IST,

IST,

Minutes of the Monetary Policy Committee Meeting February 3-5, 2021

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The twenty seventh meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from February 3 to 5, 2021. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Mridul K. Saggar, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. Dr. Shashanka Bhide, Dr. Ashima Goyal and Prof. Jayanth R. Varma joined the meeting through video conference. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting on February 5, 2021 decided to:

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. The global economic recovery slackened in Q4 (October-December) of 2020 relative to Q3 (July-September) as several countries battle second waves of COVID-19 infections, including more virulent strains. With massive vaccination drives underway, risks to the recovery may abate and economic activity is expected to gain momentum in the second half of 2021. In its January 2021 update, the International Monetary Fund (IMF) has revised upward its estimate of global growth in 2020 to (-)3.5 per cent from (-) 4.4 per cent and increased the projection of global growth for 2021 by 30 basis points to 5.5 per cent. Barring some emerging market economies, inflation remains benign on weak aggregate demand, although rising commodity prices carry upside risks. Financial markets remain buoyant, supported by easy monetary conditions, abundant liquidity and optimism from the vaccine rollout. Global trade is also expected to rebound in 2021, with services trade on a slower recovery than merchandise trade. Domestic Economy 7. The first advance estimates of GDP for 2020-21 released by the National Statistical Office (NSO) on January 7, 2021 estimated real GDP to contract by 7.7 per cent, in line with the projection of (-)7.5 per cent set out in the December 2020 resolution of the MPC. High frequency indicators – railway freight traffic; toll collection; e-way bills; and steel consumption – suggest that revival of some constituents of the services sector gained traction in Q3 (October-December). The agriculture sector remains resilient - rabi sowing was higher by 2.9 per cent year-on-year (y-o-y) as on January 29, 2021, supported by above normal north-east monsoon rainfall and adequate reservoir level of 61 per cent (as on February 4, 2021) of full capacity, above the 10 years average of 50 per cent. 8. After breaching the upper tolerance threshold of 6 per cent for six consecutive months (June-November 2020), CPI inflation fell to 4.6 per cent in December on the back of easing food prices and favourable base effects. Food inflation collapsed to 3.9 per cent in December after averaging 9.6 per cent during the previous three months (September-November) due to a sharp correction in vegetable prices and softening of cereal prices with kharif harvest arrivals, alongside supply side interventions. On the other hand, core inflation, i.e. CPI inflation excluding food and fuel remained elevated at 5.5 per cent in December with marginal moderation from a month ago. In the January 2021 round of the Reserve Bank’s survey, inflation expectations of households softened further over a three month ahead horizon in tandem with the moderation in food inflation; one year ahead inflation expectations, however, remained unchanged. 9. Systemic liquidity remained in large surplus in December 2020 and January 2021, engendering easy financial conditions. Reserve money rose by 14.5 per cent y-o-y (on January 29, 2021), led by currency demand. Money supply (M3), on the other hand, grew by only 12.5 per cent as on January 15, 2021, but with non-food credit growth of scheduled commercial banks accelerating to 6.4 per cent. Corporate bond issuances at ₹5.8 lakh crore during April-December 2020 were higher than ₹4.6 lakh crore in the same period of last year. India’s foreign exchange reserves were at US$ 590.2 billion on January 29, 2021 – an increase of US$ 112.4 billion over end-March 2020. Outlook 10. With the larger than anticipated deflation in vegetable prices in December bringing down headline closer to the target, it is likely that the food inflation trajectory will shape the near-term outlook. The bumper kharif crop, rising prospects of a good rabi harvest, larger winter arrivals of key vegetables and softer egg and poultry demand on avian flu fears are factors auguring a benign inflation outcome in the months ahead. On the other hand, price pressures may persist in respect of pulses, edible oils, spices and non-alcoholic beverages. The outlook for core inflation is likely to be impacted by further easing in supply chains; however, broad-based escalation in cost-push pressures in services and manufacturing prices due to increase in industrial raw material prices could impart upward pressure. Furthermore, there could be increased pass-through to output prices as demand normalises as indicated in the Reserve Bank’s industrial outlook, services and infrastructure outlook surveys and purchasing managers’ indices (PMIs) and firms regain pricing power. International crude oil prices may remain supported by demand build up on optimism from vaccination and continuing production cuts by OPEC plus. The crude oil futures curve has become downward sloping since December 2020. Taking into consideration all these factors, the projection for CPI inflation has been revised to 5.2 per cent in Q4:2020-21, 5.2 per cent to 5.0 per cent in H1:2021-22 and 4.3 per cent in Q3: 2021-22, with risks broadly balanced (Chart 1). 11. Turning to the growth outlook, rural demand is likely to remain resilient on good prospects of agriculture. Urban demand and demand for contact-intensive services is expected to strengthen with the substantial fall in COVID-19 cases and the spread of vaccination. Consumer confidence is reviving and business expectations of manufacturing, services and infrastructure remain upbeat. The fiscal stimulus under AtmaNirbhar 2.0 and 3.0 schemes of government will likely accelerate public investment, although private investment remains sluggish amidst still low capacity utilisation. The Union Budget 2021-22, with its thrust on sectors such as health and well-being, infrastructure, innovation and research, among others, should help accelerate the growth momentum. Taking these factors into consideration, real GDP growth is projected at 10.5 per cent in 2021-22 – in the range of 26.2 to 8.3 per cent in H1 and 6.0 per cent in Q3 (Chart 2).  12. The MPC notes that the sharp correction in food prices has improved the food price outlook, but some pressures persist, and core inflation remains elevated. Pump prices of petrol and diesel have reached historical highs. An unwinding of taxes on petroleum products by both the centre and the states could ease the cost push pressures. What is needed at this point is to create conditions that result in a durable disinflation. This is contingent also on proactive supply side measures. Growth is recovering, and the outlook has improved significantly with the rollout of the vaccine programme in the country. The Union Budget 2021-22 has introduced several measures to provide an impetus to growth. The projected increase in capital expenditure augurs well for capacity creation thereby improving the prospects for growth and building credibility around the quality of expenditure. The recovery, however, is still to gather firm traction and hence continued policy support is crucial. Taking these developments into consideration, the MPC in its meeting today decided to continue with an accommodative stance of monetary policy till the prospects of a sustained recovery are well secured while closely monitoring the evolving outlook for inflation. 13. All members of the MPC – Dr. Shashanka Bhide; Dr. Ashima Goyal; Prof. Jayanth R. Varma; Dr. Mridul K. Saggar; Dr. Michael Debabrata Patra; and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged at 4 per cent. Furthermore, all members of the MPC voted to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 14. The minutes of the MPC’s meeting will be published by February 22, 2021. 15. The next meeting of the MPC is scheduled during April 5 to 7, 2021.

Statement by Dr. Shashanka Bhide 16. The First advance estimates (FAE) of GDP for 2020-21 released by the National Statistical Office (NSO) on January 7, 2021 place the annual growth of GDP in constant prices at -7.7 per cent over the previous year. The NSO notes that these estimates are likely to see sharp revisions in view of the limitations of the data used, in the context of the Covid-19 pandemic. The official estimates of GDP for Q3: 2020-21 are expected to be available only in the last week of February along with the Second Advance Estimates for 2020-21. 17. The sectoral level breakup of annual output growth reveals that the steepest decline in FY 21 is in the services (including construction) by 9.2% followed by a decline of 8.5 per cent in industry over the previous year. Agriculture & Allied Sectors GVA increased by 3.4 per cent as per FAE. Key to projected sustained recovery in output performance in FY21 after the sharp decline in Q1 remains with (1) sustained growth of agriculture and allied activities and (2) output of industry and services in H2: FY21 reaching close to the levels of H2: FY20. 18. The pattern of growth recovery across sub-sectors of the economy points to the emergence of sustained recovery, although there are risks associated with the nascent nature of the recovery, which requires support from both its internal dynamics and exogenous factors. Internal dynamics refers to the interlinkages across sectors and the supply chains including global linkages and translation of improving supply conditions to investment decisions. As many of the external restrictions on movement and activities due to the pandemic are now lifted, the impact of such liberalisation is evident in many indicators available for Q3: 2020-21. The indicative results on sales or turnover for a sample of 445 listed non-financial private companies indicate positive growth in the case of manufacturing and IT firms. In the case of non-IT services firms, sales growth in Q3 is negative but less contractionary than Q2: 2020-21. A survey of manufacturing companies by RBI shows improved capacity utilisation for Q3: 2020-21. High frequency data for the months of October-December show high year on year growth rates for railway freight e-way bills, and trade transactions reflected in the GST collections. In the case of e-way bills and GST collections the growth rates are slightly lower in January 2021 but remain high. The important concerns relate to the demand conditions. The rise in demand in the ‘festival season’ played its part in catalysing consumer demand during September-November period and sustaining this demand requires restoration of household income and employment. 19. The surveys of business sentiments and outlook indicate improvement in the business conditions from the severe shock in Q1: 2020-21. The RBI’s survey of enterprises (Industrial Outlook Survey) shows improvement in demand conditions in Q3: 2020-21 in the case of manufacturing, services and infrastructure. Demand conditions are expected to improve further in Q4: 2020-21 and in the first two quarters of 2021-22. Business sentiments are clawing back to the levels seen just before the onset of lockdowns due to the pandemic. Enterprise survey indicates that firms are planning to hire more workers and the staff costs in the case of organised sector show increase in Q3: 2020-21 year-on-year basis, compared to the decline in the previous quarter. The overall picture that emerges is one of improving business conditions and expectations of sustaining this trend into the next few quarters. 20. One of the pre-requisites of sustained economic recovery is the control over the pandemic. The recent data suggests that the incidence of new infections has declined. However, the experience in several countries suggests that there is need to be cautious on this score and the decline in new infections and mortality cannot be taken for granted, especially in view of the new strains of the Corona virus. Availability of vaccines has provided much needed confidence that the pandemic would give way to restoration of normal economic life, even if gradually. The ongoing recovery, based on the perceptions of decline of new infections, will require all measures to sustain this decline in reality. Accelerated progress of vaccinations and access to the key health services to battle new infections would be a crucial factor in maintaining the confidence of producers and consumers in the economy. 21. The cautious consumption expenditure outlook is reflected in the findings of RBI’s Consumer Confidence Surveys. The improvement in Consumer Confidence reflected in the assessment of expenditure is significant in the longer one-year horizon than the present situation. The improvement seen in November 2020 dropped marginally in January 2021 survey, both in the current period and one year ahead. As per the FAE, the government final consumption expenditure rose by 5.8 per cent in FY21 as a whole, while the private final consumption expenditure declined. 22. While measures to address the local and domestic conditions related to both the economy and the pandemic have borne fruit, the global conditions appear diverse as far as the pandemic is concerned. While the vaccinations are making progress in the Advanced Economies, there has been a rise in Covid infections in the winter months. The World Economic Outlook by IMF has projected the world output to rise in 2021 by 5.5 per cent after the decline by 3.5 per cent in 2020. The output growth in 2021 after the decline in 2020 is projected for both Advanced Economies and Emerging Market Economies. Among the major economies, only China has managed to show a positive output growth in 2020. The World Trade Volumes of goods and services are also expected to recover from the steep decline in 2020. The global demand scenario has become optimistic but will face the challenge of restoring the disrupted supply chains. 23. Recovery in investment demand is a key factor in sustaining the economic recovery. As per the FAEs, the Gross Fixed Capital Formation (GFCF) declined by 14.5 per cent in FY 21, year on year basis. The GFCF had also decreased, year on year basis, in 2019-20 based on provisional estimates for 2019-20. The IIP for capital goods increased in October 2020, year-on-year basis, for the first time after December 2018. The IIP for infrastructure and construction goods, linked to investment spending has also shown positive growth in the two consecutive months, September and October 2020. Part of the explanation for the weak investment demand appears to be weak capacity utilisation in industry. Therefore, sustaining the on-going improvement in the demand conditions to restore capacity utilisation levels is necessary to catalyse investment demand. The strong FDI inflows in April-November 2020, surpassing the levels in the same period a year back point to the attractiveness of investment in the country but revival of the broader domestic investments is yet to be realised. 24. The Union Budget 2021-22 has laid out a number of growth orientated policies and programs, that include increased expenditure in specific sectors and also capital expenditure. Given the sharp reduction in revenues in FY21, the fiscal consolidation path now sets the fiscal deficit target below 4.5 per cent of GDP by 2025-26 from 9.5 per cent in FY21 and budget estimate of 6.8 per cent for FY22. High rates of economic growth sustained over the medium term will be needed to achieve fiscal consolidation. 25. The need for revival of economic activities back to the pre-pandemic levels and then at a pace that is consistent with income and employment goals remains prominent in the present economic policies. As the supply side restrictions are lifted, revival of demand in terms of consumption, investment and exports is needed to sustain economic recovery. 26. The recovery of economic activity from the pandemic shock has also been accompanied by relatively high rates of retail inflation. Between June and November 2020, the inflation rate has ranged between 6.2 and 7.6 per cent, in each month. The rate declined in December 2020 to 4.6 per cent. While the recent rise and decline in the inflation rate were amplified by food inflation, the core inflation has remained between 5.4-5.9 per cent during July - December 2020. The prospect of good rabi crop harvest is expected to exert downward pressure on the agricultural commodity prices in the coming months. Easing of the pressures in the non-food sector will require easing of some of the key input costs such as transportation services and energy, both by improved supply conditions and productivity. Easing the price pressures in the non-food sector will be required to achieve revival of consumer demand as well. 27. The present scenario reflects continued revival of the economy after the severe decline in GDP in Q1: 2020. For the financial year 2020-21 as a whole, the FAE by NSO estimate GDP to decline by 7.7 per cent over the previous year, indicating the severity of the shock in Q1. The economy is expected to reach the GDP level of Q3 of 2019-20 by the third quarter of 2020-21. The sustained economic recovery will require continued decline in the number of Covid infections to regain consumer confidence with successful roll out of vaccinations being a key strategy to achieve this. 28. Accommodative monetary policy stance is needed to strengthen ongoing economic recovery enabling expansion of both output and demand. 29. I vote in support of the resolution to keep the policy repo rate unchanged at 4 per cent and further to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Statement by Dr. Ashima Goyal 30. In the months since the December 2020 MPC meeting growth has exceeded market expectations and headline inflation has also come in below expectations, falling within the MPC tolerance band after 6 months. The country has done well in avoiding a second peak until now under a well-sequenced gradual unlock, careful testing and tracing. Its vaccination drive has begun. New more deadly variants of the virus remain a risk, however, requiring continuing care and acceleration of vaccination. 31. Although growth has turned positive, output levels remain below 2019 levels. Excess capacity continues, supply chains have room to normalize much further, and unemployment rates have increased despite a recovery in employment, because of the rise in labour participation rates as willingness to work rose with the waning of Covid-19 fears. While corporate India has done well, and consumer confidence is reviving, reliable data is still awaited on the resilience of the informal sector. 32. The timing and sequence of policy support has been crucial over the last year. Early liquidity support, moratorium and government warranties were vital for survival. Some of these measures have been reversed yet the financial sector remains healthy. Banks are reporting much lower than expected NPA growth as well as restructured loans as the early revival has enabled repayment. 33. Short term rates have risen to the reverse repo rate reducing risks, US Treasury bill rates are also moving up yet Indian long term rates, more important for demand, remain low and plentiful liquidity continues to sustain activity. Excess liquidity with the financial system is absorbed at the Reverse Repo window, or using other instruments, implying risk created is minimal. Money supply growth remains moderate, even as there is some rise in credit growth through diverse instruments. Quick response and very gradual withdrawal is a mantra that works for macroeconomic policy as well as for India’s response to Covid-19. 34. Supply chains improved after unlock 4 in September 2020, which prevented states from imposing arbitrary restrictions on inter-state travel, in time for the festival demand stimulus. Public spending could take a backseat in Q2 and has revived in Q3. In Q4 and over the next year it has sought to increase the share of investment, which has a larger multiplier since it also improves the supply-side, thus lowering inflation and enabling monetary support through lower interest rates1. The budget stimulus is largely through better quality spending, while the deficit itself reduces moderately. This relative fiscal conservatism also enables monetary policy flexibility to keep borrowing costs low. 35. Inflation presents a mixed picture. Prices of many food products have softened bringing down headline inflation. Profiteering in retail supply has not been able to withstand excess supply, although data shows only the beginning of reduction in retail margins. 36. Core inflation, however, remains near the upper band. The severe winter Covid-19 second spikes in many countries have kept global supply chains disrupted and raised prices of many intermediate goods and commodities. As demand revives local firms are able to pass on the rise in costs. But this is likely to be temporary, although uncertainty remains about the timeline. Rapid vaccination is already moderating spikes abroad making room for the supply response to improve. Oil has a much faster supply response now because of shale oil as well as green substitutes, capping future rise in prices. Gold prices that impact Indian core inflation are falling as vaccination spreads. 