically feasible and sustainable. On the other hand, in Indian markets, the total volume of transactions is relatively small in any class of derivatives and as such a dedicated repository for each class may pose viability problem. 5.7 A regulator can effectively collect all trade information just as a repository and disseminate such aggregate/summary information in the public domain as may be necessary for improving market transparency. However, a regulator cannot render post trade processing and event lifecycle management and thus, a TR initiative has necessarily to be a private sector initiative. Though the need for post trade services alone can justify the existence of a TR with information availability to the regulator a useful byproduct, in nascent market such as India’s with limited trading activity, the evolution of TRs has to necessarily depend on regulatory mandate for reporting of trades with post trade services a later adjunct. 5.8 As discussed earlier, the CCIL, which has been warehousing the transaction details for IRS and also offering guaranteed settlement for several other financial products, enjoys significant economy of scale and scope in taking up the functionalities of a repository. Firstly, the collection of information on trades is necessary for clearing and settlement, which is the primary activity of CCIL and in which, it has considerable experience over the years. Secondly, it already possesses a comprehensive platform with necessary infrastructure as well as connectivity. The Group does not see any conflict of interest between the clearing and settlement activities of CCIL and its functioning as a repository. Though the DTCC does not operate a clearing house for derivatives, it is involved in clearing activities through its 50 per cent equity interest in New York Portfolio Clearing and three wholly owned subsidiaries which are registered clearing agencies under the Exchange Act, subject to regulation by the SEC. On the other hand, the activities enjoined upon a repository are complete in itself and distinct from that of an institution that does clearing and settlement. Further, repositories, so as to ensure data portability as well as acceptability in foreign jurisdictions, will have to adhere to the best practices as they are formalized. As such, it would be advantageous if there is an institution which functions solely as a TR. 5.9 While from a governance and regulatory perspective, there are merits in the case for a dedicated repository without any other collateral activities, there are questions about the economic viability of such an institution. The repository has to make large initial investment in infrastructure for capturing and processing trade data. On the other hand, the only source of income for a repository is the post-trade processing services that it offers to the market participants. In a nascent and developing market like India’s, it is highly doubtful whether a repository would be economically viable on its own. 5.10 Thus, the Group feels that notwithstanding the desirability of a dedicated repository, it would be expedient if a subsidiary of CCIL is formed to take over and/or commence repository activities. Such an arrangement would both gainfully use the expertise, experience, and infrastructure of CCIL and at the same time satisfy the corporate governance issue mentioned above. However, the question of formation of a subsidiary needs to be examined with regard to its economic viability and can be taken up at an appropriate time after the markets have grown in size and repository activity has stabilized. 5.11 A related question arises in this context. The international discourse has focused on the merits of a single TR for a given asset class as discussed above. In certain jurisdictions such as that of India, a question may arise about the merits of a single TR for all asset classes. The arguments in favour of and against such a proposition are as follows. Arguments in favour of a single repository for all products

Arguments against a single repository for all products