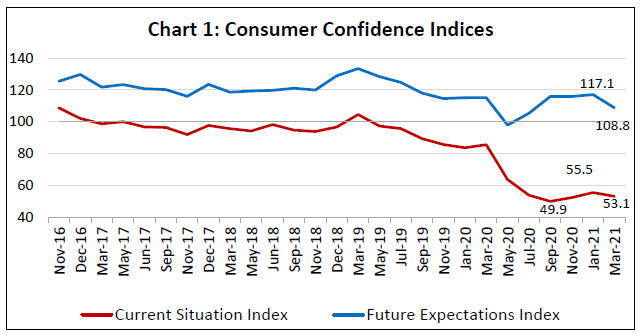

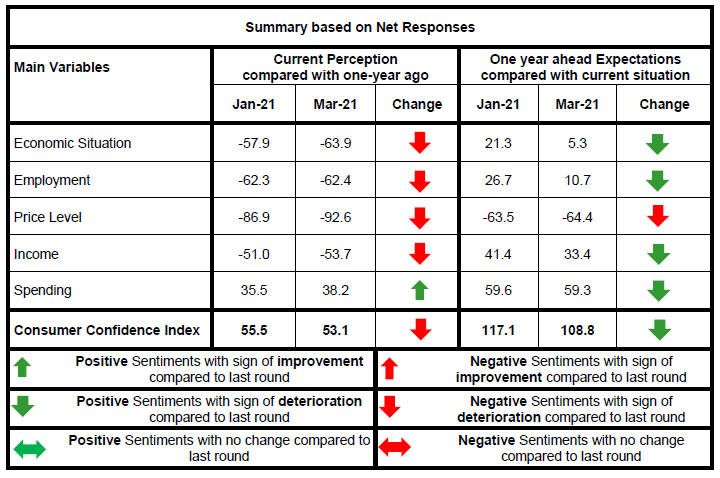

Today, the Reserve Bank released the results of the March 2021 round of its Consumer Confidence Survey (CCS)1. The survey was conducted through field interviews during February 27 to March 08, 2021 in thirteen major cities, viz., Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram. Perceptions and expectations on general economic situation, employment scenario, overall price situation and own income and spending have been obtained from 5,372 households across these cities2. Highlights: I. Consumer confidence for the current period weakened in March 2021 as the current situation index (CSI)3 dipped further in the negative territory on the back of deteriorating sentiments on general economic situation, income and prices (Chart 1 and Tables 1 and 3). II. Respondents expressed lower optimism for the year ahead, which was reflected in the future expectations index (FEI); one year ahead sentiments on all major parameters except prices, however, remained in positive terrain (Table 2, 3, 4 and 5). Note: Please see the excel file for time series data. III. With higher essential spending vis-a-vis a year ago, most consumers reported higher overall expenditure, which is expected to increase further in the coming year despite continuing moderation in discretionary spending (Table 6, 7 and 8). | Table 1: Perceptions and Expectations on the General Economic Situation | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Mar-20 | 28.4 | 19.3 | 52.3 | -23.9 | 49.8 | 15.6 | 34.7 | 15.1 | | May-20 | 14.4 | 11.2 | 74.4 | -60.0 | 39.6 | 9.0 | 51.4 | -11.7 | | Jul-20 | 11.9 | 10.3 | 77.8 | -65.9 | 44.3 | 13.5 | 42.2 | 2.1 | | Sep-20 | 9.0 | 11.4 | 79.6 | -70.6 | 50.1 | 15.1 | 34.8 | 15.3 | | Nov-20 | 11.0 | 11.5 | 77.5 | -66.5 | 50.9 | 13.9 | 35.2 | 15.7 | | Jan-21 | 14.3 | 13.6 | 72.2 | -57.9 | 52.6 | 16.1 | 31.3 | 21.3 | | Mar-21 | 12.1 | 11.9 | 76.0 | -63.9 | 44.0 | 17.3 | 38.7 | 5.3 |

| Table 2: Perceptions and Expectations on Employment | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Mar-20 | 25.2 | 19.1 | 55.7 | -30.5 | 48.8 | 17.1 | 34.1 | 14.7 | | May-20 | 19.2 | 13.4 | 67.4 | -48.2 | 41.5 | 11.1 | 47.4 | -5.9 | | Jul-20 | 13.0 | 8.9 | 78.1 | -65.1 | 48.6 | 13.3 | 38.2 | 10.4 | | Sep-20 | 10.1 | 8.1 | 81.7 | -71.6 | 54.1 | 14.3 | 31.6 | 22.5 | | Nov-20 | 11.0 | 9.5 | 79.5 | -68.5 | 52.0 | 14.9 | 33.1 | 18.9 | | Jan-21 | 13.1 | 11.5 | 75.4 | -62.3 | 55.3 | 16.1 | 28.6 | 26.7 | | Mar-21 | 12.9 | 11.8 | 75.3 | -62.4 | 46.7 | 17.3 | 36.0 | 10.7 |

| Table 3: Perceptions and Expectations on Price Level | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-20 | 87.2 | 10.3 | 2.6 | -84.6 | 78.1 | 14.2 | 7.7 | -70.4 | | May-20 | 79.1 | 17.5 | 3.4 | -75.8 | 75.8 | 14.8 | 9.4 | -66.4 | | Jul-20 | 79.7 | 16.7 | 3.6 | -76.2 | 71.6 | 18.3 | 10.1 | -61.5 | | Sep-20 | 82.9 | 14.6 | 2.5 | -80.4 | 69.5 | 20.5 | 10.0 | -59.5 | | Nov-20 | 89.7 | 9.0 | 1.4 | -88.3 | 70.5 | 17.4 | 12.1 | -58.4 | | Jan-21 | 88.6 | 9.6 | 1.7 | -86.9 | 73.2 | 17.1 | 9.7 | -63.5 | | Mar-21 | 93.8 | 5.0 | 1.2 | -92.6 | 75.0 | 14.4 | 10.6 | -64.4 |

| Table 4: Perceptions and Expectations on Rate of Change in Price Level (Inflation)* | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-20 | 80.8 | 15.7 | 3.5 | -77.3 | 75.6 | 20.3 | 4.1 | -71.5 | | May-20 | 74.8 | 18.6 | 6.6 | -68.2 | 73.4 | 19.5 | 7.1 | -66.3 | | Jul-20 | 79.8 | 15.6 | 4.5 | -75.3 | 76.4 | 18.6 | 5.0 | -71.4 | | Sep-20 | 83.0 | 13.1 | 3.9 | -79.1 | 75.9 | 19.6 | 4.6 | -71.3 | | Nov-20 | 88.3 | 8.9 | 2.8 | -85.5 | 78.3 | 16.7 | 4.9 | -73.4 | | Jan-21 | 83.5 | 13.4 | 3.1 | -80.4 | 77.7 | 17.2 | 5.0 | -72.7 | | Mar-21 | 88.8 | 8.5 | 2.7 | -86.1 | 81.1 | 14.3 | 4.5 | -76.6 | | *Applicable only for those respondents who felt price has increased/price will increase. |

| Table 5: Perceptions and Expectations on Income | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-20 | 22.7 | 52.4 | 24.9 | -2.2 | 52.0 | 40.2 | 7.8 | 44.2 | | May-20 | 12.6 | 34.0 | 53.4 | -40.8 | 39.5 | 39.1 | 21.4 | 18.1 | | Jul-20 | 8.3 | 28.9 | 62.8 | -54.5 | 43.5 | 39.3 | 17.2 | 26.3 | | Sep-20 | 8.9 | 28.4 | 62.7 | -53.8 | 53.2 | 36.7 | 10.0 | 43.2 | | Nov-20 | 8.4 | 28.5 | 63.1 | -54.7 | 51.0 | 38.3 | 10.7 | 40.3 | | Jan-21 | 9.9 | 29.2 | 60.9 | -51.0 | 51.3 | 38.8 | 9.9 | 41.4 | | Mar-21 | 7.9 | 30.5 | 61.6 | -53.7 | 46.4 | 40.7 | 13.0 | 33.4 |

| Table 6: Perceptions and Expectations on Spending | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-20 | 72.6 | 24.0 | 3.4 | 69.2 | 75.8 | 20.7 | 3.5 | 72.3 | | May-20 | 56.1 | 31.0 | 12.9 | 43.2 | 64.3 | 27.0 | 8.7 | 55.6 | | Jul-20 | 48.1 | 34.7 | 17.2 | 30.8 | 60.2 | 29.2 | 10.6 | 49.6 | | Sep-20 | 47.2 | 31.8 | 21.1 | 26.1 | 65.3 | 27.5 | 7.2 | 58.1 | | Nov-20 | 55.6 | 28.5 | 15.9 | 39.7 | 69.1 | 24.9 | 6.1 | 63.0 | | Jan-21 | 53.3 | 28.9 | 17.8 | 35.5 | 66.4 | 26.7 | 6.8 | 59.6 | | Mar-21 | 56.6 | 24.9 | 18.4 | 38.2 | 67.0 | 25.3 | 7.7 | 59.3 |

| Table 7: Perceptions and Expectations on Spending- Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-20 | 83.0 | 14.6 | 2.4 | 80.6 | 82.1 | 15.0 | 2.9 | 79.2 | | May-20 | 69.3 | 20.9 | 9.8 | 59.5 | 73.0 | 20.6 | 6.4 | 66.7 | | Jul-20 | 64.0 | 23.9 | 12.1 | 51.9 | 69.4 | 22.9 | 7.7 | 61.7 | | Sep-20 | 61.4 | 23.9 | 14.7 | 46.7 | 71.9 | 22.8 | 5.3 | 66.6 | | Nov-20 | 68.7 | 20.0 | 11.3 | 57.4 | 75.6 | 19.2 | 5.2 | 70.4 | | Jan-21 | 68.6 | 20.0 | 11.4 | 57.2 | 73.6 | 21.6 | 4.8 | 68.8 | | Mar-21 | 71.1 | 16.0 | 12.9 | 58.2 | 74.6 | 20.0 | 5.4 | 69.2 |

| Table 8: Perceptions and Expectations on Spending- Non-Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-20 | 27.7 | 42.0 | 30.3 | -2.6 | 32.4 | 43.5 | 24.1 | 8.3 | | May-20 | 13.9 | 39.6 | 46.4 | -32.5 | 22.0 | 42.4 | 35.6 | -13.6 | | Jul-20 | 9.2 | 29.4 | 61.4 | -52.2 | 22.2 | 37.9 | 39.9 | -17.7 | | Sep-20 | 10.7 | 29.5 | 59.8 | -49.1 | 31.3 | 37.4 | 31.4 | -0.1 | | Nov-20 | 11.2 | 27.9 | 60.9 | -49.7 | 28.7 | 37.3 | 34.0 | -5.3 | | Jan-21 | 13.3 | 27.1 | 59.7 | -46.4 | 27.5 | 36.7 | 35.8 | -8.3 | | Mar-21 | 11.9 | 29.5 | 58.5 | -46.6 | 24.7 | 38.3 | 37.1 | -12.4 |

|  IST,

IST,