IST,

IST,

RBI WPS (DEPR): 03/2013: Estimation of Counterfeit Currency Notes in India - Alternative Methodologies

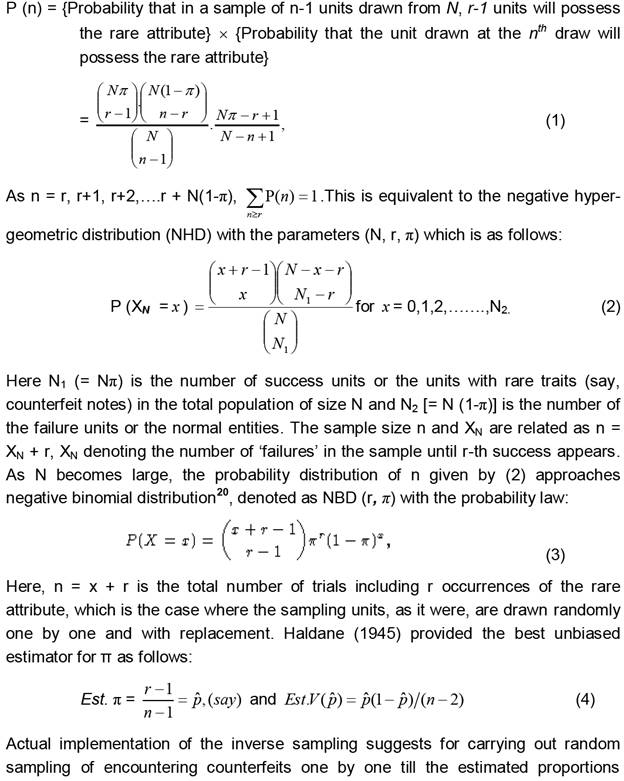

| RBI Working Paper Series No. 03 Abstract 1Alternative methodologies on estimation of counterfeit notes in the system, attempted by various countries, mostly pertain to proportions based on reported numbers vis-à-vis total figure on currency in circulation, which are having certain obvious limitations. As against, this paper suggests a probability model approach for estimating stock of circulating counterfeit notes using inverse sampling techniques for count data model by adopting negative binomial distribution in terms of diffusion and shape parameters. In order to capture regional variations in the pattern of counterfeits, such probability model based simulation (sampling experiment) would help in estimating counterfeit notes for specific region, particularly for high face value currency notes. Besides giving an estimate of counterfeit notes circulating in the system, this procedure would also give an error estimate. JEL Classifications: C10, D82, D83, E42, E50, E58. Keywords: Count Data Modelling, Inverse Sampling, Monetary and Payment systems, Bank notes, Counterfeits. Counterfeiting is a major economic problem, called “the world’s fastest growing crime wave” ……………………………………………….(Phillips, 2005). 1. Introduction Sizeable currency notes form an indispensable part of transactions needs within the sovereign contour of the developing economies like India. Persistent stock of circulating counterfeits with an increasing trend in a dispersed manner is the bane for the integrity of the currency note system management2 as it would vitiate the currency, coinage system and payment systems standards. But, there is lot of uncertainty about the actual level of counterfeiting, which at times gets heightened because of rumours. Variables which provide useful perspectives on counterfeit currency notes are: (a) directly observables namely (i) flow of counterfeits detected/seized over time by the law enforcement agency, and (ii) frequency or number of counterfeits detected/ recovered in the banking system including the note processing system of the central banks; and (b) unobservable like (i) stock of circulating counterfeits and (ii) volume of fresh counterfeits getting inducted into circulation. Flow of recovery as well as seizure of counterfeits is directly observable, whereas the stock of counterfeits floating in the system remains as an unobservable. Reserve Bank of India (RBI) adopts a range of deterrent steps for its robust currency management. Besides being deeply conscious about the fact that it is necessary to constantly enhance the security features of the currency as world-wide accepted anti-counterfeit strategy, RBI also conducts programs via media and awareness campaigns3 so as to enable the public to detect a forged note as well as help achieve systemic checks at the various possible entry points of inducting counterfeit notes. ‘Awareness campaign… to educate the public…’ so that counterfeit notes can be properly recognized, might take longer to create the necessary impact, but it will be lasting and achieving sufficiency condition (Subbarao, 2011). Other measures include close collaboration with banks and related entities like cash machine service providers, public utilities handling cash transactions as also security machinery of the country. In the Bank’s Monetary Policy Statement (2012-13), it has been stressed on how the existing detection and reporting of counterfeit notes by banks are critically important prerequisites for assessing the dimensions of counterfeit notes in the system. As stated therein, it has serious repercussions for the economy. And here comes the usefulness of developing different methodologies for estimating counterfeit notes circulating in the system with a credible accuracy as also statistical analyses to have an understanding of various vectors that might be working behind circulation of counterfeit notes. Due to proactive measures undertaken towards compulsory processing of banknotes on note sorting machines (NSMs) before re-issuing the same and spread of awareness about identifying counterfeit notes, improved reporting of data on counterfeits is expected4. Unknown stock of counterfeits at any point of time depends upon the quantum of counterfeit notes getting inducted into the system, as well as the length of time they circulate before eliminating them by the disposal of counterfeits from the banking system as also persistent seizure activity by the law enforcement agency. Basic problem is two-fold. First, quantum of counterfeit notes in circulation is neither directly measurable nor easily estimable in an unbiased manner. Second, public understanding about counterfeiting is guided by the complex phenomenon of unfounded belief5 and chance mechanism. Moreover, given multitude of territorial overlaps in the Indian subcontinent and likelihood of probable infiltration of counterfeit notes the perception about floating counterfeits would be all the more upwardly biased. In such a situation, estimating volume of counterfeit notes becomes intrinsically linked to the illusive chance mechanism behind encountering counterfeits. Ratios of counterfeits detected vis-à-vis total notes in circulation may provide underestimates given the preparedness level and rigidity in the crime detection and reporting mechanism. Bunching problem when counterfeits happen to be intercepted by enforcement also poses certain problems. It also can take place when checked in volumes at various public utility counters, bank branches or currency chest levels. Technically speaking, observing counterfeits more often in a particular sequence of counterfeit detection exercises is akin to bunching problem, particularly when observed in a non-recurrent manner. This would cause serious problem of biases and influential impact on any ratios based on such numbers. Working out simple ratios based on all kinds of such figures, occurring both in a recurrent and non-recurrent manner are only best at obtaining some numbers that may not reflect the reality. For example, there is scope of misinterpreting cumulative number of counterfeits detected per unit of total notes issued in circulation as synonymous with chance of encountering counterfeits. Such ratios can construe divergent beliefs if seen against likelihood of encountering counterfeit notes by the common people. Varied interpretations of ratios with divergent perceptions increase uncertain assessment about the actual level of counterfeits floating in the system. It, therefore, requires critical analysis of all kinds of data on counterfeits more frequently over time and regions for working out certain statistically robust estimates of probable dimensions of counterfeits that might be circulating in the system, as well as variability pattern thereof across the region. In this context it is important to fine tune alternative strategies depending on whether to go by targeting ratio kind of dimensions of the problem or the absolute size of the visible part of counterfeit notes that get reported in the system after doing due diligence. Like other chance processes, if sighting of fake currencies exhibits remarkable regularities within a statistically designed framework, the same can be meaningfully captured and estimated with the help of probability models. For example, suitable modelling of probability of encountering fake notes in the NSMs would help derive certain credible estimates. In this context, this paper deals with methodologies for obtaining credible estimates of the stock of counterfeits in the system. The paper is organised as follows: Section 2 summarises the available research on counterfeits. Section 3 provides a brief description of the extent of counterfeiting in India. Available methodologies for estimating the counterfeit notes are presented in Section 4, which begins with a newly proposed approach based on inverse sampling. In this context, an empirical illustration has been described as a practical approach in the Section 5 with the associated technicalities presented in the Appendix. Section 6 concludes. 2. Literature review on modelling of counterfeit notes Though counterfeiting is as ancient as the advent of money, economic and quantitative studies are of very recent origin. Specific aspects of money counterfeiting require specialised agent-based behaviour modelling6 and empirical validations. While literature on economics of counterfeit goods and services were available in greater depth and analyses7 prior to the 1990s, few subsequent theoretical work that were taken up in the area of counterfeit money mostly draw down from the pioneering work of Kiyotaki and Wright (1989, 1991) on the search-theoretic approach for modelling rate of return based alternative uses of money and probable presence of multiple equilibrium of more than one monetary good having alternative uses. Duffy’s (2000) paper on simulation based validation of Kiyotaki-Wright’s search model of money also gives a good synoptic view of the approach8. Economic analysis of counterfeiting is necessary to understand different implications for the incentive to counterfeit, social welfare and deterrent policies required to be adopted. The activity of forging currency notes gets sustenance due to certain critical economic as well as geopolitical ambience, and it could be difficult upfront to piece out recognisable cause and effect kind of quantitative or econometric analyses because of scantily observable and quantifiable data. Even to develop scenario based analyses validated by meaningful simulations, it is very much necessary to undertake empirical analyses of contingent occurrences of counterfeits on a continuous basis. Though there are some research works on theoretical modelling of the behaviour of relevant economic agents and possible policy responses towards counterfeiting, there are almost no established real life data based empirical work because of the limited availability of data and related statistics. There is only a small set of useful analytical literature on counterfeiting currency notes that deploys search-theoretic economic rationale in a game-theoretic set-up to study counterfeiting and policy responses of the note issuing authority (Nosal and Wallace, 2007). Such constructs involve players (counterfeiters) holding certain private information and belief that are basically hidden and unobservable who always make first move. The first set of studies relates to examining the possibility of new-style currency notes replacing the old-style ones. Green and Weber (1996) discussed how three different phases of equilibrium can arise involving old-styled counterfeits and newly introduced genuine ones, whereby both can coexist or go out of the system, the third one being the sinister one whereby counterfeiting the old-styled notes continue, for which the only deterrent stance is to follow strict enforcement effort. Nosal et al. (2007) made the strident analytical observation over benign results of Kultti (1996) as also Green and Weber (1996), that “actions taken to keep the cost of producing counterfeits high and the probability that counterfeits can be recognized high can be worthwhile even if (a significant amount of) counterfeiting is not observed” for some time. There is no scope of keeping a neutral stance by country’s central bank and it pays in the long run to have a comprehensive anti-counterfeiting strategy for maintaining authorized means of production and economic transaction as well as social welfare. This strand of research on provisioning counterfeit money as issuance of private money was further firmed up by Cavalcanti and Nosal (2007) and certain extension by Monnet (2010). A recent review on modelling the counterfeiting of bank notes from Ben Fung and Enchuan (Autumn 2011) summarises certain stylized facts about counterfeiting based on several theoretical constructs on the economics of counterfeiting. The authors conclude that empirical validation of these analytical findings are hindered due to lack of availability of credible data on counterfeiting, which at times led to contradictory results having critical implications for strategizing appropriate anti-counterfeiting policies9. This review sets out certain key theoretical perspective on counterfeiting currency notes that have been researched so far. First, there is a basic thrust about maintaining public confidence in bank notes as a means of payment. Second, periodic bouts in counterfeiting could become episodic unless the threat is kept low by staying ahead of counterfeiters. It is illustrative to know how effective anti-counterfeiting strategy can curb an ominously high level of counterfeits circulating in the system. Bank of Canada could effectively bring down counterfeit detection numbers to 35 ppm (parts per million) by 2010 from the last episodic peak of 470 ppm reported in 2004. Finally, this brief research focusses succinctly on the importance of policies against counterfeiting currency. Besides understanding the implications for the incentive to counterfeit and social welfare, it is critical for strategizing anti-counterfeiting policies to understand the framework of theoretical models for discerning the key factors that might be working behind any apparent equilibrium condition for counterfeit notes. The literature contains both partial-equilibrium and general-equilibrium economic models depending on whether demand for money is exogenous or not. Partial-equilibrium models do not explicitly specify demand for money and assumed to be not depending on the actions of agents in the model. They are used to study the interactions of counterfeiters, merchants and the note issuing authority. Most of the theoretical studies are partial-equilibrium analyses to derive stylized implications that can be compared with actual counterfeiting data. But the findings could be at times contradictory to each other. The more general set-up of general-equilibrium models make less-restrictive assumptions whereby economic environment is assumed to generate money endogenously and the demand for money depends on the interactions of agents in the model. Many of the theoretical findings needs to be matched consistently with real life experiences based on reliable data and credible statistical estimates. For example, the main finding of Lengwiler (1997) that if central bank tends to issue more secured high denomination notes to contain counterfeiting rates, counterfeiters would tend to forge more of low-denomination notes. Such analysis is having mixed evidence in real life10. Quercioli and Smith (2009) subsequently improved upon the model assumptions by allowing a probable reality of joint occurrence of both seizure and passing out counterfeits in the system depending on quality and cost involved in checking the high quality counterfeit, especially for the high denomination notes. Such revised assumptions, however, brings out a contrasting stylized fact that there is not much incentive to counterfeit low denomination notes. Moreover, both verification effort and counterfeit quality increases with the increase in denomination and interestingly enough, quantum of passed counterfeits may increase given the in-built boundaries in verification efforts and associated cost of detection and reporting. Such unauthorized medium of exchange then increasingly occupies the position of private money usable in special-purpose negotiable bilateral trade. An important empirical finding relevant for stochastic modelling and statistical validation is the derived distributional behaviour of counterfeiting rate, measured as the fraction of counterfeit notes to the total notes in circulation, displays a hump-shaped distribution across denominations, which is consistent with available time series data on counterfeited notes. In all the initial modeling exercises, counterfeiting currency is taken as private provisioning that seems to be fulfilling ‘double coincidence of wants’ akin to barter system11. As per this definition followed in the models by Kultti (1996), Green and Weber (1996), Williamson (2002), Monnet (2005) and Cavalcanti and Nosal (2007), counterfeit money can last for some time till people are willing to accept it as a medium of exchange. Sellers (of specific item exchanged in the barter) may knowingly accept counterfeit in a bilateral trade if buyers do not have genuine money and produce counterfeits at a cost. Subsequent circulation of such counterfeit notes along with genuine notes depends on how such fake notes get passed through acceptance barrier, checking mechanism or the enforced agencies. Assuming demand for counterfeit notes to be exogenous also has certain limitations. There are instances where if people think that only high-denomination notes are counterfeited, they may prefer more low-denomination notes or avoid the transaction, in which case counterfeiters would likely find it more difficult to pass such high denomination notes. Such cases obviously bring the probable endogenous nature of counterfeit notes that needs to be studied under general-equilibrium set-up. General equilibrium framework considers existence of both genuine and counterfeit money in equilibrium. Recent paper by Fung and Shao (February 2011) is worth referencing to undertake further work in this direction. Such generalised set-up allows possible co-existence of both private and public money and helps understand counterfeit from a more complete monetary cycle angle. If buyers do not have genuine money, they can produce counterfeit money at a cost. Sellers will accept genuine money, but they may or may not accept counterfeit money. If sellers refuse to trade with buyers that use counterfeit money, they will have to wait until the next period to meet another buyer. This exemplify the episodic bout of counterfeit notes after a period of low level of detection reported in the system unless continuous anti-counterfeiting measures are put in place on a continuous and sustained basis12. The main refrain of general-equilibrium is that once counterfeiting has been established as an equilibrium outcome, the model can be used to study the effects of counterfeiting on bigger economic aspects namely social welfare as well as assessing the effectiveness of policies in reducing counterfeiting. While certain extensive work has been undertaken at Bank of Canada, US Treasury, Secret Service and Federal Reserve have also made concerted efforts to come out with reliable estimates of the volume of counterfeit US currency in circulation. Ruth Judson and Richard Porter (2010) provided a range of comparable estimates for the number of counterfeits in circulation. This paper has two main conclusions, namely the stock of counterfeit US currency notes in the world as a whole is likely to be on the order of 100 ppm or lower in both piece and value terms; second, losses to the U.S. public from the most commonly used note are relatively small, and are miniscule when counterfeit notes of reasonable quality are considered. The Federal Reserve Bank’s discussion paper mostly came up to tame the flagrant belief reported in the media about sharp rise of fake US dollar currency across the globe. No specific statistical methodology is indicated except stating the fact that very good sampling data from two sources namely the United States Secret Service and the Federal Reserve were used assuming that they can be considered as independent in respect of various dimensions. In order to develop appropriate confidence bounds for extrapolation, they compared the data from these two sources. The paper makes one important argument that it is unlikely that small areas containing large numbers of counterfeits can exist for long outside the banking system, and that the total number of counterfeits circulating is higher than what the sampling data indicate. The argument is that, counterfeit notes ought to enter in the banking system much sooner than earlier thought and would remain so in a dispersed manner till they are withdrawn on detection. It, of course, assumes the extensive reach of banking within the country. According to their theoretical studies, it is also observed that high-quality counterfeiting is expensive and becomes somewhat cost effective when only a few counterfeits are passed relative to the amount of genuine currency in circulation. Such possible situation points towards the over-dispersed nature of fake notes that might be in circulation. But such argument is conditional upon the geopolitical context as also economic factors that might be sub-served by the counterfeiting agents. Vigilant stance well supported by empirical validation on a continuous basis would only lend credence to such claim that only few counterfeit notes can remain in the system at any point of time. The moot question remains about how long counterfeit notes of certain specifically identifiable characteristics remain undetected in circulation and with what intensity such notes are used for transaction purposes. Nearly indistinguishable counterfeit notes may remain in circulation as long as the average life of genuine notes of similar characteristics, which may remain till notes with new security feature start replacing them. 3. Extent of counterfeiting in India As stated earlier, it is difficult to have a directly observable parameter on the extent of counterfeiting in India. Only data available in public domain is the number of counterfeits detected/recovered in the banking system including the note processing system of RBI, which are published regularly in RBI Annual Reports. After 2007-08, however, RBI has stopped disseminating statistics on counterfeiting by denominations. So, for recent period, one can only analyse the aggregate numbers. To begin with, let us take the example of aggregate counterfeit notes detected in the banking system in the recent years. During 2007-08, the number of counterfeits detected in the banking system jumped by 86.9 per cent, from 1,04,743 pieces in 2006-07 to 1,95,811 in 2007-08. On top of this, during 2008-09, aggregate detection more than doubled (103.3 per cent) to 3,98,111 and subsequent growth witnessed a moderation in the recent years (Table 1). It may be noted that during 2008-09 notes in circulation (NIC) increased by 10.7 per cent when counterfeit notes detected in the banking channel increased by 103.3 per cent. By examining the data on counterfeiting reported through the banking channel, one can assess the threat to some extent; but quantitatively it could be an underestimate of the reality. Expressing occurrence or detection of fake notes in per million of notes in circulation is the common international convention and is to be interpreted in a vis-à-vis manner. Prima facie, one may try to figure out that during 2007-08 to 2011-12, estimated 4.4 - 8.1 pieces counterfeit notes per million NIC were floating in the system. It may, therefore, be interpreted that about 3.9 lakh pieces of counterfeit notes, on an average, seemed to be floating in the system as against about 56.74 billion pieces of NIC during 2007-08 to 2010-11, which amounts to about 6.9 pieces counterfeit notes per million NIC floating, on an average, in the system during last five-year period (Table 1). However, this may not constitute a credible estimate as it does not give a fair idea about the actual incidence of fake notes that remained floating and undetected in the system. Such numbers could have two extreme interpretations: (a) without any jugglery of numbers, this ratio could be simply higher at around 17 per million NIC if it is assumed that counterfeiting in lower denomination notes (less than 100 rupee) is negligible, which is more realistic; (b) it might be possible that the whole bunches of about two million counterfeit notes (19,52,160) detected over a period of five years had been there in the system to begin with, which got detected over a five-year period. Then the vis-à-vis position of outstanding fake notes works out to be of much higher rate, namely as high as about 44 pieces of counterfeit notes per million pieces of NIC, when the cumulative figure of 19,52,160 is seen against the total number of 44,225 million of NICs during 2007-08, instead of only 4.4 per million NIC reported to be detected in the banking system, which is 10 times higher. Such a plausible interpretation would lead to serious doubt and uncertainty about the intensity of counterfeiting that might be threatening to official currency system. Another key feature is the emerging trend in increased share of very high denomination counterfeits currency (Rs.1000 and Rs.500) recovered in the banking channel (Table 2). Proportion of Rs.1000 counterfeits has increased from 0.12 per cent in 2003-04 to 5.17 per cent in 2007-08. Over one-third of counterfeits detected in the banking channel in 2007-08 were in the denominations of Rs.500 and Rs.1000. Just to have a dimensional comparison, it may be mentioned that in Canada, the number of detected counterfeits per million notes in circulation fell from a peak of 470 (648,323 pieces) in 2004 to 105 (163,520 pieces) in 2007 (Chant, 2004). When seen against country experiences, counterfeiting tends to vary across countries. Official data available in the public domain for the period 2004-2008 shows that counterfeiting is found to be a problem in Canada (55 – 455 ppm), the United Kingdom (153 – 300 ppm), Mexico (60-125 ppm) and the Euro area (24-35 ppm), while remaining at low levels in Switzerland, Australia, India and South Korea (Fung and Shao, February 2011). India’s counterfeiting seems to be comparatively low given a much higher level of notes in circulation in India of about 40 billion pieces of notes as against 1.7 billion pieces notes in circulation in Canada in 2007. The $20 note is the denomination counterfeited most often in Canada, like the third highest denominated note (i.e., Rs.100) being counterfeited most in India. For Euro, maximum counterfeits are detected in the mid-segment (24-36 per cent for € 100, €50 and €20 notes) as against much lower incidence of counterfeiting reported to be taking place for higher denomination notes (€200 and €500)13. Denomination-wise position is, however, adverse in India as higher denominated notes (Rs.500 and Rs.1000) are being counterfeited relatively more than that of the counterfeits of the highest two denominations (C$50 and C$100) detected in Canada. Another interesting feature is that counterfeit notes are also getting detected outside India. Following Table shows relative position of counterfeit notes in respect of some of the countries detected in the Swiss system during the recent period.

Intensity of counterfeiting is revealed in several ways, namely, (i) recovery of counterfeits notes present in the notes in circulation (NIC) via banking system which occurs mostly in a dispersed manner; (ii) periodic seizure of counterfeits by official security outfits, may be in bunches, which many a time could be awaiting an entry into the NIC in a dispersed manner after getting into the banking system, and (iii) general public becoming an unwilling holder of forge note unknowingly. From the directly observable variable, one can apparently assume that the incidence of counterfeiting in India is relatively low. However, if the seizure activity is superimposed, quantum of counterfeit notes interfacing the genuine currency notes may not be less. In absence of much of committed reporting by the general public about encountering forged currency notes, it is, however, necessary to analyse the data on seizure as well as recovery of counterfeit notes to assess the underlying current in the process of counterfeiting activity. The propensity to induct fresh supply of fake notes is difficult to measure and can best be assessed by closely monitoring the pattern of seizures of counterfeits. In any case, possibility of counterfeiting could be well dispersed across regions, denominations and time. Such characteristics obviously call for some scientific sampling scheme to estimate the intrinsic proportion of fake notes floating in the system. As mentioned earlier, the impression that stock of counterfeits in circulation would be closely related to the flow of recoveries is not correct as the same invisible stock of counterfeits can be consistent with widely different levels of recovery. Following table brings out the extent of possible relation between the number of counterfeit notes in circulation and the length of time they circulate based on the rate of recovery in 2007-08.

The above Table shows how the same (unknown) stock of counterfeits can be consistent with widely different levels of recovery, depending on the length of time counterfeit notes that may remain circulating in the system, which may get inducted continuously by the counterfeiters. The 1,95,811 counterfeits recovered during 2007-08, for example, could be consistent with an outstanding stock as small as 536 (assuming that it remained undetected for any single day) as if counterfeits circulate for one day, or as large as 11,74,866 if they circulate for six years. 4. Estimating the stock of counterfeits The extent of counterfeiting in an economy is usually judged in terms of either by observing the current flow of recoveries, or by estimating the outstanding stock of counterfeits as a ratio against the total NIC. The flow of recovery as well as seizure of counterfeits is directly observable, whereas the stock of counterfeits cannot be measured directly. While it might appear that the stock of counterfeits in circulation would be closely related to the flow of recoveries, this impression is incorrect. Even for quite some time undetected counterfeits may remain in the NIC in an evenly dispersed manner and may occupy significant percentage of the NIC15. As noted earlier about scantily available empirical validation of modelled behaviour of counterfeiting structure of the forces operating behind counterfeits is still in an evolving stage. Commonly adopted survey methods may not be feasible or would result in highly judgmental and biased estimates. The belief about encountering certain high denomination note, (say, Rs.500 currency note), when gets entrenched based on recurrent past experience or even heresy, it would render commonly adopted survey method unrealistic to come out with an unbiased estimate of the quantum of counterfeit notes. In such a situation, suiable stochastic modelling of count data could help to work out some useful estimates of counterfeit notes that might be circulating in the system. Count data modelling forms a significant part of widely accepted statistical methods for modeling individual behavior when the endogenous variable is a nonnegative integer. Post-1980s, a rich class of econometric models is developed and problems encountered by over-dispersion (variance revealed to be more than the mean) have been found to be better handled by assuming underlying distribution to be negative binomial. Often initiated by empirical problems, several methodological issues have been raised and solved. Winkelmann and Zimmerman (1995) have highlighted through an application to labor mobility data illustrating the gain obtained by carefully taking into account the specific structure of the data. As regards degree of over-dispersion and associated estimation procedure a substantial literature exists on related estimation procedure focusing attention on the negative binomial distribution parameter. For example, Lloyd-Smith (2007) dealt with certain problems of upward biases, precision and associated estimation problems with highly over-dispersed data with applications to infectious diseases. Count data on rare events like infectious diseases or occurrence of counterfeits could be inherently predisposed to potential biases of the data collection process, in particular systematic under-counting of events because of bunching and systematic underreporting problems. Typically, many zeros (non-happening of the rare outcome) preceding the occurrence of the rare events or occurrence of such outcomes in bunches are required to be fine-tuned and tackled both experimentally and technically. Related issues are outside the scope of the present paper as it needs ground level data to be made empirically more tractable. The references cited by Lloyd-Smith provide some useful clue to handle such biases in experimental data. The key parameters behind the underlying process of counterfeiting are: (i) dispersion, meaning thereby increased variability of recovering a fake note over its mean frequency or chance of occurrence and (ii) rarity of counterfeits amidst huge volume of genuine notes in circulation. Presence of counterfeits in the system in a sustained manner would make them dispersed across the NIC whereas increased volume of genuine notes makes any given and dispersed stock rarer. Both the increased levels of dispersion and rarity make the estimation process quite tedious and possibly dimensionally unstable. Some of the central banks are found to be using simple ratio and proportions based method (Parts-found-in-process – PFP approach), or a method of extrapolation of the ratio of discovered counterfeits to the outstanding stock of currency in circulation using life of counterfeit (Life-of-currency or LOC method), or a suitable composition of both the PFP and LOC methods (Composite method)16. Estimating counterfeit notes amount to know its proportion periodically with tolerable standard error estimate. The estimation procedure could be model dependent or otherwise. Model dependency requires some ingenuity in designing the sampling scheme so that broad assumptions behind the model could be fulfilled. Inverse sampling scheme, discussed later, is an often used methodology to estimate frequency of occurrence of the less common attribute in the context of over-dispersed count data (Haldane, 1945). So far it is not cited in the literature about adopting such methodology in estimating counterfeit notes but it is worth exploring as model driven error estimate could be reliable if an inverse sampling scheme is correctly figured out. The success of inverse sampling depends crucially on how the counterfeits are dispersed in the population of NIC. This may require lot of experimentation with the real life data sets, which is however not explored in the present paper. The model based inverse sampling method as well as associated computations are now described below for gainful applications in real life data17. 4.1. Method of Inverse Sampling: The inverse sampling18 design is a model based method devised to estimate a proportion of units with a specific attribute, particularly when it is small but could be widely varying across different samples. Under this method, sample size n is not fixed but becomes variable. Sampling is continued until a predetermined number (r) of units possessing the rare attribute have been observed and counting the needed sample size. J.B.S. Haldane (1945) pioneered application of inverse sampling in estimating minuscule proportion of abnormal blood cells which became standard technique in haematology19. Let π denote the proportion of units in the population possessing the rare attribute under study and N be the population size. Evidently, Nπ units in the population will possess the attribute. To estimate the proportion π, the sampling units are drawn one by one with equal probability and without replacement. Sampling is discontinued as soon as the number of units in the sample possessing the rare attribute is a prefixed number (r). We denote by n the sample size required to be drawn to obtain r units possessing the rare attribute. Then the corresponding probability distribution P (n) of the random variable n is given by   This version of inverse (binomial) sampling procedure is worthwhile to be explored for establishing a monitoring system of counterfeits encountered by the currency verification processing systems and also at the currency chests so as to have a reliable quantitative understanding about whether counterfeits floating in the system is better controlled or not. It may be noted that inverse sampling would give estimate of chance or occurrence of counterfeits. It would not however provide different dimensions about total counterfeit notes that might be threateningly outstanding that would only get revealed periodically in the various systems of note detection and seizure by the law enforcement, while changing in the hands of the common public or recovered from the banking system. For example, it would be erroneous to use this chance of contingency in deriving an estimate of outstanding fake notes that might be floating in the system. As a result, most of the central banks particularly in the developed nations use various alternative ratio based estimates which, statistically speaking, may not very much robust and rigorous. These are described below. 5. Making inverse sampling practicable for estimating counterfeit currency In order to assess the extent of counterfeit notes in its totality and alternative methodologies for estimating the outstanding pieces of counterfeits, past data needs to be analysed first. This will help assess relevant dimensions of forged currency notes and proposing suitable methods of estimation of counterfeit currency. Understanding of regional pattern over a period of time is also critical. Alternative estimation procedures, despite having limitations as discussed earlier, would provide certain empirical dimensions about counterfeiting activities. It may be mentioned that inverse sampling would help estimate the unknown proportion of counterfeits, which comprises observing counterfeits in a bank note checking device equipped with counterfeit detection machines, without replacement, and discontinuing as soon as the number of counterfeits observed in the sample becomes a stable or a prefixed number. However, such commonly perceived sequential way of carrying out inverse sampling is neither practicable nor based on any sound optimal stopping rule because of probable irregularities in real life data. Then fitting a hypothesized probability distribution for counterfeits count data would provide testable robust estimate along with the associated standard error estimate. Such estimates can further be pooled by following the weighted average approach. Incidentally, it may be mentioned that statistically best estimate for proportion of counterfeits in inverse sampling is (r-1)/(n-1) in a sequence of n draws of currency notes till one encounters r many counterfeits; it is not the commonly perceived ratio r/n as applicable in fixed sample size case in case of binomial population. Adoption of inverse sampling on suitably designed output from the currency verification stages for the data on counterfeit notes would provide a workable estimate of incidence of encountering fake notes. A practical data format is mentioned as an example would look as given in the following Table. Within the banking system, incidence of counterfeiting detection is observed in three distinct stages (assuming the proportion of voluntary reporting of public detection is nil): (a) at the branches of banks; (b) currency sorting system at the currency chests; and (c) currency verification and processing system (CVPS) at RBI offices. True, that encountering counterfeits at CVPS would be rarest of the rare event as such contingency would be subject to effective functioning of all the counterfeit detection system, where they are supposed to be already processed several times. However, tracking at CVPS is still important though occurrence of counterfeits may not be amenable to inverse sampling method because of biased observations made through relatively smaller sample size. It needs to be mentioned that such detection of counterfeits needs to be carried out in the form of continuous sequence. As per the requirement of inverse sampling method, tracking counterfeit note directly is difficult as drawing a random sample is not practically feasible. However, the process can be simulated by fitting proper negative binomial distribution (NBD) in terms of diffusion and shape parameter would help. Accordingly, one can plan the experiment and collect the count data on counterfeits as per the above format in such a manner that the data can be fitted suitably. Here an important point needs to be noted that the unbiased nature of the estimate is assured in the estimation procedure in an ideal situation. In reality, non-sampling biases due to reporting problems could be there, which needs to be plugged by putting standard system in place. Moreover, the proposed experiment needs to be carried out denomination-wise. Practically speaking, there could be data capturing biases, for non-dispersed situation, particularly for smaller denomination notes where bunching could take place after a long series of null or zero counterfeits. Moreover, estimates of proportion so derived can be biased upwards due to small sample, given the pre-assessed choice of the key parameter namely, how long the observation is to be made till this pre-assigned fixed number of counterfeits (or bunches of them in case of smaller denomination notes if found to be occurring more frequently) or relative under-reporting of zero-class observation, which can happen in case of bunching. These are to be empirically handled in a suitable manner based on certain prior pilot experiments. Negative binomial distribution is popular in modeling similar kind of surveillance datasets because its flexibility for modeling count-data with varying degree of dispersion. Given the actual data, bias reduction approaches can be fine-tuned based on suitable determination of sample size and periodicity of the structured data collection exercise. The scope of adopting inverse sampling method for estimating chance of encountering fake notes is explained in detail and an easy-to-carry-out data collection as well as corresponding estimation plan is laid out citing certain practical examples in Appendix. Incidence of currency counterfeiting and probable stock of counterfeits in circulation is the bane for the currency and coinage system. Encountering counterfeits, even infrequently, becomes a critical topic for discussion in the public forum. Persistent stock of circulating counterfeits with an increasing trend is a risk to the integrity of currency management system. Existing literature cites a few theoretical studies based on modelling the agent-based behaviour to understand the economic aspects of counterfeiting and implications for the incentive to counterfeit, social welfare and anti-counterfeiting policies. Such models are premised upon search-theoretic model of money. On empirical side, not much work has come up because of the limited availability of statistics on counterfeiting. The very first hurdle is to estimate the stock of circulating counterfeits with a credible precision. This paper examines certain feasible methodologies on estimation of counterfeit notes. This includes adopting inverse sampling technique at various stages of currency detection system and also exploring the procedure adopted by Bank of Canada, to understand the incidence of counterfeiting in India. Adoption of standard inverse sampling, however, demands data on notes processed in each and every intervening stage of the first, second and subsequent fake notes detected. This process is difficult to implement and impractical too. As against, this paper has proposed an equivalent model based version in which the data collection can be planned in a practical manner. In order to reduce regional bias, such exercise could be extended across states and pool them in a way that would provide state-wise picture on intensity of counterfeiting along with an error estimate. Secondly, in order to examine the robustness of the estimates derived from the inverse sampling exercise, there is a need to undertake estimation based on parts-found-in-processing (PFP) approach also. PFP estimates, though biased, could be obtained across States by denomination, preferably with shorter periodicity (at least quarterly) based on available counterfeit data detected by seizures and banking channel, including the central bank. Finally, the estimates produced from these alternative methodologies could be compared so as to achieve high degree of confidence on the estimated proportion of counterfeit notes. Recent advances in printing technology have greatly aided production of counterfeit notes. As a result, counterfeiting is posing increasing challenges to currencies all over the world, including India. Despite the extent of counterfeiting being apparently small, it poses serious threats to the currency and financial system. The Government and RBI have progressively responded to this threat by redesigning notes as per current theories, established country practices as also perceived sufficient condition to fulfill public understanding about authenticity of currency through awareness campaigns. To assess the effectiveness of various measures to deter counterfeiting, one needs to understand the exact nature of the threat that counterfeiting poses on the economic activity. Thus, it is necessary to examine the level of counterfeiting on a regular basis. Such examination is very critical both from theoretical and empirical points of view. Towards this, the approaches proposed here would provide a scientific and practical solution in obtaining credible statistical estimates of counterfeits an enduring way. @ The authors are Directors in the Department of Statistics and Information Management, Reserve Bank of India. 1Views expressed in the paper are those of the authors and not of the Reserve Bank of India. 2 According to the estimate by Judson and Porter (2003), counterfeit U.S. currency that has been passed into circulation is about one note in ten thousands of currency in circulation. Its direct cost to the domestic public is approximately $61 million in fiscal year 2007, which is up 66% from 2003. The indirect counterfeiting costs for money are much greater, forcing a U.S. currency re-design every 7–10 years (Quercioli and Smith, 2011). 3 Some the Eurozone countries give great importance to train people about identifying counterfeits (ref. DNB Working Paper No. 121/December 2006). 4 RBI Annual Report 2011-12 (p. 128-129) describes the recent initiatives to detect and report counterfeit notes by revising the procedure to be followed at bank branches, treasuries and sub-treasuries. 5 Forged notes circulating in the system gets heightened by rumours and lack of understanding about handling such a situation. As per a recent statement of Iraq released on 23rd February 2012, certain “talk about the entry of large quantities of counterfeit currency simply is based on unreasonable rumours”. According to the release, the rumours about the existence of counterfeit foreign currency and Iraqi Dinar is an aggressive campaign designed to weaken the national currency, noting that no country is immune from such malaise. 6 Agent-based models are the social-science analogue of the computational simulations now routinely used elsewhere after it was picked up beyond physical-science in the 1990s after experiment-based simulations were made feasible with the advances in computing power. It finds increasing use in problems such as traffic flow, spread of infectious diseases as well as complex nonlinear processes such as the global climate. They occupy a middle ground between rigorous mathematics and loose, possibly inconsistent, descriptive or even untested axiomatic approach (The New Palgrave Dictionary of Economics, 2008). 7 Well cited paper on “Counterfeit-Product Trade” by Gene, G. and C. Shapiro (1988) follows the approach of general equilibrium model that lets the price of money equilibrate the model, which was later adopted in certain eclectic approach for modeling counterfeiting of money. The case study book Knockoff: The Deadly Trade in Counterfeit Goods by Tim Phillips describes in detail how the counterfeiters' criminal network costs jobs, cripples developing countries, breeds corruption …. By turning a blind eye, we become accomplices ….”. 8 Such models prove that fiat money can be valued as a medium of exchange even if it enjoys a lower rate of return than other alternative assets, which however may co-exist with other money-like goods at multiple equilibrium points. 9 A recent paper of Fung and Shao (Bank of Canada Working Paper 11-4) highlights an apparent economic incongruity between higher incidence of forged bank notes and previous theoretical findings that counterfeiting does not occur in a monetary equilibrium (Nosal et al., 2007) by showing that counterfeiting can exist as an equilibrium outcome where money is not perfectly recognizable and thus can be counterfeited. Their exercise attempted to explicitly model the interaction between sellers' verification decisions and counterfeiters' choices of counterfeit quality for better understanding of how policies can affect counterfeiting. 10 As mentioned earlier, subsequent modelling efforts of Nosal and Wallace (2007) as also Li and Rocheteau (2011) that finds that counterfeiting does not occur in a monetary equilibrium does not always match with reality. 11 Another possibility of floating counterfeits outside the sovereign boundary of note issuing authority has become important. The database of Swiss Counterfeit Currency Central Office released on their web (Falschgeldstatistik) from 1999 onwards reveals that counterfeit notes are also percolating within the Swiss zone of policing counterfeit currency (Table 3). 12 Anecdotal evidences corroborate such sporadic phenomenon getting revealed in some regions of country (Fung and Shao, Autumn 2011). 13 Sourced from ‘The euro banknotes: recent experiences and future challenges” by Antti Heinonen (2007), European Central Bank. 14 Average annual rate of recovery during last six years works out to a comparable number (1,70,915). John Chant discussed about such interpretation of a probable stock of counterfeits in circulation against the data on recoveries in the working paper on “Counterfeiting: A Canadian Perspective” , Bank of Canada Working Paper 2004-33 while describing limitations of some of the simplified methodology adopted by the US Treasury. 15 For details, please refer to the Federal Reserve Board (2006) The Use and Counterfeiting of United States Currency Abroad’, Part 3. 16 Necessary details are at the Appendix on Technical Note. 17 Technical details are indicated in the Appendix for further clarifications. 18 The method of inverse sampling inverse (binomial) sampling is based on probability distribution models of count data where random sampling (with replacement) is continued till the occurrence of a specific contingent event for a pre-specified number of times. 19 Inverse sampling based procedure for estimating low frequencies became a standard technique throughout clinical trials and biology, particularly in cytogenetic studies on chromosomal abnormalities and enumeration of aquatic marine species. Details are given in the Technical Note in the Appendix. 20 The names ‘Negative Binomial’ comes from applying the general form of the binomial theorem with a negative exponent. Similarly ‘Negative Hyper-geometric’ distribution is related to standard hyper-geometric distribution. Details are given in the Technical Note in the Appendix. References Cavalcanti, Ricardo and Ed Nosal: “Counterfeiting as Private Money in Mechanism Design”. Journal of Money Credit and Banking, forthcoming. Chant, John (2004): “Counterfeiting: A Canadian Perspective”, Bank of Canada Working Paper 2004-33. Chant, John (2004): "The Canadian Experience with Counterfeiting", Bank of Canada Review, Summer, 41-49. Curtis, Elisabeth Soler and Christopher J. Waller (2000): “A Search-theoretic Model of Legal and Illegal Currency”, Journal of Monetary Economics, 45, 155-184. Durlauf, Steven N. and Lawrence E. Blume (2008): The New Palgrave Dictionary of Economics (ed.), 2008 Federal Reserve Board (2006): ‘The Use and Counterfeiting of United States Currency Abroad’, Part 3, The final report to the Congress by the Secretary of the Treasury, in consultation with the Advanced Counterfeit Deterrence Steering Committee, pursuant to Section 807 of PL 104‑132, The Department of the Treasury, United States Secret Service, http://www.federalreserve.gov/boarddocs/rptcongress/counterfeit/default.htm. Finney, D.J. (1949): “On a method of estimating frequencies”, Biometrica, 36, 233-234. Fung, Ben and Enchuan Shao (2011): “Counterfeit Quality and Verification in a Monetary Exchange”, Bank of Canada Working Paper 2011-4 (February 2011). Fung, Ben and Enchuan Shao (2011): “Modelling the Counterfeiting of Bank Notes: A Literature Review”, Bank of Canada Review, (Autumn 2011). Gene, G., AND C. Shapiro (1988): “Counterfeit-Product Trade,” The American Economic Review, 78(1), 59–75. Green, E. J., and Weber, W. E. (1996): “Will the New $100 Bill Decrease Counterfeiting?”, Federal Reserve Bank of Minneapolis Quarterly Review, 3-10. Haldane, J.B.S (1945): “On a method of estimating frequencies” Biometrica, 33, 222 -235. Judson, R. and R. Porter (2003): “Estimating the Worldwide Volume of Counterfeit U.S. Currency: Data and Extrapolation”, Finances in Economics Discussion Paper No. 52. Judson, R. and R. Porter (2010): “Estimating the Volume of Counterfeit U.S. Currency in Circulation Worldwide: Data and Extrapolation” (updated version of 2003 paper), Policy Discussion Paper Series (March 1, 2010), Federal Reserve Bank of Chicago - Financial Market Group. Kultti, K (1996): “A monetary economy with counterfeiting”, Journal of Economics, Vol. 63 (2), 175-186. Lengwiler, Yvan (1997): “A Model of Money Counterfeits”, Journal of Economics, Vol. 65 (2), pp. 123-132. Lloyd-Smith, James O (2007): “Maximum Likelihood Estimation of the Negative Binomial Dispersion Parameter for Highly Overdispersed Data, with Application to Infectious Diseases”, PLoS ONE 2(2): e 180.doi:10.1371 / journal. pone .0000180. Mendo, Luis and Jos’em. Hernando (2010): “Estimation of a probability with optimum guaranteed confidence in inverse binomial sampling”, Bernoulli 16 (2), 2010, 493-513. Monnet, C. (2005): “Counterfeiting and Inflation”, European Central Bank Working Paper No. 512. Monnet, C. (2010): Comments on Cavalcanti and Nosal’s “Counterfeiting as Private Money in Mechanism Design”, Federal Reserve Bank of Philadelphia Working Paper No. WP 10-29. Nosal, E. and N. Wallace (2007): “A Model of (the Threat of) Counterfeiting.” Journal of Monetary Economics, 54 (4), 994 -1001. (Pre-revised version as Federal Reserve Bank of Cleveland Working Paper No. WP 04–01 in 2001). Phillips, T. (2005): Knockoff: The Deadly Trade in Counterfeit Goods. Kogan Page Limited, London. Quercioli, E. and L. Smith (2011): The Economics of Counterfeiting, http://www.gsb.stanford.edu/facseminars/events/economics/ documents/econ_10_11_smith.pdf. Reserve Bank of India, Annual Report, Various Issues. Reserve Bank of India, Annual Monetary Policy Statement, 2012-13. Subbarao, Duvvuri (2011): “Dilemmas in Central Bank Communication: Some Reflections Based on Recent Experience”, RBI Bulletin. Rainer Winkelmann and Klaus F. Zimmermann (1995): “Recent Developments in Count Data Modelling: Theory and Application”, Journal of Economic Surveys,Vol. 9(1), p1-24 Williamson, Stephen D. (2002): “Private Money and Counterfeiting”, Economic Quarterly, Federal Reserve Bank of Richmond, Vol. 88 (3), pp. 33-57. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: