IST,

IST,

FIRMS Application Foreign investment in India - Reporting in Single Master Form Introduction

Introduction

1.1 The Reserve Bank, in the First Bi-monthly Monetary Policy Review dated April 5, 2018 announced that, with the objective of integrating the extant reporting structures of various types of foreign investment in India, it will introduce a Single Master Form (SMF) subsuming all the existing reports.

1.2 In order to implement this announcement, the Reserve Bank is introducing an online application, FIRMS (Foreign Investment Reporting and Management System), which would provide for the SMF. FIRMS would be made online in two phases. In the first phase, the first module viz., the Entity Master, would be made available online. Instructions in this regard were already issued through A. P. Dir. Series Circular No. 30 dated June 07, 2018.

1.3 In the second phase, the second module containing 9 reports would be made available with effect from September 01, 2018. With the implementation of SMF, the reporting of FDI, which is presently a two-step procedure viz., ARF and FC-GPR would be merged into a single revised FC-GPR. The SMF also introduces reporting of indirect foreign investment through form DI and reporting of inflows in investment vehicles through Form InVi. Further, the reporting in FC-TRS, LLP-I, LLP-II, ESOP, DRR and CN would also be made in SMF only. The finalized structure of SMF and operational instructions thereof would be made available in the Master Direction on Reporting under FEMA, 1999.

1.4 The first module will be available to the public for data entry between June 28 (at 1:00 PM) and July 12, 2018. The date was extended till July 20, 2018. It would provide an interface for Indian entities [as defined in Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2017 dated November 07, 2017 and as amended from time to time] to input their existing foreign investment (including indirect foreign investment) data. Entities shall provide data with respect to all foreign investments received, irrespective of the fact that the regulatory reporting to the Reserve Bank for the same has been made or not and whether the same has been acknowledged or not.

1.5 Indian entities not complying with these instructions will not be able to receive foreign investment (including indirect foreign investment) and will be treated as non-compliant with Foreign Exchange Management Act, 1999 (FEMA) and regulations made thereunder and liable for action as laid in FEMA or the regulations made thereunder.

1.6 Where the entities have not been able to register for the Entity master, they may do so from September 01, 2018. However, they may provide the reasons for not registering within the time period along with the authority letter.

User Manual for Entity Master

1. Who is an Entity?

-

A company within the meaning of section 1(4) of the Companies Act, 2013

-

A Limited Liability Partnership (LLP) registered under the Limited Liability Partnership Act, 2008

-

A startup which complies with the conditions laid down in Notification No. G.S.R 180(E) dated February 17, 2016 issued by Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India

2. Process Flows

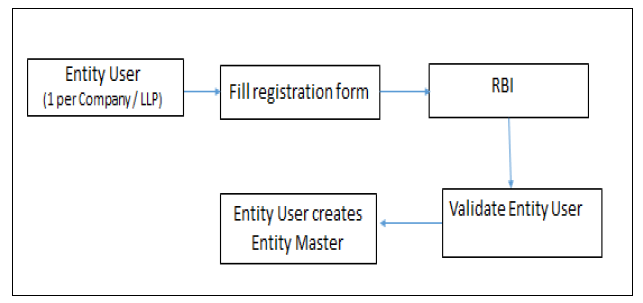

2.1 Schematic representation of Entity User Registration and Entity Master

3. Process flow for Entity Master

3.1 Entity User

-

An Entity User is a person authorized by the entity (company/ LLP/startup) to register an entity in the Entity Master of FIRMS application.

-

The Entity User would be the sole person authorized to add/update the foreign investment details of an Entity in the Entity Master and would be entirely responsible for the data entered.

-

One entity can have only one entity user. If the entity wishes to change the Entity user, it may contact RBI helpdesk, the details of which are available under “Contact Us”.

-

One person can also be an entity user for more than one entity. However, the person has to obtain separate registrations for the same as the registration is entity specific.

4. Registration for an Entity User

4.1 Pre-requisites

- Authority letter: The entity may issue an authority letter, in the format as given at Annex to the identified personnel authorizing him/her for registering as an Entity user for the entity.

