X. Communication, International Relations, Research and Statistics - আৰবিআই - Reserve Bank of India

X. Communication, International Relations, Research and Statistics

| During the year, the Reserve Bank continued to widen its communication reach through social media and public awareness campaigns. Economic and financial relations were deepened with international organisations and multilateral bodies, besides successful completion of India’s Financial Sector Assessment Programme (FSAP). Efforts were made for effective cash management on behalf of the government and sound management of foreign exchange reserves. Economic policy analysis and research were sharpened, and information management systems were further strengthened. X.1 The Reserve Bank’s communication policy, based on the broad principles of transparency, clarity and timeliness, has facilitated in effectively managing public perceptions about its various policies and actions. The Reserve Bank strengthened its communication channels further by adding podcasts in its toolkit during the year. Economic and financial relations were deepened with international organisations and multilateral bodies. Several measures were undertaken to enhance the efficiency in government cash management through onboarding stakeholders progressively to the integrated platform (viz., e-Kuber1, SNA-SPARSH2 and TIN3 2.0). Risk management practices for foreign exchange reserves were strengthened amidst heightened market uncertainty. Research studies were conducted on a variety of contemporary macroeconomic and financial issues towards providing analytical inputs for policy formulation along with timely release of flagship publications. Forecasting and statistical methods were refined using innovative techniques and models, while the information management system was further strengthened with the adoption of latest technology. The Reserve Bank also initiated work towards harmonisation of its statutory regulations. X.2 Against this backdrop, the rest of the chapter is divided into eight sections. Section 2 presents major initiatives of the Reserve Bank with regard to its communication policy and processes. Section 3 discusses the Reserve Bank’s international relations, including interactions with international organisations and multilateral bodies. Section 4 deals with the activities of the Reserve Bank as a banker to governments and banks. Section 5 analyses the conduct of foreign exchange reserves management. Section 6 focuses on activities of the Department of Economic and Policy Research (DEPR) on economic research, including statutory reports and frontline research publications. Section 7 outlines the activities of the Department of Statistics and Information Management (DSIM), whereas Section 8 presents the activities of the Legal Department. Concluding observations are provided in the last section. X.3 Clear and timely central bank communication enhances the effectiveness of central bank’s policies and pre-empt spread of misinformation in the age of social media through proactive two-way communication channel. Thus, effective communication by central banks can strengthen the efficacy of their policy measures and foster price and financial stability. X.4 During the year, the Reserve Bank’s communication strategy facilitated in instilling confidence among the public, investors and other stakeholders. When warranted, timely interventions in the supervisory and financial markets space through verbal communication were undertaken. Instances of fake news and deepfake videos about the Reserve Bank on social media platforms were promptly clarified through press releases along with undertaking public awareness campaigns (PACs) through multiple channels to ensure systemic stability and public trust. X.5 During the year, concerted efforts were made to demystify the actions and thinking of the Reserve Bank through speeches and interviews of the top management and social media interactions, which helped build public trust and confidence in its ability to achieve multiple objectives. To take its messages to younger population, the Reserve Bank announced the introduction of podcasts as an additional communication tool. Agenda for 2024-25 X.6 The Department had set out the following goals for 2024-25:

Implementation Status X.7 The Reserve Bank’s structured communication in written form through the website and social media platforms was supplemented through speeches and interviews by the top management and post monetary policy press conferences. Further, to meet the knowledge needs of regional media with respect to central banking policies, informal media interactions and workshops on important policy initiatives were held at Kolkata and Hyderabad during the year. X.8 The Reserve Bank, in its role as a full-service central bank, continued to conduct 360-degree PACs under the ‘RBI Kehta Hai ’ and ‘RBI Says’ banner. The focus of these campaigns is to create awareness on the Reserve Bank’s initiatives, alert people against fraudulent players or schemes and improve financial literacy. During 2024-25, the Reserve Bank discontinued the practice of celebrity endorsed messages, while giving more prominence to mascots - Money Kumar and Ms. Money. Compared to the previous year, when the Reserve Bank launched 30 campaigns on various themes, 43 campaigns covering 23 themes were conducted during the year (up to March 31, 2025). X.9 A revised version (version 3.0, January 2025) of the communication policy is placed on the website to account for changes in usage of social media, podcasts, fact checking and to align it with the revised Utkarsh plan. X.10 The ‘RBI Sunta Hai ’ project is currently being developed to enhance the Reserve Bank’s ability to capture cues from the media channels, which can act as early warning signal or provide input for issuing clarifications, if necessary. The project, currently in progress, will also enable the tracking and removal of fake news, paving the way for selective two-way communication. X.11 As part of the new initiative, the Reserve Bank’s PACs were released through social media platforms using Google display ads and YouTube, which resulted in better targeting of audience, and enabled niche and focused campaigns in some regions. The Reserve Bank has further expanded its outreach by adding WhatsApp as an additional means to deliver PACs. X.12 ‘The RBI Museum’ microsite was developed during the year to provide interactive content, educational resources and information about the Reserve Bank’s policies and initiatives, while showcasing snippets from its history. Major Developments X.13 During 2024-25, the Department disseminated customised communication using various media, viz., television (TV), print, radio, digital, out-of-home (OOH), Google ads, YouTube, and short-messaging-service (SMS) in 12 major regional languages apart from Hindi and English (Table X.1). X.14 Apart from these thematic customised campaigns, the Reserve Bank participated in high impact events/programmes like the Indian Premier League (IPL), Paris Olympics 2024, Kaun Banega Crorepati (KBC), Drama Juniors (Marathi), Pro Kabaddi League 2024 and child focused awareness programme with Nickelodeon. For greater reach in Tier-3 and Tier-4 cities, campaigns were also launched through national broadcasters, viz., Akashvani and Doordarshan. RBI Website X.15 During 2024-25, the Department released 2,517 press releases, 161 notifications, 16 Master Circulars, 16 Master Directions, and uploaded 14 interviews and 60 speeches of the top management, five RBI reports, seven working papers, 2,351 tenders and 53 recruitment related advertisements. The newly developed RBI website and mobile application was released on April 5, 2024. Both old and new RBI websites would run parallelly till the new website gets fully stabilised. Other Initiatives Awareness Campaign for Children X.16 As part of the ‘Catch Them Young’ initiative, simplified public awareness messages with the tagline ‘RBI Kehta Hai... Smart Bano, Cool Raho’ were released, aimed at creating awareness among children. New mascots - ‘Junior Money’ and ‘Mini Money’ - were introduced for child-focused messaging to find resonance with children. Social Media Command Centre X.17 The Reserve Bank’s presence on various social media platforms is well evidenced by the increasing number of followers, engagement and information dissemination (Table X.2). Post Monetary Policy Press Conferences X.18 On the date of announcement of the bi-monthly monetary policy, the Governor and Deputy Governors interact with the media persons. Six such press conferences were conducted during 2024-25. Informal Media Interactions X.19 The Reserve Bank conducted 13 media interactions in an informal, Chatham House4 set up in Mumbai and Delhi during 2024-25. Podcasts X.20 Podcasts, with accompanying video (commonly called ‘vodcasts’) are used for explainers, select interviews of the Reserve Bank personnel and discussing other important areas under its ambit. The podcasts are intended to create visibility and awareness in focused areas of the Reserve Bank which do not attract enough attention in traditional media (Box X.1). Agenda for 2025-26 X.21 During 2025-26, the Reserve Bank’s communication channels would be further strengthened with:

X.22 During 2024-25, the Reserve Bank through its International Department (ID) strengthened economic and financial relations with international organisations (IOs) and multilateral bodies. India’s perspectives were articulated at various international fora such as the International Monetary Fund (IMF), the G20, the Bank for International Settlements (BIS), the Financial Stability Board (FSB), SAARCFINANCE5 and BRICS6. The Reserve Bank completed its tenure of chairmanship of the South East Asian Central Banks (SEACEN) Research and Training Centre and subsequently, Bank of Korea (BoK) has assumed the chairmanship. The revised Framework of SAARC currency swap for 2024-27 was also finalised during the year, to meet the short-term liquidity needs of SAARC countries. Agenda for 2024-25 X.23 The Department had set out the following goals for 2024-25:

Implementation Status X.24 The Reserve Bank, with the approval of the Government of India, has revised the framework on currency swap arrangement for SAARC countries for the period 2024-27 (Box X.2). X.25 The Department facilitated discussions under the Financial Sector Assessment Programme (FSAP) 2024 exercise, for a comprehensive assessment of the country’s financial sector conducted jointly by the IMF and the World Bank. The assessment is based on the financial system’s adherence to global standards such as the Basel Core Principles (BCP) for Banking Supervision and the CPMI-IOSCO7 core principles. Financial stability assessment under FSAP is mandatory for 32 systemically important jurisdictions every five years and for another 15 jurisdictions every ten years. India was one of the first countries to volunteer for the FSAP assessment after the exercise began in 1999 and has been undergoing the FSAP since 2010. The majority of meetings under 2024 FSAP exercise for India started in December 2023 and concluded on October 4, 2024. The FSAP exercise has been completed with the release of the Financial System Stability Assessment (FSSA) by the IMF on February 28, 2025. The Financial Sector Assessment (FSA) report by the World Bank is also expected to be released in due course. The overall assessment of the FSAP indicates that the Indian financial system is resilient and has become more diversified and inclusive, driven by economic growth, digitalisation and supportive economic policies. X.26 The 23rd meeting of the SEACEN Executive Committee (EXCO) - a Committee of Deputy Governors of member central banks - was held virtually on August 30, 2024 under the chairmanship of Dr. Michael Debabrata Patra, Deputy Governor, Reserve Bank with the representatives of 19-member central banks. The meeting discussed the implementation of the SEACEN Centre’s Work Plan in 2024, activities, budget for 2025, and other administrative issues. Other Initiatives BIS Activities X.27 The Department provided analytical support for various meetings of the BIS, including the Governors’ bi-monthly meetings, the Committee on the Global Financial System (CGFS)8, the BIS annual meeting of Emerging Market Deputy Governors and the BIS annual conference. In addition, the Department participated in the BIS Preparatory Asian Consultative Council (ACC) meetings. FSB Initiatives on Global Financial Regulation X.28 The Department actively participated in discussions across various standing committees of the FSB, articulating the Reserve Bank’s perspectives on a wide range of topics. These included global cooperation on financial stability, the resilience of non-banking financial institutions (NBFIs), the March 2023 banking turmoil, cross-border payments, cyber and operational resilience, digital innovation [including artificial intelligence (AI) and tokenisation], and nature-related financial risks. Additionally, the Department also contributed inputs to key FSB reports and various surveys conducted by the FSB. IMF X.29 The Department provided support for the Reserve Bank participation at the bi-annual Fund-Bank meetings of the International Monetary and Financial Committee (IMFC) held in April and October 2024 on the early warning exercise; global policy agenda; the IMF quota and governance reforms; and India’s stance on exchange rate management under the integrated policy framework. The Department shared the Reserve Bank’s stance on various policy issues including IMF resource raising through its Bilateral Borrowing Arrangements (BBAs), with the Ministry of Finance (MoF), Government of India (GoI). It also facilitated the completion of the IMF’s Article IV consultations held during December 2024. The IMF Article IV report, which was released on February 27, 2025, made a favourable assessment noting that India’s economic growth remained robust, inflation broadly declined to target band, financial system remained resilient and fiscal consolidation continued. G20 X.30 Brazil’s G20 Presidency centred around the theme of ‘Building a Just World and a Sustainable Planet’. It carried forward the work on several legacy priorities, including the work initiated under India’s G20 Presidency9 such as enhancing multilateral development banks capacity to deal with shared global challenges, managing debt vulnerabilities, strengthening the global financial safety net, ensuring sustainable capital flows, enhancing cross-border payments, promoting cyber resilience, among others. X.31 As part of the troika10, India extended its support to the Brazilian Presidency in terms of its proposals, inputs, and comments. Under the Finance Track, the Reserve Bank worked in coordination with the MoF, GoI, on priorities under the financial sector issues, financial inclusion, international financial architecture, macroeconomic policy framework and sustainable finance. X.32 With the overarching theme of ‘Solidarity, Equality, and Sustainability’, South Africa became the first African country to take the helm of G20 on December 1, 2024, marking the continuity of the Global South’s leadership in the forum’s discussion. SAARCFINANCE X.33 The Reserve Bank took the lead to put in place the SAARCFINANCE roadmap for regional cooperation for the period 2025-2030 enumerating three focus areas of cooperation amongst the SAARC central banks, viz., banking regulation and supervision; financing for climate and sustainable development; and emerging digital technologies in central banking operations. BRICS X.34 Under BRICS Finance Track in 2024, discussions focused on BRICS economic outlook and policy cooperation, global economic and financial governance reforms, promoting settlements in national currencies, amendments to the Contingent Reserve Arrangement (CRA) to make it more dynamic by onboarding of new members and including alternative eligible currencies. Capacity Building X.35 The Reserve Bank continued to engage in capacity building initiatives by organising exposure visits, technical assistance, workshops and experience sharing sessions for the SAARCFINANCE members and the central bankers from the Southeast Asian, European and African nations. Agenda for 2025-26 X.36 During the year, the Department will focus on the following aspects of the Reserve Bank’s international engagements:

4. GOVERNMENT AND BANK ACCOUNTS X.37 The Department of Government and Bank Accounts (DGBA) manages the functions of the Reserve Bank as the banker to banks and banker to governments, besides maintaining internal accounts and formulating accounting policies of the Reserve Bank. Agenda for 2024-25 X.38 The Department had set out the following goal for 2024-25:

Implementation Status X.39 During the year, the CSS payment arrangements were implemented in 20 more states. With this, central government and 27 state governments are live under this arrangement. This has enabled just-in-time payments under CSS using tripartite integration between e-Kuber and financial systems of both Centre and respective state governments. Major Developments Enhancing Efficiency in Government Payment Systems X.40 The state governments of Meghalaya, Arunachal Pradesh and Nagaland have been integrated for e-payments in e-Kuber. To enhance the efficiency of banking services provided to governments, the Reserve Bank has implemented several initiatives, including the introduction of a dashboard facility for governments and Aadhaar-based direct benefit transfer (DBT) payments (Box X.3). Integration of State Governments with e-Kuber X.41 During the year, the process of manual reporting of receipts by agency banks to the Reserve Bank for various state governments that are already integrated with e-Kuber system was discontinued for faster and efficient processing along with online reconciliation of the government transactions. Seven state governments were also integrated with the Reserve Bank’s e-Kuber system for e-receipts agency bank reporting and one state government was integrated with e-Kuber system for NEFT/RTGS based receipt.

Stabilisation of Extant Government Initiatives X.42 As part of the endeavour by the Reserve Bank to continuously upgrade and enhance the process of government banking, the Indo-Nepal remittance facility was made live in e-payments for processing defence pension payments by Controller General of Defence Accounts to pensioners domiciled in Nepal. X.43 Under the SNA-SPARSH model, an alternative fund flow mechanism for just-in-time release of CSS funds, 20 more state governments were onboarded. X.44 Tax Information Network (TIN 2.0) which replaced the erstwhile Online Tax Accounting System (OLTAS) in 2023 has stabilised. New modes of payment like unified payments interface (UPI) have been added on both goods and service tax (GST) and TIN platforms to expand the available payment modes and enhance tax payer experience. The integration of state governments and union territories (UTs) with the Reserve Bank’s system for processing of online Memorandum of Error (MoE) cases related to GST was taken forward with onboarding of state of West Bengal and initiation of user acceptance test (UAT) with the governments of Mizoram, Meghalaya, Nagaland and union territory of Lakshadweep. Formation of Committee to Review Agency Commission Rates X.45 The Reserve Bank pays agency commission to agency banks for conducting government banking business. Agency commission rates are reviewed periodically. The current rates were implemented, w.e.f. July 1, 2019. The Reserve Bank constituted a committee under the Chairpersonship of Chief Financial Officer (CFO), Reserve Bank with representations from CAG, controller general of accounts (CGA), MoF, GoI, Indian Banks’ Association (IBA), Department of Statistics and Information Management (DSIM) and DGBA to review the costs of government banking and the agency commission rates. The Committee submitted its report on March 10, 2025. Digitisation of Special Deposit Scheme,1975 X.46 In line with its endeavour of leveraging technology for enhanced productivity, the Reserve Bank is in the process of developing digital solutions for maintenance of accounts under the legacy Special Deposit Scheme,1975, as part of e-Kuber 3.0. These accounts shall be brought into a digital platform with functionality of processing interest payments and withdrawals. Agenda for 2025-26 X.47 The Department proposes the following agenda for 2025-26:

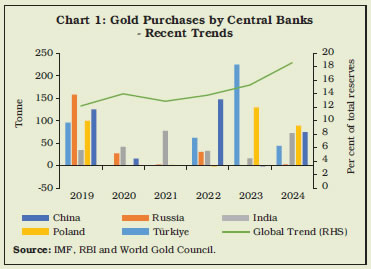

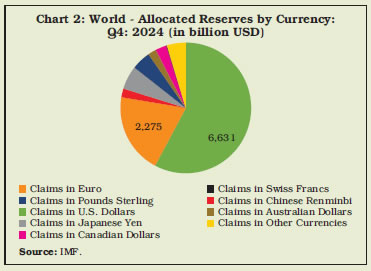

5. MANAGING FOREIGN EXCHANGE RESERVES X.48 In sync with the broader principles of reserve management, the Department of External Investments and Operations (DEIO) continued with the management of foreign exchange reserves (FER). The FER increased by 3.4 per cent during 2024-25 (11.7 per cent a year ago). The Department also sustained its endeavour to ensure diversification of forex reserves by exploring new asset classes/jurisdictions for deployment of foreign currency assets (FCA) as per its defined policy objectives. X.49 The reserve management function continued to be challenging with heightened market uncertainty driven by geopolitical risks and financial market volatility (Box X.4).

Agenda for 2024-25 X.50 The Department had set out the following goals for 2024-25:

Implementation Status X.51 The Department organised international symposium on reserve management on the theme ‘Challenges in Reserve Management - Need for Diversification’. The symposium was attended by five central banks. X.52 To encourage internationalisation of INR for bringing efficiency in the trade settlements through local currency, the Reserve Bank coordinated with partner countries to enter into local currency settlement (LCS)12 arrangements (Box X.5). MoUs for LCS were signed with the Central Bank of UAE (June 2023), Bank Indonesia (March 2024), Maldives Monetary Authority (November 2024) and Bank of Mauritius (March 2025) to facilitate trade invoicing and settlement in local currencies. Pursuant to the MoUs, some traction has been observed in the trade settlement in INR with trade partners. Further, trade in local currencies has been encouraged and promoted through payment system infrastructure of UPI quick response (QR) codes and RuPay cards, which is now integrated with several countries. X.53 An international workshop on ‘Reimagining Settlements Amongst the ACU Nations’ was conducted to explain and arrive at a consensus among the member central banks on potential use of domestic currencies. Subsequently, the ACU Board has given in-principle approval for the inclusion of domestic currencies of the members as settlement currencies under ACU mechanism. The operational mechanism for use of domestic currencies in the ACU mechanism is being deliberated. Agenda for 2025-26 X.54 The Department has set the following goals for 2025-26:

6. ECONOMIC AND POLICY RESEARCH X.55 The Department of Economic and Policy Research (DEPR) serves as the hub of research activities in the Reserve Bank by supporting policy formulation through timely and topical analytical inputs. In addition to preparing various statutory and non-statutory reports of the Reserve Bank, the Department collects, compiles, and disseminates primary and secondary data on various aspects relating to the Indian economy, and publishes topical research papers and articles authored by the Reserve Bank’s research staff. It also engages in collaborative research between the Reserve Bank’s staff and external researchers. Agenda for 2024-25 X.56 During 2024-25, the Department had set the following goals:

Implementation Status X.57 In line with the objectives set for 2024-25, the Department published 100 research papers/articles during 2024-25. These include six research articles in the RBI Occasional Paper Series, seven RBI Working Papers, one DRG Study, one Programme Funding Scheme Study, 61 RBI Bulletin articles and 24 papers in domestic and international peer-reviewed journals. Key contemporary issues relevant for policy making were covered as part of these papers/articles, viz., (a) Estimation of the Natural Rate of Interest for India; (b) Determinants of Household Saving Portfolio; (c) Analysis of Core Inflation; (d) Agriculture Supply Chain Dynamics; (e) Estimation of State-level Fiscal Multipliers; (f) Mobile Banking Adoption for Rural Financial Inclusion; and (g) Valuation of Unpaid Household Activities. X.58 The studies on ‘New Digital Economy and Productivity Paradox’; ‘Price Dynamics and Supply Chains in Vegetables, Pulses, Fruits, Livestock, and Poultry’; ‘Balance Sheet Channel of Monetary Policy Transmission’ and ‘Dynamics of Inflation Surges in India’ were also completed and released during the year. The studies ‘Financial Inclusion and Its Impact on Monetary Policy Effectiveness in India’ and ‘GVC Participation by India and Its Impact on Productivity’ are under preparation. Other Initiatives Reports X.59 During 2024-25, the Department released the Reserve Bank’s flagship statutory reports, viz., the RBI Annual Report and the Report on Trend and Progress of Banking in India in a timely manner. The reports titled ‘State Finances: A Study of Budgets of 2024-25’ and ‘Handbook of Statistics on Indian States 2023-24’ were also released. Furthermore, the ‘Report on Currency and Finance 2023-24’ based on the theme ‘India’s Digital Revolution’ and the ‘Report on Municipal Finances’ themed on ‘Own Sources of Revenue Generation in Municipal Corporations: Opportunities and Challenges’ were also released by the Department. Compilation and Dissemination of Data/Statistics X.60 All primary and secondary statistics relating to monetary aggregates, balance of payments (BoP), external debt, effective exchange rates, combined government finances, household financial savings and flow of funds were released on time, while maintaining data quality. During the year, KLEMS (capital, labour, energy, material, and services) data for 2022-23 were released along with its manual. The monthly index of supply chain pressures for India (ISPI) to monitor supply chain health and its implications for economic growth and price stability was compiled and published in the RBI Bulletin. Knowledge and Research Dissemination X.61 During the year, the DEPR Study Circle, an in-house discussion forum, organised 17 online seminars/presentations of research papers on diverse topics to facilitate in-depth discussion and improve the overall quality of research. The Department organised several notable events during the year to foster knowledge exchange. These included the organisation of a High-Level Conference on ‘Central Banking at Crossroads’ in New Delhi in October 2024 as a part of RBI@90 celebrations, where perspectives of leading practitioners and academicians on key central banking issues – inflation targeting; monetary policy; role of FinTech and CBDCs in fast cross-border payment systems; central banks and financial stability - were deliberated upon. A conference focusing on digital technology, productivity, employment, and economic growth was held in Jaipur in November 2024. X.62 For a wider dissemination of the Reserve Bank’s research and report activities, the Department conducted outreach programmes in the North-Eastern Hill University, Shillong; Banaras Hindu University, Varanasi; and various colleges and universities in India, interacting and engaging with faculty members and students. X.63 The Fourth Suresh Tendulkar Memorial Lecture was delivered by Dr. John C. Williams, President and Chief Executive Officer (CEO), Federal Reserve Bank of New York on ‘Managing the Known Unknowns’ on July 5, 2024, which highlighted key principles that are at the heart of inflation targeting strategies and have proven invaluable in managing uncertainty. The Nineteenth C.D. Deshmukh Memorial Lecture was delivered by Dr. P. K. Mishra, Principal Secretary to the Prime Minister of India on ‘Transforming Small-holder Agriculture in India in the 21st Century: Challenges and Strategies’ on November 28, 2024. X.64 During the year, the Central Library focused on digital acquisition, digital access, and digital preservation of the library resources to support the Reserve Bank’s research activities. It subscribed to two new online databases along with RemoteX application which helps in seamless remote access to all subscribed e-resources. The library also organised thematic display of books on various subjects for optimal use of library resources. X.65 The RBI Archives accessioned 4,333 files, five registers, and 12 Solid State Drives (SSD) received from various central office departments (CODs), regional offices (ROs), and training establishments. Exhibition on the history of the Reserve Bank was also displayed during the High-Level Conference on ‘Central Banking at Crossroads’ held in New Delhi. Support to Academic/Research Institutions X.66 In pursuance of Section 17(15B) of the RBI Act, 1934, the Reserve Bank provides financial assistance through the RBI Professorial Chairs and Corpus Fund Scheme to support external research activities. At present, there are 20 RBI Professorial Chairs across research institutes/ universities spread all over India. In 2024-25, the Reserve Bank created a new Chair at the Indian Statistical Institute, Kolkata. During the year, research by the RBI Chairs covered wide-ranging issues, including inflation forecasting, climate financing, financial inclusion, and merchandise trade. Several RBI Chairs conducted workshops for students and young faculty members on issues relating to open economy macroeconomics to provide an operational perspective to traditional macroeconomics teaching. The Department provided faculty support for these workshops. X.67 The Reserve Bank has also instituted external research schemes to support collaborative research. A study titled ‘Status of Digital Financial Literacy in Lakshadweep Islands: Bottlenecks and Way Forward’ was undertaken as part of the Reserve Bank’s Programme Funding Scheme, giving insights into the financial sector and digital reach in the geographically secluded and under-studied Lakshadweep islands of India. As part of the DRG Study Scheme of the Reserve Bank, a study on ‘Monetary Policy Transmission and Labour Markets in India’ was completed and published, with focus on the impact of India’s labour market on monetary policy transmission under the inflation targeting regime. Under the scholarship scheme for Faculty Members from Academic Institutions, five scholars were selected to undertake short-term research projects on various contemporary economic issues. Engagements with Domestic/International Organisation X.68 The Department actively participated in IMF’s Article IV meetings and the IMF - World Bank’s Joint Mission on India’s FSAP. The Department also contributed to the India-Japan Macroeconomic Consultation and discussions with Banque de France delegation. The Department provided support to the RBI-led collaborative study on ‘Implications of Climate Change and Environmental Sustainability for Monetary Policy in SAARC Countries’ as decided during the 44th SAARCFINANCE Governors’ Group Meeting, held in Marrakesh, Morocco. Other engagements included interactions on current economic developments with credit rating agencies, participation in SEACEN Directors of Research and Monetary Policy Meeting, BIS Asian Consultative Council (ACC) Meeting on Research Priorities, BIS Global Economy Meetings, and OECD Economic Policy Committee Meetings. Agenda for 2025-26 X.69 The Department’s agenda for 2025-26 will focus on achieving the following goals:

7. STATISTICS AND INFORMATION MANAGEMENT X.70 The Department of Statistics and Information Management (DSIM) continued with its core functions of compilation, analysis and dissemination of macro-financial statistics. The Department focused on improving the scope and quality of statistics and information management by adopting latest technologies. Methodologies used for forecasting and compilation of statistics were refined by increasing the use of innovative techniques and models. Further, the scope and coverage of surveys were expanded during the year. Agenda for 2024-25 X.71 The Department had set out the following goals for 2024-25:

Implementation Status X.72 A metadata driven standard DQE based on SDMX technology has been developed and implemented for user-friendly data access and visual analytics. This facilitates public access to macroeconomic data at desired level of granularity on the Reserve Bank’s DBIE portal. X.73 The software application for collection, processing and building element-based data repository has been completed. A converter application has been developed for building SDMX element-based data from existing traditional data architecture. Testing of SDMX element-based data has been completed for select returns. A proof of concept (PoC)14 team has been formed to conduct pilot testing. X.74 A mobile application, ‘RBIDATA App’, has been developed to provide user-friendly access to key macro-financial data. It provides access to approximately 11,000 distinct macroeconomic data series from real, corporate, financial, fiscal, and external sectors as well as payment indicators, and survey data. Each series is presented visually and updated in real-time, with download facility. The application also provides details of banking outlets on the Indian map as well as SAARC Finance database. X.75 A system has been developed in the centralised information management system (CIMS) to link borrowings of major companies from different sources. This was done by integrating the corporate borrowings data from various sources for top 500 listed non-government non-financial companies. The data is also linked to their financial performance as reported by the companies. X.76 The scope of data science [artificial intelligence (AI)/machine learning (ML)] applications in functional areas of the Reserve Bank is being expanded, using traditional and new age data sources, in coordination with other central office departments (CODs). The Department further leveraged the power of big data analytics, ML and text mining for policy purposes, and projects were undertaken for various Departments. X.77 Data governance framework - focusing on organisational structure, technology, and governance fabric - has been prepared for internal use. An assessment on the global data quality framework has been carried out and a data quality index (DQI) at overall reporting entity level, along with sub-indices covering multiple dimensions has also been prepared. Impact of rules under the Digital Personal Data Protection Act, 2023, will be suitably incorporated once they are finalised by the central government. Other Initiatives X.78 All modules under the scope of CIMS project have been completed. All reports, dashboards, ad hoc query, and other modules for the RBI users (including those covered under legacy XBRL/DBIE) have been made available for the users. X.79 Data dissemination using application programming interface (API) enabling machine readable data transmission is in advanced stage of completion. Moreover, the URL of the Reserve Bank’s data dissemination, DBIE, has been changed to https://data.rbi.org.in. X.80 The pilot run involving select scheduled commercial banks (SCBs) for the comprehensive credit information repository (CCIR) system is in progress. After successful testing, the system is scheduled to go-live in a phased manner. X.81 The Department refined the compilation of India’s international investment position in respect of portfolio investment, separate identification of special drawing rights (SDRs) and receivables/payables in other accounts. X.82 The rural consumer confidence survey (RCCS) launched in 2022, aims to capture economic sentiments of households in rural and semi-urban areas. RCCS, a bi-monthly survey, is conducted in sync with the monetary policy cycle. The survey gathers current and future views on the economy, employment, income, spending, prices, and inflation. It targets to cover 9,000 households from more than 600 rural and semi-urban areas across all Indian states and select union territories. The result of the survey was released for the first time in the public domain post announcement of monetary policy on April 9, 2025. X.83 A system using AI/ML has been developed to regularly track and analyse corporate sentiments from online and print media. The information collected through this system supplements the results of regular enterprise surveys. X.84 The nowcasting models for gross value added (GVA), non-agriculture GVA (NAGVA) and gross domestic product (GDP) were revamped, and the forecasting framework for demand side components of growth was augmented using the seasonal autoregressive integrated moving average (SARIMA) approach, along with the experimental use of large language models (LLMs) for short-term forecasting. A prototype of an atheoretical model using ML methods was developed for forecasting consumer price index (CPI) inflation in India (both headline and core), in addition to the existing inflation forecasting approaches at the Reserve Bank. Furthermore, an AI/ML-based forecasting model has been developed for onion-CPI and wheat-CPI, integrating unstructured data sets along with traditional data sources. X.85 During August 2024, a quick survey on ‘Quality Preference of Indian Consumers’ was conducted among 15,000 households and 235 automobile dealers in 19 cities to examine the phenomenon of rising sales of premium products across sectors. Agenda for 2025-26 X.86 The Department will focus on the following goals during 2025-26:

X.87 The Legal Department examines and advises the Reserve Bank on legal issues and facilitates the management of litigation on behalf of the Reserve Bank. The Department functions as the secretariat to the Appellate Authority under the Right to Information Act, 2005 and represents the Reserve Bank in the hearing of cases before the Central Information Commission (CIC). The Department also extends legal support and advice to the Deposit Insurance and Credit Guarantee Corporation (DICGC), Centre for Advanced Financial Research and Learning (CAFRAL), and other RBI-owned institutions on legal issues, litigations, and court matters. Agenda for 2024-25 X.88 The Department had set out the following goals for 2024-25:

Implementation Status X.89 The workflow automation process application, VIDHICaMS, which is being used by law officers of the Reserve Bank, has enabled uploading case documents online. The application also allows users to update status of the cases. X.90 The Department, in collaboration with the National Law School of India University, Bengaluru, organised a three-day training programme on ‘Regulation Drafting’ in December 2024 for officers from Department of Supervision, Department of Regulation, Enforcement Department, Foreign Exchange Department and FinTech Department. X.91 The Department has initiated work towards harmonisation (i.e., consolidation) of the Reserve Bank’s statutory regulations. Other Initiatives X.92 During 2024-25, the Department’s Research Cell organised several sessions under its study circle, an in-house discussion forum wherein officers of the Department as well as external experts made presentations on evolving areas of law. X.93 The Department also provided faculty support to various training establishments of the Reserve Bank as well as external institutions to equip the trainees with knowledge about law related to central banking. X.94 The Department published comprehensive data on litigation in which the Reserve Bank has been impleaded on the internal portal of the Reserve Bank. Further, certain important judgments of different courts were also uploaded, providing easy access and reference to all the departments of the Reserve Bank. Agenda for 2025-26 X.95 In 2025-26, the Department will focus on the following goal:

X.96 The Reserve Bank broadened its communication toolkit to engage with wider audience to enhance the effectiveness of its policy actions. International economic and financial relations were strengthened through collaboration with global organisations, multilateral bodies, and various regional groups. The integrated framework for real-time fund transfers under CSS was further expanded with onboarding of additional stakeholders. Foreign exchange reserves were managed with prudence amid uncertain geopolitical conditions and volatile global financial markets. Economic research on topical and emerging macroeconomic and financial issues was undertaken to aid policy formulation through timely and analytical inputs. The statistics and information management system were refined by adopting innovative methods, advanced models, and incorporating cutting-edge technology. The Reserve Bank embarked on digitisation of its court cases and consolidation of statutory regulations. 1 The core banking solution of the Reserve Bank. 2 Single Nodal Agency - Samayochit Pranali Akikrut Sheeghra Hastantaran (SNA-SPARSH) is a real time system of integrated quick transfers. 4 The Royal Institute of International Affairs, commonly known as Chatham House, is a British think-tank based in London, England. The Chatham House rule evolved to facilitate frank and candid discussions on any issue by speakers who may not have other appropriate forum to speak freely. 5 Network of Central Bank Governors and Finance Secretaries of the South Asian Association for Regional Cooperation (SAARC) countries (viz., Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka). 6 Brazil, Russia, India, China and South Africa. Egypt, Ethiopia, Iran and United Arab Emirates were admitted as new members during the 2023 BRICS Summit in South Africa. Indonesia joined the bloc as a full member in January 2025. 7 Committee on Payments and Market Infrastructures (CPMI) - International Organisation of Securities Commissions (IOSCO). 8 The CGFS assesses potential sources of stress in global financial markets and promotes improvements in their functioning and stability. 9 India successfully completed its G20 Presidency, which culminated in the endorsement of the New Delhi Leaders’ Declaration. Consequently, India handed over the G20 Presidency to Brazil on December 1, 2023. 10 The G20 troika is a group of three countries that includes the current, previous, and future G20 Presidencies. 11 Indian Financial System Code. 12 Local currency settlement refers to the usage of domestic currencies of partner countries for settlement of bilateral trade and investment. LCS reduces dependency on third party currencies for settling cross-border trade transactions and payment obligations. 13 Indian Council for Research on International Economic Relations. 14 It is an exercise in which work is focused on determining whether an idea can be turned into a reality or to verify if the idea will function as envisioned. |