IST,

IST,

Results of the Survey of Professional Forecasters on Macroeconomic Indicators - 32nd Round

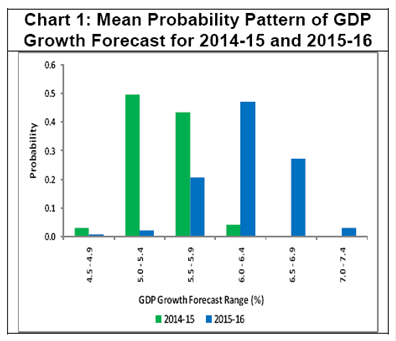

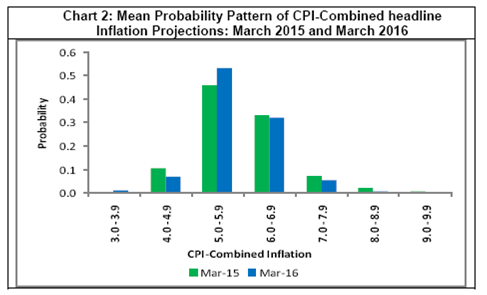

The Reserve Bank has been conducting the Survey of Professional Forecasters since September 2007. The results of the survey represent views of the respondent forecasters and in no way reflect the views or forecasts of the Reserve Bank of India. Twenty Seven professional forecasters participated in the latest survey round conducted in January 2015. The results of the survey in tabular form are presented in the Annex. Highlights: 1. Annual Forecasts^:

2. Quarterly Forecasts:

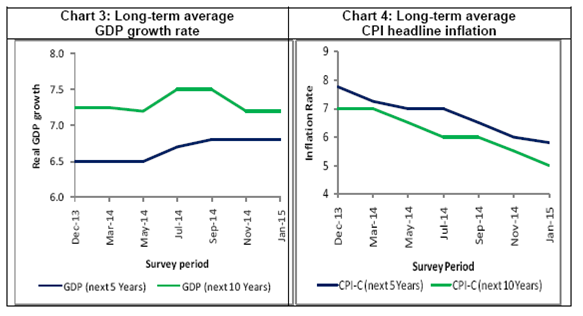

3. Long Term Forecasts:

1 Data for the previous survey round were released on December 2, 2014 on the RBI website. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: