IST,

IST,

Policy Rate Expectations in Media

Big data tools like text mining and natural language processing are relatively modern methods of information extraction from unconventional data sources, which help in providing additional policy inputs to central banks. This article analyses historical unstructured newsfeed from media on the Reserve Bank of India’s (RBI) policy (repo) rate1 to generate a Sign Success Ratio (SSR) to evaluate media sentiment with respect to the expected directional change in repo rate. Empirical analysis reveals that media sentiment appears to track the policy rate decisions reasonably well. Introduction As stated by Alan Greenspan, former Chairman of the Board of Governors of the Federal Reserve System, in 1987, although jokingly, “Since I’ve become a central banker, I’ve learned to mumble with great incoherence. If I seem unduly clear to you, you must have misunderstood what I said.” (Murray, 1987, Subbarao, 2011). From the earlier era of secrecy, opacity and constructive ambiguity, preference for enhanced transparency to influence the expectations of economic agents has been a conscious shift. Over the last few decades, central bank communication has significantly changed, recognising the role of expectations of agents in influencing macroeconomic outcomes, besides aiming to enhance public understanding of their work, and strategic communication can also influence the expectations channel of monetary policy transmission (Beyer et al., 2017, Weidmann, 2018). With the growing importance of central bank communication in market economies, the role of electronic and print media has gained importance. Media disseminates, explains and interprets news to the general public, and also conveys concerns, perceptions and opinions of various economic agents to the policy makers, either directly or indirectly. Traditionally, central banks have used various forwarding-looking surveys to elicit feedback on a wide range of macro-economic and financial variables from firms, households and professionals, to bridge data gaps and generate high frequency data for policy inputs. With deeper penetration of internet, new sources (newsfeeds, online portals, social media platforms) are transmitting news to the market as well as to the public, generating micro voluminous data at high frequency. Against this backdrop, an attempt has been made to analyse media expectations/ perceptions on repo rate, prior to policy announcement date, to infer the expectations of public in general. This article analyses historical unstructured newsfeed from media on the Reserve Bank’s policy (repo) rate. To the best of our knowledge, this is perhaps the first such study in India, on media sentiment about the Reserve Bank’s policy (repo) rate decisions captured and compiled on a near real time basis. Rest of the article is organised into five sections. Section II presents a brief review of literature, Section III describes the data and methodology used in the study. Section IV contains empirical results. Concluding remarks are presented in Section V. Central banks’ monetary policy actions get wide coverage in media and are deliberated extensively. Media is an important channel of communication and acts as a bridge between a central bank and the wider public. News reported on a real time basis draws attention of general public, market, analysts, economists and academicians. Credible and effective policy, alongwith clear communication, can help achieve central banks’ objectives. In an ideal situation, policy stance and stakeholders’ expectations/ perceptions should be aligned; yet, at times, they are not. There is ample literature on media reporting of monetary policy and also how media brings stakeholders’ perception to the forefront. This aspect has been increasingly acknowledged in modern monetary policy frameworks. We briefly review some of the recent studies. The coverage of monetary policy actions of the European Central Bank (ECB) reported in print media was analysed using a quantitative index on the extent of media coverage and a qualitative index measuring the favorableness and intensity of monetary policy discussions (Berger et al., 2006). It was found that media critically discusses the ECB policy actions taking into account market expectations and current inflation dynamics. Also, media coverage on policy action was found to be highly receptive to the ECB communications. On similar lines, a media expectation index was constructed based on media reports on ECB statements and it was observed that media communication added valuable information about the next policy decision (Lamla and Sturm, 2013). The US Federal Open Market Committee (FOMC) statements and discussion of FOMC statements in news were analysed using semantic orientation scores, which were found to have significant association with policy rate decisions (Lucca and Trebbi, 2009). Bank of Canada’s (BOC) communication and its market commentary were analysed to examine the effects on volatility/ level of returns in short-term interest rates. Text mining tools were applied to extract topics and it was established that market stories had a significant effect on volatility and returns in short-term markets (Hendry, 2012). In another study, a Hawkish-Dovish (HD) indicator was constructed on news articles post the ECB’s press conference reflecting media’s interpretation of the ECB’s official communication and the empirical analysis suggests that such an indicator can help assess future monetary policy stance (Tobback et al., 2017). In a recent research work, machine learning technique was used to extract expectations of stakeholders on Bank of Indonesia’s policy rate. An expectations index based on news was constructed a fortnight prior to policy meeting, and the analysis revealed its high degree of correlation with the policy rate (Zulen and Wibisono, 2018). III.1 Data - Policy rate announced by the Reserve Bank is taken as the benchmark indicator in the study. Policy rate expectations in media form the main data source for this article, which is described below. We begin with collection of news in online print media. This step is crucial for creation of precise corpus (collection of news items) as news in general consists of information on multiple topics, which may be noisy and out of context. The data are suitably cleaned and pre-processed following the steps below.

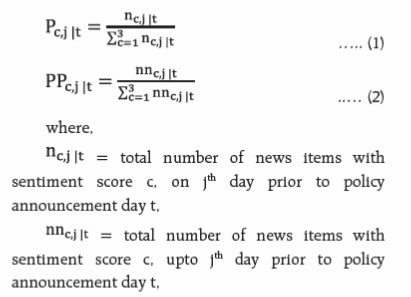

III.2 Methodology Methodology for sentiment classification, aggregation of sentiments and validation is described in detail below. III.2.1 Sentiment Classification Big data tools like text mining and natural language processing are relatively modern methods of information extraction from unconventional data sources and could provide additional policy inputs to central banks. Each news item was classified into one of three sentiment classes, viz, increase, decrease, neutral based on the semantic orientation keyword present in the news. The keywords are chosen so as to represent similar semantic orientation, as indicated in Table 1. Some news items were not assigned any sentiment, as clarity on sentiment could not be established. Sentiments were assigned to each of the news by thoroughly reading the news item3. In order to be objective and minimise human error, the sentiment assignment task was independently carried out by the authors and sentiments were reconciled / reassigned wherever required. Illustrations on the same are given below in Chart 1. After pre-processing, cleaning and eliminating news with nil sentiment, news items were assigned sentiments in one of the three classes, viz, increase, decrease, neutral during the period under consideration (April 2015 to December 2019). Sentiment class-wise proportion of news items is presented in Chart 2.   III.2.2 Aggregation of Sentiments Post classification of documents (news items) under one of the sentiment classes, viz, “increase”, “decrease” and “neutral”, the next step is to aggregate the documents and derive overall sentiment for a given period. This is done in terms of Sentiment Concentration Class (SCC), which is derived in the following manner: a. Step 1 - Each news item is assigned a sentiment score as indicated below-

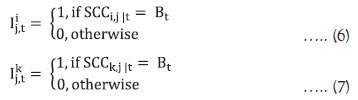

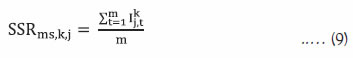

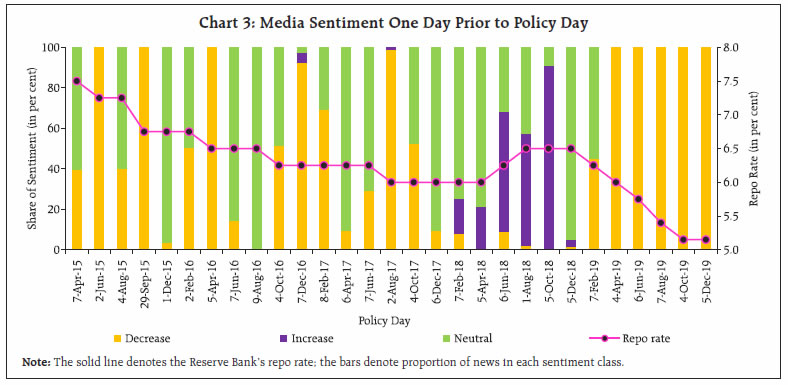

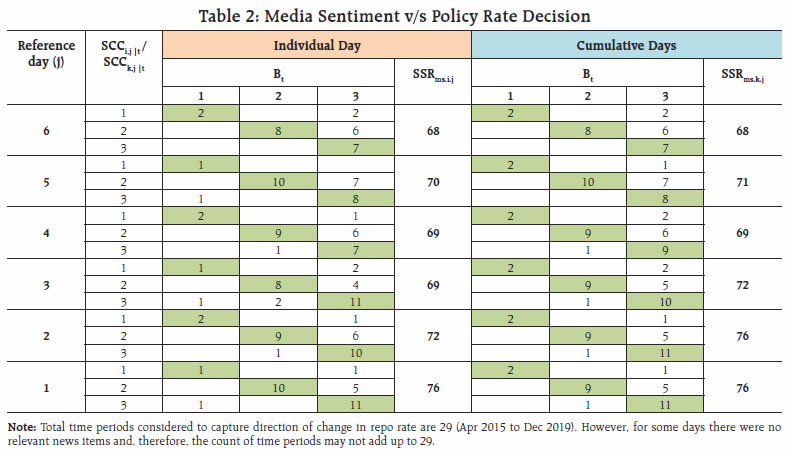

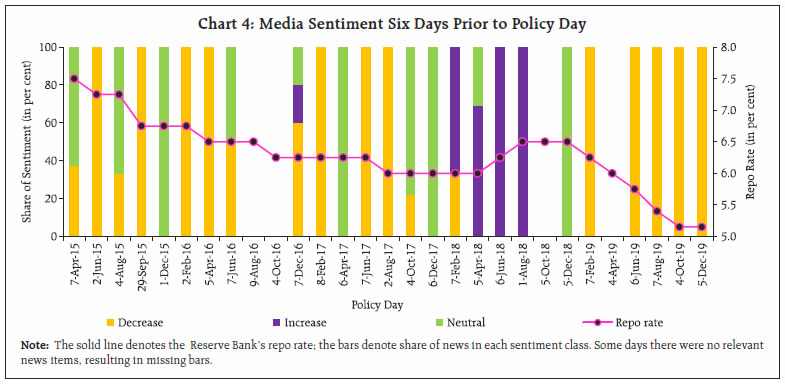

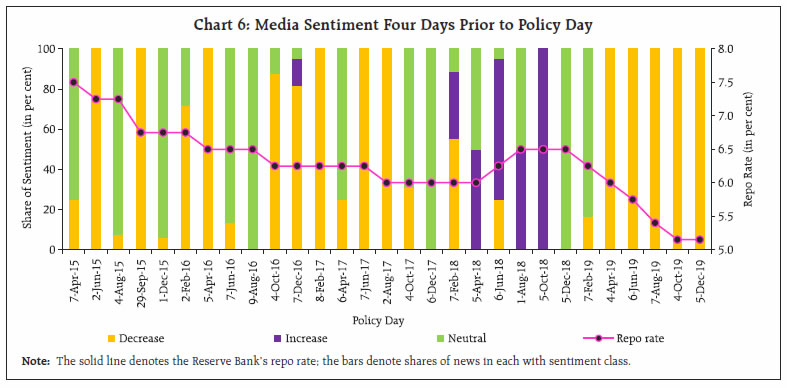

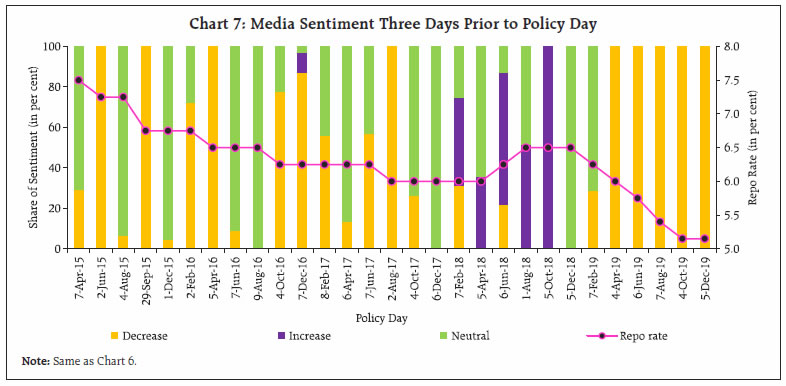

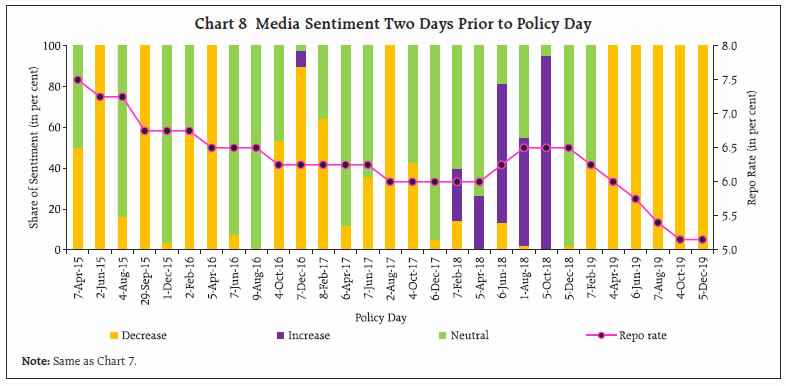

This score is just a broad numeric representation for a sentiment class and does not indicate the exact magnitude of a sentiment class. b. Step 2 - Any error on account of a particular day gets adjusted while arriving at the cumulative sentiment as of that day. However, individual day sentiments may also be considered, especially in situations wherein some important events precede the monetary policy announcement, which may have an influence on media sentiments. News items are aggregated on the basis of individual day and cumulative days, as defined below.  c = 1, 2, 3 m = number of time periods (policy announcement days) under consideration4 c. Step 3 – Sentiment Concentration Class (SCC) is derived as below:  Following the above steps, SCC can be derived for jth day for every policy announcement day t, on an individual day basis (i) as well as for cumulative day basis (k). SCC indicates the sentiment class for majority of responses, for a given policy window5. III.2.3 Validation Methodology It is important to validate any indicator with a benchmark in order to examine its usefulness. We attempt to examine how well the media sentiment is associated with actual policy rate decisions taken by the Reserve Bank’s, from time to time. Directional analysis is adopted to evaluate sentiment vis-à-vis actual policy rate. For comparative analysis, the Reserve Bank’s repo rate is converted into a qualitative indicator on the same lines as media sentiment, following the methodology below.  where repo ratet is actual repo rate for time period t. In the next step, we define an indicator function for jth day as below.  Finally, we compute a measure, Sign Success Ratio (SSR)6 to evaluate the sentiment vis-à-vis directional change in repo rate, as below.   SSR, as defined above, is a measure of proportion of time periods when the media sentiment matched with the actual change in repo rate (directionally). A large SSR indicates that media is able to gauge directional change in policy rate decision to a great extent. The analysis reveals that for most of the time period under consideration, sentiment was noticeably concentrated in one of the sentiment classes (increase/ decrease/neutral), indicating media’s overall tilt towards a particular rate action. Proportion of news one day prior (cumulative) to policy announcement day is presented in Chart 3. It is found that sentiment concentration was directionally in sync with the policy rate decision except on few occasions. Similar Charts for other days are presented in Annex I. We computed SSR for various days as defined in Section III.2.3 and the same is presented in Table 2. It is observed that media sentiment was directionally in sync with the policy rate decision taken by Reserve Bank, except on few occasions, as evident from high value of the SSR. As the news coverage generally increases with the policy announcement date approaching, the sentiment also starts firming up, as reflected by the increase in SSR. On a cumulative basis, the SSR turned out to be 68 per cent for six days prior to the policy day and 76 per cent for two days prior to the policy day. The sentiments were stronger even three days prior to the policy announcement day with a high SSR at 72 per cent.  Over the last decade, many central banks have emphasised on increased communication and transparency to assist key stakeholders in the economy by explaining the intent behind policy changes and to anchor expectations, which in turn is believed to enhance the effectiveness of monetary policy.  The central bank’s decision on policy rate is keenly awaited by various stakeholders in the economy and receives wide coverage in print and electronic media. In this article, we exploit the unstructured text contained in news items and build a sentiment indicator on policy rate decision. A measure Sign Success Ratio (SSR) is constructed to evaluate media sentiment vis-à-vis directional change in repo rate. It is found that the SCC based on media sentiment captured ahead of the policy announcement date moves in sync with the actual direction of policy rate decision on most of the occasions during the study period. Thus, a measure like the SCC can be tracked to gauge media’s expectations regarding the policy decision. The methodology has the potential to be extended to gauge media sentiments about key macroeconomic variables before their actual public release. References Beckers, B., Kholodilin, K.A. and Ulbricht, D. (2017), “Reading between the Lines: Using Media to Improve German Inflation Forecasts”, German Institute for Economic Research, Discussion Papers 1665. Berger, H., Ehrmann, M., and Fratzscher, M. (2006), “Monetary Policy in the Media”, European Central Bank (ECB), Working Paper No. 679. Beyer, A., Nicoletti, G., Papadopoulou, N., Papsdorf, P., Rünstler, G., Schwarz, C., Sousa, J. Vergote, O. (2017), “The transmission channels of monetary, macro- and microprudential policies and their interrelations”, Occasional Paper 191. Buono, D., Kapetanios, G., Marcellino, M., Mazzi, G.L., and Papailias, F. (2018), “Big Data Econometrics: Now Casting and Early Estimates,” Universita’ Bocconi, BAFFI CAREFIN, Centre for Applied Research on International Markets, Banking, Finance, and Regulation, Working Papers 82. Lamla, M. J. and Sturm, J. E (2013), “Interest Rate Expectations in the Media and Central Bank Communication”, Swiss Economic Institute (KOF), Working Papers No. 334. Lucca, D. O. and Trebbi, F. (2009), “Measuring Central Bank Communication: An Automated Approach with Application to FOMC Statements”, National Bureau of Economic Research (NBER) Working Paper No. 15367. Murray, A. (1987), “Fed Chief sees no acceleration in inflation rate”, Wall Street Journal, Eastern Edition, New York, September 22. Hendry, S (2012), “Central Bank Communication or the Media’s Interpretation: What Moves Markets?’, Bank of Canada, Working Paper 9. Subbarao, D. (2011), “Dilemmas in Central Bank Communication - Some Reflections Based on Recent Experience”, Second Business Standard Annual Lecture, New Delhi. Tobback, E, Nardelli, S. and Martens, D. (2017), “Between Hawks and Doves: Measuring Central Bank Communication”, ECB, Working Paper No. 2085. Weidmann J. (2018), “Central bank communication as an instrument of monetary policy’, Lecture at the Centre for European Economic Research. Zulen, A. A and Wibisono, O. (2018), “Measuring Stakeholders’ Expectations for the Central Bank’s Policy Rate”, paper presented at IFC - Bank Indonesia International Workshop and Seminar on Big Data for Central Bank Policies / Building Pathways for Policy Making with Big Data. Annex I : Sentiment Proportion v/s Repo Rate (Contd.)      * This article is prepared by Geetha Giddi and Shweta Kumari, Big Data Analytics Division, Department of Statistics and Information Management (DSIM), Reserve Bank of India (RBI). The views expressed in this article are those of the authors and do not represent the views of the Bank. The authors gratefully acknowledge the guidance provided by Dr. Sasanka Sekhar Maiti. The errors, if any, are those of the authors. 1 Policy rate and repo rate are used interchangeably in this article. 3 Big data tools such as machine learning and natural language processing may be applied for text mining and sentiment assignment. However, sentiment assigned by human experts is in practice (Beckers et al., 2017, Lamla & Sturm, 2013). 4 In India, policy review is at a bi-monthly frequency. Accordingly, the policy day t occurs every alternate month. In this article, it is indicated in discrete manner, with 1 period gap, for simplicity. 5 Repo rate is a policy instrument, where past experience shows that status quo in repo rate is a frequent phenomenon and the change (increase or decrease), whenever occurs, is always in discrete terms. And, therefore, validation of media sentiment (increase, decrease, neutral) vis-à-vis change in repo rate has been done on directional basis. 6 This Sign Success Ratio has been defined in line with Buono et al., 2018 |

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: