VIII. Currency Management - RBI - Reserve Bank of India

VIII. Currency Management

| During 2024-25, initiatives were undertaken towards modernisation of the currency management architecture. Maintaining adequate supply of clean banknotes in circulation, sustaining the self-sufficiency in banknote production, strengthening the integrity of banknotes through research, and improving methodologies for assessing the future demand for banknotes remained key priorities. VIII.1 The Reserve Bank remained committed during the year to ensure sufficient supply of clean banknotes and coins to meet the demand for cash from the public. Withdrawal of ₹2000 denomination banknotes initiated in 2023-24 continued during the year. The plan to modernise the currency management infrastructure in the country was taken forward during the year. An exercise to standardise the Note Sorting Machines (NSMs) being used across the currency ecosystem was undertaken in collaboration with the Bureau of Indian Standards (BIS). A research project commissioned by the Department of Currency Management (DCM) on sustainable use of banknote shreds yielded positive results and the process is being actively taken forward. VIII.2 Against this backdrop, the rest of the chapter is organised into five sections. Section 2 covers the implementation status of the agenda for 2024-25, followed by important developments in currency in circulation along with other initiatives in section 3. The developments with regard to Bharatiya Reserve Bank Note Mudran Pvt. Ltd. (BRBNMPL), a wholly owned subsidiary of the Reserve Bank, are given in section 4. The Department’s agenda for 2025-26 is provided in section 5 with concluding observations towards end of the chapter. VIII.3 The Department had set out the following goals for 2024-25:

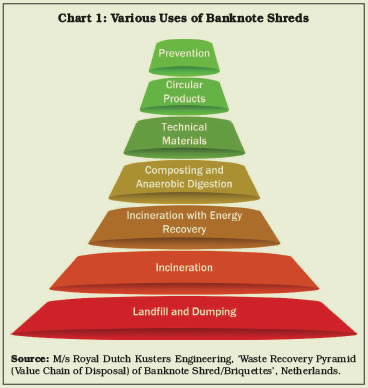

Implementation Status VIII.4 The Reserve Bank has embarked upon the project ‘Sa-Mudra’ (“With Currency”), involving multiple stakeholders for redesigning and modernising the currency management architecture in the country using network optimisation, technological solutions, automation and business process re-engineering. The underlying objective is to attain better process efficiency, clean note policy enforcement, better security, and green shift in currency management operations. A task force has been set up to implement this project. In view of the enormity and complexities involved, it has been decided to implement the project in a phased manner. VIII.5 With a view to move up the sustainability value chain for disposal of soiled banknotes, the Department undertook a project for identifying alternate usage of the banknote shreds. Following research and field level trials, it has been established that the banknote shreds can be used to supplement the raw material for manufacturing of particle boards. Accordingly, a process has been initiated for empanelment of particle board manufacturers who will procure briquettes for end use as raw material in partial replacement of wood particles in their boards (Box VIII.1).

VIII.6 The Reserve Bank undertook various initiatives to improve the circulation of coins such as their distribution and exchange of lower denomination notes through Mobile Coin Vans (MCVs), coin melas and packaging of coins in value-based small pouches. VIII.7 In pursuance of the clean note policy, the Reserve Bank has issued instructions on ‘Note Authentication and Fitness Sorting Parameters’ for NSMs installed in the banks. However, lack of uniformity in sorting of banknotes was observed due to non-standardisation of NSMs in use by the banks. To address this issue, BIS, at the Reserve Bank’s initiative, framed and issued IS 18663:2024 titled ‘Note Sorting Machines - Specifications’ in March 2024. The laboratory facility of BIS is being leveraged for certification of NSMs that duly meet the standards and performance testing parameters. Banks have also been advised to deploy only such NSM models that conform to these standards and are duly certified by BIS beginning November 1, 2025. 3. Developments in Currency in Circulation VIII.8 Currency in circulation includes banknotes, central bank digital currency (CBDC) and coins. Presently, banknotes in circulation comprise denominations of ₹2, ₹5, ₹10, ₹20, ₹50, ₹100, ₹200, ₹500 and ₹2000. The Reserve Bank is no longer printing banknotes of denominations of ₹2, ₹5 and ₹2000. Coins in circulation comprise denominations of 50 paise and ₹1, ₹2, ₹5, ₹10 and ₹20. Banknotes VIII.9 The value and volume of banknotes in circulation increased by 6.0 per cent and 5.6 per cent, respectively, during 2024-25 (Table VIII.1). During 2024-25, the share of ₹500 banknotes at 86 per cent, declined marginally in value terms. In volume terms, ₹500 denomination at 40.9 per cent, constituted the highest share of the total banknotes in circulation, followed by ₹10 denomination banknotes at 16.4 per cent. The lower denomination banknotes (₹10, ₹20 and ₹50) together constituted 31.7 per cent of total banknotes in circulation by volume. Withdrawal of ₹2000 Denomination Banknotes from Circulation VIII.10 The withdrawal of ₹2000 banknotes from circulation, initiated in terms of press release dated May 19, 2023, continued during the year and 98.2 per cent of ₹3.56 lakh crore in circulation at the time of announcement have returned to the banking system up to March 31, 2025. The facility for exchange and deposit of the ₹2000 banknotes is presently available at 19 issue offices2 of the Reserve Bank. The ₹2000 banknotes can also be sent through India Post to any of the 19 issue offices for credit to bank accounts in India. Coins VIII.11 The value and volume of coins in circulation increased by 9.6 per cent and 3.6 per cent, respectively, during 2024-25 (Table VIII.2). As on March 31, 2025, coins of ₹1, ₹2, and ₹5 together constituted 81.6 per cent of the total volume of coins in circulation, while in value terms, these denominations accounted for 64.2 per cent. e₹ in Circulation VIII.12 The value of e₹ in circulation increased by 334 per cent during 2024-25 (Table VIII.3). Currency Management Infrastructure VIII.13 The functions relating to issuance of currency (i.e., banknotes and coins) and their management are performed by the Reserve Bank through its 19 issue offices, 2,689 currency chests and 2,299 small coin depots across the country. As on March 31, 2025, State Bank of India accounted for the highest share of currency chests (Table VIII.4). Indent and Supply of Currency VIII.14 The volume of indent of banknotes and coins for 2024-25 was higher than 2023-24 (Tables VIII.5 and VIII.6). The printing presses supplied banknotes as per indent placed with them. Disposal of Soiled Banknotes VIII.15 The disposal of soiled banknotes increased by 12.3 per cent during 2024-25 as compared with the previous year (Table VIII.7). Counterfeit Notes VIII.16 During 2024-25, out of the total Fake Indian Currency Notes (FICNs) detected in the banking sector, 4.7 per cent were detected at the Reserve Bank (Table VIII.8). VIII.17 The counterfeit notes detected in the denominations of ₹10, ₹20, ₹50, ₹100 and ₹2000 declined during 2024-25, while those in ₹200 and ₹500 denominations increased by 13.9 and 37.3 per cent, respectively, as compared with the previous year (Table VIII.9). Expenditure on Security Printing VIII.18 The expenditure incurred on security printing during 2024-25 was ₹6,372.8 crore as against ₹5,101.4 crore during the previous year mainly due to increase in indent for printing of banknotes. Other Initiatives Awareness Campaign on Coins, Mobile Aided Note Identifier (MANI) and Exchange Facility for Soiled Banknotes VIII.19 During the year, the Reserve Bank conducted awareness campaigns through digital media, social media and All India Radio (AIR) to increase awareness about coins among members of the public. The Reserve Bank also conducted awareness campaign for the visually impaired through AIR about MANI App which facilitates identification of denomination of Indian banknotes. Further, print, digital and social media campaigns were organised for creating awareness on exchange facility for soiled notes. Procurement of New Security Features for Indian Banknotes VIII.20 The Reserve Bank is actively taking forward the process of introduction of new/upgraded security features for banknotes. Indigenisation of Inputs for Banknote Production VIII.21 To reduce dependencies on foreign sources, the Reserve Bank has actively pursued indigenisation of banknote production over the years. With persistent efforts, all the primary raw materials used for the production of banknotes, i.e., banknote paper, all types of inks (offset, numbering, intaglio and colour-shifting intaglio ink) and all other security features are now being procured from domestic sources. 4. Bharatiya Reserve Bank Note Mudran Pvt. Ltd. (BRBNMPL) VIII.22 The BRBNMPL has been playing a critical role in designing, printing and supply of banknotes. BRBNMPL, a subsidiary of the Reserve Bank, has been a partner in the implementation of the Reserve Bank’s strategic goal of indigenisation of banknote production. It has also been consistently focusing on enhancing logistics efficiency and bringing cost effectiveness by increasing direct remittances to various currency chests. BRBNMPL has established learning and development centre at its Mysuru campus, which is primarily focused on imparting and sharing banknote printing and allied knowledge to the domestic as well as global stakeholders. VIII.23 For conducting advanced testing of security features of Indian banknotes, counterfeit deterrence tests, forensic/scientific analysis of forged notes, ethical counterfeiting of notes through the use of latest available tools and technologies and for the development of security/ design features for Indian banknotes, a Currency Research and Development Centre (CRDC) has been set up under the administrative control of BRBNMPL. VIII.24 During the year, the Department will focus on the following:

VIII.25 During 2024-25, the Reserve Bank continued its efforts to improve the efficiency of banknote and coin distribution, raise public awareness about security features of banknotes and acceptance of coins, and ensure adequate supply of clean currency notes for the public. Action towards modernisation and automation of currency management infrastructure also gained momentum. Going forward, sustaining selfsufficiency in banknote production, analytical and developmental currency research towards further strengthening the life and integrity of banknotes and understanding the trends in public preference for cash vis-à-vis other modes of payment shall continue to remain key focus areas. 1 Institute of Wood Science and Technology is an autonomous body under the Ministry of Environment, Forest and Climate Change, Government of India. 2 Ahmedabad, Belapur, Bengaluru, Bhopal, Bhubaneswar, Chandigarh, Chennai, Guwahati, Hyderabad, Jaipur, Jammu, Kanpur, Kolkata, Lucknow, Mumbai, Nagpur, New Delhi, Patna and Thiruvananthapuram. |