IST,

IST,

Preventive Vigilance - The Key Tool of Good Governance at Public Sector Institutions

Dr. Urjit R. Patel, Governor, Reserve Bank of India

Delivered on Sep 20, 2018

|

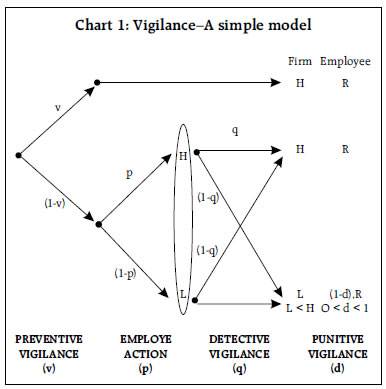

‘He is most free from danger, who even when safe, is on his guard.’ - Publilius Syrus (1st Century B.C.) It is an accepted norm of organising human societies that with the right to liberty comes good governance, the latter being designed around laws (formal governance) or norms (informal governance) restricting excessive exertions of the right to liberty: where individual actions are deemed to create adverse spillovers (‘negative externalities’) on the rest of the society, laws or norms – backed by an enforcement machinery – draw a line as to what is acceptable human behaviour. Governance could be for the society as a whole or an individual firm or entity or a group of entities (e.g., the public sector). An important term we all come across in our functioning, especially in the public sector, is Vigilance, which is the essence of what all of you are attempting to achieve at the Central Vigilance Commission, established in 1964 by the Government of India, to address corruption in the government sector. Vigilance is defined in dictionaries as ‘action or state of keeping careful watch for possible danger or difficulties.’ It takes several forms, which are often classified as: (1) Preventive vigilance, which is aimed at reducing the occurrence of a lapse (violation of a law, a norm, or, broadly speaking, a governance requirement); (2) Detective vigilance, which is aimed at identifying and verifying the occurrence of a lapse; and, finally, (3) Punitive vigilance, which is aimed at deterring the occurrence of a lapse. The first part of what follows will provide a conceptual framework, based on the economic theory of incentives, which helps understand these various aspects of vigilance, how they interact with each other, and why preventive vigilance often takes centre stage in the government or public sector institutions as an essential tool of good governance. Gary Becker’s ‘Crime and Punishment’ The modern economic theory of corruption and how to prevent it emanates largely from Gary Becker’s insightful and seminal pieces on Crime and Punishment during 1968-1974. Gary Becker, a young economist at the University of Chicago, took the theory away from moral and ethical basis to one based on optimal human behaviour in response to the presented economic incentives. He examined his own behaviour with regard to undertaking parking violations when rushing to work, which involved trading off the expected cost of illegal parking in a convenient spot, which he roughly calculated as the likelihood of getting a parking ticket violation multiplied by the parking fine (assuming non-payment of the fine would be too costly not to pay up) against the benefit in the form of convenience and reaching his class in time. Often, this calculation prompted him to opt for the parking violation, as legal parking in an inconveniently located garage did not seem economically attractive! Becker extrapolated from his own daily behaviour to an important economic insight. [As an aside, ‘economics’ derives from the Greek word ‘oikonomika’ (οίκονομία), which means ‘household management’ and was the name of a treatise by Aristotle.] The insight was that criminals in society do the same calculation of the probability of getting caught times the potential punishment while determining whether to choose a criminal lifestyle and what crimes to engage in; conversely, if criminals responded in this manner to economic incentives rather than (only) because they had character flaws or mental illnesses, then how should laws and their enforcement be organised taking into account the costs of enforcement, and might it be excessively costly and economically undesirable in practice to reduce crime rates to zero? Building on this fundamental insight that governance lapses may be rational choices rather than mental illnesses or character flaws in transgressors, we could consider a simple but instructive conceptual framework that may help understand how preventive, detective and punitive vigilance work with each other and should be designed given the rational best response of citizens or employees, who given the incentives, will all be treated uniformly as potential offenders. A conceptual framework The framework is illustrated in the following schematic of how vigilance and employee actions are sequenced in a typical institutional setting. Let us walk through it step by step (Chart 1). The employee is in control of an action whose outcome can be ‘good’ or ‘bad’. If the outcome is good, the firm’s cash flow or value is higher at H as compared to L, when the outcome is bad (L < H). The employee’s ‘effort’ is denoted as p and determines in part the likelihood that the outcome would be good (the rest being purely due to chance or background noise). The employee bears an exertion cost from undertaking this effort (so all else equal, prefers shirking), or alternatively has some private gains (side benefits from a bad-outcome for the institution). This cost creates a potential wedge between what is privately optimal for the employee and what is optimal for the institution. Recognising this wedge, the institution (or its regulator) puts in place preventive vigilance (v ), detective vigilance (q ) and punitive vigilance (d ): Preventive vigilance (v) reduces the likelihood of employee control over the action in the first place, i.e., it puts in place safeguards such that employee lapses are less likely to occur. Detective vigilance comes into play before the outcome has actually been realised (this is shown in the schematic as the oval box around the outcomes H and L). Its precision is denoted by q. The higher the q is, more precise is detective vigilance in identifying the good (bad) outcome indeed as the good (bad) outcome; conversely, (1-q ) captures the error rate of detective vigilance whereby it detects the good (bad) outcome as bad (good). [There are alternative ways of modeling detective vigilance. For instance, it may seek not just to identify when the outcome would have turned out to be low, but also aim to ‘nip it in the bud’ so as to reverse it to a good outcome. In other words, detective vigilance in some cases may catch lapses and correct them. In yet another variant, detective vigilance could also be modeled as identifying only the low outcome possibility with some likelihood but not being able to reverse the outcome. Depending on the setting, one formulation may be more suitable than the others.] Punitive vigilance reduces the employee reward in the good-outcome scenario, denoted as R, to (1-d).R, in the bad-outcome scenario, where d > 0. The punishment d.R serves an incentive for the employee to invest in increasing the good outcome likelihood. Typically, in such setups, the value of R < H is pinned down based on the employee contract being attractive enough relative to reservation opportunities such as alternative job offers for employees or payoffs from remaining unemployed. An example can help visualise the structure more concretely. Consider for instance procurement at a government institution. Efficient procurement would lead to a higher value for the institution by ensuring quality is met at the cheapest cost. In order to reduce employee discretion in the procurement process which could potentially lead to compromised choices, preventive vigilance is put in place in terms of designing the procurement process (‘L1’), requiring procurement be undertaken only through, e.g., an electronic tendering process, etc. Detective vigilance is also put in place in the form of a concurrent/internal audit within each department of the institution that tries to ensure lapses are caught and fixed before they lead to the final procurement decision. Finally, in case of a violation of procurement guidelines is found ex post in spite of the other vigilance mechanisms, the central vigilance office of the institution undertakes a disciplinary action against the involved employee. Technical assumptions Let us then come back to the conceptual framework for vigilance. To derive the equilibrium solution in the setup and understand its properties, the following intuitive assumptions are made: • Employee effort (p ) leads to exertion cost that is progressively costly (increasing and sufficiently convex) so as to rule out the corner solution that perfect governance can be implemented in practice. • Similarly, investing in preventive vigilance (v) and detective vigilance (q ) become prohibitively expensive beyond a point, i.e., the costs of increasing v and q are increasing and convex enough so as to rule out the corner solution of perfect governance. • In similar vein, there are limits on punishment levels: one being that there is limited liability so that employee’s pecuniary reward even in the badoutcome scenario can only be positive (d < 1 ) even if it is lower than the reward in case of the good outcome; further, there may be lower bounds on the bad-outcome reward as the institution may be constrained by (un-modeled) side-effects such as the costs of dealing with grievance redressal and legal recourse being undertaken by the employee in case the punishment for low-outcome scenario being realised is too severe. Key ‘insights’ Along the lines of Gary Becker’s seminal analysis, this simple framework for understanding vigilance leads to the following insights: 1. Detective and punitive vigilance are strategic complements: The greater the punishment, the more useful it is to detect. Conversely, having a high penalty is ineffective (given concomitant side-effects or costs) when the quality of detection is poor. 2. Preventive and detective (as well as punitive) vigilance are strategic substitutes: The lower the detection and punishment, the more useful it is to prevent lapses at the outset since detective and punitive vigilance do not provide adequate incentives. This is important and will be discussed further in the context of public sector institutions. 3. Preventive vigilance dominates other forms for dealing with lapses outside of control: The above schematic potentially allows the analysis of how to tackle vigilance design with human effort (which is under one’s control) versus human error (which is outside one’s control). As an extreme case, suppose that there is no control under the employee to affect the outcomes (p is fixed). Then punishment achieves absolutely nothing in improving outcomes. In this case, preventive vigilance which effectively reduces the chance of a lapse in the first place dominates detective and punitive vigilance. Detective vigilance may nevertheless be effective in identifying lapses which occur due to pure chance and possibly for reversing the bad outcomes to good ones. Dynamic considerations Outside of the simple one-period or static model outlined above, there are important dynamic considerations that may be important in real-world design of vigilance processes. One, it might be attractive for an institution to undertake punitive vigilance beyond what is desirable in a purely myopic sense for the purposes of setting a ‘precedent’; in other words, so as to deter recurrence and build a reputation or create a credible culture for zero or low tolerance for repetitive lapses. Two, in practice poor governance outcomes may not simply be due to optimal incentive-based behaviour, but also due to the presence of habitual offenders (an employee ‘type’, so to speak). In such a setting, there may be learning over time on a given employee’s type that can help separate type from pure background noise; when this is the case, some weeding out may be necessary based on initial detection phase which only after a few periods leads to a punitive vigilance outcome as it becomes certain that employee type is above a threshold in terms of repetitive lapses that cannot be attributed over time to just chance. Let us now turn to why these observations imply an essential role for preventive vigilance in good governance, especially in public sector institutions. What vigilance is likely to work the best in a public sector institution? Punitive vigilance is difficult in a public sector institution for several reasons. The rewards are low to start with, thereby limiting the possibility of downward revisions. Given this constraint, disciplinary actions that limit the chances of career progression are often the preferred punishment. However, this has the misfortune of demotivating employees beyond the point of their career when punitive vigilance action is undertaken. This could, in principle, be dealt with a ‘golden handshake’; however, the insurance that public sector jobs offer is often a key attractive feature of these jobs given the lack of significant upside financial rewards. While there are ways to fine-tune pecuniary incentives and career-based rewards for greater effectiveness even within these constraints, it is fair to conclude that their ‘bite’ is not as strong as in the private sector. In turn, given the first insight (Key insight 1) from the model, detective vigilance too is rendered somewhat ineffective. Put simply, detection does not lead to punitive outcomes (except perhaps in extreme or egregious cases and over time) so that investment in detective vigilance does not guarantee the desired reduction in incidence of lapses, even though it might help in some cases arrest the slide and contain with remedial measures. As a result, given the second insight (Key insight 2) from the model, preventive vigilance takes center stage and becomes a key effective tool of governance in a public sector institution. When lapses can arise due to background noise outside of the employee control (which is often the case in public sector due to the complexity of the interaction with a multitude of other public sector entities), punitive vigilance becomes even less attractive due to further demotivation that it might induce; in turn, so does detective vigilance. In other words, while not taking away from the need to engage in some detective and punitive vigilance, preventive vigilance is conceptually likely to be the most effective governance mechanism at public sector institutions. These observations have substantive relevance for understanding how one might tighten governance in practice, for instance, in lending outcomes (underwriting or screening, monitoring and recovering post default) at public sector banks, a setting that is beset with many of the features highlighted above. That is for another day. For now, let us turn to how vigilance is organised at the Reserve Bank of India, the central role that preventive vigilance takes at the Bank, and the measures that we have adopted to date in this regard. Vigilance functions at the Reserve Bank of India (RBI) The overall responsibility for vigilance work at the Reserve Bank vests with the Central Vigilance Cell (C. V. Cell or just Cell), which exercises its jurisdiction over all employees of the Bank and co-ordinates the activities of the 49 Branch Vigilance Units. The Cell maintains liaison with the Central Vigilance Commission (CVC) and the Central Bureau of Investigation (CBI). The focus of the Cell is to have a comprehensive preventive vigilance setup supported by an audit framework so that vigilance issues are minimised and to sensitise our employees to various aspects of vigilance administration. The guidelines on vigilance, issued by the CVC, are aimed at greater transparency, promoting a culture of honesty and probity in public life, and improving the overall vigilance administration in the organisations within its purview. The Central Vigilance Cell at the Reserve Bank, led by the CVO, follows the guidelines issued by the CVC (the Commission) from time to time. The Chief Vigilance Officers (CVOs), who are the extended arms of the Commission in their respective organisations, decide upon the possibility of a vigilance angle in individual cases in an organisation. Not only the financial propriety of transactions, but certain non-financial aspects arising, inter alia, from conflicts of interest, nepotism and considerations of post-retirement employment as a quid pro quo, are also required to be examined from a vigilance angle. As mentioned earlier, the Bank’s vigilance administration focuses on preventive vigilance functions by inculcating a sense of honesty and integrity among its employees and ensuring that sound internal systems and controls are laid down, which act as a defense against intended mala fide activity by any employee. This is borne out by the fact that the incidence of vigilance cases in the Bank has been negligible. Over the last four years, the percentage of vigilance cases against RBI employees’ vis-à-vis the total staff strength of the Bank stood on average at 0.004 per cent. Further, in terms of complaint cases received against RBI/RBI employees over this same period, the percentage that required punitive vigilance action stood on average at 0.081 per cent. We continue to endeavor to maintain high standards of integrity. Let me highlight some of the preventive measures taken by the Bank as a part of this endeavour. Preventive vigilance measures at the RBI The RBI Staff Regulations 1948 constitute one of the earliest attempts at prescribing preventive vigilance measures. The Regulations contain various ‘Do’s and Don’ts’ for the staff. A Code of Ethics was also framed subsequently in 2013 titled ‘Ethics at Work.’ Preventive vigilance measures emanating from these Regulations and the Code are enforced partly at the individual level, and, partly at the organisational level. At the individual level, instructions are in place requiring an officer to obtain prior permission for certain transactions (e.g., acquisition of immovable property and taking a loan from a financial institution); reporting of certain transactions (acquisition of movable assets above a monetary limit and employment of family members in financial institutions); and upfront disclosure when the employee has a personal interest in any official transaction which (s)he is dealing with. At the organisational level, the preventive vigilance measures in place include identification of sensitive posts, surprise visits by senior officers to vigilance sensitive areas, incorporating vigilance related sessions in the Human Resource (HR) related training programmes at the Bank’s training establishments, sensitising new recruits on various aspects of vigilance and proper conduct, periodical rotation of staff, well laid down recruitment procedures and procurement policies, close monitoring through CCTV of sensitive areas in the cash department, institution of an effective grievance redressal machinery for the staff and persons who have official interaction with the Bank, etc. As part of these preventive vigilance measures at the organisational level, • The Central Vigilance Cell brought out a Compendium of instructions on Tenders and other vigilance matters for the benefit of the staff. The Premises Department of the Bank also has a manual for all procurement. The Cell, during the course of the Vigilance Awareness Week 2017, launched a separate site on our intranet site (called the ‘EKP’) where all vigilance related information is available in one place. • In March 2017, the Cell organised a training programme at the College of Agricultural Banking (CAB), Pune, wherein the Chief Technical Examiner of the Commission addressed the officers of the Bank dealing with procurement activities and provided them with valuable tips on addressing vigilance issues that arise during the process of procurement. • Another training programme for the senior officers of the Bank was organised in September 2017 at the CBI Academy in Ghaziabad to sensitise officers on the investigative aspects of vigilance. • A workshop on ‘Principles of procurement and related case studies’ was recently conducted at Mumbai for the benefit of officers dealing with procurement. Further, a Video Conference was held to enhance awareness and to review the status of implementation of e-tendering. An important feature of preventive vigilance at the Bank is internal governance, i.e., involvement of employees themselves for disciplining each other. For instance, as a step towards further strengthening preventive vigilance in the area of procurement, the Bank has introduced the concept of ‘Integrity Pact’ (IP) for large value procurement (exceeding ₹5 crores) and the pact is overseen by an Independent External Monitor (IEM) appointed by the Bank with the concurrence of the Commission. The Integrity Pact (IP) is an agreement between the prospective bidder (vendor) and the buyer not to resort to any corrupt practices in any stage of the contract. The Pact between the vendor and the buyer involves their primarily agreeing to refrain from bribery, collusion, etc., during the entire process of the contract. The Independent External Monitor independently reviews whether and to what extent parties to the Pact have complied with their obligations under the Pact. In case of a suspicion, the IEMs examine all complaints received for breach of Pact and furnish their views to the Chief Executive of the organisation or directly forward the findings to the CVO and the Commission. Several other measures are also aimed at instilling strong internal governance. To ease lodging of vigilance related complaints, the name, address, telephone/fax number and e-mail address of the CVO is displayed on the website of the Bank. The Cell has also put in place a whistle blower policy for the Bank so that instances of corruption can be exposed by an employee without fear of retribution, or without the complainant’s identity being disclosed. Finally, with a view to promoting transparency in our functioning and restricting ad-hoc exercise of powers, the Bank has taken additional measures such as: • Providing substantial disclosure on the Bank’s website regarding its functioning; the procedures followed in its decision-making; and the timeframe for granting approvals and permissions. • Departments that have public interface are required to display a Citizen’s Charter, which indicates time schedules for diverse activities; for deficiency in service, a publicised grievance redressal system is in place. • Requirement that whenever any monetary penalty is imposed on a regulated entity, such decisions are taken by a Committee unconnected with the underlying operation, and not by any individual officer, after following a due process; the details of the penalties are also disclosed on the Bank’s website. • All tenders that are floated or awarded by the Bank above a certain monetary limit are displayed on the website. Conclusion Let me conclude. Being a public sector institution, and as argued conceptually above, the Reserve Bank of India considers preventive vigilance measures as the lynchpin of its efforts for good governance. The extant preventive vigilance measures at the Bank have helped its employees adhere to its Regulations and the Code, with any deviations being carefully detected, scrutinised and remedied. The Central Vigilance Cell at the Bank will continue in its endeavour to preserve the highest level of integrity at the Bank by sustaining and strengthening these preventive vigilance measures further. We look forward to the Commission’s support and guidance as we seek – in the ever-increasing complexity of the Bank’s environment – to strengthen its preventive vigilance framework, by simplifying rules and procedures as also by leveraging technology to ensure compliance. Thank you. References: Becker, Gary S. (March-April 1968) ‘Crime and punishment: an economic approach’, Journal of Political Economy, Chicago Journals, 76(2), 169-217. Becker, Gary S. (1974) Essays in the economics of crime and punishment. New York: National Bureau of Economic Research, Columbia University Press. * Urjit R. Patel, Governor, Reserve Bank of India, Speech delivered at the Central Vigilance Commission in New Delhi on September 20, 2018. Author’s note: The Lecture is in memory of Deena Khatkhate, who served in the RBI, 1955-1968. I would like to thank Viral Acharya and Lily Vadera for their help in preparing this Lecture. |

Page Last Updated on: