IST,

IST,

Report of the Internal Working Group to Review the Liquidity Management Framework

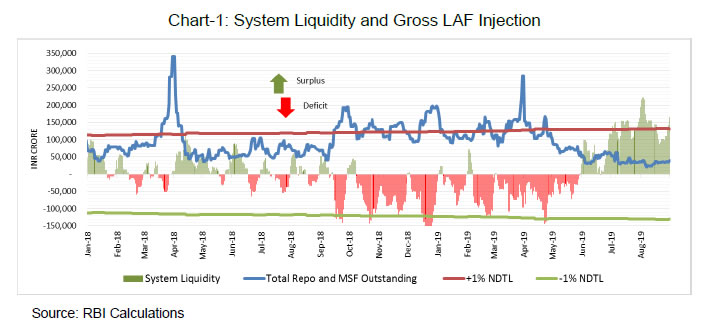

Liquidity management, which is the operating procedure of monetary policy, seeks to ensure adequate liquidity in the system so that sufficient credit is provided to all productive sectors in the economy. The first step in this process is the transmission of changes in the policy rate to the inter-bank call money rate. Subsequently, this impulse gets transmitted to longer term interest rates on financial instruments traded in markets, loans and deposits. This report is focused on the process of transmission of changes in policy rate to the overnight inter-bank rate, or the interest rate in the market for bank reserves1, through the liquidity framework. In this report, the term ‘liquidity’ has been used to mean central bank liquidity. Since successful monetary policy requires effective liquidity operations, the liquidity management framework needs to be carefully designed. The recommendations made in this report are underpinned by five guiding principles, which provide the conceptual basis to assess the efficacy of the Reserve Bank’s liquidity management framework. I. Guiding Principles of Liquidity Management Framework (i) The liquidity management framework should be guided by the objective of maintaining the target rate, i.e., the rate in the inter-bank market for reserves, close to the policy rate. Since the central bank provides reserves through its liquidity management operations to eligible entities (typically banks), the target rate is usually the rate at which reserves are borrowed or lent among banks, viz., the call money market rate in India. Towards this end, the framework should enable the central bank to be equipped with the required tools to inject and absorb liquidity at either fixed or variable rates, on an overnight basis as well as for longer tenors. The central bank should also have the freedom with respect to the instruments to be used as well as the tenor of operation. (ii) Since the determination of the policy rate by the Monetary Policy Committee (MPC) is distinct from the process governing liquidity management operations by the central bank, it is important to ensure that liquidity operations should be consistent with the policy rate set by the MPC. Liquidity management by the central bank should be aimed at achieving the first leg of transmission of monetary policy, which is to align the target rate with the policy rate set by the MPC. (iii) Different liquidity management frameworks are designed for different conditions, though they all aim to achieve the same objective, as set out in (i) above. Specifically, (a) Under a “corridor” system – i.e., with a ceiling and a floor rate – the repo rate, that is, the rate at which central banks inject liquidity, works as the policy rate. Such a system would not be efficient when dealing with surplus liquidity because in surplus liquidity conditions, the inter-bank money market rate tends to gravitate towards the reverse-repo rate, or the rate at which central banks absorb liquidity. Therefore, under a ‘corridor’ system, central banks endeavor to keep the system liquidity in deficit. (b) On the other hand, under a “floor” system, the reverse-repo rate, i.e., the rate at which central banks absorb liquidity, works as the policy rate. Using the same reasoning as in (a) above, central banks endeavor to keep system liquidity in surplus under a ‘floor’ system.2 (iv) It is important that the liquidity management framework does not undermine the price discovery process in the inter-bank money market. Particularly, the framework should incentivise banks to trade among themselves rather than with the central bank because the transmission process crucially depends on market forces working efficiently. (v) The liquidity framework should be robust enough to handle unexpected fluctuations in system liquidity without affecting its ability to adhere to the above guiding principles. Such fluctuations can arise on account of frictional factors like changes in government cash balances as well as durable factors such as the expansion or contraction of Currency in Circulation (CiC) and the impact of a central bank’s Foreign Exchange (Fx) operations on domestic liquidity. II. Operational Implications of the Guiding Principles (i) All liquidity management frameworks should provide the required liquidity to the banking system. Without such an assurance, the objective of maintaining the target rate close to the policy rate would be difficult to achieve. The liquidity management framework should ensure that liquidity available is no more, or no less, than what the banking system needs to meet its reserve requirement. Thus, the banking liquidity being kept in deficit or in surplus mode is a design feature of the liquidity management framework – whether it is the corridor system or the floor system, or, analogously, whether the policy rate is the repo rate or the reverse-repo rate. It does not reflect, or depend upon, the monetary policy stance (neutral, tightening or accommodative), because monetary policy stance, under an inflation targeting framework conducted through changes in interest rate, hinges on the direction of policy rate. The choice between the two systems, therefore, depends on the prevailing liquidity climate. (ii) The liquidity framework should provide the choice for both fixed rate and variable rate operations. While normally liquidity operations should be carried out using fixed rate operations (injecting liquidity at the policy repo rate and absorbing liquidity at the reverse repo rate), unanticipated liquidity developments may necessitate the use of variable rate operations. System liquidity may not always remain in deficit even under a ‘corridor’ system, if we recognise the possibility that certain events – like persistent capital flows – may render it difficult for the central bank to absorb liquidity. In such an eventuality, it may become necessary to absorb surplus liquidity at rates closer to the policy rate for efficient transmission of monetary policy signals. This may require the use of variable rate reverse-repo operations. (iii) The target rate being an overnight rate, liquidity operations should predominantly be of overnight maturity. However, given the overarching requirement of liquidity operations being consistent with the policy rate, and in order to minimise intervention in the inter-bank market so as to enable free play of market forces, it may, at times, be useful to inject or absorb liquidity using longer-term (7 or 14 days, in any case not exceeding a reporting fortnight) operations. For instance, a 14-day operation at the beginning of the fortnight (or a 7-day operation at the beginning of each week) could reduce the system requirement over the fortnight; and consequently, reduce the volume of overnight operations. (iv) The liquidity framework should have an array of instruments to address durable liquidity surplus or deficit. While daily overnight operations (or weekly/fortnightly operations followed by overnight operations) should address the liquidity needs of the banking system, it is nonetheless possible that unanticipated shocks (variations in Government cash balances, fluctuations of CiC, or Fx intervention operations) could lead to liquidity build-up (positive or negative) that could result in actual liquidity being different from the desired level. If the effect of such shocks is expected to be temporary, then flexible use of variable rate operations should suffice. If, however, such liquidity conditions are expected to persist, it would be necessary to bring the liquidity in the system back to the desired level. This could be achieved through outright Open Market Operations (OMOs), or where outright operations are not desirable (e.g., because of their impact on yields), by using alternative tools to achieve the desired impact on durable liquidity. One alternative could be longer-term repo or reverse repo operations (beyond 14 days and up to one year), as they do not have a discernible impact on bond yields. These instruments would, however, work if their interest rates are market determined. Similarly, Fx swaps (buy-sell or sell-buy Rupee-Dollar swaps) can also be used for durable liquidity operations. These instruments – OMOs, longer term variable rate repos or reverse-repos or Fx swaps – should be used to bring the liquidity position in the banking system back to the desired level. (v) Finally, for ensuring activity in the inter-bank money market, banks should have the incentive to trade among themselves rather than only with the central bank, to maintain the efficiency of the price discovery process in the inter-bank money market. This implies that generally banks should be able to borrow in the inter-bank money market at rates not higher than the rate at which they could borrow from a central bank (i.e., the rate at which a central bank injects liquidity). Conversely, banks should be able to lend in the inter-bank money market at rates not below the rate at which they can lend to a central bank (i.e., the rate at which a central bank absorbs liquidity). It follows that, the rate at which a central bank absorbs liquidity and the rate at which it injects liquidity should not materially be the same, as it changes incentives in the market, thereby, affecting price discovery. The above principles lay down the broad contours for the design of an efficient liquidity management framework by the Reserve Bank. Based on the guiding principles for liquidity management framework enunciated above and after considering their implications, the Group makes the following recommendations. III. Recommendations of the Internal Working Group Corridor versus floor system I. As the corridor system affords the desired flexibility to manage situations of liquidity deficit as well as liquidity surplus and given that the repo rate is the policy rate set by the MPC, the Group recommends that the liquidity management framework should continue to be based on the corridor system. Call money rate – the target rate of liquidity operations II. As the call money market is the only money market segment which trades exclusively in reserves, the Group recommends that the call money rate – with Weighted Average Call Rate (WACR) as the measure – should continue as the target rate of the liquidity management framework. The desired level of system liquidity III.1 The Group observes that the design of the corridor system, with repo rate as the policy rate, would generally require the system liquidity to be in a small deficit of about 0.25 per cent - 0.5 per cent of Net Demand and Time Liabilities (NDTL) of the banking system. However, if financial conditions warrant a situation of liquidity surplus, the framework could be used flexibly, with variable rate operations, to ensure that the call money rate remains close to the policy repo rate. III.2 Thus, liquidity operations shall take into consideration prevailing conditions, based on which the required tools will be used to achieve the objective of the liquidity management framework. Managing day-to-day liquidity IV.1 The Group recommends that uncertainty, if any, about the Reserve Bank’s liquidity management (in terms of quantum and rates at which operations are conducted) should be minimised by conducting liquidity management operations at a rate close to the policy repo rate. To this end, the daily primary liquidity management operation should be ideally one single overnight variable rate operation3. The liquidity framework should entirely meet the liquidity needs of the system. Consequently, a separate provision of assured liquidity is no longer necessary. IV.2. Recognising their important role in the primary and secondary market for Government securities, Standalone Primary Dealers (SPDs) should be allowed to participate directly in all overnight liquidity management operations. IV.3 The Group recommends that the Reserve Bank should stand ready to undertake intra-day fine-tuning operations, if necessary; however, such operations should be the exception to address unforeseeable intra-day shocks rather than the rule. Minimising the number of operations should be a goal of efficient liquidity management operations. Managing durable liquidity V.1 The Group recommends that under the corridor system, build-up of liquidity into a large deficit (greater than about 0.25 per cent to 0.5 per cent of NDTL) or surplus, if expected to persist, should be offset through appropriate durable liquidity operations. Deficit in system liquidity should ideally be offset by durable liquidity injection measures (such as OMO purchases or buy-sell Fx swaps); in the same manner, persistent surplus in system liquidity should ideally be neutralised by durable liquidity absorbing operations (such as OMO sales or sell-buy Fx swaps). V.2 The Group recommends that, as an alternative to OMO purchases, longer-term variable rate repos, of more than 14 days and up to one-year tenor, be considered as a new tool for injection if system liquidity is in a large deficit. Similarly, longer-term variable-rate reverse-repos could be used to absorb excess liquidity. As these are possible substitutes for OMOs, these instruments should be operated at market determined rates. The boundaries of the corridor system VI. The Group recommends that the current difference of 25 basis points between the repo rate and the reverse-repo rate, as well as between the repo rate and the Marginal Standing Facility (MSF) rate, be retained. The standing liquidity facilities – Fixed Rate Reverse Repo and MSF – may continue as at present. Margins VII. The Group recommends that margin requirements under the Liquidity Adjustment Facility (LAF) be reviewed on a periodic basis. The Group also recommends that the margin requirement for reverse-repo transactions should continue to be ‘Nil’, as hitherto. Reserve averaging VIII. The Group recognises that the present minimum requirement of maintaining 90 per cent of the prescribed Cash Reserve Ratio (CRR) on a daily basis has helped avoid bunching of reserve requirements of individual banks. Hence, the Group recommends that this minimum requirement be retained at the present level. Standing Deposit Facility IX. The Group recommends that the Standing Deposit Facility (SDF), a tool to absorb liquidity, may be operationalised early. Communication and disclosures X.1 For better dissemination of information on liquidity management operations, the Group recommends that the Press Release detailing the Money Market Operations (MMO) should be modified suitably to show both the daily flow impact as well as the stock impact of the Reserve Bank’s liquidity operations. X.2 The Group also recommends that a quantitative assessment of durable liquidity conditions of the banking system be published on a fortnightly basis with a fortnightly lag. I.1 Liquidity management, which is the operating procedure of monetary policy, seeks to ensure adequate liquidity in the system so that sufficient credit is provided to all productive sectors in the economy. The first step in this process is the transmission of changes in the policy rate to the inter-bank call money rate. Subsequently, this impulse gets transmitted to longer term interest rates on financial instruments traded in markets, loans and deposits. This report is focused on the process of transmission of changes in policy rate to the overnight inter-bank rate, or the interest rate in the market for bank reserves4, through the liquidity framework. I.2 Liquidity management operations thus constitute an important aspect of the implementation process of monetary policy. These operations are essentially intended to transmit the impulse of monetary policy action to the market for bank reserves (deposits kept by banks with the central bank). Since successful conduct of monetary policy requires effective liquidity operations, the liquidity management framework needs to be carefully designed and deployed. Liquidity management frameworks globally have similarities in terms of design and tools, but several differences also exist as each central bank attempts to accommodate its unique domestic conditions. However, since the Global Financial Crisis (GFC), following the quantitative easing resorted to by many central banks in Advanced Economies (AEs), a clear divergence has emerged between the liquidity management frameworks of AEs and Emerging Market Economies (EMEs). I.3 Since the introduction of an Interim Liquidity Adjustment Facility (ILAF) in April 1999, the liquidity management framework of the Reserve Bank has undergone various refinements during the last two decades in response to changing domestic conditions and global developments. Pursuant to the recommendation of the “Working group on Operating Procedure of Monetary Policy” (Chairman: Deepak Mohanty, RBI, 2011), the repo rate was used to unambiguously signal the stance of monetary policy to achieve macroeconomic objectives of price stability and growth with the WACR as the explicit operating target of liquidity management operations. A corridor around the policy rate with the MSF/Bank Rate as the upper bound (ceiling) and the reverse-repo rate as the lower bound (floor) was set to contain volatility in the operating target. Thereafter, following the recommendation of the Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R. Patel; RBI, 2014), the framework was further modified by eliminating unlimited accommodation on an overnight basis and providing liquidity through term repos. The framework was fine-tuned in April 2016 when it was decided to smoothen the supply of durable liquidity over the year and progressively lower the average ex-ante liquidity deficit in the system to a position closer to neutrality. I.4 The robustness of the current framework, which was put in place in 2014, was tested during November 2016-April 2017, when the banking system was aflush with an unprecedented amount of liquidity following withdrawal of high value notes in November 2016. In order to strengthen the operating system further, the Government has since amended the RBI Act for introduction of a SDF. Recently, the Reserve Bank also added long term Fx swap auctions as a tool for liquidity management. While the liquidity framework has proved to be resilient, multiple fine-tuning operations undertaken by the Reserve Bank have rendered it complex. The assessment of liquidity position by different market participants also varies markedly in the absence of a clear definition of what is meant by the term ‘liquidity’. In view of these developments and based on the experience gained in the conduct of liquidity management operations, it was felt necessary to review the current framework. Accordingly, as announced in the Statement on Developmental and Regulatory Policies of June 06, 2019, an Internal Working Group (IWG) was constituted with a mandate to: i) Conduct a detailed review of the current liquidity management framework with a view to simplifying it; and, ii) Suggest measures to clearly communicate the objectives, quantitative measures and the toolkit of liquidity management by the Reserve Bank. I.5 The Group greatly benefitted from its interactions with economists and bankers. I.6 The Report is organised in three chapters, including this introductory chapter. Chapter II reviews the concepts and drivers of liquidity, the evolution of the liquidity framework in India and spells out the contrasting features of the corridor-based system versus the floor-based system. Chapter III makes an assessment of the key features of the current framework and suggests measures to improve the current operating framework. Chapter II: Current Liquidity Framework – A Review Liquidity management is premised on the principle that banks are required to hold, at the end of the day, a certain level of cash in their accounts with the central bank, called required reserves. As a bank’s cash balances change throughout the day consequent to customer transactions, each bank’s need for reserves at the end of the day is also uncertain. Since the demand for reserves has implications for the overnight inter-bank rate, which in many cases is the operating target of monetary policy, central banks modulate the supply of reserves to achieve the objective of keeping the overnight market rate close to the policy rate. II.1.1 Liquidity is of paramount importance for a well-functioning and sound financial system. The term ‘liquidity’, however, has many different meanings, and the specific sense in which it is used is determined by the context. Broadly, the term ‘liquidity’ is used in three senses – funding liquidity, market liquidity and central bank liquidity. An effort is made in the ensuing paragraphs to clarify the definition and specific meaning of ‘liquidity’ when used in the context of monetary policy implementation. II.1.2 The Basel Committee on Banking Supervision (BCBS) defines funding liquidity as the ability of banks to meet their liabilities, unwind or settle their positions as they become due. Similarly, the International Monetary Fund (IMF) provides a definition of funding liquidity as the ability of solvent institutions to make agreed upon payments in a timely fashion. Thus, funding liquidity refers to the ability of individual institutions to meet their liabilities and other payments needs. Market liquidity, on the other hand, refers to the ease with which a financial asset can be converted into cash at short notice, without causing a significant movement in its price. In general, market liquidity is measured in terms of bid-ask spread, volume and frequency of transactions per unit of time, turnover ratio and price impact of a trade. While funding liquidity is specific to an institution, market liquidity is specific to a market. II.1.3 The third sense in which the term liquidity is used, central bank liquidity, refers to reserves provided by a central bank to the banking system. Banks are, in many countries, required to maintain a mandated level of balances in their accounts with the central bank. These balances are referred to as required reserves. If the banking system has less money than the required reserve, which it needs to borrow from the central bank, it is said that the system liquidity is in deficit and vice versa. Central bank liquidity operations, accordingly, refer to the injection or absorption of reserves from the banking system. In this report, the term liquidity has been used to mean central bank liquidity. II.2 Measure of Central Bank Liquidity in India II.2.1 Central bank liquidity is the key element in monetary policy implementation process and the focal point for liquidity management operations is the banking system liquidity or system liquidity. Generally, banks would need to borrow funds from the central bank to meet their reserve requirement, if it cannot be met from the inter-bank market and vice-versa, i.e. deposit the excess over the reserve requirement with the central bank. On a given day, if the banking system is a net borrower from the Reserve Bank under LAF, the system liquidity can be said to be in deficit (i.e., system demand for borrowed reserves is positive) and if the banking system is a net lender to the Reserve Bank, the system liquidity can be said to be in surplus (i.e., system demand for borrowed reserves is negative) (Chart-1). In practice, banks maintain a slightly positive margin (excess reserve) over required reserves on a daily basis to meet unanticipated settlement obligations (or precautionary demand for reserves), that needs to be reckoned to arrive at the quantum of liquidity available to the banking system on a given day. Thus, banking system liquidity can be summarised as under:

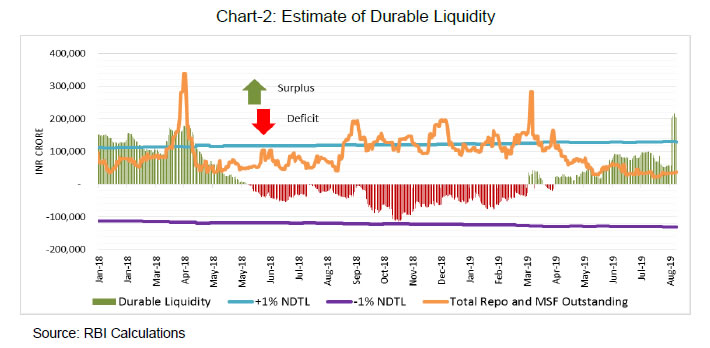

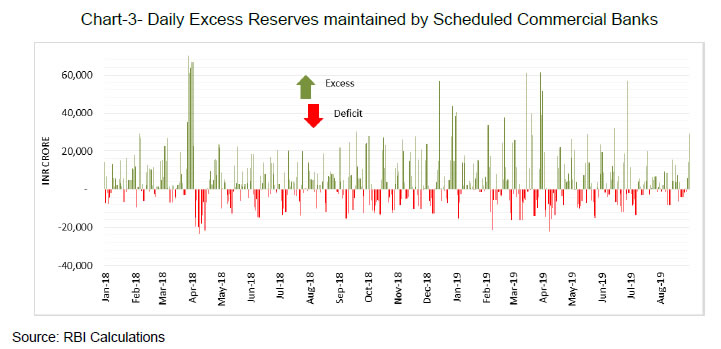

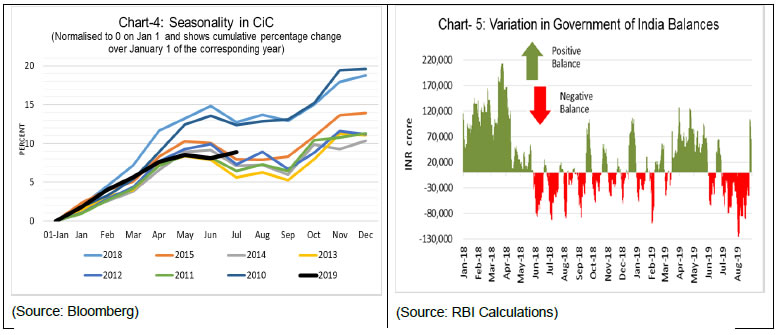

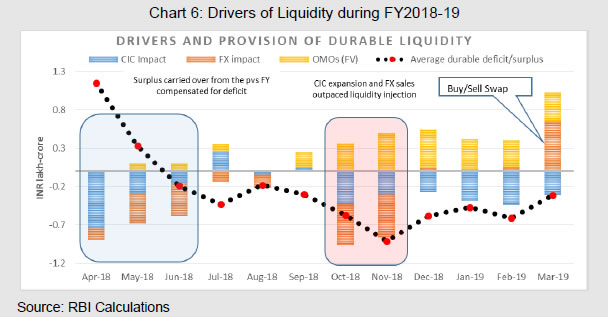

II.2.2 System liquidity or demand for reserves can also be differentiated depending upon whether the source of demand is transient/frictional or durable. Transient/frictional liquidity refers to the liquidity condition which could reverse course overnight, or over a short period of time. Government cash balances, which are held with the Reserve Bank, are a major source of transient/frictional demand for reserves. Durable liquidity or permanent demand for reserves arises from permanent or long-term changes in the liabilities of the Reserve Bank viz., expansion/contraction in CiC and decrease/increase of banking system reserves due to unsterilised Fx intervention operations. An easier derivation of durable liquidity is by adjusting the Government of India (GOI) balance from system liquidity (Chart 2). Thus, if the net borrowing by the banking system from the Reserve Bank is higher than the GOI balance, it indicates that durable liquidity is in deficit and vice-versa. II.2.3 It needs to be emphasised that the total system demand for reserves on any given day would be met by the Reserve Bank through one or more liquidity operations or windows. Therefore, from the system perspective, the distinction between durable liquidity and frictional liquidity is not very pertinent. The distinction, however, is important for the Reserve Bank from its liquidity planning point of view to minimise the need for fine-tuning operations. Thus, a longer-term or outright operation would be more appropriate to deal with durable liquidity conditions. II.2.4 An attendant issue which merits consideration is whether provision of liquidity through short-term repos, followed by continuous rollovers, can be considered a substitute for durable liquidity. It may not, in view of the attendant roll-over risks. However, it needs to be recognised that there could be leads and lags involved in the supply of and demand for reserves on a durable basis. Hence, a part of the durable demand could also be met through short-term repo operations and then rolling them over till a longer-term/outright operation can be conducted. In the short-term, both outright and repurchase operations are fungible. II.3 Drivers of Liquidity in India II.3.1 The primary demand for reserves by banks arises due to the central bank’s imposition of cash reserve requirement for banks. The demand for reserves also arises on account of movement in Government cash balances, changes in the amount of CiC and Fx operations of the Reserve Bank. All these factors are commonly referred to as autonomous drivers of demand for reserves. In India, CiC is the major driver of liquidity. It is observed that during some years, like 2014-15 and 2017-18, Fx operations of the Reserve Bank also had a significant bearing on liquidity. However, on a day to day basis, movement in Government cash balances is an important factor which drives liquidity (Table 1). II.3.2 At the start of the fortnightly reserve maintenance period, an incremental demand for reserves is created by the mandated cash reserve ratio on incremental NDTL as at the end of the second preceding fortnight of the banking system. Any increase in required reserves due to growth in NDTL should be provided by injection of liquidity by the central bank. Central banks normally allow reserve averaging during the maintenance period to enable banks to smoothen day-to-day fluctuations in the demand for reserves. Taking advantage of the reserve averaging system, banks maintain excess reserves on some days, which are then matched by deficit on other days (Chart-3). II.3.3 The currency demanded by the public or CiC grows as the economy expands and is broadly a function of nominal GDP growth. In the case of India, CiC follows a seasonal pattern whereby the demand is tepid during the first half of the financial year and picks up during the second half, coinciding with the pick-up in economic activity during the festive season (Chart-4). An increase in CiC, ceteris paribus, is a drain on bank reserves and results in an increased demand for reserves by banks. The central bank thus needs to meet this demand and replenish the level of reserves held by banks through injection of liquidity. II.3.4 Any interaction between a central bank and the banking system impacts the level of reserves. One such interaction, in India, is caused by Government transactions, revenue as well as expenditures. These transactions are mostly conducted through banks. Since the accounts of the Government as well as of the banks are maintained at the central bank, in its role as a banker to banks as well as to the Government, most Government transactions ultimately result in movement of funds between the account of the Government and that of the banks maintained in the Reserve Bank. For example, when corporates pay taxes to the Government, the outflows from the banking system to the Government would reduce the level of reserves and increase Government cash balances held with the central bank. Similarly, salary and pension payments by the Government increase the level of reserves with the banking system. II.3.5 Given their variability, Government balances impart a degree of uncertainty to the level of reserves in the banking system, except on a few occasions, such as the dates on which tax outflows and salary payments are scheduled, as these are known in advance (Chart-5). In the case of India, the demand for reserves on account of changes in GoI cash balances can be reasonably estimated on account of tax related payments and GoI borrowing programme. Since the demand for reserves emanating on account of changes in GoI balances is transitory/reversible, the Reserve Bank takes this into account in its liquidity assessment and provides liquidity for an appropriate tenor. II.3.6 Capital flows have implications for liquidity management and their impact also depends on the prevalent exchange rate regime. The policy response to capital flows depends on whether capital flows are temporary or enduring. While the distinction between short-term and long-term flows is conceptually clear, in practice, it is not always easy to distinguish a priori between the two for operational purposes and their relative composition. For an economy with a managed float, the shock to domestic liquidity conditions arising from lumpy capital flows can be large. Consequently, liquidity operations by the central bank are required to respond to the domestic liquidity impact of capital flows. II.3.7 India, being a current account deficit country, is susceptible to volatile capital flows. The Reserve Bank intervenes in the Fx market to contain excessive volatility in the exchange rate and in the process, it either supplies or absorbs foreign currency in exchange for domestic currency. Thus, in the presence of excessive capital outflows (inflows), the Fx operations of the Reserve Bank drains (injects) rupee liquidity and thereby increases demand for (supply of) reserves. The consequent impact on bank reserves is managed by the Reserve Bank through its liquidity operations.

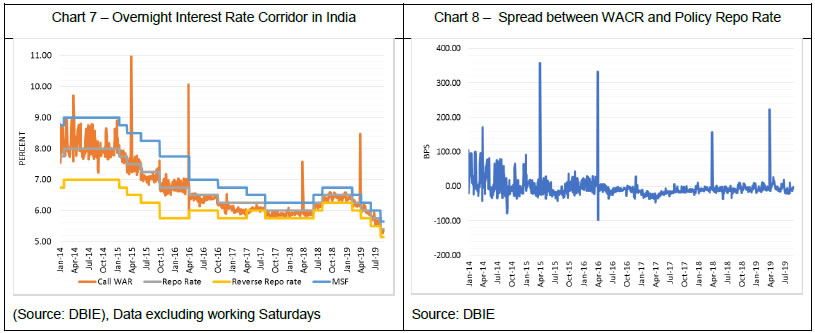

II.3.8 As noted earlier, any interaction between the Reserve Bank and the banking system impacts the level of reserves. Operations between the Reserve Bank and the Government are different as, in the first instance, they do not affect the reserves of the banking system. Such operations include interest or redemption payments on the Government securities held by the Reserve Bank in its investment portfolio, Ways and Means Advances (WMA) availed by the Government from the Reserve Bank, surplus transfer by the Reserve Bank to the Government, etc. Eventually, however, as the Government borrows the shortages in its account or spends the cash in its account, the reserves of the banking system are affected, necessitating offsetting liquidity operations by the Reserve Bank. An illustration of these drivers of demand for reserves and their impact on liquidity has been provided in Annex-1. II.4 Evolution of the Liquidity Management Framework in India II.4.1 The liquidity management framework of the Reserve Bank has evolved through progressive refinements since 1999 in response to changing domestic conditions and global developments. In April 1999, ILAF was introduced under which liquidity was injected against collateral of GoI securities at various interest rates, but surplus liquidity was absorbed at a fixed rate. A Collateralised Lending Facility (CLF) was established alongside an Additional Collateralised Lending Facility (ACLF), with export credit refinance and liquidity support to PDs linked to the Bank Rate. The transition from ILAF to a full-fledged LAF took place in June 2000. II.4.2 With the introduction of the LAF, steering overnight money market rates emerged as the key challenge in daily liquidity management operations. The LAF was operated through overnight fixed rate repo (rate at which liquidity is injected) and reverse-repo (rate at which liquidity is absorbed) from October 2004, consistent with monetary policy objectives. The LAF became the principal instrument of liquidity management with an asymmetric interest rate corridor (with repo rate as the ceiling and reverse-repo rate as the floor) varying between 100 bps and 300 bps. As an additional instrument, the Market Stabilisation Scheme (MSS) was introduced in April 2004 to aid sterilisation operations as the security holding of the Reserve Bank was inadequate. II.4.3 In the ensuing years, the effective policy rate alternated between repo and reverse-repo rates depending on deficit and surplus liquidity conditions in the system. This, in turn, was influenced by sharp swings in capital inflows/outflows. Such oscillations in liquidity conditions resulted in call money rates exhibiting volatile movements, often breaching either the ceiling or the floor of the corridor. Accordingly, the operating framework was modified in May 2011 in pursuance of the recommendations of the Working Group on Operating Procedure of Monetary Policy (Chairman: Dr. Deepak Mohanty). The repo rate was made the single independently varying policy rate for transmitting policy signals and it was decided to keep the system in a deficit mode for efficient transmission of monetary policy impulses with the WACR as the target of monetary policy. A marginal standing facility (MSF) was instituted under which banks could borrow overnight at their discretion by dipping up to 1 per cent into the Statutory Liquidity Ratio (SLR) at 100 basis points (bps) above the repo rate to provide a safety valve against unanticipated liquidity shocks. The corridor was made symmetric in May 2011 having a fixed width of 200 bps with the ceiling of the corridor, i.e., MSF rate and the floor of the corridor, i.e., reverse-repo rate being placed 100 bps above and below the repo rate, respectively. II.4.4 Subsequently, the Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R. Patel; RBI, 2014) recommended that excessive reliance of the Reserve Bank on the overnight segment of the money market should be avoided by de-emphasising overnight repos; and suggested instead that liquidity management operations should be conducted through term repos of different tenors. Accordingly, the Committee recommended design changes and refinements in the operating framework with flexibility in the use of instruments but consistent with the overall objectives of monetary policy. The key change in the framework was doing away with unlimited accommodation of liquidity needs at the fixed LAF repo rate. Other important elements of the revised framework included: (i) provision of the predominant portion of central bank liquidity through regular term repo auctions; (ii) introduction of fine-tuning operations through repo/reverse-repo auctions of maturities varying from overnight to 28 days with liquidity assessment undertaken on a continuous basis; and (iii) phasing out export credit refinance. II.4.5 The liquidity management framework was further fine-tuned in April 2016 when it was decided to progressively lower the average ex-ante liquidity deficit in the system to a position closer to neutrality. The Reserve Bank also indicated that it would smoothen the supply of durable liquidity over the year using asset purchases and sales, as per requirements. Moreover, in consonance with the recommendation of the Expert Committee, the width of the policy rate corridor was progressively narrowed from 200 bps in April 2015 to 50 bps in April 2017 in a symmetric manner6. This helped in containing volatility in the overnight market, especially during demonetisation, even as the volume of the total overnight market remained broadly unchanged (Charts 7 and 8). II.4.6 The current liquidity framework operates as a corridor system with the repo rate as the policy rate. The standing facilities consist of fixed rate reverse-repo as the floor (25 bps below the policy repo rate) and the MSF as the ceiling (25 bps above the repo rate); which represent the boundaries of the corridor. Under the present framework, banks have access to fixed rate repo up to 0.25 per cent of their NDTL and up to 0.75 per cent of the banking system NDTL through four 14-day variable rate term repo auctions. The Reserve Bank, based on its assessment, also conducts fine-tuning operations of varying tenors to align the target rate to the repo rate. The target rate is the call money rate, with the WACR as the measure. II.4.7 The current liquidity management framework of the Reserve Bank is driven by two objectives: (a) to supply or withdraw short term liquidity from the market so as to offset frictional changes in reserves; and, (b) to supply durable reserves in line with the growing economy. The first objective is met by smoothing frictional mismatches through LAF (including fine-tuning repo/reverse-repo auctions of varying tenors) to keep the system liquidity conditions closer to neutrality. The second objective is met by modulating Net Foreign Assets (NFA) (i.e., accretion or depletion of FX reserves) and/or Net Domestic Assets (NDA) (i.e., purchase or sale of domestic securities through OMOs) in the Reserve Bank’s balance sheet in sync with the growth of the economy. For example, during periods when the Reserve Bank purchases significant foreign assets through Fx interventions, the size of domestic assets may have to reduce through open market sale of domestic bonds for sterilization (for instance, 2017-18) and when there is a sale of foreign assets, the size of domestic assets may have to rise through OMO purchase operations (for instance, 2018-19). II.5 Guiding Principles for an Efficient Liquidity Management Framework II.5.1 Transmission to Target Rate II.5.1.1 The appropriate liquidity management framework should enable transmission of monetary policy impulses to shortest-end of interest rate curve by adequately meeting the system demand for reserves. II.5.1.2 Since the determination of the policy rate by the MPC is distinct from the process governing liquidity management operations by the central bank, it is important to ensure that liquidity operations should be consistent with the policy rate set by the MPC. Liquidity management by the central bank should be aimed at achieving the first leg of transmission of the monetary policy, which is to align the target rate with the policy rate set by the MPC. II.5.2 Liquidity Management Frameworks – Design II.5.2.1 There are broadly two types of liquidity frameworks – the ‘corridor’ system and the ‘floor’ system. In a corridor system, the central bank has standing facilities to lend reserves and accept deposits from banks. The deposit rate establishes a floor for the overnight money market rate, as no bank will lend money in the market at a lower interest rate than what it can get from the central bank. Similarly, the lending rate establishes a ceiling for the overnight money market rate, as usually no bank will borrow money at a rate higher than what the central bank charges (with the backing of necessary collateral). Normally, the policy rate is in the middle of the corridor, and the central bank must adjust the supply of liquidity to keep the target rate within the corridor. II.5.2.2 On the other hand, in a floor system, the key policy rate is equal to the central bank’s deposit rate, i.e., the lower bound of the corridor. In the floor system, the inter-bank rate becomes insensitive to the supply of reserves as the central bank could supply any amount of reserves to the banking system without having any impact on the inter-bank rate. Thus, under the floor system, the deposit rate becomes the effective policy rate. II.5.2.3 A synoptic view of the comparative advantages and disadvantages of a corridor versus floor system is presented below:

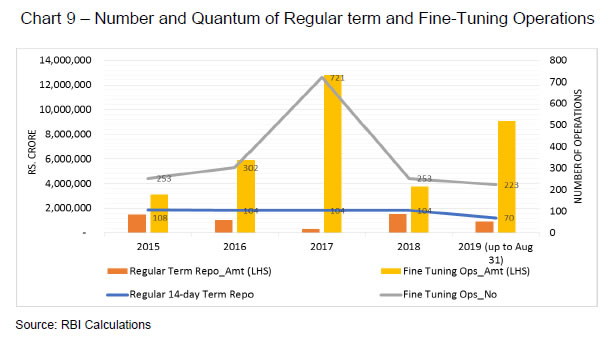

II.5.2.4 Before the Global Financial Crisis (GFC), many countries (notably the European Central Bank, the Bank of England and the Swedish Riksbank) operated through some form of corridor system and in order to make their liquidity frameworks effective, liquidity was managed in such a way that the central banks remained net lenders of reserves. Some central banks also undertook longer term liquidity operations (for example, Reserve Bank of Australia and Bank of Japan, where maturity of repo operations extends up to one year). The frequency of such operations also varied across countries. Additionally, central banks have other discretionary instruments such as central bank bills, stabilisation bonds, Fx swaps and term deposits, as a part of their liquidity management toolkit. II.5.2.5 As the GFC continued to unfold and financial stress paralysed markets, central banks pumped in large amounts of liquidity which moved the rates to the lower bound of the corridor. Central banks in some advanced economies, such as the US, have moved to a floor system of liquidity management as the liquidity injected in the aftermath of the GFC still persists. In the Euro area, the introduction of the Asset Purchase Programme (APP) and Long-Term Repo Operations (LTRO) since 2015 has ensured a position of surplus liquidity as a result of which EONIA (overnight inter-bank rate) has been hugging the lower bound of the corridor. II.5.2.6 Thus, different liquidity management frameworks are designed for different conditions, though they all aim to achieve the same objective, i.e., maintaining the target rate close to the policy rate. Specifically, (a) Under a “corridor” system – i.e., with a ceiling and a floor rate – the repo rate, that is, the rate at which central banks inject liquidity, works as the policy rate. Such a system would not be efficient when dealing with surplus liquidity because in surplus liquidity conditions, the inter-bank money market rate tends to gravitate towards the reverse-repo rate, or the rate at which central banks absorb liquidity. Therefore, under a ‘corridor’ system, central banks endeavor to keep the system liquidity in deficit. (b) On the other hand, under a “floor” system, the reverse-repo rate, i.e., the rate at which central banks absorb liquidity, works as the policy rate. Using the same reasoning as in (a) above, central banks endeavor to keep system liquidity in surplus under a ‘floor’ system. II.5.3 Principles of Liquidity Operations II.5.3.1 The liquidity management framework should be guided by the objective of maintaining the target rate, i.e., the rate in the inter-bank market for reserves, close to the policy rate. Since the central bank provides reserves through its liquidity management operations to eligible entities (typically banks), the target rate is usually the rate at which reserves are borrowed or lent among banks, viz., the call money market rate in India. II.5.3.2 However, the effectiveness of liquidity management operations requires a high degree of efficiency in the inter-bank market for central bank reserves, i.e., banks are free to borrow and lend in the inter-bank market. In an efficient market, the central bank should provide liquidity via OMOs and the banks should allocate it among themselves. However, this mechanism would fail to produce the desired results if the market suffers from information asymmetries, e.g. about bank assets7, banks free-riding on each other’s liquidity or on the central bank liquidity8. II.5.3.3 In practice, the demand for reserves is also contingent upon several other factors such as the institutional framework of the inter-bank market, volatility in the autonomous factors, information asymmetries among market players, available liquidity tools and reserve requirements, etc. Banks face two types of reserve demand uncertainty– (i) on account of their own transactions; and, (ii) regarding system demand for reserves emanating from changes in autonomous factors. Now, if banks face only the uncertainty associated with individual demand, banks with reserve deficit will be able to raise it from a surplus bank through inter-bank market. However, when there is an uncertainty regarding system demand, banks may stop lending the reserves in the inter-bank market and hoard it in the face of this information asymmetry. Resultantly, at the end of the day, the surplus bank will deposit the excess reserves with the central bank while the deficit bank will demand them from the central bank. To reduce this uncertainty, almost all central banks offer standing facilities to supply/absorb reserves at the end of the day. Further, given this uncertainty, the penalty for depositing excess reserves with the central bank should be detrimental for a bank holding surplus reserves and should incentivise it to deploy it in the inter-bank market. II.5.3.4 Therefore, it is important that the liquidity management framework does not undermine the price discovery process in the inter-bank money market. Particularly, the framework should incentivise banks to trade among themselves rather than with the central bank because the transmission process crucially depends on market forces working efficiently. Operationally, this implies that generally banks should be able to borrow in the inter-bank money market at rates not higher than the rate at which they could borrow from a central bank (i.e., the rate at which a central bank injects liquidity). Conversely, banks should be able to lend in the inter-bank money market at rates not below the rate at which they can lend to a central bank (i.e., the rate at which a central bank absorbs liquidity). It follows that, the rate at which a central bank absorbs liquidity and the rate at which it injects liquidity should not materially be the same, as it changes incentives in the market, thereby affecting price discovery. II.5.4 Level of System Liquidity II.5.4.1 All liquidity management frameworks should provide the required liquidity to the banking system. Without such an assurance, the objective of maintaining the target rate close to the policy rate would be difficult to achieve. For instance, when the banking system is in a deficit mode, there is an implicit assurance that the system liquidity deficit will be met by the central bank. Only a central bank can meet the reserve shortage; therefore, if it does not meet the deficit, the target rate is likely to go above the policy rate, and there would be defaults in reserve maintenance. Similarly, under the floor system where central banks keep the banking system in surplus, there is an assurance that the central bank would absorb the excess liquidity, lest the target rate falls below the policy rate. In the Indian context, thus, whether the system is in surplus or deficit, the liquidity management framework should ensure that liquidity available is no more, or no less, than what the banking system needs to meet its reserve requirement. Towards this end, the framework should enable a central bank to be equipped with the required tools to inject and absorb liquidity at either fixed or variable rates, on an overnight basis as well as for longer tenors. The central bank should also have the freedom with respect to the instrument to be used as well as the tenor of operation. II.5.4.2 Further, the liquidity framework should be robust enough to handle unexpected fluctuations in system liquidity without affecting its ability to adhere to the guiding principles. Such fluctuations can arise on account of frictional factors like changes in government cash balances as well as durable factors such as the expansion or contraction of CiC and the impact of a central bank’s Fx operations on domestic liquidity. Chapter III: Current Operating Framework: Issues and Options III.1 Liquidity Management Frameworks – Corridor versus Floor III.1.1 Presently, the Reserve Bank operates a corridor system. As discussed earlier, a corridor system incentivises market activity. When the overnight rate is different from the interest rates on the central bank’s standing facilities, banks seek to avoid using standing facilities and trade among themselves which, in turn, would help in development of an inter-bank market. The floor system has been adopted by some advanced economies as it is difficult to steer interest rates to the desired level in the face of large surplus liquidity which was injected after the global financial crisis, large part of which still persists. Such conditions do not prevail in India. Also, the corridor system has largely served the purpose of containing the volatility of inter-bank interest rates. Significantly, even in the face of large liquidity surplus arising out of demonetisation of high value notes, interest rates have remained generally within the corridor. III.1.2 As the corridor system affords the desired flexibility to manage situations of liquidity deficit as well as liquidity surplus and given that the repo rate is the policy rate set by the MPC, the Group recommends that the liquidity management framework should continue to be based on the corridor system. III.2 Target Rate for Liquidity Operations III.2.1 In case of India, the call money rate, with WACR as the measure, is the target rate for liquidity operations. Though the WACR has remained broadly aligned with the policy rate (Chart 7), deviations in the WACR from the policy rate, at times, could be explained by two factors. First, some co-operative banks lend to commercial banks at rates lower than those prevailing in the inter-bank market due to lack of alternative avenues for deployment of funds. These transactions are separately reported to the CCIL (called reported transactions). During FY2018-19, the average share of such trades was 22 per cent of the overall volume and weighted average rate on such trades, on an average, was 22 bps lower than overall WACR and 28 bps lower than WACR of the traded segment. Second, SPDs are allowed to participate in the inter-bank market. As SPDs normally borrow from the call market in the morning, it skews the rates to the upside in the morning trade. On an average, SPDs were found to be borrowing at rates 6 bps higher than those of commercial banks during FY2018-19. III.2.2 Among all overnight segments in the Indian market, call money market remains the pure market for reserves as banks are the players in this segment with the exception of SPDs. As such, this segment remains most sensitive to liquidity conditions. Empirical analysis9 suggests that a deficit in bank reserves of Rs.1 lakh crore, on an average, leads to an increase in the WACR by 11 bps. Recently, in another study10 the impact of surplus liquidity was examined, and it was found that structural surplus liquidity of Rs. 1 lakh crore, on an average, leads to a reduction in the WACR by 4 bps. Thus, the WACR remains sensitive to both surplus and deficit liquidity conditions, though asymmetrically. III.2.3 Further, the rates in other segments of the overnight markets could be influenced by exogenous factors such as credit risk and collateral considerations along with participation of entities which are not mandated to maintain reserves with the Reserve Bank and may not have access to central bank liquidity facilities. As the call money market is the only money-market segment which trades exclusively in reserves, the Group recommends that the call money rate – with WACR as the measure – should continue as the target rate of the liquidity management framework. Towards this end, the framework should enable the Reserve Bank to be equipped with the required tools - such as repo and reverse-repo instruments – to inject and absorb liquidity at either fixed or variable rates, on overnight basis as well as for longer tenors. The Reserve Bank should have the freedom with respect to the instrument to be used and the tenor of operations. III.3 Desired Level of System Liquidity III.3.1 All liquidity management frameworks should provide the required liquidity to the banking system. Thus, the banking liquidity being kept in deficit or in surplus mode is a design feature of the liquidity management framework – whether it is the corridor system or the floor system, or, analogously, whether the policy rate is the repo rate or the reverse-repo rate. It does not reflect, or depend upon, the monetary policy stance (neutral, tightening or accommodative), because monetary policy stance, under an inflation targeting framework conducted through changes in interest rate, hinges on the direction of policy rate. The choice between the two systems, therefore, boils down to the prevailing liquidity climate. In persistent liquidity surplus conditions, e.g., when an economy experiences persistent capital inflow (India in the mid-2000s), or, if an economy is approaching a liquidity trap, necessitating quantitative easing measures (Japan since the 1990s, or most advanced economies (AEs) since the global financial crisis), a ‘floor’ system might be preferable. Under normal conditions, as for most AEs before the global crisis, central banks prefer that banks, at the margin, depend on access to central bank liquidity. III.3.2 The Group observes that the design of the corridor system, with repo rate as the policy rate, would generally require the system liquidity to be in a small deficit of about 0.25 per cent - 0.50 per cent of NDTL. However, if financial conditions warrant a situation of liquidity surplus, the framework could be used flexibly, with variable rate operations to ensure that the call money rate remains close to the policy repo rate. Thus, liquidity operations should take into consideration the prevailing conditions, based on which the required tools will be used to achieve the objectives of liquidity management framework. III.3.3 The Group is also of the view that large surplus/deficit in reserve balances arising out of autonomous factors should be avoided. As such any surplus/deficit, if it is expected to persist, should be offset through appropriate liquidity management operations. For example, if the surplus/deficit is expected to persist for whole of the reserve maintenance period, a 14-day term operation would be appropriate. Likewise, if capital flows are believed to be of durable nature, OMOs could be conducted. The Group recommends that under the corridor system, build-up of liquidity into a large deficit (greater than about 0.25 per cent to 0.50 per cent of NDTL) or surplus, if expected to persist, should be offset through appropriate durable liquidity operations. Deficit in system liquidity should ideally be offset by durable liquidity-injection measures (such as OMO purchases or buy-sell FX swaps); in the same manner, persistent surplus in system liquidity should ideally be neutralised by durable liquidity-absorbing operations (such as OMO sales or sell-buy Fx swaps). III.4 Managing day-to-day Liquidity III.4.1 The modifications to the liquidity framework in August 2014 removed unlimited accommodation of liquidity needs at the fixed repo rate and introduced fine-tuning operations through repo/reverse-repo auctions of varying maturities. However, as the system continued to remain in deficit, the assured liquidity provision of one per cent NDTL (0.25 per cent of each banks’ NDTL available to it through overnight fixed rate repo and the rest through variable rate 14-day term repo auctions) was retained. In the monetary policy statement of April 2016, it was announced to progressively lower the average ex-ante liquidity deficit in the system to a position closer to neutrality. III.4.2 The assured liquidity provision through both, regular overnight fixed rate repo and regular 14-day variable rate repo, was mandated in ex-ante ‘deficit’ conditions but was retained during the transition period when the Reserve Bank embarked upon moving the system liquidity closer to ‘neutrality’. System liquidity, on a durable basis, first moved closer to neutrality and then to surplus. This assured liquidity provision of one per cent of NDTL has complicated liquidity management for the Reserve Bank as explained below. III.4.3 Under the current framework, banks - even with a requirement of liquidity for less than a fortnight - borrow reserves from the regular 14-day repo, more so, when they face aggregate reserve demand uncertainty. If the banking system does not require this liquidity in subsequent days, it is then returned to the Reserve Bank. The incentive to borrow at the 14-day regular window and then lend to the Reserve Bank in the reverse-repo window is high as both the variable-rate repo and reverse-repo operations are conducted almost at the same rate. For this reason, banks with either surplus/deficit liquidity prefer to trade with the Reserve Bank than among themselves in the inter-bank market. Thus, the Reserve Bank becomes a preferred counterparty where banks borrow funds from the Reserve Bank through the repo window and deposit funds in reverse-repo. This also increases the need for fine-tuning operations, which have become large (Chart -9). Assured liquidity also results in a situation where the Reserve Bank conducts repo operations even on days when system liquidity is in surplus. III.4.4 Liquidity management operations could be conducted at fixed-rate on full-allotment basis or through auctions at variable rates. The injection/absorption of liquidity on fixed-rate full-allotment basis is based on liquidity assessment of individual banks, which may be at variance with the central bank’s assessment of liquidity at the system level. The other method is that central bank assesses the liquidity needs at the system level and then provides liquidity through auctions at variable rates. The second method is more efficient as the central bank has better information of factors affecting the system liquidity. The Group agreed that the target rate being an overnight rate, liquidity operations should predominantly be of overnight maturity. III.4.5 One member suggested that since the Reserve Bank induces a change in the demand for reserves every reporting fortnight due to the statutory requirement of maintenance of CRR, it should provide/withdraw market’s requirement of liquidity through 14-day or 7-day operations, co-terminus with the CRR maintenance period, based on an assessment of the liquidity position. To accommodate the forecasting errors, if any, overnight fine-tuning operations may be conducted. III.4.6 It was, however, felt that 7-day/14-day operations are inconsistent with an overnight target rate (call money rate). Since the rate that is being targeted is of an overnight tenor, the primary liquidity provision should also be on an overnight basis. Further, because of forecasting errors that are unavoidable, longer term operations might create unintended shortages or excesses in system liquidity, warranting further operations, involving both injection and absorption. This is both wasteful and inefficient. The Group also observed that the system’s liquidity needs are estimated with far greater precision on an overnight basis relative to the estimation of liquidity needs over a longer horizon such as a week or a fortnight. III.4.7 Therefore, the Group recommends that uncertainty, if any, about the Reserve Bank’s liquidity management (in terms of quantum and rates at which operations are conducted) should be minimised by conducting liquidity management operations at a rate close to the policy repo rate. To this end, the daily primary liquidity management operation should be ideally one single overnight variable-rate operation. III.4.8 The liquidity framework should entirely meet the liquidity needs of the system. Consequently, a separate provision of assured liquidity is no longer necessary. Also, recognising their important role in the primary and secondary market for Government securities, SPDs should be allowed to participate directly in all overnight liquidity management operations. III.4.9 The Group recommends that the Reserve Bank should stand ready to undertake intra-day fine-tuning operations, if necessary; however, such operations should be the exception to address unforeseeable intra-day shocks rather than the rule. Given the overarching requirement of liquidity operations to be consistent with the policy rate, and in order to minimise intervention in the inter-bank market so as to enable free play of market forces, it may, at times, be useful to inject or absorb liquidity using longer term (7 or 14 days, in any case not exceeding a reporting fortnight) operations. For instance, a 14-day operation at the beginning of the fortnight (or a 7-day operation at the beginning of each week) could reduce the system requirement over the fortnight, consequently it may reduce the volume of overnight operations. Minimising the number of operations should be a goal of efficient liquidity management operations. III.4.10 While normally, liquidity operations should normally be carried out close to the policy rate or at the fixed rate (for example injecting liquidity close to the policy repo rate and absorbing liquidity at the reverse-repo rate), unanticipated liquidity developments may necessitate the use of variable rate operations. System liquidity may not always remain in deficit even under a ‘corridor’ system if we recognise the possibility that certain events – like persistent capital flows – may render it difficult for the Reserve Bank to absorb liquidity. In such an eventuality it may become necessary to absorb surplus liquidity at rates closer to the policy rate for efficient transmission of monetary policy signals. This may require resorting to variable rate reverse-repo operations. III.5 Managing Durable Liquidity III.5.1 To meet the demand for durable reserves, the Reserve Bank modulates NDA and/or NFA. In other words, the Reserve Bank supplies durable reserves either by buying Rupee bonds or by buying Fx exchange and vice-versa. Both these instruments have their own constraints. While excessive use of OMOs has the potential to distort the Government security yield curve, the Fx route is a state contingent instrument. When net foreign flows turned negative, as witnessed during 2018-19, the Reserve Bank had only one instrument, viz., OMOs to meet the demand for reserves. The Reserve Bank recently augmented its liquidity management toolkit by including Fx swap auctions which is a two-way tool and can be used for both, injection and absorption of liquidity. III.5.2 Another instrument which has often been debated is the use of long-term repo for supply of reserves to the system. While the Reserve Bank has conducted long-term repo/reverse-repo operations to tide over liquidity mismatch due to frictional factors which were expected to persist over slightly longer horizon, the maturity of such operations has never exceeded 90 days. One pertinent issue in acceptability of longer term operations has been policy rate expectations of market participants. Also, a longer-term repo is generally found more acceptable as compared to longer term reverse-repo as banks have preference for liquidity. Another reason could be that such operations are often supernumerary, given that banks have the option to choose the tenor. III.5.3 Also, from a balance sheet perspective of banks, reserves generated through OMOs may be more desirable as compared to term repos which expose banks to rollover risk. Term repos are auction-based and allotment is done on a best bid basis. This creates uncertainty whether the participant will be able to obtain funds in the next auction. On the contrary, there is no rollover risk attached to the primary liquidity received by market participants through outright OMO/FX route. However, as discussed above, outright operations have a spillover effect on other market segments and the Reserve Bank uses outright operations in a calibrated manner to minimise this impact. In such conditions, longer-term operations could complement outright operations. III.5.4 Towards this end, the liquidity framework should have an array of instruments to address durable liquidity surplus or deficit. While daily overnight operations (or weekly/fortnightly operations followed by overnight operations) should address the liquidity needs of the banking system, it is nonetheless possible that unanticipated shocks (variations in Government cash balances, fluctuations in CiC, or forex intervention operations) could lead to liquidity build-up (positive or negative) that could result in actual liquidity being different from the desired level. If the effect of such shocks is expected to be temporary, then flexible use of variable rate operations should suffice. If, however, such liquidity conditions are expected to persist, it would be necessary to bring the system back to the desired level. This could be achieved through outright open market operations (OMOs), or where outright operations are not feasible or desirable (e.g., because of their impact on yields), it would be beneficial to develop alternative tools to achieve the durable liquidity impact. One alternative can be longer-term repo or reverse repo operations (beyond 14 days and up to one year), as they do not have a discernible impact on bond yields. These instruments would, however, work if their interest rates are market determined. Similarly, longer-term Fx swaps (buy-sell or sell-buy Rupee-Dollar swaps) can also be used for durable liquidity operations. These instruments – OMOs, longer term variable rate repos or reverse-repos or Fx swaps – should be used to bring the liquidity position in the banking system back to the desired level. III.5.5 The Group recommends that, as an alternative to OMO purchases, longer-term variable rate repos, longer than 14 days and up to one-year tenor, be considered as a new tool for liquidity injection if system liquidity is in a large deficit. Similarly, longer-term variable-rate reverse-repos could be used to absorb excess liquidity. As these are possible substitutes for OMOs, these instruments should be operated at market determined rates. III.6 Standing Facilities and Width of the Corridor III.6.1 Liquidity management facilities can broadly be classified into two categories (i) primary liquidity operation; and (ii) discretionary or fine-tuning operations. Under the corridor system, the central bank would prefer to be a marginal player, with daily assessment of demand for reserves and conducting a single fine-tuning operation for the day, either injection or absorption. The benefit of such a system is that it reduces noise if the central bank remains on one side of the market on a given day. It will also provide a clear view of liquidity conditions to market players as perceived by the central bank and will encourage them to actively trade among themselves. However, there could still be occasions when some banks may face liquidity deficit/surplus due to certain idiosyncratic factors. To enable banks to manage such frictions, at present, there are two standing facilities, the MSF, for banks who face a deficit and fixed rate reverse-repo, for banks who have a surplus. III.6.2 The international experience regarding appropriate width of the corridor is quite varied. A large corridor allows space for more inter-bank activity, but also imparts volatility to targeted rate within the corridor. On the other hand, a narrow corridor reduces volatility but discourages inter-bank activity. In India, the width of the corridor has been substantially brought down from 200 bps to 50 bps over the last few years. The Group recommends that the existing difference of 25 basis points between the repo rate and the reverse-repo rate, as well as between the repo rate and the MSF rate, be retained. The standing liquidity facilities- fixed rate reverse repo and MSF- may continue as at present. III.6.3 In India, the fixed rate reverse repo has acted as floor to the corridor; there is no bank-wise or overall limit on the reverse repo amount and the same is limited by the collateral available with the Reserve Bank. To overcome collateral constraints, the Reserve Bank has been resorting to issuances of Cash Management Bills (CMBs) under MSS to impound the surplus liquidity. It has often been felt that for effective liquidity management operations, institutionalising an uncollateralised standing deposit facility is essential. In order to strengthen the operating framework further, the Government has since amended the RBI Act, 1934 for introduction of a SDF. The Group recommends that the SDF be operationalised early. III.7.1 Absence of funding risk and counterparty risk separates transactions with central banks from those with private entities. Also, while undertaking liquidity management operations, a central bank does not change the asset position of the eligible entities but alters the asset mix by swapping an asset of banking system either with reserves or another asset in its balance sheet. Therefore, being eligible for central bank operations structurally affects underlying collateral markets though the extent of impact may be vastly different under ‘normal’ and ‘non-normal’ situations. For example, the decision of the central bank to accept a new instrument as collateral will increase the willingness to create, trade and hold such assets in private balance sheets. III.7.2 Under ‘normal’ circumstances, if the central bank targets short-term interest rate as per its policy choice, the direct impact of its policy operations on collateral asset markets tends to be limited as under such frameworks, central banks are expected to operate at the margin. However, under ‘non-normal’ situations, when the central banks look to use broader set of instruments, their policy operations may have significant impact on underlying asset/collateral markets. Therefore, the collateral policy of the central bank should be conservative in ‘normal’ times when the market participants are ready to accept wider assets as collateral among themselves and liberal in ‘non-normal’ times when the market participants may become risk averse and disinclined to accept riskier assets as collateral. III.7.3 The collateral framework of the Reserve Bank has remained consistent and the Reserve Bank had not materially altered its eligible collateral even during the financial crisis of 2008. At present, the Reserve Bank accepts Treasury Bills, Central Government dated securities (including Oil Bonds) and State Development Loans (SDLs) as collateral in its liquidity management operations. The reasonably deep and liquid secondary market and sufficient holding of Government securities/SDLs by eligible counterparties make these securities suitable for liquidity operations of the Reserve Bank. The Reserve Bank periodically reviews its collateral policy to decide on the eligible collateral and other related issues such as haircut on the different class of securities to reflect market realities. III.7.4 The Group discussed the collateral policy and the haircuts being currently applied on the securities being accepted as collateral under LAF. The Group noted that the Reserve Bank has reviewed the margin requirements on the collateral in June 2018 and the margin is being applied on the basis of market value and residual maturity of the security. Further, the margin differs for various class and rating of securities. The Group recommends that the margin requirements under the LAF be reviewed on a periodic basis. The Group also recommends that the margin requirement for reverse-repo transactions should continue to be ‘Nil’, as hitherto. III.8.1 Mandatory reserve requirement creates a stable demand for reserves. A corridor system with standing facilities at the upper and lower end, allows banks to absorb large liquidity shocks at either end of the corridor. Reserve averaging11 has a similar impact and allows banks to absorb liquidity shocks at their discretion without incurring additional cost by creating an inter-temporal liquidity buffer to offset unanticipated liquidity shocks. If the bank is indifferent whether it holds the reserves today or tomorrow, then it would have greater discretion in meeting temporary shortfalls during the maintenance period. As a result, reserve averaging helps in stabilising short-term rates. In India, reserves need to be maintained on an average basis over a fortnight; however, 90 per cent of the CRR requirement needs to be maintained on any given day during the fortnight. This has helped banks in their day-to-day liquidity management to meet unforeseen flows while avoiding undue volatility in demand for funds. As such the existing reserve averaging system may continue. Banks cash management could be tested with the extension of National Electronic Funds Transfer (NEFT) facility to a 24X7 basis, and a similar expectation in the Real Time Gross Settlement (RTGS) system. The 90% daily maintenance requirement may be reviewed at a later date in the light of data as well as experience gained in the operation of the extended payment systems. III.8.2 The Group recognises that the present minimum requirement of maintaining 90 per cent of the prescribed CRR on a daily basis has helped avoid bunching of reserve requirements by individual banks. Hence, the Group recommends that this minimum requirement be retained at the present level. III.9 Communication and disclosures III.9.1 A clear communication of liquidity management policy and simplifying the framework would help in reducing information asymmetry between the Reserve Bank and market participants. The Group noted that most of the information relating to liquidity conditions of the system, including the government of India balances available for auction, is disseminated through MMO press release every morning before the market opens for business. Therefore, the disclosures available to the banking system regarding the liquidity conditions are broadly adequate. III.9.2 At present, in the MMO, all the outstanding operations under LAF are clubbed to arrive at the end of the day liquidity condition of the banking system. The Group notes that clubbing the term operations with the overnight operations may sometimes distort the view of daily liquidity conditions. To overcome this issue, the Group is of the view that it is appropriate to separate the day’s operations and the outstanding operations in the MMO press release. The Group recommends that the MMO press release should be modified suitably to separate the daily flow impact of the Reserve Bank’s liquidity operations from the stock impact. III.9.3 Further, the group also notes that due to unavailability of real-time data on GoI balances, sometimes, market assessment of durable liquidity conditions may not be aligned with that of the Reserve Bank. For better communication of liquidity management policy and for reducing information asymmetry between the Reserve Bank and market participants, the Group also recommends that the Reserve Bank’s quantitative assessment of durable liquidity conditions of the system be published on a fortnightly basis with a fortnightly lag. Annex-1: Drivers of Liquidity and their Impact on System Liquidity

Annex-2: Example of Calculation of Transient and Durable Liquidity

Annex-3: Monetary Policy Operating Framework in Some Major Economies