- The Entity user may keep ready all details of foreign investment in the entity.

4.2 Registration Process

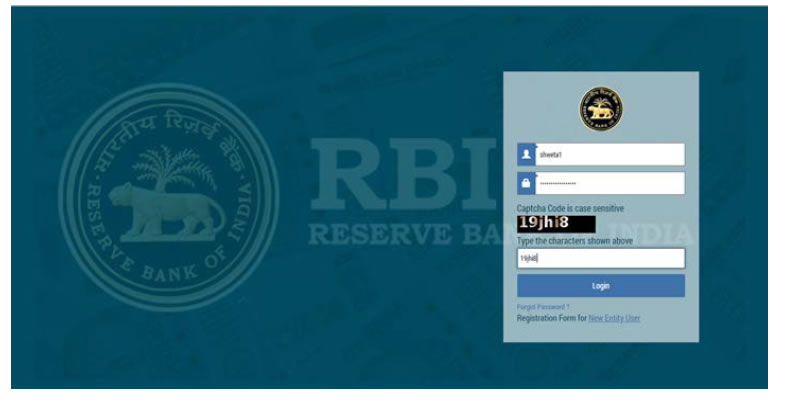

- Uniform Resource Locators (URL) of the application is https://firms.rbi.org.in

- The person, for registering as Entity User, may access the login page of the FIRMS application using the above URL on the internet.

4.3 Landing page for Registering an Entity User

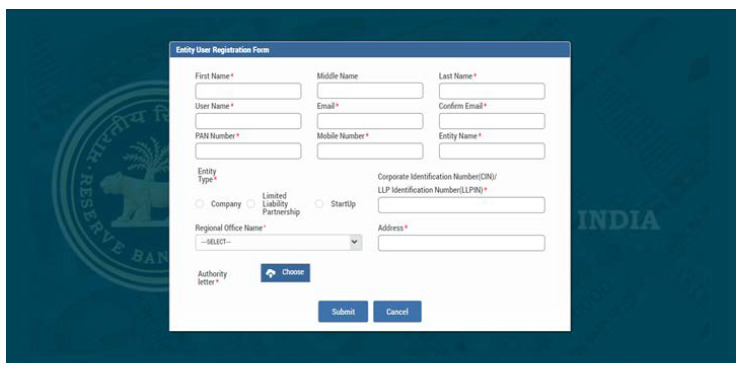

4.4 Creation of new Entity user.

Step 1: Click on Registration form for New Entity User

Step 2: A pop-up box showing Entity User Registration form opens.

Step 3: Fill all the details in the Entity User Registration Form.

4.5 Field Descriptions

The fields in the Entity User Registration Form are described in the following table.

| Field Name | Field Description |

| First Name* | First Name of the user |

| Middle Name | Middle Name of the user |

| Last Name* | Last Name of the user |

| User Name* | User has to enter a unique username. The user can use alphabets & numerics. |

| Email* | The user has to enter valid e-mail ID. The default password will be provided in the e-mail ID. |

| Confirm E-mail* | The user has to confirm the same e-mail ID |

| PAN number* |

The user should provide their own PAN No. (not the PAN No. of the company). It consists of 10 characters (first five alphabets, next four numeric and the last alphabet). |

| Mobile Number* | The user should enter its valid 10 digit mobile number. |

| Entity Name* | Name of the company as per the certificate of incorporation (only name of the company, no prefix required) |

| Company Type* | Entity type whether Company, LLP or Start Up. |

| CIN / LLPIN* |

CIN / LLPIN of the entity as available in the certificate of incorporation. If the company does not have CIN number, it may fill a dummy CIN number as below For example: if the companies name is ABC corporation Limited and registered office is in Maharashtra, where the company does not have a CIN, the dummy CIN would be |

| Regional Office Name* | Regional Office of RBI under whose jurisdiction the registered office of the entity falls. |

| Address* | City with PIN Code of the registered office of the entity. |

| Authority Letter* | The user has to attach the authority letter from the entity authorizing the person to register as the Entity User for submission of information in the Entity Master. The format of the authorization letter is provided in Annex. Only a .pdf file can be attached. |

|

*Denotes Mandatory fields. |

|

Step 4: Click on Submit button after filling all the details.

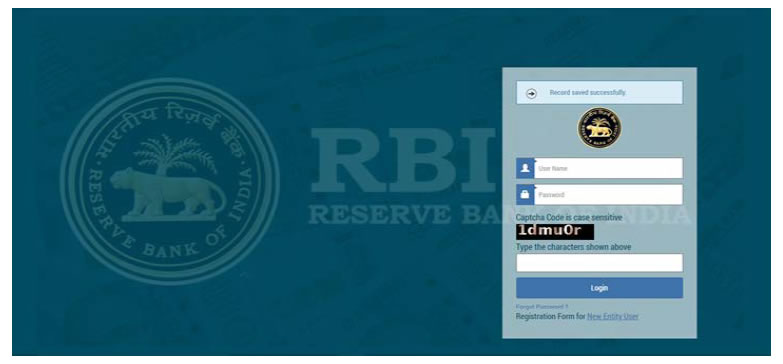

Step 5: Message “Record Saved Successfully” pops up. User has created its user ID.

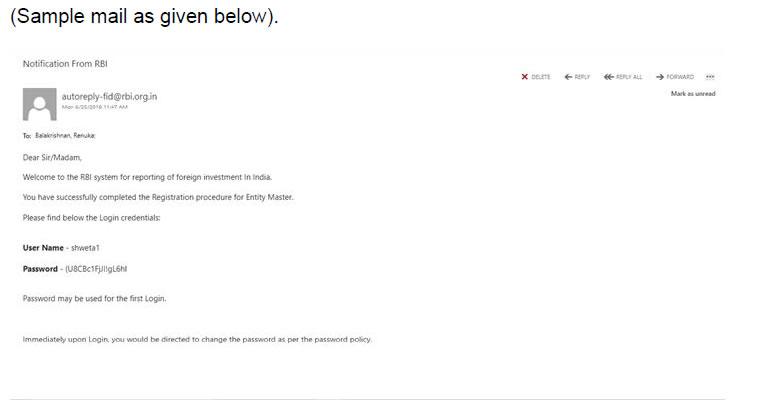

Authority Letter submitted by the entity user will be verified by RBI and after RBI’s approval, the user will receive the password on their registered email ID from RBI email ID autoreply-fid[at]rbi[dot]org[dot]in.

(Note: If the user does not receive the mail notification for approval/rejection of the registration within the next 48 hrs, he/she may contact by email)

Step 1: Enter User Name and Password as provided to the User in the email from RBI and click Login. The user would be asked to change his/her password upon first Login.

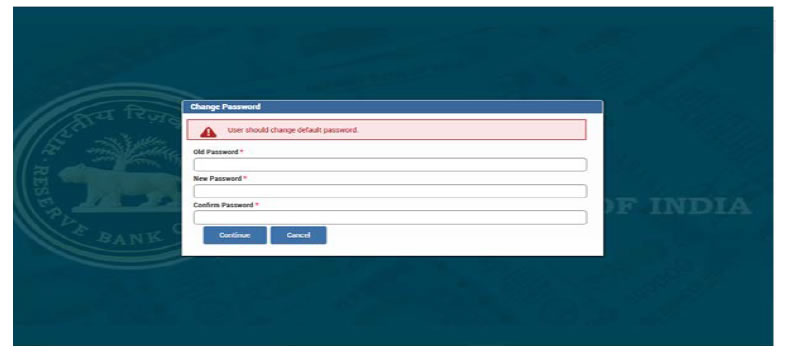

4.6 Change Password

Step 1. The Change Password window is displayed.

Step 2. Enter your old password in the Old Password field and new password in the New Password field.

Step 3. Re-enter the new password to confirm it and click continue.

5. Entity Master

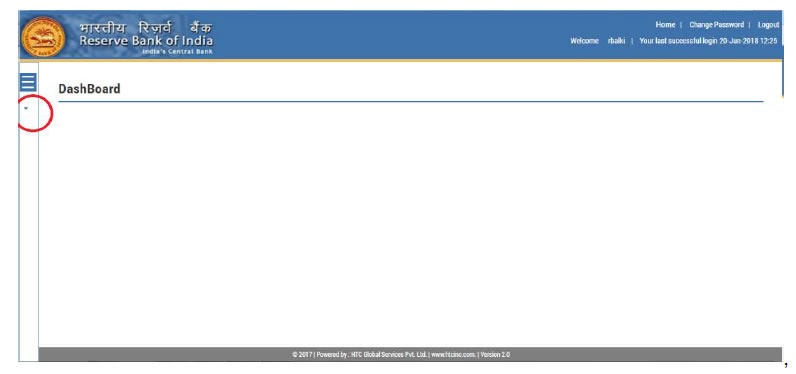

5.1 Logging on to Entity Master

Enter your user name and new password.

5.2 Entry in Entity Master:

On successful login the home page (dashboard) is displayed.

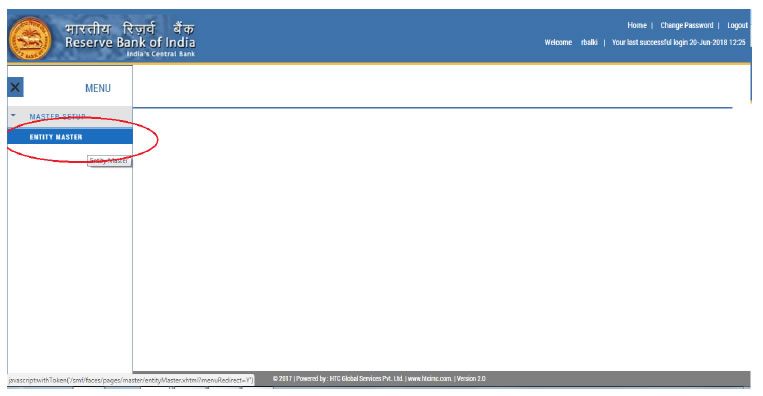

Step 1: Click on the top - left option button to open Menu.

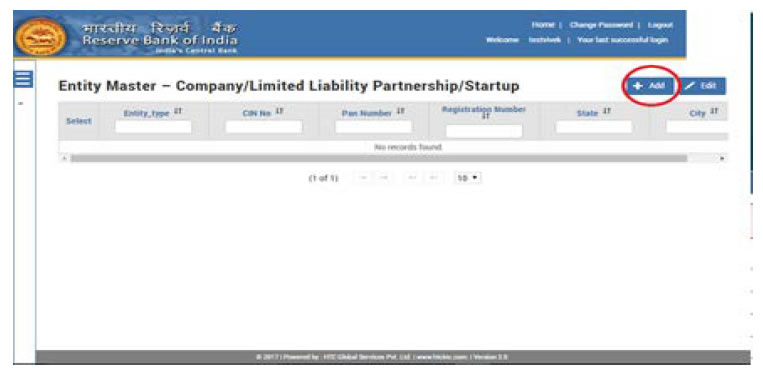

Step 2: Click on the Master Setup under Menu. Then click Entity Master. The following page is displayed:

5.3 Entity Details

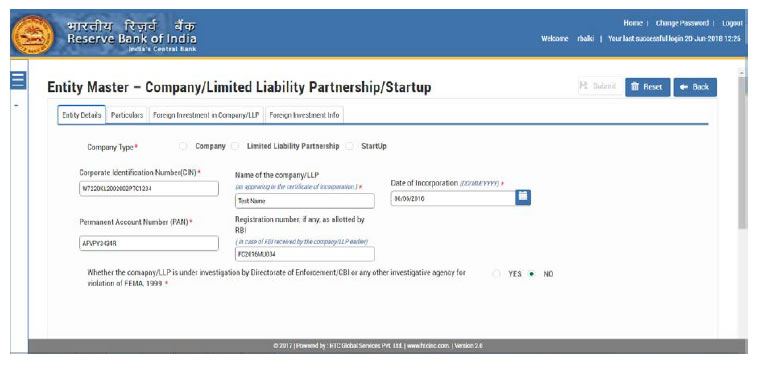

Step 3: Click ADD button. The Entity details page is displayed:

Step 4: Click Entity Details tab

The fields in the Entity Details are described in the following table.

| Field Name | Requirement |

| Name of the entity | Will be auto-populated as per the details in Registration Form |

| CIN/ LLPIN | Will be auto-populated as per the details in Registration Form |

| Date of incorporation* | As appearing in the Certificate of Incorporation (Cannot be a future date) |

| Permanent Account Number (PAN)* | PAN No. of the Entity |

| RBI Registration Number | The number provided by RBI during reporting of earlier allotments, if any, has to be entered. |

| Whether the company/LLP is under investigation by Directorate of Enforcement/CBI or any other investigative agency for violation of FEMA, 1999* | As the case may be for the entity. |

|

*Denotes Mandatory fields. |

|

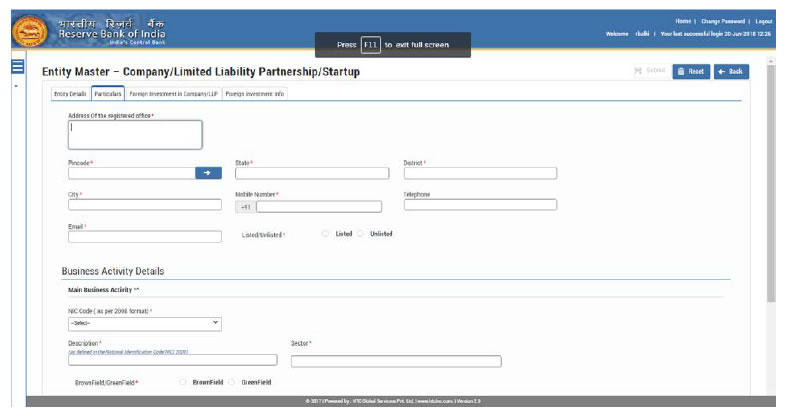

Step 5: Click Particulars Tab

The Following page is displayed:

Please add the pin code nearest to your area in case the pin code specific to your area is not displayed.

The fields in the Particulars tab are described in the following table.

| Field name | Requirement |

| Address of the registered office* | As appearing in the certificate of incorporation / in case of change of address as appearing in Form INC 22 |

| Pincode* | Choose from Dropdown |

| Mobile Number* | Mobile No of the authorized person e.g., Director, Company Secretary for the Company etc. |

| Telephone | Telephone number of the company (prefix with STD Code) e.g. +91-22-12345678 |

| Email ID* | Email ID of the entity |

| NIC Code* | If more than one applicable, then main activity for which Foreign Investment is received |

| Greenfield or Brownfield* | Select whether Greenfield or Brownfield |

| *Denotes Mandatory fields. | |

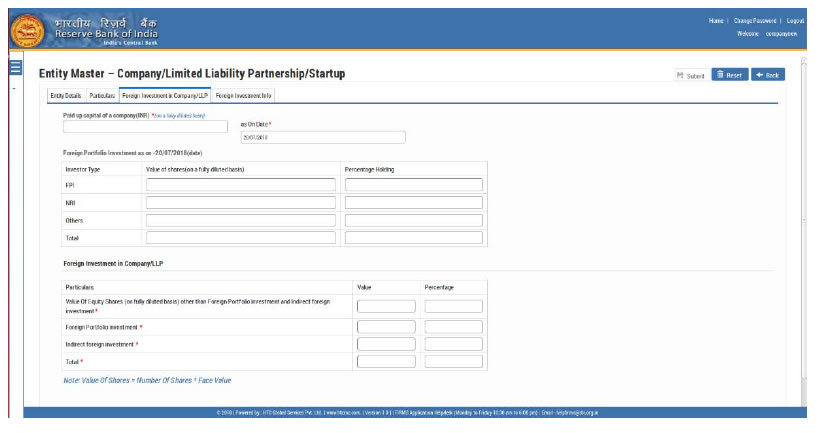

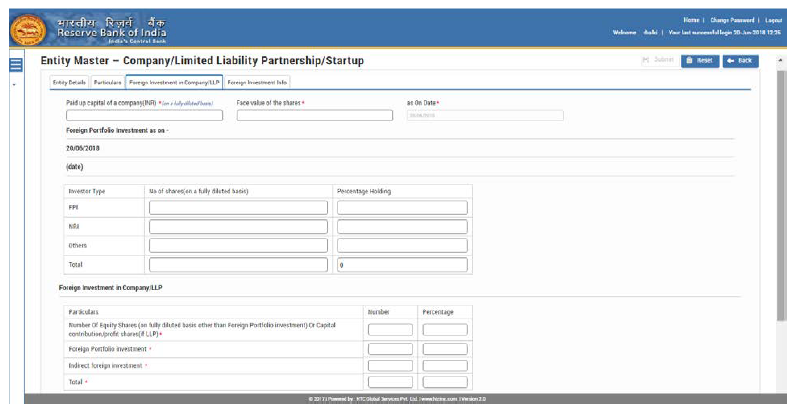

Step 6: Click Foreign Investment in Company / LLP Tab.

Following page is displayed:

(a) If Company:

Paid-up Capital of the company on a fully diluted basis (where paid up capital on fully diluted basis= paid up shares on fully diluted basis * face value) in INR

Fully diluted basis means the total number of shares that would be outstanding if all possible sources of conversion are exercised. It includes:

1. Equity shares: As equity shares

2. CCDS/ CCPS: Equivalent Equity shares. (If the conversion ratio is not fixed upfront, the company may enter the maximum number of equity shares possible upon conversion in compliance with the pricing guidelines)

3. Share warrants: Equivalent Equity shares considering 100% exercise upfront

4. ESOPs: Equivalent Equity shares considering 100% exercise upfront

Note: If a start-up company has issued, convertible notes the same shall not be included in the paid-up capital on fully diluted.

To report only Capital Instruments held by persons resident outside India on a repatriable basis

5. The Indian companies who have made downstream investment in another Indian company for which it is considered as indirect foreign investment in terms of Regulation 14 of Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2017 dated November 7, 2017 and as amended from time to time, shall inform the same to the Indian investee company for the purpose of providing details of indirect foreign investment in Entity Master.

(b) If LLP:

Total Capital contribution in LLP (in INR)

(c) Foreign Investment

-

The entity should also report indirect foreign investment received by it.

-

The entity shall provide the details of all foreign investment as on date on an aggregate level as below. This will also be inclusive of all foreign investment, irrespective of the fact that the regulatory reporting to RBI for the same has been made or not or whether the same has been acknowledged or not.

The fields in the Foreign Investment in a Company/ LLP tab are described in the following table.

| Field name | For Company / Start-up | For LLP / Start-up |

| Paid-up Capital / Capital Contribution* | Total paid up capital of the company (domestic plus foreign investment plus indirect foreign investment) on a fully diluted basis in INR | Total Capital contribution in LLP (in INR) |

|

Foreign Portfolio Investment* (Investment that is considered as foreign portfolio investment within the meaning of regulation 2(xix) of FEMA 20(R)) |

Foreign Portfolio Investments made (value of shares, where value of shares = number of shares * face value) by Foreign Portfolio Investors (FPI)/ Non-resident Indian (NRI). Others will include foreign portfolio investments made in the company other than by FPI/ NRI. |

Will be disabled |

|

Foreign Investment in Company/ LLP: |

Value of equity shares issued by the company on a fully diluted basis other than Foreign Portfolio Investment and indirect foreign investment, where value of shares = Number of shares * face value | Capital contributions/ Profit shares (in INR) |

|

Indirect Foreign Investment (please be guided by regulation 14 of FEMA 20(R) read with para 9 of Master Direction – Foreign Investment) |

Indirect Foreign Investment in the company (in value of shares) | Indirect Foreign Investment in LLP (in INR) |

|

*Denotes Mandatory fields. |

||

Prior to July 20, 2018, the tab 3 of Entity Master was as below :

| Field name | For Company / Start-up | For LLP / Start-up |

| Paid-up Capital / Capital Contribution* | On a fully diluted basis in INR | Total Capital contribution in LLP (in INR) |

| Face value of the shares* | Face value of the shares issued | Will be disabled |

| Foreign Portfolio Investment* | Foreign Portfolio Investments made by Foreign Portfolio Investors (FPI) / Non-resident Indian (NRI). Others will include foreign portfolio investments made in the company other than FPI /NRI. |

Will be disabled |

| Foreign Investment in Company/ LLP: Number of Equity Shares / Capital Contributions |

Number of equity shares issued by the company on a fully diluted basis other than Foreign Portfolio Investment and indirect foreign investment | Capital contributions / Profit shares (in INR) |

| Indirect Foreign Investment | Indirect Foreign Investment in the company (in numbers) | Indirect Foreign Investment in LLP (in INR) |

Note: The companies which have already filled in the data in the Entity Master, prior to July 20, 2018, may please check that the values in data fields as being reflected are correct with respect to the value of shares and percentage holding.

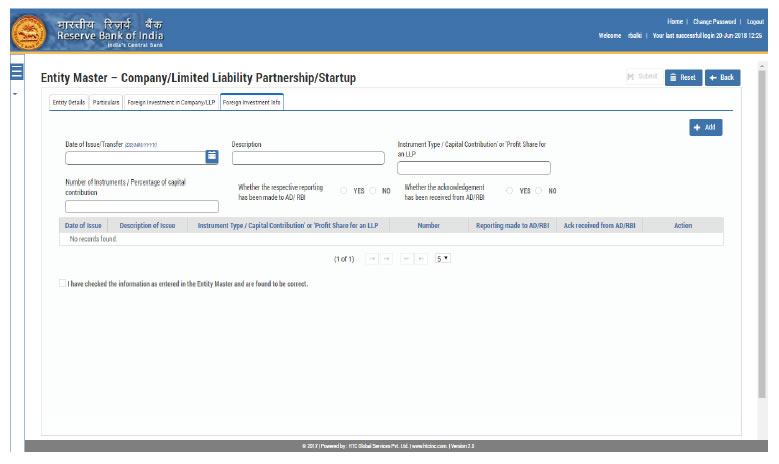

Step 7: Click Foreign Investment Info tab (Following page is displayed):

Enter all Foreign Investment received by the entity since the date of incorporation. (Details of each Issue / transfer (and not investor wise) have to be filled in this page, one after the other i.e. After entering the details of one issue user should click the Add Button (top right corner of the screen) and add the details of the next issue / transfer.)

The fields in the Foreign Investment Info tab are described in the following table.

| Field Name | Requirement |

| Date of Issue / Transfer | Enter date of allotment/transfer in dd/mm/yyyy format |

| Description | Description of the allotment/transfer (whether Rights / Bonus / Share Swap / Merger / Demerger / ESOP/ NR to R transfer/ R to NR transfer etc). |

| Instrument Type / Capital Contribution / or Profit Share for an LLP | In case of Company: Equity Shares, CCPS, CCDs, Share Warrants, Partly Paid up Shares In case of LLP: Capital Contribution or Profit Share In case of start-ups – Convertible Notes |

| Number of Instruments / Percentage of capital contribution | In case of company, number of capital instruments issued to the foreign investors to be provided In case of LLP, percentage of capital contribution received from the foreign entity to be provided. |

(Note: In case a company that has created the entity master, allots shares which are not reported in the Entity Master and reports the same on e-biz, the company has to update the entity master at ‘Foreign Investment in Company / LLP’ and ‘Foreign Investment Info’)

5.4 Declaration

Step 8: After all the issues / transfers have been added, user will have to click the declaration check box to enable submission of the entity master.

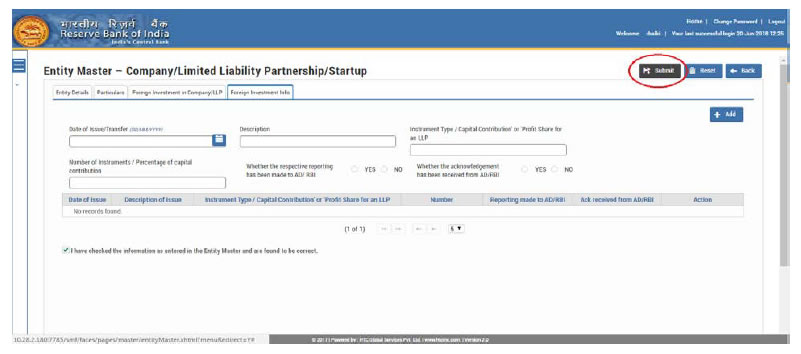

5.5 Submission

Step 9: Only after the declaration is checked, the entity user can submit the details.

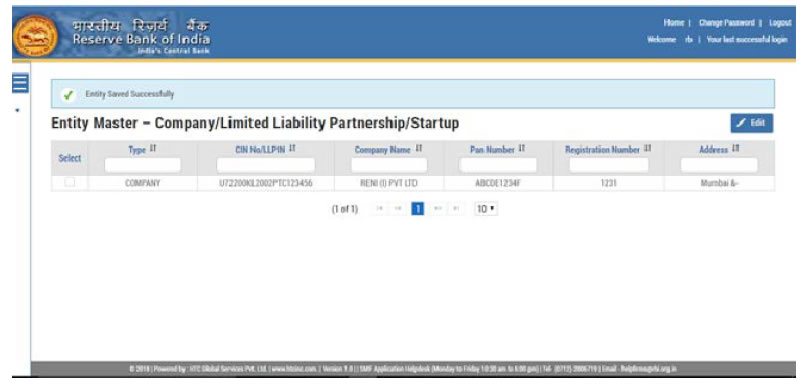

Once the details of the company have been submitted it will be available on the Entity Master page. No email acknowledgement would be sent for the submission in the Entity Master.

6. Important Notes for Entity Master

6.1 All details must be provided in one go.

6.2 Only when all the mandatory fields have been filled, the submit button is enabled.

6.3 The RESET button will reset the complete form.

6.4 Once the details have been submitted the Entity user can modify the details.

6.5 The onus of the integrity of the data entered is on the Entity user.

7. Contact Us

Helpdesk for FIRMS to receive queries from stakeholders regarding entries to be made in FIRMS or to raise any issues encountered while creating/ updating the Entity Master.

FIRMS Helpdesk Team

Telephone Number (+91-22-22601000 - Extn: 2617).

8. Do’s and Don’t’s

| Sr. No. | Do’s |

| 1 | In case of rejection of a registration, use another User Name for fresh registration (other than the one given earlier). |

| 2 | While logging in, manually type the User ID and Password (Kindly do not copy & paste). |

| 3 | In case of account getting locked/blocked send a mail |

| 4 | Authorisation letter should be in prescribed format as given in the User Manual available on RBI website |

| 5 | Nominated person and Authorising person should be different. |

| 6 | Authorisation letter should be dated on or after June 28, 2018. |

| 7 | PAN of the entity user should be filled in the Registration Form |

| 8 | Copy of PAN Card of entity user should be attached |

| 9 | CIN given in the Registration Form and Authorisation letter should be same |

| 10 | Name of Authorised person in Registration form and Authorisation letter should be same. |

| 11 | CIN / LLPIN given in the Registration Form and Authorisation letter should be same. |

| 12 | Authorisation letter should be on Entity’s letter head |

| 13 | Authority letter should be signed by proper Authority as given in the prescribed format |

| 14 | Seal/Stamp of Company/ LLP should be affixed. |

| 15 | Valid data should be entered |

| 16 | Attached pdf should be readable. |

| 17 | Valid e-mail ID should be filled in the Registration Form to ensure receipt of User ID and default Password. |

| 18 | Entity User should provide Specimen signature in the Authorisation letter. |

| Sr. No. | Dont’s |

| 1 | While logging in, do not Copy & Paste the User ID and Password, the same should be typed out. |

| 2 | The authorisation letter cannot be signed by the person nominated by the company. It should be signed by another person from the company as given in prescribed format. |

| 3 | PAN of entity should not be filled in the Entity Registration Form |

| 4 | Copy of PAN Card of entity should not be attached |

| 5 | Invalid data should not be entered |