IST,

IST,

Monetary Policy Statement, 2022-23 Resolution of the Monetary Policy Committee (MPC) June 6-8, 2022

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 8, 2022) decided to:

Consequently, the standing deposit facility (SDF) rate stands adjusted to 4.65 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.15 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below Assessment Global Economy 2. Since the MPC’s meeting in May 2022, the global economy continues to grapple with multi-decadal high inflation and slowing growth, persisting geopolitical tensions and sanctions, elevated prices of crude oil and other commodities and lingering COVID-19 related supply chain bottlenecks. Global financial markets have been roiled by turbulence amidst growing stagflation concerns, leading to a tightening of global financial conditions and risks to the growth outlook and financial stability. Domestic Economy 3. According to the provisional estimates released by the National Statistical Office (NSO) on May 31, 2022, India’s real gross domestic product (GDP) growth in 2021-22 was 8.7 per cent. This works out to 1.5 per cent above the pre-pandemic level (2019-20). In Q4:2021-22, real GDP growth decelerated to 4.1 per cent from 5.4 per cent in Q3, dragged down mainly by weakness in private consumption on the back of the Omicron wave. 4. Available information for April-May 2022 indicates a broadening of the recovery in economic activity. Urban demand is recovering and rural demand is gradually improving. Merchandise exports posted robust double-digit growth for the fifteenth month in a row during May while non-oil non-gold imports continued to expand at a healthy pace, pointing to recovery of domestic demand. 5. Overall system liquidity remains in large surplus, with the average daily absorption under the LAF moderating to ₹5.5 lakh crore during May 4 - May 31 from ₹7.4 lakh crore during April 8 - May 3, 2022 in consonance with the policy of gradual withdrawal of accommodation. Money supply (M3) and bank credit from commercial banks rose (y-o-y) by 8.8 per cent and 12.1 per cent, respectively, as on May 20, 2022. India’s foreign exchange reserves were placed at US$ 601.4 billion as on May 27, 2022. 6. CPI headline inflation rose further from 7.0 per cent in March 2022 to 7.8 per cent in April 2022, reflecting broad-based increase in all its major constituents. Food inflation pressures accentuated, led by cereals, milk, fruits, vegetables, spices and prepared meals. Fuel inflation was driven up by a rise in LPG and kerosene prices. Core inflation (i.e., CPI excluding food and fuel) hardened across almost all components, dominated by the transport and communication sub-group. Outlook 7. The tense global geopolitical situation and the consequent elevated commodity prices impart considerable uncertainty to the domestic inflation outlook. The restrictions on wheat exports should improve the domestic supplies but the shortfall in the rabi production due to the heat wave could be an offsetting risk. The forecast of a normal south-west monsoon augurs well for the kharif agricultural production and the food price outlook. Edible oil prices remain under pressure on adverse global supply conditions, notwithstanding some recent correction due to the lifting of export ban by a major supplier. Consequent to the recent reduction in excise duties, domestic retail prices of petroleum products have moderated. International crude oil prices, however, remain elevated, with risks of further pass-through to domestic pump prices. There are also upside risks from revisions in the prices of electricity. Early results from manufacturing, services and infrastructure sector firms polled in the Reserve Bank’s surveys expect further input and output price pressures going forward. Taking into account these factors, and on the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) of US$ 105 per barrel, inflation is now projected at 6.7 per cent in 2022-23, with Q1 at 7.5 per cent; Q2 at 7.4 per cent; Q3 at 6.2 per cent; and Q4 at 5.8 per cent, with risks evenly balanced (Chart 1). 8. The recovery in domestic economic activity is gathering strength. Rural consumption should benefit from the likely normal south-west monsoon and the expected improvement in agricultural prospects. A rebound in contact-intensive services is likely to bolster urban consumption, going forward. Investment activity is expected to be supported by improving capacity utilisation, the government’s capex push, and strengthening bank credit. Growth of merchandise and services exports is set to sustain the recent buoyancy. Spillovers from prolonged geopolitical tensions, elevated commodity prices, continued supply bottlenecks and tightening global financial conditions nevertheless weigh on the outlook. Taking all these factors into consideration, the real GDP growth projection for 2022-23 is retained at 7.2 per cent, with Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent; and Q4 at 4.0 per cent, with risks broadly balanced (Chart 2).  9. Inflation risks flagged in the April and May resolutions of the MPC have materialised. The projections indicate that inflation is likely to remain above the upper tolerance level of 6 per cent through the first three quarters of 2022-23. Considerable uncertainty surrounds the inflation trajectory due to global growth risks and geopolitical tensions. The supply side measures taken by the government would help to alleviate some cost-push pressures. At the same time, however, the MPC notes that continuing shocks to food inflation could sustain pressures on headline inflation. Persisting inflationary pressures could set in motion second round effects on headline CPI. Hence, there is a need for calibrated monetary policy action to keep inflation expectations anchored and restrain the broadening of price pressures. Accordingly, the MPC decided to increase the policy repo rate by 50 basis points to 4.90 per cent. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 10. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to increase the policy repo rate by 50 basis points to 4.90 per cent. 11. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das unanimously voted to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 12. The minutes of the MPC’s meeting will be published on June 22, 2022. 13. The next meeting of the MPC is scheduled during August 2-4, 2022. (Yogesh Dayal) Press Release: 2022-2023/333 |

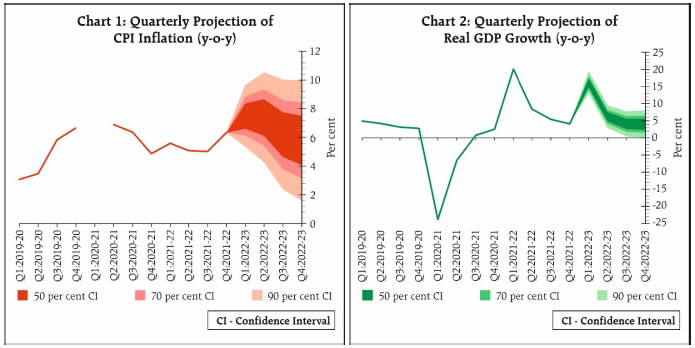

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: