IST,

IST,

II. Aggregate Demand

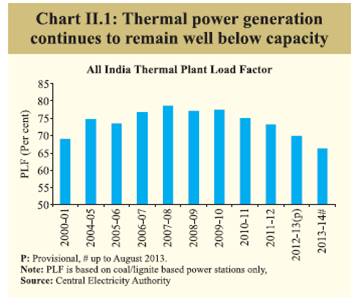

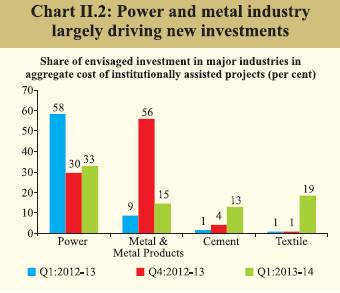

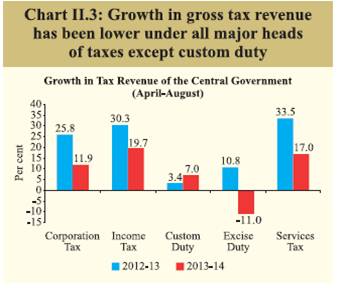

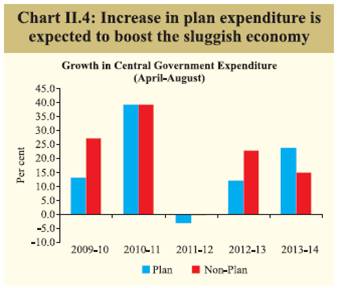

Notwithstanding a sharp rise in the government’s final consumption expenditure, aggregate demand in the economy remained weak during Q1 of 2013-14 because of deceleration in private consumption and contraction in fixed investments. Persisting consumer price inflation impacted private consumption expenditure, while structural impediments and general uncertainty regarding the policy environment weighed down on investment activities. There was a sharp fall in fresh investment proposals from the private corporate sector during the quarter, reflecting the prevalence of overall negative business sentiments. However, a good monsoon this year and the pick-up in exports could boost aggregate demand. Private consumption weakened, fixed investment contracted in Q1 of 2013-14 II.1 Expenditure-side GDP continued to weaken during Q1 of 2013-14 mainly on account of a deceleration in private final consumption expenditure and a contraction in fixed investments, even as the government’s final consumption expenditure showed a sharp increase (Table II.1). II.2 Slowdown in income growth and persistence of a high consumer price inflation impacted private consumption expenditure while structural impediments and general uncertainty regarding the policy environment weighed down on investment activities. Investment in valuables, however, increased sharply on the back of high inflation and expected relative returns. In fact, among all the components of aggregate demand, the contribution of valuables to overall growth was the highest during Q1 of 2013-14 (Table II.2). At the same time, while exports continued to contract for the third successive quarter, imports also slackened in line with overall domestic activity and consequently, net exports posted a smaller contraction in Q1 of 2013-14 vis-a-vis previous quarters. Persistent efforts to address infrastructure bottlenecks will help turnaround investment demand, boost market confidence II.3 Persistent policy logjams, particularly those associated with delayed clearances on the part of the government; aggressive bidding on the part of private developers during the high growth phase; and inadequate appraisal mechanisms on the part of financiers, brought the infrastructure sector to a standstill. Consequently project delays have been slowing India’s growth in a big way. As of June 2013, about 50 per cent of central sector projects (of `1.5 billion and above) were delayed, up from 44 per cent in June 2008, for which the cost overruns rose from 12 to 20 per cent during the last five-year period. Delayed projects were high in sectors, such as roads, followed by power, petroleum and railway. II.4 Furthermore, leverage of the firms operating in infrastructure sector for a sample of 50 BSE 500 companies has risen over the years. Total borrowing to equity has increased from 111.3 per cent in 2009-10 to 217.2 per cent in 2012-13. Raising fresh equity in this sector has been difficult of late. II.5 However, efforts at addressing the problems have begun to unlock the potential in this area. The Cabinet Committee on Investments (CII) was constituted to expedite the clearance of projects; CCI has cleared about 209 projects till mid-September 2013. A Project Monitoring Group was also set up in the Prime Minister’s Office which has finalised deadlines for the intermediate steps to be taken to accelerate key mega infrastructure projects. While the impact is not immediately seen, concerted efforts over the next six months could bring about a turnaround in investment demand. II.6 Amongst the infrastructure industry, the power sector was crippled by the poor performance of thermal power, with the plant load factor (PLF) declining continuously to almost early 2000 levels (Chart II.1). Estimates suggest that loss of power generation due to shortage of coal and gas amounted to around 50 billion units (BU) in 2012-13 and about 11.4 BU during the first four months of 2013-14. Though directives to sign fuel supply agreements (FSAs) have been given, the issue of demand-supply imbalance for coal is yet to be resolved. II.7 Activity in the roads sector was also at a low ebb, as projects awaited forest, environmental and land acquisition clearances. During April-June 2013, National Highways Authority of India (NHAI) constructed/widened and strengthened 568 km of National Highways, recording a negative growth of around 7 per cent over the same period previous year. The government and the Reserve Bank have taken several steps to remove constraints facing the sector including delinking environment from forest clearances, treatment of lenders’ debt exposure as secured loans, substitution policy for concessionaires and significant stepping up of efforts on NHAI’s part to fast-track land acquisition. Over the last few months, the government has also been engaging with financial institutions and other stakeholders to infuse greater funds in highway projects. However, with large number of tendered projects remaining uninitiated, cancellation of bids and re-biding need to be speedily undertaken. Besides, pushing engineering, procurement and construction (EPC) projects can partially offset the low interest in tendering for public-private partnership (PPP) based road projects. The PPP mode is expected to pick up again in the next 1-2 years once the measures adopted by the government fructify and as investors’ risk appetite improves. II.8 In the telecommunications sector, balance sheets of major private service providers have been under pressure for quite some time, with operating margins having shrunk. In order to revive the sector, the government took some measures including announcing the National Telecom Policy 2012 and increasing the FDI cap in the sector from 74 to 100 per cent. While Telecom Regulatory Authority of India (TRAI) made various recommendations, spectrum pricing remains a vexed issue. Corporate investment intentions continued to moderate II.9 Corporate investment intentions remained subdued. The envisaged cost of projects for which institutional assistance was sanctioned during Q1 of 2013-14 aggregated `220 billion, which was significantly lower than the quarterly average for the previous two years (Table II.3). A sharp fall in fresh investment proposals in metal and metal products and power industries mainly contributed to this decline. An industry-wise analysis indicates that during Q1 of 2013-14, the share of envisaged expenditure on new projects was the highest in the power industry followed by the textile industry (Chart II.2). Sales growth decelerated, while net profits declined II.10 Sales growth (y-o-y) of non-government non-financial listed companies continued to decelerate and reached a low of 2.5 per cent in Q1 of 2013-14 (Table II.4). The decline in sales was more distinct in the case of motor vehicles, medical precision and other scientific equipments, electrical machinery and apparatus, cement and cement products, iron and steel and real estate. The deceleration was most prominent for the manufacturing sector followed by the non-IT services sector. Sequentially, sales fell by 6.5 per cent in Q1 of 2013-14. While operating profits registered marginal growth, contraction in net profits was recorded for the second successive quarter. Further, profitability in terms of the EBITDA margin improved marginally in Q1 as compared to the previous quarter. The net profit margin, however, recorded a marginal decline. II.11 Early results of 194 listed nongovernment non-financial companies for Q2 of 2013-14 show y-o-y sales growth and operating profits have improved. The central government’s key deficit indicators widened; risks for fiscal slippage in 2013-14 II.12 The deficit indicators of the central government widened significantly during the first five months of 2013-14. Low growth of the centre’s net tax revenue on the one hand and a significant increase in revenue expenditure on the other increased the revenue deficit of the central government, which has already reached 87.4 per cent of budget estimates. The widening of revenue deficit coupled with higher capital expenditure resulted in a gross fiscal deficit of 74.6 per cent of budget estimates during the 5-month period. This is the highest in the last five years. Growth slowdown weighs on tax collections II.13 During the current fiscal so far, gross tax revenue (as a per cent of budget estimates) has been lower than the previous year due to moderation under the major tax heads. Based on latest data for April-September 2013, gross direct tax revenue was higher by 10.7 per cent (5.9 per cent a year ago), with an improvement in both corporation as well personal income tax collections. However, net of refunds, growth in direct tax collections decelerated considerably during the same period to 10.7 per cent as compared to 16.3 per cent last year and 19.5 per cent budgeted for 2013-14. II.14 On the indirect taxes front, excise duty collections recorded a decline during April- August 2013, reflecting the impact of continued industrial slowdown (Chart II.3). The growth in services tax also witnessed deceleration in tandem with a moderation of India’s services sector growth. However, collections from custom duties were higher than the previous year, reflecting the impact of rupee depreciation. II.15 There are also risks to budgetary targets arising from the slow pace of disinvestment this year. Proceeds from disinvestment programmes for 2013-14 were meagre at `14.3 billion as against `400 billion targeted in the budget. On the non-tax revenue side, the Reserve Bank’s record surplus transfer of `330 billion in August 2013 has already contributed to nearly one-fifth of the budgeted non-tax revenue of the central government. There is scope to offset the possible shortfall in disinvestment proceeds through payment of higher dividends by cash-rich public sector units (PSUs). Some of this cash can also be utilised by public sector units to boost public investments in their areas of operations depending on capacity creation needs and expected rate of returns. Restraining expenditure is necessary for fiscal consolidation II.16 The government’s total expenditure during April-August 2013 as percentage of budget estimates was higher both in the revenue and capital accounts. Though, on the non-plan front, expenditure has been lower (Chart II.4), the spending on major subsidies during the period accounted for 62.3 per cent of budget estimates. Although the government has taken several steps to contain expenditure on subsidies through various reform measures, including phased deregulation of diesel prices and restrictions on subsidised LPG cylinders, the sharp depreciation of the rupee and increase in international prices of petroleum products increased the under-recoveries of the oil marketing companies (OMCs). OMCs reported under-recoveries of `256 billion in Q1 of 2013- 14 and are currently incurring a daily under-recovery of `4.42 billion per day. There is a need to raise diesel prices further given an under-recovery of `10.24 per litre (effective October 16, 2013); on current reckoning, given the spillover from the previous year’s under recovery compensation, fuel subsidies could significantly overshoot budgetary provisions. II.17 On the food subsidy front, although the recently enacted National Food Security (NFS) Act, 2013 may not lead to a breach in the budgetary provision of `100 billion for NFS, the overall food subsidy provision of `900 billion for the current year may not be adequate to meet the requirements of the existing targeted public distribution system. In subsequent years, implementation of the NFS Act could lead to increase the food subsidies depending on how it is rolled out and how other food-related schemes are merged with it. State finances are budgeted to improve in 2013-14, although fiscal concerns remain II.18 The consolidated fiscal position of state governments for 2013-14, based on their budget estimates, shows a continuance in fiscal consolidation, with an increase in revenue surplus and a reduction in the GFD-GDP ratio (Table II.5). Revenue surplus will be generated primarily through a reduction in the revenue expenditure-GDP ratio by 0.2 percentage points. On the expenditure side, although the capital outlay-GDP ratio is budgeted to marginally increase in 2013-14, the development expenditure-GDP ratio is budgeted to decline by 0.3 percentage points over the previous year, raising concerns about the quality of expenditure. Demand management requires balancing fiscal consolidation with investment support II.19 Containing the fiscal deficit in 2013-14 within the budgetary limit could be a challenge for the government, given the level of gross fiscal deficit during the current fiscal so far. The government has started putting some correctives, such as austerity measures including a mandatory 10 per cent cut in non-Plan expenditures excluding certain identified expenditures. The government has also been making efforts to improve tax compliance through a combination of administrative steps as well as incentives, such as the Service Tax Voluntary Compliance Encouragement Scheme. More such measures are needed to avert fiscal slippage. Fiscal multipliers for capital outlay are found to be significantly higher than that for revenue expenditure. Hence, fiscal consolidation with a re-orientation in expenditure from revenue expenditure to investment spending could be growth supportive as it will also crowd in private investment. * Despite the well known limitations, expenditure-side GDP data are being used as proxies for components of aggregate demand. |

पृष्ठ अंतिम बार अपडेट किया गया: