IST,

IST,

RBI WPS (DEPR): 05/2024: Livestock and Poultry Inflation in India: A Study of Milk, Poultry Meat and Eggs

|

RBI Working Paper Series No. 05 Livestock and Poultry Inflation in India: A Study of Milk, Poultry Meat and Eggs Shyma Jose, Manish Kumar Prasad, Sabarni Chowdhury, Binod B. Bhoi, Vimal Kishore, Himani Shekhar, and Ashok Gulati1 Abstract This paper uses primary survey-based information from stakeholders and secondary data to construct monthly balance sheets of the dairy and poultry products incorporating supply-demand factors for analysing their price dynamics. The study assesses the value chain of these commodities and estimates farmers’ share in the consumer rupee, which works out to 70 per cent for milk and 75 per cent for eggs; for poultry meat, the share of farmers and aggregators taken together is 56 per cent. Further, the paper empirically investigates the relationship between availability/availability to usage ratio derived from the balance sheet and dairy/ poultry products prices by employing Autoregressive Distributed Lag (ARDL) models. The empirical analysis suggests a significant negative relationship between availability/ availability to usage ratio and consumer price index (CPI) of these commodities controlling for input costs. The forecasting analysis indicates a generally superior performance of the Seasonal Autoregressive Integrated Moving Average with Exogenous Variables (SARIMAX) models, incorporating the relevant balance sheet variables, over different forecast horizons. This underscores the importance of balance sheet analysis for understanding the price dynamics of dairy/poultry products and for designing appropriate policies to contain their price volatility. JEL Classification: E31, E37, E52, Q11 Keywords: Balance sheet, chicken, eggs, forecast, inflation, milk, poultry, SARIMAX, stock, survey, value chain Introduction The Reserve Bank of India (RBI) adopted a flexible inflation targeting (FIT) framework in 2016, under which the inflation target is defined in terms of headline Consumer Price Index (CPI) inflation of 4 per cent with a tolerance band of +/-2 per cent. Food inflation significantly impacts the headline inflation dynamics in India as the food and beverages group constitutes almost 46 per cent of the weight in the CPI basket. Moreover, as food prices exhibit high volatility owing to supply shocks and dependence on monsoon, they also impart significant volatility to headline inflation. A better understanding of the drivers of food inflation and its likely trajectory is, therefore, crucial for the conduct of forward-looking monetary policy and for the achievement of the inflation target on an ongoing basis. However, shocks such as the COVID-19 pandemic, Russia-Ukraine conflict and climate change further make it cumbersome to predict inflation accurately. The three livestock commodities - milk, poultry meat, and eggs – collectively form a major part of animal protein-rich items in the CPI basket with a combined weight of 8.1 per cent. Livestock, particularly milk, prices witnessed an intermittently rising trend over the last few years reflecting growing demand due to robust economic growth, rising per capita income and increased input cost pressures in recent years, especially of feed and fodders. Unlike agricultural crops, inflation in these commodities could be more persistent reflecting structural factors like shifts in consumption in line with income growth and transformation in the value chains. The livestock sector is an important sub-sector of agriculture which plays a significant role in generating gainful employment in the rural sector, particularly among the landless, small and marginal farmers and women. India has vast resources of livestock and poultry population which counts at more than 537 million and 852 million, respectively, as per the 20th Livestock Census (2019)2. In the last two decades, agricultural diversification in favour of livestock sector has grown significantly as the sector generates more income per unit of area in comparison to food grains, oilseeds and sugar combined. The Government has also launched several initiatives like National Livestock Mission, Innovative Poultry Productivity Project, Operation Flood, Rashtriya Gokul Mission, Integrated Dairy Development Scheme, and the National Dairy Plan to enhance livestock productivity and value chain efficiency. Consequently, there has been a significant growth in the value of output from the livestock sector – the contribution of livestock in total agriculture and allied sector rose from 25.6 per cent in 2011-12 to 31.2 per cent 2021-22 (as per the gross value of output at current prices)3. The dairy and poultry (meat and eggs) sector value chains in India are, however, very diverse and complex, each with its own set of stakeholders and dynamics. The poultry sector encompasses both commercial and backyard farming models, with the former focusing on large scale operations for market consumption. In contrast, the latter is common among small farmers for personal consumption. The poultry value chain includes breeding, hatching and farming stages. Integrator and direct farmer models are prevalent for commercial poultry meat production. The value chain of eggs involves structured cycles of production by layer birds, with commercial eggs marketed through various channels. Similarly, the dairy sector is characterised by a mix of cooperatives and private players, with value chains encompassing procurement, processing, and marketing stages. The sector's dominance lies in liquid milk, followed by dairy products and ghee. Even though the value of output has grown significantly in animal protein-rich items, especially milk, poultry meat and eggs, these items have witnessed price spikes during the post COVID-19 period. Given the high weightage of these items in the food basket as well as high volatility in their prices in recent years, these items contributed significantly to food and headline inflation in the post-pandemic period. Against this backdrop, understanding livestock and poultry market dynamics and factors determining their prices assume significant importance. Therefore, this study aims to contribute to the literature on livestock and poultry inflation in India by providing a framework for understanding the price formation process by identifying factors that affect prices and comprehending the players in the value chain and decoding the way their behaviour influences market supply and demand at any given point in time. In this regard, this paper proposes a novel methodology to construct monthly balance sheets for the three selected livestock and poultry commodities and use those for modelling and forecasting livestock and poultry prices in India. Understanding the determinants of livestock and poultry prices may provide insights to formulate policies aimed at sustaining the growth of the sector while maintaining price stability. Accordingly, the main objectives of the study are:

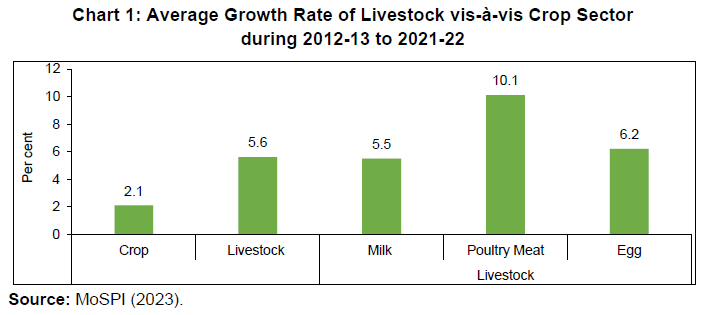

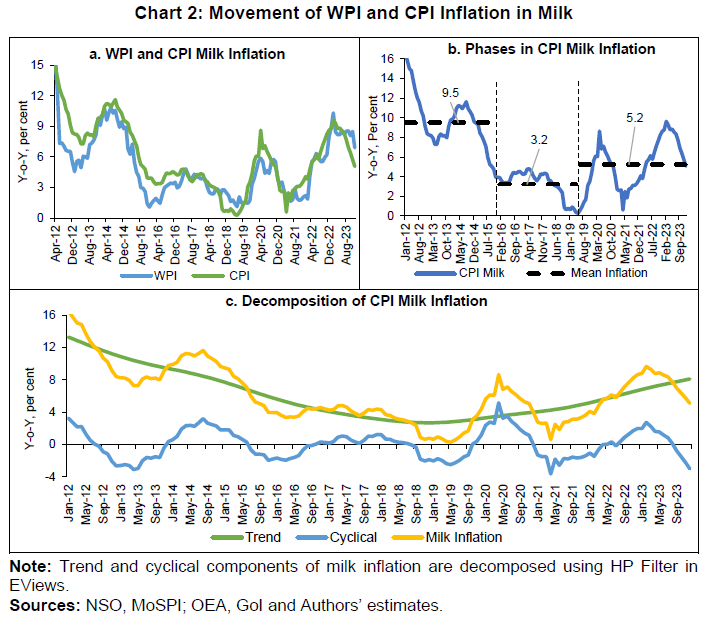

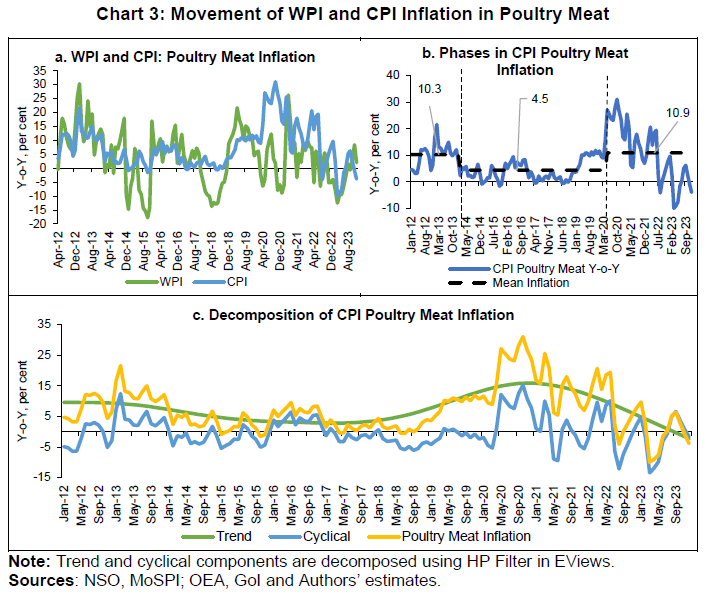

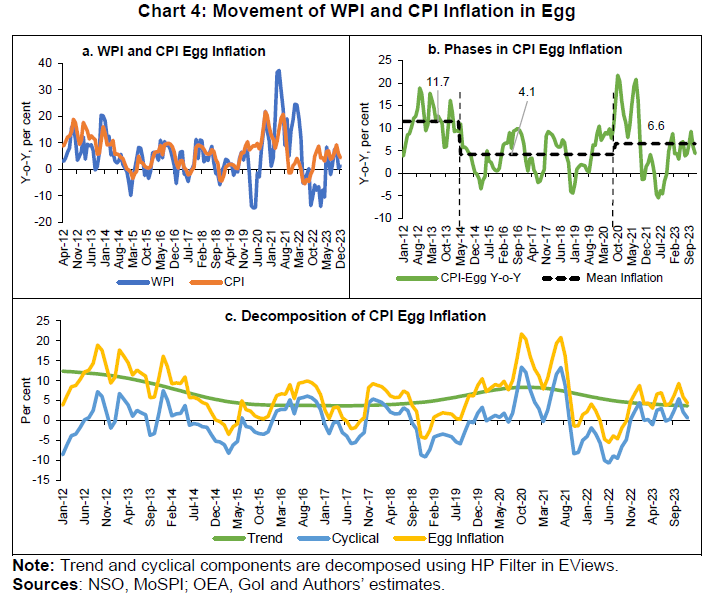

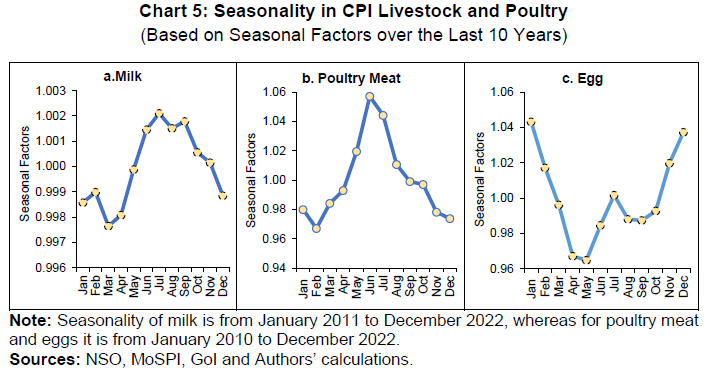

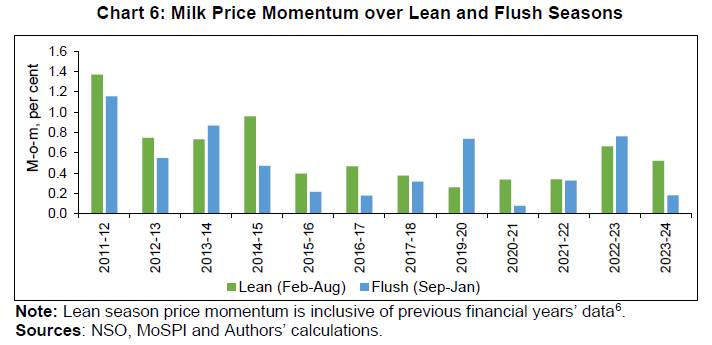

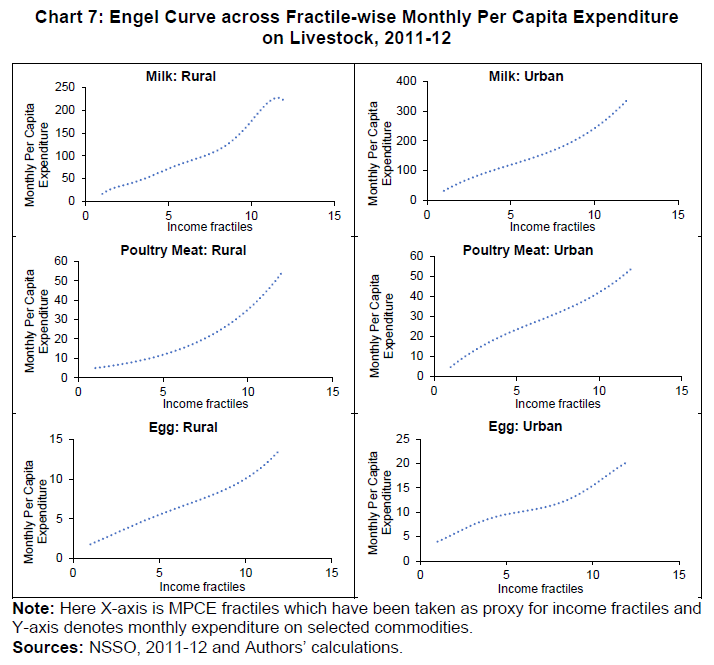

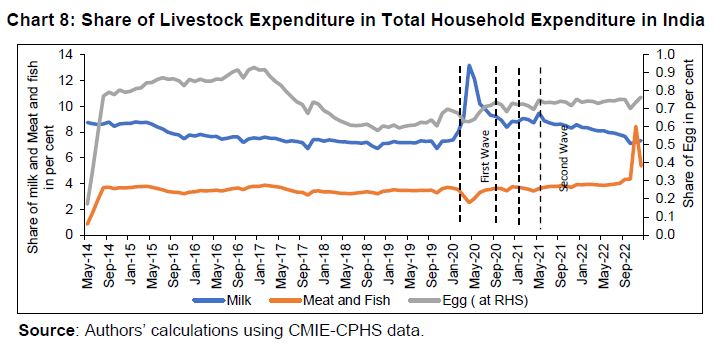

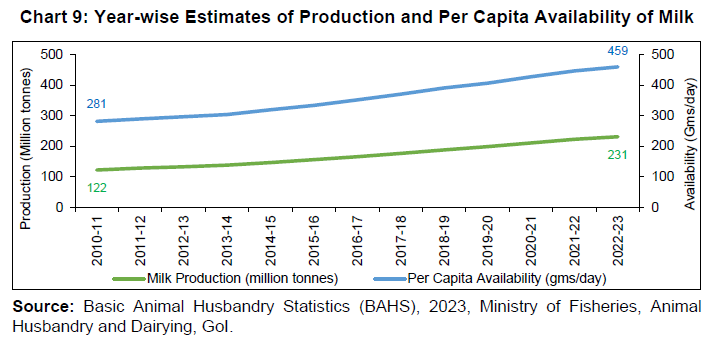

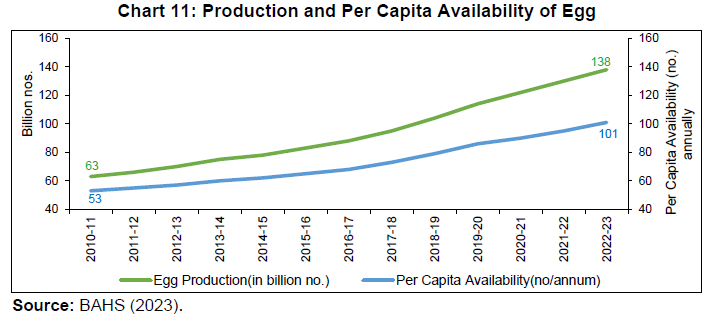

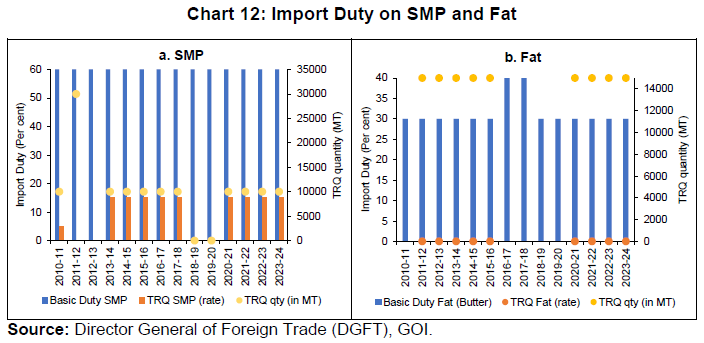

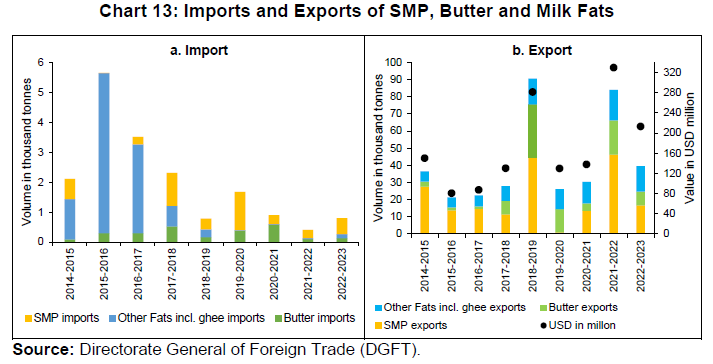

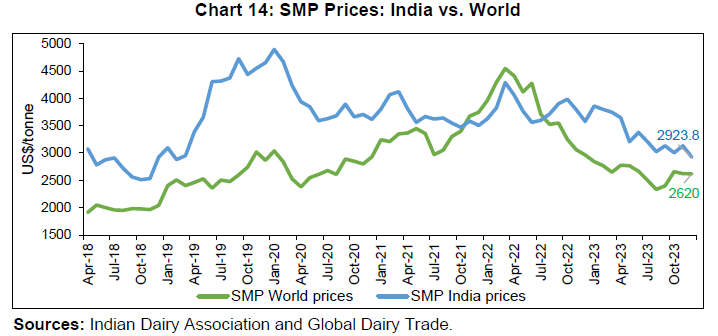

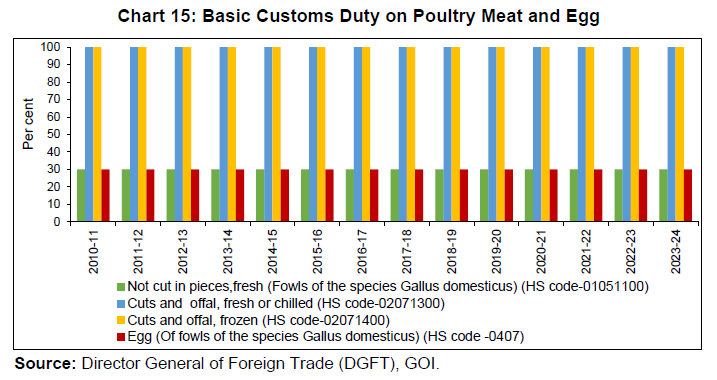

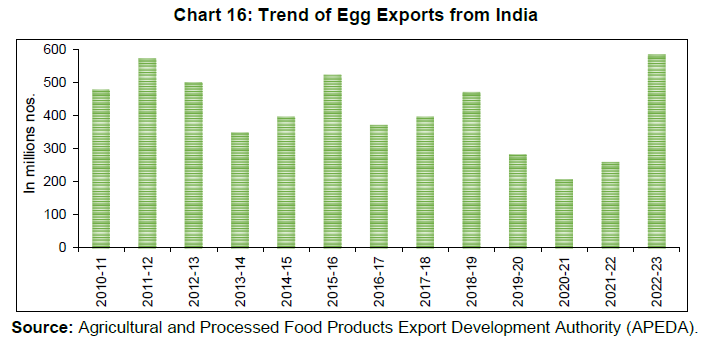

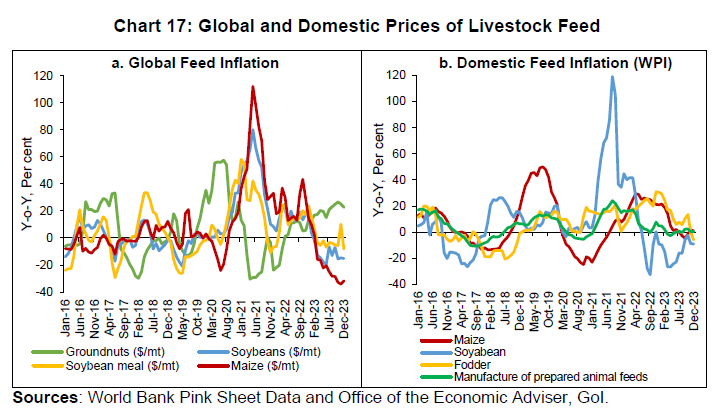

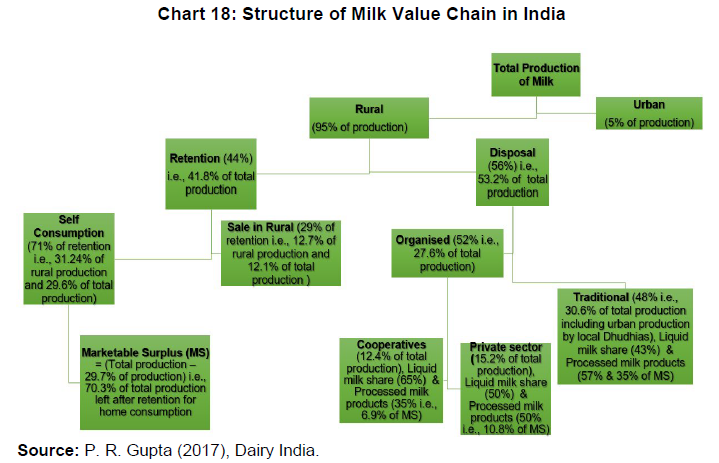

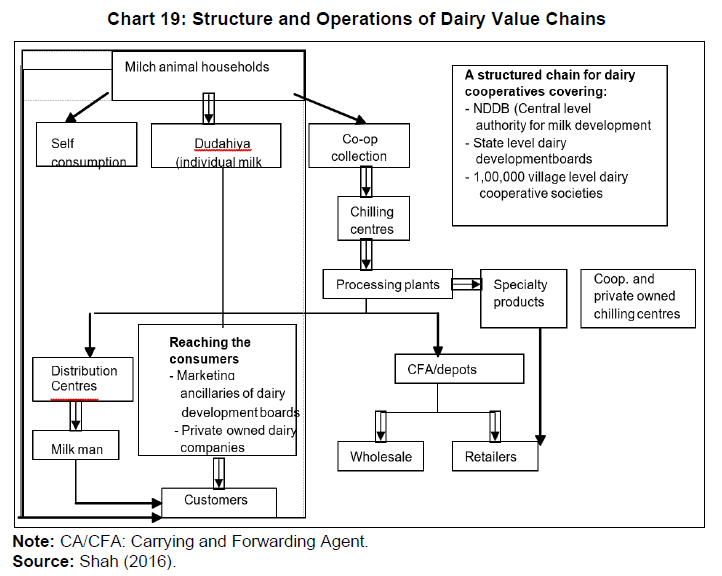

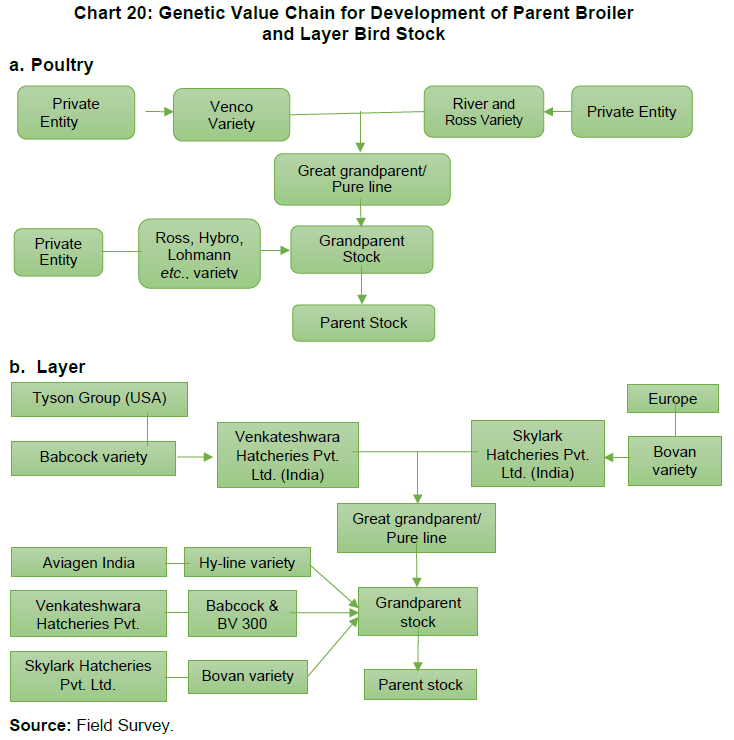

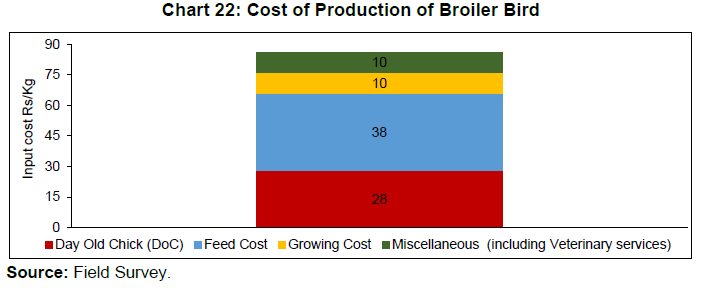

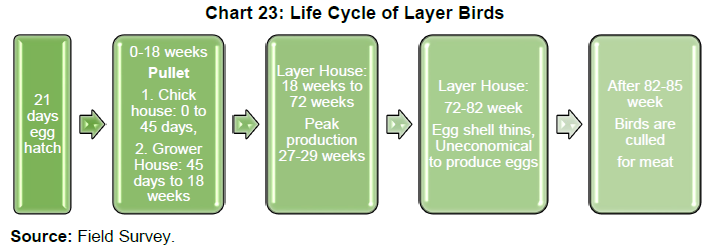

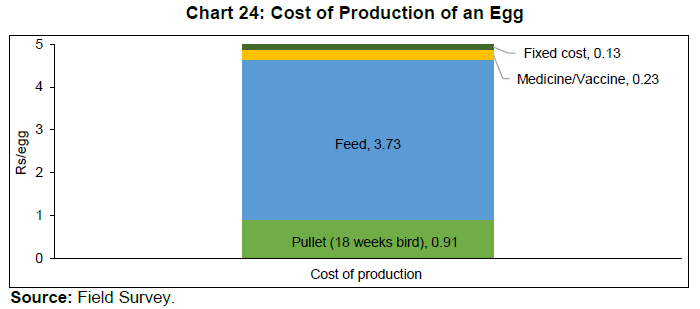

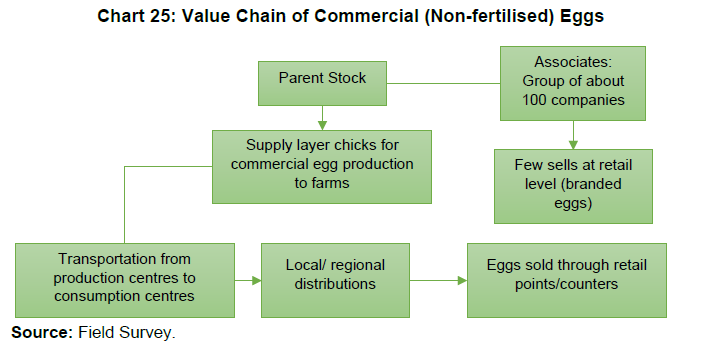

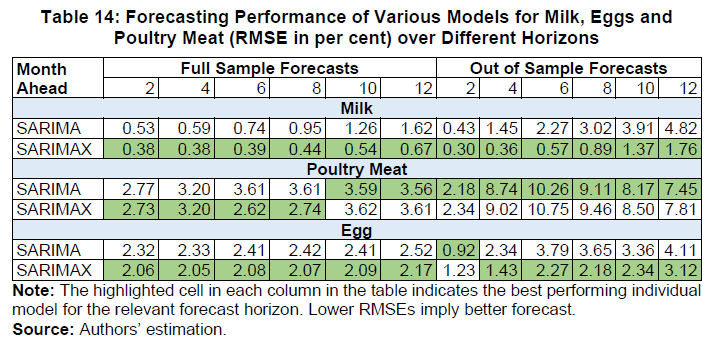

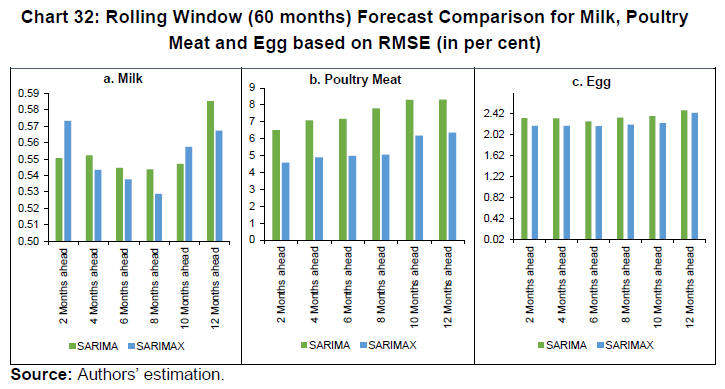

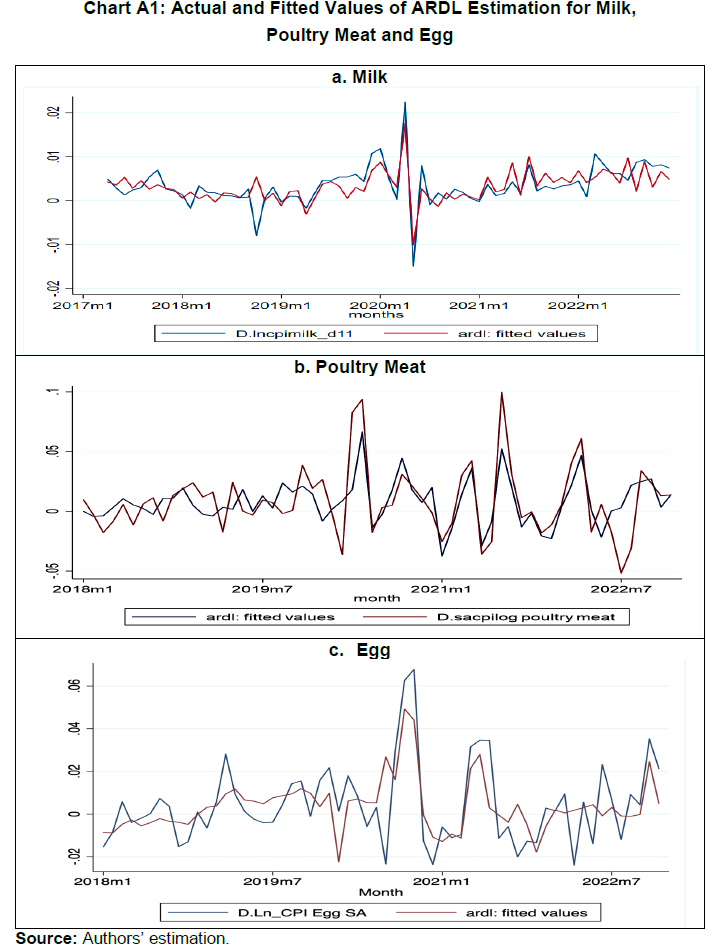

The study assesses the value chain of milk, poultry meat and eggs, and the roles of various stakeholders involved for computing monthly balance sheet variables to analyse price dynamics and for identifying measures to mitigate volatility in livestock and poultry production and inflation. The study finds that, on an average, 70 per cent and 75 per cent of the consumer rupee goes back to the dairy and egg farmers, respectively, whereas 56 per cent of the consumer rupee goes back to the farmers and integrators taken together in the poultry meat value chain. The study employs the balance sheet method to generate monthly net availability/ availability usage ratios for the three livestock/ poultry commodities that reflect demand and supply through the examination of inventory levels, production, consumption, trade and survey-based information. The balance sheet variable is then used in an Autoregressive Distributed Lag (ARDL) model for each commodity to study the underlying price dynamics controlling for input costs. The regression results show a statistically significant inverse relationship between net availability/availability to usage ratios and consumer price index (CPI) of milk, poultry meat and eggs, while feed and fodder costs impact their prices positively. The study further attempts to forecast inflation for milk, poultry meat and eggs over a 12-month horizon using univariate and multivariate time-series methodologies integrating variables which are identified as significant in the ARDL model. The forecasting analysis generally indicates a superior performance of the SARIMAX model incorporating the balance sheet variable compared to other models, over different forecast horizons. Drawing from the research outcomes, the study offers policy suggestions aimed at improving the dairy and poultry value chains to mitigate inflation in livestock and poultry items. The remainder of the paper is organised into seven sections. Section II provides a brief review of literature identifying gaps in the Indian context. Section III covers various data sources available in India, which can be utilised to analyse livestock and poultry price dynamics. Section IV presents the stylised facts about inflation in livestock and poultry products including trend and seasonality of their prices. Additionally, the section discusses in detail various supply side factors impacting livestock inflation. Section V discusses value chain of milk, poultry meat and eggs. Section VI explores the balance sheet approach and dwells upon the computation of net availability/availability to usage ratio variable. Section VII demonstrates the methodological framework and discusses structural factors which influence livestock and poultry prices as well as the forecasting performance of the alternative models. Section VIII concludes and provides policy suggestions to contain inflation in milk, poultry meat and eggs. Understanding the drivers of commodity-specific inflation is important to generate accurate inflation forecasts for the conduct of monetary policy. The determinants of food inflation have been empirically analysed by a number of studies. Gopakumar and Pandit (2017) found that items like pulses, fruits, vegetables, eggs, meat, fish and milk are not only driven by supply-side factors, but also by demand factors such as the rate of growth of real income, money supply and relative prices. Nair and Eapen (2012) emphasised that the persistent inflation in high-value commodities such as pulses, milk, meat, and fruits and vegetables with an income elastic demand is due to structural factors i.e., poor supply response to rapidly increasing demand. Chand et al. (2011) examined how various supply shocks like drought contribute to inflation in food commodities including livestock. They have noted that as the frequency of such shocks is expected to rise, India needs to have an effective food management strategy to deal with these shocks. There are also studies that have exclusively analysed price dynamics and forecasting of inflation in the livestock sector. Elliot and Dale (1980) examined the impact of changes in aggregate income, prices of close substitutes (pork and beef) and cost variables like the price of corn and soybean meal in both the short run and long run, on the US poultry sector. They found that an increase in feed costs decreases broiler production and as a result, broiler prices rise. Westcott et al. (1987) developed a model incorporating both behavioural and biological factors to forecast US egg prices in the short and medium-term for policy analysis. The paper derived feed cost, income and broiler price multiplier to show their effect on egg prices and found that a change in disposable income directly impacts demand for broiler meat and indirectly affects egg prices. As income rises, demand for broiler meat rises which increases broiler production - a 10 per cent rise in broiler production results in a change in egg production by 1 per cent, which in turn affects its price. Weimar et al. (1990) estimated an annual econometric model of the livestock and poultry sector and used it as a basis for a dynamic simulation model. Their results indicated that for a given rise in feed cost, broiler per capita consumption falls less than other meat items like pork and turkey. Broilers are better converters of feed while pork and turkey are less efficient and, therefore, the impact on broiler prices is less than pork and turkey. Milk prices can also be forecasted from a supply chain management perspective, as discussed by Kussaiynor et al., (2019) for Northern Kazakhstan. They built a model of chain price index for the period from 2010 to 2018 to estimate seasonal ups and downs in the price dynamics of milk. They showed that the degree of deviation of milk prices estimated from the model from actual prices did not exceed 3 per cent and the model can effectively be used by farms for the effective organisation of production and sales process, taking into account the seasonal characteristics in the behaviour of the market. Gandhi and Zhou (2010) found that the demand for milk and milk products also have high sensitivity to changes in income (proxied by expenditure) in India. Therefore, according to them, inflationary pressures in milk since 2005 can be attributed mainly to its increasing demand which has outpaced the increases in its production. Abdallah, et al. (2020) assessed the monthly price transmission between farmers and retailers of dairy products in Hungary where the long and short-run asymmetric transmission between price levels was measured using a nonlinear ARDL (NARDL) model. The estimated NARDL model proved the existence of long and short-run asymmetric relationships between producer milk prices and retailer dairy product prices. Zmami and Ben-Salha (2019) conducted aggregated and disaggregated analyses to find the impact of Brent and West Texas Intermediate (WTI) oil prices on international food prices using linear and nonlinear ARDL models. The results suggest the presence of asymmetries in the relationship between oil prices and food prices in the long run. The dairy price index reacted to both positive and negative changes in oil prices, with the impact of oil price increases being greater. There is a growing interest in forecasting accurately food and agricultural commodity-specific inflation due to its significant impact on overall headline inflation in developing countries. Models such as autoregressive integrated moving average (ARIMA), seasonal autoregressive integrated moving average (SARIMA), ARIMA/ SARIMA with exogenous variables (ARIMAX/SARIMAX), random walk (RW), vector autoregression (VAR), VAR with exogenous variables (VAR-X), Bayesian VAR (BVAR), models with Generalised Autoregressive Conditional Heteroscedasticity (GARCH) and Phillips curve are used to forecast inflation, but no single model either univariate or multivariate has been found to be superior in accuracy (John et al., 2020; Griessel, 2015; Benes et al., 2016; Aiolfi and Timmerman, 2006; and Behera et al., 2018). Also, researchers have highlighted the effectiveness of using an exogenous variable to improve forecast performance in a simple time-series estimation model, as demonstrated by Bhattacharya and Sengupta (2018). Shyian et al. (2021) used an ARIMA model to forecast milk prices for a period of 6 months in Ukraine, considering time lag and the share of milk prices in the sale price of finished dairy products. Atalan (2023) attempted to forecast milk prices in Turkiye using machine learning algorithms. Wickramarachchi et al., (2017) utilised time-series data and econometric models such as ARIMA and SARIMA to forecast weekly real prices of various poultry products in Sri Lanka. The findings indicated that nominal price increased due to inflation, but real prices of these products remained stagnant over time. Ihsan et al. (2022) created a prediction system for the prices of basic commodities on major holidays in Indonesia, such as Eid al-Fitr, Christmas, New Year, Chinese New Year, and Eid al-Adha, using the multi-layer perceptron (MLP) method. Monitoring and predicting the prices of basic commodities during major holidays, as they often experience sharp fluctuations, the study found that eggs are particularly prone to significant price increases during these holidays. The authors emphasised on the MLP method which can accurately predict time-series data experiencing significant fluctuations. In the Indian context, there is not much work on modelling the price dynamics of the livestock and poultry sectors. This study aims to fill this gap by analysing the market dynamics of these sectors and their value chains, identifying factors affecting prices of milk, poultry meat and eggs, and building a model for forecasting their inflation. It introduces a novel framework to generate monthly balance sheet (availability/stocks) to understand their price dynamics and uses it in a modelling framework to examine its role in explaining price movements of these commodities as well as to generate short-term inflation forecasts. Drawing from the literature and based on the empirical findings and value chain analysis of the study, it offers some policy suggestions. The present study uses data from both secondary and primary sources for milk, poultry meat and eggs. For secondary data, databases from the Government of India (GoI), state government websites, state agriculture departments and existing literature have been used. The period of analysis for milk is from April 2010 to December 2022, while for eggs and poultry meat is from January 2010 to December 2022 as per data availability from different sources. The study uses the CPI data which is available at the commodity level from the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI), GoI since 2011. For CPI commodity-wise data prior to 2011, commodity-wise CPI-IW data from the Labour Bureau available at the 2001 base year have been used, after splicing the series to the 2011 base year. For empirical analysis, the item level monthly data for CPI milk, poultry meat (i.e., chicken) and eggs have been used4. Wholesale price index (WPI) data are sourced from the Office of Economic Adviser (OEA), Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, GoI. To capture all the dynamic elements of the balance sheet, published reports and government data sources such as ICAR-CIPHET report on farm-level operation losses by Jha et al. (2015), Agricultural Statistics at a Glance (various years), and Agmarknet (various years) for arrival data have also been used. The data on trade has been taken from the Directorate General of Commercial Intelligence and Statistics (DGCI&S) database of the Ministry of Commerce and Industry, and FAOSTAT of the Food and Agriculture Organisation (FAO) of the United Nations. The production data for milk and eggs is from various issues of Basic Animal Husbandry Statistics, GoI. Production and consumption data for poultry meat have been taken from the OECD-FAO Agriculture Outlook 2022-2031. The quinquennial data on per capita consumption of milk and eggs are collected from various rounds of National Sample Survey Office (NSSO) reports. The per capita consumption for the period after 2011-12 has been projected using the behavioural approach of agricultural commodities demand predictions in view of the non-availability of data5. For the primary data or the real-time information, we created a chain of respondents by seeking references from an initial list of experts. This method was useful for comprehending value chains, balance sheet, price dynamics and market behaviour. The data are collated and verified via information collected from a cumulative list of experts and also by interviewing stakeholders like farmers, processors, exporters, traders, distributors, integrators, cooperatives and government officials during the field survey. Using purposive sampling, the study covered the major livestock producing states as well as consumption centres for the survey which include Maharashtra, Gujarat, Haryana, Telangana, Tamil Nadu, Andhra Pradesh, Uttar Pradesh, Punjab and Delhi. The survey was conducted during December 2022 and March 2023 for dairy, and during December 2022 for poultry meat. For eggs, the survey was conducted during April 2021 and December 2022. The details of the field surveys such as sample size, study area, etc., are given in Annex Table A1. There has been a significant growth in the value of output from livestock sector especially dairy, poultry meat and eggs. The contribution of livestock in total agriculture and allied sector rose from 25.6 per cent in 2011-12 to 31.2 per cent in 2021-22. At the same time, the value of output of livestock sector grew on an average by 5.6 per cent per annum while the crop sector registered a growth of 2.1 per cent during 2012-13 to 2021-22 (at constant prices) (Chart 1). Notably, the production of poultry meat has registered double digit growth during the same period (10.1 per cent), followed by eggs (6.2 per cent) and milk (5.5 per cent). Despite such considerable growth in the livestock and poultry sector, their prices have remained volatile. Among the three commodities, milk inflation measured using both WPI and CPI has been relatively less volatile (Chart 2a). This could be due to the organised nature of milk supply chain through milk cooperatives as well as lag in pass-through of input cost pressures, unlike in the poultry sector where the transmission is fast. Notably, the correlation between WPI and CPI milk inflation is high at 0.9. Further, a structural break analysis indicates that CPI milk inflation, which averaged 6.1 per cent during January 2012 to December 2023, had two structural breaks - one in December 2015 and the other in May 2019, which suggests that milk inflation has moved through three different phases (Chart 2b). The first phase (January 2012 to December 2015) observed an average inflation of 9.5 per cent reflecting rapidly rising demand on the back of increases in net disposable income and high-income elasticity of milk. The surging global milk prices and rising feed costs (fodder) for smallholders further added to the inflationary pressure. The second phase (January 2016 to May 2019) had a moderate inflation of 3.2 per cent primarily because of the prolonged level of negative WPI fodder inflation averaging (-)3.7 per cent. The third phase (June 2019 to December 2023) registered an uptick in milk inflation to 5.2 per cent due to a combination of factors such as COVID-19 shock, lumpy skin disease, and a rise in feed and fodder cost, which also resulted in lower procurement by the milk cooperatives. The under-feeding of cattle during the pandemic impacted milk prices due to lower productivity of cattle. Moreover, during April-November 2022, India exported 16,206 tonnes of milk fat, which by reducing domestic availability added to milk inflation. A decomposition of CPI milk inflation into trend and cyclical components suggests that the movement in milk inflation has been generally dominated by the trend component (Chart 2c). The post-pandemic rise in milk inflation was also driven by rising trend inflation. In the case of poultry meat, the co-movement between CPI and WPI inflation is rather weak with a correlation of 0.39 during April 2012-December 2023, which fell further to 0.07 during the pandemic period (March 2020 to December 2022) (Chart 3a). A structural break analysis indicates that the CPI poultry meat inflation, which averaged 7.4 per cent during January 2012 to December 2023, had two structural breaks - one in January 2014 and the other in April 2020 (Chart 3b). Thus, the movement of CPI poultry meat inflation can be divided into three phases - the first phase from January 2012 to January 2014 with an average inflation of 10.3 per cent, the second phase from February 2014 to April 2020 with an average inflation of 4.5 per cent and the third phase from May 2020 to December 2023 with the highest average inflation of 10.9 per cent. Further, a decomposition of the CPI poultry meat inflation illustrates that the trend component largely dominated the movement of CPI inflation during the pandemic, while volatility was also high compared to the past as reflected in the cyclical component (Chart 3c). In the case of eggs, CPI and WPI inflation generally moved together with a correlation of 0.52 during April 2012-December 2023 albeit with a greater volatility in WPI after the pandemic (Chart 4a). CPI egg inflation averaged 6.3 per cent during January 2012 to December 2023 with two structural breaks – one in April 2014 and the other in August 2020 (Chart 4b). Thus, movement in CPI egg inflation can be divided into three phases - the first phase from January 2012 to April 2014 with an average inflation of about 11.7 per cent, the second phase between May 2014 and August 2020 with a moderate inflation of 4.1 per cent, and the third phase between September 2020 and December 2023 which coincided with the pandemic with a higher average inflation of 6.6 per cent, albeit with the egg inflation peaking at 21.7 per cent in October 2020 and 20.8 per cent in July 2021. The high inflation in poultry meat and eggs during phase 1 coincided with the period of high inflation in soya and maize in international and domestic markets. Increasing feed cost thus contributed to higher poultry inflation during the first phase. The lower poultry inflation in the second phase was due to moderation in domestic feed prices and real rural wages along with a fall in private consumption growth, which reduced demand-side pressure on food inflation (Anand et al., 2016). The high inflation in the third phase, particularly in poultry meat, reflects the COVID-19 pandemic induced shifts in demand and supply along with disruption in the poultry value chain. Moreover, the feed prices also increased both globally and domestically, which further put pressure on retail inflation in poultry meat and eggs. Moreover, misinformation during the pandemic resulted in reduction in poultry production due to culling of poultry birds in the early phase. A decomposition of CPI egg inflation illustrates that eggs inflation has been primarily driven by trend component, albeit with some recent moderation. However, cyclical component dominated during the first two waves of COVID-19 pandemic (Chart 4c). Seasonality An analysis of seasonality in prices indicates that livestock and poultry items exhibit different seasonal behaviour. Milk prices peak in July and trough in March within a year (Chart 5a). Generally, prices of poultry meat trough during the winter months (December-February) on improved supply and picks up during summer months with a peak in June (Chart 5b). On the other hand, eggs prices witness seasonal peaks during the winter months (December-January) on higher winter demand and troughs during summer months of April-May on lower demand (Chart 5c). Egg prices also record some pick up during the monsoon season. Further, both poultry meat and eggs exhibit festival related seasonality with fall in prices during Shravan (end of July and August) and Navaratri (September-October) on lower demand in some parts of India as people avoid a non-vegetarian diet during this time. In the case of milk price, seasonality is observed generally with an upward trend from April to July. Milk prices generally do not fall back to base level due to downward rigidity in prices. It is, therefore, essential to interpret its seasonality with caution due to the constantly increasing milk prices. To address this limitation, an alternative approach has been adopted to analyse the momentum (month-on-month (m-o-m) change) of milk prices by separately examining the lean season (February to August) and the flush season (September to January) (Chart 6). The lean and flush season patterns clearly illustrate that the average milk price momentum during the lean season is generally significantly higher compared to the flush season. It should be noted that there is an inflection point after the COVID-19 pandemic, during which there was a change in the trend, with the flush season exhibiting similar or higher momentum than the lean season (except 2020-21 and 2023-24). This change in momentum is attributed to several factors, including the impact of rising demand during the COVID-19 period, higher input (feed and fodder) costs pass-through, and lower yield due to under-feeding of cows and lumpy skin disease during COVID leading to upward revision in milk prices by many cooperatives in several rounds. Additionally, cooperatives also exported excess stock, which further contributed to the shift in momentum. This analysis of milk price momentum provides a more comprehensive perspective on the seasonal variations and helps to better understand the market’s underlying dynamics. IV.1. Factors Determining Livestock Inflation: Demand-Supply Dynamics Price fluctuations in livestock commodities could be due to demand-supply imbalances resulting from trade policy changes, movements in international or domestic input costs including feed and fodder, and market interventions. Since the global food crisis of 2008, it has become apparent that the domestic food prices are integrated with world prices although the co-movement varies across commodities. The correlation for staples like rice and wheat has been found to be weaker in view of robust procurement policy and public distribution system. In case of staples particularly, the governments are reluctant to allow any significant pass-through from international to domestic prices (Mishra and Roy, 2016). Highly tradable products such as edible oils exhibit a high degree of co-movement between domestic and international prices. In livestock commodities, however, there is a moderate correlation between domestic and international prices. For instance, correlation between world dairy indices reported by the IMF and domestic WPI milk is found to be 0.52, while that between international poultry meat indices and WPI poultry meat is 0.44. (a) Demand-side Factors India’s growing food demand towards livestock needs to be analysed to understand inflation dynamics in livestock commodities. Robust economic growth with increasing per capita income in the last decade (5.4 per cent during 2010-11 to 2015-16 and 3.7 per cent during 2016-17 to 2022-23) coupled with sizable increase in population has been shifting the food basket of the people away from staple food to high-valued horticulture and livestock commodities in India. The shift in consumption pattern of Indian households is corroborated by the Bennett's law. That is, as income rises, people eat relatively fewer calorie-dense starchy staple foods and relatively more nutrient-dense meats, oils, sweeteners, fruits, and vegetables. Using the various rounds of the Consumption Expenditure Survey of the NSSO, Gandhi and Zhou (2010) show that demand for livestock products has risen significantly along with the expenditure share of livestock products as stated earlier. For instance, in rural areas, milk consumption increased from 3.94 litres per capita per month to 4.33 litres per capita per month between 1993-94 and 2011-12 while the consumption of eggs (no.) increased from 0.64 eggs per capita per month to 1.94 eggs per capita per month, and poultry meat increased from 0.02 kg per capita to 0.18 kg per capita over the same period. Similarly, in urban areas, milk consumption increased from 4.89 litres per capita per month to 5.42 litres per capita per month between 1993-94 and 2011-12, while the consumption of eggs increased from 1.48 eggs per capita per month to 3.18 eggs per capita per month, and that of poultry meat increased from 0.03 kg per capita to 0.24 kg per capita over the same period. This can be attributed to various factors including diversification of food basket, changing lifestyles and/or rise in income (Mittal, 2008; and Kumar et al., 2011). As per the Engel’s law, with an increase in the average household income, the average share of food expenditure in total expenditure declines. Chart 7 plots the Engel curves for milk, poultry meat and egg for both rural and urban areas using the household survey (NSSO 68th round 2011-12)7. The Engel curve plots monthly per capita expenditure of selected livestock commodity on y-axis and income fractiles on the x-axis (income fractiles have been deduced using household’s monthly expenditure). It suggests that for the households who spend a lot on food (which have high weight on food expenditure), their income elasticity of food expenditure is also high. The findings are reiterated in studies (Anand et al., 2016; and Gokarn, 2011) which show that milk, meat and egg tend to have high income elasticity, i.e., on an average, expenditure on livestock commodities (across all households) rises proportionally more than the increase in total food expenditure. Further, Mishra and Roy (2016) state that inflationary pressures, particularly in milk are attributed to rise in demand, which has outpaced increase in production. The demand patterns have further changed since the COVID-19 pandemic. Recent studies have highlighted how pandemic has resulted in a significant increase in the share of food in total expenditure in both rural and urban areas (Kaicker et al., 2022). The Centre for Monitoring Indian Economy–Consumer Pyramids Household Survey (CMIE-CPHS) monthly expenditure data show changes in food expenditure shares for animal protein rich items in India (Chart 8). The share of expenditure on milk in total household expenditure registered a sharp increase during the first wave and a marginal increase during the second wave before moderating somewhat thereafter, while that on the poultry meat saw a sharp decline during the first wave due to misinformation about COVID-19 spread. In contrast, the share of expenditure on egg fell since early 2017, before rising somewhat since the pandemic, though its share in total expenditure remains low (Chart 8). (b) Supply-side Factors Supply-side factors of inflation include changes in production and productivity, input costs and supply chain dynamics. Commodities experiencing higher demand growth also have relatively higher supply growth (Anand et al., 2016). This study further propounded that if relatively higher supply growth of food commodities with higher expenditure elasticities such as livestock products can be sustained going forward, it will help contain relative food price pressures. A number of studies have incorporated supply chain dynamics including the contribution of mark-ups between farm gate and retail price, constituents of those mark-ups and inter-linkages between different market stakeholders including traders, stockists, retailers, and farmers to understand the sources of food inflation and its volatility (Bhoi et al., 2019; Banerji and Meenakshi, 2004; and Bhattacharya and Sengupta, 2015). Production Trend of Milk, Poultry Meat and Eggs India has been the largest milk producer globally, surpassing the United States in 1998. The three-phased implementation of Operation Flood (1970-1996) which expanded the presence of dairy cooperatives and subsequent expansion of organised private dairies along with the government initiatives to increase milk production has ensured growth in milk production from 122 million metric tonnes (MMTs) in 2010-11 to 231 MMTs in 2022-23, thereby increasing the per capita availability of milk from 281 grams/day to 459 grams/day (Chart 9). Cows and buffaloes contribute 52 per cent and 45 per cent of total milk production, respectively, while the remaining 3 per cent is from goats8. The average yield of exotic/crossbred cow is 8.55 kg per day and for indigenous/non-descript cow is 3.44 kg per day in 2022-23 (BAHS, 2023). Despite India being the largest producer, the USA’s yield of milk is more than five times that of India, whereas Australia’s yield is more than three times and New Zealand’s yield is more than double in triennium ending (TE) 2022 (FAOSTAT). Uttar Pradesh is the highest milk producing state in India (with a share of 15.3 per cent) followed by Rajasthan (14.7 per cent) and Madhya Pradesh (8.6 per cent) in TE 2022-23. Within livestock, poultry meat production (from broiler industry) has grown steadily with the emergence of vertically integrated poultry producers. Today, India is the fifth largest producer of poultry meat globally after USA, China, Brazil and Russia (FAOSTAT, 2022). As per OECD-FAO (2022), India’s poultry meat production increased from 2.2 MMTs to 4.6 MMTs during 2010 to 2023 (Chart 10). However, the annual per capita consumption of poultry meat in 2023 was 2.85 kg in India, which was low by global standards. For instance, per capita consumption was highest in Israel (64.31 kg) followed by USA (51.54 kg), Brazil (43.1 kg) and China (13.7 kg) in 2023 (OECD-FAO Agricultural Outlook 2022-2031). Nonetheless, the sector also witnessed gradual growth in consumption in the last two decades reflecting rising income and rapidly expanding middle class along with development of value chains. Among the states, Maharashtra is the highest poultry meat producing state amounting to 15 per cent followed by West Bengal (13 per cent) and Haryana (12.5 per cent) in TE 2022-23 (BAHS, 2023). Within the poultry sector, egg has also grown both in volume and value terms over the last decade. India ranks third in global egg production after China and Indonesia in TE 2022 (FAOSTAT). The egg production in the country has increased from 63 billion numbers (nos.) to 138 billion numbers (nos.) between 2010-11 and 2022-23 (Chart 11). In 2022-23, the improved fowls contributed 88.4 per cent of the total egg production whereas desi fowls contributed 10.7 per cent, while the remaining was contributed by desi ducks and improved ducks. There has been a steady increase in per capita availability of eggs from 53 to 101 eggs per annum during the same period (BAHS, 2023). However, the consumption of egg is still lower than other countries. In 2023, the annual per capita consumption was 288 eggs in Mexico, 284 eggs in China, and 163.2 eggs in Brazil (OECD-FAO Agricultural Outlook 2022-2031). Three highest egg producing states in India are Andhra Pradesh (with a share of 20.3 per cent), Tamil Nadu (16 per cent) and Telangana (12.8 per cent) in TE 2022-23. Role of Government Interventions for Supply Management of Livestock and Poultry Sector To enhance yield and supply in this sector, and to make livestock products accessible to consumers at affordable prices, various programmes were launched by the central government to improve breeding, feeding and health status. In 2014-15, the central government implemented the National Livestock Mission (NLM) which aims to generate employment opportunities and foster development of entrepreneurship in the livestock sector along with efforts to increase per-animal productivity, promote feed and fodder development, and improve breeds to target increased production of meat, goat milk, egg, and wool. In the dairy sector, implementation of Operation Flood (1970-1996) was significant in expanding the presence of dairy cooperatives and subsequent expansion of organised private dairies, ensuring multi-fold growth in milk production. During the Operation Flood, the major issue was the low productivity of Indian bovines in the dairy industry, wherein milk yield was less than 1 kg per day. Crossbreeding technology initiated in 1961 resulted in an increase in average productivity from less than 1 kg per animal per day in the pre-Operation Flood era to 4.5 kg per (in-milk) animal per day. This increase in milk production resulted in competitive prices and eliminated the need for imported skimmed milk powder (SMP) to meet domestic demand. Before the completion of Operation Flood III (1985–1996), India relied on imported SMP to meet its domestic milk demand. Similarly, to enhance milk production and productivity of milk cattle, the Rashtriya Gokul Mission has been crucial for the development and conservation of indigenous breeds. The other important schemes for dairy sector are the Integrated Dairy Development Scheme and the National Dairy Plan. The main focus of these schemes has been to promote dairy development and offer financial assistance for activities such as breed improvement, feed and fodder development, and infrastructure development, thereby improving the productivity and profitability of the dairy sector. In addition, the National Programme for Dairy Development (NPDD), Dairy Infrastructure Development Fund (DIDF) and Animal Husbandry Development Fund (AHIDF) are some of the initiatives of the Government of India focussing on dairy infrastructure development along with milk procurement, processing, marketing, and the quality of milk and milk products. The NPDD scheme is designed to install approximately 8,900 bulk milk coolers, which are expected to cover around 26,700 villages, thereby benefiting more than 800,000 milk producers and resulting in an additional procurement of 20 lakh litres of milk per day (LLPD). By improving milk procurement, processing and marketing, these schemes will not only benefit millions of milk producers but also further strengthen the dairy value chain and enhance the overall impact of the programme (DAHD, 2022). At present, the poultry sector and especially poultry meat is one of the fastest growing sectors within agriculture in India. The revolution in the poultry sector has been primarily due to innovations in policies, institutions and breeding stocks particularly with the liberalisation of import of improved genetic material. In 1993-94, the government reduced the import duty on grandparent poultry stock from 105 per cent to 40 per cent (Kabeer and Murthy, 1996). Until 2001, the import of poultry grandparent stock was controlled by permits and governed by a duty structure. However, since then all quantitative restrictions on India’s import of poultry items were dismantled and grandparent stock was imported without any barriers (Mehta et al., 2007). The policy resulted in a massive increase in private investment in breeding operations with the use of imported grandparent stock. It also led to the production of day-old chicks under strict bio-secure conditions leading to performance improvement in the pure-line stock of improved parent lines (Emsley, 2006). Private enterprises have taken up research and development (R&D) of parent stocks and have developed breeds that suit Indian environmental conditions. Innovations in watering systems, and climate controls designed for Indian markets have ensured efficient poultry management. Moreover, the egg productivity of improved fowls (Bowans, Hyline, Lohman LSL, among others) also registered a significant increase. At the same time, technology breakthroughs with improved varieties of chicks for poultry meat like Cobb, Hubbard and Lohman, among others enabled the country to achieve high-conversion ratios for chicken to gain the required weight in a lesser time period. Under NLM, the Innovative Poultry Productivity Project (IPPP) is another initiative aiming to transform backyard poultry into a commercial economic model. Under IPPP, a pilot model has been implemented to upscale the subsistence model of backyard poultry farming to a scaled-up entrepreneur model. An important concern that impacts dairy and poultry production as well as its supply dynamics, however, is the losses or mortality due to susceptibility to various diseases. For example, foot and mouth disease (FMD), lumpy skin diseases and brucellosis in dairy cattle, and avian flu in poultry birds have a drastic impact on productivity and production of livestock sector, thereby increasing volatility in prices. In this regard, the government’s initiative like the Livestock Health and Disease Control programme aims at reducing the risk to animal health by capacity building of veterinary services, disease surveillance, and strengthening veterinary infrastructure in the country. Recently, the central government has allocated Rs.9,800 crores for leveraging total investment of Rs.54,618 crores for the next five years starting from 2020-21 (DAHD, 2022). Trade Policy and Price Dynamism in Livestock and Poultry Sector Supply and price dynamics of livestock and poultry products also depend on the trade policies adopted by the government. The central government uses a combination of trade policy tools including custom duties, import quotas, import bans and port restrictions to manoeuvre the supply and price dynamics. The customs duty on SMP has remained unchanged at 60 per cent since 2010-11. India also permitted imports of SMP/whole milk powder (WMP) under a tariff rate quota (TRQ) of 10,000 MT, with a 15 per cent import duty from 2020 to 2022. However, outside of the TRQ, imports are still subjected to a 60 per cent import duty. Over the last ten years, the quantity under TRQ has been varying under SMP (Chart 12a). For instance, during 2011-12 and 2012-13, the TRQ quantity was around 30,000 and 50,000 tonnes, respectively with an import duty of zero per cent for both years. However, for the rest of the years, the import duty under TRQ remained stagnant at 15 per cent. Likewise, fat has been imported at a basic customs duty of 30/40 per cent since 2011-12 (Chart 12b). India permitted imports of butter and other milk fats under a TRQ of 15,000 MT, with a 0 per cent import duty from 2011-12 to 2015-16 and 2020-21 to 2023-24. Additionally, a goods and services tax (GST) of 12 per cent is charged on fat imports whereas SMP has a lower GST of 5 per cent. India’s import of SMP and fat has been negligible over the last decade. In contrast, India exported significant quantity of butter and other milk fats including ghee in the last few years. In 2022-23, India exported 8,081 tonnes of butter and 14,796 tonnes of other milk fats including ghee (Chart 13). Such high exports of milk fat in the form of butter, ghee, and anhydrous milk fat can add to the domestic shortage. Interestingly, the exports of SMP from India during 2018-19 and 2021-22 were high despite domestic SMP prices being higher than the world SMP price (Chart 14). The majority of exports in these years were sent to Bangladesh (about 45 per cent in 2018-19 and 60 per cent in 2021-22) given lower freight costs. India's competitiveness in the SMP market requires making the dairy value chain efficient and reducing the production costs. In contrast, imports of poultry meat are low9 while India exports minimal quantity to countries like Bhutan, Bahrain and Malaysia. In 2022-23, India exported only about 3 tonnes of poultry meat as against almost zero tonnes in 2019-2010. The domestic demand for poultry is not met with imports as consumption in India is largely driven by fresh meat from live markets (95 per cent) while processed/chilled or frozen meats account for 5 per cent of market share (BAHS, 2021). Further, high tariffs on poultry meat imports along with inadequate processing makes India uncompetitive in global market. The basic customs duty on import of cuts and offal, frozen category is 100 per cent and not cuts in pieces offal, frozen category is 30 per cent (Chart 15). In case of egg, India allows export without any restrictions. The basic customs duty on import of fresh eggs and egg powder is 30 per cent for the last ten years. India imports a very small quantity of eggs. On the other hand, India exports fresh eggs mostly to Oman and Maldives and middle-east countries like Kuwait, Qatar, Bahrain, Iraq and Iran (Chart 16). India also exports eggs and its by-products to some African countries including Liberia, Sierra Leone, Kenya, Uganda, Nigeria, Somalia, Malawi and Sudan. Most of the eggs exported from India are from Namakkal, Tamil Nadu referred as the India’s hub of egg production. According to Department of Animal Husbandry and Dairying (DAHD), the strength of exports mainly lies in the competitive cost of production, proximity to international markets and successful regaining of freedom from Highly Pathogenic Avian Influenza (HPAI). Role of Feed in Livestock Price Formation Another important factor that impacts production and prices in the livestock sector is feed cost or feed availability. The literature shows that feed cost is a significant component of the total cost of livestock production, accounting for around 60-70 per cent of the total cost of production in milk (Lawrence et al., 2008), 60–70 per cent of broiler’s cost of production (Gulati et al., 2022), and 70–80 per cent of layer’s total production costs (Gunasekar, 2006; FAO, 2003; and Mallick, 2020). However, there have been high price and production fluctuations in various components of feed in milk, poultry meat and egg. The cow/buffalo feed constitute two major categories: roughages and concentrates (Udharwar, 2020). The roughages include dry roughage (e.g., hay, stovers like jowar kabdi, and straws of paddy, wheat, karad) and green roughages11 (e.g., cultivated fodder plants of leguminous fodder such as lucerne, berseem, cowpea, and non-leguminous fodder like Napier grass, para grass, maize, sorghum, tree leaves and silage). The concentrate mixture comprises maize grain - ground, soybean meal, groundnut cake, cotton seed cake, rice polish, mineral mixture and salt (Annex Table A2). The roughage requirement (dry matter) of cattle/buffalo is 2.5-3.0 kg per 100 kg body weight per day. The recommended fodder composition is discussed in Annex Table A3. Literature suggests that green fodder is more beneficial in terms of maintaining good health and increasing the yield, but on account of lower availability in most parts of the country, green fodder is generally substituted with dry fodder, and farmers have to thereby increase the content of concentrates in the total feed proportion. Whereas, the concentrate requirement depends on the state of cattle, for just maintenance of the cattle (no gain/loss in milk yield) 1.0 (1.5) kg concentrate is required for cow (buffalo), while lactating animals are advised to be given 1 kg of extra concentrate for every 2.5 (3) kg for cow (buffalo) milk produced and pregnant cow/buffalo should also get 1.5 kg/day extra above the ration schedule of adult animal in order to meet nutrients need for growth of foetus (DAHD, 2020). According to the Report “Vision 2050” of the ICAR-Indian Grassland and Fodder Research Institute (IGFRI 2013), India faced a net deficit of 35.66 per cent green fodder, 10.95 per cent dry crop residues and 44 per cent concentrate feed ingredients in 2012-13 (Annex Table A4). The Report also highlighted that at the current level of growth in forage resources, there will be an 18.4 per cent deficit in green fodder and a 13.2 per cent deficit in dry fodder in the year 2050. To meet the growing demand, green forage supply needs to grow at 1.69 per cent annually. In the domestic market, fodder and manufactured prepared animal feed costs have also experienced high inflation in the last three years leading to a rise in prices of leading milk brands (Chart 17). The Gujarat Cooperative Milk Marketing Federation (GCMMF), under the brand name of Amul, has hiked its milk prices for consumers thrice during 2022 citing an increase in feed costs12. For instance, rice bran extract and Gola cattle feed recorded WPI inflation of 27 per cent and 8.6 per cent, respectively in December 2022, while fodder registered WPI inflation of 30.6 per cent in December 2022. In the poultry sector (layer and broiler), feed constitutes maize (60 per cent), soya (25 per cent), de oiled rice bran (8 to15 per cent) and mustard extraction and groundnut cake (2 per cent each). Moreover, given India’s dependence on feed imports, international feed prices also transmit to domestic feed prices. For instance, in view of global inflation in maize and soya spiking to almost 112 and 80 per cent, respectively, in May 2021, domestic soya prices spiked by 119 per cent in August 2021. In view of skyrocketing prices and growing demand by the domestic animal feed industry as well as increased oil meal exports, India imported approximately 0.65 MMT of soybean meal primarily from Argentina, Vietnam, and Thailand during 2021-22. Moreover, the Union government approved a 1.2 MMT quota for soybean meal derived from genetically modified soybeans to address high animal feed prices impacting the industry (USDA, 2022). The high prices of soya meal, maize and soyabean have significant repercussions on the poultry industry. V. Overview of Livestock Value Chain in India To better understand the balance sheet approach, it is important to first examine the value chain of milk, poultry meat and egg, and the roles of various stakeholders involved. Understanding the commodity specific value chain is crucial not only for computing balance sheet variables and dynamic monthly stock/availability variables but also for identifying measures to mitigate volatility in livestock production and inflation. V.1. Dairy Value Chain The dairy sector in India provides livelihood to more than 63 million households (NDDB, 2022) constituting mostly small, marginal and landless farmers with an average herd size of 3 animal holdings (20th Livestock Census). Operation Flood led to the creation of three-tier cooperative structures at the state level, which gave a huge boost to India’s milk production and processing capacity and linked the milk distribution network efficiently linking 700 cities and towns in the country through a National Milk Grid. Since the 1990s, there has been an increase in private sector participation in dairy processing, with the processing capacities of the private sector dairy players surpassing that of the cooperatives (Gupta, 2017). In India, out of the total milk produced, 41.8 per cent is consumed at rural level: 29.7 per cent for self-consumption and 12.1 per cent for meeting the demand of those who do not possess milch animals (Chart 18). The balance 58.2 per cent of the milk (inclusive of 5 per cent produced in urban areas) is available for sale to urban consumers. Out of the total disposal of milk available, about 52 per cent is equally handled or marketed by the organised sector - dairy cooperatives and organised private sector players, while the remaining 48 per cent is handled by the unorganised sector popularly referred to as Doodhwalas (Gupta, 2017). Out of the cooperative share in total marketed surplus of milk, 65 per cent is sold as liquid milk and 35 per cent is processed into milk products. Within the private sector, the share of marketed surplus is 50 per cent each for liquid milk and processed milk products. Currently, there are 28 functional state-level cooperatives. The cooperatives follow a three-tier structure – a dairy cooperative society at the village level affiliated to the milk union at the district level, which is further federated into a milk federation at the state level. The three-tier structure was set up for delegating the various functions - milk collection which is carried out at the Village Dairy Society, milk procurement and processing at the District Milk Union, and milk and milk products marketing at the State Milk Federation (Chart 19). State federations market their products under common brand names – such as Amul, Nandini, Aavin, Saras, etc. This model is also referred to as the ‘Amul Model’ or ‘Anand Pattern’ of dairy cooperatives as implemented during the Operation Flood. Currently, the top five cooperatives: Gujarat (Amul), Karnataka (Nandini), Tamil Nadu (Aavin), Rajasthan (Saras) and Bihar (Sudha) handle more than 76 per cent of the total milk processed by cooperatives. The Anand Pattern is an integrated cooperative structure which procures, processes and markets the produce and is owned and governed by farmers. There are around 25 major private dairies operating across states in India. As per the National Dairy Development Board (NDDB), the capacity created by private dairies in the last 20 years is more than the capacity set up by the cooperatives over the past 30 years. While the value chain of dairy cooperatives and organised private sector dairy companies follow a similar structure in terms of procurement, processing and marketing, dairy cooperatives’ ownership rests with the members who pour milk into their procurement system while in the case of organised private dairies, farmers do not have any ownership in the company, as these companies are mostly privately held (through shareholdings) and some are listed in the stock market because of public shareholdings. In cooperatives, members of the cooperative society in the village supply milk to their procurement system, whereas, in the case of most of the private dairy, farmers are under no obligation to sell or supply milk to them, although there are cases where some private players have agreements with dairy farmers to supply milk to them. Procurement by private dairies is based on the demand and supply scenario while in case of cooperatives, milk brought in by members has to be procured and processed irrespective of the demand for dairy products in the market. However, during the period of high milk production, procurement by cooperatives may depend on their capacity to procure and process. In the case of cooperatives, private dairies as well as organised private players, the milk procurement price paid to farmers is on the basis of fat and solids-not-fat (SNF) contents. Industry estimates suggest that the private sector has more processing capacity than the cooperatives. However, cooperatives have a significant presence in the liquid milk segment, while both private dairies and cooperatives have a significant share in the processed products market. The unorganised sector still has a major share in the handling of the marketable surplus of milk, as they have localised operations. Major portions of milk procured from farmers are sold in the market or supplied door to door through vendors. Some of the unorganised sector players also supply value-added products like paneer, curd and others to the retail markets. The processing capacity of the unorganised players is estimated to be 35 per cent of the total marketable surplus. The biggest component of India’s dairy market is liquid milk with an estimated share of around 71 per cent, followed by dairy products with a share of 29 per cent under which milk gets processed into khoya, chhena and paneer and further used as the base material for a variety of indigenous sweets and preparations, followed by ghee (Gupta, 2017). Many of these products are produced by households or halwais (sweetmeat makers). V.2. Poultry Value Chain Poultry farming is classified into commercial and backyard sector with varying sizes measured by the number of birds (Table 1). Backyard poultry is mostly owned by small and marginal farmers, consisting of only a few birds, primarily for personal consumption, with only a small amount sold commercially. Compared to backyard farms, poultry farmers who sell eggs and meat commercially, the farm size varies from 5,000 birds to 1,00,000 birds. Within broiler industry, commercial sector accounts for 82 per cent of total poultry meat production, whereas within layer industry, commercial sector contributes to 83 per cent of egg production. The remaining 18 per cent and 17 per cent are contributed by backyard poultry in broiler and layer industry, respectively (BAHS, 2020). Poultry value chain consists of three main operations: (i) breeding (breeder farms), (ii) hatching (hatchery farms), and (iii) layer farming (for egg production) or broiler farming (meat production). The breeder farms focus on producing fertilised eggs for either egg or broiler production, using specific ratios of male and female breeders to ensure the eggs are fertile for development of pure line broiler and layer birds or the grandparent stock. These fertilised eggs collected from breeder farms are sent to centralised hatcheries for incubation. After 21 days, the hatched chicks are vaccinated, assessed for uniform quality, and shipped to other locations for further rearing. The process of steps of development of the great grandparent (GGP) stock to parent stock in genetic value chain for poultry meat and egg value chain is illustrated in Chart 20. For the rearing of broiler and layer birds, the first step of the value chain is the identification of a pure genetic breed for ensuring multiplication into chicks. In commercial poultry farming, birds are reared under controlled conditions or cage housing. In India, the great grandparent stocks, also referred to as pure lines, are supplied by two companies. According to a field survey, there are around 100 companies or ‘associates’ which are into parent stock production. Major players such as Venkateshwara Hatcheries, Skylark and Suguna are the main supplier of layer chicks for commercial production from the parent stocks. These ‘associates’ are the key players in the egg value chain which supply layer chicks to the farms which are reared for the production of commercial or table or non-fertilised eggs. The second aspect of the value chain explains the production of commercial poultry meat and layer egg from the parent stocks. The day-old broiler chicks from the hatcheries are sent to broiler farms without being sorted by gender, while chicks from egg-laying stock are separated by gender, with only female chicks sent for egg production. V.2.1. Value Chain of Commercial Poultry (Broiler bird/meat) The second aspect of the value chain explains the process from the parent stocks to commercial bird production, which works through two models: (i) Integrator model, and (ii) Direct farmer model. Each of this is detailed below: i. Integrator model In the integrator model, a contract farming agreement is underwritten between the integrator and farmer. Around 65 to 70 per cent of commercial poultry meat production comes from this model (based on our field survey). The integrator provides day-old-chicks (DoC), feed, veterinary services and vaccines to the farmers and the farmer or farm owners take care of the cost of the shed, electricity and labour for poultry birds rearing. In other words, except the growing cost, all other costs are borne by the integrator. This contract farming system ensures price stability or assured returns for the farm owners irrespective of volatility in prices in the wholesale market. The integrators take most of the risk in the value chain while farmers mostly focus on rearing broiler birds without being involved in the marketing aspects (Chart 21). There are several integrators or companies such as Venkateshwara Hatcheries (Venky’s), IB group, Suguna chickens which are at present following contract farming model. In contract farming of broiler chicks, the farmers are remunerated based on a predetermined level of feed conversion ratio (FCR), weight and mortality. For instance, FCR ratio for large hatcheries were around 1.6 (as per our field survey conducted during December 2022). If this FCR and mortality rate of 7-8 per cent is maintained, then on an average, the farmer is paid Rs.6.5-7/kg. Over these charges, performance linked incentives are also given to the farmers. The feed, comprising maize and soyabean meal, is the largest component of total production cost while the cost of DoCs is Rs.25-30 (Chart 22). Along with this, integrators also bear the medicine cost (which is around Rs.2 per kg.), transport cost and other administrative costs. The broiler chicks are usually reared for 35-40 days to get a market weight of 1.8 to 2.2 kg. Integrators buy back 36-40 days old broiler bird (around 2 kg size) by paying Rs.7 per kg (on an average) to farm owners. ii. Direct farmer model The second part of the value chain relating to commercial production are those 30 per cent of the farmers or farm owners who rear broiler chicks by investing from their own resources. These farmers also have to look at the marketing aspects of the broiler birds while bearing the costs of DoCs, feed costs, medicine costs, land and labour costs all by themselves. Traders sell the birds to retailers who would sell the raw meat at the live market (sold as dressed or culled chicken meat). Farmers generally prefer integrator model as it mitigates risk and gives them assured return irrespective of the price fluctuation in the market. Farmers who are not part of the integration model face initial investment barriers and also risk resulting from unsured return as a consequence of price fluctuations. Interactions with the officials of the Poultry Federation of India underscored that poultry meat mostly sold through wet market, where birds are culled and raw meat is sold to the consumers, accounts for 95 per cent of the total production of broiler birds. Only 5 per cent of poultry meat production is processed as value-added products. There is another segment of traders who source broiler meat or birds from farmers or farm owners for institutional consumption such as hotels, restaurants, catering services (HORECA) and defence forces. Value Chain of Backyard Poultry Meat Around 18 per cent of the poultry meat production is contributed by backyard poultry, practised mostly in rural areas. A portion of poultry meat production (around 5 per cent) is also used for self-consumption. The unorganised and backyard poultry sector is one of the tools for subsidiary income generation for many landless or marginal farmers and it also provides nutritional security to the rural poor. In case of the value-chain of backyard poultry, the parent stock of broiler chicks and indigenous/genetically improved poultry birds are provided to farmers in the rural areas mostly through respective state government supported programmes or sold to farmers for promoting rural livelihood options. V.2.2 Commercial Egg Value Chain The marketing of eggs is dominated by traders who purchase eggs from layer-farmers based on the region-specific daily prices announced by National Egg Coordination Committee (NECC) [an apex body of the layer farmers]. The female parent stock (or the one-day old chick) from hatcheries is sent to commercial egg layer farms for egg production. Based on the inputs provided by NECC, commercial layer birds have around 72 weeks life span, where the birds start laying eggs commercially from 18-19 weeks of age (as per the field survey). During the first 18 weeks, when the bird is not laying eggs (also called pullet), it is kept in the chick house (0 to 45 days) and later moved to grower house (45 days to 18 weeks). One day-old layer chick supplied by these companies cost in the range of Rs.37 - 40 per chick. There are some intermediary farmers who rear these one-day old chick till 18 weeks and supply it to layer houses for egg production. The pullets cost around Rs.300. During the bird’s life cycle, it lays eggs during 18 to 72 weeks totalling 290 to 310 eggs (Chart 23). After 72 weeks, it becomes uneconomical for poultry farmer to keep rearing the birds for eggs as the yield decreases and probability of breakage increases as the egg’s shell thins. However small poultry farmers tend to keep birds till 80-85 weeks in India and then sell it for its meat. Based on the field survey conducted during December 2022, the cost of production of an egg is around Rs.5 where the feed accounts for 75 per cent of the total cost of production. The pullet cost adjusted for an egg comes to around Re. 0.91 per egg. The other heads are medicines and fixed cost inclusive of electricity, cage and labour which account for Re.0.23 and Re.0.13 per egg, respectively (Chart 24). The eggs sourced from commercial layer firms are referred to as non-fertilised eggs. The commercial egg production from the farm gate to retail consumers follows several chains depending on the transportation from the production centres to the consuming centres (Chart 25). Because of regional concentration of production in some states such as Andhra Pradesh, Tamil Nadu and Telangana, traders from the consuming or deficient regions buy egg from surplus regions/states and transport them to consuming points. At the consuming points, local traders buy egg brought from the producing regions and transport them to the retail points, where local agents deliver it to retail outlets. In case of backyard poultry, eggs are sold directly by farmers in the market or purchased directly by consumers at farm gate. In addition to supplying layer chicks, major players also market their non-fertilised eggs, also known as value-added eggs, directly to consumers through retail channels. Egg powder, prepared by dehydrating eggs through the spray drying process, has same amounts of proteins as eggs and has low carbohydrates, cholesterol and fats. Value Chain of Backyard Poultry (fertilised eggs) In backyard poultry, rearing of layer birds as well as improved desi varieties in smaller numbers is carried out in a free-range system where birds scavenge for food and natural process of hatching is practiced. In case of backyard poultry, the egg produced is referred to as fertilised as these can be hatched to provide replacement birds. The backyard poultry varieties lay 180 - 200 eggs during their life span of 72 weeks13. The smaller backyard layer farms do not have infrastructure or facilities to transfer the eggs directly to consumption centres, and hence it is the intermediary who aggregates and transport to the markets. In case of backyard poultry, eggs are sold directly by farmers in the market or purchased directly by distributors at the farm gate. V.3. Estimating the Price Mark-ups in the Livestock Value Chain Price Mark-ups in the Dairy Value Chain For this study, we have taken into account major dairy cooperatives based in Gujarat and Maharashtra. In terms of the realisation of the consumer’s rupee by the farmers, the cooperatives are the most efficient as they transfer about 70 per cent of consumer rupee earned from selling liquid milk to the retail consumers (Table 2). This makes the dairy value chain of cooperatives more inclusive. Price Mark-up in Poultry Value Chain (poultry meat and egg) For the analysis of farmer’s share in consumer rupee, we have considered two chains: (1) Pune and Mumbai chain for poultry meat and egg, and (2) Barwala (Haryana) and Delhi chain for egg. The mark-ups in the poultry value chain are explained in detail in Table 3. A. Notes for Broiler:

B. Notes for Layer eggs:

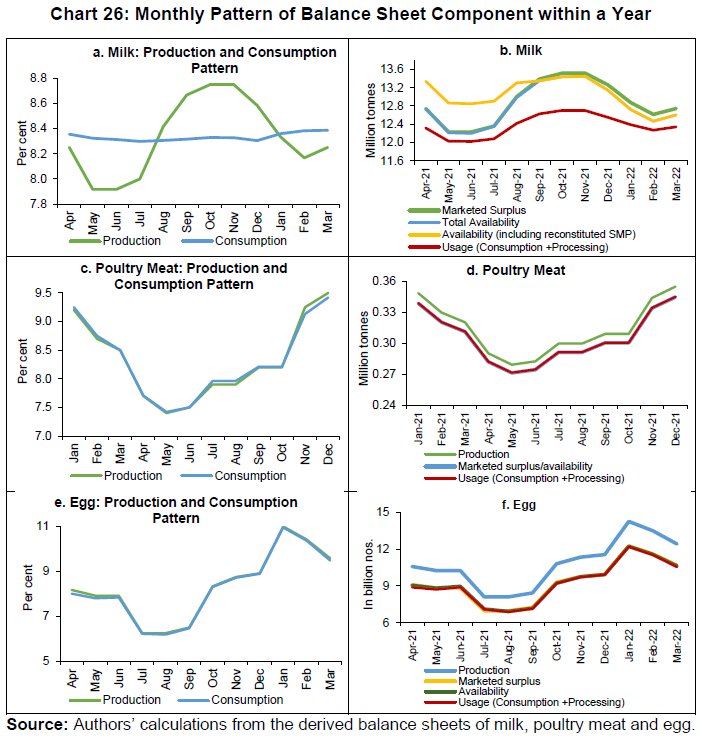

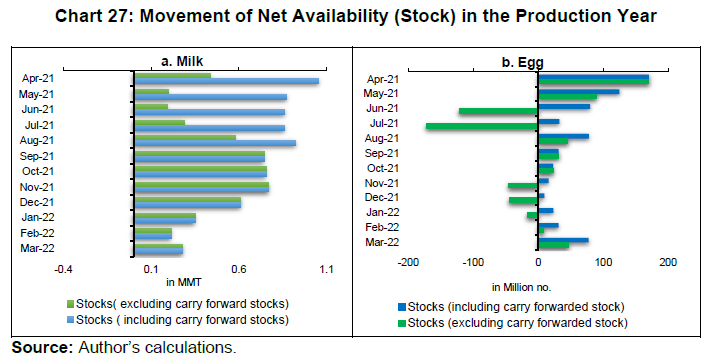

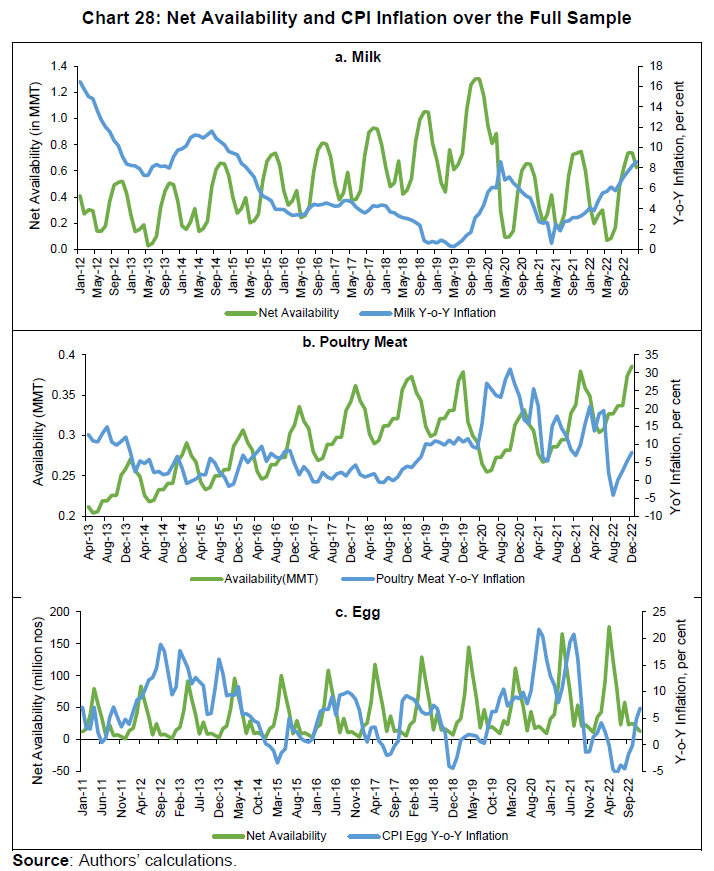

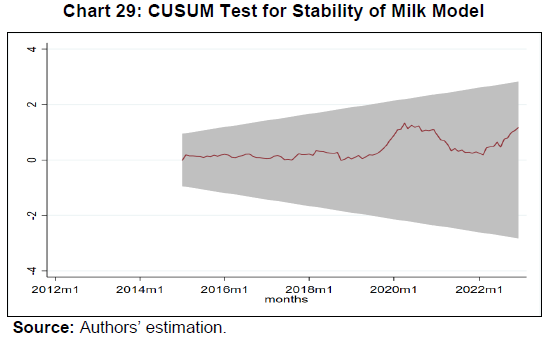

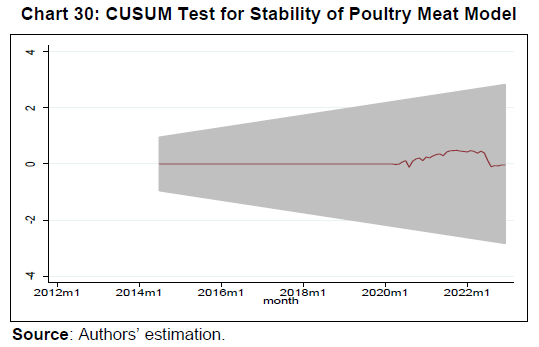

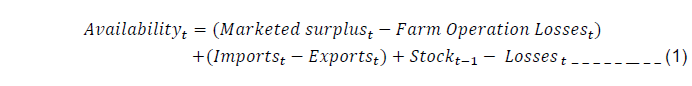

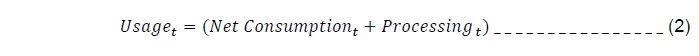

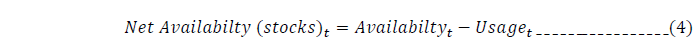

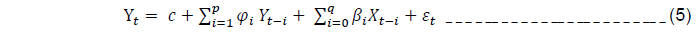

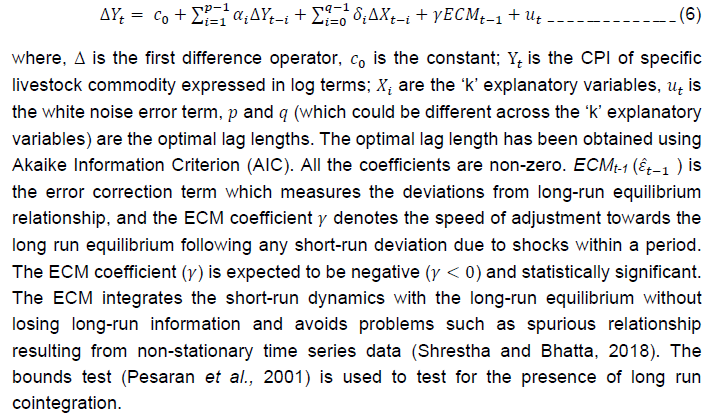

Given the objective of understanding price dynamics of livestock and to create a representative variable which can capture demand and supply imbalances, we use the balance sheet approach. The framework is used to assess the supply and demand of a commodity by analysing its inventory level, production, consumption and trade, and thereby creating monthly stocks or stock-to-use (STU) ratios. In this paper, we use this approach to analyse the supply and demand of livestock and poultry sectors including milk, poultry meat and egg. Milk can be stored for longer period once it is processed into skimmed milk powder and fat, while commodities like egg cannot be stored for a long period. In contrast, poultry meat is not stored and is primarily sold in the wet market in India. Therefore, we have assumed net availability or stock to be zero in case of poultry meat. Once we have established the monthly total stocks (in case of milk and egg) or availability (in case of poultry meat), we can proceed to analyse the impact of various factors including the balance sheet variable on livestock prices. Components of the Monthly Balance Sheet The livestock and poultry commodities (milk, poultry meat and egg) studied in this paper have unique value chain structures as discussed earlier. The balance sheet data, which are available on an annual basis is transformed into monthly data based on factors such as production and release patterns and consumer/institutional demand collated through primary surveys. The monthly patterns of production, consumption and stocking have been generalised for the period from January 2010 to December 2022 for milk, poultry meat and egg. Some key assumptions for generating the livestock and poultry balance sheets are as follows: