IST,

IST,

Presentations

| Name | File |

|---|---|

| Payment and Settlement Systems – Changing Global Dynamics :- Mr Marc Bayle, Programme Manager, Target2-Securities and Principal Adviser at the European Central Bank | |

| Evolution of ISO 20022 Standards :- Mr. Stephen Lindsay, Head of Standards, SWIFT | |

| RBI’s Experience on Adoption of ISO 20022 for RTGS :- Dr A S Ramasastri, CGM-in-Charge, Dr AK Hirve, CGM and Dr A K Sharma, GM from DIT |

Contacts

| Group | Name | Number | |

|---|---|---|---|

| Overall Coordination | Mr A S Meena |

+91-22-2262-6138

+91-99304-60605 |

asmeena@rbi.org.in |

| Mr T K Rajan |

+91-22-2757-7723

+91-98701-45656 |

tkrajan@rbi.org.in | |

| Participant Group | Dr Anil K Sharma |

+91-22-2261-0447

+91-98200-59710 |

anilksharma@rbi.org.in |

| Mr S S Nishank |

+91-22-2260-2859

+91-77383-86600 |

ssnishank@rbi.org.in | |

| Speaker Group | Ms. Nikhila Koduri |

+91-22-2266-8271

+91-99304-60609 |

knikhila@rbi.org.in |

| Ms Vijaya Gangadharan |

+91-22-22602287

+91-99302-63967 |

vpnayak@rbi.org.in | |

| Logistics Group | Ms Baljit Birah |

+91-22-2262-4851

+91-99304-93860 |

baljitbirah@rbi.org.in |

| Ms Binita Topno |

+91-22-2261-0418

+91-99302-63694 |

btopno@rbi.org.in | |

| CAB contact | Mr Sundar Murthi |

+91-20-2553-8257

+91-98901-29993 |

sundarmurthi@rbi.org.in |

Useful Information

Facilities for participants

- All international flights land at Chhatrapati Shivaji International Airport, Mumbai (at Sahar). Transportation for pick up and drop will be provided to foreign participants only from Sahar International Airport, Mumbai to CAB, Pune.

- CAB, Pune has comfortable hostel facilities with AC rooms on single occupancy basis. Breakfast, lunch and dinner will be served at the Tungabhadra Lounge of the Godavari hostel. Breakfast timing would be between 08.15 and 09.00 daily. For bed tea, tea maker is provided in the hostel rooms with adequate tea bags/coffee sachets. On arrival, please approach the Hostel Reception at the Indrayani Hostel to know about the room reserved for you.

- A well equipped gymnasium / health club is attached to the Godavari hostel.

- Yoga classes are conducted in the Indrayani hostel between 06.45 and 07.30 daily.

- Internet cafes in the Godavari and Indrayani hostels are equipped with high speed internet facility.

- A well stacked modern library is functioning at Narmada from 08.00 hours to 20.00 hours where you can access various magazines, newspapers, journals, books, reports, etc. Please fill the library card and produce it at the library for requisitioning books, etc.

- Dispensary facilities are available in the Indrayani hostel. Bank Medical Officer (BMO) is available between 09.00 am and 11.15 am and 16.45 and 18.45. For emergency, Dr. N.D. Kulkarni, BMO may be contacted at 9860094433.

- Hostel supervisor is available at Extn. 2234 and the caterer Shri Subash is available at 9850302048.

Useful Information

International Seminar on adoption of IS020022 standards in RTGS is being held at Reserve Bank of India’s College of Agricultural Banking (CAB) in Pune.

About Pune

Pune is situated on the Deccan Plateau of the Indian Subcontinent, just 170 kms from Mumbai. The two prominent cities of the State of Maharashtra are separated by the mountain range known as Western Ghats.

Pune is connected to International Locations either through direct flights or through connecting flights via Mumbai / New Delhi / Kolkata / Chennai / Bangalore etc.

Time

India is 5 hours 30 minutes ahead of Greenwich Mean Time (GMT+5.5)

Climate Conditions

In September - October the weather in Pune is pleasant / slightly cool with the onset of winter. Daily temperature is likely to be within 14° C and 30° C. Light woollen jacket / shawl may be required in morning / evening.

The College of Agricultural Banking (CAB)

The College of Agricultural Banking (CAB) was established by the Reserve Bank of India in 1969 as a training institution to provide training to bankers in Rural and Cooperative Banking. Subsequently, recognising the changing needs of the Indian financial sector, the college expanded its scope of training to other areas viz., Information Technology, Human Resource Management and General Banking. The college also conducts programs in collaboration with international institutions and agencies such as FAO, APRACA, CICTAB, UNDP, UNIFEM and the Commonwealth Secretariat.

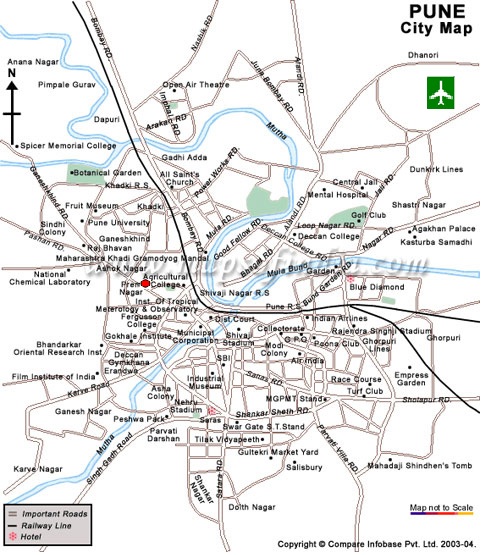

RBI’s College of Agriculture Banking (CAB) is situated on the University Road, also known as Ganeshkhind Road (not to be confused with the University Agriculture College located on the same road around 0.5 km ahead). CAB is around 15 Km from the Pune International Airport. Pre-paid taxi is available at the Airport (to be engaged at the pre-paid taxi booth within the airport terminal) and it will charge around Rs 400/- for commuting to CAB.

College of Agricultural Banking

College of Agricultural Banking

Pune International Airport

Pune International Airport

Travelling To / From Mumbai

The Chhatrapati Shivaji International Airport, Mumbai (at Sahar) can be reached directly as most of the international airlines operate from various international locations on a daily basis. Pune is connected to Mumbai by domestic flight operational from domestic airport, Mumbai (at Santacruz). The International airport and domestic airport are connected by airport shuttle service (please enquire within airport terminal building).

Passport & Visa

Delegates are required to possess a valid passport for a minimum of 6 (six) months from the date of entry into India. Visa is required for most nationalities to enter India and it is strongly recommended that delegates verify requirements with the Indian embassy/consulate in his / her country.

Currency & Credit Cards

The Indian currency is Indian Rupee (INR), called ‘Rupee’. Notes are issued in denominations of Rs.5, Rs.10, Rs.20, Rs50, Rs.100, Rs.500 and Rs.1, 000. There are also Rupee 1, Rs.2, and Rs.5 and Rs.10 coins in circulation. Major credit cards are accepted at bigger Shops and Restaurants. Currency exchange can be availed at the airport.

Dress Code

Dress code for the Seminar is business formal.

Language

Official Language of the Seminar is English.

Spoken Languages in Pune: Marathi (Regional language), Hindi (National language) and English.

Tipping

No specific rule

Electricity

230 Volt is standard voltage in Pune. Voltage converter will be required if you are carrying a device that does not accept 230 volts at 50 hertz.

Outlets in India generally accept the following types of plug:

- Two round pins

- Three round pins arranged in a triangle

If your appliance’s plug has any other shape, you will need a plug adapter.

Insurance and Medical Cover

The Seminar organisers do not take the responsibility for medical, travel or life insurance, and participants are advised to hold valid international personal insurance policies.

Water and Food: Bottled water recommended.

Communications To make an international call, dial: 00 + country code + area code + telephone number.

To dial into India:

- 00-91-20-local number (Pune)

- 00-91-22-local number (Mumbai)

- 00-91-0-Mobile number

Places of Interest

Further tourist information on Pune may be accessed through the Maharashtra Tourism Development Corporation (MTDC) website at following link:

http://www.maharashtratourism.gov.in/mtdc/html/MaharashtraTourism/Default.aspx?strpage=../MaharashtraTourism/CitiestoVisits/Pune/PuneAttractions.html

Panshet Dam

For water sports, you can visit Panset Dam and try your hand at ayaking or wind surfing at the recently developed water sports complex. There are special facilities for speed boats and water scooters. Limited accommodation is available. It is easily accessible from Pune.

Bhatgar Dam

One of the highest river dam walls in India, built on river Velvandi, Bhatgar Dam is 40 kms from Pune. Fun lovers often frequent the entire area around the dam. ST buses play between Pune and Bhatgar Dam

Pimpri Chinchwad

As you leave Pune, and start going towards Mumbai, by the perpetually busy Mumbai-Pune national highway or by a train on the Central Railway, around 20 minutes later you will notice an increasing number of industrial establishments present on both sides of the road. This is a sure sign that you are now entering the area of the Pimpri Chinchwad Municipal Corporation.

Various places of historical importance as well as natural beauty in the area are being developed in a pre-planned manner. Durga Devi Park and Indira Gandhi Park can be pointed out as a step in the right direction. A godess spring temple adds to the scenic beauty of the area. The inside of the temple is hexagonal in shape and there is a variety of beautiful pictures on the walls. In order to see the Devi or goddess, one has to crawl through a small cave. There is an almost-live spring in the cave, which automatically washes your feet clean before you reach the Devi. No leather articles are allowed inside the temple. There is a provision for ample clean and cool water. Evenings are usually crowded. At night due to the effect of lights, the temple looks like a 'divine beauty'! Tuesday is said to be the special day of worship of the goddess.

Sinhagad

Sinhagad -- where valour is etched on every stone and the soil has turned red seeped by the blood of martyrs! From the time when a Koli chieftain, Nag Naik stoutly defended this fort (AD 1328) against the might of Muhammad-bin-Tughlaq for nine months to Jaswant Singh, Aurangzeb's commander, who dragged his guns up the fort's steep shoulders to avenge the insult to Shaista Khan, who was rebuffed by Shivaji, this fort has been infused by tales of bravery.

Raigad

This is the very heart of Maratha country -- Raigad, the capital of Shivaji's kingdom. Strategically perched atop a wedge-shaped block of hill, split off from the Western Ghats and inaccessible from three sides. Stories of incredible valour and heroic deeds are etched on every pebble at Raigad.

Further Enquiries

For further information or enquiries, please contact:

1. Shri Sundar Murthi, DGM

2. Smt Bharati Bhide, Mgr

Thank You Note

Dear friends

On behalf of Reserve Bank of India, I am thankful to you for having participated in the Seminar on 'Adoption of ISO 20022 Messaging Standards for RTGS'.

In the world of payments processing, the role played by standards in information exchange between the participants can be compared to the role of language in communication between people. We, at Reserve Bank of India, are treating this Seminar as an opportunity to share our experience in adoption of standards for RTGS and obtain feedback from the international community in this regard. We trust the Seminar will turn out to be a great learning experience for all of us.

We are privileged to have eminent speakers and panelists from the European Central Bank, ISO 20022 Forum, Deutsche Bundesbank, Central Bank of Brazil and South African Reserve Bank at the Seminar to lead our learning experience.

Let us all use this opportunity to interact with the speakers and participants from other countries.I wish all of you a memorable stay at Pune.

Dr. A S Ramasastri

Chief General Manager-in-Charge

Department of Information Technology

Reserve Bank of India

Speakers

Anand Sinha

Anand Sinha is Deputy Governor in Reserve Bank of India where he is in-charge of regulation of commercial banks, Non-Banking Financial Companies and Urban Cooperative Banks. His other responsibilities include, among others, Information Technology. He has been closely associated with the banking sector reforms in India. He has represented the Reserve Bank of India in various Committees/Groups of BIS such as Basel Committee on Banking Supervision (BCBS), Policy Development Group (PDG), Macro Prudential Supervision Group (MPG), Macro Variable Task Force (MVTF) and Committee on Global Financial Systems (CGFS). He represented India on the G20 Working Group on Enhancing Sound Regulation & Strengthening Transparency. He is the Chairman, Governing Council of the Institute for Development and Research in Banking Technology (IDRBT), a research and development institution on financial sector technology, set up by the Reserve Bank of India. He is also a member on the Board of the Securities and Exchange Board of India (SEBI).

Mr. Sinha holds Masters Degree in Physics from the Indian Institute of Technology (IIT), New Delhi.

Harun R Khan

Harun R. Khan is one of the four Deputy Governors of the Reserve Bank of India. His current responsibilities include departments dealing with forex reserve management, foreign exchange, internal debt management, development & regulation of government securities market, payment and settlement system, internal inspection and security, government & bank accounts.

He is Reserve Bank’s representative on the Committee on Global Financial System (CGFS) of the Bank for International Settlements (BIS).

He also represents the Reserve Bank of India on the Boards of two apex financial institutions in the country - the National Bank for Agriculture and Rural Development (NABARD) and the National Housing Bank (NHB). He has chaired a number of Committees/Groups including the Internal Group on Rural Credit and Microfinance which recommended the expansion of banking outreach through the Business Facilitators & Business Correspondents for scaling up the bank-led ICT – supported financial inclusion in India.

G Padmanabhan

G Padmanabhan, is Executive Director in the Reserve Bank of India, with over 30 years experience in various capacities in the Bank.

His areas of work experience include regulation and supervision of the foreign exchange market in India, payment and settlements and debt markets. He drove IT initiatives in the Reserve Bank for over three years during which time several important projects fructified the most important being the state of the art Tier IV data centre of the Bank. Before being elevated to his present post, he also headed the Department of Payment and Settlement Systems in the Bank. Under his initiative, the country saw the introduction of a wide range of new payment systems products like pre-paid cards, m-wallets etc. Alongside, the country took pioneering efforts in improving the security of payment transactions particularly over the internet.

He has been a panel member at many of the Seminars on market issues organized in India and a regular guest speaker at many of the training establishments run by the Reserve Bank/ Commercial Banks. He is representative of Reserve Bank of India on the Committee for Payment and Settlement Systems (CPSS) in Bank for International Settlements, Basle. Presently, he is the Chairman of the CPSS Working Group on Non-Banks in Retail Payments.

He is a post graduate in Economics, holds a Masters degree in Business Administration from the Birmingham University and is an Alumnus of the Kellogg Business School.

Marc Bayle

Marc Bayle is the Target2-Securities (T2S) Programme Manager and Principal Adviser at the European Central Bank. The work of the ECB’s team consists of the overall management and coordination of the project, as well as the provision of support to the work of the T2S Board. It also includes more technical matters such as compiling the user requirements, designing the operational framework, testing and migration strategies, maintaining relations with central securities depositories (CSDs) and users, providing advice on all legal issues and preparing the contractual agreements.

Marc Bayle is the Chairman of the Project Managers Group (PMG) - a composition of project managers from various Euro and non-Euro Central Banks - that reports to the T2S Board and provides the Currency Steering Groups with regular updates on its work.

In his previous roles, he has managed dossiers related to the promotion of market integration and the definition of the Eurosystem’s operational framework, focusing in particular on payment systems and market infrastructure aspects. He has authored publications on the market infrastructure integration process and on related issues, such as the Euro repo market.

Before joining the ECB, he has worked for ten years at SICOVAM S.A. (now Euroclear France) as Adviser to senior management. He has a Master’s degree in Finance, CERAM having specialised in audit and post-market infrastructure.

Stephen Lindsay

Stephen Peter Lindsay is the Head of the SWIFT Standards department, which is responsible for the maintenance of the SWIFT MT standard, ISO 15022, and SWIFT-submitted ISO 20022 messages. SWIFT Standards also operates the registration authority (RA) for ISO 20022, and several other ISO standards including ISO 15022, ISO 9362 (BIC), ISO 10383 (MIC) and ISO 13616 (IBAN).

He joined Swift in 2007, having spent the previous 20 years at Misys Banking Systems working on financial messaging and payments software.

Stephen Lindsay is an active blogger, blogging about SWIFT and other financial industry standards.

Daso Maranhao Coimbra

Daso Coimbra is the Head of the Department of Banking Operations and Payment System at the Banco Central do Brasil, the Brazilian Central Bank. He has been with Banco Central do Brasil for the last 36 years, most of them at the International Reserves Operations Department, where he was the Head of Department from 1999 to 2006.

He is a non-voting member of the Brazilian Monetary Policy Committee (COPOM) for 10 years and the Brazilian Central Bank representative at the Basel Committee on Payment and Settlement Systems (CPSS) at the Bank for International Settlements.

His present responsibilities include the Discount Window and Reserve Requirement operations, the supervision of the Brazilian Payments System, and the oversight of the Financial Markets Infrastructures and retail payments operations.

Edward Leach

Edward Leach is the Head of Operations in the National Payment System Department at the South African Reserve Bank. In his previous assignments, he has also functioned as the Head of Africa South at SWIFT.

At the South African Reserve Bank, two of his major functions are:

1. The operations of the SAMOS system (South Africa domestic RTGS system); and

2. The SADC regionalisation project including the operations of SIRESS (SADC Integrated Regional Electronic Settlement System) the SADC regional RTGS system.

Jochen Metzger

Jochen Erich Metzger is Head of the Department Payments and Settlement Systems at the Deutsche Bundesbank. He holds a Master degree in economics from the University of Mannheim.

He represents the Bundesbank at the Eurosystems Payments and Settlement Systems Committee (PSSC) and the Target 2 Securities Advisory Group—the G20-Committee on Payments and Settlement Systems— and is the Responsible Senior Officer for cooperative oversight of CLS. Since May 2009, Jochen has been a Member of the TARGET2-Securities Programme Board.

Jochen Metzger has been a member of the Bundesbank’s staff since 1988 and previously held positions in the markets, payments and infrastructure areas of the Bank. He has also served as the Bundesbank Representative for Latin America at the German Embassy in Buenos Aires, Argentina. From 2000 to 2003, he was a Senior Policy Advisor and member of the secretariat of the Financial Stability Forum at the BIS in Basel.

A S Ramasastri

Dr Ramasastri is the Chief General Manager in Charge of Department of Information Technology at Reserve Bank of India. He has spearheaded some of the important initiatives like XBRL standards for data reporting from commercial banks to Reserve Bank of India as well as automated data flow. He has been guiding the project on the new RTGS project in India, right from approach paper to implementation. He has led the team towards implementation of ISO 20022 standards for new RTGS.

Dr Ramasastri holds a Ph.D from Indian Institute of Technology, Madras. He has been working in Reserve Bank of India for more than three decades. He has authored several articles and books in the area of IT, banking and finance. One of his books is translated into Chinese.

A K Hirve

Dr. A. K. Hirve is the Chief General Manager, Department of Information Technology, Reserve Bank of India.

Anil Kumar Sharma

Dr. Anil Kumar Sharma is a General Manager in Department of Information Technology in Reserve Bank of India where he is in-charge of Payment Systems Application Division. He has been closely associated with the implementation of ISO 20022 messaging standards in Next-Generation Real-Time Gross Settlement System (NG-RTGS) in India. He is also a Principal member of the Software and Systems Engineering Sectional Committee, which is responsible for preparation of Indian Standards relating to processes, supporting tools and supporting technologies for the engineering of software products and systems and Interoperable Distributed Application Platforms and Services including Web Services, Service Oriented Architecture (SOA), and Cloud Computing.

Dr. Sharma holds Ph.D. in Economics from Mumbai University and M.Phil. and Masters Degree in Statistics from University of Delhi.