IST,

IST,

Households’ Inflation Expectations Survey

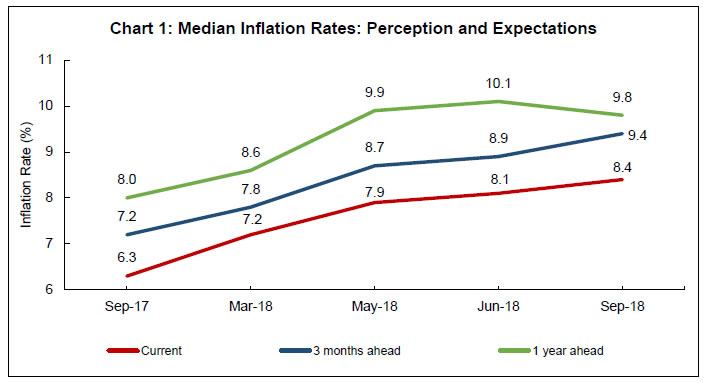

Today, the Reserve Bank released the results of the September 2018 round of the Inflation Expectations Survey of Households (IESH)1 2. The survey was conducted in 18 cities and the results are based on responses from 5,760 urban households covering various occupational categories. Highlights: i. The proportion of respondents expecting general prices to rise at more than the current rate in the next three months and one year ahead horizons remained similar to that in the June 2018 round (Tables 1 a and b). ii. At the product group level, a higher proportion of respondents expect prices of food and non-food products to rise faster than the current rate. iii. Three months ahead median inflation expectations rose sharply by 50 basis points (bps) compared to that in the June 2018 round; however, over the longer horizon of a year ahead, households lowered their expectations by 30 bps (Chart 1, Table 2). iv. The gap between the current perceptions and near term inflation expectations widened while it narrowed down over the medium term. Note: Please see the excel file for time series data.

1 The survey is conducted at regular intervals by the Reserve Bank of India. It provides useful directional information on near-term inflationary pressures and also supplements other economic indicators. However, these expectations are formed by the respondents and may reflect their own consumption pattern. Hence, these should not be treated as benchmarks for official measures of inflation. 2 As approved by the Technical Advisory Committee on Surveys (TACS), a two-stage probability sampling scheme has been implemented in place of quota sampling from the September 2018 round of the survey. Consequent changes in reporting the results of survey are stated in the footnote to the respective tables. Further, city-wise sample size has been revised in proportion to number of households of each city as per Census 2011, keeping the overall sample size 6,000. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: