Maturity Profile of Assets and Liabilities of Banks

3.44 The maturity structure of commercial banksí assets and liabilities reflect a combination of various concerns of banks relating to business expansion, liquidity management, cost of funds, return on assets, asset quality and the risk appetite. Broadly, major components of balance sheet such as deposits, borrowings, loans and advances, and investments of major bank groups depicted a non-linear pattern across the maturity spectrum during 2005-06. The maturity structure of loans and advances of public sector banks and old private sector banks depicted a synchronous pattern with that of deposits. However, loans and advances of new private sector banks and foreign banks were more in higher maturity buckets as compared with their deposits. New private sector and foreign banks held most of their investments in shorter maturity bucket, while PSBs and old private sector banks held most of their investment in a longer maturity bucket (Table III.18). 3. Off-Balance Sheet Operations 3.45 Off-balance sheet (OBS) exposures of SCBs rose sharply by 50.9 per cent in 2005-06 over and above the increase of 58.0 per cent in 2004-05. In the last five years, total OBS exposure of banks witnessed a significant growth, as a result of which the share of off-balance sheet exposures in total assets increased sharply to 152.5 per cent at end-March 2006 from 57.7 per cent at end-March 2002 (Chart III.10), reflecting the impact of deregulation, risk management operations, diversification of income and new business opportunities thrown up by advances in information technology.

3.46 Among bank-groups, foreign banks had the highest share of off-balance sheet exposures as percentage of total assets, followed distantly by new private sector banks and other bank groups (Appendix Table III.12). OBS exposure of the banking system is concentrated in 15 banks, most of which are foreign banks. These banks are particularly active in the derivatives segment.

Table III.18: Bank Group-wise Maturity Profile of Select Liabilities/Assets |

(As at end-March) |

(Per cent) |

Assets/Liabilities |

Public Sector |

Old Private |

New Private |

Foreign |

|

Banks |

Sector Banks |

Sector Banks |

Banks |

|

2005 |

2006 |

2005 |

2006 |

2005 |

2006 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

I. |

Deposits |

† |

† |

† |

† |

† |

† |

† |

† |

|

a) |

Up to 1 year |

36.3 |

39.7 |

53.3 |

48.0 |

53.9 |

58.7 |

54.2 |

53.2 |

|

b) |

Over 1 year and up to 3 years |

35.3 |

30.6 |

37.6 |

38.2 |

43.1 |

36.9 |

39.2 |

43.6 |

|

c) |

Over 3 years and up to 5 years |

11.9 |

11.7 |

3.4 |

6.0 |

2.1 |

3.0 |

0.9 |

0.4 |

|

d) |

Over 5 years |

16.5 |

17.9 |

5.7 |

7.7 |

0.9 |

1.4 |

5.7 |

2.8 |

II. |

Borrowings |

† |

† |

† |

† |

† |

† |

† |

† |

|

a) |

Up to 1 year |

41.8 |

42.1 |

80.7 |

81.5 |

51.2 |

55.5 |

84.4 |

84.6 |

|

b) |

Over 1 year and up to 3 years |

20.2 |

26.3 |

4.1 |

3.7 |

34.1 |

18.7 |

12.3 |

13.7 |

|

c) |

Over 3 years and up to 5 years |

12.7 |

10.9 |

7.1 |

6.2 |

7.6 |

20.8 |

3.3 |

1.5 |

|

d) |

Over 5 years |

25.3 |

20.7 |

8.2 |

8.5 |

7.0 |

5.0 |

ñ |

0.3 |

III. |

Loans and Advances |

† |

† |

† |

† |

† |

† |

† |

† |

|

a) |

Up to 1 year |

36.7 |

35.5 |

42.3 |

43.0 |

39.7 |

30.7 |

55.9 |

55.8 |

|

b) |

Over 1 year and up to 3 years |

34.6 |

35.2 |

33.7 |

36.1 |

32.2 |

40.2 |

17.9 |

25.7 |

|

c) |

Over 3 years and up to 5 years |

12.0 |

11.5 |

9.0 |

10.0 |

9.5 |

11.3 |

6.5 |

5.3 |

|

d) |

Over 5 years |

16.6 |

17.8 |

15.0 |

10.9 |

18.6 |

17.9 |

19.7 |

13.2 |

IV. |

Investment |

† |

† |

† |

† |

† |

† |

† |

† |

|

a) |

Up to 1 year |

13.4 |

11.9 |

21.9 |

20.2 |

47.6 |

50.5 |

53.1 |

58.8 |

|

b) |

Over 1 year and up to 3 years |

12.7 |

14.3 |

11.1 |

9.7 |

27.5 |

25.5 |

27.3 |

29.4 |

|

c) |

Over 3 years and up to 5 years |

17.3 |

16.8 |

12.6 |

14.3 |

6.2 |

7.1 |

6.1 |

4.7 |

|

d) |

Over 5 years |

56.6 |

56.9 |

54.4 |

55.7 |

18.8 |

16.8 |

13.6 |

7.1 |

4. Financial Performance of Scheduled Commercial Banks 3.47 The overall financial performance of the banking sector improved during 2005-06 as compared with the previous year. Banks were able to increase net interest income. Net profits of banks increased, despite decline in trading profits (due to hardening of sovereign yield) on the one hand, and increase in expenditure and provisions and contingencies, on the other.

Interest Rate Scenario 3.48 The high credit demand during 2005-06 exerted an upward pressure on lending rates as well as deposit rates of banks. Interest rates offered on deposits by banks, in general, firmed up during 2005-06 (Table III.19). However, the increase was more pronounced at the short-end of the maturity. The spread between deposits of up to one year maturity and above three years maturity offered by PSBs narrowed down to 75 basis points at end-March 2006 from 100 basis points at end-March 2005. Likewise, the spread between interest rates on deposits up to one year and three year maturity offered by private sector banks narrowed down to 50 basis points from 100 basis points. The hike in deposit rates was indicative of the increased competition from other saving instruments and firming up of interest rates

Table III.19: Movements in Deposit and Lending Interest Rates |

(Per cent) |

Interest Rates |

March 2004 |

March 2005 |

March 2006 |

June 2006 |

1 |

2 |

3 |

4 |

5 |

Domestic Deposit Rates |

|

|

|

|

Public Sector Banks |

|

|

|

|

a) Up to 1 year |

3.75 ñ 5.25 |

2.75-6.00 |

2.25-6.50 |

2.75-6.50 |

b) 1 year and up to 3 years |

5.00 ñ 5.75 |

4.75-6.50 |

5.75-6.75 |

5.75-7.00 |

c) Over 3 years |

5.25 ñ 6.00 |

5.25-7.00 |

6.00-7.25 |

6.00-7.25 |

Private Sector Banks |

|

|

|

|

a) Up to 1 year |

3.00 ñ 6.00 |

3.00-6.25 |

3.50-7.25 |

3.50-6.75 |

b) 1 year and up to 3 years |

5.00 ñ 6.50 |

5.25-7.25 |

5.50-7.75 |

6.50-7.75 |

c) Over 3 years |

5.25 ñ 7.00 |

5.75-7.00 |

6.00-7.75 |

6.50-8.25 |

Foreign Banks |

|

|

|

|

a) Up to 1 year |

2.75 ñ 7.75 |

3.00-6.25 |

3.00-5.75 |

3.25-6.50 |

b) 1 year and up to 3 years |

3.25 ñ 8.00 |

3.50-6.50 |

4.00-6.50 |

5.00-6.50 |

c) Over 3 years |

3.25 ñ 8.00 |

3.50-7.00 |

5.50-6.50 |

5.50-6.75 |

BPLR |

|

|

|

|

Public Sector Banks |

10.25-11.50 |

10.25-11.25 |

10.25-11.25 |

10.75-11.50 |

Private Sector Banks |

10.50-13.00 |

11.00-13.50 |

11.00-14.00 |

11.00-14.50 |

Foreign Banks |

11.00-14.85 |

10.00-14.50 |

10.00-14.50 |

10.00-14.50 |

Actual Lending Rates* |

|

|

|

|

Public Sector Banks |

4.00-16.00 |

2.75-16.00 |

4.00-16.50 |

4.00-16.50 |

Private Sector Banks |

3.00-22.00 |

3.15-22.00 |

3.15-20.50 |

3.15-26.00 |

Foreign Banks |

3.75-23.00 |

3.55-23.50 |

4.75-26.00 |

4.75-25.00 |

* : Interest rate on non-export demand and term loans above Rs.2 lakh excluding lending rates at the

extreme five per cent on both sides. |

in general. Banks increased their deposit rates further by about 25-75 basis points across various maturities between March 2006 and June 2006. A majority of PSBs adjusted their deposit rates ëup to three yearí maturity upwards by 25 to 50 basis points, while deposit rates for over three year maturity remained unchanged (Chart III.11). 3.49 During 2005-06, the range of BPLRs of PSBs and foreign banks remained unchanged, while that of private sector banks moved up by 50 basis points. The band of BPLRs of private sector banks and foreign banks was wider than that of public sector banks. More than half of private sector banks had BPLRs in a range of 11-12 per cent at end-March 2006. As regards foreign banks, nine of them had BPLRs in the range of 12-13 per cent, five banks in the range of 10-11 per cent and another five in the range of 11-12 per cent. Even in an environment of increased credit demand, a substantial part of banksí lending was at sub-BPLR rates, reflecting the competitive conditions in the credit market. The share of sub-BPLR lending in total lending of commercial banks, excluding export credit and small loans, increased from 59.0 per cent at end-March 2005 to 69.0 per cent at end-March 2006, and further to 75.0 per cent at end-June 2006. 3.50 During the period April-June 2006, the BPLRs of PSBs increased by 25-50 basis points. The range of BPLR of foreign banks remained unchanged during the same period. 3.51 The yield on Government securities with 5-year and 10-year residual maturity hardened by 87 and 84 basis points, respectively, during 2005-06 (Table III.20). The increase in yields

Table III.20: Structure of Interest Rates |

(Per cent) |

Instruments |

March 2004 |

March 2005 |

March 2006 |

August 2006 |

1 |

2 |

3 |

4 |

5 |

I. |

Debt market |

|

|

|

|

|

1. |

Government Securities Market |

|

|

|

|

|

|

5-Year* |

4.89 |

6.37 |

7.24 |

7.57 |

|

|

10-Year* |

5.15 |

6.69 |

7.53 |

7.9 |

II. |

Money Markets |

|

|

|

|

|

2. |

Call Borrowing (Average) |

4.37 |

5.00 |

6.58 |

6.06 |

|

3. |

Commercial papers |

|

|

|

|

|

|

WADR 61 ñ 90 days |

5.19 |

5.89 |

8.72 |

7.26 |

|

|

WADR 91-180 days |

4.73 |

5.87 |

8.54 |

7.02 |

|

|

Range |

4.70 - 6.50 |

5.45 - 6.51 |

6.69 - 9.25 |

6.60 - 9.00 |

|

4. |

Certificates of deposit |

|

|

|

|

|

|

Range |

3.87 - 5.16 |

4.21 - 6.34 |

6.50 - 8.94 |

6.00 - 8.62 |

|

|

Typical Rate |

|

|

|

|

|

|

3 Months |

4.96 |

5.9 |

8.72 |

6.64 |

|

|

12 Months |

5.16 |

6.26 |

8.7 |

8.5 |

|

6. |

Treasury Bills |

|

|

|

|

|

|

91 days |

4.38 |

5.32 |

6.11 |

6.35 |

|

|

364 days |

4.45 |

5.61 |

6.42 |

6.99 |

* : As at end-month. |

|

|

|

|

WADR - Weighted Average Discount Rate. |

was, however, more pronounced for short-term maturities than for long-term maturities, reflecting relatively stable medium-term inflation expectations. Intra-year movements in yields were influenced by domestic liquidity conditions, inflationary expectations, volatility in crude oil prices and movements in US yields. On April 30, 2005, yields on 10-year paper firmed up sharply by 70 basis points to 7.35 per cent over end-March 2005 on fears of higher inflation in the backdrop of rising global crude oil prices and hike in the reverse repo rate by 25 basis points on April 28, 2005. The yields, however, eased during May and June 2005 to 6.89 per cent on June 30, 2005 amidst comfortable liquidity position, benign inflation and fall in the US treasury yields. The markets rallied briefly in July 2005 and yields softened but remained broadly stable between August and December 2005. Yields, however, edged up in the last week of January 2006 following the increase of 25 basis points in both the reverse repo and the repo rates on January 24, 2006. The 10-year yield moved up to 7.41 per cent on January 27, 2006 before declining to 7.28 per cent on January 31, 2006. For most part of February-March 2006, yields were range-bound. The 10-year yield hardened to 7.53 per cent on March 31, 2006 reflecting the rise in US yields. The spread between 1-year and 10-year yields narrowed to 98 basis points at end-March 2006 (from 114 basis points at end-March 2005), mirroring liquidity tightness in money markets. The spread between 10-year and 30-year yields narrowed to 30 basis points (from 54 basis points at end-March 2005), reflecting increased appetite for long-term securities from non-bank participants such as insurance companies and pension funds. 3.52 Financial markets adjusted to the changes in interest rate and monetary conditions in an orderly fashion during 2005-06. Money market conditions, after remaining generally comfortable during the first half of 2005-06, turned relatively tight in the third quarter of 2005-06. Owing to IMD redemptions, build-up of Centreís cash balances and sustained growth of credit, market liquidity conditions remained relatively tight till February 2006. Call money rate hovered around the repo rate for the most part of the fourth quarter of 2005-06. The monthly average of weighted average call rate, which reached 6.83 per cent in January 2006, further increased to 6.93 per cent in February 2006. The weighted average call rate declined to 6.58 per cent in March 2006. The weighted average discount rate (WADR) on commercial paper of 61-90 day maturity moved up to 8.72 per cent in March 2006 from 5.89 per cent in March 2005. The WADR of CPs of the same tenor declined by 146 basis points to 7.26 per cent by August 2006.

Cost of Deposits and Return on Advances 3.53 Notwithstanding the rise in deposit rates of SCBs during the year, the cost of deposits declined marginally due to increase in the share of low cost deposits in the form of current and savings deposits. The movements in the cost of deposits reflect the average rate at which different deposits are contracted rather than the movement in deposit interest rates as such. The cost of borrowings, however, moved up somewhat due mainly to tightening of liquidity conditions in the market. The overall cost of funds remained unchanged at the previous yearís level. Bank group-wise, while the overall cost of funds for foreign banks and new private sector banks increased, the cost of funds for the public sector banks remained unchanged. Return on advances of SCBs increased marginally during 2005-06, reflecting the increase in lending rates. Return on investment, on the other hand, remained at the previous yearís level. Overall return on funds, however, was slightly higher than the overall cost of funds, resulting in increase in spread (Table III.21).

Income 3.54 The income of SCBs increased by 16.8 per cent as compared with 3.5 per cent in the previous year. However, as percentage of assets, income at 8.0 per cent in 2005-06 was marginally lower than 8.1 per cent in 2004-05. Interest income, which is the major source of income of SCBs, rose sharply by 18.4 per cent compared with 7.9 per cent in the previous year, mainly due to increased volumes of credit and rise in interest rates (Table III.22 and Appendix Table III.14). The ëother incomeí increased by 9.5 per cent as against a decline of 12.9 per cent in the last year. As percentage of assets, while interest income remained unchanged, other income declined marginally.

3.55 Continuing the trend of the previous year, composition of ëother incomeí of SCBs changed further during 2005-06. While the

Table III.21: Cost of Funds and Returns on Funds ñ Bank Group-wise |

(Per cent) |

Variable/ |

|

Public Sector |

Old Private |

New Private |

Foreign |

Scheduled |

Bank Group |

Banks |

Sector Banks |

Sector Banks |

Banks |

Commercial Banks |

|

|

2004-05 |

2005-06 |

2004-05 |

2005-06 |

2004-05 |

2005-06 |

2004-05 |

2005-06 |

2004-05 |

2005-06 |

1 |

|

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

1. |

Cost of Deposits |

4.4 |

4.3 |

4.6 |

4.5 |

3.4 |

3.6 |

3.0 |

2.8 |

4.2 |

4.1 |

2. |

Cost of Borrowings |

1.3 |

2.2 |

2.7 |

2.7 |

1.4 |

3.1 |

3.5 |

4.3 |

1.7 |

2.8 |

3. |

Cost of Funds |

4.2 |

4.2 |

4.6 |

4.5 |

3.0 |

3.5 |

3.1 |

3.2 |

4.0 |

4.0 |

4. |

Return on Advances |

6.9 |

7.1 |

8.0 |

7.9 |

7.3 |

7.0 |

7.3 |

7.6 |

7.1 |

7.2 |

5. |

Return on Investments |

7.9 |

8.2 |

7.7 |

7.2 |

5.3 |

5.5 |

6.9 |

7.3 |

7.6 |

7.6 |

6. |

Return on Funds |

6.9 |

7.1 |

8.0 |

7.9 |

7.3 |

7.0 |

7.3 |

7.6 |

7.1 |

7.2 |

7. |

Spread (6-3) |

2.8 |

2.9 |

3.4 |

3.4 |

4.3 |

3.5 |

4.2 |

4.4 |

3.1 |

3.2 |

Note :

1. Cost of Deposits = Interest Paid on Deposits/Deposits.

2. Cost of Borrowings = Interest Paid on Borrowings/Borrowings.

3. Cost of Funds = (Interest Paid on Deposits + Interest Paid on Borrowings)/(Deposits + Borrowings).

4. Return on Advances = Interest Earned on Advances /Advances.

5. Return on Investments = Interest Earned on Investments /Investments.

6. Return on Funds = (Return on Advances + Return on Investments)/(Investments + Advances). |

share of trading income in investments declined during the year, that of fee income, income from foreign exchange operations and miscellaneous income increased (Chart III.12). The trading income of SCBs declined during 2004-05 and 2005-06 due mainly to firming up of yields on Government securities.

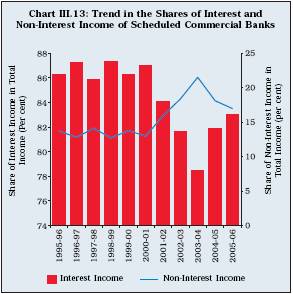

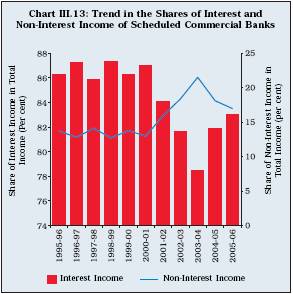

3.56 The share of non-interest income in banksí total income declined for the second year in succession to 17.0 per cent in 2005-06 from 18.1 per cent in 2004-05. The share of non-interest income had increased sharply from 13.7 per cent in 1995-96 to a peak of 21.5 per cent in 2003-04, before it started declining from the next year (Chart III.13). The trend in non-interest income has been influenced mainly by the behaviour of trading income, which in turn, follows the pattern of movement in interest rate as bulk of the trading income comprises income from trading in Government securities. The bank-wise data reveal that trading income of all PSBs, except three banks, declined during 2005-06.

Table III.22: Important Financial Indicators of Scheduled Commercial Banks |

(Amount in Rs. crore) |

|

2003-04 |

2004-05 |

2005-06† |

† |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

|

|

to Assets |

|

to Assets |

|

to Assets |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

1. Income |

1,83,861 |

9.3 |

1,90,236 |

8.1 |

2,22,209 |

8.0 |

a) |

Interest Income |

1,44,333 |

7.3 |

1,55,801 |

6.6 |

1,84,510 |

6.6 |

b) |

Other Income |

39,528 |

2.0 |

34,435 |

1.5 |

37,698 |

1.4 |

2. Expenditure |

1,61,590 |

8.2 |

1,69,278 |

7.2 |

1,97,616 |

7.1 |

a) |

Interest Expended |

87,567 |

4.4 |

89,079 |

3.8 |

1,06,919 |

3.8 |

b) |

Operating Expenses |

43,702 |

2.2 |

50,133 |

2.1 |

58,729 |

2.1 |

|

of which : Wage Bill |

26,380 |

1.3 |

29,479 |

1.3 |

33,425 |

1.2 |

c) |

Provision and Contingencies |

30,322 |

1.5 |

30,065 |

1.3 |

31,968 |

1.1 |

3. Operating Profit |

52,593 |

2.7 |

51,023 |

2.2 |

56,560 |

2.0 |

4. Net Profit |

22,271 |

1.1 |

20,958 |

0.9 |

24,592 |

0.9 |

5. Net Interest Income/Margin (1a-2a) |

56,766 |

2.9 |

66,722 |

2.8 |

77,591 |

2.8 |

Note : The number of scheduled commercial banks in 2003-04, 2004-05 and 2005-06 were 90, 88 and 84, respectively. |

3.57 Banksí overall income increased sharply by 16.8 per cent during 2005-06 compared with an increase of 3.5 per cent in the previous year. Both interest and non-interest income increased during 2005-06 (Chart III.14). 3.58 Among bank-groups, income of new private sector banks grew at the highest rate (45.2 per cent) during 2005-06, followed by foreign banks (33.7 per cent), public sector banks (15.6 per cent) and old private sector banks (11.4 per cent) (Appendix Table III.15A to 15G). Interest income to total assets ratio increased during the year for SBI group and foreign banks, while it moved down for nationalised banks and old private sector banks.

Expenditure

3.59 The expenditure of SCBs moved up significantly by 16.7 per cent in 2005-06 as compared with 4.8 per cent in 2004-05. Reversing the trend of the previous two years, interest expended increased sharply by 20.0 per cent (compared with the increase of 1.7 per cent in the previous year) mainly on account of increase in cost of borrowings (Table III.23). Non-interest

Table III.23: Changes in Income-Expenditure |

Profile of Scheduled Commercial Banks |

(Amount in Rs. crore) |

|

2004-05 |

2005-06 |

|

Amount |

Per cent |

Amount |

Per cent |

1 |

2 |

3 |

†4 |

5 |

1. Income (a+b) |

6,375 |

3.5 |

31,973 |

16.8 |

a) |

Interest Income |

11,468 |

7.9 |

28,709 |

18.4 |

b) |

Other Income |

-5,093 |

-12.9 |

3,263 |

9.5 |

2. Expenses (a+b+c) |

7,687 |

4.8 |

28,339 |

16.7 |

a) |

Interest Expenses |

1,512 |

1.7 |

17,840 |

20.0 |

b) |

Other Expenses |

6,432 |

14.7 |

8,596 |

17.1 |

c) |

Provisioning |

-257 |

-0.8 |

1,903 |

6.3 |

3. Operating Profit |

-1,569 |

-3.0 |

5,537 |

10.9 |

4. Net Profit |

-1,313 |

-5.9 |

3,634 |

17.3 |

Source : Balance Sheets of respective banks. |

or operating expenses increased by 17.1 per cent during 2005-06 as compared with 14.7 per cent in the previous year. This was despite the lower increase in the wage bill as compared with the previous year. From the overall profitability viewpoint, operating expenses need to be seen in conjunction with non-interest income. The gap between the two widened further, albeit marginally, during 2005-06 due to smaller increase in non-interest income. Accordingly, banksí burden (excess of non-interest expenditure over non-interest income) increased marginally to 0.8 per cent of assets in 2005-06 (from 0.7 per cent in 2004-05) and the efficiency ratio (operating expenses as percentage of net interest income plus non-interest income) deteriorated to 50.9 per cent from 49.6 per cent in the previous year.

3.60 The wage bill for the banking sector, on the whole, increased by 13.4 per cent during 2005-06 as compared with 11.7 per cent in the last year. Wage bill declined both as percentage of total assets (to 1.2 per cent from 1.3 per cent), as well as percentage of operating expenses (to 56.9 per cent from 58.8 per cent). During the year, the wage bill as percentage of operating expenses was lowest in the case of new private sector banks (27.3 per cent), followed by foreign banks (35.1 per cent); the ratio was highest for PSBs (65.9 per cent) (Chart III.15). Although, wage bill of all bank groups increased during the year, the increase in wage bill was the lowest for the PSBs. This is a healthy development from the point of view of reducing the high wage bill (as percentage of operating expenses) of PSBs.

Net Interest Income

3.61 Net interest income, defined as the difference between interest income and interest expenses, is an important indicator of efficiency of banks. The net interest income (spread) of SCBs as percentage of total assets remained unchanged at 2.8 in 2005-06, which may be considered high in comparison with the international standards. The net interest margin of foreign banks increased further to 3.5 per cent in 2005-06 from 3.3 per cent. Net interest margin of PSBs and private sector banks remained stable around 2.9 per cent and 2.3 per cent, respectively, in 2005-06.

Operating Profits 3.62 Operating profits of SCBs increased by 10.9 per cent in 2005-06 as against a decline of 3.0 per cent in the previous year, reflecting largely the impact of increase in interest income. Operating profits of all bank groups, except nationalised banks, increased during 2005-06. Operating profits to total assets ratio declined to 2.0 per cent during 2005-06 from 2.2 per cent in the previous year. However, it varied widely in the range of 11.7 per cent to (-)0.5 per cent at the individual bank level.

Provisions and Contingencies 3.63 The provisions and contingencies of SCBs showed a modest increase of 6.3 per cent in 2005-06 as against a marginal decline during 2004-05. Bank-group wise, provisions and contingencies increased for public sector banks, new private sector banks and foreign banks, but declined for old private sector banks. Provisions for investments increased in respect of all bank groups. At the aggregate level, while provisions for loan losses declined sharply by 11.5 per cent, those for depreciation in value of investments increased sharply by 96.3 per cent during 2005- 06 (see also sub-section on Investment Fluctuation Reserve and Capital Adequacy). The provision for loan losses made by PSBs and foreign banks declined, while those made by private sector banks increased. The provision for depreciation in value of investments increased for all bank groups, except old private sector banks.

Table III.24: Operating Profit and Net Profit ñ Bank Group-wise |

††(Amount in Rs. crore) |

Bank Group |

Operating Profit |

Net Profit |

|

2004-05 |

Percentage |

2005-06 |

Percentage |

2004-05 |

Percentage |

2005-06 |

Percentage |

|

|

Variation |

|

Variation |

|

Variation |

|

Variation |

1 |

2 |

3 |

4 |

5 |

†6 |

7 |

8 |

9 |

Scheduled Commercial Banks |

51,023 |

-3.0 |

56,560 |

10.9 |

†20,958 |

-5.9 |

24,592 |

17.3 |

Public Sector Banks |

38,761 |

-1.3 |

39,142 |

1.0 |

†15,442 |

-6.7 |

16,539 |

7.1 |

Nationalised Banks |

23,121 |

-7.2 |

23,011 |

-0.5 |

†9,459 |

-13.4 |

10,021 |

5.9 |

State Bank Group |

15,279 |

6.4 |

15,330 |

0.3 |

†5,676 |

1.0 |

5,956 |

4.9 |

Other Public Sector Bank |

361 |

ñ |

801 |

121.8 |

†307 |

ñ |

561 |

82.5 |

Old Private Sector Banks |

2,242 |

-29.9 |

2,369 |

5.7 |

†436 |

-69.9 |

876 |

101.1 |

New Private Sector Banks |

5,443 |

6.3 |

8,388 |

54.1 |

†3,098 |

52.2 |

4,109 |

32.6 |

Foreign Banks |

4,577 |

-8.2 |

6,661 |

45.5 |

†1,982 |

-11.6 |

3,069 |

54.8 |

ñ : Not Applicable.

Source : Balance sheets of respective banks. |

Net Profit 3.64 Net profits increased by 17.3 per cent during 2005-06 as against the decline of 5.9 per cent last year, despite an increase in provisions and contingencies (Table III.24). Reversing the trend of decline in profits of the previous year, net profits of public sector banks, old private sector banks and foreign banks increased during 2005-06. Net profits of new private sector banks declined as compared with the previous year.

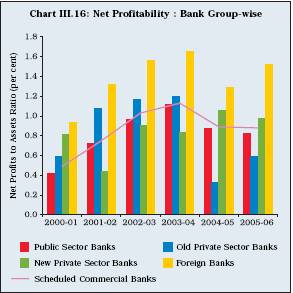

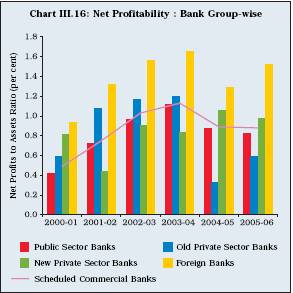

Return on Assets 3.65 Return on assets (RoA) is an indicator of efficiency with which banks deploy their assets. Net profits to assets ratio of SCBs remained almost unchanged in 2005-06. Return on assets of old private sector banks and foreign banks increased during 2005-06 as against the decline in the previous year (Chart III.16). However, return on assets of PSBs and new private sector banks declined marginally.

Return on Equity

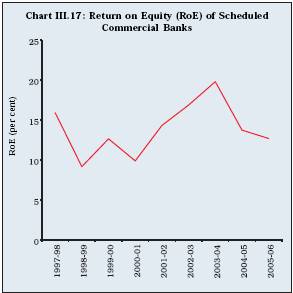

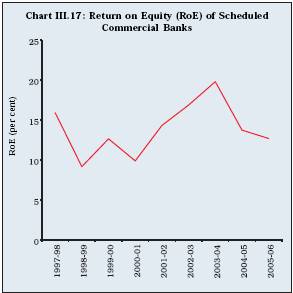

3.66 Return on equity (RoE), an indicator of efficiency of banking institutions in using its capital, declined further to 12.7 per cent in 2005-06, reflecting mainly the impact of a higher capital base (Chart III.17). 3.67 Detailed data on financial performance of commercial banks across bank groups are presented in Appendix Tables III.13 to III.24.

5. Soundness Indicators 3.68 Capital and asset quality, which are two crucial parameters reflecting the soundness of a financial institution, have improved steadily over the years (Chart III.18). The net non-performing loans (NPL) to capital ratio, a worst-case scenario measure, remained at the previous yearís level of 15.5 per cent. However, this was significantly lower as compared with that of 71.3 per cent at end-March 1999.

Asset Quality 3.69 The sharp rise in credit growth continued to be accompanied by a significant improvement in asset quality. In continuation with the recent trend, recoveries in non-performing assets (NPAs) during 2005-06 outpaced fresh accruals during the year (Table III.25). This trend was observed across all bank groups. The gross NPAs of SCBs declined by Rs.7,309 crore during 2005-06 over and above the decline of Rs.6,561 crore in the previous year. 3.70 Several options available to banks for dealing with bad loans and the improved industrial climate in the country helped in recovering a significant amount of NPAs during the year (Table III.26). Banks were specifically advised to ensure that

recoveries of NPAs exceed write-offs while bringing down bad debts. Total amount recovered and written-off increased to Rs.28,717 crore during 2005-06 as compared with Rs.25,007 crore in the previous year. 3.71 In the case of direct agricultural advances, the recovery rate improved significantly to 84.1 per cent for the year ended June 2005 (Table III.27).

Table III.25: Movements in Non-performing Assets ñ Bank Group-wise |

††(Amount in Rs. crore) |

Item |

Scheduled |

Public |

Nationa- |

State |

Old Private |

New Private |

Foreign |

|

Commercial |

Sector |

lised |

Bank |

Sector |

Sector |

Banks |

|

Banks |

Banks |

Banks |

Group |

Banks |

Banks |

(29) |

|

(84) |

(28) |

(20) |

(8) |

(19) |

(8) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Gross NPAs |

|

|

|

|

|

|

|

As at end-March 2005 |

59,124 |

48,406 |

31,587 |

15,602 |

4,190 |

4,336 |

2,191 |

Addition during the year |

21,408 |

16,740 |

9,255 |

5,601 |

1,217 |

2,358 |

1,091 |

Recovered and written-off during the year |

28,717 |

23,040 |

13,141 |

7,915 |

1,667 |

2,653 |

1,355 |

As on 31st March 2006 |

51,815 |

42,106 |

27,701 |

13,288 |

3,740 |

4,042 |

1,927 |

Net NPAs |

|

|

|

|

|

|

|

As at end-March 2005 |

21,638 |

16,903 |

9,693 |

6,362 |

1,845 |

2,240 |

648 |

As at end-March 2006 |

18,529 |

14,560 |

7,930 |

6,067 |

1,367 |

1,793 |

807 |

Memo: |

† |

† |

† |

† |

† |

† |

† |

Gross Advances |

15,51,491 |

11,34,724 |

6,99,408 |

3,78,993 |

85,267 |

2,32,536 |

98,965 |

Net Advances |

15,15,669 |

11,06,128 |

7,34,608 |

3,71,520 |

81,980 |

2,30,005 |

97,555 |

Ratio |

† |

† |

† |

† |

† |

† |

† |

Gross NPAs/Gross Advances |

3.34 |

3.71 |

3.96 |

3.51 |

4.31 |

1.74 |

1.95 |

Net NPAs/Net Advances |

1.22 |

1.32 |

1.08 |

1.63 |

1.64 |

0.78 |

0.83 |

Note : Figures in brackets are the number of banks in the respective group.

Source : Balance sheets of respective banks. |

Table III.26: NPAs Recovered by SCBs through Various Channels |

(Amount in Rs. crore) |

Item |

2004-05 |

2005-06 |

|

No. of cases |

Amount |

Amount |

No. of cases |

Amount |

Amount |

|

referred |

involved |

Recovered |

referred |

involved |

Recovered |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

i) |

One-time settlement/

compromise schemes* |

ñ |

ñ |

ñ |

10,262 |

772 |

608 |

ii) |

Lok Adalats |

1,85,395 |

801 |

113 |

181,547 |

1,101 |

223 |

iii) |

DRTs |

4,744 |

14,317 |

2,688 |

3,524 |

6,123 |

4,710 |

iv) |

SARFAESI Act |

39,288 # |

13,224 |

2,391 |

†38,969 # |

9,831 |

3,423 |

* : The scheme for OTS for SME accounts by public sector banks at end-June 2006.

# : Number of notices issued under Section 13(2) of the SARFAESI Act. |

3.72 The Reserve Bank has so far issued Certificate of Registration to four Securitisation Companies/Reconstruction Companies (SCs/RCs), of which three have commenced their operations. Asset Reconstruction Company (India) Limited (ARCIL) set up in 2003 has provided a major boost to the efforts to recover the NPAs of banks. With a view to facilitating resolution of NPAs of the Indian banking system by SCs/RCs and to enhance the possibility of banks realising better value for their NPAs through the expertise and resources of foreign institutions with international experience in management of stressed assets, the Government of India permitted FDI up to 49 per cent in the equity capital of SCs/RCs registered with the Reserve Bank. So far, none of the SCs/RCs registered with the Reserve Bank has any FDI participation in equity. 3.73 During 2005-06, ARCIL acquired 559 cases of NPAs from 31 banks/FIs with total dues amounting to Rs.21,126 crore (Table III.28). The portfolio of assets acquired by ARCIL was diversified across major industry segments, which were generally performing well in the stock market. About 78 per cent of assets under management were fully/partially operational. Movements in Provisions for Non-performing Assets 3.74 While the gross NPAs declined by Rs.7,309 crore in absolute terms during 2005-06, the decline

Table III.27: Recovery of Direct Agricultural

Advances of PSBs |

(Amount in Rs. crore) |

Year ended |

Demand |

Recovery |

Overdues |

Percentage |

June |

|

|

|

of Recovery |

|

|

|

|

to Demand |

1 |

2 |

3 |

4 |

5 |

2003 |

28,940 |

21,011 |

7,929 |

72.6 |

2004 |

33,544 |

25,002 |

8,542 |

74.5 |

2005 |

35,192 |

29,612 |

5,580 |

84.1 |

in net NPAs was lower at Rs.3,109 crore. Write-offs and write-back of excess provisions were more than the fresh provisions made by SCBs during the year across all bank groups, except for old private sector and new private sector banks. Cumulative provisions made at end-March 2006 were lower in respect of PSBs and foreign banks than their level a year ago, while they were higher in the case of private sector banks (both old and new). The cumulative provisions as percentage of NPAs declined to 58.9 per cent at end-March 2006 from 60.3 per cent at end-March 2005. This is indicative of improved recovery climate. Nationalised banks had the highest cumulative provisions as proportion to the gross NPAs at end-March 2006, followed by old private banks, new private banks, foreign banks and the State Bank group (Table III.29).

3.75 Increased recovery of NPAs, decline in fresh slippages and a sharp increase in gross loans and advances by SCBs led to a sharp decline in the ratio of gross NPAs to gross advances to 3.3 per cent at end-March 2006 from 5.2 per cent at end-March 2005. Likewise, net NPAs as percentage of net advances declined to 1.2 per cent from 2.0 per cent at end-March 2005. A significant decline in gross and net NPAs was evident across all bank groups [Table III.30 and Appendix III.25 and 26].

Table III.28: Details of Financial Assets

Acquired by ARCIL |

(As on March 31, 2006) |

(Amount in Rs. crore) |

Bank/FIs |

No. of |

Principal |

Interest |

Total Dues |

|

cases |

debt |

and |

purchased |

|

|

acquired |

other |

|

|

|

|

charges |

|

1 |

2 |

3 |

4 |

5 |

Public Sector Banks |

599 |

3,638 |

3,917 |

7,555 |

Old Private Sector Banks |

34 |

186 |

150 |

336 |

New Private Sector Banks |

152 |

5,037 |

4,727 |

9,764 |

Financial Institutions |

51 |

1,460 |

2,011 |

3,471 |

Total |

559 |

10,321 |

10,805 |

21,126 |

Table III.29: Movements in Provisions for Non-performing Assets ñ Bank Group-wise† |

(Amount in Rs. crore) |

Items |

Scheduled |

Public |

Nationa- |

State |

Old Private |

New Private |

Foreign |

|

Commercial |

Sector |

lised |

Bank |

Sector |

Sector |

Banks |

|

Banks |

Banks |

Banks |

Group |

Banks |

Banks |

|

|

(84) |

(28) |

(19) |

(8) |

(19) |

(8) |

(29) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Provision for NPAs |

† |

† |

† |

† |

† |

† |

|

As at end-March 2005 |

34,484 |

28,857 |

20,185 |

8,303 |

2,185 |

2,067 |

1,374 |

Add |

: Provision made during the year |

8,968 |

6,272 |

4,350 |

419 |

545 |

1,509 |

640 |

Less |

: Write-off/write-back of excess provisions |

12,916 |

10,082 |

6,364 |

2,399 |

451 |

1,363 |

1,018 |

|

as at end-March 2006 |

30,536 |

25,047 |

18,171 |

6,323 |

2,279 |

2,212 |

997 |

Memo: |

† |

† |

† |

† |

† |

† |

|

Gross NPAs |

51,815 |

42,106 |

27,701 |

13,288 |

3,740 |

4,042 |

1,927 |

Ratio |

|

† |

† |

† |

† |

† |

† |

|

Cumulative Provision to Gross NPAs (per cent) |

58.9 |

59.5 |

65.6 |

47.6 |

60.9 |

54.7 |

51.8 |

Note : Figures in brackets indicate the number of banks in that group for 2005-2006.

Source : Balance sheets of respective banks. |

Table III.30: Gross and Net NPAs of Scheduled Commercial Banks ñ Bank Group-wise

(As at end-March) |

(Amount in Rs. crore) |

Bank Group/Year |

Gross Advances |

Gross NPAs |

Net Advances |

Net NPAs |

|

|

Amount |

Per cent |

Per cent |

|

Amount |

Per cent |

Per cent |

|

|

|

to Gross |

to total |

|

|

to Net |

to total |

|

|

|

Advances |

Assets |

|

|

Advances |

Assets |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Scheduled Commercial Banks† |

2003 |

7,78,043 |

68,717 |

8.8 |

4.1 |

7,40,473 |

29,692 |

4.0 |

1.8 |

2004 |

9,02,026 |

64,785 |

7.2 |

3.3 |

8,62,643 |

24,396 |

2.8 |

1.2 |

2005 |

11,52,682 |

59,373 |

5.2 |

2.5 |

11,15,663 |

21,754 |

2.0 |

0.9 |

2006 |

15,51,378 |

51,816 |

3.3 |

1.9 |

15,15,669 |

18,529 |

1.2 |

0.7 |

Public Sector Banks† |

2003 |

5,77,813 |

54,090 |

9.4 |

4.2 |

5,49,351 |

24,877 |

4.5 |

1.9 |

2004 |

6,61,975 |

51,538 |

7.8 |

3.5 |

6,31,383 |

19,335 |

3.1 |

1.3 |

2005 |

8,77,825 |

48,399 |

5.5 |

2.7 |

8,48,912 |

16,904 |

2.1 |

1.0 |

2006 |

11,34,724 |

42,106 |

3.7 |

2.1 |

11,06,128 |

14,561 |

1.3 |

0.7 |

Old Private Sector Banks† |

2003 |

51,329 |

4,550 |

8.9 |

4.3 |

49,436 |

2,548 |

5.2 |

2.5 |

2004 |

57,908 |

4,393 |

7.6 |

3.6 |

55,648 |

2,142 |

3.8 |

1.8 |

2005 |

70,412 |

4,200 |

6.0 |

3.1 |

67,742 |

1,859 |

2.7 |

1.4 |

2006 |

85,154 |

3,740 |

4.3 |

2.5 |

81,980 |

1,368 |

1.6 |

0.9 |

New Private Sector Banks |

2003 |

94,718 |

7,232 |

7.6 |

3.8 |

89,515 |

1,365 |

1.5 |

0.7 |

2004 |

1,19,511 |

5,961 |

5.0 |

2.4 |

1,15,106 |

1,986 |

1.7 |

0.8 |

2005 |

1,27,420 |

4,582 |

3.6 |

1.6 |

1,23,655 |

2,353 |

1.9 |

0.8 |

2006 |

2,32,536 |

4,042 |

1.7 |

1.0 |

2,30,005 |

1,793 |

0.8 |

0.4 |

Foreign Banks |

† |

† |

† |

† |

† |

† |

† |

† |

2003 |

54,184 |

2,845 |

5.3 |

2.4 |

52,171 |

903 |

1.7 |

0.8 |

2004 |

62,632 |

2,894 |

4.6 |

2.1 |

60,506 |

933 |

1.5 |

0.7 |

2005 |

77,026 |

2,192 |

2.8 |

1.4 |

75,354 |

639 |

0.8 |

0.4 |

2006 |

98,965 |

1,927 |

1.9 |

1.0 |

97,555 |

808 |

0.8 |

0.4 |

Source : Balance sheets of respective banks. |

Table III.31: Distribution of Scheduled Commercial

Banks by Ratio of Net NPAs to Net Advances |

(Number of banks) |

Bank Group |

As at end-March |

|

2002 |

2003 |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

Public Sector Banks |

27 |

27 |

27 |

28 |

28 |

Up to 2 per cent |

0 |

4 |

11 |

19 |

23 |

Above 2 and up to 5 per cent |

11 |

14 |

13 |

7 |

5 |

Above 5 and up to 10 per cent |

13 |

7 |

3 |

2 |

0 |

Above 10 per cent |

3 |

2 |

0 |

0 |

0 |

Old Private Sector Banks |

21 |

20 |

20 |

20 |

19 |

Up to 2 per cent |

2 |

2 |

2 |

4 |

11 |

Above 2 and up to 5 per cent |

2 |

4 |

9 |

12 |

7 |

Above 5 and up to 10 per cent |

12 |

12 |

7 |

4 |

1 |

Above 10 per cent |

5 |

2 |

2 |

0 |

0 |

New Private Sector Banks |

9 |

9 |

10 |

9 |

8 |

Up to 2 per cent |

1 |

2 |

4 |

5 |

6 |

Above 2 and up to 5 per cent |

3 |

2 |

5 |

3 |

2 |

Above 5 and up to 10 per cent |

5 |

4 |

0 |

1 |

0 |

Above 10 per cent |

0 |

1 |

1 |

0 |

0 |

Foreign Banks |

42 |

36 |

33 |

31 |

29 |

Up to 2 per cent |

24 |

19 |

22 |

23 |

26 |

Above 2 and up to 5 per cent |

4 |

3 |

2 |

2 |

0 |

Above 5 and up to 10 per cent |

1 |

6 |

3 |

2 |

0 |

Above 10 per cent |

13 |

8 |

6 |

4 |

3 |

3.76 At end-March 2006, the ratio of net NPAs to net advances of public sector banks and old private sector banks was less than 2 per cent at the bank group level. Net NPA ratio of new private banks and foreign banks were 0.8 per cent. As at end-March 2006, 66 banks (as against 51 last year) out of 84 (as against 88 last year) had net NPAs to net advances ratio less than 2 per cent. Only four banks, three of which were foreign banks, had net NPAs ratio higher than 5 per cent as compared with 13 in the previous year (Table III.31). The NPAs to advances ratio improved during 2005-06 for all scheduled banks, except seven banks (Appendix Table III.25 and 26).

3.77 Decline in NPAs ratio was observed across all categories, viz., ësub-standardí, ëdoubtfulí and ëlossí. In two categories (ëlossí and ëdoubtfulí), NPAs declined in absolute terms. NPAs in ësub-standardí category increased marginally. More or less the same trend was observed across all bank groups, except old private sector banks, in which case ësub-standardí assets declined and new private sector banks, in which case ëloss assetsí increased marginally (Table III.32). Sector-wise NPAs

3.78 NPAs of public and private sector banks are classified into three broad sectors, viz., priority sector, public sector and non-priority sector. NPAs in two sectors (priority and non-priority) declined during 2005-06, while those in the public sector increased. Notwithstanding some decline, NPAs were highest in the priority sector, followed closely by the non-priority sector. In the previous year, NPAs were the largest in the non-priority sector (Table III.33). NPAs in the agriculture sector in the case of new private sector banks increased, while those in the SSI sector of all bank groups declined during the year [Appendix Table III.27 (A and B) and 28 (A and B)].

Movements in Provisions for Depreciation on Investments

3.79 The provisions for depreciation on investments increased by 30.6 per cent during the year. Provisions made during the year were far higher than the write-offs and write back of excess provisions as a result of which provisions

Table III.32: Classification of Loan Assets ñ Bank Group-wise |

(As at end-March) |

(Amount in Rs. crore) |

Bank Group/Year |

Standard |

Sub-standard |

Doubtful |

Loss |

Total |

Total |

|

Assets |

Assets |

Assets |

Assets |

NPAs |

Advances |

|

Amount |

per |

Amount |

per |

Amount |

per |

Amount |

per |

Amount |

per |

Amount |

|

|

cent |

|

cent |

|

cent |

|

cent |

|

cent |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

Scheduled Commercial Banks |

2003 |

7,09,260 |

91.2 |

20,078 |

2.6 |

39,731 |

5.1 |

8,971 |

1.1 |

68,780 |

8.8 |

7,78,040 |

2004 |

8,37,130 |

92.9 |

21,026 |

2.3 |

36,247 |

4.0 |

7,625 |

0.9 |

64,898 |

7.2 |

9,02,027 |

2005 |

10,93,523 |

94.9 |

14,016 |

1.2 |

37,763 |

3.3 |

7,382 |

0.6 |

59,161 |

5.1 |

11,52,684 |

2006 |

14,99,431 |

96.7 |

14,826 |

1.0 |

30,105 |

2.0 |

7,016 |

0.4 |

51,947 |

3.3 |

15,51,378 |

Public Sector Banks |

2003 |

5,23,724 |

90.6 |

14,909 |

2.6 |

32,340 |

5.6 |

6,840 |

1.1 |

54,089 |

9.4 |

5,77,813 |

2004 |

6,10,435 |

92.2 |

16,909 |

2.5 |

28,756 |

4.4 |

5,876 |

0.9 |

51,541 |

7.8 |

6,61,975 |

2005 |

8,30,029 |

94.6 |

11,068 |

1.3 |

30,779 |

3.5 |

5,929 |

0.7 |

47,796 |

5.4 |

8,77,825 |

2006 |

10,92,607 |

96.2 |

11,453 |

1.0 |

25,028 |

2.2 |

5,636 |

0.5 |

42,117 |

3.7 |

11,34,724 |

Old Private Sector Banks |

2003 |

46,761 |

91.1 |

1,474 |

2.9 |

2,772 |

5.4 |

321 |

0.6 |

4,567 |

8.9 |

51,328 |

2004 |

53,516 |

92.4 |

1,161 |

2.0 |

2,727 |

4.7 |

504 |

0.9 |

4,392 |

7.6 |

57,908 |

2005 |

66,212 |

94.0 |

784 |

1.1 |

2,868 |

4.0 |

549 |

0.8 |

4,201 |

6.0 |

70,413 |

2006 |

81,414 |

95.6 |

710 |

0.8 |

2,551 |

3.0 |

479 |

0.6 |

3,740 |

4.4 |

85,154 |

New Private Sector Banks |

2003 |

87,487 |

92.3 |

2,700 |

2.9 |

3,675 |

3.9 |

856 |

0.9 |

7,231 |

7.6 |

94,718 |

2004 |

1,13,560 |

95.0 |

1,966 |

1.6 |

3,665 |

3.0 |

321 |

0.3 |

5,952 |

5.0 |

1,19,512 |

2005 |

1,22,577 |

96.2 |

1,449 |

1.1 |

3,061 |

2.4 |

334 |

0.3 |

4,844 |

3.8 |

1,27,421 |

2006 |

2,28,504 |

98.3 |

1,717 |

0.7 |

1,855 |

0.8 |

460 |

0.2 |

4,032 |

1.8 |

2,32,536 |

Foreign Banks |

2003 |

51,288 |

94.7 |

995 |

1.8 |

944 |

1.7 |

954 |

1.8 |

2,893 |

5.3 |

54,181 |

2004 |

59,619 |

95.1 |

990 |

1.6 |

1,099 |

1.8 |

924 |

1.5 |

3,013 |

4.8 |

62,632 |

2005 |

74,705 |

97.0 |

715 |

1.0 |

1,035 |

1.3 |

570 |

0.7 |

2,320 |

3.0 |

77,025 |

2006 |

96,907 |

98.0 |

946 |

1.0 |

670 |

0.7 |

441 |

0.5 |

2,057 |

2.0 |

98,965 |

Note : Constituent items may not add up to the total due to rounding off.

Source : DBS Returns (BSA) submitted by respective banks. |

at end-March 2006 were almost twice the amount of provisions at end-March 2005. Thus, banks have made significant progress to protect their investment portfolio (Table III.34).

Table III.33: Sector-wise NPAs ñ Bank Group-wise* |

(As at end-March) |

† (Amount in Rs. crore) |

Sector |

Public Sector |

Old Private Sector |

New Private Sector |

All SCBs |

|

Banks |

Banks |

Banks |

|

|

|

2004-05 |

2005-06 |

2004-05 |

2005-06 |

2004-05 2005-06 |

2004-05 |

2005-06 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

A. |

Priority Sector |

23,397 |

22,374 |

182 |

1,632 |

407 |

652 |

25,586 |

24,658 |

|

i) |

Agriculture |

7,254 |

6,203 |

304 |

265 |

161 |

250 |

7,719 |

6,718 |

|

ii) |

Small Scale Industries |

7,835 |

6,917 |

792 |

656 |

172 |

152 |

8,799 |

7,725 |

|

iii) |

Others |

8,308 |

9,253 |

686 |

711 |

73 |

251 |

9,067 |

10,215 |

B. |

Public Sector |

450 |

340 |

8 |

1 |

34 |

3 |

493 |

345 |

C. |

Non-Priority Sector |

23,849 |

18,664 |

2,444 |

2,078 |

4,125 |

3,463 |

30,417 |

24,205 |

Total (A+B+C) |

47,696 |

41,378 |

4,234 |

3,711 |

4,566 |

4,118 |

56,496 |

49,208 |

* : Excluding foreign banks.

Source : Based on off-site returns submitted by banks. |

Table III.34: Movements in Provisions for Depreciation on Investment ñ Bank Group-wise |

(Amount in Rs. crore) |

Particulars |

Scheduled |

Public |

Nationa- |

State |

Old |

New |

Foreign |

|

Commercial |

Sector |

lised |

Bank |

Private |

Private |

Banks |

|

Banks |

Banks |

Banks |

Group |

Sector |

Sector |

(29) |

|

(84) |

(28) |

(19) |

(8) |

Banks |

Banks |

|

|

|

|

|

|

(19) |

(8) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Provision for Depreciation on Investment |

|

|

|

|

|

|

|

As at end-March 2005 |

8,333 |

6,474 |

1,854 |

4,576 |

401 |

668 |

790 |

Add : Provision made during the year |

10,861 |

9,716 |

4,233 |

5,285 |

180 |

272 |

693 |

Less :Write-off, write back of excess during the year |

2,849 |

2,463 |

1,169 |

1,277 |

169 |

192 |

25 |

As at end-March 2006 |

16,345 |

13,726 |

4,918 |

8,584 |

412 |

748 |

1,459 |

Note : Figures in brackets indicate the number of banks for 2005-06.

Source: Balance sheets of respective banks. |

Investment Fluctuation Reserve 3.80 As treasury profits are sensitive to fluctuations in interest rates, banks were advised to set aside a part of treasury income as investment fluctuation reserve (IFR). The IFR, created as a revaluation reserve, is a below-the-line item and is a charge on net profit. However, in view of move towards Basel II, the Reserve Bank advised in October 2005 that those banks which would maintain capital of at least 9 per cent of the risk-weighted assets for both credit risk and market risk, for both ëHFTí and ëAFSí categories as on March 31, 2006, would be permitted to treat the entire balance in the IFR as Tier I capital. For this purpose, banks could transfer the balance in the IFR to Statutory Reserve, General Reserve or balance of Profit and Loss Account. Several PSBs and new private sector banks transferred their entire IFR balances to their Profit and Loss Appropriation Account, to Statutory Reserve, General Reserve or balance of Profit and Loss Account. Accordingly, at end-March 2006, the IFR ratio (IFR as a percentage of investments under HFT and AFS categories) for SCBs dropped sharply to below 0.1 per cent from 4.4 per cent at end-March 2005 (Table III.35 and Appendix Table III.29).

Capital Adequacy 3.81 The overall CRAR for all SCBs declined marginally to 12.4 per cent at end-March 2006 from 12.8 per cent at end-March 2005. The ratio, however, continued to be significantly above the stipulated minimum of 9.0 per cent (Table III.36). The slight decline in the CRAR during the year needs to be viewed in the context of (i) application of capital charge for market risk from March

Table III.35: Investment Fluctuation Reserves ñ Bank Group-wise |

(As at end-March 2006) |

(Amount in Rs. crore) |

Bank Group |

Investment |

|

Investment |

IFR as |

|

Available |

Held for |

Fluctuation |

percentage to |

|

for sale |

Trading |

Reserve |

Total of |

|

(AFS) |

(HFT) |

(IFR) |

AFS+HFT |

1 |

2 |

3 |

4 |

5 |

Scheduled Commercial Banks |

3,83,649 |

23,092 |

1,334 |

0.3 |

Public Sector Banks |

2,77,930 |

2,147 |

625 |

0.2 |

Nationalised Banks |

1,70,372 |

679 |

625 |

0.4 |

State Bank Group |

99,414 |

179 |

0 |

0.0 |

Other Public Sector Bank |

8,143 |

1,288 |

0 |

0.0 |

Old Private Sector Banks |

18,979 |

176 |

416 |

2.2 |

New Private Sector Banks |

46,752 |

10,612 |

0 |

0.0 |

Foreign Banks |

39,988 |

10,157 |

294 |

0.6 |

Source : Balance sheets of respective banks. |

Table III.36: Scheduled Commercial Banks ñ

Component-wise CRAR

(As at end-March) |

(Amount in Rs. crore) |

Item / Year |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

A. Capital Funds (i+ii) |

1,25,249 |

1,65,928 |

2,21,363 |

i) |

Tier I Capital |

78,550 |

1,08,949 |

1,66,538 |

|

of which: |

|

|

|

|

Paid-up Capital |

22,022 |

25,724 |

25,142 |

|

Reserves |

65,948 |

91,320 |

1,41,592 |

|

Unallocated/Remittable |

|

|

|

|

Surplus |

4,983 |

6,937 |

11,075 |

|

Deductions for Tier-I |

|

|

|

|

Capital |

14,403 |

15,031 |

11,271 |

ii) |

Tier-II Capital |

46,699 |

56,979 |

54,825 |

|

of which: |

|

|

|

|

Discounted Subordinated |

|

|

|

|

Debt |

20,011 |

26,291 |

43,214 |

|

Investment Fluctuation |

|

|

|

|

Reserve |

19,032 |

21,732 |

1,334 |

B. Risk-weighted Assets |

9,69,886 |

1,29,6,223 |

17,97,207 |

of which: |

|

|

|

Risk-weighted Loans and |

|

|

|

Advances |

6,59,921 |

9,19,544 |

12,38,163 |

C. CRAR (A as per cent of B) |

12.9 |

12.8 |

12.3 |

of which: |

|

|

|

Tier I |

8.1 |

8.4 |

9.3 |

Tier II |

4.8 |

4.4 |

3.1 |

Source : Off-site returns submitted by banks. |

2006; (ii) a sharp increase in risk-weighted assets on account of higher credit growth (driven partly by shifting of risk free assets); and (iii) increase in risk weights for personal loans, real estate and capital market exposure.

3.82 Tier I capital adequacy ratio increased significantly to 9.3 per cent at end-March 2006 from 8.4 per cent at end-March 2005 partly due to transfer of IFR from Tier II capital and partly due to increase in reserves and surplus and raising of resources from the capital market, both domestic and international (Chart III.19). The higher Tier I ratio implies the more headroom for raising capital funds through the Tier II route. 3.83 Among bank groups, the CRAR of new private sector banks improved, while those of all other bank groups declined. The CRAR of nationalised banks, which had improved marginally in the previous year, declined to the industry average at end-March 2006; the CRAR of the State Bank group and old private sector banks remained below the industry average. Despite decline to 13.0 per cent at end-March 2006, the CRAR of foreign banks was still higher than the industry average (Table III.37). The CRAR of SCBs declined on account of high growth of advances, increase in risk weights for certain

Table III.37: Capital Adequacy Ratio ñ Bank Group-wise |

(As at end-March) |

(Per cent) |

Bank Group |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Scheduled Commercial Banks |

11.3 |

11.1 |

11.4 |

12.0 |

12.7 |

12.9 |

12.8 |

12.3 |

Public Sector Banks |

11.3 |

10.7 |

11.2 |

11.8 |

12.6 |

13.2 |

12.9 |

12.2 |

Nationalised Banks |

10.6 |

10.1 |

10.2 |

10.9 |

12.2 |

13.1 |

13.2 |

12.3 |

SBI Group |

12.3 |

11.6 |

12.7 |

13.3 |

13.4 |

13.4 |

12.4 |

11.9 |

Old Private Sector Banks |

12.1 |

12.4 |

11.9 |

12.5 |

12.8 |

13.7 |

12.5 |

11.7 |

New Private Sector Banks |

11.8 |

13.4 |

11.5 |

12.3 |

11.3 |

10.2 |

12.1 |

12.6 |

Foreign Banks |

10.8 |

11.9 |

12.6 |

12.9 |

15.2 |

15.0 |

14.0 |

13.0 |

Source : Off-site returns submitted by banks. |

|