IST,

IST,

Survey of Professional Forecasters on Macroeconomic Indicators - Results of the 45th Round

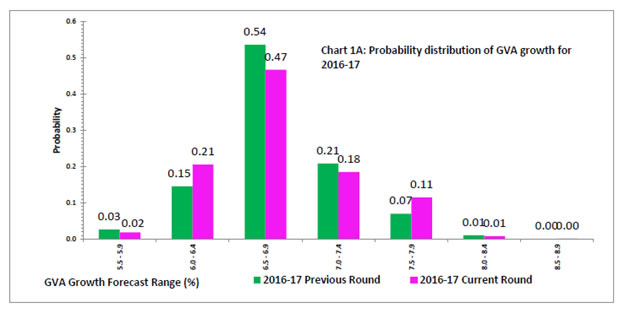

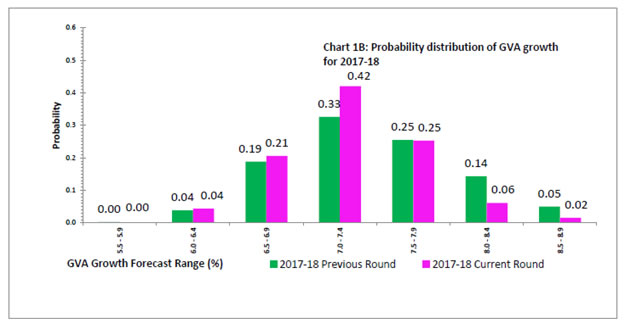

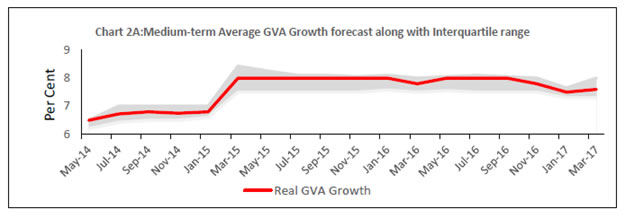

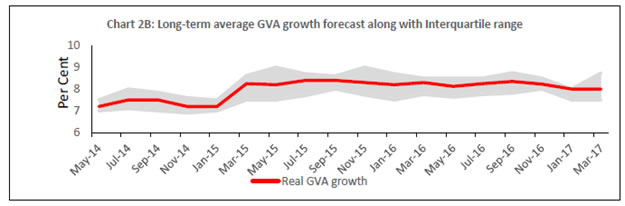

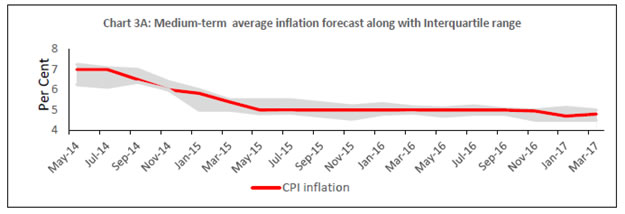

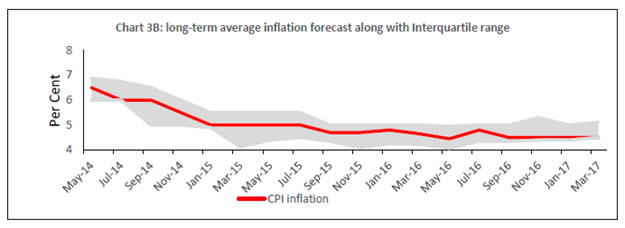

Professional forecasters predict gradual consolidation of growth in 2017-18, supported by both consumption and investment on the back of industrial recovery and reversal of the slowdown in the services sector. Medium to long-term growth expectations remain unchanged. Inflation is expected to rise to around 5.3 per cent by Q4:2017-18. Medium-term (5 years) and long-term (10 years) inflation expectations largely remain unaltered. On the external front, they anticipate improvement in foreign trade and gradual hardening of global crude prices. The Reserve Bank has been conducting the Survey of Professional Forecasters (SPF) since September 2007. Twenty-one professional forecasters participated in the latest survey round (Round 45) conducted in March 20172. The survey results are summarised in terms of their median forecasts and a snapshot is presented in the Annex. Highlights: 1. Output

2. Inflation

3. Fiscal Deficit

4. Money and Banking

5. External Sector

6. Medium-term and Long-term Forecasts

1 Results the previous survey round were released on February 8, 2017 on the RBI website. 2 The results of the survey represent the views of the respondent forecasters and in no way reflect the views or forecasts of the Reserve Bank. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: