IST,

IST,

VII. Monetary Transmission Mechanism (Part 1 of 2)

7.1 Monetary policy affects its final goals – prices and output – with long lags. Policies responding only to the current state of the economy may be destabilising and monetary authorities are, therefore, required to be forward-looking in their approach. A forward-looking approach would, however, be contingent upon a broad understanding of the monetary transmission mechanism - the process through which changes in monetary policy instruments affect output and inflation. Moreover, the transmission lags are not only long but often also found to be variable. The variability of the lags has been accentuated by the ongoing financial deregulation, liberalisation and innovations in a large number of economies.

7.2 Reflecting the process of financial liberalisation, there have been changes in operating procedures of monetary policy. Notably, monetary aggregates have been de-emphasised as an intermediate target of monetary policy and, for an increasingly large number of economies, short-term interest rates have emerged as the operating target of monetary policy. In this context, the speed and size of pass-through from policy rates to market rates become critical. Concomitantly, concepts such as neutral real rate have been an issue of debate.

7.3 Like other Emerging Market Economies (EMEs), monetary policy in India has witnessed significant changes in its operating procedures and instruments. A multiple indicator approach has been put in place in lieu of the earlier monetary targeting approach. With gradual deregulation of financial markets and a move towards indirect instruments of monetary management, short-term interest rates have emerged as instruments of conveying the monetary policy stance. At the same time, rigidities in the market rates of interest have blunted the effectiveness of monetary policy actions. With the phased opening up of the Indian economy to external flows and increasing trade openness, the role of the exchange rate in the transmission mechanism has assumed importance.

7.4 Against this backdrop, this Chapter undertakes a discussion of issues related to monetary transmission. Section I provides an overview of various channels through which monetary policy affects output and prices. Cross-country empirical evidence on monetary policy lags and pass-through from policy rates to market rates is examined. The relevance of a neutral rate of interest as a guide for monetary policy formulation is also critically evaluated. Section II focuses on monetary transmission mechanism process in India. It dwells upon various policy efforts to impart flexibility to the interest rate structure in India. Estimates of interest rate pass-through in India are attempted. Finally, the Section undertakes an empirical exercise to understand the dynamics of output and prices in response to monetary policy shocks. Concluding observations are contained in Section III.

I. ISSUES IN MONETARY TRANSMISSION

7.5 The monetary transmission mechanism refers to the process through which changes in monetary policy instruments (such as monetary aggregates or short-term policy interest rates) affect the rest of the economy and, in particular, output and inflation. Monetary policy impulses transmit through various channels, affecting different variables and different markets, and at various speeds and intensities (Loayza and Schmidt-Hebbel, 2002). For monetary policy to be effective, it is, therefore, essential to have a broad understanding of these channels and the associated lags. Monetary policy affects output and prices through its influence on key financial variables such as interest rates, exchange rates, asset prices, credit and monetary aggregates (Box VII.1). At the same time, changes in the structure of the economy tend to alter the effects of a given monetary policy measure. This requires central banks to continuously reinterpret monetary transmission channels (Kamin et al., 1998).

7.6 The recent literature has also focused on the role of transparency in the transmission mechanism. A part of the impetus to greater transparency can be attributed to the framework of inflation targeting followed by a number of economies. As discussed in Chapter V, a key feature of inflation targeting vis-à-vis the previous regimes is the focus on transparency. However, even central banks that do not follow an inflation targeting regime have increasingly realised that transparency adds to the credibility of their policy actions. Transparency buttresses the credibility of a central bank and this raises the effectiveness of central bank policy actions. Given the forward-looking nature of financial markets and the critical role played by them in the monetary transmission process, it is of paramount importance that monetary policy actions are seen as credible. Otherwise, changes in monetary instruments may have less than the desired effect on the array of other financial prices such as long-term interest rates, which would then weaken the transmission process. Since long-term rates depend, inter alia, on expectations of future policy actions, greater clarity about the objectives of monetary policy could speed up the response of market interest rates (Sellon, 2002). The effectiveness of monetary policy depends as much as on the public’s expectations about future policy as upon actual actions. Successful monetary policy is not so much a matter of effective control of overnight interest rates as it is of shaping market expectations of the way in which interest rates, inflation and income are likely to evolve over the coming year and later (Woodford, 2003). Accordingly, successful central banking involves management of expectations and monetary authorities are today much more transparent in their policy objectives and the decision making process.

Box VII.1

Monetary Transmission Channels

Monetary policy actions are transmitted to the rest of the economy through changes in financial prices (e.g., interest rates, exchange rates, yields, asset prices, equity prices) and financial quantities (money supply, credit aggregates, supply of government bonds, foreign denominated assets). In recent years, financial price channels have attracted greater attention, partly reflecting concerns about stability of money demand functions. With the short-term interest rates emerging as the predominant instrument of monetary signals worldwide, the interest rate channel is the key channel of transmission. An increase in nominal short-term interest rate, given nominal rigidities (sticky nominal wages and prices in the short-run), translates into higher real interest rates. Higher real interest rates affect spending and investment behaviour of individuals as well as firms. By reducing disposable income, higher real interest rates depress current consumption. At the same time, higher real interest rates encourage current savings. In a similar vein, an increase in interest rates reduces profits of the firms. This makes fresh investments less attractive. Overall, consumption and investment declines which contracts output. This, in turn, pulls prices downwards. As wages/goods prices adjust over time, real GDP returns to the potential level and the real interest rate and the real exchange rate also return to their fundamental levels (Loayza and Schmidt-Hebbel, 2002; Kuttner and Moser, 2002).

The transmission of monetary policy through interest rates is augmented by changes in the exchange rates and balance sheets of the firms as well as banks. Higher interest rates make domestic financial assets attractive and this induces an appreciation of the domestic currency. This has both a direct and indirect effect on prices. Depending upon the extent of the pass-through of exchange rate to prices, appreciation of the exchange rate lowers domestic prices of imports (the direct effect). At the same time, appreciation of the domestic currency adversely affects the external competitiveness of the economy. This leads to a reduction in net exports and, hence, in aggregate demand and output leading to a decline in prices (the indirect effect). Both the direct and indirect effects work in the same direction, i.e., reduce prices. Movements in interest rates also affect asset prices such as equity and property prices. An increase in interest rates depresses asset prices and the consequent reduction in wealth of households pulls down their consumption.

The effects of the conventional interest rate channel can get magnified due to market imperfections such as asymmetric information in financial markets. Recent literature has, therefore, stressed the importance of the credit channel of transmission. The credit channel is, however, not a distinct, free-standing alternative but rather a set of factors that amplify and propagate conventional interest rate effects (Bernanke and Gertler, 1995; Walsh, 2003). The credit channel makes a distinction between banks and non-banks as sources of funds on the one hand and between internal and external finance on the other hand. Within this view, two sub-channels are identified: the bank-lending channel and the balance-sheet channel. According to the bank-lending channel, banks play a special role since they are well-suited to deal with certain types of borrowers, especially small firms, where the problems of asymmetric information can be especially pronounced.

Thus, a contractionary monetary policy that decreases bank reserves also curtails banks’ lending capacity. This reduces loans to small borrowers and hence aggregate spending in the economy. Large firms, in contrast, can directly access capital markets (bonds/ equities). The bank-lending channel is particularly relevant for developing and emerging markets with underdeveloped financial markets where interest rates may not move to clear the market. Banks may instead prefer to ration credit to obviate adverse selection problems. In such cases, aggregate demand is often influenced by the quantity of its credit rather than its price (Kamin et al., 1998). Even in liberalised, developed financial markets, changes in credit conditions can influence economic activity and this forms the basis of the balance-sheet channel. According to the balance-sheet channel (also called net worth channel), higher interest rates reduce asset prices as well as cash flows of the firms. Taken together, these erode the net worth/collateral of borrowers restricting their ability to borrow. Due to asymmetric information, the reduction in collateral will increase the cost of external funds to firms, i.e., the firms have to pay a risk premium on external loans. This raises the external finance premium (EFP), which is the difference in the cost between funds raised externally (by issuing equity or debt) and funds generated internally. This has an adverse effect on investment and demand. These effects on demand and prices can get further reinforced through a ‘financial accelerator’ mechanism –the initial decline in demand further reduces the cash flows of firms and through its impact on collateral/EFP, output and price fall further.

The conventional views of monetary transmission discussed above focus on the demand side effects – a monetary tightening initially reduces output and then prices. In contrast, the 'cost-channel' of monetary transmission stresses that supply-side or cost effects might dominate the usual demand-side effects and therefore, monetary tightening could be followed by an increase in prices. In this view, a rise in interest rates increases the cost of funds for bank-dependent firms. This raises the cost of holding inventories. Accordingly, the cost shock pushes up prices (Barth and Ramsey, 2001).

Empirical Evidence

7.7 Recent research on monetary transmission confirms that monetary policy actions affect output in the short-run. While output is quicker to respond to monetary policy, prices display inertial behaviour and remain largely unaffected for almost one year or even more. Movements in real output are not only substantial but also long-lived (though not permanent) with the effects remaining up to three years (Friedman and Schwartz, 1963; Romer and Romer, 1989). The recent vector autoregression (VAR) literature confirms these results. Output, consumption and investment display a hump-shaped response, and for the US economy, the peak effect is found to occur about 1.5 years after a monetary policy shock. Inflation also displays a hump-shaped response, with the peak response after about two years. Interest rate returns to its pre-shock level within one year (Christiano et al., 1999). According to estimates for the US economy made by Romer and Romer (2003), a shock of 100 basis points to the interest rate starts to reduce industrial production after five months and the peak decline of 4.8 per cent occurs after 22 months. The impact then weakens gradually, reaching (-) 1.2 per cent after 48 months. As regards prices, there is little effect for the first 18 months and the prices start falling in the subsequent period. The prices decline by around 2 per cent after 30 months and by 6 per cent after 48 months.

7.8 For the United Kingdom, a temporary increase (increased for one year and then reversed) of interest rates by 100 basis points lowers output by around 0.2-0.35 per cent after about a year and reduces inflation by around 20-40 basis points a year or so after (Bank of England, 1999). The results for the Euro area broadly conform to this pattern. The peak effect of output occurs after one year while inflation hardly moves during the first year. The delayed response of prices relative to that of output suggests that studying the transmission of policy to spending and output is a logical step, even if the aim of monetary policy is defined primarily or exclusively in prices (Angeloni et al., 2003). Although the persistence of inflation has declined per se in the US and the UK, the lags in the impact of systematic monetary policy actions on inflation still persist despite numerous changes in monetary policy arrangements and advances in information processing as well as financial market sophistication (Batini and Nelson, 2002).

7.9 Notwithstanding the broad similarities in the transmission process across countries, there are a few differences as well. In the Euro area and Japan, real output changes are brought about largely by the response of investment whereas in the US, output variations are mainly brought about by consumption. The differential response of investment and consumption - the 'output composition puzzle' –suggests that it is important to understand not only the dynamics of the overall output but also to have a reasonable grasp of the various constituents of GDP. Accordingly, the key monitoring indicators may differ for each central bank. Thus, given the above results, consumer behaviour needs to be watched more carefully in the US and accordingly, changes in the mortgage markets may be more important than studying changes in the tax treatment of depreciation. In contrast, it appears that, in the Euro area, disposable income is relatively less responsive to monetary changes which might reflect wider social safety nets in the Euro area (Angeloni et al., 2003). Thus, the particular institutional structure in each economy affects the transmission process differently.

7.10 A comparative analysis of the alternative channels for the Euro area, as a whole, suggests that the exchange rate channel is the dominant channel of transmission in the first two years, both in terms of its impact on output and on prices; from the third year onwards, the user cost of capital channel is dominant in terms of impact on output. The ‘credit channel’ is found to operate significantly in Germany and Italy but is irrelevant in some other Euro area countries. Thus, the role of the banks is found to be smaller than expected. On the other hand, evidence for Japan indicates a strong role for the ‘credit channel’ since borrowers have been unable to substitute bank borrowing with alternative sources and consequently, business investment is especially sensitive to monetary shocks (Morsink and Bayoumi, 2001). In contrast to the above studies with their focus on aggregate output, Dedola and Lippi (2000) undertook an industry-wise analysis of monetary policy effects and found that the impact of monetary policy is stronger in industries that (i) produce durable goods (ii) have greater requirements for working capital and (iii) a smaller borrowing capacity. These results can be viewed as supportive of the credit channel. Cost-channel is found to be operative only for the period till the 1970s (pre-Vocker period). The weak evidence in the subsequent period can be attributed to financial innovations and deregulation (Barth and Ramsey, 2001; Rabanal, 2003).

7.11 On the relative roles of money and interest rates, the Japanese evidence shows that a money shock is found to have a large impact on economic activity even when the interest rate is included in the VAR. This suggests that the interest rate channel does not fully account for the transmission mechanism in Japan.

7.12 Recent research has also focused on the role of alternative forms of wealth – housing wealth and equity wealth - in transmission. For Canada, consumer spending is found to respond very little to changes in equity wealth but is more sensitive to housing wealth. The average marginal propensity to consume from wealth (5.7 cents per dollar) is found to be more than 10 times that from equity wealth (less than 0.5 cents per dollar). The weaker response to equity wealth arises from the fact that changes in equity prices tend to be more temporary coupled with the fact that only a small segment of households holds equities in their portfolios (Pichette, 2004). Similar results are found by Case, Quigley and Shiller (2001) for a panel of 14 countries and a panel of US States. This suggests that property prices play a greater role in the transmission process vis-à-vis equity prices. In this context, the recent household borrowing behaviour has raised concerns to policymakers. Household borrowing has grown considerably in many countries over the past two decades, reflecting easing of liquidity constraints as well as lower borrowing rates. The large build-up of household wealth in housing suggests that the household sector consumption, and hence overall domestic demand, will be more sensitive to shocks to interest rates and household incomes in the future (Debelle, 2004).

7.13 There is some evidence of temporal changes in the transmission process: between 1970-85 and 1985-95, in the case of the US, the interest rate elasticity of investment indicates a decline while the consumption elasticity shows an increase. No general pattern of change in these interest rate elasticities is, however, observed for the G-7 group of countries as a whole (Taylor, 1995). Moreover, the response of output to monetary policy signals might be asymmetric, with a tight monetary policy being more effective than an easy monetary policy. For the US, the short-run response of output to increases in the Fed Funds rate is estimated to be more than twice the response to decreases in the Fed Funds rate (Piger, 2003).

7.14 As regards the transmission mechanism in emerging market economies, available empirical evidence suggests a broadly similar pattern as prevailing in key advanced economies. For instance, evidence for Chile indicates that, on average, it takes three to five quarters for a change in monetary policy to reach its main impact on demand and production and an additional four to six quarters are necessary for these changes in activity to have the maximum impact on inflation (Central Bank of Chile, 2000). For South Africa, a change in the repo rate takes around five quarters to have its maximum impact on output and around 6-8 quarters for maximum impact on inflation (Smal and Jager, 2001). At the same time, some subtle differences have also been brought out by empirical evidence. In view of the relatively underdeveloped financial markets as well as the prevalence of liquidity constraints, lags of monetary policy transmission may be shorter. For the Czech Republic, the peak effect on inflation occurs within 18 months of variation in policy interest rate which is shorter than that in major advanced economies (Mahadeva and Smidkova, 2000). Quicker exchange rate pass-through coupled with a more centralised system of wage bargaining can explain the relatively fast response of prices. For a sample of East Asian economies, Fung (2002) finds that prices decline immediately in response to interest rate hikes. The relatively quick response of prices is attributed to lesser rigidity in the labour markets in these East Asian countries which imparts a greater flexibility to prices.

7.15 In brief, the above cross-country evidence suggests that monetary policy actions affect output with a lag of almost one year while it takes nearly two years for monetary policy to have significant impact on inflation. The latter finding explains as to why inflation targeting central banks typically operate with a two-year framework for monetary policy. It must, however, be stressed that these lags are average lags and are surrounded by a great deal of uncertainty. In view of the ongoing structural changes in the real sector as well as financial innovations, the precise lags may differ in each business cycle.

The Transmission Mechanism: Evolving Challenges

7.16 Apart from the ongoing structural changes, monetary policy transmission in the future would have to contend with the evolving pattern of demographics. Over the next few decades, as the proportion of elderly population to the total increases, the pattern of global savings will change and this may reduce the natural rate of interest. Typically, the elderly population is richer in financial and real capital while the young are richer in human capital. With the growing share of elderly population, the role of the wealth channel in monetary transmission might assume greater importance (Bean, 2004). A central bank, therefore, needs to constantly monitor the transmission lags for monetary policy effectiveness.

7.17 Monetary authorities will have to take into account the implications of the ongoing financial innovations such as e-banking and e-money1 on the transmission mechanism. In one view, e-banking is expected to reduce transactions costs for depositors. Lower transaction costs, following the Baumol-Tobin framework, suggest a reduction in demand for money2. At the same time, e-banking increases depositors’ access to a wide range of financial assets in addition to bank deposits. This increases the opportunity cost of money and hence demand for money may turn out to be more interest elastic. In terms of the IS-LM framework, this will flatten the LM curve. Thus, increased recourse to e-banking might have two implications: reduction in money demand and a flattening of the LM curve. Reduction in money demand will reduce interest rates and increase growth as formerly idle transaction balances are reallocated to savings and investment. On the other hand, a flattening of the LM curve (with an unchanged IS curve) could weaken monetary policy effectiveness (Fullenkamp and Nsouli, 2004). Thus, desired changes in output and prices will require a comparatively large monetary policy stimulus.

7.18 Moreover, e-finance development could enlarge the pool of potential lenders. Thus, in the event of a monetary tightening, previously credit-constrained firms may more easily find alternative avenues of credit which would weaken the effectiveness of monetary policy. Furthermore, if hedging against exchange and interest rate fluctuations becomes easier and cheaper, this could also reduce the responsiveness of output and prices to changes in interest rates. On the other hand, increased use of internet technology in the real economy is likely to accelerate the impact of monetary policy. Use of information technology for inventory management will mean that changes in sales will reflect more quickly in changes in output and prices (Hawkins, 2001).

7.19 As regards e-money, its implications will critically depend upon the extent to which private e-money replaces central bank currency. According to Freedman (2000), the special role of central banks in providing for final settlement is unlikely to be ever replaced owing to the unimpeachable solvency of these institutions. To establish its credibility, a private e-money provider will have to promise to redeem its e-money liabilities in government money and will thus be required to maintain deposit accounts with the central banks. Overall, monetary policy is likely to remain a key instrument of macroeconomic stabilisation albeit its effectiveness could be weakened to some extent.

Interest Rate Pass-through

7.20 A key aspect of the transmission mechanism is the speed with which the changes in policy rates feed on to banks’ deposit and lending rates (Box VII.2). Available empirical evidence on the interest-rate pass-through from policy rates/money market rates indicates that interest rates of banks - deposit as well as lending rates - are sluggish in responding to monetary policy actions with lags ranging from several weeks to several months. A cross-country survey of recent studies on pass-through estimates is presented in Table 7.1. A number of interesting features emerge from these studies. First, the pass-through estimates lie in a wide range and vary a lot from country to country.

1 E-banking may be defined as the use of electronic methods to deliver traditional banking services using any kind of payment media. On the other hand, e-money is any electronic payment media – any material, device or system that conducts payment via the transfer of electro-magnetically stored information (Fullenkamp and Nsouli, 2004).

2 Money held for transaction purposes has an opportunity cost in terms of interest foregone on other assets. Economic agents would, therefore, like to economise on their use of transaction balances by making frequent transactions to sell interest-bearing non-money assets. However, as this process involves transaction costs, economic agents hold more transaction balances than if there were no transaction costs. If these transaction costs were to decline, demand for transactions balances will also fall.

Box VII.2

Determinants of Interest Rate Pass-through

For interest rate channel to work effectively and efficiently, changes in the short-term policy rate should feed into the bank and other market rates in the economy. The critical issue is the ‘pass-through’, i.e., the degree and the speed with which the variations in monetary policy stance is passed on to the interest rate spectrum of the economy. A high pass-through would suggest that a given change in the policy rate will have a larger effect on prime and other lending rates or equivalently, a smaller change in the policy rate will achieve the desired change in the prime rates. Similarly, a speedier pass-through implies that financial markets have become forward looking and this would lead to decline in transmission lags. The pass-through would depend upon a number of factors such as: the structure of the financial system (like the extent of the regulation of the financial system, ceilings on interest rates and geographical and product-line restrictions); the degree of competition between intermediaries; the usage of variable-rate products (both deposits and loans) by the banking system; the response of portfolio substitution to the policy rate; and, the transparency of the monetary policy operations (Sellons, 2002).

Accordingly, if the financial system is well-diversified in terms of institutions and products, policy signals will transmit quickly and more fully onto market rates. On the other hand, a higher degree of volatility in the money market rates makes it difficult for market participants to disentangle noise from policy signals and this may reduce the pass-through. The response would also depend upon the extent to which the policy change was anticipated and how the change affects expectations of future interest rates. If the change in the policy rate is believed to persist for an extended period of time, the long-term interest rates would be more responsive. The short-run interest rate stickiness could also reflect the maturity structure of bank balance sheets. A prudent bank would prefer to set its retail lending rates in consonance with movements in long-term market rates rather than with short-term market rates to limit its interest rate risk exposure. In this view, short-run stickiness is a rational response on the part of banks (Bondt, 2002; Bondt et al., 2003).

Second, the pass-through increases over time and, in the long-run, the pass through is typically more or less complete. In the euro area, for instance, only one-third (with a maximum of 50 per cent) of the change in money market rates gets reflected in bank deposit and lending rates in the first month. In the long-run, the pass-through is almost 100 per cent for bank lending rates or even higher and it typically takes 3-10 months for the full pass-through. The overshooting exhibited by the long-run pass-through in case of lending rates could be on account of asymmetric information. In case banks increase lending rate one-for-one, they will attract more risky class of borrowers and, hence banks compensate themselves for the higher risk by increasing the lending rate premium (Bondt, 2002).

7.21 Third, there is no uniform pattern in the pass-through between deposits and loans. In some countries, deposit rates are stickier than lending rates and vice versa. For instance, in the Euro area, overnight deposit rates and ‘deposits redeemable at notice of three months’ are the stickiest, with even long-run pass-through of, at most, 40 per cent. The low pass-through in this case can be attributed partly to administered nature of these deposits in some Euro area countries and partly the fact that demand for such deposits is relatively inelastic. In contrast to the euro area evidence, Mizen and Hofmann (2002) find that, for the UK, pass-through in case of deposit rates is larger than that for lending rates. Fourth, the size and the speed of the pass-through are found to decline as the maturity of the bank instruments increases. Thus, the higher the maturity, the lower the pass-through. Fifth, between various type of loans, pass-through in case of consumer lending is found to be the weakest, reflecting a variety of factors -weak competition, inelastic demand, asymmetric information and credit rationing (Bondt, 2002; Bondt et al., 2003). In the US, credit card rates even today remain the stickiest with pass-through of only 0.3 during the 1990s, albeit higher than that of almost negligible level during the 1970s (Sellon, op cit). Sixth, evidence is inconclusive as to whether the response is symmetric to monetary policy signals. A few studies find an asymmetric response: the pass-through is quicker when monetary policy is tightened and sluggish when monetary policy is easing (Sellon, op cit.). This has an important implication for the transmission mechanism with monetary tightening being more effective than monetary easing of the same magnitude. Other studies, however, do not find any evidence in favour of this proposition. Finally, the pass-through estimates for emerging economies are generally comparable to that of advanced economies.

7.22 Amongst the other key findings of the literature, competition increases pass-through, but mainly in deposit markets (Sander and Kleimeier, 2004). Market concentration (say, mergers) per se does not reduce the pass-through as long as the markets are contestable (Cottarelli and Kourelis, 1994). A well-developed market for negotiable short-term instruments (such as certificates of deposit) increases the pass-through; on

|

Table 7.1: Estimates of Interest Rate Pass-through |

||||

|

Study |

Sample |

Pass-through |

||

|

Countries |

Short-run |

Long-run |

||

|

1 |

2 |

3 |

4 |

|

|

Cottarelli and |

31 countries (developing and |

0.04-0.83 (lending rates); |

0.30-1.48 (lending rates); |

|

|

Kourelis (1994) |

developed) |

average: 0.32 |

average: 0.97 |

|

|

Mizen and Hofmann |

United Kingdom |

0.23 (lending rates) |

0.54-0.92 (lending rates) |

|

|

(2002) |

0.65 (deposit rates) |

|||

|

Bondt et al. (2003) |

8 Euro area countries |

0.14-0.76 (short-term loans) |

0.86 (lending rates) |

|

|

as well as the entire |

0.06-0.54 (long-term loans) |

Around 1 (deposit rates) |

||

|

Euro area |

0.10-0.53 (consumer credit) |

0.36-1.24 (short-term loans) |

||

|

0.02-0.45 (mortgages) |

0.42-1.23 (long-term loans) |

|||

|

0.08-0.82 (deposit rates) |

0.33-1.08 (consumer credit) |

|||

|

0.30-1.07 (mortgages) |

||||

|

0.37-0.89 (deposit rates) |

||||

|

Sander and Kleimeier |

Euro area countries |

0.20-0.22 (lending rates) |

062-0.68 (lending rates) |

|

|

(2004) |

0.17-0.20 (deposit rates) |

0.40-0.47 (deposit rates) |

||

|

Crespo-Cuaresma |

Czech Republic |

0.64-0.76 (lending rates) |

||

|

et |

al. (2004) |

0.75-0.85 (deposit rates) |

||

|

Hungary |

1.01-1.02 (lending rates) |

|||

|

0.49-0.92 (deposit rates) |

||||

|

Poland |

0.98-1.02 (lending rates) |

|||

|

0.77-0.98 (deposit rates) |

||||

|

Espinosa-Vega and |

Chile |

0.63 (short-term loans) |

0.56 (short-term loans) |

|

|

Rebucci (2003) |

0.58 (medium-term loans) |

0.88 (medium-term loans) |

||

|

0.18 (long-term loans) |

0.55 (long-term loans) |

|||

|

0.68 (short-term deposits) |

0.54 (short-term deposits) |

|||

|

0.39 (medium-term deposits) |

0.39 (medium-term deposits) |

|||

|

0.20 (long-term deposits) |

0.68 (long-term deposits) |

|||

|

Canada |

0.83 (short-term loans) |

1.01 (short-term loans) |

||

|

0.63 (medium-term loans) |

0.51 (medium-term loans) |

|||

|

0.46 (long-term loans) |

0.24 (long-term loans) |

|||

|

1.13 (short-term deposits) |

0.98 (short-term deposits) |

|||

|

1.05 (medium-term deposits) |

0.93 (medium-term deposits) |

|||

|

United States |

0.86 (short-term loans) |

1.00 (short-term loans) |

||

|

1.00 (short-term deposits) |

1.00 (short-term deposits) |

|||

|

0.84 (medium-term deposits) |

0.93 (medium-term deposits) |

|||

|

0.87 (long-term deposits) |

0.64 (long-term deposits) |

|||

|

Australia |

0.46 (loans) |

1.09 (loans) |

||

|

0.40 (short-term deposits) |

0.67 (short-term deposits) |

|||

|

0.69 (medium-term deposits) |

0.87 (medium-term deposits) |

|||

|

0.87 (long-term deposits) |

0.81 (long-term deposits) |

|||

|

New Zealand |

0.21 (loans) |

0.77 (loans) |

||

|

0.34 (short-term deposits) |

0.74 (short-term deposits) |

|||

|

0.42 (medium-term deposits) |

0.71 (medium-term deposits) |

|||

the other hand, a well-developed market for commercial papers does not appear to increase the pass-through. Excessive volatility in money markets reduces the information content of monetary policy signals and hence weakens the pass-through.

7.23 As regards the effects of a monetary union, evidence is inconclusive with some studies finding an improvement in the pass-through (Angeloni and Ehrmann, 2003) but others find no such evidence (Bondt et al., 2003). For the US economy, there is evidence of an increase in pass-through during the recent years. For instance, the pass-through from the Fed Funds rate to the prime rate has increased significantly during the 1990s, being almost immediate (Sellon, op cit.). In the case of housing mortgage, the pass-through increased from around 0.2 in the early 1970s to almost unity by 1999-2000. For other loans (car loans, credit cards and personal loans), the size increased by 3-4 times during the 1990s but was still lower than unity. Evidence from Chile indicates significant differences in banks’ responses: the smaller the bank, the lower the portion of past-due loans and the larger the share of the household consumers, the faster is the pass-through of lending rates to money market rates (Berstein and Fuentes, 2004).

7.24 In brief, the above survey shows that pass-through is rather sluggish in the short-run. The pass-through increases over time, but not necessarily complete even in the long-run. There is no uniform pattern on pass-through between deposit and loans. Within loans, consumer loans typically display the weakest pass-through.

Real Interest Rates

7.25 With interest rates emerging as a key instrument of monetary policy, issues relating to appropriate real rate of interest have attracted debate. Central banks change short-term nominal interest rates to achieve their desired policy objectives. However, what matters for investment and consumption decisions is not the nominal rate but the ex ante real interest rate. Ex ante real interest rate at a given point of time may be defined as nominal rate of interest less expected inflation. There are a number of approaches to measure expected inflation such as periodic surveys or inflation-indexed bonds. However, since reliable data on inflation expectations may not be available in all economies, a common approach is to compute real rates based on actual inflation rates. If the real interest rate, howsoever measured, is lower than the economy’s equilibrium real rate, this will stimulate demand in the economy and push output above its potential. Over time, this would put upward pressure on prices. On the other hand, if the actual real rate is above the equilibrium rate, it would lead to deflationary pressures in the economy. Estimates of equilibrium real rate of interest for the economy, therefore, assume importance. A yardstick for such an equilibrium rate is provided by natural (or neutral) rate of interest. As in the case of actual real rate, the natural rate is also unobserved. Accordingly, practical difficulties in its measurement severely limit the use of the natural rate in day-to-day monetary policy formulation (Box VII.3). There are further problems with the measurement of the neutral rate on a real time basis as real time data are subject to sharp revisions. Thus, at best, the neutral rate concept can be useful in historical analysis of monetary policy rather than as a guide for the current and the future conduct of monetary policy. On a real time basis, averages of past real interest rates provide a more accurate estimate of the neutral rate (Clark and Kozicki, 2004).

Box VII.3

Natural Rate of Interest

Natural rate of interest is defined as the real short-term interest rate consistent with output at its potential and a stable rate of inflation (ECB, 2004). It may also be defined as the equilibrium real rate of return in the case of fully flexible prices (Woodford, 2003). Natural rate is determined by savings and investment in the economy and, therefore, depends upon factors such as time preference of consumers (between current and future consumption), productivity growth, demographics and fiscal policy. If households increase their preference for current consumption vis-à-vis future consumption, this would depress current savings and, thereby raise equilibrium rate of interest. A pick-up in productivity growth and an increase in working-age population will increase investment demand in the economy and this will have the effect of raising the equilibrium rate of interest. Greater uncertainty in the economy – for instance, volatile inflation and exchange rates – will require investors to be compensated for the increased risk premia and this will push up the equilibrium rate. A well-diversified and efficient financial system can enlarge the pool of domestic savings which will reduce the equilibrium rate of interest. In brief, it is apparent that natural rate of interest need not be constant and can increase as well as decrease depending upon movements in the underlying factors. In particular, increase in the trend growth rate of the economy can lead to a commensurate increase in the natural rate of interest.

Difficulties in measuring the fundamental determinants of the natural rate, in turn, make it difficult to identify the appropriate level of natural rate at any point of time. Researchers have accordingly employed a number of statistical techniques such as averaging/filtering of the actual real interest rates as a proxy for the natural rate. These techniques, however, implicitly assume that over long-period of time, on average, the actual real interest rate is close to the natural rate. Another difficulty emanates from the fact that real-time data on key macroeconomic variables necessary for estimating the neutral rate are available with a lot of uncertainty and undergo periodic revisions. This further adds to uncertainty of neutral rate estimates and reduces their utility on a real-time basis (Clark and Kozicki, 2004). In view of these uncertainties, natural rate of interest is not used by central banks in their day-to-day conduct of monetary policy. In brief, natural rate is a useful aid in thinking about monetary policy providing an important benchmark for monetary policy and a potential indicator of monetary policy stance. Its practical relevance is, however, severely limited by the fact of it being unobservable and measurement problems (ECB, op cit; Ferguson, 2004).

7.26 Empirical evidence for the US, the UK, France and Germany suggests that the real interest rates increased during 1980s and 1990s over the levels prevailing during the 1950s and 1960s (Chadha and Dimsdale, 1999). The low real interest rates during the 1950s and 1960s reflected the greater policy weight assigned to output expansion. Low real interest rates during these periods were also on account of financial repression due to widespread use of statutory pre-emptions. Exchange controls during this period restricted international arbitrage of financial flows and this also enabled low, and even negative, real rates during the 1970s (Kahn and Farrell, 2002). The surge in real rates from 1980s onwards reflected tighter monetary policy to contain inflation. Higher real interest rates since the 1980s also reflected a lax fiscal policy stance (Ford and Laxton, 1999) and an overall tendency towards deregulation of financial markets.

7.27 More recent estimates for the euro area suggest that the natural rate has reversed its rising trend since mid-1990s. The decline in the natural rate in the euro area could be attributed to a number of factors: deceleration in productivity as well as population growth; fiscal consolidation; and, lowering of risk premia. Elimination of exchange rate risk in intra-Euro area following the introduction of euro as well as low and stable inflation contributed to lowering of the risk premia (ECB, 2004). Basdevant et al. (2004) also find evidence that low and stable inflation has led to a reduction in the natural rate in New Zealand since 1992. For the US, estimates suggest that natural rate has shown significant variation over the past four decades and variation in trend growth of output is an important determinant (Laubach and Williams, 2003).

7.28 A cross-country analysis of interest rates reveals a number of interesting facets. First, real deposit and lending rates have generally moderated since the early 1990s. Second, real interest rates in a number of EMEs are now more stable and generally positive compared to the 1980s. Third, interest rate spreads have also tended to moderate across a number of economies. Fourth, compared to other EMEs, real rates in India are more stable. Both real deposit and lending rates in India are generally higher than those prevailing in the Asian economies but lower than those in Latin American economies. A similar pattern holds for interest rate spreads, although spreads in India are lower than that prevailing in some of the advanced economies (Tables 7.2, 7.3 and 7.4).

|

Table 7.2: Real Deposit Rates |

||||||||

|

(Per cent per annum) |

||||||||

|

Country |

1981-85 |

1986-90 |

1991-95 |

1996-00 |

2001-03 |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

|||

|

Argentina |

-64.1 |

2687.6 |

-21.0 |

7.8 |

9.1 |

|||

|

Australia |

2.4 |

5.8 |

4.3 |

2.9 |

-0.2 |

|||

|

Brazil |

45.3 |

2245.2 |

1108.1 |

16.8 |

9.7 |

|||

|

Chile |

14.2 |

5.9 |

3.6 |

6.5 |

1.3 |

|||

|

China |

-- |

-- |

-3.5 |

2.5 |

1.8 |

|||

|

Germany |

-- |

-- |

-- |

1.6 |

1.3# |

|||

|

Hong Kong, China |

-- |

-- |

-3.9 |

3.9 |

3.3 |

|||

|

India |

-1.7 |

1.2 |

0.3 |

2.1 |

2.7 |

|||

|

Indonesia |

0.7 |

9.7 |

8.4 |

3.5 |

4.1 |

|||

|

Israel |

-- |

-8.1 |

-0.5 |

5.3 |

4.2 |

|||

|

Japan |

1.0 |

0.9 |

1.1 |

-0.1 |

0.7 |

|||

|

Korea, Rep. |

2.9 |

4.6 |

3.0 |

5.5 |

1.5 |

|||

|

Malaysia |

4.5 |

2.9 |

2.6 |

3.0 |

1.8 |

|||

|

Mexico |

-14.7 |

-17.3 |

3.1 |

-3.8 |

-1.0 |

|||

|

Paraguay |

-- |

-15.3 * |

3.5 |

7.5 |

7.7 |

|||

|

Peru |

-- |

-- |

-50.8 |

8.0 |

4.5 |

|||

|

Philippines |

-3.2 |

5.0 |

2.3 |

2.6 |

2.2 |

|||

|

Poland |

-- |

514 @ |

-7.0 |

3.8 |

4.5 |

|||

|

Russian Federation |

-- |

-- |

-96 |

$ |

-17.5 |

-12.2 |

||

|

Singapore |

4.0 |

2.2 |

0.7 |

2.1 |

0.6 |

|||

|

South Africa |

0.0 |

-1.3 |

2.1 |

7.0 |

3.4 |

|||

|

Turkey |

5.1 |

-9.0 |

-7.3 |

-0.9 |

12.7 |

|||

|

United Kingdom |

3.4 |

4.3 |

2.5 |

-- |

-- |

|||

|

* Pertains to 1990; |

||||||||

II. MONETARY TRANSMISSION: THE INDIAN EXPERIENCE

7.29 With the initiation of financial sector reforms, monetary management in India has been increasingly relying on the use of indirect instruments like open market operations and fine-tuning of liquidity conditions through the Liquidity Adjustment Facility. As discussed in Chapter III, modulations in policy interest rates have emerged as a principal instrument of signalling monetary policy stance. This Section analyses movements in nominal and real interest rates. Policy efforts to impart greater flexibility to the interest rate structure are discussed and an attempt is made to estimate pass-through from policy rates to market rates. Finally, the dynamics of output and prices to monetary policy signals and the interaction between exchange rate and interest rate are empirically examined in an attempt to explore channels of monetary transmission in India.

|

Table 7.3: Real Lending Rates |

|||||

|

(Per cent per annum) |

|||||

|

Country |

1981-85 |

1986-90 |

1991-95 |

1996-00 |

2001-03 |

|

1 |

2 |

3 |

4 |

5 |

6 |

|

Argentina |

-- |

-- |

10.9 $ |

11.1 |

19.5 |

|

Australia |

5.9 |

10.9 |

9.6 |

7.0 |

5.2 |

|

Brazil |

-- |

-- |

-- |

-- |

52.3 |

|

Chile |

28.3 |

12.7 |

10.0 |

11.3 |

4.1 |

|

China |

3.3 |

1.9 |

-2.2 |

6.7 |

4.5 |

|

Germany |

8.2 |

7.0 |

8.9 |

8.7 |

-- |

|

Hong Kong, China |

-- |

0.6 * |

0.4 |

9.1 |

8.4 |

|

India |

7.3 |

8.4 |

6.8 |

7.0 |

7.4 |

|

Indonesia |

-- |

12.4 |

13.2 |

-0.2 |

10.0 |

|

Israel |

155.2 |

19.1 |

6.8 |

10.0 |

7.9 |

|

Japan |

4.5 |

4.4 |

4.2 |

3.1 |

3.8 |

|

Korea, Rep. |

3.6 |

3.3 |

1.0 |

7.5 |

4.0 |

|

Malaysia |

-- |

-- |

5.9 |

5.6 |

5.3 |

|

Mexico |

-- |

-- |

-- |

6.9 |

2.9 |

|

Paraguay |

-- |

-5.3 * |

14.1 |

21.4 |

28.1 |

|

Peru |

-- |

-750.9 |

113.6 |

22.8 |

14.9 |

|

Philippines |

0.8 |

9.6 |

7.6 |

6.4 |

5.4 |

|

Poland |

-- |

-- |

1.1 |

10.1 |

11.5 |

|

Russian Federation |

-- |

-- |

176.3 @ |

19.1 |

0.0 |

|

Singapore |

7.4 |

3.6 |

3.3 |

6.7 |

5.8 |

|

South Africa |

4.3 |

0.8 |

5.1 |

11.5 |

6.9 |

|

United Kingdom |

4.5 |

5.9 |

4.4 |

3.5 |

1.4 |

|

United States |

8.0 |

6.1 |

4.8 |

6.7 |

3.4 |

|

* Pertains to 1990; |

@ Pertains to 1995; $ |

Pertains to 1994-95. |

|||

|

Notes : 1.

Real lending rate is defined as nominal lending rate less GDP deflator

inflation. |

|||||

7.30 Key monetary policy rates – the Bank Rate and the repo rate – have been reduced substantially since 1998 reflecting the countercyclical monetary policy stance. The Bank Rate was reduced from 11.0 per cent in January 1998 to 6.0 per cent by April 2003. The repo rate also witnessed a cut from 6.0 per cent in January 1999 to 4.5 per cent in August 2003 (before being raised to 4.75 percent in October 2004), notwithstanding an increase in the second half of 2000 (touching a peak of 15.0 per cent in August 2000 before falling to 8.0 per cent by December 2001). The reduction in key policy rates has been supplemented with cuts in cash reserve ratio from 10.5 per cent in January 1998 to 4.5 per cent by June 2003 (although subsequently increased to 5.0 per cent in September-October 2004). While the changes in policy rates were quickly mirrored in the money market rates as well as in Government bond yields, lending and deposits rates of banks, however, exhibited a degree of sluggishness.

|

Table 7.4: Interest Rate Spreads |

|||||||

|

(Per cent per annum) |

|||||||

|

Country |

1981-85 |

1986-90 |

1991-95 |

1996-00 |

2001-03 |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

||

|

Argentina |

-- |

-- |

4.0 |

@ |

2.8 |

11.0 |

|

|

Australia |

3.2 |

3.8 |

4.4 |

4.1 |

5.0 |

||

|

Brazil |

-- |

-- |

-- |

51.6 |

42.9 |

||

|

Chile |

11.9 |

7.5 |

5.5 |

4.5 |

4.4 |

||

|

China |

0.9 |

0.5 |

0.6 |

3.1 |

3.4 |

||

|

Germany |

5.3 |

4.8 |

6.2 |

6.5 |

6.7# |

||

|

Hong Kong, China |

-- |

3.3 * |

3.8 |

3.7 |

4.1 |

||

|

India |

8.1 |

7.3 |

6.5 |

3.4 |

4.4 |

||

|

Indonesia |

-- |

4.3 |

4.0 |

0.9 |

4.3 |

||

|

Israel |

254.2 |

28.1 |

7.7 |

5.3 |

3.9 |

||

|

Japan |

3.3 |

3.4 |

2.7 |

2.1 |

1.8 |

||

|

Korea, Rep. |

1.6 |

0.3 |

0.0 |

1.3 |

1.9 |

||

|

Malaysia |

-- |

5.2 |

2.8 |

3.6 |

3.4 |

||

|

Mexico |

-- |

-- |

8.3 |

9.5 |

4.9 |

||

|

Paraguay |

-- |

8.1 * |

10.8 |

13.1 |

20.7 |

||

|

Peru |

-- |

909.2 |

158.2 |

14.2 |

10.5 |

||

|

Philippines |

5.7 |

5.1 |

5.1 |

4.4 |

4.1 |

||

|

Poland |

-- |

213.2 |

1.9 |

5.9 |

5.3 |

||

|

Russian Federation |

-- |

-- |

218.4 |

$ |

35.1 |

10.8 |

|

|

Singapore |

2.9 |

3.0 |

3.0 |

3.4 |

4.5 |

||

|

South Africa |

4.7 |

2.6 |

4.3 |

5.1 |

4.9 |

||

|

United Kingdom |

0.7 |

1.7 |

1.9 |

2.9 |

-- |

||

|

* Pertains to 1990; |

|||||||

7.31 The relative downward inflexibility in the commercial interest rate structure

can be attributed to a number of factors:

- Average cost of deposits for major banks continues to be relatively high.

- A substantial portion of deposits is in the form of long-term deposits at fixed interest rates which reduced the flexibility available to banks to reduce interest rates in the shor t-run, without adversely affecting their return on assets.

- Relatively high interest rates on competing instruments of savings, viz.¸ administered small saving instruments.

- Relatively high overhang of non-performing assets (NPAs), although these have been declining quite substantially in the last three years.

- In view of legal constraints and procedural bottlenecks in recovery of dues by banks, the risk-premium tends to be higher resulting in wider spread between deposit rates and lending rates.

- Large borrowing programme of the Government, over and above the SLR requirements, provides significant prospects for deployment of funds by banks in sovereign paper (RBI, 2003).

7.32 In order to overcome these rigidities and to provide more flexibility in the interest rate structure, the Reserve Bank has initiated a number of measures in the past 3-4 years. These include, inter alia, advising banks: to introduce flexible interest rate option for new deposits; to review their maximum spreads over PLR and reduce them wherever they are unreasonably high; to announce the maximum spread over PLR to the public along with the announcement of their PLR; and, to switch over to 'all cost' concept for borrowers by explicitly declaring the various charges such as processing and service charges. To have a greater degree of transparency in regard to actual interest rates for depositors as well as borrowers, the Reserve Bank has put out information on its website on (a) deposit rates for various maturities and effective annualised return to the depositors and (b) maximum and minimum interest rates charged to their borrowers.

7.33 To further enhance the transparency and to reduce the complexity involved in pricing of loans as also to ensure that the PLR truly reflects the actual costs, the Reserve Bank in its Annual Monetary Policy Statement (April 2003) advised banks to announce a benchmark PLR (BPLR) taking into account the following factors: (i) actual cost of funds, (ii) operating expenses and (iii) a minimum margin to cover regulatory requirement of provisioning/capital charge and profit margin. These initiatives were helpful and the public sector banks reduced their interest rates by 25 to 100 basis points in January 2004 while announcing their BPLR.

7.34 More generally, the various policy initiatives of the Reserve Bank over the last 3-4 years have been able to impart a greater degree of flexibility to the interest rate structure, leading to a softening of interest rates on both deposits and loans. Illustratively, more than one-half of outstanding time deposits of scheduled commercial banks at end-March 2003 were contracted at interest rates of upto eight per cent per annum. In contrast, this proportion was as low as 11 per cent at end-March 1996. Correspondingly, the proportion of time deposits in the high interest bracket (11 per cent per annum and above) has seen a significant decline from 67 per cent at end-March 1996 to less than eight per cent at end-March 2003 (Table 7.5). Based on these data, weighted average interest rate on time deposits of scheduled commercial banks is estimated to have declined from around 11.6 per cent at end-March 1996 to around eight per cent at end-March 2003.

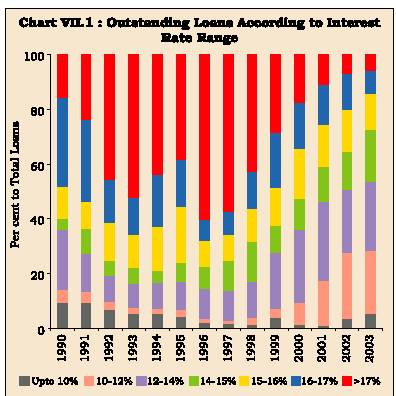

7.35 A similar softening in lending rates is visible from an analysis of the outstanding loans. At present, more than one-half of the outstanding loans has been lent at interest rates of 14 per cent per annum or below. In contrast, this proportion was as low as 17 per cent at end-March 1995 and 36 per cent at end-March 2000 (Table 7.6 and Char t VII.1). Correspondingly, the proportion of outstanding loans at interest rates of more than 16 per cent has declined from almost two-thirds of total outstanding loans at end-March 1997 to less than 15 per cent by end-March 2003. Based on these data, the weighted average lending rate is estimated to have declined from its recent peak of 17.1 per cent in March 1997 to 13.6 per cent in March 2003 and is, in fact, at its lowest level in the last two decades.

|

Table 7.5: Outstanding Term Deposits of Scheduled Commercial Banks by Interest Rate |

||||||||

|

(per cent to total deposits) |

||||||||

|

Interest Rate Slab |

Mar-96 |

Mar-97 |

Mar-98 |

Mar-99 |

Mar-00 |

Mar-01 |

Mar-02 |

Mar-03 |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

Less than 8 per cent |

10.8 |

11.2 |

11.5 |

13.3 |

16.8 |

16.9 |

25.0 |

53.7 |

|

8 - 9 per cent |

2.4 |

5.2 |

4.8 |

6.1 |

6.5 |

10.5 |

22.6 |

16.4 |

|

9 - 10 per cent |

4.5 |

7.1 |

6.4 |

9.0 |

14.3 |

16.1 |

19.8 |

12.0 |

|

10 - 11 per cent |

15.2 |

14.1 |

13.7 |

17.7 |

20.9 |

23.9 |

17.3 |

10.5 |

|

11 - 12 per cent |

13.9 |

14.3 |

16.3 |

20.2 |

19.2 |

17.9 |

9.1 |

4.5 |

|

12 - 13 per cent |

23.4 |

20.9 |

22.3 |

19.2 |

13.9 |

9.1 |

4.3 |

2.3 |

|

13 per cent and above |

29.8 |

27.2 |

25.0 |

14.5 |

8.4 |

5.6 |

1.9 |

0.8 |

|

Source : Basic Statistical Returns of Scheduled Commercial Banks in India (Various Issues), Reserve Bank of India. |

||||||||

|

Table 7.6: Outstanding Loans of Scheduled Commercial Banks by Interest Rate |

|||||||||

|

(Per cent to total loans) |

|||||||||

|

Interest Rate Slab |

Mar-90 |

Mar-95 |

Mar-97 |

Mar-98 |

Mar-99 |

Mar-00 |

Mar-01 |

Mar-02 |

Mar-03 |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

<6% |

2.7 |

2.3 |

1.1 |

1.0 |

0.3 |

0.2 |

0.2 |

0.1 |

0.1 |

|

6-10% |

6.8 |

2.1 |

0.5 |

0.4 |

3.7 |

1.0 |

0.6 |

3.2 |

5.3 |

|

10-12% |

4.8 |

2.3 |

1.4 |

2.3 |

3.3 |

7.9 |

17.0 |

24.5 |

22.9 |

|

12-14% |

21.4 |

10.6 |

10.7 |

13.2 |

20.3 |

26.8 |

28.6 |

22.5 |

25.1 |

|

14-15% |

4.4 |

6.7 |

10.9 |

14.9 |

9.7 |

11.5 |

12.6 |

14.1 |

19.4 |

|

15-16% |

11.7 |

20.3 |

9.6 |

11.7 |

14.0 |

17.9 |

15.7 |

15.5 |

12.5 |

|

16-17% |

32.2 |

17.3 |

8.3 |

13.7 |

20.2 |

17.1 |

14.1 |

12.5 |

8.6 |

|

17-18% |

10.8 |

15.6 |

17.2 |

14.3 |

13.1 |

8.6 |

5.2 |

3.0 |

1.8 |

|

18-20% |

4.5 |

14.5 |

26.8 |

20.2 |

10.5 |

6.2 |

4.0 |

3.2 |

3.0 |

|

>20% |

0.6 |

8.3 |

13.5 |

8.3 |

4.9 |

2.8 |

2.0 |

1.4 |

1.2 |

|

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

|

Source : Basic Statistical Returns of Scheduled Commercial Banks in India (Various Issues), Reserve Bank of India. |

|||||||||

7.36 Between June 2002 and June 2004, the lending rates of the banks (the rates at which at least 60 per cent of lending takes place) have declined further (Table 7.7). The sharpest decline is witnessed in the case of private sector banks. Similarly, interest rates on deposits have seen a further softening since March 2001 (Chart VII.2). In particular, deposits above one-year maturity have exhibited a significant reduction which suggests an enhanced flexibility to the banks in pricing their loans in the future. Empirical evidence confirms that pass-through in India is less than unity although there are signs of an increase in pass-through over time (Box VII.4).

Page Last Updated on: