IST,

IST,

RBI WPS (DEPR): 06/2016: Measurement of Central Bank Output - Methodological Issues for India

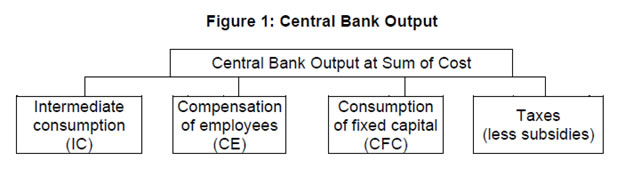

| RBI Working Paper Series No. 06 Abstract The paper deliberates on methodological issues relating to the measurement of central bank output in Indian context. CSO classified RBI output as non-market in the new series of GDP with 2011-12 as base due to non-availability of disaggregated account for RBI services. Cost approach as per SNA 2008 was adopted to measure the output of RBI. There was a downward revision of around 87 per cent in RBI output as per the revised method. The paper deliberates on a few aspects in connection with measurement of RBI output and proposes a method to measure the same. Key words: central bank output JEL Classification: E50, G20. Output of central bank is identified as one among the new issues arising from System of National Accounts (SNA) 2008 [UN (2012)]. Evolving nature of central bank role has made measurement of its output quite complex. Primary responsibility of a central bank lies in its role as monetary policy authority through key commitments such as interest rates management, reserve requirement, issue and management of currency, and acting as a lender of last resort to the banking sector, one of the classic functions of a central bank. A typical function of central bank is also to supervise commercial banks with an objective to detect incipient weakness and prevent bank failure and systemic crisis arising from such failure. A very critical issue in the field of central banking is that central bank’s role continues to evolve while responding to several financial crises leading to persistent policy problems. Price stability became one of the prime objectives of the central bank due to prolonged inflation in the 1970s and 1980s that needed fine tuning to nurture financial stability which also gained importance post-global financial and the euro area debt crises. These crises generated a strong school of thought to widen the mandate of central banks to cover financial stability and sovereign debt sustainability along with price stability, due to the close links among the three [RBI (2012)]. In addition to these, central banks in developing economies take major initiatives to promote economic development and thus follow multiple objectives. Nevertheless, central banks are now identified as complex institutions and the underlying objective behind all its evolving functions is the economic interest of the nation, consistent with government economic policy [BIS (2009)]. All these factors have made the measurement of central bank output challenging since its determinants are difficult to measure or estimate. Output measurement needs to be analysed with an approach that provides economic interpretation. Estimation of central bank output as well assumed further importance with the emergence of the concept of index of service production (ISP). The compilation manual for ISP also recommends inclusion of central banking for construction of ISP for banking [OECD (2007)]. Measurement of central bank output revealed further complexities due to changed guidelines in the modified version of the SNA 2008 [EC et.al. (2008)], as some of the central banks may predominantly produce non-market services. So far as output metric is concerned, it needs to be viewed within the economic framework of cost, profit, production and a measurable contour of efficiency scale. However, the uniqueness of some of the activities of central banking renders it difficult to measure some of the outputs, and the complicated and multiple objectives pursued by central banks makes application of the standard techniques problematic. SNA 2008 has set out a specific approach to quantify output of a central bank as differentiated from financial services rendered by entities other than central banks and made different recommendations for measurement of central bank output from that in SNA 1993 [EC et.al. (1993)]. SNA 2008 endorsed non-market view of central bank’s output as against non-prescriptive assumption in its 1993 version that presumed that all output of the central bank as market production. SNA 1993 thus recommended use of fees, commissions, and financial intermediation services indirectly measured (FISIM) approach. It is, however, clarified in SNA 2008 that application of such method sometimes resulted in unusually large positive or negative estimates of output. SNA 2008 recommends classification of the central bank output into market and non-market for measurement purpose. If market and non-market output are not separable, the suggestion is to include whole of the output of the central bank under non-market category and measure the same as sum of costs [including intermediate consumption (IC), compensation of employees (CE), consumption of fixed capital (CFC) and other taxes on production (less subsidies)]. Although countries are now adopting the SNA 2008 approach for official estimates of output of their central banks, methods followed are however not uniform. This has raised an issue on incomparability of data on gross domestic product (GDP) and government final consumption (GFC) across countries [UN (2013)]. Reserve Bank of India (RBI) is the central bank authority of India. Central Statistics Office (CSO) in the Ministry of Statistics and Programme Implementation (MoSPI), Government of India (GoI) compiles the output of the economy including that of RBI. Major change has been made in compilation of RBI output in the new series of GDP with 2011-12 as base following SNA 2008. Until recently, output of RBI was partly treated as market and partly non market [GoI (2015a)]. However, in the new series of GDP with 2011-12 as base, entire output of RBI is treated as non-market and sum of cost approach, as stated above, is followed to compute the same [GoI (2015a)]. The reason cited is non-availability of disaggregated accounts of RBI in respect of the three broad groups of central bank services viz. monetary policy services, financial intermediation services and borderline cases (supervisory services) as defined in SNA 2008. Output of RBI witnessed downward revision of around 87 per cent as per the new method. This paper deliberates on three aspects. The first one is regarding classification of RBI output. This paper argues that activities of RBI possess enough traits to qualify as collective in nature and this should be the primary reason for which its output should be treated as non-market. It is the predominance of collective goal of RBI for which disaggregated accounts of RBI is not available. The second aspect of the paper is on estimation of CFC. CSO has used traditional perpetual inventory method (PIM) to compile this component. This paper discusses an alternative PIM (APIM) to estimate CFC. This method produces mutually consistent productive capital stock, CFC and net capital stock that may not be the case under traditional PIM [NZG (2014)]. APIM is used by a few countries including US Bureau of Labor Statistics, Australian Bureau of Statistics and Statistics New Zealand. The third and the most important aspect raised by this paper is that whether sum of costs [IC, CE, CFC and taxes (less subsidies)] would represent the output of the central banks. Specific recommendations in SNA 2008 on central bank output have addressed quite a few issues to a great extent, but the subject on measurement of the output still appears to remain open for the central banks in EMDEs like India. In such countries, central banks play a very critical role and are entrusted with wide gamut of activities having long term perspective with a direct bearing on nation building process. Use of cost approach (based on IC, CE CFC, taxes) could severely under estimate the output as has been observed for RBI with huge downward revision of its output as per this method. As an appropriate method to quantify the output of the RBI activities is not available due to collective nature of its activities, this paper proposes to use the entire cost incurred by RBI in direct connection with its central banking activities to estimate the output. It is observed that there is a significant increase in RBI output compiled based on this method vis-a-vis the estimates based on IC, CE, CFC and taxes (less subsidies). Further, it also addresses to some extent the issue of significant downward revision in the estimates given by CSO. Rest of the paper is planned as follows. Section 2 of the paper discusses activities of central banks. Challenges faced to measure central bank output and prescribed method are deliberated in sections 3 & 4, respectively, based on SNA 2008 guidelines and other literatures. Current practice followed by CSO to measure output of RBI is discussed in section 5. Section 6 presents in detail the activities of RBI. Section 7 examines the issues to measure output of RBI and presents a method for its measurement. Section 8 concludes the paper. ‘Central bank’ is included as a sub-sector under the sector ‘Financial corporations’ in SNA 2008. Based on the discussion in UN (2008), IMF (2000), Bloem et al. (2006) and BIS (2009), activities of central banks are listed in Table 1. The list is illustrative and may not be exhaustive. 3. Classification of Central Bank Output SNA 2008 classifies central bank services into three broad groups, viz. monetary policy services, financial intermediation services and borderline cases (supervisory services) and output of these services into two groups, viz. market and non-market. It defines monetary policy services as collective and defines the output as non-market output. Output of financial intermediation services in the manual is defined as market output. Supervisory services are included under borderline cases. SNA 2008 thus categorises central bank services into collective or individual from the point of view of consumption and the output into market and non-market from valuation angle. A brief discussion on the concept of all these terminologies is presented below. 3.1 Consumption of Service - Individual and Collective The terms private and public are used to distinguish individual services from collective services. SNA 2008 clarifies that individual goods and services are private, because once they are procured by an entity, the same cannot be obtained by another. Collective consumption service is, on the other hand, available simultaneously to the public for automatic acquirement and consumption by all. Collective services are identified by the following attributes, as stated in SNA 2008 – they are delivered simultaneously to the public, there is no explicit agreement or active participation by the users (passive use) and these services are available in unlimited amount. It is further clarified that collective services are beneficial to the public and are not charged as their uses cannot be recorded. Among the central bank activities presented in Table 1 above, Bloem et al. (2006) classifies the following as collective - issuing and managing the country’s currency, monitoring and control of the money supply, taking deposits that are used for clearance between financial institutions, holding the country’s international reserves and transacting with the IMF. The reason given is - these services are for the population at large and do not aim at any specific sector. This paper adds ‘financial stability functions’, ‘research activities’ and ‘other public good functions’ also to the list of collective activities for a similar reason. Remaining all other activities except supervision/regulation of banking operations are classified as individual by Bloem et al. (2006). The explanation is that such services cannot be delivered simultaneously to all, are based on express agreement, and their use by one reduces the services available to others. Regarding supervision/regulation of banking operations, Bloem et al. (2006) and SNA 2008 suggest that such service may be collective if they are for the benefit of society in general. SNA 2008 further suggests that there could be an argument to classify supervisory services as individual if a central bank charges fee for these services. The final recommendation, however, is as follows - if the fees charged falls short of the cost of supervision, then the supervisory services would be treated as non-market. 3.2 Valuation of Output - Market and Non-Market Classification of output into market and non-market is also an important factor in measurement of central bank output. SNA 2008 makes a distinction between the two based on the economic significance of their prices. Economically significant prices are the amount at which producers would like to sell their goods/services and buyers agree to buy. Market output is valued at economically significant prices. Market establishments produce market outputs and are priced at market rate. Prices of non-market output are either not economically significant or are supplied free. Government units and non-profit institutions serving households (NPISHs) constitute non-market producers and yield non-market output as part of their socio-economic policies. Non-market output is for collective purposes and given free. There is no market for collective services. SNA 2008 estimates the value of the non-market output using cost based approach discussed in detail in the next section. 3.3 Issue on Classification of Central Bank Output It may, thus, be seen that the main issue in measurement of central bank output is separation of market from non-market output. This is possible only after correct classification of central bank activities either as collective or individual. In this regard, SNA 2008 suggests that “in principle, a distinction should be made between market and non-market output... In cases where market output is not separated from non-market output, the whole of the output of the central bank should be treated as non-market and valued at the sum of costs”. Regarding measurement of market output, it is recommended in SNA 2008 to use receipt from sales etc. However, for financial intermediation services, it suggests adopting FISIM method, and recommends application of the same to loans and deposits only and only when those loans and deposits are provided by, or deposited with, financial institutions. For non-market output, SNA 2008 recommends use of cost based approach and suggests the following formula (Figure 1): Total output = sum of costs of production = intermediate consumption (IC) + compensation of employees (CE) + consumption of fixed capital (CFC) + taxes (less subsidies) on production … (1) The component titled ‘taxes less subsidies’ consist of taxes payable and subsidies receivable in production of goods or services. Discussion on the other three items i.e. IC, CE and CFC is presented below. 4.1 Intermediate Consumption (IC) Goods and services consumed in production during the accounting period describe IC as defined in SNA 2008. IC includes cost incurred for the rentals paid on the use of fixed assets including those from other institutional units under operating lease and also fees, commissions, royalties, etc., payable under the licensing arrangements. Good or service thus used is valued at the purchaser’s price prevailing at the time of production. 4.2 Compensation of Employees (CE) All payments in cash and in kind given to employees for their services during the accounting period define CE as stated in SNA 2008. It also includes government contributions to social insurance schemes. It is recorded on an accrual basis and excludes taxes payable by the employer on the wage and salary bill. It covers persons engaged in an activity that falls within the production boundary of the SNA. CE has two main components: (i) wages and salaries in cash and kind (ii) employers’ social contributions. 4.3 Consumption of Fixed Capital (CFC) SNA 2008 defines CFC “as the decline, during the course of the accounting period, in the current value of the stock of fixed assets owned and used by a producer as a result of physical deterioration, normal obsolescence or normal accidental damage”. It acknowledges that CFC is one of the most important and difficult items in the national accounts to define conceptually and to estimate in practice. Physical assets of a business viz. buildings, machines etc. are referred to as fixed capital. As per national account principle, assets that are in repeated/ continuous use in production for over one year qualify as fixed assets. Examples cited are machinery, equipment, buildings or other structures. It also covers intangible assets that include intellectual property products such as software used in production. The concept of CFC can be clearly understood from the statement in SNA 2008 that assets used in production have to be paid for decline in its value due to its use in production. Concept of CFC is different from depreciation shown in business accounts and taxation. The latter does not meet the requirements of national accounts. SNA 2008 clarifies that CFC being imputed in nature has different economic significance from accounting entries. There are two different approaches to estimate CFC – traditional approach and alternative approach2 and are discussed below. 4.3.1 Traditional PIM Approach In the traditional approach, a depreciation function is applied to gross capital stock (GCS) to estimate CFC. SNA 2008 defines the GCS as the stock of fixed assets surviving from past investment and revalued at the purchasers’ prices of the current period. GCS excluding accumulated CFC gives the net capital stock (NCS). The limitation of this method is that several different depreciation functions are available and each implies a different age-efficiency profile which may lead to inconsistency between age-efficiency profiles and CFC [NZG (2014)]. Productivity studies require GCS adjusted for efficiency decline due to aging. Efficiency-adjusted GCS is defined as productive capital stock (PCS). GCS and NCS are measures of values of fixed assets held by producers while PCS is a measure of volume of the capital services produced by fixed assets. The traditional PIM produces NCS that does not explicitly factor in decline in efficiency, which is implicit in the depreciation function and may lead to the NCS and PCS measures being inconsistent [NZG (2014)]. The alternative PIM eliminates this inconsistency. 4.3.2 Alternative PIM (APIM) Approach In the alternative approach, real asset values are first obtained using age-efficiency profiles and age-price profiles for different types of assets. CFC is then calculated differentiating the real asset values of consecutive ages. US Bureau of Labor Statistics [BLS (2013)], Australian Bureau of Statistics [ABS (2014)] and Statistics New Zealand [NZG (2014)] have adopted APIM. It does not make assumptions about the form of the depreciation function and ensures consistency between age-efficiency profiles and CFC. Assumptions are made about the form of the age-efficiency profiles. SNA 2008 also suggests making assumptions about efficiency decline than about the rate of price decline. It is stated that assumptions about efficiency decline leads to superior results for the value of stocks, their decline in value and the income they generate. 5. Current Practice to Measure RBI Output As mentioned earlier in Section 1, for estimation of GDP, output of RBI is compiled by CSO (GoI). The compilation has undergone major changes in the new series of GDP with 2011-12 as base. Output of RBI was partly market and partly non-market in the earlier series [GoI (2015a)]. RBI accounts comprise of Issue Department and Banking Department. The first one is in connection with its sole function of currency management and is known as the balance sheet of the Issue Department. The second one, called as the balance sheet of the Banking Department, reflects the impact of all other functions of RBI. The balance sheet of RBI is largely a reflection of its activities on currency as well as monetary and reserve management policy objectives [RBI (2014)]. Earlier series of GDP included the output of the Issue Department under the general Government while the Banking Department output was included under the corporate financial sector. Entire operations of the Banking Department were considered as market and its output was measured as a sum of actual income net of output of the Issue Department, imputed income (interest and discount received less interest paid by RBI) minus intermediate consumption [GoI (2012)]. Output of Issue Department was measured on cost basis as done for public administration (based on data provided by RBI), and accounted as the output of Public Administration and disposed of as Government Final Consumption Expenditure. The new series treats entire function of RBI as non-market and hence follows sum of cost method as recommended in SNA 2008 to compute the output of RBI. It is also stated that since the new series excludes net profit of RBI on sale of securities from FISIM computation, such contribution now is not a part of the output [GoI (2015a)]. 5.1 RBI Output based on 2004-05 series vis-à-vis 2011-12 series Table 2 presents the output of RBI at current price based on cost method [defined as gross value added (GVA) of RBI (2011-12 series)]. The table also presents the output of RBI based on income method used earlier [defined as GVA of RBI (2004-05) series].It may be observed that there has been substantial downward revision in the GVA of RBI with the new series i.e. 2011-12. Consequently, share of RBI output to total output of the country also declined noticeably in the new series. In this regard, it may be mentioned that balance sheet size of RBI (total assets of Banking and Issue Department of RBI) expanded by 8.2 and 9.8 per cent, respectively, at end June 2012-13 and 2013-14 after a growth of 22.4 per cent at end June 2011-12. As central bank of the country, RBI is entrusted with wide range of tasks including developmental activities3. It is essential to examine the nature and type of activities of RBI so as to suggest a suitable approach for the measurement of its output. A brief description of the activities of RBI is presented below. 6.1 Evolution of RBI Activities Activities of RBI have evolved over time. RBI in its Report on Currency and Finance for the year 2004-05 presented the changing features of its activities since its inception in 1935 [RBI (2005)]. The Report has documented very well about the far-reaching transformations of RBI activities. The Report narrated the evolution of central banking in India for a period of seventy years from 1935 to 2005. The period is sub-divided into three broad phases, viz. foundation phase (1935-1950), development phase (1951-1990) and reform phase (1991 - 2005) to enumerate the changing role of RBI in response to fast changing economic environment inside as well outside of the country. Activities of RBI were mostly traditional in nature in the formation period i.e. foundation phase. It was limited to issuing currency notes and to function as banker to the Government. As the central bank of a developing county after independence, RBI assumed the role of building institutional infrastructure during the development phase. In the reform phase, RBI’s endeavour was to ensure financial sector soundness and development of the financial market for transmission of monetary policy impulses in an efficient manner. 6.2 Nature of Activities Performed by RBI RBI is the monetary authority of the country. Objectives of monetary policy of RBI include maintenance of price stability, ensuring adequate flow of credit to the productive sectors of the economy to support economic growth and to achieve financial stability. RBI is India’s sole note issuing authority in the country. Along with the GoI, RBI is responsible for management of the country’s currency for adequate supply of clean notes. RBI acts as the banker to governments and manages the government’s banking transactions. As per the RBI Act 1934, the Central Government is required to entrust RBI with all its money, remittance, exchange and banking transactions in India and the management of its public debt [RBI (1934)]. Cash balance of the Central Government is also maintained with RBI. It is also responsible for development of market for government securities to help the government to raise debt at a reasonable cost. RBI also acts as the banker to a state governments by agreement. As the banker to banks, RBI acts as lender of the last resort and thus provides liquidity to banks that are unable to raise short term liquid resources from the inter-bank market. It plays the role of clearing and settlement house for inter-bank obligations, enables banks to maintain their accounts with it for statutory reserve requirements and transaction balances. As the regulator and supervisor of the banking system in the country, RBI plays a critical role to ensure the safety and soundness of the financial system. Protection of the interests of depositors and hence public confidence in the system is one of the pivotal tasks entrusted to RBI. As the manager of the foreign exchange, RBI plays a vital role in the regulation and development of the forex market and in maintaining the stability of the exchange rate of the Indian Rupee. It regulates transactions related to the external sector and manages the foreign currency assets and gold reserves of the country. As the regulator and supervisor of payment and settlement systems, RBI has the task to ensure a safe, secure and efficient mechanism for payment and settlement. As part of its endeavour to maintain financial stability, RBI has put in place a system for continuous monitoring of the macro financial conditions and conducts macro-prudential surveillance of the financial system on an ongoing basis and also publishes periodic reports. As part of its developmental role, RBI initiates several activities particularly for the agriculture and rural sectors and remains closely engaged to ensure credit availability to the productive sectors of the economy, establish institutions to build the country’s financial infrastructure, expand access to affordable financial services, promote financial education & literacy and extend banking service as part of its financial inclusion initiative. RBI also undertakes policy-oriented economic research, data compilation and knowledge-sharing. A closer look at the roles performed by RBI presented above reveals that the sole purpose behind all the activities of RBI is welfare of the public. This makes a strong ground for all these activities to qualify as collective in nature and all output as non-market. The preamble to the RBI Act sets forth its functions - ‘to regulate the issue of bank notes and the keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage’ [RBI (1934)]. Regarding CSO’s observation to treat entire output of RBI as non-market because disaggregated accounts of RBI services are not available, it may be stated that predominance of collective goal of RBI is the reason for non-availability of such disaggregation. Table 3 presents the sources of income of RBI, part of which is domestically sourced (interest and other earnings) and the remaining from foreign sources (interest, discount, exchange) [RBI(2014)]. Income components under ‘a’ &‘d’ in Table 3 relate to RBI’s role as monetary authority. Activities under ‘b’ are in connection with RBI’s role as monetary authority as well as banker to the government and banks while items under ‘c’ in Table 3 are in connection with RBI’s role as currency manager (also a part of monetary policy activity), regulator/supervisor of payment and settlement system in India. A substantial part of RBI’s income is from foreign sources out of its deployment of forex reserves4. However, the utmost concern for such deployment is safety, not profit. RBI statement in this regard is as follows: “the basic parameters of the Reserve Bank’s policies for foreign exchange reserves management are safety, liquidity and returns”5. If any income is generated out of these investments, these are incidental, not out of the primary motive. In respect of services (like real time gross settlement, cheque clearance etc.) for which RBI may like to charge fees/ commissions, but the primary intention is to facilitate a safe and sound payment system. RBI incurs cost to set up and maintain these systems. Thus, some portion of RBI’s income although apparently seems to be out of market production, a deeper insight may eventually reveal that all such income are actually incidental, originating out of activities, the primary intention behind which is collective. Further, although RBI acts as financial intermediary to the Government and banks, making profit is not the objective. Rationale behind policy and other interest rates (repo/reverse repo and bank rates) fixed by RBI are not on commercial lines. Also, RBI does not pay any interest on the statutory reserves (cash reserve ratio) kept with it by banks. These are part of RBI’s role as monetary authority. FISIM is prescribed for measuring income out of intermediation services. SNA 2008, however, clarifies that “if central bank interest rates are out of line with those of commercial banks, then the difference between flows calculated using the reference rate and the actual rate set by the central bank should be recorded not as market output, specifically FISIM but as implicit taxes and subsidies”. Regarding supervisory services which is defined as market or non-market depending on the explicit fees charged, it may be mentioned that this service is rendered free by RBI and hence, the output qualifies as non-market type. Unlike commercial entities, RBI uses the word ‘surplus’ not ‘profit’ in its profit and loss statement for the net income (income minus expenditure). RBI pays entire surplus to the GoI that holds its full ownership. Further, it has also renamed its ‘Profit and Loss Account’ as ‘Income Statement’ from the accounting year 2014-15. The change was as per the Gazette notification by the GoI on July 15, 2015 [RBI (2015)]. The notification was based on the recommendations of a Technical Committee [Chairman: Shri Y.H. Malegam (Technical Committee I)] constituted by RBI in 2012-13 to review the presentation of its balance sheet and profit & loss Account. The statement in the Report of the Committee in this regard was as follows: RBI is not a commercial organization. Its main source of income is the income it earns on its investments and these investments are largely held as a backing for the issue of notes or as part of the foreign exchange reserves or as part of its open market operations. It does not actively trade in investments and gains or losses which arise on the sale of these investments are incidental to the activities performed in the discharge of its responsibilities. It renders services to the Government as a banker to the Government and as a debt manager and to the banking industry through its operation of the Payment and Settlement System as also as a monetary authority and regulator and supervisor. Since it is not the primary objective of central banks to earn profits, the nomenclature ‘Profit & Loss Account’ tends to be a misnomer and the Committee therefore recommends that it should be replaced by the nomenclature ‘Income Statement’ [RBI (2013b)]. 7. Measurement of RBI Output - Issues and Proposed Method Although non-market stance for central bank output has been recognized in SNA 2008 and output of RBI was compiled by CSO using cost approach in conformity with these guidelines, the subject of compilation of output for RBI does not appear to be fully resolved. The methodological change has resulted into a decline of RBI output by 87 per cent in 2011-12 and 2012-13 as shown above. A few observations are made below on compilation of RBI output. The observation could possibly be applicable to other central banks as well especially those in EMDEs. 7.1 Output based on Cost Method A central bank for EMDEs like India needs to perform wide range of activities for sustainable economic development of the country thus becoming an integral part of the nation building process. Many of these activities have a long term perspective and the outcome is reflected only through the overall economic and financial development of the country that happens only in a gradual manner. The activities of RBI have been undergoing significant transformation since its inception. With the change in methodology to sum of cost [including IC, CE, CFC and taxes (less subsidies)] as recommended in SNA 2008, the output of RBI went down quite noticeably in 2011-12 and 2012-13 (Table 2). SNA 2008 has not thrown much light on such issues where change of methodology could result into such huge change in central bank output. In view of the nature and type of activities of a central bank like RBI and also by taking into account the huge changes in the output of RBI as per revised method, this paper would like to suggest that the output based on sum of cost [IC, CE, CFC and taxes (less subsidies)] method may not represent output of RBI very well. It appears that national accounts authorities needs to explore further to devise a more appropriate method that helps in realistic assessment of output of central banks especially for India, where the central bank assume whole lot of responsibilities for the development of the country. 7.2 Non-uniform Practices across Various Countries Market and non-market concept introduced by SNA 2008 have also created non-uniformity in methodologies followed by various countries. European system of accounts (ESA) 2010 considers all output of central banks as market output but measures the same as the sum of costs by convention [UN (2013)]. They have also acknowledged that the SNA 2008/ ESA 2010 recommendations on treatment of central bank output might present an issue in comparison of data on GDP and GFC across countries [OECD (2015)]. Australian System of National Accounts (ASNA) follows a combination of market and non-market approach. For monetary policy and other non-market services of Reserve Bank of Australia (RBA), cost based method is used. Gross operating surplus is used for financial market operations of the RBA [ABS (2014)]. 7.3 Treatment of RBI Output by CSO The reason cited by CSO for treating the output of RBI as non-market is non availability of disaggregated accounts for monetary policy, financial intermediary and supervisory services of RBI [GoI (2015a)]. The discussion above on the evolution, nature and type of activities of RBI clearly suggests that activities of RBI would hold enough ground to qualify as collective in nature and this should be the primary basis to treat its output as non-market. 7.4 Observation on CFC for RBI Traditional approach of PIM is used by CSO to estimate the constant price estimates of CFC [GoI (2012)]. Estimation of CFC is done based on declining balance formula that assumes efficiency decline at a constant rate. SNA included hyperbolic rate of efficiency loss in its 2008 edition in addition to linear (straight line) and geometric decline suggested earlier in its 1993 version. APIM uses hyperbolic age efficiency profile which postulates slow rate of efficiency decline in the earlier years of service life of an asset and faster rate towards its retirement. Statistics New Zealand stated evidences of this as common efficiency profile for many kinds of assets that included both structures and plant & machinery [NZG (2014)]. As per SNA 2008 classifications, fixed assets of RBI fall under ‘dwellings & other buildings and structures (includes buildings other than dwellings, other structures, land improvement)’, ‘machinery and equipment (computer servers and mint/note printing presses)’ and ‘intellectual property products (computer software etc.)’. The underlying assumption of hyperbolic age efficiency appears suitable to the type of fixed assets held by RBI. Further, APIM produces mutually consistent NCS, PCS and CFC measures as they are based on identical assumptions and data which may not be true for traditional PIM [NZG (2014)]. APIM requires input on time series of gross fixed capital formation (GFCF) at current prices, the corresponding deflators (asset price indices), age-price and age efficiency profile for cohorts of particular types of assets and depreciation (discount rate). The PCS, NCS and CFC for a hypothetical asset viz. a computer [using an illustration in NZG (2014)] are compiled in this paper, as per APIM and the estimates are presented in Table 4 (detailed calculation is in Annex 1). RBI uses straight-line (SL) method for depreciation of computer at a constant rate of 33.33 per cent [RBI (2015)]. Values of CFCs and NCS computed using SL method for the hypothetical asset are also presented in Table 4. It may be seen that these values of CFC and NCS differ from those computed using APIM. The hypothetical asset is written off much before its retirement age yielding NCS to erode too early. SL approach gives CFC and hence NCS measures without factoring efficiency decline due to aging assuming that the decline is implicit in the depreciation function; this may also lead to inconsistent estimates of NCS and PCS as discussed earlier. In view of this, it may be suggested that CSO may explore usage of APIM for compilation of CFC. 7.5 Proposed Method to Measure RBI Output There has been a downward revision of around 87 per cent in the GVA of RBI under the revised method shown earlier. It appears that the total cost arrived under sum of cost approach based on ‘IC, CE, CFC and taxes (less subsidies)’ as per SNA 2008 remained significantly lower as compared to the total cost incurred by RBI as per its profit and loss account (renamed as income statement from 2014-15 as stated earlier). This states that some of the costs incurred by RBI while performing its central banking activities are excluded under the sum of cost method of SNA 2008 used by CSO. Expenses of RBI are on account of the following 15 items viz. (i) printing of notes, (ii) expense on remittance of currency, (iii) agency charges, (iv) interest, (v) employee cost, (vi) postage and telecommunication charges, (vii) printing and stationery, (viii) rent, taxes, insurance, lighting etc., (ix) repairs and maintenance, (x) directors and local board members’ fees and expenses, (xi) auditors’ fees and expenses, (xii) law charges, (xiii) miscellaneous expenses, (xiv) depreciation and (xv) provisions [RBI (2015)]. All these components, other than ‘interest’, ‘miscellaneous’ and ‘provisions’, appear to be in direct connection with RBI’s role as central banker. The cost for ‘interest’ is on account of credit to employee welfare funds , ‘provisions’ is a new head added from 2014-15 for expenditure in connection with transfers to the ‘contingency fund’ and the ‘asset development fund’ and cost accounted for ‘miscellaneous’ is not specified in detail. Total expenses on account of these three items were ₹ 577 crore in 2011-12, ₹ 443 crore in 2012-13, ₹ 497 crore in 2013-14 and ₹ 1,798 crore in 2014-15. Total cost incurred by RBI after excluding the cost for these three components (‘interest’, ‘miscellaneous’ and ‘provisions’) are presented in Table 5. Since all the activities performed by RBI are non-market in nature, a proper valuation of such activities is important to appropriately estimate its output. Although such valuation may not be possible, non-availability of an appropriate method should not result into gross under estimation of output. Under such circumstances, it may to some extent be reasonable to use the total cost incurred by RBI to perform its activities for estimating its output as shown in Table 5. It may be seen that the estimates of RBI output derived show substantial increase over CSO estimates based on sum of cost method [including IC, CE, CFC and taxes (less subsidies)] presented earlier in Table 2. Measurement of central bank output is one of the critical issues arising from SNA 2008. In the earlier series of GDP, output of RBI compiled by CSO was partly market and partly non-market. Entire output of RBI, however, is now treated by CSO as non-market in the new series of GDP with 2011-12 as base [GoI (2015a)]. The reason cited was non-availability of disaggregated accounts of RBI services. Cost based approach as a sum of IC, CE, CFC and tax (less subsidies) is recommended in SNA 2008 to measure non-market output. The paper argues that collective nature of RBI activities could be the primary reason to treat all its output as non-market as per SNA 2008 recommendations and not the non-separation of market from non-market output. An alternative PIM (APIM) is presented in the paper to estimate CFC. This method possesses certain important properties of consistency and has been adopted by a few advanced countries e.g. US Bureau of Labor Statistics, Australian Bureau of Statistics and Statistics New Zealand [NZG (2014)]. This paper, therefore, proposes that CSO may consider compilation of CFC using APIM and a beginning could be made with compilation of output of RBI. The activities performed by RBI may not support the method to measure its output based on IC, CE, CFC and taxes (less subsidies). There was a downward revision of 87 per cent in the GVA of RBI estimates based on this method. Proper valuation of the output from RBI activities may be quite challenging as they are collective (and hence non-market) in nature. Such problem, however, should not lead to huge under estimation of the output. Although SNA 2008 has identified measurement issues in connection with central bank output very well, the issue still remains unresolved to measure output for RBI. Further, market and non-market output approach recommended by SNA has also raised the issue of international comparability of GDP and GFC. It may be reasonable to use the total cost incurred by RBI to perform its activities in estimating its output in view of non-availability of a suitable method. It is observed that there is significant increase in the RBI output based on this method as compared to the estimates based on sum of costs for IC, CE, CFC and taxes (less subsidies). It is, therefore, felt the need to explore a more suitable method to measure output of central bank more realistically especially for an emerging country like India. @ Dr. P. Bhuyan is a Director in the Department of Statistics & Information Management (DSIM), Reserve Bank of India (RBI), Mumbai. An earlier version of the paper was presented in the annual conference of RBI (DSIM) held in Jaipur in April 2014. The author is grateful to the discussant Prof. Ravindra H. Dholakia, IIM Ahmedabad for his valuable observations on the paper in the conference. The author would like to thank the Internal Review Group members in DSIM, RBI and to an anonymous referee for their suggestions. Subsequently, the paper was presented in a seminar held in the Department of Economic and Policy Research (DEPR), RBI in February 2016. The author gratefully acknowledges the suggestions offered by Shri B.M. Misra, Principal Adviser, DEPR, RBI who chaired the seminar. Author is also thankful to other officers present in the seminar for their active participation in the discussion. Views expressed in the paper are those of the author and not necessarily of the organisation he belongs to. 2 The terms traditional and alternative approaches are coined in NZG (2014) 3 RBI-brochure explaining RBI’s role & functions in brief (/documents/87730/30842423/RBIB140520012.pdf) 4 Although income from foreign securities does not fall under the purview of GVA, the same is discussed here for the sake of completing the argument on collective nature of RBI activities. 5 Reserve Bank of India: Functions and Working (/documents/87730/39016390/FUNCWWE080910.pdf) 6 referred in Annex 1 7 prepared based on NZG (2014) and OECD (2009) References: ABS (2014). “Australian System of National Accounts, Concepts, Sources and Methods”, Australian Bureau of Statistics. BIS (2009). “Issues in the Governance of Central Banks, A report from the Central Bank Governance Group”, Bank for International Settlements, May. BLS (2013). “BLS Handbook of Methods”, U.S. Bureau of Labor Statistics. Bloem, A. M., Gorter, C. and Rivas, L. (2006). “Output of Central Banks, Fourth meeting of the Advisory Expert Group on National Accounts”, Frankfurt, url:https://unstats.un.org/unsd/nationalaccount/aeg/papers/m4cb.pdf. EC, IMF, OECD, UN, World Bank (1993): “System of national accounts 1993”. ---- (2008): “System of National Accounts 2008”. GoI (2012). “National Accounts Statistics, Sources and Methods”, CSO, MOSPI. ---- (2014). “National Accounts Statistics”, CSO, MOSPI. ---- (2015a). “Changes in Methodology and Data Sources in the new series of national accounts”, MOSPI, June. ---- (2015b). “National Accounts Statistics”, CSO, MOSPI. IMF (2000). “Monetary and Financial Statistics Manual”. NZG (2014). “Measuring capital stock in the New Zealand economy”, 4th edition, Statistics New Zealand, New Zealand Government. OECD (2007). “Compilation Manual for an Index of Service Production”. ---- (2009)6. “Measuring Capital (revised version)”. ---- (2015). “New standards for compiling national accounts: what’s the impact on GDP and other macro-economic indicators?”, OECD Statistics brief, url: http://www.oecd.org/std/na/new-standards-for-compiling-national-accounts-SNA2008-OECDSB20.pdf. RBI (1934). “Reserve Bank of India Act, as amended up to January 7, 2013”. ---- (2005). “Report on Currency and Finance 2004-05”. ---- (2012). “Report on Currency and Finance 2009-12”. ---- (2013a). “Annual Report, 2012-13”. ---- (2013b). “Report of the Technical Committee to review the form of presentation of the Balance Sheet and Profit & Loss Account”. ---- (2014). “Annual Report, 2013-14”. ---- (2015). “Annual Report, 2014-15”. UN (2008). “International Standard Industrial Classification (ISIC) Revision 4”. ---- (2012). “Report of activities to support the implementation of the 2008 SNA in Eastern European and Central Asian countries”, UN Economic Commission for Europe, Statistical Division. ---- (2013). “Treatment of the output of central banks By ISWGNA”, SNA News, url: http://unstats.un.org/unsd/nationalaccount/sna/nn36-en.pdf. Estimation of CFC, PCS and NCS based on APIM The following assumptions are made: (i) the asset is a computer; (ii) the GFCF is 1000 (at constant price), (iii) it has an average life of 8 years, (iv) the asset uses an Weibull retirement function, (v) the asset has hyperbolic efficiency profile and (v) a discount rate of 4 per cent is used. The Weibull retirement function takes the following form:

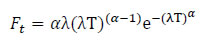

T is the age of the asset, α>0 is the shape parameter and λ > 0 is the scale parameter of the distribution. Statistics Netherlands based on their surveys on discard patterns for computers estimated λ and α in the range 0.066 to 0.286 and 1.140 to 2.840 respectively [OECD (2009)]. Based on the assumptions stated above, composite age efficiency and age price profiles for the asset (a computer) with GFCF of 1000 (at constant price) are compiled and presented in Table A1 (detailed calculation is given in Tables A2 to A5)7. Using the composite age efficiency and age price profiles in Table A2, the PCS, NCS and CFC for the asset are estimated as shown in Table 3.

The second column in Table A5 shows the age-efficiency profile (in %) derived earlier, starting at 100 percent efficiency in year one and declining each year after. These entries are put in the top diagonal line. Each entry in this diagonal line shows the revenue expected from the asset in the year in question. The numbers below the diagonal show the future years’ earnings suitably discounted. For example in the column ‘year 1’, 69.87 is the second year’s earnings of 72.78 discounted once (with a discount rate of 4 percent); 38.01 is the value of the third year’s earnings of 41.24 discounted twice and so on. When each column is complete, the column totals are calculated. These are scaled to give 100 in year one and accordingly the age-price profile is estimated as shown in the last row. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: