IST,

IST,

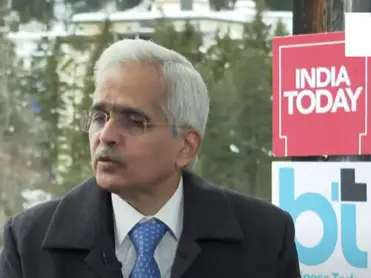

Interview of Governor Shri Shaktikanta Das with Business Today at World Economic Forum 2024, Davos on January 18,2024

Shri Shaktikanta Das, Governor, Reserve Bank of India

Delivered on Jan 25, 2024

Siddharth Zarabi: Hello and welcome to Business Today Television. I am Siddharth Zarabi and with me here is Mr. Shaktikanta Das, the Governor of the Reserve Bank of India. Thank you very much, Mr. Das, for joining us at the India Today Business Today studio here at Davos at the World Economic Forum. You have been here. I want to begin with the big question. Last year, the mood around the global economy and the pessimism that existed among CEOs was quite a bit. How is the mood as far as the global economy is concerned? What is your reading of the situation, particularly the supply side bottlenecks that caused a huge inflationary spiral all across the world, Sir? Shaktikanta Das: At the moment, the mood all around the world is a lot better. When COVID started, and more so when the Ukraine war started, followed by the spike in inflation, there was a widespread expectation or apprehension, let me say, that the world economy as a whole is moving towards recession. In the past, we have seen advanced economies whenever they have resorted to monetary policy tightening to tackle the problem of high inflation, those cycles usually have ended in a recession. This time around, not unnaturally, there was apprehension that advanced economies and also emerging market economies would enter into a zone of recession, but that has not happened. That has not happened because this time around the inherent resilience of individual economies, both advanced economies as well as emerging market economies, has withstood the pressures much better. Therefore, recession has not happened, unlikely to happen but growth has slowed down. Therefore, while there is confidence coming from the fact and while there is optimism that recession has not happened, which was the worry earlier but, there is also the other realisation that global growth has slowed down. I would say the mood is a lot better than last year because from an apprehensive mood of a recession or a hard landing, now the mood is expectation of a soft landing, but remains in a territory of low growth. I am talking about the global so, there is optimism. Coming to inflation, which spiked in 2022 almost everywhere, has now moderated. That is a matter of satisfaction for every central bank, for every country but at the same time, individual countries are yet to reach their target rates. It is that last mile which is proving to be challenging. The mood is a lot better but at the same time, there is a mood of cautiousness about how the future will play out, more so in the background of continuing geopolitical tensions. As far as India is concerned, it is a different story. India has responded to recent challenges a lot better than what India has done in the past. The last four years have been a period of great volatility. Now in that period of great volatility, India has responded far better. Our inflation has moderated. It is within the target zone. We are moving towards 4%. The GDP growth has revived and it has been 7% or above during the last three successive years including this year. Our expectation for the next financial year is about 7%. So, the India Story is definitely a story of greater resilience compared to the rest of the world. Siddharth Zarabi: Governor, do you see geopolitical flashpoints impacting India in any manner? You touched upon it but we have also seen geopolitics quite well over the last year. Is that at all any cause of concern? Shaktikanta Das: Whatever happens today in the world, the fact that India is a lot more integrated with the global economy and being one of the major players there will naturally affect India. But, our inherent resilience, our macroeconomic stability and our approach in recent years have been different from other countries. India is very well placed and better placed than many countries to deal with these challenges. Siddharth Zarabi: Right here just the other day, the IMF said that they will have to revise India's growth forecast upwards from the one that they had already put out. Is your own reading that for the current year, that growth could be even better than what has been projected by the RBI economists themselves? Shaktikanta Das: We had projected 7% towards the end of October 2023. Our previous projection for the current year was 6.5%, but we projected 7% in October and in December’s Monetary Policy we stated that clearly. The projection given by the National Statistical Office (NSO) came in January. NSO obviously had data for one more month. They have access to several other data to which we do not have access. So, the growth in the current year will be around 7.3% and if it is better, it is always welcome. What is interesting in all this process is that the momentum of economic activity is still holding its ground and continues to be quite strong, and that gives us the confidence to say that next year's growth will also touch 7%. Siddharth Zarabi: Between the last time that you publicly spoke to now, I want to ask you for your own reading of the consumer lending space and the overall banking approach, lending approach to it; the RBI has taken several steps and I do not want to go into that. But, between then and now, would it be possible for you to offer our viewers a certain view as far as consumer lending is concerned and any concerns that may bother the RBI economists? Shaktikanta Das: All segments of the credit market are under our supervision and we monitor them very clearly. Wherever we see some incipient signs of possible stress, we act preemptively. Whatever we have done in the consumer lending space, in the personal loan space was because we thought that it is perhaps leading towards a kind of stress, and we wanted to avoid that. So, it was a preemptive measure but even now the numbers are within reasonable limits, and we have no major cause of concern. Siddharth Zarabi: As we wind down the conversation, I know you have a very, very tight schedule. I just want one more point on your reading of the inflationary situation from a calendar year perspective. It is 2024 and given what happened in 2022, the RBI's measures, and the Central Government’s measures, how is the price situation likely to pan out in 2024? And we have our own Big Lok Sabha Election as an event and obviously, you will not be taking your eyes off the price situation. How is it likely to pan out? Shaktikanta Das: The headline inflation, i.e., CPI inflation, is moderating, and this trend of moderation towards 4% will continue that is our expectation. In the financial year 2024-25, the average inflation will be 4.5%. You are talking about inflation in the calendar year 2024; our expectation at this point of time is that it will moderate. Within inflation, the core part of inflation has also moderated significantly. It is, in fact, a little below 4% now and core inflation is substantially impacted by Monetary Policy actions. So, core inflation has come to around 3.8% or so. It is food inflation, which needs careful monitoring because food inflation is exposed to external risk factors like some disruption in the supply chain or climate-related changes or domestic weather-related events. You had heavy rain in one month and suddenly the prices of tomatoes went up causing vegetable inflation to impact the headline inflation in a substantial manner. Given these uncertainties with regard to food inflation, the volatility built around it because of weather-related events and because external development is one area which needs careful monitoring. So far as the Rabi crop is concerned, initially, there were fears of the Rabi sowing area falling short of the annual average. But as we speak here, the shortfall is very marginal compared to last year’s bumper crop. The Rabi sowing is now almost there at last year's level. That is also a positive for our domestic food inflation but the fact that there is volatility coming from external factors, external sources and the uncertainty around weather-related events, needs to be carefully watched, especially from the point of view of food inflation. Siddharth Zarabi: My final question, Sir. Since you have lots of meetings here, would it be possible for you to share what you are asked about the Indian economy by various people from across the globe, anything that you can recall offhand? Shaktikanta Das: There is a lot of interest in knowing how India has managed and maintained this kind of macroeconomic resilience and financial stability. There is evidence of growing confidence in India and the potential and robustness of the Indian economy. Siddharth Zarabi: On one hand, at the fiscal level, at the Central Government level, we have Modinomics. Has anyone told you that they are also falling into Das Kapital very closely? Shaktikanta Das: That is for people like you to assess or say, but we should not get carried away. On a serious note, we have to remain focused. We have achieved all this, the banking sector has shown a remarkable turnaround, the economy is showing its resilience, and the financial sector is remaining stable. Therefore, we have to not only preserve this, but we have to further build on it. That should be our focus. Siddharth Zarabi: Those are very, very important words from the RBI Governor, a person who has restored a sense of calm not just to inflation and our Monetary Policies, but to the Central Bank itself. Many thanks Sir for taking out the time for all this. |

Page Last Updated on: