IST,

IST,

what's-new

-

ఫిబ్ర 27, 2026Quarterly Basic Statistical Return (BSR)-1 on Credit by Scheduled Commercial Banks – December 2025Quarterly Basic Statistical Return (BSR)-1 on Credit by Scheduled Commercial Banks – December 2025

-

ఫిబ్ర 27, 2026Quarterly Basic Statistical Return (BSR)-2 on Deposits with Scheduled Commercial Banks - December 2025Quarterly Basic Statistical Return (BSR)-2 on Deposits with Scheduled Commercial Banks - December 2025

-

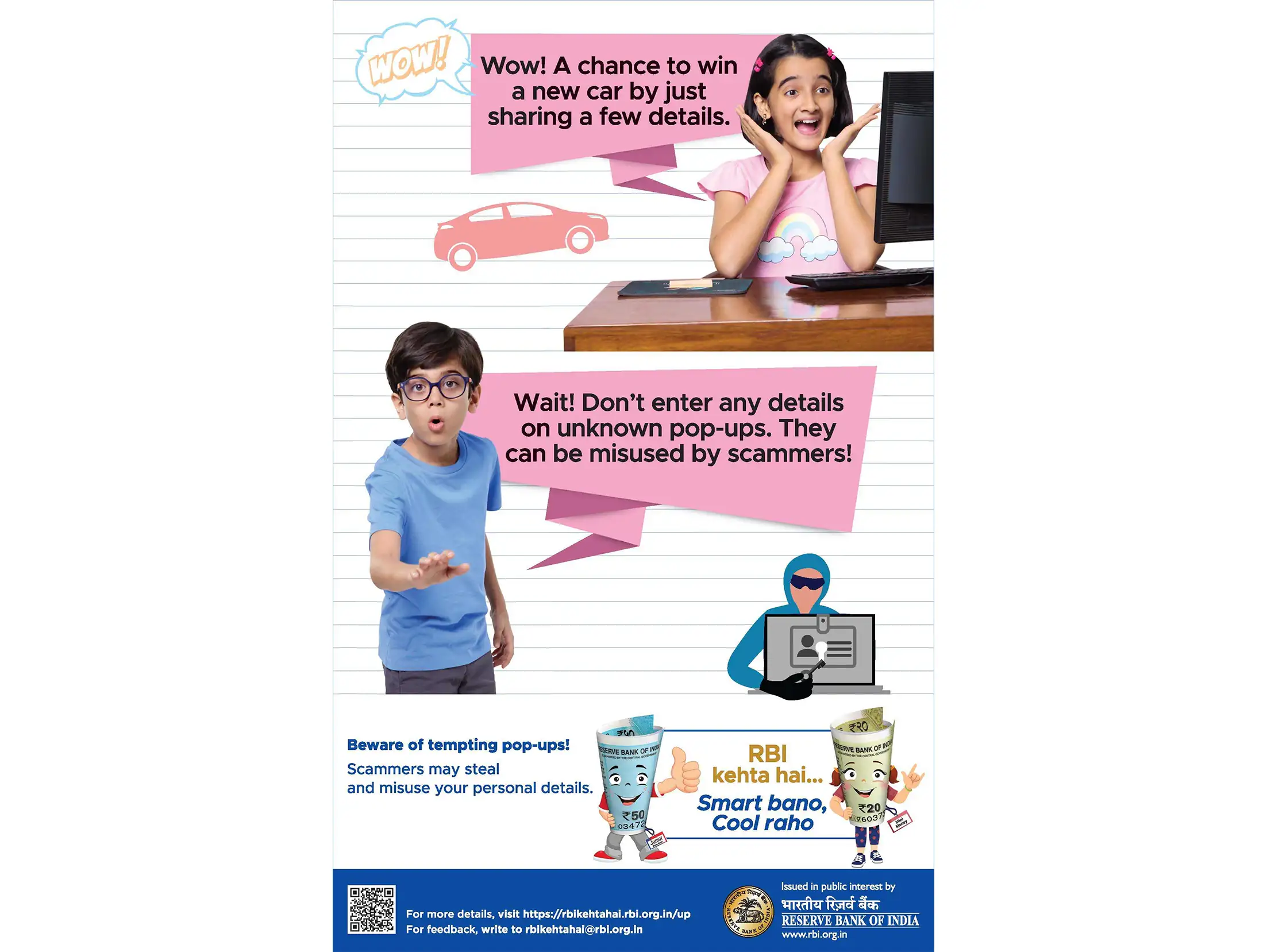

ఫిబ్ర 26, 2026Workshop on Digital / Cyber FraudsWorkshop on Digital / Cyber Frauds

-

ఫిబ్ర 25, 2026Performance of Private Corporate Business Sector during Q3:2025-26Performance of Private Corporate Business Sector during Q3:2025-26

-

ఫిబ్ర 24, 2026Perspectives on India’s Growth: Last Four Decades to the Present - Speech by Dr. Poonam Gupta, Deputy Governor, Reserve Bank of India - delivered at the 14th Foundation Day Lecture of the Centre for Development Studies (CDS) on Friday February 20, 2026 at Centre for Development Studies, ThiruvananthapuramPerspectives on India’s Growth: Last Four Decades to the Present - Speech by Dr. Poonam Gupta, Deputy Governor, Reserve Bank of India - delivered at the 14th Foundation Day Lecture of the Centre for Development Studies (CDS) on Friday February 20, 2026 at Centre for Development Studies, Thiruvananthapuram

-

ఫిబ్ర 23, 2026Finance Minister addresses the Central Board of Directors of Reserve Bank of IndiaFinance Minister addresses the Central Board of Directors of Reserve Bank of India

-

ఫిబ్ర 20, 2026RBI Bulletin – February 2026RBI Bulletin – February 2026

-

no-upcoming-msg

Current Rates

-

Policy Rates

-

Reserve Ratios

-

Exchange Rates

-

Lending/Deposit Rates

-

Market Trends

As on

%

Activating the following links will update the graph above.

As on

%

Activating the following links will update the graph above.

As on

%

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

MONEY MARKET :

CAPITAL MARKET :

GOVERNMENT SECURITIES MARKET :

View RBI developments on Social Media