The Reserve Bank has been conducting the survey of professional forecasters (SPF) since September 2007. The responses for 79th round of the survey were received during November 15-30, 2022, wherein forty-three panellists participated. The survey results are summarised in terms of their median forecasts (Annexes 1-7), along with quarterly paths for key variables. Highlights: 1. Output - Real gross domestic product (GDP) is expected to grow by 6.9 per cent in 2022-23 [projections revised down by 10 basis points (bps) from the last survey round]; it is expected to grow by 6.0 per cent in 2023-24 (Table 1).

- SPF panellists have placed GDP growth forecasts in the range of 6.5-7.3 per cent for 2022-23 and in the range of 5.0-7.2 per cent for 2023-24; the ranges have narrowed from the last SPF round, indicating reduced uncertainty around the median forecast as the year progressed (Annexes 1 and 2).

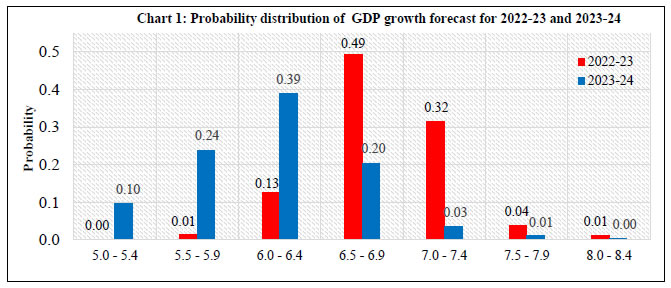

- Forecasters have assigned highest probability to real GDP growth in the range 6.5-6.9 per cent in 2022-23 (Chart 1). For 2023-24, highest probability has been assigned to the range 6.0-6.4 per cent.

Note: Tail parts of the distributions are not presented in this chart but are included in Annex 6. -

Annual growth in real private final consumption expenditure (PFCE) and real gross fixed capital formation (GFCF) for 2022-23 are expected at 9.4 per cent and 9.9 per cent, respectively. -

Real gross value added (GVA) growth projection for 2022-23 has been retained at 6.6 per cent. | Table 1: Median Forecast of Growth in GDP, GVA and components | | (in per cent) | | | 2022-23 | 2023-24 | | Real GDP | 6.9

(-0.1) | 6.0

(-0.1) | | a. Real PFCE | 9.4

(+1.4) | 6.3

(+0.2) | | b. Real GFCF | 9.9

(+1.9) | 7.0

(-0.3) | | Nominal PFCE | 17.8

(-0.4) | 11.4

(-0.5) | | Real GVA | 6.6

(0.0) | 5.9

(-0.1) | | a. Agriculture and Allied Activities | 3.3

(0.0) | 3.0

(0.0) | | b. Industry | 4.9

(-0.1) | 5.1

(-0.1) | | c. Services | 8.2

(+0.2) | 7.1

(+0.1) | Gross Saving Rate

[per cent of gross national disposable income] | 28.0

(0.0) | 28.9

(+0.2) | Gross Capital Formation Rate

[per cent of GDP at current market prices] | 31.4

(+0.1) | 31.5

(0.0) | | Note: The figures in parentheses indicate the extent of revision in median forecasts (in percentage points) relative to the previous SPF round (applicable for all Tables). | - Real GDP is expected to grow (y-o-y) by 4.8 per cent in Q3:2022-23 and moderate thereafter to 4.3 per cent in Q4:2022-23 (Table 2). GDP growth in the first half of 2023-24 is expected in the range of 6.0-6.6 per cent.

| Table 2: Median Growth Forecast of Quarterly GDP, GVA and components | | (in per cent) | | | Q3:2022-23 | Q4:2022-23 | Q1:2023-24 | Q2:2023-24 | | Real GDP | 4.8

(0.0) | 4.3

(+0.1) | 6.6

(0.0) | 6.0

(-0.4) | | a. Real PFCE | 4.8

(-0.3) | 5.2

(+0.1) | 6.0

(-0.4) | 6.4

(0.0) | | b. Real GFCF | 7.7

(-0.1) | 7.0

(0.0) | 6.5

(-0.1) | 7.0

(-0.2) | | Real GVA | 4.3

(-0.3) | 4.0

(0.0) | 6.3

(+0.1) | 5.9

(-0.2) | 2. Inflation - Annual headline inflation, based on consumer price index (CPI), is expected at 6.7 per cent for 2022-23 (Annex 1) and is likely to moderate to 5.2 per cent during 2023-24 (Annex 2).

- Headline CPI inflation (y-o-y) is expected at 6.6 per cent during Q3:2022-23 and moderate thereafter to 6.1 per cent by Q4:2022-23 (Table 3). During the first two quarters of 2023-24, it is expected to remain in the range of 5.0-5.2 per cent.

- CPI inflation, excluding food and beverages, pan, tobacco and intoxicants, and fuel and light, is expected at 6.1 per cent in Q3:2022-23 and soften thereafter to 5.9 per cent in Q4:2022-23 and further to 5.3 per cent in Q2:2023-24.

| Table 3: Median Forecast of Quarterly Inflation | | (in per cent) | | | Q3:2022-23 | Q4:2022-23 | Q1:2023-24 | Q2:2023-24 | | CPI Combined (General) | 6.6

(+0.2) | 6.1

(+0.1) | 5.0

(+0.1) | 5.2

(+0.2) | | CPI Combined excluding food and beverages, pan, tobacco and intoxicants and fuel and light | 6.1

(+0.1) | 5.9

(+0.2) | 5.2

(+0.2) | 5.3

(+0.2) | | WPI All Commodities | 7.5

(-1.5) | 5.7

(-0.9) | 2.1

(-0.7) | 3.8

(-0.4) | | WPI Non-food Manufactured Products | 4.6

(-1.8) | 3.9

(-1.7) | 2.2

(-1.0) | 2.8

(-1.3) | - Forecasters have assigned the highest probability to CPI inflation lying in the range of 6.5-6.9 per cent in Q3:2022-23; in the wide range of 5.5-6.4 per cent in Q4:2022-23; and in the range of 5.0-5.4 per cent in during the first two quarters of 2023-24 (Chart 2).

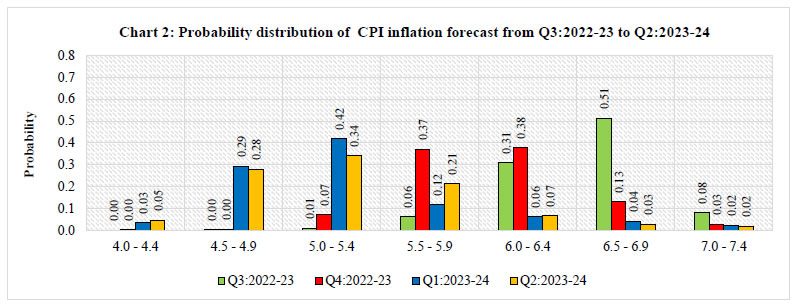

Note: Tail parts of the distributions are not presented in this chart but are included in Annex 7. 3. External Sector - Merchandise exports and imports are projected to grow by 5.6 per cent and 18.2 per cent, respectively, during 2022-23 and moderate to 4.9 per cent and 2.5 per cent, respectively, during 2023-24 (Table 4).

- SPF panellists expect current account deficit (CAD) at 3.5 per cent (of GDP at current market prices) in 2022-23 and at 2.7 per cent in 2023-24.

| Table 4: Median Forecast of Select External Sector Variables | | | 2022-23 | 2023-24 | Merchandise Exports in US $ terms

(annual growth in per cent) | 5.6

(-1.6) | 4.9

(-1.4) | Merchandise Imports in US $ terms

(annual growth in per cent) | 18.2

(-0.8) | 2.5

(-3.2) | Current Account Balance

(per cent of GDP at current market prices) | -3.5

(-0.1) | -2.7

(0.0) |

The Reserve Bank thanks the following panellists for their participation in this round of the Survey of Professional Forecasters (SPF):

Abhishek Gupta (Bloomberg Economics), Aditi Nayar (ICRA Limited), Anjali Verma (PhillipCapital India Ltd.), Ashish Kumar (Adani Group), CRISIL Ltd., Debopam Chaudhuri (Piramal Enterprise Limited), Devendra Kumar Pant (India Ratings & Research), Gaura Sen Gupta (IDFC FIRST Bank), Gaurav Kapur (IndusInd Bank Limited), ICICI Securities Primary Dealership, Indranil Pan (Yes Bank), Madan Sabnavis (Bank of Baroda), Madhavi Arora (Emkay Global Financial Services Ltd), Manasi Swamy (Centre for Monitoring Indian Economy Pvt Ltd.), Prithviraj Srinivas (Axis Capital), Rahul Bajoria (Barclays Bank PLC), Rupa Rege Nitsure (L&T Finance Holdings Limited), Shailesh Kejariwal (B&K Securities India Pvt ltd), Shubhada Rao (QuantEco Research), Siddharth Kothari (Sunidhi Securities & Finance Limited), Sudarshan Battacharjee (Yubi), Sujit Kumar (Union Bank of India), Tirthankar Patnaik (National Stock Exchange) and Upasna Bhardwaj (Kotak Mahindra Bank). The Bank also acknowledges the contribution of nineteen other SPF panellists, who prefer to remain anonymous. |

| Annex 1: Annual Forecasts for 2022-23 | | | Key Macroeconomic Indicators | Annual Forecasts for 2022-23 | | Mean | Median | Max | Min | 1st quartile | 3rd quartile | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 6.9 | 6.9 | 7.3 | 6.5 | 6.8 | 7.0 | | a | Private Final Consumption Expenditure (PFCE) at constant (2011-12) prices: Annual Growth (per cent) | 9.5 | 9.4 | 13.5 | 6.7 | 7.9 | 11.1 | | b | Gross Fixed Capital Formation (GFCF) at constant (2011-12) prices: Annual Growth (per cent) | 9.9 | 9.9 | 16.0 | 4.6 | 8.9 | 10.9 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 17.2 | 17.8 | 21.3 | 10.0 | 15.9 | 19.4 | | 3 | Gross Capital Formation Rate (per cent of GDP at current market prices) | 30.9 | 31.4 | 33.5 | 29.0 | 30.0 | 31.5 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 6.6 | 6.6 | 7.5 | 5.8 | 6.4 | 6.7 | | a | Agriculture & Allied Activities at constant (2011-12) prices: Annual Growth (per cent) | 3.2 | 3.3 | 4.0 | 1.8 | 3.0 | 3.5 | | b | Industry at constant (2011-12) prices: Annual Growth (per cent) | 4.7 | 4.9 | 7.0 | 1.7 | 3.8 | 5.6 | | c | Services at constant (2011-12) prices: Annual Growth (per cent) | 8.3 | 8.2 | 10.6 | 6.8 | 7.9 | 8.7 | | 5 | Gross Saving Rate (per cent of Gross National Disposable Income) -at current prices | 27.8 | 28.0 | 31.2 | 24.0 | 27.1 | 28.5 | | 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 6.4 | 6.4 | 6.8 | 6.0 | 6.4 | 6.5 | | 7 | Combined Gross Fiscal Deficit (per cent to GDP at current market prices) | 9.6 | 9.6 | 10.8 | 7.5 | 9.4 | 9.9 | | 8 | Bank Credit of Scheduled commercial banks: Annual Growth (per cent) | 14.3 | 14.8 | 17.0 | 7.7 | 13.4 | 15.0 | | 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 7.4 | 7.5 | 8.0 | 7.1 | 7.3 | 7.5 | | 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 6.6 | 6.6 | 7.2 | 5.5 | 6.4 | 6.8 | | 11 | Merchandise Exports (BoP basis in US$ terms): Annual Growth (per cent) | 6.2 | 5.6 | 25.0 | -4.4 | 2.6 | 8.4 | | 12 | Merchandise Imports (BoP basis in US$ terms): Annual Growth (per cent) | 20.2 | 18.2 | 50.0 | 14.7 | 17.5 | 21.5 | | 13 | Current Account Balance in US$ bn. | -115.7 | -118.0 | -29.9 | -139.0 | -125.0 | -111.2 | | a | Current Account Balance (per cent to GDP at current market prices) | -3.4 | -3.5 | -1.5 | -4.0 | -3.6 | -3.3 | | 14 | Overall BoP in US$ bn. | -47.0 | -50.0 | 52.2 | -78.0 | -55.7 | -44.1 | | 15 | Inflation based on CPI Combined: Headline | 6.7 | 6.7 | 7.1 | 6.3 | 6.6 | 6.8 | | 16 | Inflation based on CPI Combined: excluding Food and Beverages, Pan, Tobacco and Intoxicants and Fuel and Light | 6.1 | 6.1 | 6.5 | 5.4 | 6.0 | 6.2 | | 17 | Inflation based on WPI: All Commodities | 10.4 | 10.3 | 13.8 | 7.5 | 10.0 | 10.9 | | 18 | Inflation based on WPI: Non-food Manufactured Products | 6.9 | 6.7 | 9.0 | 5.0 | 6.5 | 7.3 |

| Annex 2: Annual Forecasts for 2023-24 | | | Key Macroeconomic Indicators | Annual Forecasts for 2023-24 | | Mean | Median | Max | Min | 1st quartile | 3rd quartile | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 6.0 | 6.0 | 7.2 | 5.0 | 5.9 | 6.2 | | a | Private Final Consumption Expenditure (PFCE) at constant (2011-12) prices: Annual Growth (per cent) | 6.2 | 6.3 | 8.2 | 1.2 | 6.0 | 6.9 | | b | Gross Fixed Capital Formation (GFCF) at constant (2011-12) prices: Annual Growth (per cent) | 7.0 | 7.0 | 12.5 | -1.8 | 6.4 | 7.5 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 12.2 | 11.4 | 18.0 | 9.8 | 11.0 | 12.7 | | 3 | Gross Capital Formation Rate (per cent of GDP at current market prices) | 31.3 | 31.5 | 33.9 | 28.5 | 30.5 | 31.8 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 5.8 | 5.9 | 7.2 | 4.5 | 5.6 | 6.0 | | a | Agriculture & Allied Activities at constant (2011-12) prices: Annual Growth (per cent) | 3.1 | 3.0 | 4.3 | 2.0 | 3.0 | 3.4 | | b | Industry at constant (2011-12) prices: Annual Growth (per cent) | 5.0 | 5.1 | 7.5 | 2.7 | 4.4 | 5.5 | | c | Services at constant (2011-12) prices: Annual Growth (per cent) | 7.2 | 7.1 | 11.5 | 5.5 | 6.8 | 7.4 | | 5 | Gross Saving Rate (per cent of Gross National Disposable Income) -at current prices | 28.7 | 28.9 | 31.5 | 25.0 | 28.2 | 29.0 | | 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 6.0 | 6.0 | 6.7 | 5.2 | 5.8 | 6.0 | | 7 | Combined Gross Fiscal Deficit (per cent to GDP at current market prices) | 9.0 | 9.0 | 10.3 | 7.3 | 8.8 | 9.2 | | 8 | Bank Credit of Scheduled commercial banks: Annual Growth (per cent) | 11.6 | 12.0 | 15.0 | 8.5 | 11.0 | 12.0 | | 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 7.2 | 7.2 | 7.8 | 6.5 | 7.0 | 7.5 | | 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 6.2 | 6.5 | 6.9 | 4.9 | 6.0 | 6.6 | | 11 | Merchandise Exports (BoP basis in US$ terms): Annual Growth (per cent) | 2.6 | 4.9 | 22.0 | -20.0 | -4.0 | 7.1 | | 12 | Merchandise Imports (BoP basis in US$ terms): Annual Growth (per cent) | 2.4 | 2.5 | 27.0 | -10.0 | -5.0 | 7.1 | | 13 | Current Account Balance in US$ bn. | -100.0 | -100.0 | -27.5 | -156.1 | -107.3 | -95.0 | | a | Current Account Balance (per cent to GDP at current market prices) | -2.7 | -2.7 | -1.4 | -4.0 | -2.9 | -2.5 | | 14 | Overall BoP in US$ bn. | -6.7 | -6.5 | 55.5 | -75.0 | -15.0 | 4.2 | | 15 | Inflation based on CPI Combined: Headline | 5.2 | 5.2 | 6.6 | 4.5 | 5.0 | 5.3 | | 16 | Inflation based on CPI Combined: excluding Food and Beverages, Pan, Tobacco and Intoxicants and Fuel and Light | 5.2 | 5.2 | 6.0 | 4.5 | 5.0 | 5.5 | | 17 | Inflation based on WPI: All Commodities | 5.0 | 4.8 | 11.5 | 2.0 | 3.3 | 5.8 | | 18 | Inflation based on WPI: Non-food Manufactured Products | 3.5 | 3.7 | 7.2 | 0.7 | 2.5 | 4.6 |

| Annex 3: Quarterly Forecasts from Q2:2022-23 to Q2:2023-24 | | | Key Macroeconomic Indicators | Quarterly Forecasts | | Q2: 2022-23 | Q3: 2022-23 | Q4: 2022-23 | | Mean | Median | Max | Min | Mean | Median | Max | Min | Mean | Median | Max | Min | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 6.1 | 6.2 | 7.3 | 4.0 | 4.7 | 4.8 | 5.9 | 3.9 | 4.3 | 4.3 | 5.2 | 3.2 | | a | Private Final Consumption Expenditure (PFCE) at constant (2011-12) prices: Annual Growth (per cent) | 8.1 | 7.7 | 13.7 | 6.4 | 5.1 | 4.8 | 11.3 | -0.6 | 5.2 | 5.2 | 10.9 | 0.8 | | b | Gross Fixed Capital Formation (GFCF) at constant (2011-12) prices: Annual Growth (per cent) | 7.6 | 6.8 | 13.5 | 2.2 | 8.6 | 7.7 | 15.8 | 3.9 | 6.5 | 7.0 | 10.7 | 3.5 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 16.8 | 16.8 | 23.8 | 10.2 | 12.2 | 12.6 | 17.5 | 5.4 | 11.7 | 12.2 | 15.6 | 7.5 | | 3 | Gross Fixed Capital Formation (GFCF) Rate (per cent of GDP at current market prices) | 29.9 | 29.7 | 31.8 | 28.7 | 28.5 | 28.7 | 31.5 | 26.4 | 29.4 | 30.4 | 32.5 | 17.5 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 5.8 | 5.9 | 6.9 | 3.2 | 4.4 | 4.3 | 5.6 | 3.7 | 4.0 | 4.0 | 5.3 | 2.8 | | a | Agriculture & Allied Activities at constant (2011-12) prices: Annual Growth (per cent) | 3.1 | 3.2 | 5.3 | 1.2 | 2.8 | 3.0 | 4.0 | 0.8 | 2.8 | 3.0 | 4.0 | 0.2 | | b | Industry at constant (2011-12) prices: Annual Growth (per cent) | 3.7 | 4.2 | 7.1 | 0.0 | 4.4 | 4.0 | 9.9 | 0.9 | 3.4 | 3.4 | 7.8 | -0.3 | | c | Services at constant (2011-12) prices: Annual Growth (per cent) | 7.3 | 7.5 | 9.3 | 4.0 | 5.1 | 5.3 | 7.0 | 3.1 | 5.0 | 4.9 | 7.3 | 3.3 | | 5 | IIP (2011-12=100): Quarterly Average Growth (per cent) | - | - | - | - | 3.2 | 2.9 | 5.0 | 1.4 | 2.4 | 2.8 | 4.5 | -1.9 | | 6 | Merchandise Exports -BoP basis (in US$ bn.) | 111.2 | 112.0 | 122.0 | 103.2 | 106.5 | 104.0 | 131.2 | 95.0 | 112.0 | 113.0 | 146.4 | 88.0 | | 7 | Merchandise Imports -BoP basis (in US$ bn.) | 191.3 | 191.2 | 199.0 | 182.9 | 180.3 | 179.7 | 207.7 | 170.0 | 179.9 | 177.2 | 236.8 | 162.0 | | 8 | Rupee per US $ Exchange rate (end-period) | - | - | - | - | 82.0 | 82.0 | 84.1 | 79.7 | 81.9 | 81.8 | 85.0 | 79.1 | | 9 | Crude Oil (Indian basket) price (US $ per barrel) (end-period) | - | - | - | - | 92.2 | 93.0 | 100.4 | 84.0 | 91.1 | 92.7 | 100.1 | 74.7 | | 10 | Policy Repo Rate (end-period) | - | - | - | - | 6.26 | 6.25 | 6.50 | 6.00 | 6.43 | 6.50 | 6.75 | 6.00 |

| | Key Macroeconomic Indicators | Quarterly Forecasts | | Q1: 2023-24 | Q2: 2023-24 | | Mean | Median | Max | Min | Mean | Median | Max | Min | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 6.8 | 6.6 | 10.4 | 4.1 | 6.0 | 6.0 | 7.2 | 4.6 | | a | Private Final Consumption Expenditure (PFCE) at constant (2011-12) prices: Annual Growth (per cent) | 6.5 | 6.0 | 14.0 | 0.7 | 6.1 | 6.4 | 9.8 | -0.6 | | b | Gross Fixed Capital Formation (GFCF) at constant (2011-12) prices: Annual Growth (per cent) | 7.4 | 6.5 | 13.5 | 4.1 | 7.4 | 7.0 | 13.9 | 5.0 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 11.4 | 11.5 | 19.0 | 4.5 | 11.2 | 11.8 | 14.9 | 3.6 | | 3 | Gross Fixed Capital Formation (GFCF) Rate (per cent of GDP at current market prices) | 29.6 | 29.5 | 31.5 | 28.0 | 30.1 | 30.2 | 31.6 | 28.3 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 6.5 | 6.3 | 10.2 | 4.0 | 5.8 | 5.9 | 6.9 | 4.5 | | a | Agriculture & Allied Activities at constant (2011-12) prices: Annual Growth (per cent) | 3.3 | 3.2 | 4.5 | 2.1 | 3.2 | 3.0 | 4.9 | 2.1 | | b | Industry at constant (2011-12) prices: Annual Growth (per cent) | 5.0 | 5.2 | 8.4 | 0.4 | 4.6 | 4.9 | 6.5 | 2.2 | | c | Services at constant (2011-12) prices: Annual Growth (per cent) | 7.9 | 7.7 | 12.7 | 5.5 | 6.8 | 6.8 | 8.6 | 5.4 | | 5 | IIP (2011-12=100): Quarterly Average Growth (per cent) | 2.6 | 3.1 | 8.5 | -3.6 | 3.8 | 3.9 | 6.9 | 0.8 | | 6 | Merchandise Exports -BoP basis (in US$ bn.) | 115.9 | 118.0 | 145.0 | 82.0 | 113.5 | 112.1 | 144.9 | 78.0 | | 7 | Merchandise Imports -BoP basis (in US$ bn.) | 186.2 | 185.9 | 226.8 | 160.0 | 190.4 | 190.0 | 244.3 | 160.0 | | 8 | Rupee per US $ Exchange rate (end-period) | 81.3 | 81.5 | 84.0 | 78.5 | 81.1 | 81.0 | 84.4 | 77.9 | | 9 | Crude Oil (Indian basket) price (US $ per barrel) (end-period) | 89.1 | 90.0 | 100.0 | 72.4 | 86.4 | 85.0 | 100.0 | 67.7 | | 10 | Policy Repo Rate (end-period) | 6.44 | 6.50 | 6.75 | 6.00 | 6.44 | 6.50 | 6.75 | 6.00 |

| Annex 4: Forecasts of CPI Combined Inflation | | (per cent) | | | CPI Combined (General) | CPI Combined excluding Food and Beverages, Pan, Tobacco and Intoxicants and Fuel and Light | | Mean | Median | Max | Min | Mean | Median | Max | Min | | Q3:2022-23 | 6.6 | 6.6 | 7.2 | 6.1 | 6.1 | 6.1 | 6.4 | 5.6 | | Q4:2022-23 | 6.1 | 6.1 | 6.9 | 5.5 | 5.8 | 5.9 | 6.6 | 4.9 | | Q1:2023-24 | 5.1 | 5.0 | 6.6 | 3.9 | 5.2 | 5.2 | 6.0 | 4.5 | | Q2:2023-24 | 5.2 | 5.2 | 6.6 | 4.3 | 5.3 | 5.3 | 6.0 | 4.0 |

| Annex 5: Forecasts of WPI Inflation | | (per cent) | | | WPI All Commodities | WPI Non-food Manufactured Products | | Mean | Median | Max | Min | Mean | Median | Max | Min | | Q3:2022-23 | 8.1 | 7.5 | 13.4 | 6.7 | 5.2 | 4.6 | 7.7 | 3.9 | | Q4:2022-23 | 6.3 | 5.7 | 13.4 | 3.1 | 3.9 | 3.9 | 7.5 | 1.7 | | Q1:2023-24 | 3.5 | 2.1 | 11.5 | -0.5 | 2.1 | 2.2 | 7.2 | -1.2 | | Q2:2023-24 | 4.5 | 3.8 | 11.5 | 1.5 | 3.0 | 2.8 | 7.2 | 0.4 |

| Annex 6: Mean probabilities attached to possible outcomes of Real GDP growth | | Growth Range | Forecasts for 2022-23 | Forecasts for 2023-24 | | 12.0 per cent or more | 0.00 | 0.00 | | 11.5 to 11.9 per cent | 0.00 | 0.00 | | 11.0 to 11.4 per cent | 0.00 | 0.00 | | 10.5 to 10.9 per cent | 0.00 | 0.00 | | 10.0 to 10.4 per cent | 0.00 | 0.00 | | 9.5 to 9.9 per cent | 0.00 | 0.00 | | 9.0 to 9.4 per cent | 0.00 | 0.00 | | 8.5 to 8.9 per cent | 0.00 | 0.00 | | 8.0 to 8.4 per cent | 0.01 | 0.00 | | 7.5 to 7.9 per cent | 0.04 | 0.01 | | 7.0 to 7.4 per cent | 0.32 | 0.03 | | 6.5 to 6.9 per cent | 0.49 | 0.20 | | 6.0 to 6.4 per cent | 0.13 | 0.39 | | 5.5 to 5.9 per cent | 0.01 | 0.24 | | 5.0 to 5.4 per cent | 0.00 | 0.10 | | 4.5 to 4.9 per cent | 0.00 | 0.02 | | 4.0 to 4.4 per cent | 0.00 | 0.01 | | 3.5 to 3.9 per cent | 0.00 | 0.00 | | 3.0 to 3.4 per cent | 0.00 | 0.00 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | | 1.5 to 1.9 per cent | 0.00 | 0.00 | | 1.0 to 1.4 per cent | 0.00 | 0.00 | | 0.5 to 0.9 per cent | 0.00 | 0.00 | | 0.0 to 0.4 per cent | 0.00 | 0.00 | | below 0.0 per cent | 0.00 | 0.00 | | Note: The sum of the probabilities may not add up to one due to rounding off. |

| Annex 7: Mean probabilities attached to possible outcomes of CPI (Combined) inflation | | Inflation Range | Forecasts for Q3:2022-23 | Forecasts for Q4:2022-23 | Forecasts for Q1:2023-24 | Forecasts for Q2:2023-24 | | 9.0 per cent or above | 0.00 | 0.00 | 0.00 | 0.00 | | 8.5 to 9.0 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 8.0 to 8.4 per cent | 0.01 | 0.01 | 0.00 | 0.00 | | 7.5 to 7.9 per cent | 0.02 | 0.01 | 0.01 | 0.01 | | 7.0 to 7.4 per cent | 0.08 | 0.03 | 0.02 | 0.02 | | 6.5 to 6.9 per cent | 0.51 | 0.13 | 0.04 | 0.03 | | 6.0 to 6.4 per cent | 0.31 | 0.38 | 0.06 | 0.07 | | 5.5 to 5.9 per cent | 0.06 | 0.37 | 0.12 | 0.21 | | 5.0 to 5.4 per cent | 0.01 | 0.07 | 0.42 | 0.34 | | 4.5 to 4.9 per cent | 0.00 | 0.00 | 0.29 | 0.28 | | 4.0 to 4.4 per cent | 0.00 | 0.00 | 0.03 | 0.05 | | 3.5 to 3.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 3.0 to 3.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 1.5 to 1.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 1.0 to 1.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 0.5 to 0.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 0.0 to 0.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | -0.5 to -0.1 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | -1.0 to -0.6 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | Below -1.0 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | Note: The sum of the probabilities may not add up to one due to rounding off. | Note: CPI: Consumer Price Index; GDP: Gross Domestic Products; GFCF: Gross Fixed Capital Formation; GVA: Gross Value Added; IIP: Index of Industrial Production; PFCE: Private Final Consumption Expenditure; WPI: Wholesale Price Index.

|

IST,

IST,