Monetary and liquidity aggregates continued to expand at a strong pace during 2007-08, albeit with some moderation, reflecting large and persistent capital flows. Broad money growth at 20.7 per cent at end-March 2008 was above the indicative trajectory of 17.0-17.5 per cent for 2007-08 set out in the Annual Policy Statement in April 2007. Expansion in bank credit to the commercial sector moderated and remained within the Reserve Bank’s policy projection of 24.0-25.0 per cent (April 2007). Accretion to bank deposits, led by time deposits, remained buoyant. Banks' investments in SLR securities increased in tandem with growth in deposits. As a result, their SLR investments as a proportion of their NDTL remained almost at the same level as at end-March 2007. The Reserve Bank continued to actively manage liquidity during 2007-08 by using all the policy instruments at its disposal including cash reserve ratio (CRR), issuances of securities under the market stabilisation scheme (MSS), operations under the liquidity adjustment facility (LAF) and conduct of open market operations (OMO).

Monetary Survey

Broad money (M3) growth, on a year-on-year (y-o-y) basis, was at 20.7 per cent as at end-March 2008 lower than 21.5 per cent a year ago, reflecting some deceleration in time deposits. Broad money growth, nevertheless, was strong with expansion in aggregate deposits, y-o-y, remaining higher than the projected aggregates of Rs. 4,90,000 crore for 2007-08 set out in the Annual Policy Statement (April 2007). The primary source of monetary expansion continued to be the accretion to net foreign exchange assets, while bank credit to the commercial sector moderated. Expansion in the residency-based new monetary aggregate (NM3) – which does not directly reckon non-resident foreign currency deposits such as FCNR(B) deposits – was marginally higher at 21.2 per cent at end-March 2008 than 21.0 per cent a year ago. Growth in liquidity aggregate, L1, at 20.4 per cent at end-March 2008 was marginally lower than that of 20.6 per cent a year ago (Table 25 and Chart 11).

Taking into consideration the evolving monetary and liquidity conditions, while the focus of the Reserve Bank’s operations was generally on managing excess capital flows through various instruments at its disposal, it remained vigilant to the evolving situation. The CRR was raised by 150 basis points in three phases (April, August and November 2007) during 2007-08. The estimated amount of liquidity impounded in the first round on account of increase in CRR during 2007-08 was Rs.47,000 crore1. The ceiling on the outstanding amount under the MSS for the year 2007-08 was also successively raised on four occasions (April, August, October and November 2007) to Rs. 2,50,000 crore

Table 25: Monetary Indicators |

(Amount in Rupees crore) |

Item |

Outstanding as on |

Variation |

|

March 31, |

March 31, 2007 |

March 31, 2008 |

|

2008 |

Absolute |

Per cent |

Absolute |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

I. |

Reserve Money |

9,28,317 |

1,35,935 |

23.7 |

2,19,326 |

30.9 |

II. |

Narrow Money (M1) |

11,43,640 |

139,714 |

16.9 |

1,77,550 |

18.4 |

|

|

|

|

|

|

|

III. |

Broad Money (M3) |

40,02,189 |

5,86,548 |

21.5 |

6,86,096 |

20.7 |

|

a) |

Currency with the Public |

5,67,746 |

69,786 |

16.9 |

84,840 |

17.6 |

|

b) |

Aggregate Deposits |

34,25,379 |

5,16,134 |

22.3 |

5,99,687 |

21.2 |

|

|

i) |

Demand Deposits |

5,66,829 |

69,300 |

17.1 |

91,142 |

19.2 |

|

|

ii) |

Time Deposits |

28,58,550 |

4,46,834 |

23.5 |

5,08,546 |

21.6 |

|

|

of which: Non-Resident |

|

|

|

|

|

|

|

Foreign Currency Deposits |

56,564 |

8,185 |

13.8 |

-10,897 |

-16.2 |

IV. |

|

NM3 |

|

40,27,891 |

5,77,013 |

21.0 |

7,03,293 |

21.2 |

|

of which: Call Term Funding from FIs |

1,05,857 |

2,692 |

3.2 |

20,021 |

23.3 |

V. |

a) |

L1 |

|

41,42,470 |

5,88,644 |

20.6 |

7,02,323 |

20.4 |

|

|

of which: Postal Deposits |

1,14,579 |

11,631 |

11.2 |

-970 |

-0.8 |

|

b) |

L2 |

|

41,45,402 |

5,88,644 |

20.6 |

7,02,323 |

20.4 |

|

c) |

L3 |

|

41,71,370 |

5,90,718 |

20.5 |

7,03,594 |

20.3 |

VI. |

Major Sources of Broad Money |

|

|

|

|

|

|

a) |

Net Bank Credit to the Government (i+ii) |

9,04,927 |

70,969 |

9.3 |

67,363 |

8.0 |

|

|

i) |

Net Reserve Bank Credit to Government |

-1,10,223 |

-2,384 |

- |

-1,15,975 |

- |

|

|

of which: to the Centre |

-1,10,353 |

-3,024 |

- |

-1,12,489 |

- |

|

|

ii) |

Other Banks' Credit to Government |

10,15,150 |

73,353 |

9.7 |

1,83,338 |

22.0 |

|

b) |

Bank Credit to Commercial Sector |

25,62,652 |

4,37,074 |

25.8 |

4,32,574 |

20.3 |

|

c) |

Net Foreign Exchange Assets |

12,66,297 |

1,86,985 |

25.7 |

3,53,118 |

38.7 |

|

d) |

Government Currency Liability to Public |

9,228 |

-493 |

-5.6 |

968 |

11.7 |

|

e) |

Net Non-Monetary Liabilities of the |

|

|

|

|

|

|

|

Banking Sector |

7,40,915 |

1,07,987 |

23.2 |

1,67,926 |

29.3 |

Memo : |

Aggregate Deposits of SCBs |

31,92,141 |

5,02,885 |

23.8 |

5,80,208 |

22.2 |

Non-food Credit of SCBs |

23,04,094 |

4,18,282 |

28.5 |

4,19,425 |

22.3 |

SCBs: Scheduled Commercial Banks.

FIs: Financial Institutions.

NBFCs: Non-Banking Financial Companies.

NM 3 is the residency-based broad money aggregate and L1, L2 and L3 are liquidity aggregates compiled on the recommendations of the Working Group on Money Supply (Chairman: Dr. Y.V. Reddy, 1998).

L1 = NM3+ Select deposits with the post office saving banks.

L2= L1 +Term deposits with term lending institutions and refinancing institutions +

Term borrowing by Fis + Certificates of deposit issued by FIs..

L3= L2 + Public deposits of NBFCs

Note :

1. Data are provisional. Wherever data are not available the estimates for the last available month have been repeated.

2. Data for postal deposits pertain to February 2008.

3. Government Balances as on March 31, 2008 are before closure of accounts. |

from the initial limit of Rs.80,000 crore. In view of the prevailing liquidity conditions, the Reserve Bank during 2008-09 so far increased CRR by 50 basis points to 8.0 per cent in two stages, 25 basis points in each stage, effective from the fortnight beginning April 26, 2008 and May 10, 2008, respectively. As a result of the above hike in CRR, an amount of about Rs. 18,500 crore of resources of banks is likely to be absorbed.

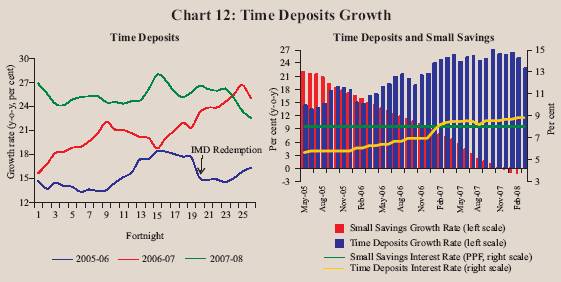

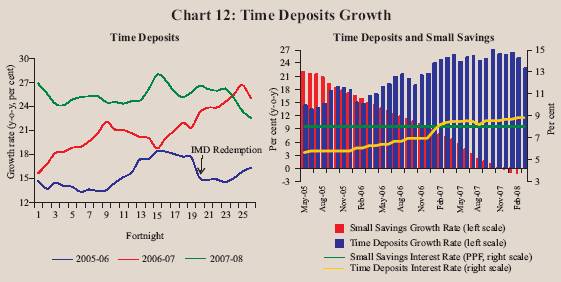

Expansion in currency with the public was of a lower order throughout 2007-08, except in November 2007, when it increased sharply on account of festive season currency demand. Currency with the public increased by 17.6 per cent, y-o-y, as at end-March 2008, marginally higher than the growth of 16.9 per cent a year ago. Growth in demand deposits, y-o-y, as at end-March, 2008 was higher at 19.2 per cent than 17.1 per cent a year ago. Demand deposits, after remaining subdued for most part of the year, expanded during the brief period of January and beginning of February 2008, mainly reflecting developments in the equity market. Accordingly, growth in narrow money (M1), y-o-y, was higher at 18.4 per cent at end-March 2008 higher than 16.9 per cent recorded a year ago. The buoyancy in time deposits continued in 2007-08, although some moderation was observed during the last quarter of 2007-08. Growth in time deposits was 21.6 per cent, y-o-y, as at end-March 2008 as compared with 23.5 per cent a year ago (Table 26). The strong growth in time deposits could be attributed, inter alia, to robust economic activity, higher interest rates on bank deposits relative to postal deposits and extension of tax benefits under Section 80C for bank deposits. During 2007-08 accretion to postal deposits decelerated significantly up to November 2007 and started depleting thereafter (Chart 12). In order to revive interest in postal deposits, the Government of India had announced in December 2007 some incentives, including tax benefits for certain postal deposits.

Table 26: Monetary Aggregates - Variations |

(Rupees Crore) |

Item |

|

|

2007-08 |

|

2006-07 |

2007-08 |

Q1 |

Q2 |

Q3 |

Q4 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

M 3(1+2+3 = 4+5+6+7-8) |

5,86,548 |

6,86,096 |

73,824 |

1,93,671 |

1,15,159 |

3,03,443 |

|

(21.5) |

(20.7) |

|

|

|

|

Components |

|

|

|

|

|

|

1 |

Currency with the Public |

69,786 |

84,840 |

18,237 |

-14,478 |

47,731 |

33,350 |

|

|

(16.9) |

(17.6) |

|

|

|

|

2 |

Aggregates Deposits with Banks |

5,16,134 |

5,99,687 |

56,023 |

2,09,628 |

68,233 |

2,65,804 |

|

|

(22.3) |

(21.2) |

|

|

|

|

|

2.1 Demand Deposits with Banks |

69,300 |

91,142 |

-44,030 |

58,308 |

-6,809 |

83,673 |

|

|

(17.1) |

(19.2) |

|

|

|

|

|

2.2 Time Deposits with Banks |

4,46,834 |

5,08,546 |

1,00,053 |

1,51,320 |

75,042 |

1,82,131 |

|

|

(23.5) |

(21.6) |

|

|

|

|

3 |

'Other' Deposits with Banks |

628 |

1,568 |

-436 |

-1,479 |

-805 |

4,289 |

|

Sources |

|

|

|

|

|

|

4 |

Net Bank Credit to Government |

70,969 |

67,363 |

24,787 |

17,137 |

-37,057 |

62,495 |

|

|

(9.3) |

(8.0) |

|

|

|

|

|

4.1 RBI’s Net Credit to Government |

-2,384 |

-1,15,975 |

-25,483 |

-54,695 |

-65,787 |

29,990 |

|

4.1.1 RBI’s Net Credit to Centre |

-3,024 |

-1,12,489 |

-21,825 |

-55,588 |

-65,078 |

30,002 |

|

4.2 Other Banks' Credit to Government |

73,353 |

1,83,338 |

50,270 |

71,832 |

28,730 |

32,505 |

5 |

Bank Credit to Commercial Sector |

4,37,074 |

4,32,574 |

-30,547 |

1,38,692 |

89,513 |

2,34,916 |

|

|

(25.8) |

(20.3) |

|

|

|

|

6 |

NFEA of Banking Sector |

1,86,985 |

3,53,118 |

-17,945 |

1,18,249 |

94,204 |

1,58,610 |

|

6.1 NFEA of RBI |

1,93,170 |

3,69,977 |

-2,745 |

1,19,430 |

94,681 |

1,58,610 |

7 |

Government’s Currency Liabilities |

|

|

|

|

|

|

|

to the Public |

-493 |

968 |

166 |

354 |

312 |

136 |

8 |

Net Non-Monetary Liabilities of the |

|

|

|

|

|

|

|

Banking Sector |

1,07,987 |

1,67,926 |

-97,362 |

80,760 |

31,814 |

1,52,714 |

Memo: |

|

|

|

|

|

|

1 |

Non-resident Foreign Currency Deposits |

|

|

|

|

|

|

|

with SCBs |

8,185 |

-10,897 |

-4,202 |

-1,181 |

-3,490 |

-2,025 |

2 |

SCB' Call Term Borrowing from |

|

|

|

|

|

|

|

Financial Institutions |

2,692 |

20,021 |

-2,984 |

5,756 |

7,441 |

9,808 |

3 |

Overseas Borrowing by SCBs |

2,071 |

13,644 |

-6,928 |

7,830 |

1,734 |

11,008 |

SCBs: Scheduled Commercial Banks.

NFEA: Net Foreign Exchange Assets.

Note:

1. Figures in parentheses are percentage variations.

2. Government Balances as on March 31, 2008 are before closure of accounts. |

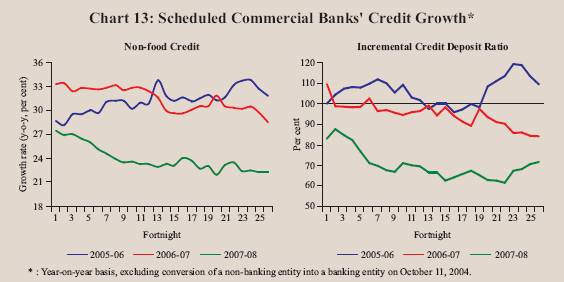

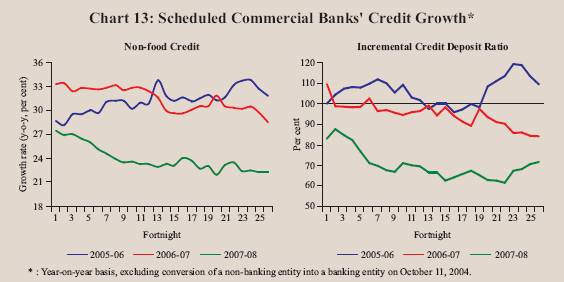

Expansion in the bank credit to the commercial sector moderated during 2007-08 and remained within the Reserve Bank’s policy projection in April 2007, after a strong pace of credit expansion for three consecutive years. Non-food credit by scheduled commercial banks (SCBs) expanded by 22.3 per cent, y-o-y, as at end-March 2008 as compared with 28.5 per cent a year ago. The deceleration in credit growth relative to the acceleration in deposit growth led to a decline in the incremental credit-deposit ratio, y-o-y, of SCBs to 71.9 per cent as at end-March 2008 from 84.3 per cent a year ago (Chart 13).

Disaggregated sectoral data available up to February 15, 2008 showed that about 45 per cent of incremental non-food credit, y-o-y, was absorbed by industry, compared with 36 per cent in the corresponding period of the previous year. The expansion of incremental non-food credit to industry during this period was led by infrastructure (power, port and telecommunication), textile, food processing, iron and steel, engineering, chemicals, vehicles, construction and

petroleum industries. The infrastructure sector alone accounted for around 33 per cent of the incremental credit to industry as compared with 21 per cent in the corresponding period of the previous year. The agricultural sector absorbed around 9 per cent of the incremental non-food bank credit expansion as compared with 12 per cent in the corresponding period of the previous year. Personal loans accounted for 16 per cent of incremental non-food credit; within personal loans, the share of incremental housing loans was at 46 per cent. Growth in loans to commercial real estate remained high, notwithstanding some moderation (Table 27).

Table 27: Non-food Bank Credit - Sectoral Deployment |

(Amount in Rupees Crore) |

Sector/Industry |

Outstanding as on |

Year-on-Year Variations |

|

February |

February 16, 2007 |

February 15, 2008 |

|

15, 2008 |

Absolute |

Per cent |

Absolute |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

Non-food Gross Bank Credit

(1 to 4) |

20,60,131 |

3,90,095 |

30.1 |

3,71,053 |

22.0 |

1. |

Agriculture and Allied Activities |

2,41,802 |

46,212 |

28.6 |

34,013 |

16.4 |

2. |

Industry (Small, Medium and Large) |

8,14,976 |

1,41,459 |

28.0 |

1,67,819 |

25.9 |

|

Small Scale Industries |

1,41,283 |

21,052 |

24.9 |

35,553 |

33.6 |

3. |

Personal Loans |

5,03,728 |

1,04,225 |

30.6 |

58,669 |

13.2 |

|

Housing |

2,51,688 |

46,019 |

25.8 |

26,930 |

12.0 |

|

Advances against Fixed Deposits |

42,671 |

3,018 |

8.9 |

5,773 |

15.6 |

|

Credit Cards |

19,344 |

4,003 |

45.3 |

6,502 |

50.6 |

|

Education |

20,471 |

5,170 |

55.3 |

5,938 |

40.9 |

|

Consumer Durables |

9,368 |

1,720 |

24.2 |

525 |

5.9 |

4. |

Services |

4,99,625 |

98,198 |

33.9 |

1,10,553 |

28.4 |

|

Transport Operators |

31,984 |

7,521 |

50.9 |

9,669 |

43.3 |

|

Professional & Other Services |

26,689 |

7,154 |

50.1 |

5,188 |

24.1 |

|

Trade |

1,18,892 |

23,719 |

30.9 |

17,731 |

17.5 |

|

Real Estate Loans |

53,897 |

18,770 |

79.0 |

11,361 |

26.7 |

|

Non-Banking Financial Companies |

64,106 |

12,021 |

39.2 |

20,979 |

48.6 |

Memo : |

|

|

|

|

|

Priority Sector |

6,85,567 |

1,09,094 |

22.9 |

99,277 |

16.9 |

Industry (Small, Medium and Large) |

8,14,976 |

1,41,459 |

28.0 |

1,67,819 |

25.9 |

Food Processing |

48,290 |

7,904 |

27.6 |

11,720 |

32.0 |

Textiles |

90,261 |

19,191 |

35.5 |

16,862 |

23.0 |

Paper & Paper Products |

13,190 |

1,650 |

18.2 |

2,470 |

23.0 |

Petroleum, Coal Products & Nuclear Fuels |

39,291 |

12,489 |

64.4 |

7,412 |

23.3 |

Chemicals and Chemical Products |

60,892 |

8,610 |

19.2 |

7,437 |

13.9 |

Rubber, Plastic & their Products |

9,788 |

1,988 |

31.0 |

1,355 |

16.1 |

Iron and Steel |

72,290 |

14,609 |

31.8 |

11,661 |

19.2 |

Other Metal & Metal Products |

23,302 |

5,459 |

38.5 |

3,634 |

18.5 |

Engineering |

51,203 |

6,198 |

18.1 |

10,623 |

26.2 |

Vehicles, Vehicle Parts and Transport Equipments |

26,437 |

2,028 |

11.9 |

7,337 |

38.4 |

Gems & Jewellery |

24,353 |

2,619 |

13.3 |

2,073 |

9.3 |

Construction |

23,418 |

6,132 |

52.6 |

5,856 |

33.3 |

Infrastructure |

1,88,171 |

29,033 |

28.2 |

55,716 |

42.1 |

Note : Data are provisional and relate to select scheduled commercial banks. |

In addition to bank credit for financing their requirements, the corporate sector continued to rely on a variety of non-bank sources of funds such as capital markets, external commercial borrowings and internal generation of funds. Resources raised through domestic equity issuances during 2007-08 (Rs.48,153 crore) were 68 per cent higher than a year ago. Net mobilisation through external commercial borrowings (ECBs) during April-December of 2007-08 increased by 54 per cent over the corresponding period of the previous year. Mobilisation through issuances of commercial paper (CPs) during 2007-08 was nearly three times the issuances during the previous year. Internal generation of funds continued to provide a strong support to the funding requirements of the corporate sector, despite the profits after tax of select non-financial non-government companies during April-December of 2007-08 witnessing some deceleration as compared with the corresponding period of the previous year (see Table 12). Resources raised in the form of equity issuances through American depository receipts (ADRs) and global depository receipts (GDRs) during 2007-08 (Rs.13,023 crore) were lower by nearly 20 per cent than a year ago (Table 28).

Table 28: Select Sources of Funds to Industry |

(Rupees Crore) |

Item |

2006-07 |

2007-08 |

2007-08 |

|

|

|

Q1 |

Q2 |

Q3 |

Q4 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

A. |

Bank Credit to Industry # |

1,41,543 |

85,166 * |

-15,603 |

59,776 |

40,993 |

32,476^ |

|

|

|

|

(46,566) * |

|

|

|

|

|

B. |

Flow from Non-banks to Corporates |

|

|

|

|

|

|

|

1 |

Capital Issues (i+ii) |

29,178 |

51,479 |

13,788 |

6,226 |

14,400 |

17,065 |

|

|

i) |

Non-Government Public Ltd. |

|

|

|

|

|

|

|

|

|

Companies (a+b) |

29,178 |

48,962 |

13,261 |

4,236 |

14,400 |

17,065 |

|

|

|

a) Bonds/Debentures |

585 |

809 |

0 |

0 |

0 |

809 |

|

|

|

b) Shares |

28,593 |

48,153 |

13,261 |

4,236 |

14,400 |

16,256 |

|

|

|

|

|

|

|

|

|

|

|

|

ii) PSUs and Government Companies |

0 |

2,517 |

527 |

1,990 |

0 |

0 |

|

2 |

ADR/GDR Issues |

16,184 |

13,023 |

1,251 |

9,899 |

289 |

1,584 |

|

|

|

|

|

|

|

|

|

|

|

3 |

External Commercial Borrowings (ECBs) |

1,04,046 |

1,09,592 * |

35,808 |

36,168 |

37,616 |

– |

|

|

|

|

( 70,966) * |

|

|

|

|

|

|

4 |

Issue of CPs |

4,970 |

14,904 |

8,568 |

7,358 |

6,629 |

-7.651 |

C. |

Depreciation Provision + |

37,095 |

29,604 * |

10,173 |

10,576 |

10,961 |

– |

|

|

|

|

(24,392) * |

|

|

|

|

|

D. |

Profits after Tax + |

1,11,107 |

99,272 * |

32,699 |

34,266 |

37,470 |

– |

|

|

|

|

(75,036) * |

|

|

|

|

|

– : Not Available. * : April-December. ^ : up to February 15, 2008.

# : Data pertain to select scheduled commercial banks.

+ : Data are based on abridged results of select non-financial non-Government companies. The quarterly data may not add up to annual data due to differences in the number and composition of companies covered in each period (see Chapter 1).

Note :

1. Data are provisional.

2. Data on capital issues pertain to gross issuances excluding issues by banks and financial institutions

and are not adjusted for banks' investments in capital issues, which are not expected to be significant.

3. Data on ADR/GDR issues exclude issuances by banks and financial institutions.

4. Data on external commercial borrowings include short-term credit. |

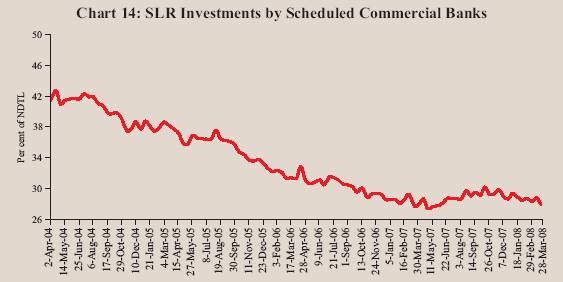

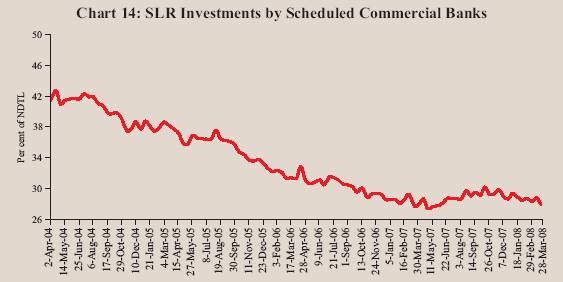

Scheduled commercial banks' investment in Government and other approved securities expanded during 2007-08, mainly reflecting the need to maintain SLR requirements in consonance with the increase in their net demand and time liabilities. Investment in SLR securities by SCBs increased by 22.9 per cent, y-o-y, as at end-March 2008 as compared with 10.3 per cent a year ago (Table 29). Commercial banks' holdings of such securities at end-March 2008 remained at 27.9 per cent of their NDTL almost the same as at end-March 2007 (Chart 14). Excess SLR investments of SCBs, thus, increased to Rs.1,02,422 crore as at end-March 2008 from Rs.81,484 crore at end-March 2007. Investment by SCBs in non-SLR securities increased substantially during the year. Banks' overseas foreign currency borrowings accelerated. They also drew down their holdings of foreign currency assets.

Table 29: Scheduled Commercial Bank’s Survey |

(Amount in Rupees Crore) |

Item |

|

Variation (Year-on-Year) |

|

Outstanding

as on March |

As on Mar 30, 2007 |

As on Mar 28, 2008 |

|

28, 2008 |

Amount |

Per Cent |

Amount |

Per Cent |

1 |

2 |

3 |

4 |

5 |

6 |

Sources of Funds |

|

|

|

|

|

1. |

Aggregate Deposits |

31,92,141 |

5,02,885 |

23.8 |

5,80,208 |

22.2 |

2. |

Call/Term Funding from Financial |

|

|

|

|

|

|

Institutions |

1,05,857 |

2,692 |

3.2 |

20,021 |

23.3 |

3. |

Overseas Foreign Currency |

|

|

|

|

|

|

Borrowings |

45,549 |

2,071 |

6.9 |

13,644 |

42.8 |

4. |

Capital |

43,598 |

1,461 |

4.5 |

9,523 |

27.9 |

5. |

Reserves |

2,26,068 |

23,613 |

16.3 |

57,343 |

34.0 |

Uses of Funds |

|

|

|

|

|

1. |

Bank Credit |

23,48,493 |

4,24,112 |

28.1 |

4,17,304 |

21.6 |

|

of which: Non-food Credit |

23,04,094 |

4,18,282 |

28.5 |

4,19,425 |

22.3 |

2. |

Investments in Government and |

|

|

|

|

|

|

Other Approved Securities* |

9,72,738 |

74,062 |

10.3 |

1,81,222 |

22.9 |

a) |

Investments in Government Securities |

9,53,525 |

75,316 |

10.7 |

1,77,467 |

22.9 |

b) |

Investments in Other Approved

Securities |

19,213 |

-1,255 |

-7.5 |

3,755 |

24.3 |

3. |

Investments in non-SLR Securities |

1,68,526 |

5,114 |

3.8 |

28,071 |

20.0 |

4. |

Foreign Currency Assets |

30,884 |

15,260 |

35.1 |

-27,869 |

-47.4 |

5. |

Balances with the RBI |

2,57,122 |

53,161 |

41.8 |

76,900 |

42.7 |

* : Refers to investment in SLR securities as notified in the Reserve Bank

notification DBOD No. Ref. BC. 61/ 12.02.001/2007-08 dated February 13, 2008.

Note: Data are provisional. |

Reserve Money Survey

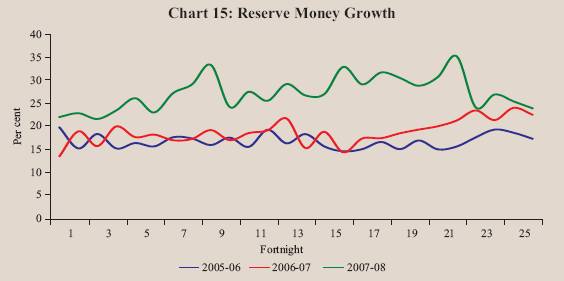

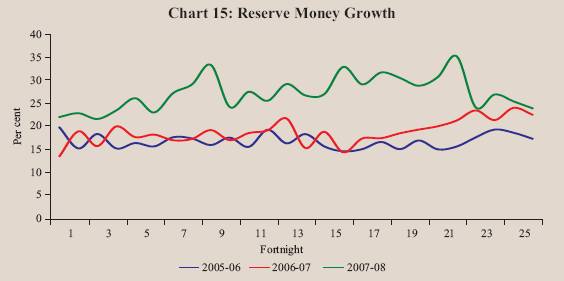

Expansion in reserve money as on March 28, 2008, y-o-y, was 23.8 per cent higher than 22.5 per cent a year ago (Chart 15). Reserve money growth was higher at 30.9 per cent, y-o-y, as on March 31, 2008 than 23.7 per cent a year ago mainly due to Reserve Bank’s injection of liquidity through LAF, reflecting the year-end liquidity requirements of the banks. Adjusted for the first round effect of the hike in CRR, reserve money growth at 25.3 per cent was higher than 18.9 per cent a year ago. Intra-year movements in reserve money largely reflected the Reserve Bank’s market operations and movements in bankers' deposits with

the Reserve Bank in the wake of hikes in the CRR and large expansion in demand and time liabilities. Bankers' deposits with the Reserve Bank expanded by 66.5 per cent during 2007-08 as compared with 45.6 per cent during 2006-07. Growth in currency in circulation at 17.2 per cent during 2007-08 was marginally higher than 17.1 per cent a year ago (Table 30).

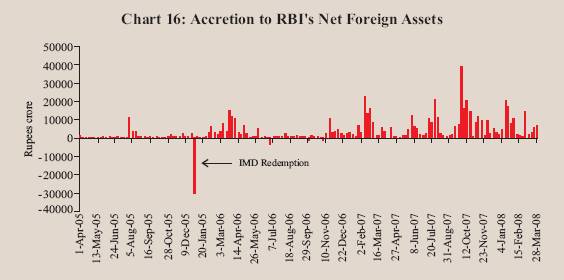

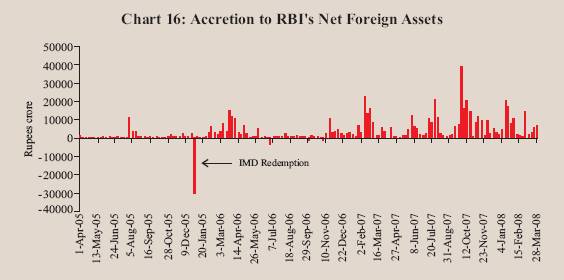

On the sources side, reserve money continued to be driven by Reserve Bank’s foreign currency assets (adjusted for revaluation), increasing by Rs.3,70,550 crore during 2007-08 as compared with Rs.1,64,601 crore during the previous year (Chart 16).

Table 30 : Reserve Money - Variations |

(Amount in Rupees Crore) |

Item |

Outstanding as on |

2006-07 |

2007-08 |

2007-08 |

|

March31, 2008 |

|

|

Q1 |

Q2 |

Q3 |

Q4 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Reserve Money |

9,28,317 |

1,35,935 |

2,19,326 |

11,630 |

60,688 |

26,607 |

1,20,402 |

Components (1+2+3) |

|

(23.7) |

(30.9) |

|

|

|

|

1. |

Currency in Circulation |

5,90,805 |

73,523 |

86,606 |

16,866 |

-13,297 |

46,781 |

36,256 |

|

|

|

(17.1) |

(17.2) |

|

|

|

|

2. |

Bankers' Deposits with RBI |

3,28,447 |

61,784 |

1,31,152 |

-4,800 |

75,464 |

-19,369 |

79,857 |

|

|

|

(45.6) |

(66.5) |

|

|

|

|

3. |

'Other' Deposits with the RBI |

9,065 |

628 |

1,568 |

-436 |

-1,479 |

-805 |

4,289 |

|

|

|

(9.1) |

(20.9) |

|

|

|

|

Sources (1+2+3+4-5) |

|

|

|

|

|

|

|

1. |

RBI’s net Credit to Government |

-1,10,223 |

-2,384 |

-1,15,975 |

-25,483 |

-54,695 |

-65,787 |

29,990 |

|

of which: to Centre (i+ii+iii+iv-v) |

-1,10,353 |

-3,024 |

-1,12,489 |

-21,825 |

-55,588 |

-65,078 |

30,002 |

|

i. Loans and Advances |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

ii. Treasury Bills held by the RBI |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

iii. RBI’s Holdings of

Dated |

|

|

|

|

|

|

|

|

Securities |

1,14,593 |

26,763 |

17,421 |

-34,284 |

4,019 |

20,874 |

26,812 |

|

iv. RBI’s Holdings of Rupee coins |

132 |

-143 |

121 |

128 |

20 |

3 |

-31 |

|

v. Central Government Deposits |

2,25,079 |

29,644 |

1,30,031 |

-12,330 |

59,627 |

85,956 |

-3,221 |

2. |

RBI’s Credit to Banks and |

|

|

|

|

|

|

|

|

Commercial Sector |

6,378 |

1,990 |

-2,794 |

-6,450 |

-1,256 |

848 |

4,064 |

3. |

NFEA of RBI |

12,36,130 |

1,93,170 |

3,69,977 |

-2,745 |

1,19,430 |

94,681 |

1,58,610 |

|

|

|

(28.7) |

(42.7) |

|

|

|

|

|

of which : FCA, adjusted for revaluation |

|

1,64,601 |

3,70,550 |

47,728 |

1,18,074 |

1,00,888 |

1,03,860 |

4. |

Governments' Currency Liabilities |

|

|

|

|

|

|

|

|

to the Public |

9,228 |

-493 |

968 |

166 |

354 |

312 |

136 |

5. |

Net Non-Monetary Liabilities of RBI |

2,13,197 |

56,347 |

32,849 |

-46,142 |

3,145 |

3,447 |

72,398 |

Memo: |

|

|

|

|

|

|

|

LAF- Repos (+) / Reverse Repos (-) |

50,350 |

36,435 |

21,165 |

-32,182 |

9,067 |

16,300 |

27,980 |

Net Open Market Sales # * |

|

5,125 |

-5,923 |

1,246 |

1,560 |

-3,919 |

-4,810 |

Centre’s Surplus |

76,686 |

1,164 |

26,594 |

-34,597 |

15,376 |

54,765 |

-8,950 |

Mobilisation under MSS |

1,68,392 |

33,912 |

1,05,419 |

19,643 |

48,855 |

31,192 |

5,728 |

Net Purchases(+)/Sales(-) from |

|

|

|

|

|

|

|

Authorised Dealers |

|

1,18,994 |

3,00,875 ^ |

38,873 |

1,01,814 |

87,596 |

72,592 ^ |

NFEA/Reserve Money @ |

133.2 |

122.2 |

133.2 |

119.8 |

125.8 |

133.4 |

133.2 |

NFEA/Currency @ |

209.2 |

171.8 |

209.2 |

165.7 |

193.6 |

194.3 |

209.2 |

NFEA : Net Foreign Exchange Assets.

FCA : Foreign Currency Assets.

LAF : Liquidity Adjustment Facility.

* : At face value.

# : Excludes Treasury Bills @ : Per cent, end of period.

^ : up to end-February 2008

Note:

1. Data are based on March 31 for Q4 and last reporting Friday for all other quarters.

2. Figures in parentheses are percentage variations during the fiscal year.

3. Government Balances as on March 31, 2008 are before closure of accounts. |

Movements in the Reserve Bank’s net credit to the Central Government during 2007-08 largely reflected the liquidity management operations by the Reserve Bank and movements in Government deposits with the Reserve Bank. The sterilisation operations of the Reserve Bank under the MSS led to an increase in Central Government deposits with the Reserve Bank. Surplus cash balances of the Central Government with the Reserve Bank also increased. Reserve Bank’s holdings of Central Government dated securities increased on account of injection of liquidity under LAF. Reflecting the net impact of these developments, the Reserve Bank’s net credit to the Centre declined by Rs.1,12,489 crore during 2007-08 as compared with the decline of Rs. 3,024 crore during 2006-07.

Liquidity Management

The Reserve Bank continued with its policy of active management of liquidity during 2007-08 through appropriate use of the CRR and open market operations (OMO), including MSS and LAF and other policy instruments at its disposal flexibly. The objective was to maintain appropriate liquidity in the system such that all legitimate requirements of credit were met, consistent with the objective of price and financial stability. The liquidity management operations during 2007-08 had to contend with greater variations in market liquidity, on account of variations in cash balances of the Central Government and capital flows.

In the first quarter of 2007-08, liquidity conditions remained largely easy with transient periods of tightness (Table 31). Liquidity was modulated mainly through increase in CRR by 50 basis points in April 2007 and issuances of government securities under the MSS as and when required, as the liquidity absorption through reverse repos was capped at Rs.3,000 crore under the modified arrangement of LAF. The annual ceiling of MSS outstandings for 2007-08 was raised to Rs.1,10,000 crore on April 27, 2007 from Rs.80,000 crore (Chart 17). The Reserve Bank injected liquidity through LAF during the brief period of liquidity tightness from June 28-July 2, 2007.

In the second quarter, with the withdrawal of the ceiling on daily reverse repos under the LAF with effect from August 6, 2007, the sustained capital flows and the decline in Central Government balances were reflected in the Reserve Bank’s absorption of large liquidity through reverse repos under LAF in addition to sizeable absorptions under the MSS. In view of the large and continuous capital flows, the ceiling of the MSS was again raised to Rs.1,50,000 crore in August 2007. The cumulative impact of the hike in the CRR by 50 basis points to 7.0 per cent in August 2007 and also market operations under the MSS moderated the daily absorption through reverse repos towards the close of the quarter. On account of quarterly advance tax outflow in mid-September, some tightness was observed during the end of the quarter and accordingly the Reserve Bank injected liquidity on two occasions through LAF.

Table 31: Reserve Bank’s Liquidity Management Operations |

(Amount in Rupees Crore) |

|

Variation |

Item |

2006-07 |

2007-08 |

2007-08 |

|

(April

-March) |

(April -

February) |

Q1 |

Q2 |

Q3 |

Jan |

Feb |

March |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

A. |

Drivers of Liquidity (1+2+3+4+5) |

62,278 |

2,11,440 |

51,146 |

1,10,891 |

-1,702 |

38,154 |

12,950 |

- |

1. |

RBI’s net Purchases from |

|

|

|

|

|

|

|

|

|

Authorised Dealers |

1,18,994 |

3,00,875 |

39,791 |

1,00,896 |

88,545 |

47,554 |

24,089 |

- |

2. |

Currency with the Public |

-69,786 |

-71,353 |

-12,946 |

9,187 |

-47,139 |

-7,220 |

-13,233 |

-13,488 |

3. |

Surplus Cash Balances of |

|

|

|

|

|

|

|

|

|

the Centre with the |

|

|

|

|

|

|

|

|

|

Reserve Bank |

-1,164 |

-18,546 |

49,992 |

-30,771 |

-49,820 |

9,934 |

2,119 |

-8,048 |

4. |

WMA and OD |

0 |

0 |

15,159 |

-15,159 |

0 |

0 |

0 |

0 |

5. |

Others (residual) |

14,234 |

463 |

-40,850 |

46,739 |

6,712 |

-12,114 |

-24 |

- |

B. |

Management of Liquidity (6+7+8+9) |

-24,257 |

-1,85,361 |

-53,943 |

-68,621 |

-11,189 |

-39,112 |

-12,790 |

67,912 |

6. |

Liquidity impact of LAF Repos |

36,435 |

-37,270 |

-20,290 |

-2,825 |

27,795 |

-34,850 |

-7,100 |

58,435 |

7. |

Liquidity impact of OMO (Net) * |

720 |

10,730 |

10 |

40 |

5,260 |

2,760 |

2,660 |

2,780 |

8. |

Liquidity impact of MSS |

-33,912 |

-1,12,115 |

-18,163 |

-50,336 |

-28,244 |

-7,022 |

-8,350 |

6,697 |

9. |

First round liquidity impact due to |

|

|

|

|

|

|

|

|

|

CRR change |

-27,500 |

-47,000 |

-15,500 |

-15,500 |

-16,000 |

0 |

0 |

0 |

C. |

Bank Reserves (A+B) # |

38,021 |

25,785 |

-2,797 |

42,270 |

-12,891 |

-958 |

160 |

60,133 |

- : Not Avaliable WMA : Ways and means advances OD: Overdraft

(+) : Indicates injection of liquidity into the banking system.

(-): Indicates absorption of liquidity from the banking system.

# : Includes vault cash with banks and adjusted for first round liquidity impact due to CRR change.

* : Adjusted for Consolidated Sinking Funds (CSF) and including private placement.

@ : Excludes minimum cash balances with the Reserve Bank in case of surplus.

Note : For end-March, data pertain to March 31; for all other months data pertain to last Friday. |

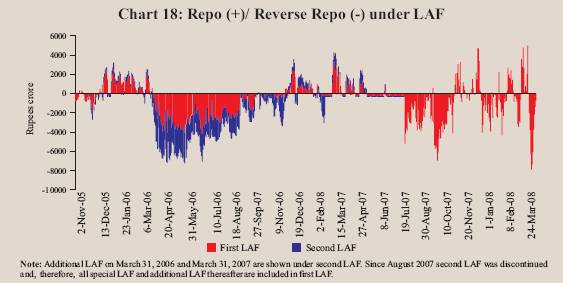

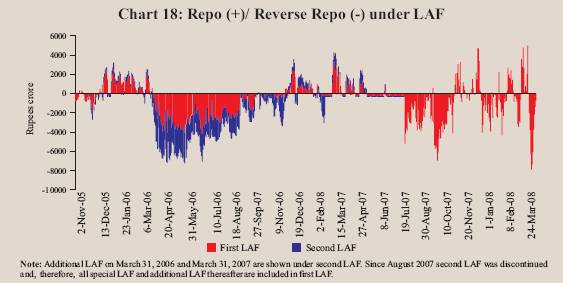

Liquidity conditions eased at the beginning of the third quarter on account of a decline in surplus balances of the Central Government and Reserve Bank’s foreign exchange operations. Notwithstanding brief periods of tightness on account of festive season currency demand, liquidity conditions remained easy up to November 2007, reflecting continued inflows of foreign capital. This necessitated upward revisions in the ceiling for outstandings under the MSS to Rs. 2,00,000 crore on October 4, 2007 and further to Rs. 2,50,000 crore on November 7, 2007. The CRR was also raised by 50 basis points to 7.5 per cent in November 2007. However, as the surplus cash balances of the Central Government increased, liquidity conditions tightened by the end of the month. The tightness in liquidity condition persisted in December 2007 largely on account of quarterly advance tax outflows. This necessitated injection of liquidity by the Reserve Bank through LAF (Chart 18).

Liquidity conditions in the last quarter of 2007-08 were driven mainly by variation in the Central Government’s surplus cash balances and capital flows. Some easing of the liquidity condition was observed in the beginning of the quarter on account of reduction in the surplus cash balances of the Central Government and foreign exchange operations by the Reserve Bank in the wake of large capital flows over the period. Keeping in view the evolving liquidity conditions, auction of dated securities under the MSS was resumed in January 2008, after a gap of two-and-half months (Table 32). However, in the second-half of January 2008, surplus liquidity declined with the increase in Centre’s cash balances with the Reserve Bank. The daily average net outstanding liquidity

absorption through LAF was Rs.15,692 crore during January 2008. During February 2008, the LAF window shifted from absorption to injection mode on account of further increase in surplus cash balances of the Central Government with the Reserve Bank. The average daily net outstanding liquidity injection was Rs. 1,294 crore in February 2008. In view of the prevailing liquidity conditions, no auction under the MSS was conducted from the middle of the month. The liquidity conditions eased in the beginning of March 2008 due to reduction in the surplus cash balances of the Centre and purchase of securities under the OMO2 by the Reserve Bank. The absorption under the LAF was Rs. 30,335 crore as on March 13, 2008.

Liquidity conditions tightened from March 17, 2008 in view of advance tax outflows and concomitantly the Centre’s surplus increased from Rs. 66,241 crore on March 14, 2008 to Rs. 1,03,645 crore on March 28, 2008. The Reserve Bank, in anticipation of the usual schedule of advance tax outflows and demand for funds at the end-of-the financial year, made additional arrangements for smoothening the liquidity and conducted (i) three-day repo/reverse repo auctions under additional LAF on March 14, 2008; (ii) seven-day repo auction under additional LAF on March 17, 2008; and (iii) two-day repo/reverse repo auctions under additional LAF on March 31, 2008. Reserve Bank injected Rs. 50,350 crore on March 31, 2008 through its LAF operation. The average daily net outstanding liquidity injection was Rs. 8,271 crore during March 2008.

Table 32: Liquidity Management |

(Rupees crore) |

Outstanding as on

Last Friday |

LAF |

MSS |

Centre’s Surplus

with the RBI @ |

Total (2 to 4) |

1 |

2 |

3 |

4 |

5 |

2006 |

January |

-20,555 |

37,280 |

39,080 |

55,805 |

February |

-12,715 |

31,958 |

37,013 |

56,256 |

March* |

7,250 |

29,062 |

48,828 |

85,140 |

April |

47,805 |

24,276 |

5,611 |

77,692 |

May |

57,245 |

27,817 |

-1,203 |

83,859 |

June |

42,565 |

33,295 |

8,621 |

84,481 |

July |

44,155 |

38,995 |

8,770 |

91,920 |

August |

23,985 |

42,364 |

26,791 |

93,140 |

September |

1,915 |

42,064 |

34,821 |

78,800 |

October |

12,270 |

40,091 |

25,868 |

78,229 |

November |

15,995 |

37,917 |

31,305 |

85,217 |

December |

-31,685 |

37,314 |

65,582 |

71,211 |

2007 |

January |

-11,445 |

39,375 |

42,494 |

70,424 |

February |

6,940 |

42,807 |

53,115 |

1,02,862 |

March * |

-29,185 |

62,974 |

49,992 |

83,781 |

April |

-9,996 |

75,924 |

-980 |

64,948 |

May |

-4,690 |

87,319 |

-7,753 |

74,876 |

June |

-8,895 |

81,137 |

-15,159 |

57,083 |

July |

2,992 |

88,010 |

-20,199 |

70,803 |

August |

16,855 |

1,06,434 |

20,807 |

1,44,096 |

September |

-6,070 |

1,31,473 |

30,771 |

1,56,174 |

October |

18,135 |

1,74,277 |

23,735 |

2,16,147 |

November |

-1,320 |

1,71,468 |

36,668 |

2,06,816 |

December |

-33,865 |

1,59,717 |

80,591 |

2,06,443 |

2008 |

January |

985 |

1,66,739 |

70,657 |

2,38,381 |

February |

8,085 |

1,75,089 |

68,538 |

2,51,712 |

March * |

-50,350 |

1,68,392 |

76,586 |

1,94,628 |

April (up to April 18) |

7,045 |

1,72,533 |

40,283 |

2,19,861 |

@ : Excludes minimum cash balances with the Reserve Bank in case of surplus.

* : Data pertain to March 31.

Note:

1. Negative sign in column 2 indicates injection of liquidity through LAF repo.

2. Between March 5 and August 5, 2007, daily reverse repo absorptions were restricted to a maximum of Rs.3,000 crore comprising Rs.2,000 crore in the First LAF and Rs.1,000 crore in the Second LAF.

3. Negative sign in column 4 indicates injection of liquidity through WMA/overdraft. |

The liquidity conditions eased from the beginning of April 2008, mainly due to substantial reduction in cash balances of the Central Government. The auctions under the MSS have been resumed and the balances under MSS stand at Rs. 1,72,533 crore as on April 18, 2008. The absorption under LAF stands at Rs. 17,130 crore as on April 23, 2008.

1 Between December 2006 and March 2008 the Reserve Bank increased CRR by 250 basis points and the estimated amount of liquidity impounded in the first round due to the hike in CRR was Rs. 74,500 crore.

2 During 2007-08, the total amount of Government of India securities purchased under OMO was Rs. 13,510 crore. The OMO operations are liquidity neutral up to the amount of redemption of Government securities in the portfolio of the Reserve Bank. |

IST,

IST,