|

Today, the Reserve Bank released the results of 41st round of its quarterly Services and Infrastructure Outlook Survey (SIOS) conducted during Q1:2024-25. This forward-looking survey[1] captures qualitative assessment and expectations of Indian companies engaged in the services and infrastructure sectors on a set of business parameters relating to demand conditions, price situation and other business conditions. In the latest round of the survey, 755 companies provided their assessment for Q1:2024-25 and expectations for Q2:2024-25 as well as outlook on key parameters for the subsequent two quarters.

Highlights:

A. Services Sector

Assessment for Q1:2024-25

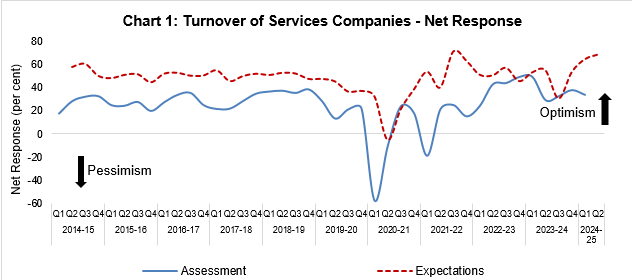

- Service sector firms’ assessment of the overall business situation and their own turnover during Q1:2024-25 remained positive though tempered from that in the previous quarter (Chart 1 and Table A).

- Employment conditions, availability of finance and technical/service capacity were assessed to have improved further during the quarter.

- Pressures stemming from input costs, salary outgo and cost of finance were gauged to be higher during Q1:2024-25.

- At aggregate level, respondents reported lower rise in both selling prices and profit margin.

Expectations for Q2:2024-25

- Services firms remain highly optimistic about overall business situation, their turnover, employment situation, capacity, availability of finance and physical investment in Q2:2024-25 (Chart 1 and Table A).

- Cost pressures for inputs, wage bill and financing are expected to remain at elevated levels.

- Optimism on selling prices rise improved further; the perception on profit margin also remained high and close to its level in the previous survey round.

Expectations for Q3:2024-25 and Q4:2024-25

- Enterprises expect further improvement in the overall business situation, turnover and employment in the second half of the current financial year (Table C).

- Input cost pressures are likely to continue for services firms; sequential rise in selling prices is expected in the ensuing quarters.

- At the aggregate level, spare capacity[2] in the services sector has been coming down in the recent quarters; responding services firms reported that they could provide 11.3 per cent additional services with their present resources in Q4:2023-24 (Table S14).

B. Infrastructure Sector

Assessment for Q1:2024-25

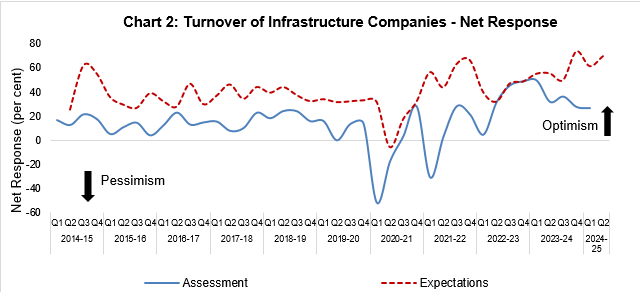

- Infrastructure companies reported positive assessment of the overall business situation and their own turnover, though their sentiments somewhat moderated vis-à-vis the previous quarter (Chart 2 and Table B).

- Sentiments on both full-time employment and part-time employment improved.

- Enterprises gauged lower pressures from input costs and cost of finance; higher pressures was, however, reported from salary outgo.

- Respondents expressed relatively higher growth in selling prices and profit margins when compared to the previous quarter.

Expectations for Q2:2024-25

- Infrastructure firms remain highly optimistic on overall business situation and demand conditions in Q2:2024-25 (Chart 2 and Table B).

- Cost pressures are likely to rise further, and firms expect higher growth in selling prices and profit margins.

- Respondents expect to make higher physical investment during Q2:2024-25.

Expectations for Q3:2024-25 and Q4:2024-25

- Demand conditions and employment situation are expected to be fairly positive during H2:2024-25 (Table D).

- Input cost pressures are expected to persist, while selling prices are anticipated to record robust growth.

Summary of Net Responses[3] on Survey Parameters

|

Table A: Services Sector

|

|

(per cent)

|

|

Parameters

|

Assessment period

|

Expectations period

|

|

Q4:2023-24

|

Q1:2024-25

|

Q1:2024-25

|

Q2:2024-25

|

|

Overall Business Situation

|

37.5

|

34.1

|

65.3

|

69.4

|

|

Turnover

|

37.6

|

33.5

|

64.6

|

68.7

|

|

Full-time Employees

|

24.8

|

27.8

|

46.3

|

50.5

|

|

Part-time Employees

|

22.7

|

22.7

|

48.3

|

52.9

|

|

Availability of Finance

|

27.8

|

32.0

|

55.3

|

57.6

|

|

Cost of Finance

|

-31.5

|

-35.1

|

-45.5

|

-56.9

|

|

Salary & Wages

|

-30.2

|

-42.6

|

-46.7

|

-53.8

|

|

Cost of Inputs

|

-42.8

|

-44.7

|

-56.7

|

-65.9

|

|

Selling Price

|

22.4

|

21.7

|

50.8

|

54.1

|

|

Profit Margin

|

16.3

|

10.5

|

46.4

|

45.4

|

|

Inventories

|

25.4

|

24.3

|

47.8

|

52.0

|

|

Technical/Service Capacity

|

24.3

|

26.2

|

54.7

|

57.0

|

|

Physical Investment

|

22.6

|

24.2

|

53.2

|

55.4

|

|

Table B: Infrastructure Sector

|

|

(per cent)

|

|

Parameters

|

Assessment period

|

Expectations period

|

|

Q4:2023-24

|

Q1:2024-25

|

Q1:2024-25

|

Q2:2024-25

|

|

Overall Business Situation

|

32.5

|

26.6

|

66.1

|

74.5

|

|

Turnover

|

27.5

|

26.6

|

61.5

|

69.9

|

|

Full-time Employees

|

20.0

|

21.4

|

46.6

|

62.7

|

|

Part-time Employees

|

24.7

|

25.5

|

53.5

|

60.7

|

|

Availability of Finance

|

28.0

|

29.2

|

57.8

|

68.0

|

|

Cost of Finance

|

-31.5

|

-29.1

|

-59.4

|

-62.4

|

|

Salary & Wages

|

-26.1

|

-34.4

|

-55.2

|

-70.6

|

|

Cost of Inputs

|

-49.1

|

-36.1

|

-63.4

|

-75.2

|

|

Selling Price

|

18.9

|

21.5

|

55.1

|

66.7

|

|

Profit Margin

|

8.4

|

16.9

|

47.9

|

61.8

|

|

Inventories

|

30.1

|

29.0

|

55.0

|

70.1

|

|

Technical/Service Capacity

|

29.9

|

31.9

|

64.9

|

79.1

|

|

Physical Investment

|

26.0

|

27.3

|

64.0

|

75.8

|

Expectations of Select Parameters for extended period – Net response (in per cent)

|

Table C: Services Sector

|

|

Parameter

|

Round 40

|

Round 41

|

|

Q1:2024-25

|

Q2:2024-25

|

Q3:2024-25

|

Q4:2024-25

|

|

Overall Business Situation

|

65.3

|

69.4

|

71.9

|

72.4

|

|

Turnover

|

64.6

|

68.7

|

72.2

|

73.2

|

|

Full-time Employees

|

46.3

|

50.5

|

51.2

|

51.7

|

|

Part-time Employees

|

48.3

|

52.9

|

56.6

|

54.8

|

|

Cost of Inputs

|

-56.7

|

-65.9

|

-61.3

|

-62.0

|

|

Selling Price

|

50.8

|

54.1

|

56.6

|

57.7

|

|

Table D: Infrastructure Sector

|

|

Parameter

|

Round 40

|

Round 41

|

|

Q1:2024-25

|

Q2:2024-25

|

Q3:2024-25

|

Q4:2024-25

|

|

Overall Business Situation

|

66.1

|

74.5

|

78.9

|

78.5

|

|

Turnover

|

61.5

|

69.9

|

79.6

|

78.1

|

|

Full-time Employees

|

46.6

|

62.7

|

64.7

|

65.1

|

|

Part-time Employees

|

53.5

|

60.7

|

69.5

|

69.3

|

|

Cost of Inputs

|

-63.4

|

-75.2

|

-70.1

|

-69.9

|

|

Selling Price

|

55.1

|

66.7

|

71.9

|

72.4

|

Note:Please see the excel file for time series data

Services Sector

|

Table S1: Assessment and Expectation for Overall Business Situation

|

|

(Percentage responses)@

|

|

Quarter

|

Assessment

|

Expectation

|

|

Better

|

No Change

|

Worse

|

Net response#

|

Better

|

No Change

|

Worse

|

Net response

|

|

Q1:23-24

|

55.0

|

32.0

|

13.0

|

42.0

|

64.2

|

27.4

|

8.4

|

55.8

|

|

Q2:23-24

|

48.4

|

37.7

|

14.0

|

34.4

|

62.3

|

31.3

|

6.4

|

56.0

|

|

Q3:23-24

|

47.6

|

40.4

|

12.0

|

35.6

|

51.0

|

41.2

|

7.8

|

43.1

|

|

Q4:23-24

|

48.9

|

39.8

|

11.4

|

37.5

|

59.4

|

36.0

|

4.6

|

54.8

|

|

Q1:24-25

|

43.0

|

48.1

|

8.9

|

34.1

|

68.5

|

28.4

|

3.1

|

65.3

|

|

Q2:24-25

|

|

|

|

|

71.5

|

26.5

|

2.0

|

69.4

|

‘Increase’ in Overall business situation is optimistic.

@: Due to rounding off percentage may not add up to 100.

#: Net Response (NR) is the difference of percentage of the respondents reporting optimism and that reporting pessimism. The range is -100 to 100. Any value greater than zero indicates expansion/ optimism and any value less than zero indicates contraction/ pessimism. |

|

Table S2: Assessment and Expectation for Turnover

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

59.4

|

30.2

|

10.4

|

49.0

|

60.0

|

33.1

|

6.9

|

53.1

|

|

Q2:23-24

|

43.8

|

41.3

|

14.9

|

28.9

|

59.3

|

36.3

|

4.4

|

54.9

|

|

Q3:23-24

|

48.2

|

35.9

|

15.9

|

32.3

|

40.3

|

49.9

|

9.8

|

30.5

|

|

Q4:23-24

|

51.6

|

34.3

|

14.0

|

37.6

|

59.8

|

33.8

|

6.4

|

53.4

|

|

Q1:24-25

|

45.2

|

43.1

|

11.7

|

33.5

|

70.5

|

23.6

|

5.9

|

64.6

|

|

Q2:24-25

|

|

|

|

|

71.9

|

24.8

|

3.3

|

68.7

|

|

‘Increase’ in Turnover is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S3: Assessment and Expectation for Full-time Employees

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

40.1

|

47.8

|

12.1

|

27.9

|

47.8

|

45.9

|

6.3

|

41.6

|

|

Q2:23-24

|

34.3

|

48.7

|

17.0

|

17.3

|

44.7

|

52.6

|

2.7

|

42.0

|

|

Q3:23-24

|

29.9

|

61.6

|

8.5

|

21.4

|

26.4

|

63.7

|

9.9

|

16.5

|

|

Q4:23-24

|

33.9

|

57.1

|

9.0

|

24.8

|

32.4

|

64.0

|

3.6

|

28.8

|

|

Q1:24-25

|

34.8

|

58.2

|

7.0

|

27.8

|

48.4

|

49.5

|

2.1

|

46.3

|

|

Q2:24-25

|

|

|

|

|

52.2

|

46.0

|

1.7

|

50.5

|

|

‘Increase’ in Full-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S4: Assessment and Expectation for Part-time Employees

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

30.9

|

59.1

|

9.9

|

21.0

|

35.3

|

60.6

|

4.2

|

31.1

|

|

Q2:23-24

|

24.4

|

57.5

|

18.1

|

6.2

|

36.7

|

57.9

|

5.3

|

31.4

|

|

Q3:23-24

|

21.5

|

70.3

|

8.2

|

13.2

|

31.0

|

52.3

|

16.7

|

14.4

|

|

Q4:23-24

|

30.2

|

62.4

|

7.5

|

22.7

|

28.8

|

65.4

|

5.8

|

23.1

|

|

Q1:24-25

|

28.9

|

65.0

|

6.1

|

22.7

|

50.8

|

46.7

|

2.5

|

48.3

|

|

Q2:24-25

|

|

|

|

|

55.4

|

42.1

|

2.5

|

52.9

|

|

‘Increase’ in Part-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S5: Assessment and Expectation for Availability of Finance

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Improve

|

No Change

|

Worsen

|

Net response

|

Improve

|

No Change

|

Worsen

|

Net response

|

|

Q1:23-24

|

29.3

|

61.2

|

9.5

|

19.7

|

36.0

|

61.4

|

2.6

|

33.4

|

|

Q2:23-24

|

30.6

|

56.8

|

12.6

|

18.0

|

39.5

|

57.0

|

3.5

|

36.0

|

|

Q3:23-24

|

32.3

|

60.3

|

7.4

|

24.9

|

31.5

|

61.1

|

7.3

|

24.2

|

|

Q4:23-24

|

36.3

|

55.3

|

8.4

|

27.8

|

40.4

|

56.7

|

2.9

|

37.4

|

|

Q1:24-25

|

37.9

|

56.2

|

5.9

|

32.0

|

56.4

|

42.5

|

1.1

|

55.3

|

|

Q2:24-25

|

|

|

|

|

58.8

|

40.0

|

1.2

|

57.6

|

|

‘Improve’ in Availability of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S6: Assessment and Expectation for Cost of Finance

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

42.1

|

49.6

|

8.3

|

-33.7

|

35.4

|

62.0

|

2.6

|

-32.8

|

|

Q2:23-24

|

39.0

|

52.1

|

8.9

|

-30.1

|

38.1

|

57.6

|

4.3

|

-33.7

|

|

Q3:23-24

|

36.5

|

59.3

|

4.2

|

-32.3

|

32.8

|

61.0

|

6.2

|

-26.6

|

|

Q4:23-24

|

38.0

|

55.6

|

6.5

|

-31.5

|

38.1

|

58.2

|

3.7

|

-34.4

|

|

Q1:24-25

|

40.0

|

55.1

|

4.9

|

-35.1

|

51.0

|

43.5

|

5.5

|

-45.5

|

|

Q2:24-25

|

|

|

|

|

59.4

|

38.0

|

2.6

|

-56.9

|

|

‘Decrease’ in Cost of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S7: Assessment and Expectation for Salary/Wages

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

48.8

|

45.6

|

5.6

|

-43.2

|

45.9

|

46.7

|

7.5

|

-38.4

|

|

Q2:23-24

|

44.5

|

50.3

|

5.3

|

-39.2

|

46.4

|

52.0

|

1.6

|

-44.8

|

|

Q3:23-24

|

42.4

|

53.5

|

4.0

|

-38.4

|

33.6

|

62.3

|

4.1

|

-29.5

|

|

Q4:23-24

|

34.8

|

60.7

|

4.5

|

-30.2

|

38.6

|

59.6

|

1.8

|

-36.8

|

|

Q1:24-25

|

45.3

|

52.0

|

2.7

|

-42.6

|

46.7

|

53.3

|

0.0

|

-46.7

|

|

Q2:24-25

|

|

|

|

|

54.5

|

44.9

|

0.7

|

-53.8

|

|

‘Decrease’ in Salary/Wages is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S8: Assessment and Expectation for Cost of Inputs

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

45.2

|

45.4

|

9.5

|

-35.7

|

43.8

|

53.6

|

2.7

|

-41.1

|

|

Q2:23-24

|

39.1

|

49.9

|

11.0

|

-28.1

|

47.0

|

46.8

|

6.1

|

-40.9

|

|

Q3:23-24

|

44.6

|

48.6

|

6.8

|

-37.9

|

32.1

|

57.9

|

9.9

|

-22.2

|

|

Q4:23-24

|

46.7

|

49.3

|

4.0

|

-42.8

|

47.4

|

50.9

|

1.7

|

-45.7

|

|

Q1:24-25

|

47.5

|

49.6

|

2.9

|

-44.7

|

57.1

|

42.5

|

0.4

|

-56.7

|

|

Q2:24-25

|

|

|

|

|

66.5

|

32.9

|

0.6

|

-65.9

|

|

‘Decrease’ in Cost of Inputs is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S9: Assessment and Expectation for Selling Price

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

28.8

|

59.8

|

11.4

|

17.4

|

35.7

|

60.0

|

4.3

|

31.3

|

|

Q2:23-24

|

21.9

|

62.7

|

15.4

|

6.5

|

39.5

|

53.7

|

6.8

|

32.7

|

|

Q3:23-24

|

24.3

|

66.6

|

9.2

|

15.1

|

26.4

|

61.5

|

12.1

|

14.2

|

|

Q4:23-24

|

29.9

|

62.6

|

7.5

|

22.4

|

35.3

|

60.0

|

4.7

|

30.7

|

|

Q1:24-25

|

26.9

|

67.9

|

5.2

|

21.7

|

52.4

|

46.0

|

1.6

|

50.8

|

|

Q2:24-25

|

|

|

|

|

55.5

|

43.2

|

1.4

|

54.1

|

|

‘Increase’ in Selling Price is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S10: Assessment and Expectation for Profit Margin

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

26.3

|

52.3

|

21.4

|

4.9

|

48.4

|

42.3

|

9.3

|

39.1

|

|

Q2:23-24

|

26.3

|

51.8

|

22.0

|

4.3

|

50.3

|

40.6

|

9.1

|

41.2

|

|

Q3:23-24

|

27.1

|

55.5

|

17.4

|

9.7

|

27.3

|

59.2

|

13.5

|

13.8

|

|

Q4:23-24

|

29.6

|

57.0

|

13.3

|

16.3

|

36.1

|

55.2

|

8.6

|

27.5

|

|

Q1:24-25

|

26.5

|

57.5

|

16.0

|

10.5

|

50.6

|

45.1

|

4.2

|

46.4

|

|

Q2:24-25

|

|

|

|

|

49.6

|

46.3

|

4.2

|

45.4

|

|

‘Increase’ in Profit Margin is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S11: Assessment and Expectation for Inventories

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

30.4

|

58.8

|

10.8

|

19.6

|

38.6

|

57.7

|

3.7

|

34.8

|

|

Q2:23-24

|

30.2

|

56.2

|

13.6

|

16.5

|

40.3

|

54.3

|

5.4

|

34.8

|

|

Q3:23-24

|

29.6

|

62.9

|

7.5

|

22.2

|

34.5

|

53.9

|

11.6

|

22.9

|

|

Q4:23-24

|

32.2

|

60.9

|

6.9

|

25.4

|

34.2

|

60.0

|

5.8

|

28.3

|

|

Q1:24-25

|

31.2

|

62.0

|

6.9

|

24.3

|

50.9

|

45.9

|

3.2

|

47.8

|

|

Q2:24-25

|

|

|

|

|

54.3

|

43.4

|

2.3

|

52.0

|

|

‘Increase’ in Inventories is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S12: Assessment and Expectation for Technical/Service Capacity

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

30.0

|

65.1

|

4.9

|

25.1

|

36.4

|

61.1

|

2.5

|

34.0

|

|

Q2:23-24

|

28.1

|

69.2

|

2.7

|

25.3

|

51.2

|

47.5

|

1.3

|

49.8

|

|

Q3:23-24

|

22.6

|

75.8

|

1.6

|

21.0

|

41.9

|

56.3

|

1.9

|

40.0

|

|

Q4:23-24

|

29.1

|

66.2

|

4.8

|

24.3

|

34.1

|

65.9

|

0.0

|

34.1

|

|

Q1:24-25

|

29.4

|

67.4

|

3.2

|

26.2

|

54.7

|

45.3

|

0.0

|

54.7

|

|

Q2:24-25

|

|

|

|

|

57.2

|

42.5

|

0.2

|

57.0

|

|

‘Increase’ in Technical/Service Capacity is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S13: Assessment and Expectation for Physical Investment

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

26.9

|

66.8

|

6.3

|

20.7

|

33.0

|

64.3

|

2.7

|

30.3

|

|

Q2:23-24

|

30.7

|

66.1

|

3.1

|

27.6

|

43.4

|

54.8

|

1.8

|

41.5

|

|

Q3:23-24

|

21.7

|

76.6

|

1.6

|

20.1

|

23.3

|

75.8

|

0.9

|

22.3

|

|

Q4:23-24

|

28.0

|

66.7

|

5.3

|

22.6

|

32.2

|

67.8

|

0.0

|

32.2

|

|

Q1:24-25

|

27.4

|

69.3

|

3.2

|

24.2

|

53.8

|

45.7

|

0.5

|

53.2

|

|

Q2:24-25

|

|

|

|

|

55.7

|

44.1

|

0.3

|

55.4

|

|

‘Increase’ in Physical Investment is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table S14: Estimated Spare Capacity for the Services Sector

|

|

Survey conducted during

|

Reference quarter

|

Response rate for the question on Spare Capacity

(per cent)

|

Spare Capacity

(per cent)

|

|

Q4:2020-21

|

Q3:2020-21

|

73.4

|

13.9

|

|

Q1:2021-22

|

Q4:2020-21

|

25.0

|

13.3

|

|

Q2:2021-22

|

Q1:2021-22

|

69.3

|

24.8

|

|

Q3:2021-22

|

Q2:2021-22

|

64.4

|

11.1

|

|

Q4:2021-22

|

Q3:2021-22

|

40.8

|

13.0

|

|

Q1:2022-23

|

Q4:2021-22

|

58.3

|

17.4

|

|

Q2:2022-23

|

Q1:2022-23

|

79.5

|

13.5

|

|

Q3:2022-23

|

Q2:2022-23

|

25.2

|

12.6

|

|

Q4:2022-23

|

Q3:2022-23

|

63.0

|

13.8

|

|

Q1:2023-24

|

Q4:2022-23

|

79.8

|

13.6

|

|

Q2:2023-24

|

Q1:2023-24

|

84.3

|

12.3

|

|

Q3:2023-24

|

Q2:2023-24

|

74.0

|

11.8

|

|

Q4:2023-24

|

Q3:2023-24

|

74.8

|

11.7

|

|

Q1:2024-25

|

Q4:2023-24

|

78.8

|

11.3

|

Infrastructure Sector

|

Table I1: Assessment and Expectation for Overall Business Situation

|

|

(Percentage responses)@

|

|

Quarter

|

Assessment

|

Expectation

|

|

Better

|

No Change

|

Worse

|

Net response#

|

Better

|

No Change

|

Worse

|

Net response

|

|

Q1:23-24

|

62.6

|

23.1

|

14.3

|

48.4

|

60.5

|

34.2

|

5.3

|

55.3

|

|

Q2:23-24

|

44.2

|

41.3

|

14.4

|

29.8

|

62.6

|

30.8

|

6.6

|

56.0

|

|

Q3:23-24

|

44.2

|

45.8

|

10.0

|

34.2

|

67.3

|

29.8

|

2.9

|

64.4

|

|

Q4:23-24

|

45.0

|

42.5

|

12.5

|

32.5

|

73.1

|

21.8

|

5.0

|

68.1

|

|

Q1:24-25

|

37.7

|

51.3

|

11.0

|

26.6

|

70.3

|

25.4

|

4.2

|

66.1

|

|

Q2:24-25

|

|

|

|

|

76.5

|

21.6

|

2.0

|

74.5

|

‘Increase’ in Overall business situation is optimistic.

@: Due to rounding off percentage may not add up to 100.

#: Net Response (NR) is the difference of percentage of the respondents reporting optimism and that reporting pessimism. The range is -100 to 100. Any value greater than zero indicates expansion/ optimism and any value less than zero indicates contraction/ pessimism. |

|

Table I2: Assessment and Expectation for Turnover

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

64.8

|

19.8

|

15.4

|

49.5

|

61.4

|

32.5

|

6.1

|

55.3

|

|

Q2:23-24

|

46.2

|

39.4

|

14.4

|

31.7

|

61.1

|

33.3

|

5.6

|

55.6

|

|

Q3:23-24

|

47.9

|

40.3

|

11.8

|

36.1

|

53.8

|

42.3

|

3.8

|

50.0

|

|

Q4:23-24

|

42.5

|

42.5

|

15.0

|

27.5

|

75.6

|

22.7

|

1.7

|

73.9

|

|

Q1:24-25

|

37.7

|

51.3

|

11.0

|

26.6

|

68.4

|

24.8

|

6.8

|

61.5

|

|

Q2:24-25

|

|

|

|

|

73.2

|

23.5

|

3.3

|

69.9

|

|

‘Increase’ in Turnover is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I3: Assessment and Expectation for Full-time Employees

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

46.7

|

40.0

|

13.3

|

33.3

|

50.9

|

44.7

|

4.4

|

46.5

|

|

Q2:23-24

|

28.8

|

58.7

|

12.5

|

16.3

|

48.9

|

48.9

|

2.2

|

46.7

|

|

Q3:23-24

|

32.5

|

57.3

|

10.3

|

22.2

|

42.3

|

54.8

|

2.9

|

39.4

|

|

Q4:23-24

|

27.5

|

65.0

|

7.5

|

20.0

|

63.2

|

34.2

|

2.6

|

60.7

|

|

Q1:24-25

|

31.2

|

59.1

|

9.7

|

21.4

|

47.5

|

51.7

|

0.8

|

46.6

|

|

Q2:24-25

|

|

|

|

|

64.7

|

33.3

|

2.0

|

62.7

|

|

‘Increase’ in Full-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I4: Assessment and Expectation for Part-time Employees

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

48.1

|

40.7

|

11.1

|

37.0

|

43.8

|

55.4

|

0.9

|

42.9

|

|

Q2:23-24

|

37.9

|

55.2

|

6.9

|

31.0

|

50.9

|

45.3

|

3.8

|

47.2

|

|

Q3:23-24

|

35.8

|

57.5

|

6.6

|

29.2

|

60.3

|

34.5

|

5.2

|

55.2

|

|

Q4:23-24

|

29.2

|

66.3

|

4.5

|

24.7

|

68.3

|

31.7

|

0.0

|

68.3

|

|

Q1:24-25

|

32.8

|

59.9

|

7.3

|

25.5

|

55.8

|

41.9

|

2.3

|

53.5

|

|

Q2:24-25

|

|

|

|

|

63.7

|

33.3

|

3.0

|

60.7

|

|

‘Increase’ in Part-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I5: Assessment and Expectation for Availability of Finance

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Improve

|

No Change

|

Worsen

|

Net response

|

Improve

|

No Change

|

Worsen

|

Net response

|

|

Q1:23-24

|

28.9

|

54.4

|

16.7

|

12.2

|

46.8

|

50.5

|

2.7

|

44.1

|

|

Q2:23-24

|

36.5

|

52.9

|

10.6

|

26.0

|

51.1

|

43.3

|

5.6

|

45.6

|

|

Q3:23-24

|

36.7

|

57.5

|

5.8

|

30.8

|

46.6

|

49.5

|

3.9

|

42.7

|

|

Q4:23-24

|

34.7

|

58.5

|

6.8

|

28.0

|

63.0

|

35.3

|

1.7

|

61.3

|

|

Q1:24-25

|

35.1

|

59.1

|

5.8

|

29.2

|

58.6

|

40.5

|

0.9

|

57.8

|

|

Q2:24-25

|

|

|

|

|

68.0

|

32.0

|

0.0

|

68.0

|

|

‘Improve’ in Availability of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I6: Assessment and Expectation for Cost of Finance

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

50.6

|

41.2

|

8.2

|

-42.4

|

43.8

|

53.6

|

2.7

|

-41.1

|

|

Q2:23-24

|

51.0

|

42.7

|

6.3

|

-44.8

|

44.0

|

53.6

|

2.4

|

-41.7

|

|

Q3:23-24

|

38.2

|

55.5

|

6.4

|

-31.8

|

54.2

|

45.8

|

0.0

|

-54.2

|

|

Q4:23-24

|

35.2

|

61.1

|

3.7

|

-31.5

|

61.7

|

37.4

|

0.9

|

-60.7

|

|

Q1:24-25

|

36.4

|

56.3

|

7.3

|

-29.1

|

60.4

|

38.7

|

0.9

|

-59.4

|

|

Q2:24-25

|

|

|

|

|

65.1

|

32.2

|

2.7

|

-62.4

|

|

‘Decrease’ in Cost of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I7: Assessment and Expectation for Salary/Wages

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

40.7

|

56.0

|

3.3

|

-37.4

|

46.5

|

50.9

|

2.6

|

-43.9

|

|

Q2:23-24

|

42.7

|

50.5

|

6.8

|

-35.9

|

47.8

|

52.2

|

0.0

|

-47.8

|

|

Q3:23-24

|

44.9

|

50.8

|

4.2

|

-40.7

|

41.2

|

56.9

|

2.0

|

-39.2

|

|

Q4:23-24

|

27.7

|

70.6

|

1.7

|

-26.1

|

59.8

|

39.3

|

0.9

|

-59.0

|

|

Q1:24-25

|

38.3

|

57.8

|

3.9

|

-34.4

|

55.2

|

44.8

|

0.0

|

-55.2

|

|

Q2:24-25

|

|

|

|

|

70.6

|

29.4

|

0.0

|

-70.6

|

|

‘Decrease’ in Salary/Wages is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I8: Assessment and Expectation for Cost of Inputs

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

47.7

|

47.7

|

4.5

|

-43.2

|

49.6

|

48.7

|

1.8

|

-47.8

|

|

Q2:23-24

|

50.0

|

45.1

|

4.9

|

-45.1

|

51.1

|

44.3

|

4.5

|

-46.6

|

|

Q3:23-24

|

52.1

|

43.6

|

4.3

|

-47.9

|

52.0

|

41.0

|

7.0

|

-45.0

|

|

Q4:23-24

|

52.6

|

43.9

|

3.5

|

-49.1

|

59.1

|

37.4

|

3.5

|

-55.7

|

|

Q1:24-25

|

42.2

|

51.7

|

6.1

|

-36.1

|

63.4

|

36.6

|

0.0

|

-63.4

|

|

Q2:24-25

|

|

|

|

|

75.9

|

23.4

|

0.7

|

-75.2

|

|

‘Decrease’ in Cost of Inputs is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I9: Assessment and Expectation for Selling Price

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

29.3

|

63.4

|

7.3

|

22.0

|

43.5

|

53.7

|

2.8

|

40.7

|

|

Q2:23-24

|

33.7

|

53.3

|

13.0

|

20.7

|

43.4

|

54.2

|

2.4

|

41.0

|

|

Q3:23-24

|

37.0

|

54.0

|

9.0

|

28.0

|

42.4

|

53.3

|

4.3

|

38.0

|

|

Q4:23-24

|

28.9

|

61.1

|

10.0

|

18.9

|

62.0

|

36.0

|

2.0

|

60.0

|

|

Q1:24-25

|

30.8

|

60.0

|

9.2

|

21.5

|

60.7

|

33.7

|

5.6

|

55.1

|

|

Q2:24-25

|

|

|

|

|

69.8

|

27.1

|

3.1

|

66.7

|

|

‘Increase’ in Selling Price is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I10: Assessment and Expectation for Profit Margin

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

36.7

|

38.9

|

24.4

|

12.2

|

47.3

|

45.5

|

7.1

|

40.2

|

|

Q2:23-24

|

24.5

|

58.8

|

16.7

|

7.8

|

46.1

|

48.3

|

5.6

|

40.4

|

|

Q3:23-24

|

35.0

|

55.0

|

10.0

|

25.0

|

37.3

|

56.9

|

5.9

|

31.4

|

|

Q4:23-24

|

26.1

|

56.3

|

17.6

|

8.4

|

56.3

|

36.1

|

7.6

|

48.7

|

|

Q1:24-25

|

28.6

|

59.7

|

11.7

|

16.9

|

54.7

|

38.5

|

6.8

|

47.9

|

|

Q2:24-25

|

|

|

|

|

65.1

|

31.6

|

3.3

|

61.8

|

|

‘Increase’ in Profit Margin is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I11: Assessment and Expectation for Inventories

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

28.3

|

58.3

|

13.3

|

15.0

|

48.2

|

50.0

|

1.8

|

46.4

|

|

Q2:23-24

|

42.1

|

52.6

|

5.3

|

36.8

|

36.7

|

60.0

|

3.3

|

33.3

|

|

Q3:23-24

|

41.7

|

53.4

|

4.9

|

36.9

|

60.5

|

36.8

|

2.6

|

57.9

|

|

Q4:23-24

|

34.0

|

62.1

|

3.9

|

30.1

|

75.2

|

23.8

|

1.0

|

74.3

|

|

Q1:24-25

|

34.8

|

59.4

|

5.8

|

29.0

|

58.0

|

39.0

|

3.0

|

55.0

|

|

Q2:24-25

|

|

|

|

|

71.5

|

27.0

|

1.5

|

70.1

|

|

‘Increase’ in Inventories is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I12: Assessment and Expectation for Technical/Service Capacity

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

35.7

|

59.5

|

4.8

|

31.0

|

45.0

|

53.2

|

1.8

|

43.1

|

|

Q2:23-24

|

38.3

|

59.6

|

2.1

|

36.2

|

51.2

|

48.8

|

0.0

|

51.2

|

|

Q3:23-24

|

39.8

|

55.9

|

4.3

|

35.5

|

66.7

|

33.3

|

0.0

|

66.7

|

|

Q4:23-24

|

32.5

|

64.9

|

2.6

|

29.9

|

75.0

|

25.0

|

0.0

|

75.0

|

|

Q1:24-25

|

36.2

|

59.5

|

4.3

|

31.9

|

66.2

|

32.4

|

1.4

|

64.9

|

|

Q2:24-25

|

|

|

|

|

79.1

|

20.9

|

0.0

|

79.1

|

|

‘Increase’ in Technical/Service Capacity is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

|

Table I13: Assessment and Expectation for Physical Investment

|

|

(Percentage responses)

|

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:23-24

|

37.1

|

52.9

|

10.0

|

27.1

|

43.9

|

52.3

|

3.7

|

40.2

|

|

Q2:23-24

|

38.0

|

58.2

|

3.8

|

34.2

|

36.8

|

60.3

|

2.9

|

33.8

|

|

Q3:23-24

|

35.8

|

60.0

|

4.2

|

31.6

|

46.8

|

53.2

|

0.0

|

46.8

|

|

Q4:23-24

|

28.6

|

68.8

|

2.6

|

26.0

|

75.3

|

24.7

|

0.0

|

75.3

|

|

Q1:24-25

|

33.1

|

61.2

|

5.8

|

27.3

|

64.0

|

36.0

|

0.0

|

64.0

|

|

Q2:24-25

|

|

|

|

|

75.8

|

24.2

|

0.0

|

75.8

|

|

‘Increase’ in Physical Investment is optimistic. Footnotes @ and # given in Table 1 are applicable here.

|

[1] The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank. Results of the previous survey round were released on the Bank’s website on April 05, 2024.

[2] In the SIOS questionnaire, the question on spare capacity is phrased as “With your present infrastructure, employees and other resources, could you increase your volume of activity / business to meet any increase in demand for your services? If ‘Yes’, by how much per cent?”

The estimates of spare capacity are derived as two-stage weighted average with company-level sales/ turnover as first stage weights and second stage weights are gross value added at the sub-sector level.

[3] Net Response (NR) is the difference between the percentage of respondents reporting optimism and those reporting pessimism. It ranges between -100 to 100. Positive value indicates expansion/optimism and negative value indicates contraction/pessimism. In other words, NR = (I – D); where, I is the percentage response of ‘Increase/optimism’, D is the percentage response of ‘Decrease/pessimism’ and E is the percentage response as ‘no change/ equal’ (i.e., I+D+E=100). For example, increase in turnover is optimism whereas decrease in cost of inputs is optimism.

|

IST,

IST,