IST,

IST,

Government Securities Market in India – A Primer

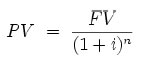

The time value of money functions related to calculation of Present Value (PV), Future Value (FV), etc. are important mathematical concepts related to bond market. An outline of the same with illustrations is provided in Box II below.

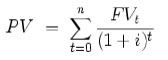

| Time Value of Money Money has time value as a Rupee today is more valuable and useful than a Rupee a year later. The concept of time value of money is based on the premise that an investor prefers to receive a payment of a fixed amount of money today, rather than an equal amount in the future, all else being equal. In particular, if one receives the payment today, one can then earn interest on the money until that specified future date. Further, in an inflationary environment, a Rupee today will have greater purchasing power than after a year. Present value of a future sum The present value formula is the core formula for the time value of money. The present value (PV) formula has four variables, each of which can be solved for: Present Value (PV) is the value at time=0  The cumulative present value of future cash flows can be calculated by adding the contributions of FVt, the value of cash flow at time=t  An illustration Taking the cash flows as;

Assuming that the interest rate is at 10% per annum; The discount factor for each year can be calculated as 1/(1+interest rate)^no. of years The present value can then be worked out as Amount x discount factor The PV of ₹100 accruing after 3 years:

The cumulative present value = 90.91+82.64+75.13 = ₹ 248.69 Net Present Value (NPV) Net present value (NPV) or net present worth (NPW) is defined as the present value of net cash flows. It is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting, and widely throughout economics, it measures the excess or shortfall of cash flows, in present value (PV) terms, once financing charges are met. Formula Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore  Where In the illustration given above under the Present value, if the three cash flows accrues on a deposit of ₹ 240, the NPV of the investment is equal to 248.69-240 = ₹ 8.69 |

The price of a bond is nothing but the sum of present value of all future cash flows of the bond. The interest rate used for discounting the cash flows is the Yield to Maturity (YTM) (explained in detail in question no. 24) of the bond. Price can be calculated using the excel function ‘Price’ (please refer to Annex 6).

Accrued interest is the interest calculated for the broken period from the last coupon day till a day prior to the settlement date of the trade. Since the seller of the security is holding the security for the period up to the day prior to the settlement date of the trade, he is entitled to receive the coupon for the period held. During settlement of the trade, the buyer of security will pay the accrued interest in addition to the agreed price and pays the ‘consideration amount’.

An illustration is given below;

For a trade of ₹ 5 crore (face value) of security 8.83% 2023 for settlement date Jan 30, 2014 at a price of ₹100.50, the consideration amount payable to the seller of the security is worked out below:

Here the price quoted is called ‘clean price’ as the ‘accrued interest’ component is not added to it.

Accrued interest:

The last coupon date being Nov 25, 2013, the number of days in broken period till Jan 29, 2014 (one day prior to settlement date i.e. on trade day) are 65.

| The accrued interest on ₹100 face value for 65 days | = 8.83 x (65/360) |

| = ₹1.5943 |

When we add the accrued interest component to the ‘clean price’, the resultant price is called the ‘dirty price’. In the instant case, it is 100.50+1.5943 = ₹102.0943

| The total consideration amount | = Face value of trade x dirty price |

| = 5,00,00,000 x (102.0943/100) | |

| = ₹ 5,10,47,150 |

If market interest rate levels rise, the price of a bond falls. Conversely, if interest rates or market yields decline, the price of the bond rises. In other words, the yield of a bond is inversely related to its price. The relationship between yield to maturity and coupon rate of bond may be stated as follows:

-

When the market price of the bond is less than the face value, i.e., the bond sells at a discount, YTM > > coupon yield.

-

When the market price of the bond is more than its face value, i.e., the bond sells at a premium, coupon yield > > YTM.

-

When the market price of the bond is equal to its face value, i.e., the bond sells at par, YTM = coupon yield.

24.1 An investor who purchases a bond can expect to receive a return from one or more of the following sources:

-

The coupon interest payments made by the issuer;

-

Any capital gain (or capital loss) when the bond is sold/matured; and

-

Income from reinvestment of the interest payments that is interest-on-interest.

The three yield measures commonly used by investors to measure the potential return from investing in a bond are briefly described below:

i) Coupon Yield

24.2 The coupon yield is simply the coupon payment as a percentage of the face value. Coupon yield refers to nominal interest payable on a fixed income security like G-Sec. This is the fixed return the Government (i.e., the issuer) commits to pay to the investor. Coupon yield thus does not reflect the impact of interest rate movement and inflation on the nominal interest that the Government pays.

Coupon yield = Coupon Payment / Face Value

Illustration:

Coupon: 8.24

Face Value: ₹100

Market Value: ₹103.00

Coupon yield = 8.24/100 = 8.24%

ii) Current Yield

24.3 The current yield is simply the coupon payment as a percentage of the bond’s purchase price; in other words, it is the return a holder of the bond gets against its purchase price which may be more or less than the face value or the par value. The current yield does not take into account the reinvestment of the interest income received periodically.

Current yield = (Annual coupon rate / Purchase price) X100

Illustration:

The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below:

Annual coupon interest = 8.24% x ₹100 = ₹8.24

Current yield = (8.24/103) X 100 = 8.00%

The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return.

iii) Yield to Maturity

24.4 Yield to Maturity (YTM) is the expected rate of return on a bond if it is held until its maturity. The price of a bond is simply the sum of the present values of all its remaining cash flows. Present value is calculated by discounting each cash flow at a rate; this rate is the YTM. Thus, YTM is the discount rate which equates the present value of the future cash flows from a bond to its current market price. In other words, it is the internal rate of return on the bond. The calculation of YTM involves a trial-and-error procedure. A calculator or software can be used to obtain a bond’s YTM easily (please see the Box III).

| YTM Calculation YTM could be calculated manually as well as using functions in any standard spread sheet like MS Excel. Manual (Trial and Error) Method Manual or trial and error method is complicated because G-Secs have many cash flows running into future. This is explained by taking an example below. Take a two year security bearing a coupon of 8% and a price of say ₹ 102 per face value of ₹ 100; the YTM could be calculated by solving for ‘r’ below. Typically, it involves trial and error by taking a value for ‘r’ and solving the equation and if the right hand side is more than 102, take a higher value of ‘r’ and solve again. Linear interpolation technique may also be used to find out exact ‘r’ once we have two ‘r’ values so that the price value is more than 102 for one and less than 102 for the other value.

Spread Sheet Method using MS Excel In the MS Excel programme, the following function could be used for calculating the yield of periodically coupon paying securities, given the price. YIELD (settlement,maturity,rate,price,redemption,frequency,basis) Wherein; Settlement is the security's settlement date. The security settlement date is the date on which the security and funds are exchanged. Maturity is the security's maturity date. The maturity date is the date when the security expires. Rate is the security's annual coupon rate. Price is the security's price per ₹100 face value. Redemption is the security's redemption value per ₹100 face value. Frequency is the number of coupon payments per year. (2 for Government bonds in India) Basis is the type of day count basis to use. (4 for Government bonds in India which uses 30/360 basis) |

Day count convention refers to the method used for arriving at the holding period (number of days) of a bond to calculate the accrued interest. As the use of different day count conventions can result in different accrued interest amounts, it is appropriate that all the participants in the market follow a uniform day count convention.

For example, the conventions followed in Indian market are given below.

Bond market: The day count convention followed is 30/360, which means that irrespective of the actual number of days in a month, the number of days in a month is taken as 30 and the number of days in a year is taken as 360.

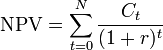

Money market: The day count convention followed is actual/365, which means that the actual number of days in a month is taken for number of days (numerator) whereas the number of days in a year is taken as 365 days. Hence, in the case of T-Bills, which are essentially money market instruments, money market convention is followed.

In some countries, participants use actual/actual, some countries use actual/360 while some use 30/actual. Hence the convention changes in different countries and in different markets within the same country (eg. Money market convention is different than the bond market convention in India).

It is calculated as per the following formula

27.1 Duration (also known as Macaulay Duration) of a bond is a measure of the time taken to recover the initial investment in present value terms. In simplest form, duration refers to the payback period of a bond to break even, i.e., the time taken for a bond to repay its own purchase price. Duration is expressed in number of years. A step by step approach for working out duration is given in the Box IV below.

| Calculation for Duration First, each of the future cash flows is discounted to its respective present value for each period. Since the coupons are paid out every six months, a single period is equal to six months and a bond with two years maturity will have four time periods. Second, the present values of future cash flows are multiplied with their respective time periods (these are the weights). That is the PV of the first coupon is multiplied by 1, PV of second coupon by 2 and so on. Third, the above weighted PVs of all cash flows is added and the sum is divided by the current price (total of the PVs in step 1) of the bond. The resultant value is the duration in no. of periods. Since one period equals to six months, to get the duration in no. of year, divide it by two. This is the time period within which the bond is expected to pay back its own value if held till maturity. Illustration: Taking a bond having 2 years maturity, and 10% coupon, and current price of ₹101.79, the cash flows will be (prevailing 2 year yield being 9%):

Duration in number of periods = 379.28/101.79 = 3.73 Duration in years = 3.73/2 = 1.86 years |

More formally, duration refers to:

-

The weighted average term (time from now to payment) of a bond's cash flows or of any series of linked cash flows.

-

The higher the coupon rate of a bond, the shorter the duration (if the term of the bond is kept constant).

-

Duration is always less than or equal to the overall life (to maturity) of the bond.

-

Only a zero coupon bond (a bond with no coupons) will have duration equal to its maturity.

What is Modified Duration?

27.2 Modified duration (MD) is a modified version of Macaulay Duration. It refers to the change in value of the security to one per cent change in interest rates (Yield). The formula is

Illustration

In the above example given in Box IV, MD = 1.86/(1+0.09/2) = 1.78

Duration is useful primarily as a measure of the sensitivity of a bond's market price to interest rate (i.e., yield) movements. It is approximately equal to the percentage change in price for one percent change in yield. For example the duration is the approximate percentage by which the value of the bond will fall for a 1% per annum increase in market interest rate. So, a 15-year bond with a duration of 7 years would fall approximately 7% in value if the interest rate increased by 1% per annum. In other words, duration is the elasticity of the bond's price with respect to interest rates. This ignores convexity explained in para 24.7

What is PV 01?

27.3 PV01 describes the actual change in price of a bond if the yield changes by one basis point (equal to one hundredth of a percentage point). It is the present value impact of 1 basis point (0.01%) (1%=100 bps) movement in interest rate. It is often used as a price alternative to duration (a time measure). Higher the PV01, the higher would be the volatility (sensitivity of price to change in yield).

Illustration

From the modified duration (given in the illustration under 27.2), we know that the security value will change by 1.78% for a change of 100 basis point (1%) change in the yield. In value terms that is equal to 1.78*(101.79/100) = ₹ 1.81.

Hence the PV01 = 1.81/100 = ₹0.018, which is 1.8 paise. Thus, if the yield of a bond with a Modified Duration of 1.78 years moves from say 9% to 9.05% (5 basis points), the price of the bond moves from ₹101.79 to ₹101.70 (reduction of 9 paise, i.e., 5x1.8 paise).

What is Convexity?

27.4 Calculation of change in price for change in yields based on duration works only for small changes in yields. This is because the relationship between bond price and yield is not strictly linear. Over large variations in yields, the relationship is curvilinear i.e., the reduction in option free bond price is less than the change calculated based only on duration for yield increase, and increase in option free bond price will be more than the change calculated based only on duration for yield decrease. This is measured by a concept called convexity, which is the change in duration of a bond due to change in the yield of the bond.

28.1 For Cooperative banks, investments classified under 'Held to Maturity' (HTM) category need not be marked to market and will be carried at acquisition cost unless it is more than the face value, in which case the premium should be amortized over the period remaining to maturity. The individual scrip in the ‘Available for Sale’ (AFS) category in the books of the cooperative banks will be marked to market at the year-end or at more frequent intervals. The individual scrip in the ‘Held for Trading’ (HFT) category will be marked to market at monthly or at more frequent intervals. The book value of individual securities in AFS and HFT categories would not undergo any change after marking to market.

28.2 RBI vide FMRD.DIRD.7/14.03.025/2017-18 dated March 31, 2018 has notified that Financial Benchmark India Pvt. Ltd (FBIL) has been advised to assume the responsibility for administering valuation of Government securities with effect from March 31, 2018. From this date, FIMMDA has ceased to publish prices/yield of Government securities and this role has been taken over by FBIL. FBIL had commenced publication of the G-Sec and SDL valuation benchmarks based on the extant methodology. Going forward, FBIL will undertake a comprehensive review of the valuation methodology. RBI regulated entities, including banks, non-bank financial companies, Primary Dealers, Co-Operative banks and All India Financial Institutions who are required to value Government securities using prices published by FIMMDA as per previous directions may use FBIL prices with effect from March 31, 2018. Other market participants who have been using Govt. securities prices/yields published by FIMMDA may use the prices/yields published by FBIL for valuation of their investment portfolio.

28.3 State Development Loans were previously valued by applying YTM method by marking it up by a spread of 25 basis points on the Central G-Sec yield of the corresponding residual maturity, whereas for corporate bonds the spreads given by the FIMMDA need to be added. RBI vide its notification DBR.BP.BC.No.002 /21.04.141/2018-19 dated July 27, 2018 decided that securities issued by each state government, i.e., State Development Loans (SDLs), shall be valued in a manner which would objectively reflect their fair value based on observed prices/yields and Financial Benchmarks India Pvt. Ltd. (FBIL) shall make available prices for valuation of SDLs based on the above principles. Brief details of valuation methodology is provided in Box V.

| A framework in this regard has been formulated by FBIL having the following elements: (a) On any business day, the secondary market prices/YTM of SDLs and the auction prices/YTM of SDLs, as available, will be used for their valuation. However, the secondary market trades that are referred to the Dispute Resolution Committee (DRC) of the Fixed Income Money Market and Derivatives Association of India (FIMMDA) and the reversed trades when they occur, will be excluded, (b) Interpolation/ extrapolation technique will be used in respect of the remaining SDLs which do not trade on that day, and (c) Consistency/market alignment check, as applicable, will be applied in respect of all traded prices/YTM. The methodology seeks to strike a judicious and prudent balance between two opposing considerations: Since the number of actual/observed prices in respect of SDLs are very small, the opportunity cost of not including any actual/observed price is high (consequence of the so-called Type 1 error). However, sufficient care has been exercised, by way of the imposition of a set of objective criteria, to make sure that (i) off-market data are excluded, and (ii) no incentive for market manipulation is provided (reducing the possibility of the so called Type 2 error). The detailed valuation methodology along with illustrations is provided on FBIL website at link https://www.fbil.org.in/uploads/general/FBIL-SDL_Valuation_Methodology.pdf |

28.4 In the case of corporate bonds, the spread that need to be added to the corresponding yield on central G-Sec will be published by the FIMMDA from time to time. FIMMDA gives out the information on corporate bond spreads for various ratings of bonds. While valuing a bond, the appropriate spread has to be added to the corresponding CG yield and the bond has to be valued using the standard ‘Price’ formula.

G-Secs are generally referred to as risk free instruments as sovereigns rarely default on their payments. However, as is the case with any financial instrument, there are risks associated with holding the G-Secs. Hence, it is important to identify and understand such risks and take appropriate measures for mitigation of the same. The following are the major risks associated with holding G-Secs:

29.1 Market risk – Market risk arises out of adverse movement of prices of the securities due to changes in interest rates. This will result in valuation losses on marking to market or realizing a loss if the securities are sold at adverse prices. Small investors, to some extent, can mitigate market risk by holding the bonds till maturity so that they can realize the yield at which the securities were actually bought.

29.2 Reinvestment risk – Cash flows on a G-Sec includes a coupon every half year and repayment of principal at maturity. These cash flows need to be reinvested whenever they are paid. Hence there is a risk that the investor may not be able to reinvest these proceeds at yield prevalent at the time of making investment due to decrease in interest rates prevailing at the time of receipt of cash flows by investors.

29.3 Liquidity risk – Liquidity in G-Secs is referred to as the ease with which security can be bought and sold i.e. availability of buy-sell quotes with narrow spreads. Liquidity risk refers to the inability of an investor to liquidate (sell) his holdings due to non-availability of buyers for the security, i.e., no trading activity in that particular security or circumstances resulting in distressed sale (selling at a much lower price than its holding cost) causing loss to the seller. Usually, when a liquid bond of fixed maturity is bought, its tenor gets reduced due to time decay. For example, a 10-year security will become 8 year security after 2 years due to which it may become illiquid. The bonds also become illiquid when there are no frequent reissuances by the issuer (RBI) in those bonds. Bonds are generally reissued till a sizeable amount becomes outstanding under that bond. However, issuer and sovereign have to ensure that there is no excess burden on Government at the time of maturity of the bond as very large amount maturing on a single day may affect the fiscal position of Government. Hence, reissuances for securities are generally stopped after outstanding under that bond touches a particular limit. Due to illiquidity, the investor may need to sell at adverse prices in case of urgent funds requirement. However, in such cases, eligible investors can participate in market repo and borrow the money against the collateral of such securities.

Risk Mitigation

29.4 Holding securities till maturity could be a strategy through which one could avoid market risk. Rebalancing the portfolio wherein the securities are sold once they become short term and new securities of longer tenor are bought could be followed to manage the portfolio risk. However, rebalancing involves transaction and other costs and hence needs to be used judiciously. Market risk and reinvestment risk could also be managed through Asset Liability Management (ALM) by matching the cash flows with liabilities. ALM could also be undertaken by matching the duration of the assets and liabilities.

Advanced risk management techniques involve use of derivatives like Interest Rate Swaps (IRS) through which the nature of cash flows could be altered. However, these are complex instruments requiring advanced level of expertise for proper understanding. Adequate caution, therefore, need to be observed for undertaking the derivatives transactions and such transactions should be undertaken only after having complete understanding of the associated risks and complexities.

30.1 While the G-Secs market generally caters to the investors with a long-term investment horizon, the money market provides investment avenues of short term tenor. Money market transactions are generally used for funding the transactions in other markets including G-Secs market and meeting short term liquidity mismatches. By definition, money market is for a maximum tenor of one year. Within the one year, depending upon the tenors, money market is classified into:

i. Overnight market - The tenor of transactions is one working day.

ii. Notice money market – The tenor of the transactions is from 2 days to 14 days.

iii. Term money market – The tenor of the transactions is from 15 days to one year.

What are the different money market instruments?

30.2 Money market instruments include call money, repos, T- Bills (for details refer para 1.3), Cash Management Bills (for details refer para 1.4), Commercial Paper, Certificate of Deposit and Collateralized Borrowing and Lending Obligations (CBLO).

Call money market

30.3 Call money market is a market for uncollateralized lending and borrowing of funds. This market is predominantly overnight and is open for participation only to scheduled commercial banks and the primary dealers.

Repo market

30.4 Repo or ready forward contact is an instrument for borrowing funds by selling securities with an agreement to repurchase the said securities on a mutually agreed future date at an agreed price which includes interest for the funds borrowed.

30.5 The reverse of the repo transaction is called ‘reverse repo’ which is lending of funds against buying of securities with an agreement to resell the said securities on a mutually agreed future date at an agreed price which includes interest for the funds lent.

30.6 It can be seen from the definition above that there are two legs to the same transaction in a repo/ reverse repo. The duration between the two legs is called the ‘repo period’. Predominantly, repos are undertaken on overnight basis, i.e., for one day period. Settlement of repo transactions happens along with the outright trades in G-Secs.

30.7 The consideration amount in the first leg of the repo transactions is the amount borrowed by the seller of the security. On this, interest at the agreed ‘repo rate’ is calculated and paid along with the consideration amount of the second leg of the transaction when the borrower buys back the security. The overall effect of the repo transaction would be borrowing of funds backed by the collateral of G-Secs.

30.8 The repo market is regulated by the Reserve Bank of India. All the above mentioned repo market transactions should be traded/reported on the electronic platform called the Clearcorp Repo Order Matching System (CROMS).

30.9 As part of the measures to develop the corporate debt market, RBI has permitted select entities (scheduled commercial banks excluding RRBs and LABs, PDs, all-India FIs, NBFCs, mutual funds, housing finance companies, insurance companies) to undertake repo in corporate debt securities. This is similar to repo in G-Secs except that corporate debt securities are used as collateral for borrowing funds. Only listed corporate debt securities that are rated ‘AA’ or above by the rating agencies are eligible to be used for repo. Commercial paper, certificate of deposit, non-convertible debentures of original maturity less than one year are not eligible for this purpose. These transactions take place in the OTC market and are required to be reported on FIMMDA platform within 15 minutes of the trade for dissemination of trade information. They are also to be reported on the clearing house of any of the exchanges for the purpose of clearing and settlement.

Triparty Repo

"Tri-party repo" means a repo contract where a third entity (apart from the borrower and lender), called a Tri-Party Agent, acts as an intermediary between the two parties to the repo to facilitate services like collateral selection, payment and settlement, custody and management during the life of the transaction. Funds borrowed under repo including tri-party repo in government securities shall be exempted from CRR/SLR computation and the security acquired under repo shall be eligible for SLR provided the security is primarily eligible for SLR as per the provisions of the Act under which it is required to be maintained.

Tri Party Repo Dealing System (TREPS) facilitates, borrowing and lending of funds, in Triparty Repo arrangement. CCIL is the Central Counterparty to all trades from TREPS and also perform the role and responsibilities of Triparty Repo Agent. All the repo eligible entities are entitled to participate in Triparty Repo. The entity type admitted include, Public Sector Banks, Private Banks, Foreign Banks, Co-operative Banks, Financial Institutions, Insurance Companies, Mutual Funds, Primary Dealers, Bank cum Primary Dealers, NBFCs, Corporates, Provident/ Pension Funds, Payment Banks, Small Finance Banks, etc.

TREPS Dealing System is an anonymous order matching System provided by CCDS (Clearcorp Dealing Systems (India) Ltd) to enable Members to borrow and lend funds. It also disseminates online information regarding deals concluded, volumes, rate etc., and such other notifications as relevant to borrowing and lending under Triparty Repo by the members. The borrowing and/ or lending can be done for settlement type T+0 and T+1.

Commercial Paper (CP)

30.13 Commercial Paper (CP) is an unsecured money market instrument issued in the form of a promissory note and held in a dematerialized form through any of the depositories approved by and registered with SEBI. A CP is issued in minimum denomination of ₹5 lakh and multiples thereof and shall be issued at a discount to face value No issuer shall have the issue of CP underwritten or co-accepted and options (call/put) are not permitted on a CP. Companies, including NBFCs and AIFIs, other entities like co-operative societies, government entities, trusts, limited liability partnerships and any other body corporate having presence in India with net worth of ₹100 cr or higher and any other entities specifically permitted by RBI are eligible to issue Commercial papers subject to conditions specified by RBI. All residents, and non-residents permitted to invest in CPs under Foreign Exchange Management Act (FEMA), 1999 are eligible to invest in CPs; however, no person can invest in CPs issued by related parties either in the primary or secondary market. Investment by regulated financial sector entities will be subject to such conditions as the concerned regulator may impose.

RBI has issued Reserve Bank Commercial Paper Directions 2017 - FMRD.DIRD.01/CGM (TRS) - 2017 dated August 10, 2017

Certificate of Deposit (CD)

30.14 Certificate of Deposit (CD) is a negotiable money market instrument and issued in dematerialised form or as a Usance Promissory Note, for funds deposited at a bank or other eligible financial institution for a specified time period. Banks can issue CDs for maturities from 7 days to one year whereas eligible FIs can issue for maturities from 1 year to 3 years.

31.1 The Fixed Income Money Market and Derivatives Association of India (FIMMDA), an association of Scheduled Commercial Banks, Public Financial Institutions, Primary Dealers and Insurance Companies was incorporated as a Company under section 25 of the Companies Act,1956 on June 3, 1998. FIMMDA is a voluntary market body for the bond, money and derivatives markets. FIMMDA has members representing all major institutional segments of the market. The membership includes Nationalized Banks such as State Bank of India, its associate banks and other nationalized banks; Private sector banks such as ICICI Bank, HDFC Bank; Foreign Banks such as Bank of America, Citibank, Financial institutions such as IDFC, EXIM Bank, NABARD, Insurance Companies like Life Insurance Corporation of India (LIC), ICICI Prudential Life Insurance Company, Birla Sun Life Insurance Company and all Primary Dealers.

31.2 FIMMDA represents market participants and aids the development of the bond, money and derivatives markets. It acts as an interface with the regulators on various issues that impact the functioning of these markets. FIMMDA also plays a constructive role in the evolution of best market practices by its members so that the market as a whole operates transparently as well as efficiently.

31.3 Financial Benchmarks India Pvt. Ltd (FBIL) was incorporated in 2014 as per the recommendations of the Committee on Financial Benchmarks. FBIL has taken over existing benchmarks such as Mumbai Inter-Bank Outright Rate (MIBOR) and option volatility and introduced new benchmarks such as Market Repo Overnight Rate (MROR), Certificate of Deposits (CDs) and T-Bills yield curves. The development of FBIL as an independent organisation for administration of all financial market benchmarks including valuation benchmarks is important for the credibility of these benchmarks and integrity of financial markets. FBIL has assumed the responsibility for administering valuation of Government securities with effect from March 31, 2018.

FBIL has also assumed the responsibility for computation and dissemination of the daily “Reference Rate” for Spot USD/INR and other major currencies against the Rupee, which was previously being done by the Reserve Bank.

32.1. RBI financial market watch - /en/web/rbi/financial-markets/other-links/financial-market-watch

This site provides links to information on prices of G-Secs on NDS-OM, money market and other information on G-Secs like outstanding stock etc.

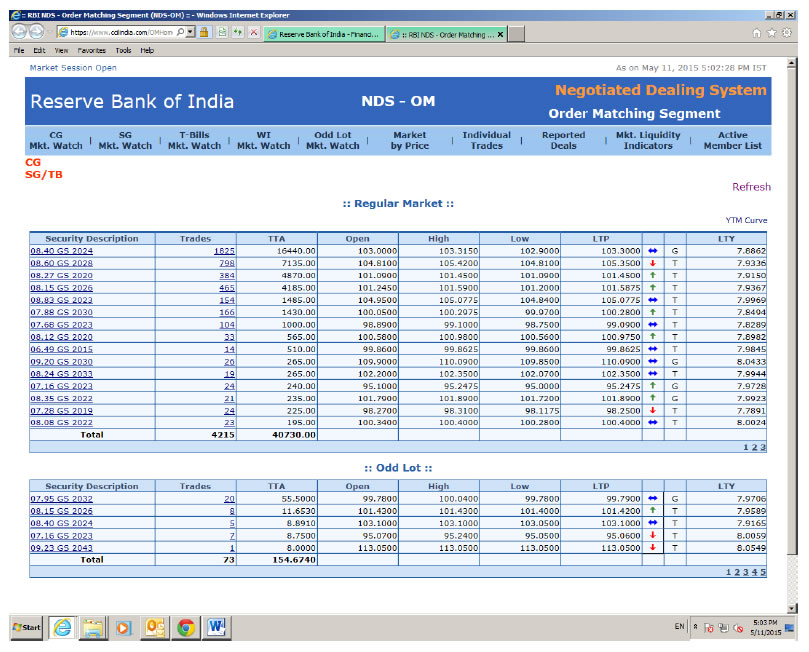

32.2. NDS-OM market watch https://www.ccilindia.com/OMHome.aspx

This site provides real-time information on traded as well as quoted prices of G-Secs, both in Order matching and Reporting segment. In addition, prices of When Issued (WI) (whenever trading takes place) segment are also provided.

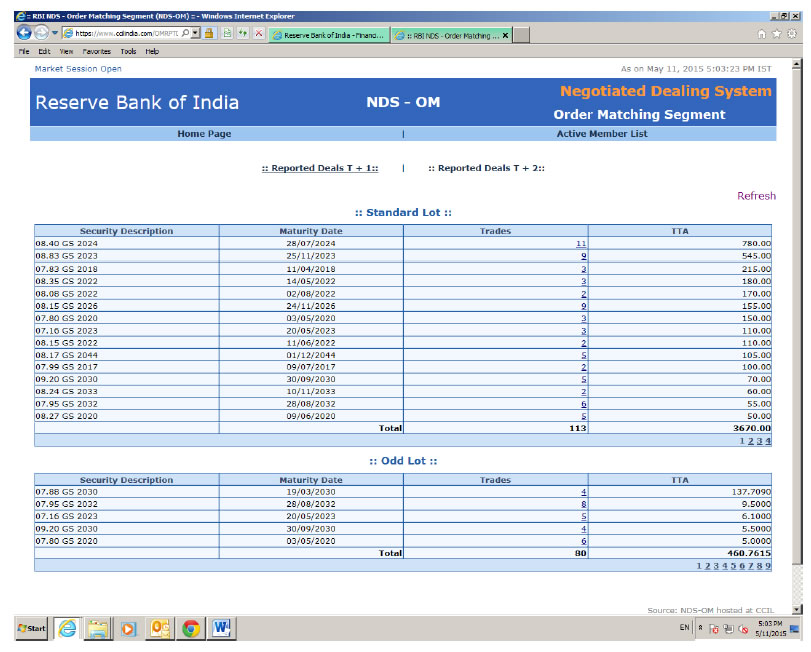

32.3. Reported deals on NDS-OM: https://www.ccilindia.com/OMRPTDeals.aspx

This site provides information on prices of G-Secs in OTC market as reported. One can see chronological traded price levels and quantity in various securities.

32.4 FBIL – www.fbil.org.in

Financial Benchmark India Private Ltd (FBIL) was jointly promoted by Fixed Income Money Market & Derivative Association of India (FIMMDA), Foreign Exchange Dealers’ Association of India (FEDAI) and Indian Banks’ ‘Association (IBA). It was incorporated on 9th December 2014 under the Companies Act 2013. It was recognised by Reserve bank of India as an independent Benchmark administrator on 2nd July 2015.

The company is run by a Board of Directors, assisted by an oversight committee. The main object of the company is to act as the administrators of the Indian interest rate and foreign exchange benchmarks and to introduce and implement policies and procedures to handle the benchmarks. It also will make policies for possible cessation of any benchmark and to follow steps for ensuring orderly transition to the new benchmarks. FBIL will review each benchmark to ensure that the benchmarks accurately represent the economic realities of the interest that it intends to measure. It will take up/consider such other benchmarks as may be required from time to time by periodically assessing the emerging needs of the end -users.

32.5 FIMMDA - http://www.fimmda.org/

This site provides a host of information on market practices for all the fixed income securities including G-Secs. Accessing information from this site requires a valid login and password which are provided by FIMMDA to the eligible entities.

List of Primary Dealers (As on April 01, 2020)

| STANDALONE PRIMARY DEALERS | BANK PRIMARY DEALERS |

| ICICI Securities Primary Dealership Limited ICICI Centre H.T.Parekh Marg Churchgate Mumbai- 400 020 Phone: (022) 22882460/70, 66377421 | Bank of America, N.A. One BKC, ‘A’ Wing ‘G’ Block, Bandra Kurla Complex Bandra (E), Mumbai – 400 051 Phone: 022-66323111 |

| Morgan Stanley India Primary Dealer Pvt. Ltd. 18F / 19F One Indiabulls Centre Tower 2, Jupiter Mills Compound Elphinstone Road Mumbai - 400013 Phone : (022) 61181000 Fax : (022) 61181011 | Bank Of Baroda Specialised Integrated Treasury 4th & 5th Floor, Baroda Sun Tower, C-34, G-Block, Bandra Kurla Complex Bandra East, Mumbai-400 051 Phone:(022) 66363636 / 67592705 |

| Nomura Fixed Income Securities Pvt. Ltd. Ceejay House, 11th Level Plot F, Shivsagar Estate Dr.Annie Besant Road Worli Mumbai - 400 018 Phone : (022) 40374037 Fax : (022) 40374111 | Canara Bank Domestic Back Office Integrated Treasury Wing VI Floor, Canara Bank Building C-14, G Block, Bandra Kurla Complex Bandra East Mumbai- 400 051 Phone: (022) 26725126, 123 |

| PNB Gilts Ltd. 5, Sansad Marg New Delhi- 110 001 Phone: Mumbai - (022) 22693315/17 New Delhi - (011) 23325751,22693315/17 | Citibank N.A FIFC, 12th floor, C-54 and 55, G block, Bandra Kurla Complex, Mumbai – 400 051. Phone:(022) 6175 7187 |

| SBI DFHI Ltd 3rd Floor, Voltas House, 23, J.N.Heredia Marg, Ballard Estate, Mumbai- 400 001 Phone:(022) 22625970/73, 22610490, 66364696 | Union Bank of India |

| STCI Primary Dealer Limited Marathon Innova, Marathon Nextgen Compound, Off Ganpatrao Kadam Marg, Lower Parel(W), Mumbai- 400 013 Phone:(022) 30031100, 66202261/2200 | HDFC Bank Ltd. Treasury Mid Office, 1st Floor,HDFC Bank House Senapati Bapat Marg, Lower Parel Mumbai- 400 013 Phone:(022) 24904702/4935/3899, 66521372/9892975232 |

| Goldman Sachs (India) Capital Markets Pvt. Ltd. 951-A, Rational House, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025 Phone : (022) 66169000 | Hongkong and Shanghai Banking Corpn. Ltd.(HSBC) Treasury Services 52/60, Mahatma Gandhi Road Mumbai- 400 001 Phone:(022) 22681031/34/33, 22623329/22681031/34/38 |

| J P Morgan Chase Bank N.A, Mumbai Branch J.P. Morgan Tower Off C.S.T. Road, Kalina Santacruz (East) Mumbai - 400 098 Phone -61573000 Fax- 61573990 & 61573916 | |

| Kotak Mahindra Bank Ltd. 27BKC, 5th Floor Plot No. C-27, G-Block Bandra Kurla Complex Bandra East Mumbai 400 051. Phone:(022) 6659 6022/6454, 66596235/6454 | |

| Standard Chartered Bank Financial Markets Financial Market Operation Crescenzo, 5th Floor Plot no. C-38 & 39, G – Block Bandra Kurla Complex Mumbai – 400 051 Phone : (022) 61158893 | |

| Axis Bank Ltd. Treasury Operations Corporate Office, 4th Floor, Axis House Bombay Dyeing Compound Pandurang Budhkar Marg Worli, Mumbai - 400 025 Phone- (022) 24254430, 24254434 Fax- (022) 24252400 / 5400 | |

| IDBI Bank Limited IDBI Tower, Cuffe Parade Mumbai- 400 005 Phone- (022) 66263351 | |

| Deutsche Bank AG C-70, G Block, Bandra Kurla Complex Mumbai-400051 Phone: (022) 71804444 | |

| Yes Bank Limited Yes Bank Tower, IFC 2, Elphinstone (W), Senapati Bapat Marg, Mumbai-400013 Phone: (022) 33669000 |

* Bank PDs are those which take up PD business departmentally as part of the bank itself.

** Stand alone PDs are Non Banking Financial Companies (NBFCs) that exclusively take up PD business.

Update to the list of Primary dealers is available on the RBI website at /en/web/rbi/citizen-corner/primary-dealers

Glossary of Important Terms and Commonly Used Market Terminology

Accrued Interest

The accrued interest on a bond is the amount of interest accumulated on a bond since the last coupon payment. The interest has been earned, but because coupons are paid only on coupon dates, the investor has not gained the money yet. In India day count convention for G-Secs is 30/360.

Auction –Multiple price and Uniform Price

In a Multiple Price auction, the successful bidders are required to pay for the allotted quantity of securities at the respective price / yield at which they have bid. On the other hand, in a Uniform Price auction, all the successful bidders are required to pay for the allotted quantity of securities at the same rate, i.e., at the auction cut-off rate, irrespective of the rate quoted by them.

Bid Price/ Yield

The price/yield being offered by a potential buyer for a security.

Big Figure

When the price is quoted as ₹102.35, the portion other than decimals (102) is called the big figure.

Competitive Bid

Competitive bid refers to the bid for the stock at the price stated by a bidder in an auction.

Coupon

The rate of interest paid on a debt security as calculated on the basis of the security’s face value.

Coupon Frequency

Coupon payments are made at regular intervals throughout the life of a debt security and may be quarterly, semi-annual (twice a year) or annual payments.

Discount

When the price of a security is below the par value, it is said to be trading at a discount. The value of the discount is the difference between the FV and the Price. For example, if a security is trading at ₹ 99, the discount is ₹ 1.

Duration (Macaulay Duration)

Duration of a bond is the number of years taken to recover the initial investment of a bond. It is calculated as the weighted average number of years to receive the cash flow wherein the present value of respective cash flows are multiplied with the time to that respective cash flows. The total of such values is divided by the price of the security to arrive at the duration. Refer to Box IV under question 27.

Face Value

Face value is the amount that is to be paid to an investor at the maturity date of the security. Debt securities can be issued at varying face values, however in India they typically have a face value of ₹100. The face value is also known as the repayment amount. This amount is also referred as redemption value, principal value (or simply principal), maturity value or par value.

Floating-Rate Bond

Bonds whose coupon rate is re-set at predefined intervals and is based on a pre-specified market based interest rate.

Gilt/ G-Secs

G-Secs are also known as gilts or gilt edged securities. “G-Sec” means a security created and issued by the Government for the purpose of raising a public loan or for any other purpose as may be notified by the Government in the Official Gazette and having one of the forms mentioned in the G-Secs Act, 2006.

Market Lot

Market lot refers to the standard value of the trades that happen in the market. The standard market lot size in the G-Secs market is ₹ 5 crore in face value terms.

Maturity Date

The date when the principal (face value) is paid back. The final coupon and the face value of a debt security is repaid to the investor on the maturity date. The time to maturity can vary from short term (1 year) to long term (30 years).

Non-Competitive Bid

NCB means the bidder would be able to participate in the auctions of dated G-Secs without having to quote the yield or price in the bid. The allotment to the non-competitive segment will be at the weighted average rate that will emerge in the auction on the basis of competitive bidding. It is an allocating facility wherein a part of total securities are allocated to bidders at a weighted average price of successful competitive bid. (Please also see paragraph no.4.3 under question no.4).

Odd Lot

Transactions of any value other than the standard market lot size of ₹ 5 crore are referred to as odd lot. Generally, the value is less than the ₹ 5 crore with a minimum of ₹10,000/-. Odd lot transactions are generally done by the retail and small participants in the market.

Par value

Par value is nothing but the face value of the security which is ₹ 100 for G-Secs. When the price of a security is equal to face value, the security is said to be trading at par.

Premium

When the price of a security is above the par value, the security is said to be trading at premium. The value of the premium is the difference between the price and the face value. For example, if a security is trading at ₹102, the premium is ₹ 2.

Price

The price quoted is for per ₹ 100 of face value. The price of any financial instrument is equal to the present value of all the future cash flows. The price one pays for a debt security is based on a number of factors. Newly-issued debt securities usually sell at, or close to, their face value. In the secondary market, where already-issued debt securities are bought and sold between investors, the price one pays for a bond is based on a host of variables, including market interest rates, accrued interest, supply and demand, credit quality, maturity date, state of issuance, market events and the size of the transaction.

Primary Dealers

In order to accomplish the objective of meeting the Government borrowing needs as cheaply and efficiently as possible, a group of highly qualified financial firms/ banks are appointed to play the role of specialist intermediaries in the G-Sec market between the issuer on the one hand and the market on the other. Such entities are generally called Primary dealers or market makers. In return of a set of obligations, such as making continuous bids and offer price in the marketable G-Secs or submitting reasonable bids in the auctions, these firms receive a set of privileges in the primary/ secondary market.

Real Time Gross Settlement (RTGS) system

RTGS system is a funds transfer mechanism for transfer of money from one bank to another on a “real time” and on “gross” basis. This is the fastest possible money transfer system through the banking channel. Settlement in “real time” means payment transaction is not subjected to any waiting period. The transactions are settled as soon as they are processed. “Gross settlement” means the transaction is settled on one to one basis without bunching with any other transaction. Considering that money transfer takes place in the books of the Reserve Bank of India, the payment is taken as final and irrevocable.

Repo Rate

Repo rate is the return earned on a repo transaction expressed as an annual interest rate.

Repo/Reverse Repo

Repo means an instrument for borrowing funds by selling securities of the Central Government or a State Government or of such securities of a local authority as may be specified in this behalf by the Central Government or foreign securities, with an agreement to repurchase the said securities on a mutually agreed future date at an agreed price which includes interest for the fund borrowed.

Reverse Repo means an instrument for lending funds by purchasing securities of the Central Government or a State Government or of such securities of a local authority as may be specified in this behalf by the Central Government or foreign securities, with an agreement to resell the said securities on a mutually agreed future date at an agreed price which includes interest for the fund lent.

Residual Maturity

The remaining period until maturity date of a security is its residual maturity. For example, a security issued for an original term to maturity of 10 years, after 2 years, will have a residual maturity of 8 years.

Secondary Market

The market in which outstanding securities are traded. This market is different from the primary or initial market when securities are sold for the first time. Secondary market refers to the buying and selling that goes on after the initial public sale of the security.

Tap Sale

Under Tap sale, a certain amount of securities is created and made available for sale, generally with a minimum price, and is sold to the market as bids are made. These securities may be sold over a period of day or even weeks; and authorities may retain the flexibility to increase the (minimum) price if demand proves to be strong or to cut it if demand weakens. Tap and continuous sale are very similar, except that with Tap sale the debt manager tends to take a more pro-active role in determining the availability and indicative price for tap sales. Continuous sale are essentially at the initiative of the market.

Treasury Bills

Debt obligations of the Government that have maturities of one year or less are normally called Treasury Bills or T-Bills. Treasury Bills are short-term obligations of the Treasury/ Government. They are instruments issued at a discount to the face value and form an integral part of the money market.

Underwriting

The arrangement by which investment bankers undertake to acquire any unsubscribed portion of a primary issuance of a security.

Weighted Average Price/ Yield

It is the weighted average mean of the price/ yield where weight being the amount used at that price/ yield. The allotment to the non-competitive segment will be at the weighted average price/yield that will emerge in the auction on the basis of competitive bidding.

Yield

The annual percentage rate of return earned on a security. Yield is a function of a security’s purchase price and coupon interest rate. Yield fluctuates according to numerous factors including global markets and the economy.

Yield to Maturity (YTM)

Yield to maturity is the total return one would expect to receive if the security is being held until maturity. Yield to maturity is essentially the discount rate at which the present value of future payments (investment income and return of principal) equals the price of the security.

Yield Curve

The graphical relationship between yield and maturity among bonds of different maturities and the same credit quality. This curve shows the term structure of interest rates. It also enables investors to compare debt securities with different maturities and coupons.

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: