IST,

IST,

Financial Market Regulation in India - Looking Back, Looking Ahead

Shri Harun R Khan, Deputy Governor, Reserve Bank of India

Delivered on Aug 25, 2015

Mr. Jiri Rusnok, Former Prime Minister & Member of the Board of the Czech National Bank; Dr. M. Venkatachalam, Charge d’Affairs Indian Embassy, Prague; Mr. N. S. Venkatesh, Chairman FIMMDA; Mr. Pradeep Madhav, PDAI; distinguished panelists and all the delegates. It gives me great pleasure to be delivering the keynote address for the FIMMDA – PDAI Annual Conference in this culturally rich, historically vibrant, naturally blessed city of Prague which still maintains its old-world charm. 2. The theme for this year’s conference Evolving Markets –Institutions & Regulations rightly underscores the role of both the regulations as well as institutional practices in influencing the market development. The post-crisis overhaul of the global financial regulatory regime may, however, have altered the balance between the two as newer regulations have been changing the institutional practices themselves in very fundamental ways in many jurisdictions. It may still be a bit early to definitively conclude about the impact of these changes on evolution of markets going forward. The shift to CCPs and increased costs of OTC transactions; increased capital requirements for trading activities; new leverage and liquidity regimes, etc. all are contributing to reshaping the financial markets landscape globally. While the state of financial markets may be qualitatively heterogeneous across countries, the harmonized implementation of the reform program is an essential necessity countries are confronted with. 3. Given the above backdrop, I thought it appropriate on this occasion to undertake a broad assessment of the evolution of our own financial markets and the issues we have been grappling with. It is critical for us to learn the right lessons from the experience of other countries in reshaping their regulatory frameworks while we debate the right model. There could be different viewpoints and perspectives but it is imperative that certain basic principles are agreed upon. Introduction 4. Regulation of financial sector internationally is broadly guided by two objectives: prudential regulation and conduct of business regulation, including consumer protection. The four key institutional frameworks for regulation of the financial sector internationally – Institutional Approach (entity-based regulation), Functional Approach (activity-based regulation), Integrated Approach (universal regulator model) and Twin Peaks Approach (separation of prudential regulation and conduct of business regulation) – all attempt to address the above objectives through different formal structures. Post-crisis, a new dimension of ‘systemic stability’ is being sought to be added as another objective of financial sector regulation but the exact contours in this regard are still in the works. 5. Financial markets in India have evolved, as has the regulatory framework for them, historically in the context of a primarily bank-dominated financial system. It was only after the financial reform process was initiated in the early nineties and the regulation of banks started getting aligned to the international best practices that gradually different market elements were introduced as part of the market development agenda. This agenda focused, first and foremost, on putting in place the requisite market microstructure in terms of institutions, technology, market participants and appropriate regulations. 6. Study of the development of the financial markets in India provides an opportunity to analyse an alternate and, more importantly, functioning model of regulation of financial markets. It may have evolved out of legacy factors and contextual considerations but in terms of regulatory orientation, this approach contained many elements of a ‘systemic focus’ as is being sought to be incorporated globally in the post-crisis scenario. The instruments and objectives entailed balancing the given systemic imperatives with the need for bringing about changes in a non-disruptive manner. The major elements implicit in the regulation of different market segments included the following:

7. The absence of an efficient ‘bond-currency-derivative’ construct, so called BCD nexus, is sometimes held against the entire market development process. However, the conception of a synergistic, harmonized BCD nexus implies a perfect seamless market with enormous possibilities of risk-payoff combinations using some basic instruments. Implicit behind it is the efficient market hypothesis which itself is being reinterpreted. Though it might seem that the Efficient Market Hypothesis was one of fundamental, sacrosanct tenets of finance, there is a long history of divided opinion among leading academics on this issue, eloquently captured in the book “The Myth of Rational Markets” by Justin Fox. Way back in 1984, in one of his seminal papers, Robert Shiller had commented that the Efficient Market Hypothesis was “one of the most remarkable errors in the history of economic thought”2. The BCD construct is fundamentally premised on complete absence of any kind of market frictions and policy interventions. Obviously such a pre-requisite cannot be interpreted in an absolute sense and must be contingent on several factors including the state of development of markets and the broader macro-economy that is influenced by both local and global factors. There are certain macroeconomic policy objectives, in particular the capital account management framework, which need to be pursued for their own sake instead of solely addressing the need for market development. Even in the most developed of markets this ‘nexus’ is being made subservient to broader stability objectives, for example the restrictions placed on short selling by many regulators in the wake of the crisis. In fact, one of the major criticisms of the ongoing work by the international standard setting bodies is that their prescriptions amount to ‘regulatory overreach’ which severely impact market functioning. Evolution of Markets and Market Regulation in India 8. From a regulatory perspective, one of the biggest challenges is to recognize the inherent market imperfections and build a framework around that to leverage the benefits of well-functioning, deep, liquid markets. Over more than a decade, the Reserve Bank has been firmly committed to financial sector reforms. A lot of has already been achieved with active participation of regulators, the Government, market bodies like FIMMDA, PDAI and market participants. Specifically in the area of debt markets, these achievements include the introduction of NDS-OM platform, setting up of CCPs like CCIL, introduction of short sale/When-Issued market (WI), repo in G-Sec/Corp bonds, Trade Repository (TR) for OTC derivatives, introduction of credit default swaps (CDS), etc. and most recently the introduction of 6 year & 13 year IRFs and electronic trading platform for IRS. But there is still much to do. There are many issues with the existing products which we need to address. I will take this opportunity to highlight those issues and measures under consideration within the Reserve Bank towards the next phase of reform and the role market bodies like FIMMDA, PDAI and market participants can play in making the market robust, efficient and liquid. Interest Rate Derivatives 9. IRS market in India is in place since 1999 and it has evolved over a period of time as may be observed from the data given in the table below. Daily trading volumes have improved significantly over a period of time. Though RBI did not mandate any benchmark for IRS, market on its own has primarily used three benchmarks viz. MIBOR, MIFOR, INBMK. Of the three benchmarks currently being used in the market, MIBOR is the most liquid benchmark in IRS with a current share of around 92% of total trades. Trading in other two benchmarks is almost negligible (Table 1). This is an area where efforts are required to encourage trading in other benchmarks. 10. Another issue with the IRS market is the activity being concentrated at few tenor points, mostly upto 5 year (Chart 1). In view of long term funding requirements for infrastructure sector, there is a need to develop long term IRS. FIMMDA or the Financial Benchmarks India Pvt. Ltd. (FBIL) may consider developing appropriate benchmark for long tenors which can be used by the market participants to take long tenor position in IRS. This will help in the development of term money market in India. 11. Further, IRS market is mostly inter-bank and customer related transactions comprise less than 1 per cent of the volume. It is also observed that the participation in IRS market is dominated by foreign banks (around 70-80% of total trades) followed by private banks constituting around 12-15% (Chart 2). There is a need to diversify the participation base in IRS. To encourage wider participation, Reserve Bank has allowed CCIL to introduce anonymous electronic trading platform. To address counterparty credit risk, Reserve Bank has also permitted CCIL to provide guaranteed central clearing of IRS contracts. With these measures, we expect active participation from various segments of the market. Recent introduction of anonymous trading platform with CCP facility has many benefits like availability of transparent quotes, less documentation requirement, reduced credit risk, saving of capital, higher credit exposure etc. I will urge banks to actively use the interest rate derivative products like IRS and IRF to manage interest rate risk in their portfolio so that the need for seeking regulatory relief during periods of stress could be avoided. 12. When we come to Interest Rate Futures, unlike IRS, the experience was not encouraging till the launch of single bond cash settled IRF in January 2014. The earlier avatars of IRFs contracts did not attract enough market interest mainly due to illiquid securities in the underlying basket leading to fear of receiving illiquid securities in delivery based settlement and complex theoretical calculations for cash settled contracts. Taking into account the feedback of the market participants, it was decided to introduce cash settled single bond IRF on underlying security with residual maturity between 9-10 years. The 10 year single bond IRF has received good response from the market as the product is simple to understand and is cash settled. In view of success of cash settled 10 year single bond IRF and taking into account the request of market participants, exchanges have been permitted to introduce single bond futures for the 4-8 year bucket and 12-15 year bucket as well. Though the daily average trading volume in IRFs has shown consistent growth since its introduction in January 2014, the participation in IRF is yet to become broad based (Chart 3). 13. We also hope that now the single bond cash settled futures have seen some encouraging response from the market, the exchanges could also consider re-launching futures based on a basket, which could be a much more efficient instrument from a hedging perspective. It could also improve liquidity in some of the illiquid bonds. Ready forward facility 14. You all know that Reserve Bank has been undertaking repo/reverse repo transactions with market participants as part of its monetary and liquidity management since 1992. Interbank repo facility in Government securities was introduced in 2003. The repo market in G-Sec, has witnessed considerable growth during the last 10 years (Chart 4). Leveraging technology and the availability of a robust clearing and settlement mechanism have been instrumental in the migration of the repo market from a pure OTC market to an electronic environment. India is among few countries to have anonymous electronic order matching platform with CCP facility for the repo market. The growth of the repo market is evident from the fact that the daily average trading volume has increased from ₹ 106.72 billion in 2004-05 to ₹ 548.28 billion in 2014-15. 15. Though the repo market has witnessed reasonable growth over a period of time, the repo market predominantly remains ‘overnight’. The per cent of repo trades in the overnight to 3 day tenor bucket constitute around 95% of total trades (Table 2). Measures are being taken to encourage market participants to enter into long term repo contracts. As a first step, Reserve Bank has introduced term repos of 7 and 14-days in October 2013. However, from the perspective of development of financial market, it is important to develop term repo outside the central bank’s window. Accordingly, re-repo of securities acquired under market repo was allowed in February 2015. With the availability of liquid overnight rates, RBI term repos of various tenures and T-Bill auctions of 91 and 182 days, many of the essential tenors of term repos are present in the market which can be used to develop the term yield curve. STRIPS (Separate Trading of Registered Interest and Principal of Securities) 16. STRIPS were introduced in India in 2010 for developing a market determined zero coupon yield curve (ZCYC) and help institutional investors in asset-liability management. Further, as STRIPS have zero reinvestment risk, it was felt that they can be attractive to retail/non-institutional investors. However, except for a few trades in 2010 (securities amounting to ₹.13 billion have been stripped till date), there has not been any activity in the STRIPS market. Reserve Bank would review the existing guidelines with regard to including more number of eligible securities for stripping, allowing banks in addition to PDs to initiate the process of stripping and reconstitution. In parallel, FIMMDA and PDAI may conduct awareness program for retail investors, insurance companies and mutual funds to encourage their participation in STRIPS. Repo in Corporate Bonds 17. To improve liquidity in the corporate bond market and provide an alternate source of funding, repo in corporate debt was introduced in January 2010. Since then, the guidelines have been relaxed in terms of minimum haircut/margin requirements expanding the list of eligible bonds by allowing short term instruments like CPs and CDs as eligible underlying and allowing more entities like multilateral institutions, Government owned NBFCs, etc. to participate in repo market. Internationally, GMRA is used as standard document for repo transactions and the same document with suitable amendments have been prescribed in India too. Accounting norms have been revised to make it in sync with globally accepted norms. Regulatory reporting and DVP-I settlement have been prescribed to enhance transparency and reduce settlement risk. Still, participation in the repo market is almost nil. Though the Reserve Bank is aware of the structural issues of the corporate debt repo market and is examining various options to encourage activity in the repo market, FIMMDA and PDAI may discuss with their members and suggest measures for activating the corporate debt repo market. Credit Default Swaps 18. In order to provide an avenue for participants to mitigate credit risk and enable effective redistribution of credit risk within the system, the Reserve Bank introduced CDS in the Indian market in December 2011. The guidelines on CDS were framed after extensive market consultations. However, there was hardly any market interest in the product. Subsequently changes were made in the guidelines, such as, increasing the scope of reference/deliverable obligations by permitting CDS on unlisted but rated bonds even for issues other than infrastructure companies andpermitting CDS on securities with original maturity up to one year like CP, CD and NCDs as reference / deliverable obligations. But investor interest is still elusive. Major reason cited for the lack of trading interest in CDS is restriction on netting of Mark to market (MTM) position for capital adequacy and exposure norms. The Reserve Bank’s extant instructions on computation of exposure arising out of OTC derivative contracts do not permit bilateral netting of exposures due to uncertainty on legal enforceability of close-out netting in the event of liquidation of statutory corporations. 19. To my mind, the issue needs to be addressed through legislative changes in one of the two possible ways: by amending Acts/Statutes that govern statutory corporations and state owned/nationalised banks, wherever applicable. Amendments to a large number of enactments, particularly in a synchronised manner, may be, however, practically difficult. Accordingly, as an alternative, a single, harmonized and uniform legislation for close-out netting with overriding powers on all other Acts/Statutes applicable to all types of banks and other entities may be enacted. This will provide transparency, comprehensiveness and clarity and provide ease of regulation and supervision to the Reserve Bank. The legislation can be a standalone law or can form part of existing laws – The Reserve Bank of India Act, 1934 or the Payment & Settlement Systems Act, 2007.Pending legislative changes, feasible options could be explored based on understanding with the Government. 20. There are examples in emerging markets which have attempted solving the netting issue, such as, the recent Malaysian example. Malaysia hasenacted unified legislation for all kinds of financial services [Financial Services Act 2013] which provides a ‘safe harbour’ for “Qualified Financial Agreements” (QFAs). Approach to market regulation 21. In order to have a more focused approach towards market development and regulation along with a surveillance system for ensuring market integrity and stability, a new department called Financial Markets Regulation Department (FMRD) has been set up at RBI. The Technical Advisory Committee (TAC) on Financial Markets has recently been reconstituted to guide our future agenda. Going forward, the explicit entity-neutral legal framework prevailing in India for regulation of money, interest rate and currency markets will be leveraged, to put in place a structured process focusing on (i) making market access norms easier for all participants (ii) expanding the menu of products and participants across all segments (iii) strengthening market infrastructure in line with global standards; and (iv) leveraging the market and surveillance mechanism for policy inputs. Interest Rate Options 22. In line with the above approach, introduction of interest rate options in the Indian market is a key part of agenda. A Working Group has already been constituted under the TAC to comprehensively look into all relevant issues and give its recommendations on the product design. 23. The Committee is deliberating on the hedging requirement for these options. For retail participants, a small threshold without explicit underlying requirement is being considered. This would help retail participants and small enterprises to hedge their risk without much documentation burden. For larger corporates, while the underlying exposure requirement may be necessary, but similar to forex hedging, concept of ‘anticipated interest rate exposures’ is being explored. Review of FPI Limits 24. The limit for FPI investments in Government securities in India has been part of the larger framework for capital account management. The risks of sovereign borrowing in foreign currency, the ‘original sin’, have been extensively analysed over the years, particularly after the Asian crisis in the nineties. The concerns relating to sudden stops, however, are as relevant for domestic currency denominated debt as foreign currency debt. It is therefore imperative to balance the benefits of lower yields in normal times and the costs associated with increased volatility and yield impact in crisis times. 25. The Governor has recently announced a Medium Term Framework in this regard, which includes:

The Framework will create space for participation of different kinds of investors (long term investors, such as, Pension Funds and Sovereign Wealth Funds as well as medium term investors and those coming through International Central Security Depositories, such as, Euroclear and Clearstream. 26. We are in dialogue with the Government. Once the Framework is decided, we may wait for suitable market conditions, including possibly greater certainty about Federal Reserve actions and appropriate liquidity conditions in domestic markets, before making a public announcement. Permitting other regulated entities in OTC derivatives and repos 27. As I have mentioned above, explicit regulation of OTC markets is one of the cornerstones of the financial sector regulatory framework in India. With the gradual strengthening of the market infrastructure, greater participation of different entities in the OTC derivatives market can be considered other than the Reserve Bank regulated entities. It is proposed to explore various options in consultation with the Government and other regulators to permit a wider set of regulated entities greater access to OTC derivative markets subject to the laid down reporting requirements. Electronic dealing platform for repo in corporate bonds 28. Guidelines on repo in corporate debt were issued in January 2010. Since then, the guidelines have been relaxed in terms of minimum haircut/margin requirements and allowing more entities like multilateral institutions, Government owned NBFCs, etc. to participate in repo market. However, there is very limited trading volume in corporate debt repo market. In order to develop the repo market, it is proposed to introduce an electronic dealing platform for repo in corporate. To begin with, a Request for Quote System could be considered and depending on market response, it could slowly graduate to a full-fledged order matching system. Review of guidelines on repo in G-Sec and corporate bonds – expanding participation base and relaxing certain conditions 29. Existing repo guidelines also put various restrictions on entities accessing the repo market through CSGL route, viz. prohibition on repo transactions between primary member and its client and two clients of the same custodian, etc. We are in process of reviewing these guidelines to facilitate wider participation. Since one of the subtheme of the conference is “Term Rate Structure and Transmission of Rates”. I will urge the panel members to discuss these issues relevant for further development of the repo market and forward their comments to RBI. Triparty Repo 30. Internationally, various jurisdictions have moved to tripartite repo to improve operational efficiency in the repo market. In India, CBLO is somewhat akin to tripartite repo. However we do not have true tripartite repo. Substitution of securities in repo transactions is not permitted in India. This has discouraged borrowers to enter into repo transactions for long tenors. Though introduction of re-repo has created enabling environment for lender of funds to go for long term funding, borrower of funds continue to have the problem of securities being blocked for longer period. It is argued that the introduction of tripartite repo in G-Sec which allows substitution of securities will encourage market participants to enter into repo contracts for longer tenors. The Working Group on Enhancing Liquidity in the Government Securities and Interest Rate Derivatives Markets (Chairman: Shri R Gandhi) has also made the recommendation and Reserve Bank is in process examining the recommendation. Market making in Government securities 31. Secondary market liquidity in the Government securities market has grown substantially in absolute terms during the past one decade. However, it is observed that the secondary market trading in is limited to about eight-ten securities out of a total number of 86 securities. In fact, of late, liquidity in bond markets is becoming a problem in many countries for various reasons. For better monetary transmission, it is necessary to improve liquidity across yields curve. The issues have been examined in detail by the Gandhi Committee and recommendations made by the Committee are being implemented in phased manner. 32. One of the recommendations which is crucial for enhancing liquidity across the maturity spectrum is introduction of market making scheme for the PDs. Various options have been discussed with PDs in last few months, and a model based on market feedback is being discussed with the Government. I would also suggest that PDs may consider providing two way quotes for liquid securities in various tenors in the odd lot segment. The list of securities can be identified and published by PDAI on quarterly basis. This will not only encourage participation of retail and small investors in the G-Sec market but would also act as stepping stone towards implementation of market making scheme in the interbank market. RBI on its part would evaluate the proposal of allowing higher shorting limits for such securities to facilitate PDs to provide two way quotes. Review of guidelines on LAF accounting 33. The revised accounting guidelines for market repo transactions in government securities and corporate debt securities were issued in March 23, 2010. These guidelines recognised the economic essence of a repo transaction as a collateralized lending and borrowing transaction, with an agreement to repurchase, on the agreed terms. These were, however, not to apply to repo / reverse repo transactions conducted under the Liquidity Adjustment Facility (LAF) with RBI. We are in the process of converging the LAF accounting norms as well to the market repo norms. In line with market repo guidelines, securities acquired by entities under LAF reverse repo would be eligible for SLR. Further, we are also examining the feasibility of making these eligible for re-repo. This may significantly contribute to the development of a term money market. Electronic trading platforms for OTC derivatives 34. Electronic trading and central clearing for all OTC derivatives has become one of the fundamental principles of the reform of the financial markets. Several models are being implemented globally (US, UK, EU) to bring trading of OTC derivatives onto electronic platforms with a central clearing. In India, CCIL has emerged as the major CCP for a large segment of OTC markets and is one of the recognized QCCP, apart from the three CCPs under SEBI. CCIL is also subjected, on an on-going basis, to rules and regulations that are consistent with the Principles for Financial Market Infrastructures (PFMIs) issued by the Committee on Payment and Markets Infrastructure (CPMI) and International Organisation of Securities Commissions (IOSCO). 35. Ideally all trading pools on whatever platform must have access to such a CCP arrangement. We are in the process of preparing a broad policy framework, based on consultation with all stakeholders, on authorization of Electronic Trading Platforms for various asset classes and their access to CCP facilities. Issue of Rupee Bonds Overseas 36. The Reserve Bank had issued draft guidelines for public feedback on issuance of Rupee bonds overseas. Several comments have been received and the final guidelines are expected to be issued shortly covering a comprehensive review of the ECB guidelines. It is recognised that while the issuance of Rupee bonds will broadly be under the ECB norms, a differential set of criteria would be required for such issuances. The objective would be to prescribe a simpler regime addressing many of the issues raised by the respondents. Given the fact that the currency risk would be borne by the investors, from an external debt perspective, raising of funds through the Rupee bond issuance should sit a tad higher in the hierarchy of preferences under the overall external debt framework. OTC market reforms – Cross border issues 37. The ongoing international efforts towards strengthening OTC markets are taking place at two levels:

38. However, considerable work needs to be done in the area of equivalence and substituted compliance across jurisdictions. Blanket application of such requirements, without recognition of the country-specific requirements, may have unintended consequences for the development of markets. I would like to highlight the challenges being faced in us in three specific areas: Central Counter-parties 39. The approach being adopted in major international jurisdictions with regard to CCP requirements have raised concerns over possibilities of extra territorial regulatory jurisdiction leading to regulatory conflict and disruptions for market activity. For instance, European Market Infrastructure Regulation (EMIR) and the Commodity Exchange Act (CEA) as modified by the Dodd-Frank Act contain prescriptive rules that may prevent European/US banks from participating in third-country clearing houses that have not applied for recognition by the European Securities and Markets Authority (ESMA) or that are not registered as a Derivatives Clearing Organization (DCO) as per CFTC regulations. While the discussions are still on, the uncertainty over the inconsistencies between EU and US rules, the process and timeline for equivalence assessments may affect the trust in the functioning of international financial markets and may have impact on progress of implementation of G-20 reform agenda. Trade Repositories 40. As per FSB commitments, jurisdictions should remove barriers to trade reporting by market participants, with particular attention to removing barriers to reporting of counterparty information and to information access by authorities. However, a distinction may need to be made between barriers to reporting to a domestic TR and reporting to foreign TR. As long as the one leg of the transaction is being reported to any one recognised TR in any jurisdiction, no other sharing requirement may be needed at the individual entity level. Efforts should be made to make the global TRs talk to each other, which could be greatly facilitated after full implementation of the LEI regime. Such measures would also reduce cost of compliance for the market participants without compromising on regulatory effectiveness. 41. The Payment & Settlement Systems Act in India (under which the TR is now governed) has enabled RBI to disclose such document / information to any person, if it considers necessary in protecting the larger public interest. At the entity level, sharing of client/counterparty data with third party, which includes a non-domestic TR, is governed by the contractual relationship and being done after obtaining customer consent. Entities are expected to keep into consideration the provisions under the various statutes, rules and case laws dealing with bankers’ duty of confidentiality of customer information and the secrecy obligations. Benchmarks 42. The European Commission has released a proposed regulation "on indices used as benchmarks in financial instruments and financial contracts". "Users" of benchmarks which are EU supervised entities may not use benchmarks provided by non-EU benchmark administrators from jurisdictions which do not satisfy an equivalence requirement. There is an urgent need for all jurisdictions to agree to a set of harmonized equivalence criteria to avoid any unintended consequences. Conclusion 43. My limited objective behind sketching a broad canvas of our past and ongoing efforts was to bring home the point that development of financial markets is a complex web of various underlying factors and processes which need to synergistically come together. While it definitely cannot happen by a regulatory fiat, regulatory nudges are indeed necessary. It is an incremental process based on adaptive learning. While central banks, as extended financial regulators, have been enjoined upon greater responsibilities in the post-crisis context, they have also been at the center of criticism for not getting the balance right. This is a judgement issue and policy makers are expected to carry out this responsibility within a broad set of principles and an understanding shaped by various adaptive learning processes. It is difficult to codify this into a set of simple rules/laws. The draft Indian Financial Code (IFC), though an ambitious attempt in this direction, leaves large gaps unaddressed. 44. Any exercise to reshape the legislative architecture of the financial sector should evolve organically, starting with an objective reassessment of where the current system has failed. In this regard it is pertinent to note the observation of Joseph J. Norton, that “each country situation is sui-generis, with the best, informed decision dependent on and taking regard of local historical, social, economic, financial market, regulatory and political factors and conditions.”3 This is particularly important when there are many open ended policy issues which are being debated internationally. Post-crisis, there has been a comprehensive reassessment internationally of the approaches to financial regulation marked by clear shift in preferred models. The realignment in UK with the prudential regulation coming back to the Bank of England was the strongest statement against the pre-crisis regulatory philosophy which lies at the core of some of the current proposals. 45. We are fortunately not faced with severe system failures, the key trigger for other countries to overhaul their frameworks. There is therefore no reason for a hasty, radical revamping. It must be kept in mind that from a public policy perspective the risk of getting the systemic costs and benefits wrong can be very serious as has been borne out by experience of many Asian and Latin American economies in the past few decades. The lessons of the last crisis are getting crystallised and addressed through the work of various international bodies such as the FSB, BSBC, CPMI, IOSCO etc. where India is a prominent member. Significant changes can be and are being brought about through this process itself towards achievement of the same objectives. 46. The way forward should necessarily emerge out of a broad policy agreement and shared commitment among various stakeholders including the Government, the regulators and the market participants about the direction and outcomes of the process. There should be a healthy, informed and robust debate on the specific issues. While there may be multiple expert committees giving their recommendations, the terms of the debate need to be set and discussed threadbare by the key policy stakeholders. Industry bodies such as FIMMDA and PDAI must contribute actively to this debate and provide meaningful feedback to the policymakers. Thank you very much for a patient listening. 1Keynote address by Harun R. Khan, Deputy Governor, Reserve Bank of India at the FIMMDA – PDAI 16th Annual Conference 2015 at Prague on August 17, 2015. The speaker acknowledges the contributions of Shri Vaibhav Chaturvedi and Shri Vivek Singh of the Reserve Bank of India. 2Shiller, R. J. (1984), ‘Stock Prices and Social Dynamics’, The Brookings Papers on Economic Activity 2 3Joseph J. Norton, Global Financial Sector Reform: The Single Financial Regulator Model Based on the United Kingdom FSA Experience – A Critical Re-evaluation, 39 INT’L LAW. 15, 19 (2005) |

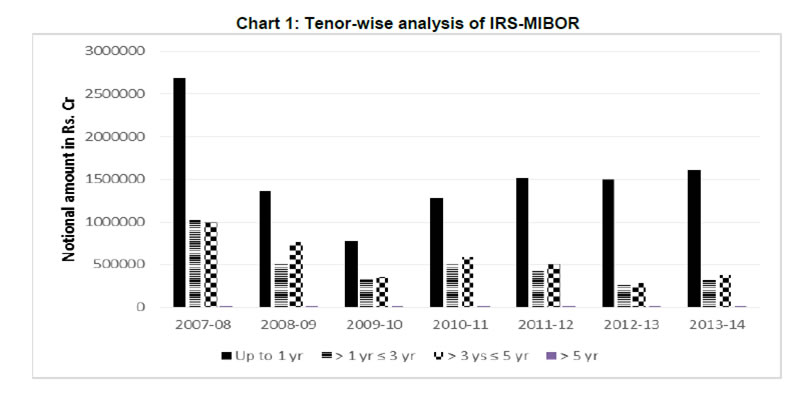

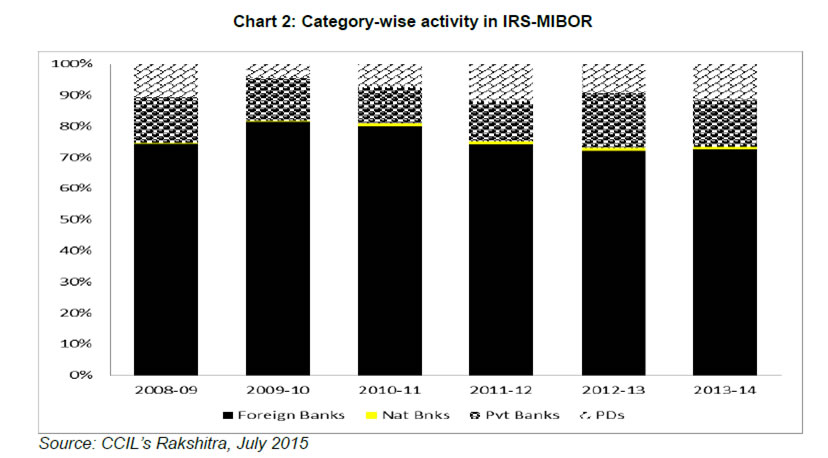

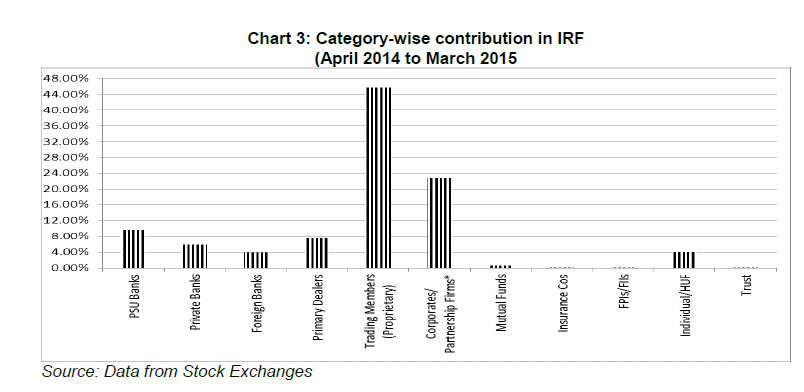

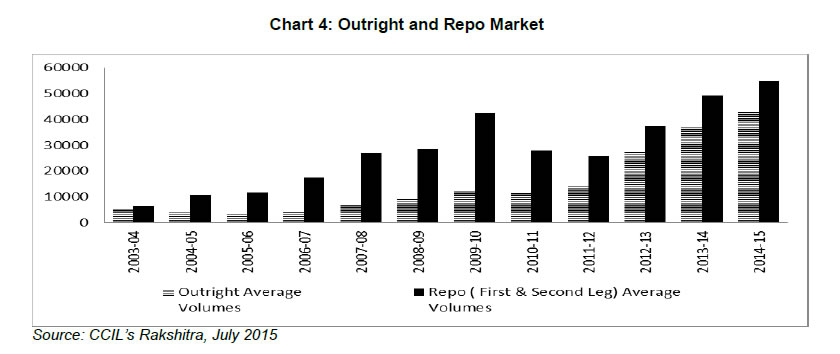

Page Last Updated on: