IST,

IST,

Liquidity Risk Management Framework for Non-Banking Financial companies and Core Investment Companies – Draft Guidelines for public comments

Draft Guidelines All Non-Banking Financial Companies (NBFCs) including Core Investment Companies (CICs) Madam/ Sir, Liquidity Risk Management Framework for Non-Banking Financial companies and Core Investment Companies – Draft Guidelines for public comments Please refer to paragraph 107 and paragraph 94 of Master Direction - Non-Banking Financial Company - Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016, and Master Direction - Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking Company (Reserve Bank) Directions, 2016, both dated September 01, 2016, respectively. 2. In order to strengthen and raise the standard of Asset Liability Management (ALM) framework applicable to NBFCs, it has been decided to revise the extant guidelines on liquidity risk management for NBFCs. All non-deposit taking NBFCs with asset size of ₹ 1 billion and above, systemically important Core Investment Companies and all deposit taking NBFCs irrespective of their asset size, shall adhere to the set of liquidity risk management guidelines given below. It will be the responsibility of the Board of each NBFC to ensure that the guidelines are adhered to. The internal controls required to be put in place by NBFCs as per these guidelines shall be subject to supervisory review. Further, as a matter of prudence, all other NBFCs are also encouraged to adopt these guidelines on liquidity risk management on voluntary basis. 3. While some of the current regulatory prescriptions applicable to NBFCs on ALM framework have been recast below, a few additional features including disclosure standards have also been introduced. While the detailed guidelines are given in Annex A, the important changes are as under: i) Granular Maturity Buckets and Tolerance Limits The 1-30 day time bucket in the Statement of Structural Liquidity is bifurcated into granular buckets of 1-7 days, 8-14 days, and 15-30 days. The net cumulative negative mismatches in the maturity buckets of 1-7 days, 8-14 days, and 15-30 days should not exceed 10%, 10% and 20% of the cumulative cash outflows in the respective time buckets. NBFCs, however, are expected to monitor their cumulative mismatches (running total) across all other time buckets upto 1 year by establishing internal prudential limits with the approval of the Board. The above granularity in the time buckets would also be applicable to the interest rate sensitivity statement required to be submitted by NBFCs. ii) Liquidity risk monitoring tools NBFCs shall adopt liquidity risk monitoring tools/metrics in order to capture strains in liquidity position, if any. Such monitoring tools should cover a) concentration of funding by counterparty/ instrument/ currency, b) availability of unencumbered assets that can be used as collateral for raising funds; and, c) certain early warning market-based indicators, such as, price-to-book ratio, coupon on debts raised, breaches and regulatory penalties for breaches in regulatory liquidity requirements. The Board of NBFCs should put in place necessary internal monitoring mechanism in this regard. iii) Adoption of “stock” approach to liquidity In addition to the measurement of structural and dynamic liquidity, NBFCs are also mandated to monitor liquidity risk based on a “stock” approach to liquidity. The monitoring shall be by way of predefined internal limits as decided by the Board for various critical ratios pertaining to liquidity risk. Indicative liquidity ratios areshort-term liability to total assets; short-term liability to long-term assets; commercial papers to total assets; non-convertible debentures(NCDs)(original maturity less than one year)to total assets; short-term liabilities to total liabilities; long-term assets to total assets; etc. iv) Extension of liquidity risk management principles In addition to the liquidity risk management principles underlining extant prescriptions on key elements of ALM framework, it has been decided to extend relevant principles covering other aspects of monitoring and measurement of liquidity risk, viz., off-balance sheet and contingent liabilities, stress testing, intra-group fund transfers, diversification of funding, collateral position management, and contingency funding plan. Introduction of Liquidity Coverage Ratio 4. All non-deposit taking NBFCs with asset size of ₹ 50 billion and above, and all deposit taking NBFCs irrespective of their asset size, shall maintain a liquidity buffer in terms of a Liquidity Coverage Ratio (LCR) which will promote resilience of NBFCs to potential liquidity disruptions by ensuring that they have sufficient High Quality Liquid Asset (HQLA) to survive any acute liquidity stress scenario lasting for 30 days. The stock of HQLA to be maintained by the NBFCs shall be minimum of 100% of total net cash outflows over the next 30 calendar days. The LCR requirement shall be binding on NBFCs from April 01, 2020 with the minimum HQLAs to be held being 60% of the LCR, progressively increasing in equal steps reaching up to the required level of 100% by April 01, 2024, as per the time-line given below:

Detailed draft guidelines on LCR including disclosure standards are provided in Annex B. 5. The draft guidelines are put in public domain to elicit comments from NBFCs, market participants and other stakeholders. Feedback should be sent by email not later than June 14, 2019. Yours faithfully (Manoranjan Mishra) Guidelines on Liquidity Risk1 Management Framework Non-deposit taking NBFCs with asset size of ₹ 1 billion and above, systemically important Core Investment Companies and all deposit taking NBFCs shall adhere to the guidelines as mentioned herein below. It will be the responsibility of the Board to ensure that the guidelines are adhered to. The internal controls required to be put in place by NBFCs as per these guidelines shall be subject to supervisory review. Further, as a matter of prudence, all other NBFCs are also encouraged to adopt these guidelines on liquidity risk management on voluntary basis. The guidelines deal with following aspects of Liquidity Risk Management framework. A. Liquidity Risk Management Policy, Strategies and Practices In order to ensure a sound and robust liquidity risk management system, the Board of the NBFC shall frame a liquidity risk management framework which ensures it maintains sufficient liquidity2, including a cushion of unencumbered, high quality liquid assets to withstand a range of stress events, including those involving the loss or impairment of both unsecured and secured funding sources. It should spell out the entity-level liquidity risk tolerance; funding strategies; prudential limits; system for measuring, assessing and reporting / reviewing liquidity; framework for stress testing; liquidity planning under alternative scenarios/formal contingent funding plan; nature and frequency of management reporting; periodical review of assumptions used in liquidity projection; etc. Key elements of the liquidity risk management framework are as under: i) Governance of Liquidity Risk Management Successful implementation of any risk management process has to emanate from the top management in the NBFC with the demonstration of its strong commitment to integrate basic operations and strategic decision-making with risk management. A desirable organisational set up for liquidity risk management should be as under: a) Board of Directors (BoD) The BoD shall have the overall responsibility for management of liquidity risk. The Board should decide the strategy, policies and procedures of the NBFC to manage liquidity risk in accordance with the liquidity risk tolerance/limits decided by it. b) Risk Management Committee The Risk Management Committee, which reports to the Board and consisting of Chief Executive Officer (CEO)/ Managing Director and heads of various risk verticals shall be responsible for evaluating the overall risks faced by the NBFC including liquidity risk. c) Asset-Liability Management Committee (ALCO) The ALCO consisting of the NBFC’s top management shall be responsible for ensuring adherence to the risk tolerance/limits set by the Board as well as implementing the liquidity risk management strategy of the NBFC. The CEO/MD or the Executive Director (ED) should head the Committee. The Chiefs of Investment, Credit, Resource Management or Planning, Funds Management / Treasury (forex and domestic), International Banking and Economic Research may be members of the Committee. The role of the ALCO with respect to liquidity risk should include, inter alia, decision on desired maturity profile and mix of incremental assets and liabilities, sale of assets as a source of funding, the structure, responsibilities and controls for managing liquidity risk, and overseeing the liquidity positions of all branches. d) Asset Liability Management (ALM) Support Group The ALM Support Group consisting of operating staff should be responsible for analysing, monitoring and reporting the liquidity risk profile to the ALCO. Such support groups will be constituted depending on the size and complexity of liquidity risk management in an NBFC. The Chief Risk Officer appointed by the NBFC vide our circular DNBR (PD) CC. No.099/03.10.001/2018-19 dated May 16, 2019 shall be involved in the process of identification, measurement and mitigation of liquidity risks. ii) Liquidity risk Tolerance An NBFC should have a sound process for identifying, measuring, monitoring and controlling liquidity risk. It should clearly articulate a liquidity risk tolerance that is appropriate for its business strategy and its role in the financial system. Senior management should develop the strategy to manage liquidity risk in accordance with such risk tolerance and ensure that the NBFC maintains sufficient liquidity. iii) Liquidity Costs, Benefits and Risks in the Internal Pricing NBFCs should endeavour to develop a process to quantify liquidity costs and benefits so that the same may be incorporated in the internal product pricing, performance measurement and new product approval process for all material business lines, products and activities. iv) Off-balance Sheet Exposures and Contingent Liabilities The process of identifying, measuring, monitoring and controlling liquidity risk should include a robust framework for comprehensively projecting cash flows arising from assets, liabilities and off-balance sheet items over an appropriate set of time horizons. The management of liquidity risks relating to certain off-balance sheet exposures on account of special purpose vehicles, financial derivatives, and, guarantees and commitments may be given particular importance due to the difficulties that many NBFCs have in assessing the related liquidity risks that could materialise in times of stress. v) Funding Strategy - Diversified Funding An NBFC should establish a funding strategy that provides effective diversification in the sources and tenor of funding. It should maintain an ongoing presence in its chosen funding markets and strong relationships with fund providers to promote effective diversification of funding sources. An NBFC should regularly gauge its capacity to raise funds quickly from each source. There should not be over-reliance on a single source of funding. Funding strategy should also take into account the qualitative dimension of the concentrated behaviour of deposit withdrawal (for deposit taking companies) in typical market conditions and over-reliance on other funding sources arising out of unique business model. vi) Collateral Position Management An NBFC should actively manage its collateral positions, differentiating between encumbered and unencumbered assets. It should monitor the legal entity and physical location where collateral is held and how it may be mobilised in a timely manner. Further, an NBFC should have sufficient collateral to meet expected and unexpected borrowing needs and potential increases in margin requirements over different timeframes. vii) Stress Testing Stress testing should form an integral part of the overall governance and liquidity risk management culture in NBFCs. An NBFC should conduct stress tests on a regular basis for a variety of short-term and protracted NBFC-specific and market-wide stress scenarios (individually and in combination). In designing liquidity stress scenarios, the nature of the NBFC’s business, activities and vulnerabilities should be taken into consideration so that the scenarios incorporate the major funding and market liquidity risks to which the NBFC is exposed. viii) Contingency Funding Plan An NBFC should formulate a contingency funding plan (CFP) for responding to severe disruptions which might affect the NBFC’s ability to fund some or all of its activities in a timely manner and at a reasonable cost. Contingency plans should contain details of available / potential contingency funding sources and the amount / estimated amount which can be drawn from these sources, clear escalation / prioritisation procedures detailing when and how each of the actions can and should be activated, and the lead time needed to tap additional funds from each of the contingency sources. ix) Public disclosure An NBFC should publicly disclose information (Appendix I) on a regular basis that enables market participants to make an informed judgment about the soundness of its liquidity risk management framework and liquidity position. x) Intra Group transfers With a view to recognizing the likely increased risk arising due to Intra-Group transactions and exposures (ITEs), the Group Chief Financial officer (CFO) is expected to develop and maintain liquidity management processes and funding programmes that are consistent with the complexity, risk profile, and scope of operations of the Group. The Group liquidity risk management processes and funding programmes are expected to take into account lending, investment, and other activities, and ensure that adequate liquidity is maintained at the head and each constituent entity within the group. Processes and programmes should fully incorporate real and potential constraints, including legal and regulatory restrictions, on the transfer of funds among these entities and between these entities and the principal. B. Management Information System (MIS) An NBFC should have a reliable MIS designed to provide timely and forward-looking information on the liquidity position of the NBFC and the Group to the Board and ALCO, both under normal and stress situations. It should capture all sources of liquidity risk, including contingent risks and those arising from new activities, and have the ability to furnish more granular and time-sensitive information during stress events. An NBFC shall have appropriate internal controls, systems and procedures to ensure adherence to liquidity risk management policies and procedure. Management should ensure that an independent party regularly reviews and evaluates the various components of the NBFC’s liquidity risk management process. a) For measuring and managing net funding requirements, the use of a maturity ladder and calculation of cumulative surplus or deficit of funds at selected maturity dates is adopted as a standard tool. The Maturity Profile should be used for measuring the future cash flows of NBFCs in different time buckets. The time buckets shall be distributed as under:

b) NBFCs would be holding in their investment portfolio, securities which could be broadly classifiable as 'mandatory securities' (under obligation of law) and other 'non-mandatory securities'. In case of NBFCs not holding public deposits, all investments in securities, and in case of NBFCs holding public deposits, the surplus securities (held over and above the requirement), shall fall in the category of 'non-mandatory securities'. Alternatively, the NBFCs may also follow the concept of Trading Book as per the extant prescriptions for NBFCs. c) Within each time bucket, there could be mismatches depending on cash inflows and outflows. While the mismatches up to one year would be relevant since these provide early warning signals of impending liquidity problems, the main focus shall be on the short-term mismatches viz., 1-30/31 days. The net cumulative negative mismatches in the Statement of Structural Liquidity in the maturity buckets 1-7 days, 8-14 days, and 15-30 days buckets should not exceed 10%, 10% and 20% of the cumulative cash outflows in the respective time buckets. NBFCs, however, are expected to monitor their cumulative mismatches (running total) across all other time buckets upto 1 year by establishing internal prudential limits with the approval of the Board. NBFCs shall also adopt the above cumulative mismatch limits for their structural liquidity statement for consolidated operations. d) The Statement of Structural Liquidity may be prepared by placing all cash inflows and outflows in the maturity ladder according to the expected timing of cash flows. A maturing liability shall be a cash outflow while a maturing asset shall be a cash inflow. e) In order to enable the NBFCs to monitor their short-term liquidity on a dynamic basis over a time horizon spanning from 1 day to 6 months, NBFCs shall estimate their short-term liquidity profiles on the basis of business projections and other commitments for planning purposes. E. Liquidity Risk Measurement – Stock Approach NBFCs shall adopt a “stock” approach to liquidity risk measurement and monitor certain critical ratios in this regard by putting in place internally defined limits as approved by their Board. The ratios and the internal limits shall be based on an NBFC’s liquidity risk management capabilities, experience and profile. An indicative list of certain critical ratios to monitor are short-term liability to total assets; short-term liability to long term assets; commercial papers to total assets; non-convertible debentures (NCDs)(original maturity of less than one year) to total assets; short-term liabilities to total liabilities; long-term assets to total assets; etc. Exchange rate volatility imparts a new dimension to the risk profile of an NBFC’s balance sheets having foreign assets or liabilities. The Board of NBFCs should recognise the liquidity risk arising out of such exposures and develop suitable preparedness for managing the risk. G. Managing Interest Rate Risk (IRR) NBFCs shall manage interest rate risk as per the extant regulatory prescriptions. H. Liquidity Risk Monitoring Tools The Statement of Structural Liquidity is currently one of the prescribed monitoring tools.In addition to this, the following tools shall be adopted by the Board of the NBFC for internal monitoring of liquidity requirements: a) Concentration of Funding This metric is meant to identify those significant sources of funding, withdrawal of which could trigger liquidity problems. The metric thus encourages diversification of funding sources and monitoring of each of the significant counterparty, significant product / instrument and significant currency. b) Available Unencumbered Assets This metric provides significant information on available unencumbered assets, which have the potential to be used as collateral to raise additional secured funding in secondary markets. It shall capture the details of the amount, type and location of available unencumbered assets that could serve as collateral for secured borrowing in secondary markets. c) Market-related Monitoring Tools

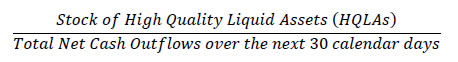

Liquidity Coverage Ratio (LCR) 1) Applicability In addition to the conditions laid down in Annex A of these guidelines, all non-deposit taking systemically important NBFCs with asset size above ₹ 50 billion and all deposit taking NBFCs shall adhere to the following guidelines while computing the Liquidity Coverage Ratio. 2) Definitions A) In these Directions, unless the context otherwise requires, the terms herein shall bear the meanings assigned to them below — i. “High Quality Liquid Assets (HQLA)” means liquid assets that can be readily sold or immediately converted into cash at little or no loss of value or used as collateral to obtain funds in a range of stress scenarios. ii. Liquidity Coverage Ratio (LCR) is represented by the following ratio:  iii. “Unencumbered” means free of legal, regulatory, contractual or other restrictions on the ability of the NBFC to liquidate, sell, transfer, or assign the asset. B) All other expressions unless defined herein shall have the same meaning as have been assigned to them under the Reserve Bank of India Act, 1934 or any statutory modification or re-enactment thereto or as used in commercial parlance, as the case may be. 3) General Guidelines A) An NBFC shall maintain an adequate level of unencumbered HQLA that can be converted into cash to meet its liquidity needs for a 30 calendar-day time horizon under a significantly severe liquidity stress scenario, as specified in these guidelines. B) LCR shall be maintained as at C) below on an ongoing basis to help monitor and control liquidity risk. C) The LCR requirement shall be binding on NBFCs from April 01, 2020, with the minimum LCR to be 60% , progressively increasing in equal steps till it reaches the required level of 100% , by April 1, 2024, as per the time-line given below:

D) The LCR shall continue to be minimum 100% (i.e., the stock of HQLA should at least equal total net cash outflows) on an ongoing basis with effect from April 01, 2024, i.e., at the end of the phase-in period. Provided that NBFCs shall have the option to use their stock of HQLA thereby allowing LCR to fall below 100% during a period of financial stress. Provided further that NBFCs shall immediately report to RBI (Department of Non-Banking Regulation as also Department of Non-Banking Supervision) such use of stock of HQLA during a period of financial stress along with reasons for such usage and corrective steps initiated to rectify the situation. E) The stress scenario for LCR intends to cover a combined idiosyncratic and market-wide shock that would result in:

4) High Quality Liquid Assets A) Liquid assets comprise of high quality assets that can be readily sold or used as collateral to obtain funds in a range of stress scenarios. They should be unencumbered. Assets are considered to be high quality liquid assets if they can be easily and immediately converted into cash at little or no loss of value. The liquidity of an asset depends on the underlying stress scenario, the volume to be monetized and the timeframe considered. Nevertheless, there are certain assets that are more likely to generate funds without incurring large discounts due to fire-sales even in times of stress. B) The fundamental characteristics of HQLAs include low credit and market risk; ease and certainty of valuation; low correlation with risky assets and listing on a developed and recognized exchange market. The market related characteristics of HQLAs include active and sizeable market; presence of committed market makers; low market concentration and flight to quality (tendencies to move into these types of assets in a systemic crisis). C) Assets to be included in the computation of HQLAs are those that the NBFC is holding on the first day of the stress period. Depending upon the nature of assets, they have been assigned different haircuts below, which are to be applied while calculating the HQLA for the purpose of calculation of LCR. The assets and the haircuts are as under: (I) Assets to be included as HQLA without any haircut: i. Cash ii. Government securities. iii. Marketable securities issued or guaranteed by foreign sovereigns satisfying all the following conditions: (a) Assigned a 0% risk weight by banks under standardized approach for credit risk; (b) Traded in large, deep and active repo or cash markets characterised by a low level of concentration; and proven record as a reliable source of liquidity in the markets (repo or sale) even during stressed market conditions. (c) Not issued by a bank/financial institution/NBFC or any of its affiliated entities. (II) Assets to be considered for HQLA with a minimum haircut of 15%:

(III) Assets to be considered for HQLA with a minimum haircut of 50%: i. Marketable securities representing claims on or claims guaranteed by sovereigns having risk weights higher than 20% but not higher than 50%, i.e., they should have a credit rating not lower than BBB-as prescribed for banks in India. ii. Common Equity Shares which satisfy all of the following conditions: (a) not issued by a bank/financial institution/NBFC or any of its affiliated entities; (b) included in NSE CNX Nifty index and/or S&P BSE Sensex index. iii. Corporate debt securities (including commercial paper) and the securities having usual fundamental and market related characteristics for HQLAs and meeting the following conditions: (a) not issued by a bank, financial institution, PD, NBFC or any of its affiliated entities; (b) have a long-term credit rating from an eligible credit rating agency between A+ and BBB- or in the absence of a long term rating, a short-term rating equivalent in quality to the long-term rating; (c) traded in large, deep and active repo or cash markets characterised by a low level of concentration; and (d) have a proven record as a reliable source of liquidity in the markets (repo or sale) even during stressed market conditions, i.e. a maximum decline of price not exceeding 20% or increase in haircut over a 30-day period not exceeding 20 percentage points during a relevant period of significant liquidity stress. D) For the purpose of computing LCR for deposit taking NBFCs, such assets reckoned as per the provisions of section 45 IB of RBI Act, would be available for HQLA purposes only to the extent of 80% of the required holding. E) All assets in the stock of liquid assets must be managed as part of that pool by the NBFC and shall be subject to the following operational requirements:

F) NBFCs should periodically monetize a proportion of assets through repo or outright sale to test the saleability of these assets and to minimize the risk of negative signalling during period of stress. NBFCs are also expected to maintain liquid assets consistent with distribution of their liquidity needs by currency. G) If an eligible liquid asset becomes ineligible (e.g. due to downgrade), NBFCs will be allowed to keep the asset in their stock of liquid assets for an additional 30 calendar days in order to have sufficient time to adjust the stock / replace the asset. 5) Total net cash outflows A) Total net cash outflows is defined as the total expected cash outflows minus total expected cash inflows for the subsequent 30 calendar days. Considering the unique nature of the balance sheet of the NBFCs, stressed cash flows is computed by assigning a predefined stress percentage to the overall cash inflows and cash outflows. Total expected cash outflows (stressed outflows) are calculated by multiplying the outstanding balances of various categories or types of liabilities and off-balance sheet commitments by 115% (15% being the rate at which they are expected to run off further or be drawn down). Total expected cash inflows (stressed inflows) are calculated by multiplying the outstanding balances of various categories of contractual receivables by 75% (25% being the rate at which they are expected to under-flow). However, total cash inflows will be subjected to an aggregate cap of 75% of total expected cash outflows. In other words, total net cash outflows over the next 30 days = Stressed Outflows - Min (stressed inflows; 75% of stressed outflows).

Computation of Net cash outflows

B) NBFCs will not be permitted to double count items, i.e., if an asset is included as part of the “stock of HQLA” (i.e., the numerator), the associated cash inflows cannot also be counted as cash inflows (i.e., part of the denominator). Where there is potential that an item could be counted in multiple outflow categories (e.g., committed liquidity facilities granted to cover debt maturing within the 30 calendar day period), an NBFC only has to assume up to the maximum contractual outflow for that product. 6) LCR Disclosure Standards A) NBFCs are required to disclose information on their LCR in their annual financial statements under Notes to Accounts, starting with the financial year ending March 31, 2020, for which the LCR related information needs to be furnished only for the quarter ending March 31, 2020. However, in subsequent annual financial statements, the disclosure should cover all the four quarters of the relevant financial year. The disclosure format is given in the Appendix I. B) Data must be presented as simple averages of monthly observations over the previous quarter (i.e., the average is calculated over a period of 90 days). However, with effect from the financial year ending March 31, 2022, the simple average should be calculated on daily observations. C) In addition to the disclosures required by the format given in Appendix I, NBFCs should provide sufficient qualitative discussion (in their annual financial statements under Notes to Accounts) around the LCR to facilitate understanding of the results and data provided. For example, where significant to the LCR, NBFCs could discuss: (a) the main drivers of their LCR results and the evolution of the contribution of inputs to the LCR’s calculation over time; (b) intra-period changes as well as changes over time; (c) the composition of HQLAs; (d) concentration of funding sources; (e) derivative exposures and potential collateral calls; (f) currency mismatch in the LCR; (g) other inflows and outflows in the LCR calculation that are not captured in the LCR common template but which the institution considers to be relevant for its liquidity profile. 1 “Liquidity Risk” means inability of an NBFC to meet such obligations as they become due without adversely affecting the NBFC’s financial condition. Effective liquidity risk management helps ensure an NBFC’s ability to meet its obligations as and when they fall due and reduces the probability of an adverse situation developing. 2 “Liquidity” means NBFC’s capacity to fund the increase in assets and meet both expected and unexpected cash and collateral obligations at reasonable cost and without incurring unacceptable losses. |

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: