IST,

IST,

About

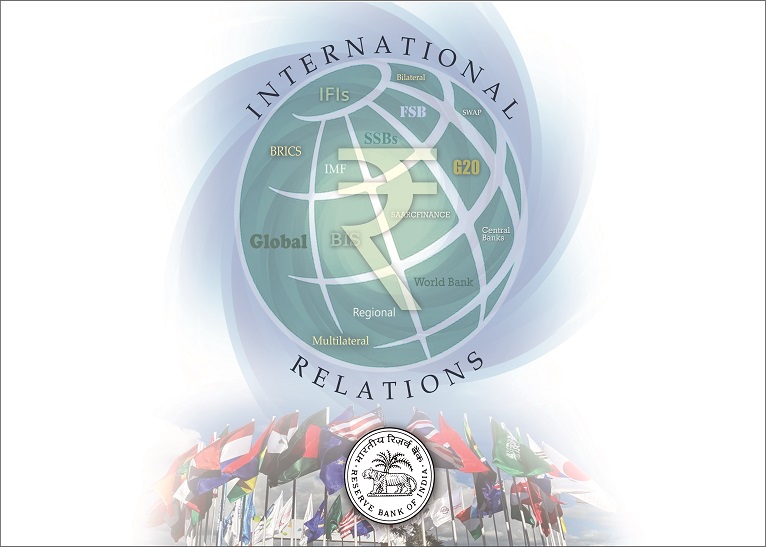

To play a key role in international financial diplomacy as the face of the Bank by driving the global policy agenda, articulating stance on international macroeconomic policy issues in various international fora and contributing to global regulatory standards with the ultimate objective of furthering national interests.

International Department was created on November 3, 2014, to augment the Reserve Bank's focus on international financial diplomacy and participation in formulation of global regulatory standards. The Department is responsible for participation in international fora and supporting the Top Management's interactions in this area, as also to facilitate their involvement in international economic cooperation. It has a research orientation towards framing the Reserve Bank's stance on issues in this sphere. The Department is also responsible for the Reserve Bank's external services and relations including matters of technical cooperation with other central banks.

-

It involves RBI’s economic cooperation and financial diplomacy in various multilateral groupings, such as G20, BRICS, South Asian Association for Regional Cooperation Finance (SAARCFINANCE), the South East Asian Central Banks (SEACEN) Research and Training Centre, Association of Southeast Asian Nations (ASEAN), G24, G30, the Shanghai Cooperation Organisation (SCO), Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) and others. Most of the work often requires extensive co-ordination with the Ministries of Finance and External Affairs, Government of India, and departments within the Bank.

-

The Reserve Bank actively engages with various international financial institutions and standard setting bodies, such as the International Monetary Fund (IMF), the World Bank, Bank for International Settlements (BIS), Financial Stability Board (FSB), World Trade Organization (WTO), Asian Development Bank (ADB), Organisation for Economic Cooperation and Development (OECD) and South Asia Regional Training and Technical Assistance Center (SARTTAC).

-

The Department undertakes several measures to deepen RBI’s relations with foreign central banks and institutions in a bilateral manner. The Bank has formalized bilateral engagements with various institutions by entering into Memoranda of Understanding (MoUs) and Terms of Engagements. The Department also organises study visits for students from foreign universities and exposure visits/ attachments, technical assistance and scholarships for officials of foreign central banks and financial institutions, for the purpose of capacity building.

-

The Department formulates polices related to the SAARC Currency Swap Framework, handles various engagements under the BRICS Contingent Reserve Arrangement (CRA) and participates in the macroeconomic discussions held in connection with the Bilateral Swap Arrangement between India and Japan. The Department signs the swap agreements with central banks under the SAARC Currency Swap Framework and conducts detailed macroeconomic assessments on receiving swap requests. Through these currency swap engagements, the RBI plays a key role in the Global Financial Safety Net (GFSN).

-

The Department conducts research and prepares analytical notes on relevant topics, issues in international economic cooperation and provides data-driven inputs for policy and decision-making. The Department undertakes regular updated assessment of the global macroeconomic and financial sector scenario and contributes to the periodic surveys conducted by international financial institutions. The Department also prepares and updates country profiles for major economies, for use in bilateral discussions of the Bank’s Top Management. It undertakes collaborative research and contributes to various RBI publications.

পেজের শেষ আপডেট করা তারিখ: