FAQ Page 1 - RBI - Reserve Bank of India

A. Classification of loans

Clarification : Priority Sector Lending (PSL) eligibility of loans outstanding as on April 1, 2025 shall be determined with reference to the provisions of the Master Directions on Priority Sector Lending 2025

B. Computation of Adjusted Net Bank Credit (ANBC)

Clarification : The net PSLC outstanding (PSLC Buy minus(-) PSLC Sell) is added to the Net Bank Credit, as mentioned in para 6 of the Master Directions on Priority Sector Lending, 2025 (updated from time to time). Further, a PSLC remains outstanding until its expiry (s. no. ix of Annex to circular on Priority Sector Lending certificates dated April 07, 2016). All PSLCs will expire by March 31st and will not be valid beyond the reporting date (i.e. March 31st), irrespective of the date it was first bought/sold. Accordingly, the effect of PSLC buy is increase in ANBC and conversely the effect of PSLC sell is decrease in ANBC and the net of PSLC buy/sell is adjusted to the ANBC for every quarter. Thus, PSLCs bought or sold in any quarter of a FY will have to be taken into account in all subsequent quarters till the end of that FY.

Clarification:

(i) Outstanding deposits with NABARD made on account of PSL shortfall are eligible to be reckoned towards Agriculture sub-target and count for the achievement of overall PSL target as well.

(ii) Outstanding deposits with SIDBI and MUDRA are eligible to be reckoned under MSME lending and count for the achievement of the overall PSL target.

(iii) Outstanding deposits with NHB are eligible to be reckoned under Housing and count for the achievement of overall PSL target.

(iv) All outstanding deposits as above shall be added to Net Bank Credit (NBC) for the computation of ANBC.

Clarification: (i) In terms of the circulars mentioned above, the amount eligible for exclusion from ANBC is the incremental advances extended out of the resources generated from the eligible incremental FCNR (B) / NRE deposits. The incremental advance is calculated as the difference between outstanding advances in India as on March 7, 2014 and the Base Date (July 26, 2013).

(ii) The amount to be excluded from ANBC for computation of priority sector targets will not exceed incremental FCNR (B) / NRE deposits eligible for exemption from maintenance of CRR / SLR in terms of the circulars mentioned above.

(iii) In case, the difference in the amount of outstanding advances between March 7, 2014 and base date is zero or negative, no amount would be eligible for deduction from ANBC for the purpose of arriving at the priority sector lending targets.

Clarification: The bills purchased/ discounted/ negotiated (payment to beneficiary not under reserve) under LC is allowed to be treated as interbank exposure only for the limited purpose of computing exposure and capital requirements. It should not be excluded from the computation of ‘bank credit in India’ [As prescribed in item No.VI of Form 'A’ under Section 42(2) of the RBI Act, 1934] which allows for exclusion of interbank advance. While exposure may be to the LC issuing bank, the bills purchased/discounted amount to bank credit to its borrower constituent. If this advance is eligible for priority sector classification, the bank can classify it as PSL. Banks have to take note of the above aspect while reporting Net Bank Credit in India as well as while computing the Adjusted Net Bank Credit for PSL targets and achievement.

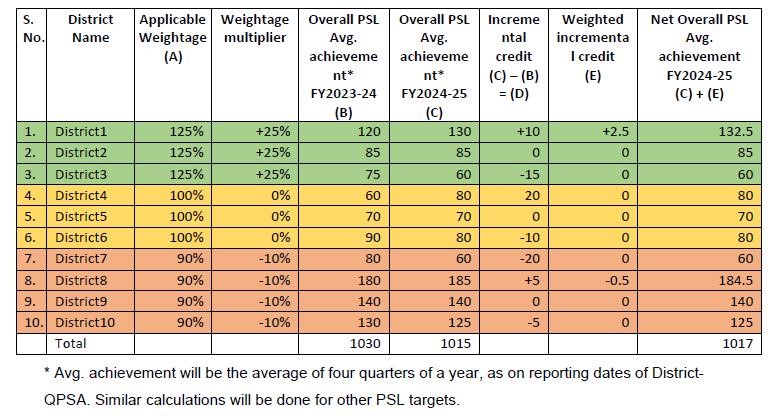

C. Adjustment for Weights in PSL Achievement

Clarification: If there is a decline in credit, the weighted incremental credit will be zero (0). The methodology as given below will be considered for all the districts for which data is reported in ADEPT and District-QPSA statement. Further, based on the methodology detailed below, banks are expected to monitor their own PSL achievement during the year taking into account the prescription of differential weights for credit in identified districts, for the purpose of trading in PSLCs.

Clarification: For mapping a credit facility to a particular district, the ‘place of utilization of credit’ shall be the qualifying criteria.

Clarification: While calculating district-wise incremental credit for assigning weights, the organic credit i.e. only the credit directly disbursed by banks and for which the actual borrower/beneficiary wise details are maintained in the books of the bank, will be considered. Credit disbursed through the following inorganic routes shall not be considered for incremental weights.

- Investments by banks in securitised assets

- Transfer of Assets through Direct Assignment/Outright purchase

- Inter Bank Participation Certificates (IBPCs)

- Priority Sector Lending Certificates (PSLCs)

- Bank loans to MFIs (NBFC-MFIs, Societies, Trusts, etc.) for on-lending

- Bank loans to NBFCs for on-lending

Bank loans to HFCs for on-lending

D. Agriculture

Clarification: The PSL guidelines are activity and beneficiary specific and are not based on type of collateral. Therefore, bank loans given to individuals/ businesses for undertaking agriculture activities do not automatically become ineligible for priority sector classification, only on account of the fact that underlying asset is gold jewellery/ornament etc. It may, however, be noted that as per FIDD Circular dated December 6, 2024, it has been advised that banks may waive collateral security and margin requirements for agricultural loans upto ₹2 lakh. Therefore, bank should have extended the loan based on scale of finance and assessment of credit requirement for undertaking the agriculture activity and not solely based on available collateral in the form of gold. Further, as applicable to all loans under PSL, banks should put in place proper internal controls and systems to ensure that the loans extended under PSL are for approved purposes and the end use is continuously monitored.

Clarification: Banks should ensure proper documentation for classifying agricultural loans under PSL as approved by their Board. Particularly while classifying loans under agriculture/SMF category, banks should maintain details regarding the location of the land for cultivation, details of crop grown, hypothecation of crops, if any; sanction of loan based on scale of finance, record of field visit by bank officials to monitor end use of agricultural loans, etc. Some of the above aspects should be available with the bank in the absence of copy of land record/lease deed particularly in case of agriculture loans to landless labourers, sharecroppers etc.

Clarification: As per extant guidelines, loans for Agriculture Infrastructure or loans for Food & Agro-processing activity are each subject to an aggregate sanctioned limit of ₹100 crore per borrower from the banking system. In case aggregate exposure across the banking industry exceeds the limit of ₹100 crore, then total exposure will cease to be classified under PSL category. The sanctioned limit of ₹100 crore has to be ascertained facility-wise for a particular entity and is exclusive of the other borrowings of the entity for PSL / non-PSL purposes. However, it needs to be ensured that the bank has assessed and sanctioned separate limits for the specific purpose of Agriculture Infrastructure or Food & Agro Processing activities of the entity, for the loans to qualify as PSL. Banks should take a declaration from the borrower regarding loan/s sanctioned by any other bank/s for the same activity and also independently seek confirmation from those banks. In the scenario, where new sanction by the bank leads to overall limit across banks exceeding ₹100 crore, it will have to inform other banks about the same. Accordingly, all other banks will have to declassify the same from PSL.

Clarification : As per Annex-III of Master Directions on Priority Sector Lending, 2025 transportation is an eligible activity under indicative list of permissible activities under Food Processing Sector. However, while classifying any facility to transporters for purchasing commercial vehicles under “Food & Agro-processing” category, it needs to be ensured that the vehicles are used exclusively for transportation of food and agro-processed products or are types of vehicles specifically used for “Food & Agro-processing” e.g. cold storage trucks, vans etc. If the commercial vehicle is also used for transportation of products other than those related to food & agro processing, the facility shall not be eligible for classification under ‘Food & Agro-processing’ category. Such loans may, however, be classified under MSME, if the borrower is eligible for classification as MSME in terms of definition given in the Master Direction – Lending to Micro, Small & Medium Enterprises (MSME) Sector dated July 24, 2017 (as updated from time to time)

Clarification: While classifying any facility to transporters for purchasing commercial vehicles under “Agriculture Infrastructure” category, it needs to be ensured that the vehicle is used exclusively for activities that are ancillary to “Agriculture Infrastructure”. If the commercial vehicle is also used for other purposes, the facility shall not be eligible for classification under ‘Agriculture Infrastructure’. Such loans may, however, be classified under MSME, if the borrower is eligible for classification as MSME as per the definition given in the Master Direction – Lending to Micro, Small & Medium Enterprises (MSME) Sector dated July 24, 2017 (as updated from time to time)

E. Export Credit

Clarification: Export credit extended by banks to the agriculture and MSME sectors is eligible to be classified as priority sector lending under the respective categories viz, agriculture and MSME, without any upper limit.

F. Education

Clarification: The outstanding value may exceed ₹25 lakh on account of accrued interest due to moratorium on repayment during the study period. Accordingly, the entire outstanding amount shall be reckoned for priority sector provided the sanctioned limit does not exceed ₹25 lakh.

G. Housing

Clarification: Housing loans to banks’ own employees are not eligible for classification under priority sector lending, irrespective of whether they are extended on commercial terms or at subsidised rates.

H. Social Infrastructure

Clarification: Bank loans for above purposes can be classified under MSME, wherein no cap on credit has been prescribed. However, banks can classify such activities either under MSME or Social Infrastructure, and not both. It may be noted that for classification under Social Infrastructure, the associated cap on credit shall be applicable.

I. Weaker Sections

Clarification: For classification under ‘Weaker Sections’, the loans should first be eligible for classification under any of the eight PSL categories as per underlying activity.

Clarification: As per extant guidelines, SMF includes individuals, SHGs, JLGs, Farmers’ Producer Companies (FPC) and Co-operatives of farmers with the accompanying criteria of membership by number and land-holding. Therefore, loans to partnership firms/co-borrowers or any director of a company holding agriculture land upto 2 hectares are not eligible to be classified under the SMF category of PSL.

Clarification: As per extant guidelines, priority sector loans are eligible for classification as loans to minority communities as per the list notified by the GoI from time to time. The same may be read with Master Circular- Credit Facilities to Minority Communities which at para 2.2 states “In the case of a partnership firm, if the majority of the partners belong to one or the other of the specified minority communities, advances granted to such partnership firms may be treated as advances granted to minority communities. Further, if the majority beneficial ownership in a partnership firm belongs to the minority community, then such lending can be classified as advances to the specified communities. A company has a separate legal entity and hence advances granted to it cannot be classified as advances to the specified minority communities”

Page Last Updated on: December 10, 2022