|

Acknowledgements

The Group is grateful for the guidance provided by the members of the Technical Advisory Committee (TAC) on Money, Foreign Exchange and Government Securities Markets.

The Group also places on record its appreciation of the contribution by Dr. K V Rajan, Shri Himadri Bhattacharya, Shri Salim Gangadharan, Shri G Padmanabhan, Ms Meena Hemchandra, Shri Chandan Sinha, Shri G Mahalingam, Smt Supriya Pattnaik, Shri R N Kar, Dr. M K Saggar, Shri S Chatterjee, Shri T Rabisankar, Shri K Babuji and Shri Indranil Chakraborty.

The Group would like to place on record its appreciation of the research and secretarial assistance provided by Shri H S Mohanty, Shri Navin Nambiar and Shri Puneet Pancholy of the Financial Markets Department.

Abbreviations

AFS |

Available For Sale |

AIFI |

All India Financial Institutions |

AMFI |

Association of Mutual Funds of India |

AS |

Accounting Standards |

CBLO |

Collateralized Borrowing and Lending Obligation |

CBOT |

Chicago Board of Trade |

CCIL |

Clearing Corporation of India Limited |

CDS |

Credit Default Swaps |

CDSL |

Central Depository Services Limited |

CFTC |

Commodities Futures Trading Commission, USA |

CME |

Chicago Mercantile Exchange |

CTD |

Cheapest To Deliver |

DMO |

Debt Management Office |

DP |

Depository Participant |

ECB |

European Central Bank |

EONIA |

Euro Over Night Index Average |

FASB |

Financial Accounting Standards Board |

FEMA |

Foreign Exchange Management Act,2000 |

FI |

Financial Institution |

FII |

Foreign Institutional Investor |

FIMMDA |

Fixed Income Money Market and Derivative Association of India |

FMC |

Forwards Market Commission |

FMD |

Financial Markets Department |

FRA |

Forward Rate Agreement |

GoI |

Government of India |

HFT |

Held For Trading |

HLCC |

High Level Committee on Capital Markets |

HTM |

Held Till Maturity |

IAS |

International Accounting Standards |

IASB |

International Accounting Standards Board |

ICAI |

Institute of Chartered Accountants of India |

IDMD |

Internal Debt Management Department |

IGIDR |

Indira Gandhi Institute of Development Research |

IRD |

Interest Rates Derivatives |

IRDA |

Insurance Regulatory and Development Authority |

IRF |

Interest Rate Futures |

IRS |

Interest Rate Swaps |

ISF |

Individual Share Futures |

JGB |

Japanese Government Bond |

KRW |

Korean Won |

LAB |

Local Area Bank |

LIBOR |

London Inter-Bank Offered Rate |

MIBOR |

Mumbai Inter-Bank Offered Rate |

MTM |

Mark-to-Market |

NRI |

Non Resident Indian |

NSDL |

National Securities Depositories Limited |

NSE |

National Stock Exchange |

OIS |

Overnight Indexed Swaps |

OTC |

Over The Counter |

PD |

Primary Dealer |

PFRDA |

Pension Fund Regulatory and Development Authority |

RBI |

Reserve Bank of India |

RRB |

Regional Rural Bank |

SCB |

Scheduled Commercial Banks |

SCRA |

Securities Contract (Regulation) Act |

SEBI |

Securities and Exchange Board of India |

SFE |

Sydney Futures Exchange |

SGL |

Subsidiary General Ledger |

SIBOR |

Singapore Inter-Bank Offered Rate |

SLR |

Statutory Liquidity Ratio |

SOMA |

System Open Market Account |

TAC |

Technical Advisory Committee on Money, Foreign Exchange and

Government Securities Markets |

TOCOM |

Tokyo Commodity Exchange |

USD |

US Dollar |

YTM |

Yield To Maturity |

ZCYC |

Zero Coupon Yield Curve |

Executive Summary

Background

In the wake of deregulation of interest rates as part of financial sector reforms and the resultant volatility in interest rates, a need was felt to introduce hedging instruments to manage interest rate risk. Accordingly, in 1999, the Reserve Bank of India took the initiative to introduce Over-the-Counter (OTC) interest rate derivatives, such as Interest Rate Swaps (IRS) and Forward Rate Agreements (FRA). With the successful experience, particularly with the IRS, NSE introduced, in 2003, exchange-traded interest rate futures (IRF) contracts. However, for a variety of reasons, discussed in detail in the report, the IRF, ab initio, failed to attract a critical mass of participants and transactions, with no trading at all thereafter.

2. The Working Group was asked to review the experience so far and make recommendations for activating the IRF, with particular reference to product design issues, regulatory and accounting frameworks for banks and the scope of participation of non-residents, including FIIs.

3. The first draft of the Report was placed before the Technical Advisory Committee whose views/ suggestions were duly addressed in the second revised draft which was endorsed by the TAC in their subsequent meeting. Comments received from one Member, who could not be present for the meetings, are annexed to the Report.

Activating the IRF Market-Product Design Issues

4. The Group noted that banks, insurance companies, primary dealers and provident funds, who between them carry almost 88 per cent of interest rate risk on account of exposure to GoI securities, need a credible institutional hedging mechanism to serve as a “true hedge” for their colossal pure-time-value-of-money / credit-risk-free interest rate-risk exposure. Although the IRS (OIS) is one such instrument for trading and managing interest rate risk exposure, it does not at all answer the description of a ‘true hedge’ for the exposure represented by the holding of GoI securities of banks because, much less price itself, even remotely, off the underlying GoI securities yield curve, it directly represents, on a stand-alone basis, an unspecified private sector credit risk and not at all the pure, credit risk-free time-value-of-money exposure of GoI securities. Government securities yield curve is the ultimate risk-free sovereign proxy for pure time value of money, and delivers all over the world, without exception, the most crucial and fundamental public good function in the sense that all riskier financial assets are priced off it at a certain spread over it.

5. One of the reasons for the IRF not taking off is ascribable to deficiency in the product design of the bond futures contract, which was required to be cash-settled and valued off a Zero Coupon Yield Curve (ZCYC). As the ZCYC is not directly observable in the market, and is not representative in an illiquid market, participants were not willing to accept a product which was priced off a theoretical ZCYC. In response to this ‘felt-need’, the SEBI proposed in January 2004, a contract based on weighted average YTM of a basket of securities.

6. However, as regards cash settlement of IRF contracts proposed earlier, the Group was of the opinion that while the money market futures may continue to be cash-settled with the 91 day T-Bills/MIBOR/ or the actual call rates serving as benchmarks, the bond futures contract/s would have to be physically-settled, as is the case in all the developed, and mature, financial markets, worldwide. Although, very few contracts are actually carried to expiration and settled by physical delivery, it is the possibility of final delivery that ties the spot price to the futures price. In any futures contract, the key driver of both price discovery, and pricing, is the so called “cash-futures-arbitrage”, which guarantees that the futures price nearly always remained aligned, and firmly coupled, with the price of the ‘underlying’ so that the futures deliver on their main role viz., that of a ‘true hedge’. Cash-futures arbitrage cannot occur always if contracts are cash-settled due to a very real possibility of settlement price being discrepant / at variance with the underlying cash market price – whether because of manipulation, or otherwise - at which the long will ultimately offload / sell. Last, but not the least, any suggestion of artificial/manipulated prices can severely undermine Government’s ability to borrow at fair and reasonable cost.

7. As regards the specific product, the Group was of the view that to begin with it would be desirable to introduce a futures contract based on a notional coupon bearing 10-year bond, settled by physical delivery. Depending upon market response and appetite, exchanges concerned may consider introducing contracts based on 2-year, 5-year and 30-year GoI securities, or those of any other maturities, or coupons. In the Group’s view, some of the market micro-structure issues such as notional coupon, basket of deliverable securities, dissemination of conversion factors, and hours of trading were best left to respective exchanges.

8. The Group was of the view that delivery-based, longer term / tenor / maturity short-selling of the underlying GoI Securities, co-terminus with that of the futures contract is a necessary condition to ensure that cash-futures arbitrage, deriving from the ‘law of one price’ / ‘no arbitrage argument’, aligned prices in the two markets. Hence, to begin with, delivery-based, longer term / tenor / maturity short selling in the cash market may be allowed only to banks and PDs, subject to the development of an effective securities lending and borrowing mechanism / a deep, liquid and efficient Repo market.

9. The Group further felt that with the introduction of delivery-based, longer term short-selling in GoI securities and IRF, as recommended, the depth, liquidity and efficiency of GoI securities will considerably improve on account of seamless coupling through arbitrage between IRS, IRF and the underlying GoI securities, which, in turn, would be seamlessly transmitted to the corporate debt market.

Regulatory Issues and Accounting Framework

10. The RBI (Amendment) Act 2006 vests comprehensive powers in the RBI to regulate interest rate derivatives except issues relating to trade execution and settlement which are required to be left to respective exchanges. The Group was of the view that considering the RBI’s role in, and responsibility for, ensuring efficiency and stability in the financial system, the broader policy, including those relating to product and participants, be the responsibility of the RBI and the micro-structure details, which evolve thorough interaction between exchanges and participants, be best left to respective exchanges.

11. Under the existing regulatory regime, while banks are allowed to take hedging as well as trading positions in IRS / FRAs, they are permitted to use IRFs only for hedging. However, Primary Dealers (PDs) are allowed to take both trading and hedging positions in IRFs. As banks constitute the single most dominant segment of the Indian financial sector, in order to re-activate the IRF market, and reduce uni-directionality, it is imperative that banks be also allowed to contract IRF not only to hedge interest rate risk inherent in their balance sheets (both on and off), but also to take trading positions, subject, of course, to appropriate prudential/ regulatory guidelines.

12. In the present dispensation, as banks can classify their entire SLR portfolio as “held-to-maturity” and, which, therefore, does not have to be marked to market, they have no incentive to hedge risk in the market. Since a deep and liquid IRF market will provide banks with a veritable institutional mechanism for hedging interest rate risk inherent in the statutorily-mandated SLR portfolio, the Group was of the considered view that the present dispensation be reviewed synchronously with the introduction of IRF, as given the maturity, and considerable experience of banks with the IRS, the same policy purpose will be achieved transparently through a market-based hedging solution.

13. Besides, it will only be appropriate that the accounting regime be aligned across participants and markets with similar profile. Currently, there exists divergent / differential accounting treatment for IRS and IRF. While the Accounting Standards (AS) 30 recently issued by the ICAI - which prescribes convergence of accounting treatment of all financial instruments in line with the international best practice - is expected to remedy the situation, the standard shall not become mandatory until 2011. Therefore, in the interregnum, the RBI may consider exercising its overarching powers over interest rate derivatives and GoI securities markets under the RBI (Amendment) Act, 2006, and mandate uniform accounting treatment for IRS and IRF.

14. With a view to ensuring symmetry between cash market in GoI securities (and other debt instruments) and IRF, as also imparting liquidity to the IRF market which is an important step towards deepening the debt market, the Group recommends that IRF may be exempted from Securities Transaction Tax (STT).

Participation by Foreign Institutional Investors/Non-Resident Indians

At present, FIIs have been permitted to take position in IRF up to their respective cash market exposure (plus an additional USD 100 million) for the purpose of managing their interest rate risk. Considering the number of FIIs and sub-accounts, the additional USD 100 million allowed per FII would imply a total permissible futures position of USD 128.3 billion, which would be far in excess of the currently permitted limit of USD 4.7 billion. Since long position in cash market is similar to long position in futures market, FIIs may be allowed to take long position in the IRF market subject to the condition that the gross long position in the cash market as well as the futures market does not exceed the maximum-permissible cash market limit which is currently USD 4.7 billion. FIIs may also be allowed to take short positions in IRF, but only to hedge actual exposure in the cash market upto the maximum limit permitted. The same may, mutatis mutandis, also apply to NRIs’ participation in the IRF.

CHAPTER 1

INTRODUCTION

Interest Rate Futures (IRF) were introduced in India in June 2003 on the National Stock Exchange (NSE) through launch of three contracts - a contract based on a notional 10-year coupon bearing bond, a contract based on a notional 10-year zero coupon bond and a contract based on 91-day Treasury bill. All the contracts were valued using the Zero Coupon Yield Curve (ZCYC). The contracts design did not provide for physical delivery. The IRF, ab initio, failed to attract a critical mass of participants and transactions, with no trading at all thereafter. A proposal for change in the product design - introducing pricing based on the YTM of a basket of securities in lieu of ZCYC - was made in January 2004 but has not been implemented.

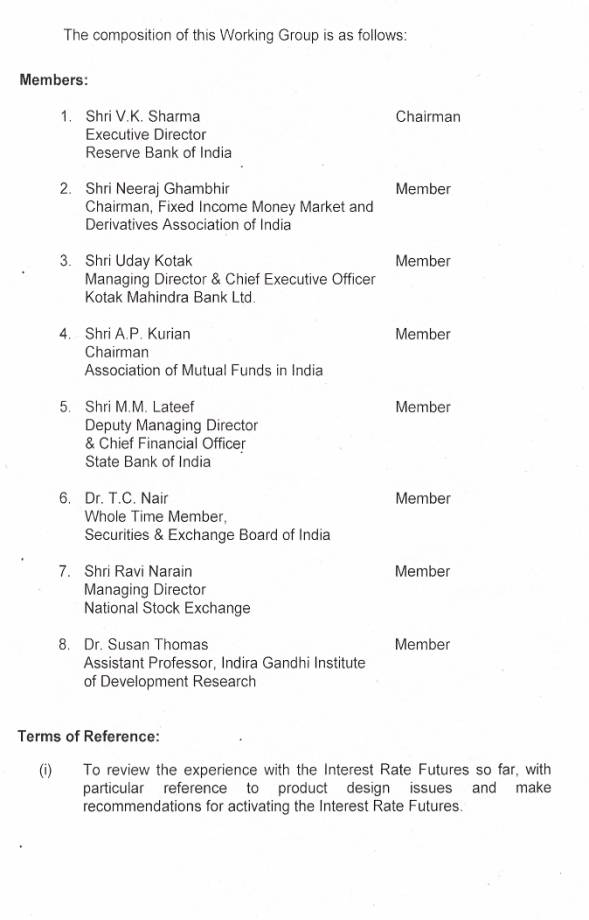

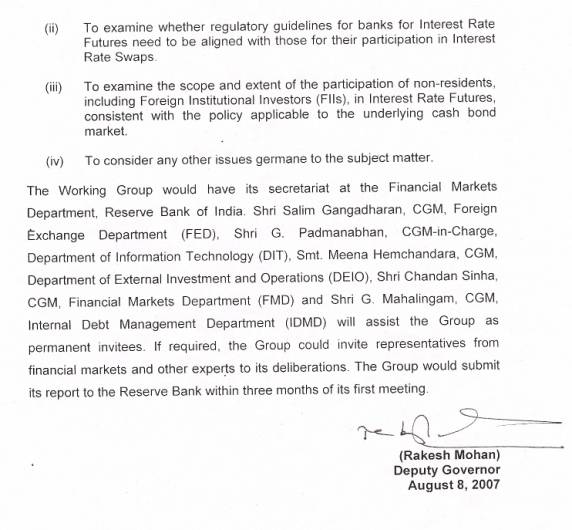

1.2 In the background of this experience with the IRF product, amidst an otherwise rapidly evolving financial market, the Reserve Bank’s Technical Advisory Committee (TAC) on Money, Foreign Exchange and Government Securities Markets in its meeting in December 2006 and July 2007, discussed the need for making available a credible choice of risk management instruments to market participants to actively manage interest rate risk. On the suggestion of the TAC, the Reserve Bank of India (RBI) on August 09, 2007, set up a Working Group on IRF under the Chairmanship of Shri V K Sharma, Executive Director, RBI with the following terms of reference:

(i) To review the experience with the IRF so far, with particular reference to product design issue and make recommendations for activating the IRF.

(ii) To examine whether regulatory guidelines for banks for IRF need to be aligned with those for their participation in Interest Rate Swaps (IRS).

(iii) To examine the scope and extent of the participation of non-residents, including Foreign Institutional Investors (FIIs), in IRF, consistent with the policy applicable to the underlying cash bond market.

(iv) To consider any other issues germane to the subject matter.

1.3 The constitution of the Working Group was as follows:

| 1. |

Shri V.K. Sharma

Executive Director

Reserve Bank of India |

Chairman |

2. |

Dr. T.C. Nair

Whole Time Member,

Securities & Exchange Board of India |

Member |

3. |

Shri Neeraj Ghambhir

Chairman, Fixed Income Money Market and

Derivatives Association of India (FIMMDA) |

Member |

4. |

Shri Uday Kotak

Managing Director & Chief Executive Officer

Kotak Mahindra Bank Ltd. |

Member |

5. |

Shri A.P. Kurian

Chairman

Association of Mutual Funds of India |

Member |

6. |

Shri M.M. Lateef

Deputy Managing Director

& Chief Financial Officer

State Bank of India |

Member |

7. |

Shri Ravi Narain

Managing Director

National Stock Exchange |

Member |

8. |

Dr. Susan Thomas

Assistant Professor,

Indira Gandhi Institute of Development Research |

Member |

1.4 The Group met on August 16, September 25 and November 30, 2007. The Group benefited from the contributions of Shri Anand Sinha, Executive Director, RBI, Shri Pavan Sukhdev, MD & Head of Global Markets, India, Deutsche Bank AG and Shri S Balakrishnan, Management Consultant, who participated in the Group’s meetings as invitees.

1.5 The rest of this Report is organized as follows. Chapter 2 reviews the experience with IRF in the Indian markets and provides a backdrop to the subsequent Chapters. Chapter 3 discusses imperatives of symmetry across cash and futures markets, participants including banks, regulatory and accounting issues. Chapter 4 deals with the specific issue of participation of non-residents, particularly FIIs, in the IRF markets. Chapter 5 nuances product design issues such as imperatives of physical settlement of the bond futures contract. Chapter 6 summarizes the key observations and recommendations of the Group.

1.6 One of the Members of the Group, Dr. Susan Thomas, submitted a note on her reservations on some of the recommendations of the Group which is appended.

1.7 The Report has three Annexes: Memorandum setting up Working Group, a study on cross-country practices in IRF and an illustrative design for a contract based on settlement by physical delivery.

CHAPTER 2

A REVIEW OF INTEREST RATE FUTURES IN INDIA

2.1 In the wake of deregulation of interest rates as part of financial sector reforms and the resultant volatility in interest rates, a need was felt to introduce hedging instruments to manage interest rate risk. Accordingly, in 1999, the Reserve Bank of India took the initiative to introduce Over-the-Counter (OTC) interest rate derivatives, such as Interest Rate Swaps (IRS) and Forward Rate Agreements (FRA). In November 2002, a Working Group under the Chairmanship of Shri Jaspal Bindra was constituted by RBI to review the progress and map further developments in regard to Interest Rate Derivatives (IRD) in India. On the recommendation of the High Level Committee on Capital Markets (HLCC), the Bindra Group also examined the issues relating to Exchange Traded Interest Rate Derivatives (ETIRD).

2.2. In its report (January 2003), the Bindra Group discussed the need for ETIRD to create hedging avenues for the entities that provide OTC derivative products and listed anonymous trading, lower intermediation costs, full transparency and better risk management as the other positive features of ETIRD. It also discussed limitations of the OTC derivative markets viz., information asymmetries and lack of transparency, concentration of OTC derivative activities in major institutions, etc. The Bindra Group favored a phased introduction of products but suggested three bond futures contracts that were based on indices of liquid GoI securities at the short, the middle and the long end of the term structure. The Bindra Group also considered various contracts for the money market segment of the interest rates and came to a conclusion that a futures contract based on the overnight MIBOR would be a good option.

2.3 The Security and Exchange Board of India’s (SEBI) Group on Secondary Market Risk Management also considered introduction of ETIRD in its consultative document prepared in March 2003. Concurring with the recommendations of the Bindra Group, the SEBI Group considered various options in regard to launching IRF and recommended a cash-settled futures contract, with maturities not exceeding one year, on a 10-year notional zero-coupon bond. It is pertinent to mention that the Group recognized the advantages of physical settlement over cash settlement. However, it recommended that ‘the ten year bond futures should initially be launched with cash settlement’ because of possibility of squeeze caused by low outstanding stock of GoI securities, lack of easy access to GoI security markets for some participants (particularly households) and absence of short selling.

2.4 Accordingly, in June 2003 IRF was launched with the following three types of contracts for maturities up to 1 year on the NSE.

- Futures on 10-year notional GoI security with 6% coupon rate

- Futures on 10-year notional zero-coupon GoI security

- Futures on 91-day Treasury bill

2.5 While the product design issues were primarily handled by the exchanges and their regulators, RBI permitted the Scheduled Commercial Banks (SCBs) excluding RRBs & LABs, Primary Dealers (PDs) and specified All India Financial Institutions (AIFIs) to participate in IRF only for managing interest rate risk in the Held for Trading (HFT) & Available for Sale (AFS) categories of their investment portfolio. Recognizing the need for liquidity in the IRF market, RBI allowed PDs to hold trading positions in IRF subject, of course, to prudential regulations. However, banks continued to be barred from holding trading positions in IRF. It may be mentioned that there were no regulatory restrictions on banks’ taking trading positions in IRS. Thus SCBs, PDs and AIFIs could undertake IRS both for the purpose of hedging underlying exposure as well as for market making with the caveat that they should place appropriate prudential caps on their swap positions as part of overall risk management.

2.6 In terms of RBI’s circular, SCBs, PDs and AIFIs could either seek direct membership of the Futures and Options (F&O) segment of the stock exchanges for the limited purpose of undertaking proprietary transactions, or could transact through approved F & O members of the exchanges.

2.7 As far as the accounting norms were concerned, pending finalization of specific accounting standards by the Institute of Chartered Accountants of India (ICAI), it was decided to apply the provisions of the Institute’s Guidance Note on Accounting for Equity Index Futures, mutatis-mutandis, to IRF as an interim measure. The salient features of the recommended accounting norms were as under:

2.7.1. Since transactions by banks were essentially for the purpose of hedging, the accounting was anchored on the effectiveness of the hedge.

2.7.2. Where the hedge was appropriately defined and was ‘highly effective’, offsetting was permitted between the hedging instruments and hedged portfolio. Thereafter, while net residual loss had to be provided for, net residual gains if any, were to be ignored for the purpose of Profit & Loss Account.

2.7.3 If the hedge was not found to be ‘highly effective’, the position was to be treated as a trading position, till the hedge effectiveness was restored and accounted for with daily MTM discipline, but with asymmetric reckoning of losses and gains; while the losses were to be reckoned, gains were to be ignored.

2.7.4 In the case of trading positions of PDs, they were required to follow MTM discipline with symmetric reckoning of losses and gains in the P&L Account.

2.8 On the other hand, the accounting norms for the IRS were simply predicated on fair value accounting without any explicit dichotomy between recognition of loss and gain. The general principles followed were as follows:

2.8.1 Transactions for hedging and market making purposes were to be recorded separately.

2.8.2 Transactions for market making purposes should be MTM, at least at fortnightly intervals, with changes recorded in the income statement.

2.8.3 Transactions for hedging purposes were required to be accounted for on accrual basis.

2.9 While Rupee IRS, introduced in India in July 1999, have come a long way in terms of volumes and depth, the IRF, ab initio, failed to attract a critical mass of participants and transactions, with no trading at all thereafter. Since both the products belong to the same class of derivatives and offer similar hedging benefits, the reason for success of one and failure of the other can perhaps be traced to product design and market microstructure. Two reasons widely attributed for the tepid response to IRF are:

2.9.1 The use of a ZCYC for determining the settlement and daily MTM price, as anecdotal feedback from market participants seemed to indicate, resulted in large errors between zero coupon yields and underlying bond yields leading to large basis risk between the IRF and the underlying. Put another way, it meant that the linear regression for the best fit resulted in statistically significant number of outliers.

2.9.2 The prohibition on banks taking trading positions in the IRF contracts deprived the market of an active set of participants who could have provided the much needed liquidity in its early stages.

2.10 In late 2003, an attempt to improve the product design was made by SEBI in consultation with RBI and the Fixed Income Money Market and Derivative Association of India (FIMMDA). Accordingly, in January 2004, SEBI dispensed with the ZCYC and permitted introduction of IRF contracts based on a basket of GoI securities incorporating the following important features:

- The IRF contract was to continue to be cash-settled.

- The IRF contract on a 10-year coupon bearing notional bond was to be priced on the basis of the average ‘Yield to Maturity’ (YTM) of a basket comprising at least three most liquid bonds with maturity between 9 and 11 years.

- The price of the futures contract was to be quoted and traded as 100 minus the YTM of the basket.

- In the event that bonds comprising the basket become illiquid during the life of the contract, reconstitution of the basket shall be attempted, failing which the YTM of the basket shall be determined from the YTMs of the remaining bonds. In case 2 out of the 3 bonds comprising the basket become illiquid, polled yields shall be used.

However, the exchanges are yet to introduce the revised product.

2.11 In December 2003, an internal working group of the RBI headed by Shri. G Padmanabhan, then CGM, Internal Debt Management Department (IDMD), evaluated the regulatory regime for IRD, both OTC as well as exchange-traded, with a view to recommending steps for rationalization of the existing regulations. Starting with the premise that the regulatory regime in respect of both products which belong to the same family of derivatives should be symmetrical, the working group recommended removing anomalies in the regulatory, accounting and reporting frameworks for the OTC derivatives (IRS / FRA) and IRF. Among the principal recommendations were allowing banks to act as market makers by taking trading positions in IRF and convergence of accounting treatment in respect of both the products.

CHAPTER 3

REGULATORY ISSUES AND ACCOUNTING FRAMEWORK

Symmetry in Regulatory Treatment

3.1 One of the basic principles governing regulation of financial markets is that there should be symmetry across markets as well as across products which are similar. Any asymmetry in this regard is likely to create opportunities for regulatory arbitrage and other inequities. As mentioned in the previous chapter, an earlier Working Group had brought out several areas of divergence in this regard between the OTC and exchange-traded segments of Interest Rate Derivatives, identifying limited participation of banks in IRF as a major hindrance to its development.

3.2 The existing regulatory regime is asymmetrical / anomalous in that (i) a Primary Dealer (PD) is allowed to hold trading positions in IRF whereas a bank is not, and (ii) a bank is allowed to hold trading positions in IRS but not in IRF. The first asymmetry / anomaly is further reinforced by the fact that many PDs have since folded back into their parent banks and as on date out of 19 PDs, 10 are bank PDs.

3.3 The success of any financial product, at least in the early stages, critically depends not only upon the presence of market makers but also on their credibility and ability to provide liquidity. It is true that the order-driven, exchange traded products do not need market makers in the same manner as the quote-driven OTC ones do; they nevertheless need liquidity which is imparted by active traders. At the time of initial launch of IRF, only PDs were allowed to take trading positions. Considering that subsequently many PDs have reverse-merged with their parent banks, it has become so much more imperative that banks be also allowed to take trading positions which will be symmetrical with what they are currently allowed to do in the IRS market.

3.4 The large volumes traded in IRS market owe themselves to a number of factors. First, banks were allowed, right from day one, to play a market making role by taking trading positions. This incentivised the market-savvy banks to play an active role and provide liquidity to the product. Second, notwithstanding the fact that IRS may not provide the most appropriate hedge for fixed income portfolios (which predominantly comprise GoI securities) because of the ‘disconnect’ between the IRS rates and yields on GoI securities, it may have been used for hedging due to lack of any other alternative competing product. Thirdly, anecdotal evidence in conjunction with large volumes traded in the IRS seem to suggest that it is used more widely as an instrument of speculation because of its inherent characteristics of cash settlement and high leverage due to absence of any margins.

3.5 The Group, therefore, unequivocally feels that the current restriction limiting banks’ participation in IRF to only hedging their interest rate risks should be done away with and that banks be freely allowed to take trading positions in IRF, depending on their risk appetite, symmetrically with the underlying cash market and IRS market. Needless to mention, banks shall have to put in place appropriate structures for identification and management of risks inherent in the trading book. Besides, they should be subject to prudential regulations of RBI as well as risk management requirements of the exchange(s). Integrated risk management framework should apply symmetrically to cash as well as interest rate derivatives viz., IRS and IRF.

Symmetry in Accounting Treatment

3.6 International accounting practices are currently seeing a move towards standardization and convergence in respect of all financial instruments including derivatives. While Financial Accounting Standards Board (FASB) of the US has its own standards codified in FASB 133, International Accounting Standards Board (IASB) has formulated IAS 39 which has been adopted in many countries including the Euro-zone. The Institute of Chartered Accountants of India has also issued Accounting Standard (AS) 30, which incorporates the norms for recognition and measurement of all financial instruments in line with IAS 39 and other international best practice. These norms would ensure consistency not only across all financial instruments, cash and derivatives, but also across all participants, be it banks or corporates. However, AS 30 issued by the ICAI will come into effect from April 1, 2009 and will be only recommendatory in nature until 2011. Moreover, it will also require appropriate endorsement by the regulatory authorities for full implementation of the new accounting standards.

3.7As has been mentioned earlier, there is no asymmetry in the accounting treatment across IRF and IRS insofar as these instruments are held for trading purposes - IRF by PDs and IRS by banks, PDs and AIFIs. Both the instruments are required to be MTM at periodic intervals with transfer of gains / losses to the P&L account. It is presumed that when banks are allowed to take up trading positions in IRF, identical accounting treatment would be extended to them as well. The Group notes that this accounting practice is in conformity with the international best practice.

3.8 There is, however, a dichotomy in the treatment of IRF and IRS held by entities for the purpose of hedging. While in case of IRF, a detailed procedure based on hedge effectiveness has been laid out, in case of IRS, accrual accounting has been prescribed without any amplification / clarification. This, as documented in the report of the Working Group headed by Shri Padmanabhan, has led to divergent accounting practices among the banks insofar as use of IRS as a hedge is concerned. Some banks take the entire portfolio of IRS in their trading books. Some others, whose parent entities conform to IAS / FASB, adopt the principle of effective hedge akin to the method prescribed for IRF. Yet others adopt a more conservative approach as presently prescribed by RBI for fixed income securities i.e. ignoring the notional gains and recognizing the notional loss and transferring it to the P&L Account.

3.9 In this context, the Group felt that in case it is decided to bring into effect the recommended course of action for revitalizing the IRF markets, it would be necessary to spell out the accounting treatment for IRF as also to ensure that there is symmetry not just between the accounting treatment for IRF and IRS, but also between the derivatives and the underlying.

Symmetry between Cash and Derivative Markets

3.10 The Group recognizes the imperative of permitting short selling in the cash market symmetric to futures market. At present, short selling in the cash market is restricted to five days. A short position in futures contract is equivalent, in effect, to short selling the corresponding ‘underlying’ GoI security.

3.11 There is a very cogent rationale of 'cash futures arbitrage' which alone ensures the 'connect' between the two markets throughout the contract period and also forces convergence between the cash and futures markets, at settlement. In case of discrepancy in prices between the cash market and derivatives market like futures, cash-futures arbitrage, deriving from the ‘law of one price’ / ‘no-arbitrage argument’, will quickly align the prices in the two markets. Specifically, if futures are expensive / rich relative to the cash market, i.e. if the actual Repo rate is less than the implied Repo rate, arbitrageurs will go long the GoI security in the cash market by financing it in the Repo market at the actual Repo rate and short the futures contract, thus realizing the arbitrage gain, being the difference between the implied Repo rate and actual Repo rate. On the other hand, if the futures are cheap relative to the cash market, i.e. if the actual Repo rate is more than the implied Repo rate, arbitrageurs will short the cash market by borrowing the GoI security, for a period exactly matching the tenor / maturity of the futures contract, in the Repo market for delivery into short sale, investing the sale proceeds at the actual Repo rate and go long the bond futures, thereby realizing the arbitrage gain, being the difference between actual Repo rate and implied Repo rate! In either case, such arbitrage-driven trades will inevitably settle at expiration of the contracts by physical delivery with risk-free arbitrage profits being realized.

3.12 In view of the above, the present restriction of five days on short selling in the cash market needs to be revisited. This will depend on the development of effective securities lending and borrowing mechanism / a deep, liquid and efficient Repo market. Subject to these, and other safeguards currently applicable, the short selling period will have to be extended to be co-terminus with the maturity of futures contract. The risk concerns with delivery-based, longer term / tenor / maturity short selling, co-terminus with futures term / tenor /maturity can be equally effectively addressed by the same set of symmetrical prudential regulations as are applicable to futures contracts. Accordingly, the Group recommends that delivery-based, longer term / tenor / maturity short selling co-terminus with futures term / tenor / maturity, be allowed to banks and PDs, subject to the development of an effective securities lending and borrowing mechanism / a deep, liquid and efficient Repo market. It is pertinent also to appreciate that permitting short selling in GoI securities alone will not work in the absence of a liquid and an efficient Repo market. By extension, it can be said that success of IRF would depend upon the vibrancy of the Repo market. In this context the Group noted that the collateralized market is dominated by Collateralized Borrowing and Lending Obligation (CBLO) which is akin to a tri-partite Repo. Notwithstanding the efficiency of the CBLO as a money market instrument as well as for financing the securities portfolio, the fact remains that it cannot serve the purpose of a ‘short’ that needs to borrow a specific security for fulfilling its delivery obligation. While removal of restriction on short selling and introduction of IRF shall provide an impetus to the demand for borrowing securities in the Repo Market, the supply is likely to be fragmented between the Repo and the CBLO market. The Group felt that for the success of IRF, it would be necessary to improve the depth, liquidity and efficiency of the Repo market, for which, the Group felt, it was necessary to replace the existing regulatory penalty for SGL bouncing with transparent and rule-based pecuniary penalties for instances of SGL bouncing.

3.13 Introduction of IRF along with delivery-based, longer tenor short selling (co-terminus with the tenor / maturity of the IRF) will not only impart liquidity and depth to the GoI securities market but will also, as a logical, and natural, concomitant, deliver liquidity and depth to the corporate debt market. The comfort of being able to hedge their interest rate risks through short selling of GoI securities or shorting the IRF will enable the market-makers in corporate debt securities to make two way prices in the corporate debt with very tight bid-offer spreads. In other words, the resultant liquidity and depth in the GoI securities will be seamlessly transmitted to / replicated in the corporate debt market, which will, in turn, facilitate mobilizing much needed financial resources for the infrastructure sector.

Scope of RBI Regulation in the IRF:

3.14 In the USA, the Commodities Futures Trading Commission (CFTC) regulates all exchange traded futures contracts, including those on commodities, foreign exchange, interest rates and equities. In Germany, it is BaFIN (the Federal Financial Supervisory Authority), in the UK, it is the Financial Services Authority (FSA) and in Japan it is the Financial Services Agency which have omnibus regulatory jurisdiction over all exchange-traded futures contracts.

3.15 In India, in terms of the section 45W read with 45 U (a) of chapter III D of RBI Act, 1934, the RBI is vested with authority ‘to determine the policy relating to interest rate products and give directions in that behalf to all agencies…’ The Act also provides that the directions issued under the above provision shall not relate to the procedure of execution or settlement of trades in respect of the transactions on the stock exchanges recognized under section IV of the Securities Contract (Regulation) Act (SCRA), 1956.

3.16 The RBI has a critical role inasmuch as it regulates the market for the underlying viz., Government Securities, as also a significant part of the participants’ viz., banks and PDs. The overall responsibility of ensuring smooth functioning of the financial markets as well as ensuring financial stability rests with the RBI. This position has been comprehensively recognized, and provided for, in the legislation mentioned in the earlier paragraph.

3.17 The RBI (Amendment) Act 2006 vests comprehensive powers in the RBI to regulate interest rate derivatives except issues relating to trade execution and settlement which are required to be left to respective exchanges. The Group was of the view that considering the RBI’s role in, and responsibility for, ensuring efficiency and stability in the financial system, the broader policy, including those relating to product and participants, be the responsibility of the RBI and the micro-structure details, which evolve thorough interaction between exchanges and participants, be best left to respective exchanges.

CHAPTER 4

PARTICIPATION OF FIIs

4.1 Non-residents including FIIs are prohibited, under the provisions of Foreign Exchange Management Act (FEMA), 2000, to undertake any capital account transaction unless generally or specifically permitted by RBI. In this context, it is pertinent to mention that since 1996, the FIIs have been allowed to invest in GoI securities and corporate bonds within a limit which has been progressively revised upwards and presently stands at USD 4.7 billion with a sub-limit of USD 3.2 billion for GoI securities and USD 1.5 billion for corporate bonds.

4.2 FIIs have been permitted by RBI to take position in IRFs up to their respective cash market exposure in the GoI securities (book value) plus an additional USD 100 million each. If each of the registered FIIs were to take position within the permitted limits, the total exposure of FIIs will come to USD 128.3 billion, far in excess of the currently permitted limit for investment / long position in the cash market, which is USD 4.7 billion!

4.3 Public policy symmetry demands that what an entity is not allowed to do in the cash market, it should not be allowed to do in the derivatives market. As a corollary, it follows that an entity should be allowed to take position in the derivatives market only to the extent it is permitted to do so in the cash market. In view of the above overriding limitation, the Group makes the following observations:

4.3.1 The basic purpose that IRF serve is to provide a means for hedging interest rate exposures of economic agents. Since FIIs are permitted to hold long position in GoI securities (and also corporate bonds), they have an interest rate risk and therefore, it would be in order if they are allowed to take short position in IRF, only to hedge exposure in the cash market up to the maximum permitted limit, which is currently USD 4.7 billion.

4.3.2 A long position in the IRF is equivalent to a long position in the underlying. It follows, therefore, that FIIs be allowed to take long position in IRF market as an alternative strategy to investing in GoI securities, subject, of course, to the caveat that the total gross long position in both cash and futures market taken together should not exceed the limit of investment in GoI securities (and corporate bonds) in force – currently USD 4.7 billion.

4.3.3 At present, the limit of total FII investment in GoI securities and corporate bonds is fixed at an aggregate level, but it is allocated amongst individual FIIs and monitored / enforced as such. For reasons of symmetry, it is only appropriate that the various limits on FIIs exposures in the IRF (and also in the underlying) be fixed, monitored and enforced at an individual level. Since all the positions uniquely flow from the permitted limit of cash market investment, the proposed regime shall be but an extension of the existing structure for fixing, monitoring and enforcing the latter limit and shall not place any additional burden on the regulatory framework.

4.4 Accordingly, the Group recommends that participation of FIIs in the IRF be subject to the following:

a) Its total gross long position in cash market and IRF together does not exceed the permitted limit on its cash market investment,

b) Its short position in IRF does not exceed its actual long position in cash market.

The same may, mutatis mutandis, also apply to NRIs participation in IRF.

4.5 It is evident that the regime discussed above does not admit a FII taking short position in IRF without any long position in the cash market. There can be valid arguments in favour of allowing FIIs such positions as these entities carry considerable market experience with them and can, therefore, play a significant role if permitted wide access to the IRF market. However, considering the nascent stage of development of the IRF and bearing the spirit behind the restrictions on their cash market exposures in mind, the Group felt that the regime proposed in the paragraph 4.4 above would be appropriate at the current stage of Capital Account Liberalization.

CHAPTER 5

PRODUCT DESIGN & SOME ISSUES RELATING TO MARKET MICROSTRUCTURE

5.1 While launching a new product, issues relating to its design assume critical importance for its success. The design has to ensure that the product serves the ends of buyers as well as sellers and facilitates transaction with the ease of comprehension and at minimal cost. In the case of a financial product such as IRF, it is also necessary that the product design aligns the incentives of all stakeholders –hedgers, speculators, arbitrageurs and exchanges – with the larger public policy imperatives. The key public policy objective in introducing IRF is to take a step closer to market completion in the Arrowvian sense, i.e., to expand the set of hedging tools available to financial as well as non financial entities against interest rate risks. Therefore, the product must be so designed as to be acceptable to, as well as beneficial for, the target users. At the same time, public policy concerns enjoin that the product design almost eliminate the possibility of market manipulation.

Basis of Pricing / Valuation

5.2 IRF, as these were launched in June 2003 in Indian markets, were priced off a ZCYC computed by the NSE. This apparent design flaw (which does not exist in any major markets like those of the USA, the UK, the Euro Zone and Japan) of using the contrivance of a ZCYC for determining settlement prices, could be one of the reasons why the IRF contracts met the fate they actually did.

5.3 In theoretical literature, the importance of ZCYC is well recognized and indeed, in a frictionless world without behavioral issues, it may be an ideal basis for pricing. In this context, Dr. Susan Thomas presented some studies for the benefit of the Group. Using historical data, she demonstrated that, (a) IRF do mitigate risk of portfolio of GoI securities, (b) it is possible to price IRF based on ZCYC and because the market players are concerned with hedging the duration of their fixed income portfolios which is equal to the maturity of the zero coupon bond, pricing based on a zero- coupon bond may be desirable, and (c) given the volume of transactions of GoI securities, there was considerable migration of liquidity between the individual securities from quarter to quarter and that this would make a physical delivery based contract difficult to implement.

5.4 While the theoretical underpinnings of these propositions are well founded, the Group felt the need for acknowledging the behavioral idiosyncrasies of the marketplace. The market’s discomfort with the complexities of ZCYC and reservations about its lack of transparency are factors that cannot be ignored. The market participants are more comfortable with YTM based pricing, presumably because they are accustomed to dealing in coupon bearing securities - and this fact cannot be ignored while choosing the product design. It may be mentioned that this problem had been recognized as early as 2004 and an important change in the product design was introduced linking the price to the YTM of a basket of government securities (but retaining the cash settlement feature).

Mode of Settlement

5.5 One of the critical components of product design in the case of IRF relates to the mode of settlement. The evolution of futures markets indicates that settlement by physical delivery was the primal mode. Following introduction of financial futures on indices, settlement by exchange of cash flows was introduced not as a matter of choice but as a matter of compulsion because the underlying i.e. an index is entirely impractical to deliver. Cash settlement had also been advocated as an alternative to physical delivery in cases where the underlying was heterogeneous, involved high costs of storage, transportation and delivery, or exhibited inelastic supply conditions. At various times, exchanges which adopted cash settled futures contracts, have cited reduction in the possibility of market manipulation as motivation for their action.

5.6 IRF settled by cash as well as by physical delivery co-exist in the global financial markets. The oldest and most well established IRF markets in terms of turnover, liquidity and product innovation in US, UK, Eurozone and Japan use contracts based on physical delivery. Some of the recent IRF markets, notably in Australia, Korea, Brazil and Singapore have cash-settled contracts and have reportedly attracted sizeable volumes for obvious reasons of having not to deliver at all (the features of IRF contracts in some of the major exchanges worldwide are outlined in Annex-II).

5.7 The theoretical literature as well as practitioners’ views on relative advantages and disadvantages of the two modes of settlement is largely predicated on the possibility of manipulation in either markets. The proponents of cash settlement mode point out that manipulation in the futures market mostly happens by a phenomenon called ‘cornering’ where those long in the futures also take large long positions in the cash market as well, thus creating an artificial shortage of the deliverable and thereby squeezing the ‘shorts’. But this view has not gone unchallenged either. As Pirrong (2001) mentions, “cash-settled contracts are not necessarily less susceptible to manipulation than delivery-settled contracts. In fact, it is always possible to design a delivery-settled contract with multiple varieties that is less susceptible to market power manipulation by large long traders than any cash-settled contract based on the prices of the same varieties.”

5.8 In any futures contract the key driver of both price discovery and pricing, is the so called ‘cash-futures-arbitrage’ which guarantees that the futures price nearly always remained aligned, and firmly coupled, with the price of the ‘underlying’ so that the futures deliver on their main role viz., that of a ‘true hedge’. The generic theoretical and analytical underpinning of pricing of any derivative including options and swaps, is the so-called famous ‘law of one price’ also known in the literature as ‘no-arbitrage argument’, the essence of which, stated simply, is that a derivatives position should be replicable as a risk-less hedge in the underlying cash market. Thus, in case of any discrepancy in prices between the cash market and derivatives market like futures, cash-futures arbitrage will quickly align the prices in the two markets. This is because, as explained in detail in paragraph 3.12, if futures are expensive / rich relative to the cash market, arbitrageurs will go long the GoI security in the cash market by financing it in the Repo market and short the futures contract, thus realizing the arbitrage gain, being the difference between the implied Repo rate and actual Repo rate. On the other hand, if the futures are cheap relative to the cash market, arbitrageurs will short the cash market by borrowing the GoI security in the Repo market for delivery into short sale, investing the sale proceeds at the actual going Repo rate and going long the bond futures, thereby realizing the arbitrage gain, being the difference between actual Repo rate and implied Repo rate! In either case, such arbitrage driven trades will inevitably settle at expiration of the contracts by physical delivery with the arbitrage profits being realized. This, in turn, necessitates the settlement of the contract at expiration by actual physical delivery of any of prescribed deliverable government bonds, (unless such contracts are closed out before expiration) and not by cash settlement! Indeed, in nearly all the developed and mature financial markets world-wide, ‘cash settlement’ is allowed only where there is no actual ‘underlying’, for example, in the case of stock market index or Euro-dollar interest rates. In the absence of physical settlement, the futures contract will become completely decoupled / misaligned from the ‘underlying’ and, therefore, will be of use only to speculators and not to hedgers. This will also mean that the futures contract will become a new asset class, as IRS has indeed, in its own right and, therefore, would not qualify at all to be called a derivative in the first place! In other words, it will be a non-derivative! Therefore, strictly and conceptually speaking, cash-futures arbitrage cannot occur always if the contracts are cash settled due to a very real possibility of settlement price being discrepant / at variance with the underlying cash market price – whether because of manipulation or otherwise - at which the long will ultimately offload / sell.As Hull emphatically remarks, “…it is the possibility of the final delivery that ties the futures price to the spot price.” This cogent argument makes the physical-settlement mode a sine qua non.

5.9 It is a fact that whatever be the mode of settlement, very few futures contracts are taken to delivery. In this regard, it must be emphasized that even in physically settled futures market, typically around 3 per cent of the interest rate futures contract are settled via actual physical delivery (according to CBOT data on 10-year US Treasury futures) while the rest of the contracts get closed out before settlement date and / or rolled over into the next settlement. These 3 per cent of the contracts are mostly driven by cash-futures arbitrage. Indeed there are only three basic motives for buying / selling futures contracts, (a) to hedge (b) to trade and speculate (c) cash futures arbitrage. In the case of (a) and (b) short squeeze is not an issue because the futures position will be closed out and / or rolled over into the next settlement. In case of (c), there might be a remote possibility of a ‘short squeeze’ of the speculative shorts who are counter-parties through the futures exchange to the arbitrage-driven ‘longs’. But at the first level, unlike in the case of futures contracts on individual stocks and commodities, in the case of bond futures contracts, a basket of deliverable bonds reasonably addresses such concerns. At the second level, a well functioning, deep, efficient and liquid Repo market will further mitigate the possibility of such short squeezes. Any residual possibility of a short squeeze can be completely eliminated by such well developed institutional mechanisms as put in place by regulators like the US Federal Reserve and Bank of England. For instance, US Federal Reserve lends securities out of its System Open Market Accounts (SOMA) and the Bank of England extends ‘standing repo facility’. If required, RBI can intervene similarly to counter the possibility or consequence of any residual short squeeze.

5.10 The proponents of cash settled contracts argue that cash-futures-arbitrage can be achieved even when the contracts are cash settled. However, this is an asymptotic possibility, contingent on appropriate construction of the index and perfect liquidity of the components of the index. As noted by several researchers, although cash settlement assures convergence to cash index, it does not assure convergence to equilibrium cash prices. For future prices to properly reflect equilibrium prices, it has to be ensured that the cash price or the cash index to which the futures contract settles is not distorted. The literature records several barriers to such a possibility – unavailability of price of components of index, reporting bias, outlier problems, etc. The pricing of the index where the components are illiquid will involve polling of price reports which may include unintentional as well as intentional bias. Use of mathematical tools to eliminate bias may involve efficiency loss. Moreover, the resultant complexity of the pricing of the index may cause unease to the market participants.

5.11 While on the subject of the mode of settlement, the Group considered certain interesting features of a comparable, and very liquid and widely traded, interest rate derivative instrument in the OTC segment viz., the IRS based on Mumbai Inter-bank Offered Rate (MIBOR) – an Overnight Indexed Swap (OIS). The MIBOR-IRS market where contracts by default are cash-settled is far more liquid than the GoI securities market. It turned out that ever since the IRS market started, almost without exception, the theoretical Credit Default Swap (CDS) price in spread terms of the 5-year Government of India security has ranged between 70 to 80 basis points! Indeed, if anything, both intuitively, and conceptually, sovereign CDS premium should be negative, although in actual practice, it can be no more than zero in a sovereign's own domestic currency and domestic market. For example, theoretically the 5-year US Treasury CDS premium is approximately negative 20 basis points but in practice it will be no more than zero. However, in Indian market, this quirky and warped feature and behavior is entirely internally consistent with the fact that secularly the 5-year IRS rate has been about 70-80 basis points lower than the corresponding maturity benchmark Government of India bond! This, in turn, has perhaps to do with the fact that by its very design, IRS swap market can, and should, settle in cash as physical delivery / settlement is by design not possible. The result has been, and is, that the trading and outstanding volumes in the IRS market are about 4 to 5 times those in the corresponding maturity GoI securities market. But even in the US, although the outstanding volumes of the IRS are much larger than the US treasury market, it still trades at a spread of 20 to 30 basis points over the corresponding maturity US Treasury yield which is how intuitively, conceptually, and practically speaking, it should be.

5.12 Indeed, unlike in the case of IRS market in India, which quotes prices in terms of absolute yields for various fixed rate legs, in the case of IRS market in USA, fixed rate leg is quoted as a certain spread over the corresponding maturity US Treasury yield. The reason for this is simply that swap dealers / market makers quote prices based upon the ability to hedge their quotes either in the cash market or in the US Treasury futures market. In particular, if the swap dealer / market maker gets hit whereby he has to pay fixed and receives floating, he immediately hedges it by buying the identical maturity US Treasury and finances it in the Repo market. On the other hand, if he gets hit whereby he has to receive fixed and pay floating he immediately shorts the corresponding maturity US Treasury and invests the sale proceeds in the Repo market. Another equally effective alternative for the swap dealer / market maker is to hedge by buying the corresponding maturity US treasury futures contract in the first case and selling the corresponding maturity US Treasury futures contract in the second. As a result of this seamless arbitrage between the cash market, the interest rate swap market and the US Treasury futures market, there is complete ‘connect’ and ‘coupling’ between all the three! This in fact is the touchstone, and hallmark, of an integrated arbitrage free financial market. Given this quirky, warped and anomalous feature, and behaviour, of the reality of the Indian market, the cash-settled IRF market will only, and perversely, further reinforce this quirky and warped behaviour at the expense of the GoI securities market due to liquidity and traded volumes shifting to cash–settled IRF market.

5.13 This anomalous quirk in the behaviour of the IRS market can be removed only when there is a firmer coupling between the IRS market and the risk free GoI securities with development of active, deep and liquid Repo market in GoI securities and extending the tenor of delivery-based short selling. The same argument and logic apply to the case of IRF market where the ‘coupling’ and ‘connect’ will be guaranteed only by physical settlement and delivery of one of the many exchange pre-specified GoI securities in the deliverable basket and frictionless cash-futures arbitrage through delivery-based, longer term / tenor / maturity short selling, co-terminus with futures term / tenor /maturity.

5.14 In the Group’s considered opinion, beginning with the easier option of cash settlement with plans for subsequent migration to a physically settled regime will be inadvisable since empirical evidence seems to suggest that migration from one form of settlement to another is a difficult proposition because of behavioral problems. Switchover from cash settlement to physical settlement has been reported to result in increased volatility in the spot and future prices as well as the basis. Therefore, it would be desirable to start with whatever form of settlement is considered optimal, ab initio, with no need for a subsequent change.

5.15 The stylized facts that emerge from the above discussion are:

5.15.1 A physical delivery based IRF market ensures arbitrage-free cash futures price linkage. Even though such linkage is achievable in cash settled IRF market in principle, it seems an onerous task in practice particularly in Indian conditions, given the illiquidity of the underlying market and the difficulties involved in construction of index as well as arriving at the settlement price of the index.

5.15.2 Both physical delivery based as well as cash-settled IRF contracts are subject to manipulation. The manipulation in the former is easier to handle given the fact that at any point of time, there will be a finite set of deliverable securities and it will be possible to inject liquidity into these securities. On the other hand, manipulation in the later is more difficult to handle because in an illiquid market, the polled prices of the index basket is likely to include unintentional and intentional (manipulative) biases and attempts to filter the same is likely to bring in efficiency loss.

5.15.3 The absence of obligation to deliver, however miniscule proportion it may be, in conjunction with the illiquidity of underlying market and low floating stock is likely to impact the integrity of the underlying market.

5.15.4 The leading and established markets in the world which are liquid, efficient and innovative use physical delivery based IRF and there has not been any occasion to change the mode of settlement from physical to cash.

5.16 Considering all the pros and cons of the two forms of settlement and, more importantly, the specific ground realities of the Indian financial markets, and the international experience and the best practices in the major markets in the USA, Eurozone, UK and Japan, the Group, on balance, favors physically settled futures contracts.

IRF for the money market

5.17 The futures contracts introduced in India in June 2003 also included a cash-settled contract at the short end based on 91-day Treasury bills. As in the case of bond futures, banks were allowed to transact in this product only for the purpose of hedging their exposure in the AFS and HFT portfolios whereas PDs were allowed to take trading positions. This product too received tepid response in the beginning and became completely illiquid subsequently.

5.18 The Group felt that conclusions in respect of bond futures regarding the imperatives of symmetry in participation, accounting and regulation apply equally to money market futures as well and, therefore, obviate the need for any detailed treatment in the Report.

5.19 As regards the mode of settlement, the choice in the case of money market futures contract seems obvious. This is because these contracts can be based either on notional treasury bills or on a benchmark interest rate. In the latter case, the contract has to be necessarily cash-settled. On the other hand, settlement by physical delivery of a contract based on notional treasury bills is an extremely difficult proposition because unlike dated securities, where, the maturities are much longer than the tenor / maturities of the futures contract, in the case of 91-day Treasury bill, it is self evident that even in the case of one month futures contract on an underlying 91-day Treasury bill, the remaining term to maturity of the Treasury bill will be two months, and in the case of three month futures contract, the remaining term to maturity might be hardly a day or two. This will make the cash-futures arbitrage principle of pricing of futures, the hallmark of physically-settled futures contracts, completely impossible to operate for the simple reason that a short in the futures contract will buy physically the most current 91-day Treasury bill, financing it in the Repo market for the maturity / tenor of the futures contract, but will not be able to deliver into expiration the promised underlying 91-day Treasury bill! Hence, the inevitability of cash settlement even in the case of an otherwise physically traded and available 91-day Treasury bill! Incidentally, but significantly, even in US, where treasury bills market is quite large and liquid, the 13-week Treasury bills contracts on CME are cash settled.

5.20 While the Group favors retention of the 91-day Treasury bill futures as it is, it notes that the existing system of pricing based on polled rates is not optimal in view of the lack of transparency in the polling process and possibility of manipulation by interested parties. Therefore, it would be desirable to base the settlement on the yield discovered in the primary auction of the RBI which is a more transparent and efficient (price discovery) process and completely immune to manipulation. For this reason, it has to be ensured that the expiry of the contract is timed synchronously with the primary issuance date of the T-Bill.

5.21 The Group also favors introduction of a contract based on some popular and representative index of short term interest rates. Obviously, the choice has to be an overnight interest rate that is liquid and incorporates the market expectations most efficiently. The MIBOR which is based on the overnight call rates might be the first choice, but considering the fact that it is basically a polled rate subject to deficiencies discussed elsewhere in the Report, the Group feels that the use of actual call rates at which transactions are effected might be a better choice now that such rate is available on the screen almost on a real time basis. Doing this will avoid the possibility of manipulation to which MIBOR might be subject to. Nevertheless, considering its acceptance by the market participants, it would be desirable to anchor the short dated IRF to an overnight money market rate. In this context, it may be pertinent to mention that in the US markets, short-dated Euro-dollar futures contract (LIBOR based) is the most dominant product which commands about 75 per cent share of IRF market.

5.22 The SEBI Technical Group, in its April 2003 Report, had considered a short-end future based on MIBOR to be the most optimal choice but had side-stepped the issue because of doubts about the legality of such a contract. The 2006 amendment to RBI Act which vests overarching power over interest rate derivatives with RBI is expected to remove any doubts on the issue.

5.23 In sum, in respect of the money market IRF:

5.23.1 Banks should be permitted to take trading positions in respect of money market IRF products.

5.23.2 The regulatory and accounting treatment should be symmetrical to that in respect of bond futures.

5.23.3 The existing product i.e. a cash-settled, notional 91-day Treasury bill based contract may continue, with the settlement price being that of the 91-day Treasury bill auction price discovered in the RBI primary auction.

5.23.4 Introduction of a futures contract based on index of traded / actual call rates may be considered.

Other Micro-structure Issues

5.24 Considering the fact that the 10-year GoI securities constitute the most liquid benchmark maturity, the Group felt that a physical delivery based contract on a 10-year notional coupon bearing GoI security would be the ideal choice. Further, it would perhaps be desirable to introduce, in the first stage, a single product at the long end to prevent fragmentation of liquidity in the early stages. Any subsequent expansion of the range of products may be left to the exchanges depending on market response.

5.25 The choice of the coupon rate on the notional security is critical for the success of a futures contract. The coupon rate should be close to the prevailing yield levels so as to become representative of the general underlying market. Besides, the coupon rate plays a crucial role in determining the CTD security. It may be noted that the CTD security has the highest implied Repo rate, and also it is generally the security with the lowest or the highest duration, depending on whether the coupon on the notional security is less or more, respectively, than the prevailing yield. While fixing the coupon it has to be ensured that (a) a single security is not entrenched as the CTD irrespective of, and insensitive to shifts in the yield curve, and (b) several securities are available with yields at small variance from that of the CTD. These conditions will ensure that the bond basis is driven by a basket of bonds rather than a single entrenched issue and will mitigate the possibility of squeezes. Needless to mention, a coupon rate on the notional security far removed from the prevalent yields will lead to an increase in the cost of switching from one security to another in the deliverable basket. In this context it may be mentioned that the CBOT changed the coupon rate on the notional Treasury bonds, 10- year, 5 -year and 2-year Treasury note futures from 8% to 6% beginning with the March 2000 contracts. This emphasizes the point that not only the coupon rate on the notional security has to be fixed taking into account the above factors but also it has to be dynamically reviewed. In any case, this issue may be resolved by the exchanges at appropriate time after due consideration. Some of the issues involved in choice of the coupon rate of the notional security are discussed in Annex III.

5.26 To ensure that the possibilities of market manipulation / short squeeze / failed deliveries are minimized, the universe of deliverable securities may be restricted to securities with a minimum total outstanding stock of say Rs 20,000 Crores. The essential objective is to ensure that there is a large floating stock of the deliverable securities so as to make it difficult for anyone to corner a sizable chunk and it is felt that outstanding stock provides a good proxy for the purpose.

5.27 Because the contract would be physically settled, it would be necessary to synchronize the trading hours of IRF with those of the underlying i.e. GoI securities.

5.28 While IRF market will be used by corporates and individuals as well, the Group is not in favor of allowing corporates and individuals to short sell GoI securities in the cash market as the key purpose of risk management through short sales will in any case be more efficiently and transparently served through their participation in IRF.

5.29 Another feature which is likely to adversely impact liquidity in the IRF market relates to the permission granted to the banks to hold their entire portfolio of SLR securities in the HTM category. At present, the banks are allowed to hold upto 25 per cent of their total investments under HTM category. However, since September 2, 2004, they have been allowed to exceed the limit of 25 per cent provided the excess comprises only of SLR securities. In effect, this enables the banks to park their entire SLR portfolio in the HTM category, which is exempt from MTM requirement and hence bears no interest rate risk and provides no market incentive for trading and makes hedging redundant. This dispensation was granted in view of the fact that there was limited scope for hedging in case statutorily mandated securities were held in AFS and HFT categories. Since introduction of IRF is expected to afford an efficient hedging instrument for hedging interest rate risk in the entire portfolio, it may be only appropriate and just as well to reconsider this regulatory dispensation synchronously with the launching of IRF, as precisely the same policy purpose / objective will be transparently achieved through a market-based hedging solution.

Settlement Infrastructure

5.30 As mentioned earlier, the Group felt that RBI, as the overarching regulator of interest rate derivative as well as GoI securities market, would be concerned with broad policy issues relating to the market and the products. However, IRF inherently being an exchange traded product, the trade execution and settlement procedures on the exchanges will come under the purview of SEBI. IRF products already exist, de jure, on the exchanges since 2003 and the above approach would not be substantively inconsistent with the existing position.

5.31 As far as settlement is concerned, an IRF contract can culminate in either of the two situations viz.

- It may be closed out before its expiry.

- It may be carried to expiry and settled by physical delivery, as recommended.

In the first case, the party has to pay to (receive from) the exchange a sum equivalent to the incremental margin. In the second case the ‘short’ has to deliver the (cheapest-to-deliver) security to the ‘long’ as decided by the exchange and receive the funds from the exchange. While the bye-laws of the exchange concerned would guarantee the settlement, the delivery of the security can take place through the settlement infrastructure already in place for the purpose of retail trade in GoI securities.

5.32 The present settlement infrastructure in the cash market involves Clearing Corporation of India limited (CCIL) as the central counterparty which generates settlement files for the cash as well as the security legs, both of which are settled at RBI. The depository participants National Securities Depositories Limited (NSDL) and Central Depository Services Limited (CDSL) have SGL accounts in Public Debt Office (PDO), Mumbai. Therefore the settlement infrastructure for a delivery based settlement in the IRF market will require the exchange clearing houses to send the settlement files - cash as well as security leg files - to RBI, Mumbai. PDO will continue to remain at the top of the depository system architecture for the GoI securities. The cash leg settlement files will be akin to those of equity market settlement wherein the clearing houses of the exchanges send the ‘payment’ files to designated settlement banks which settle on RTGS.

5.33 Under the present regime of Securities Transaction Tax (STT), as introduced by the Finance Act, 2004 and further modified in Finance (No 2) Act, 2004, transactions in government securities and other debt instruments on the stock exchanges are exempt from STT. However, no such exemption has been accorded to derivatives. Consequently, Interest Rate Futures will be subject to STT, which may be a retarding factor for the liquidity of IRF. The Group debated on the impact of STT on the growth and development of IRF based on GoI securities and was of the view that STT should not be made applicable to IRF for the following reasons:

- The purchase and sale of GoI securities, and indeed, all debt instruments on the stock exchange are not liable to STT. The need for public policy symmetry makes it imperative that what is not applicable to cash market should also not be applicable to the derivatives market.

- The basic purpose behind exempting GoI securities and debt instruments, as stated by the Finance Mister in a debate in the parliament on July 21, 2004, was to deepen the market in debt instruments. An active IRF market is a necessary institutional arrangement for a vibrant debt market, inasmuch as it provides hedging tools to the debt market participants.

The Group, therefore, recommends that necessary steps may be taken to exempt IRF from STT.

CHAPTER 6

SUMMARY OF OBSERVATIONS AND RECOMMENDATIONS

The key overriding public policy purpose in allowing, and even encouraging, introduction of interest rate derivatives is to make available to a broader group of economic agents and participants an effective hedging instrument which is immune to market manipulation and systemic risk. In this background, the Group reckoned with the fact that a major chunk of interest rate risk exposure comprises the outstanding stock of Government securities, currently equivalent to about Rs 17.33 trillion (USD 438 billion approximately) – about 80 per cent of the total bond market - as against the corporate bond market worth Rs 4.45 trillion (USD 112.7 billion approximately) – the residual 20 per cent, both of which are cash-market tradable exposures, although currently may not entirely be so. The broader group of economic agents comprising banks, primary dealers, insurance companies and provident funds between them carry almost 88 per cent of interest rate risk exposure of GoI securities. This is then the largest constituency that needs a credible institutional hedging mechanism to serve as a ‘true hedge’ for their colossal pure-time-value-of-money / credit-risk-free interest rate-risk exposure. Although currently the IRS (OIS) is one such hugely successful and traded IRD instrument for trading and managing interest rate risk exposure, it does not at all answer the description of a ‘true hedge’ to the colossal exposure represented by the outstanding stock of GoI securities of Rs 17.33 trillion (USD 438 billion) because, much less price itself, even remotely, off the underlying GoI securities yield curve, it directly represents, on a stand-alone basis, an unspecified private sector credit risk and not at all the pure, credit risk free time value of money exposure of GoI securities!