37. For the last so many years manufacturing inflation has been low in India—a factor responsible for the wide gap between WPI and CPI inflation. One reason is India is a very competitive price sensitive market. Manufacturers pricing power is temporary and will not survive the full resumption of supply it will attract. Many firms have reduced costs over the last year, which also gives them the ability to absorb some rise in input prices. Mark-ups tend to be counter-cyclical, falling as capacity utilization rises and fixed costs are spread. 38. The fall in short-term household inflation perceptions shows that households are observing improvements in retail supply—as yet more for perishables. Sustained double-digit one year ahead inflation expectations seem to be due to higher uncertainty since the dispersion across households’ expectations has risen. There is evidence of some success in anchoring expectations in the inflation targeting period2. That inflation has returned within the tolerance band even in the very difficult Covid-19 period should further improve its credibility and reduce uncertainty. 39. The current macroeconomic configuration and its expected future evolution as outlined above implies there is space for the MPC to continue to support the revival of the economy with inflation remaining in the target band. Therefore, I vote to maintain the status quo in policy rate and stance. Statement by Prof. Jayanth R. Varma 40. I support maintaining the policy rate at its current level and I also support the accommodative stance as these decisions are consistent with the forward guidance provided by the MPC in its last two meetings (October and December 2020). With both inflation and growth outcomes being well within the range of expectations of the MPC, and short term interest rates being within the corridor defined by the repo and reverse repo rate, there is nothing to be done and there is nothing to be said as of now. The MPC must of course continue to be data driven and must continue to monitor future developments carefully. Statement by Dr. Mridul K. Saggar 41. The MPC call to hold policy rates despite inflation staying elevated above the upper tolerance level during H2 of 2020 was based on the assessment that inflation will recede going forward. This was a difficult call given the observed persistence in inflation. It enabled the monetary policy to afford a countercyclical support to growth in a rather critical period that could otherwise have resulted in extensive scaring of big and small businesses and a large hysteresis in aggregate output. Had this happened, India’s growth trajectory would have been pulled down for a long time to come. 42. There was recognition of risks while taking this call, especially as there was some evidence that price pressures were starting to get distended with elements of cost-push pressures emerging. Nevertheless, when CPI data was available only till August, in my statement at the October MPC I stated that vegetable prices should correct starting December. Vegetable prices dropped 15.7 per cent month-over-month in December, bringing headline inflation down from 6.9 per cent to 4.6 per cent - within the tolerance band for the first time in seven months. This inflation correction bears testimony to careful projections and judgment that by keeping policy accommodative, enabled avoiding what could have been a costly policy mistake. 43. Since monetary policy is forward-looking, there is little point in looking back except for the limited purpose of drawing lessons. Given the long and variable transmission lags, we now need to focus on carefully assessing not just the baseline inflation trajectory but also the risks to it, the nature of inflation and its internals going forward. 44. Two things are noteworthy. First, bulk of the food-price correction in CPI has already happened. From the DCA data till January it looks that food prices are at near bottom and though they may start firming up from Q1:2021-22 with some price build up aided partly from firming food and non-food international commodity prices, high food inflation like last year is unlikely to be repeated. However, cost-push increases may come from higher crude oil prices that will feed into costs, especially fertiliser prices and as they get factored in MSPs. 45. Second, some upside risk to inflation comes from core inflation stickiness and its persistence at elevated levels that may make the task of keeping the headline at the 4 per cent target a challenging one. There is evidence that firms are able to pass on cost push increases by raising retail prices. Early corporate results for Q3:2020-21 suggests that margins are rising steeply in automobiles and components, metals, chemicals, capital goods, health care services, telecommunication and real estate. Not all of this is through cost saving. Price hikes have been reported in items of iron ore, steel, automobiles, yarn, textiles, chemical and chemical products, rubber products besides oilseeds and edible oils, some of which may get reflected in next three months in WPI and CPI indices. Mineral oil prices have also witnessed increases. 46. There is a significant probability that global oil prices may turn out to be markedly higher than the current prevailing prices given the possibility of a large US dollar depreciation this year and signals sent last month by the largest OPEC oil producer by announcing additional supply restraint. Even though the relationship between dollar movements and oil prices has relatively weakened in recent years, the large dollar invoicing of global commodities trade can not only cause an upswing in commodity prices but through financial market interdependencies may cause ripple effects in asset prices, inflation and business cycles. Effect on equities of changes in global nominal and real bond yields and financial market spillovers to EMEs may particularly cause macroeconomic shifts. How the challenges of trilemma amid capital flow volatility are handled with less than corner solutions will influence the monetary policy and inflation outcomes, though a weaker dollar ceteris paribus also means stronger rupee, which will somewhat offset the effect of firmer global oil prices. 47. However, one can draw considerable comfort from the fact that the core inflation stickiness is embedded in our baseline projections and fully accounts for the trend in momentum. Also, empirical exercises suggest that while the passthrough from 1 per cent change in WPI non-food manufactured products inflation to CPI core goods inflation is likely to be about 0.20 per cent, the passthrough is much less for overall CPI core inflation and even lesser to headline CPI inflation. However, this passthrough is time varying and depends on output gap. When IIP output gap is positive, the passthrough on an average is about double that when it is negative. Though strong momentum in core goods CPI has taken its inflation to 6.9 per cent, some solace comes from the fact that ex-gold, petrol. diesel and liquor, the core goods inflation is only at 4.9 per cent. Also, as contact services may take long to normalise, core services inflation is unlikely to surge in near term. So, as of now the risks of headline inflation coming back are, therefore, contained in line with our projections. 48. So, let me turn to growth. I will just make two points. First, faster than anticipated, most manufacturing and rural high frequency indicators have already normalised past pre-pandemic levels. However, services sector indicators such as commercial vehicle sales, registration of transport vehicles, three-wheeler sales, domestic and international air passenger traffic, international cargo, railway passenger traffic, retail and recreation and foreign tourist arrivals are languishing much below those levels. Second, hysteresis is visible to some degree with anecdotal evidence of some micro-enterprises and informal unincorporated household enterprises having permanently closed production shops. Quantitative estimates using a range of methods show that even without further disruptions, output gap is unlikely to close before 3Q:2021-22 and more likely only by the end of the next fiscal year. As growth is still fragile, support to it need to be extended into Q1:2021-22 and longer if necessary, though with risk of a re-calibration in some scenarios such as one in which core inflation momentum picks up further. Since this is not the baseline and the announced exit dates for various measures are planned at a very gradual pace, the process of change in policy can be non-disruptively achieved. 49. In my October statement, I had stated that as fiscal authorities have a first mover advantage in the game of chickens, monetary policy will naturally have to factor this to avert Nash equilibria. With the second successive year of very large gross market borrowing, this is even more important. Monetary policy will need to lean against the wind to keep interest rates low to the extent possible. If central bank open market operation purchases are moderate, it entails the risk of crowding out of private investment; if they are large, it carries risk of reengineering inflation. However, with capacity utilisation rate currently at 63 per cent in Q2:2020-21 and likely to be about 70 per cent by end of the year, capex funding need of private sector are currently limited and the monetary-fiscal coordination to support a larger public investment that can crowd-in private investment can work so long as it is followed by an unflinching commitment to strong fiscal consolidation thereafter. 50. In conclusion, going forward, while efforts should continue to extend output expansion and close output gap, a necessary concomitant for monetary policy is to secure price stability. With headline inflation having already corrected as supply shocks have substantially faded, keeping inflation around the target is the best contribution monetary policy can make to fortify and sustain growth. In my statement, I have focussed more on risks than the baseline. In my view, the baseline is still consistent with supporting growth through accommodative policy stance in near term. Therefore, I vote to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 per cent. I also vote for retaining the accommodative stance and accompanying forward guidance. Statement by Dr. Michael Debabrata Patra 51. Macroeconomic configurations have shifted and brightened the outlook. Estimates/projections indicate that GDP growth may have attained positive territory in the second half of 2020-21, mainly on the back of a surge in government expenditure but contractions in private consumption spending are also easing and net exports are finally emerging out of a long retrenchment. Foreign investment flows are already scenting the imminent upturn. On the supply side, agriculture and allied activities are clearly demonstrating resilience in the face of the pandemic, and manufacturing activity is gradually limping back to growth on the back of recovery in sales. This is also evident in rising capacity utilization. With stronger demand conditions and still moderate costs, operating profits are improving across the board. Some categories of services such as information technology, construction, real estate, finance, domestic trade and transport are slowly healing from the deep scars left by the virus but several other categories of services remain deeply wounded due to their contact-intensity. Consumer and business confidence is either cautiously returning to expansion or already in it. These developments vindicate the stance of monetary policy. 52. The most heartening feature of the recent shifts is the large fall in inflation, taking it closer to the target after 6 months of persisting outside the tolerance band. If the sharp disinflation in vegetable prices extends into the spring, headline inflation can ease further, empowering the conduct of monetary policy. Meanwhile, mending of supply chains and normalization of activity is underway, especially recouping of lost incomes by both households and businesses, and that is keeping mark-ups and blue-collar wages elevated. It is worthwhile to note that households have internalised this outcome in their near-term inflation expectations polled in January 2021 – while current inflation perceptions and expectations three months ahead have declined, those for a year ahead remain flat amidst considerable uncertainty. 53. Upside risks to the outlook for inflation persist. First, core inflation remains stubborn and will warrant close monitoring as it has the potential to render the recent fortuitous improvements in the macroeconomic outlook stillborn. Second, rising international commodity prices are being watched the world over with concern as heralding the return of inflation. For India, the relentless hardening of international crude prices is worrisome, especially as their impact on inflation is amplified by disproportionately high excise duties. Third, crude and other commodity prices are translating into higher inputs costs, especially in an environment in which demand is recovering. Pricing power could gain bite as normal demand flows gather traction. Fourth, the flush of capital flows favouring emerging market economies, including India, has imparted volatility to asset prices and increased the risks of imported inflation. 54. Overall, the near-term outlook for inflation appears less risky than the near-term challenges for growth which warrant continuing policy support, at least until the elusive engine of investment fires and consumption, the mainstay of aggregate demand in India, stabilizes. Trade-offs facing the conduct of monetary policy may become sharper in the near-term, however. First, shocks to economic activity from the winding down of exceptional pandemic measures will have to be balanced against the persuasive incentive to continue with them but with the risk of becoming immobilized in liquidity traps. Second, concerns about financial stability have risen. The recent new highs scaled by equity markets could be driven by irrational exuberance; it is difficult to tell in an environment of exceptionally low interest rates all around, large corporate profits but still no capex to write home about, and high levels of market borrowings. Banks have stronger capital buffers than during the global financial crisis, but stress in the financial sector’s balance sheets could intensify as the camouflage of moratorium, asset classification standstill and restructuring fades. Capital infusion and innovative ways of dealing with potential loan delinquencies need to occupy the highest policy attention so that the embryonic recovery in credit growth can be nurtured into a more durable trajectory that also fuels the macroeconomic recovery. Strong complementarities are emerging between financial and macroeconomic stability. The best results will obtain when monetary policy ensures that the nominal anchor is firmly moored. 55. Against this backdrop, I vote for keeping the policy rate unchanged and for maintaining the accommodative stance of policy. Statement by Shri Shaktikanta Das 56. The macroeconomic environment – in terms of both growth and inflation – turned out to be better than anticipated since the December 2020 meeting of the MPC. These outcomes, along with the sharp reduction in COVID-19 infections in the country and the rollout of the vaccination programme, have brightened the outlook even though some uncertainties remain. The Union Budget 2021-22 has given further impetus through a qualitative shift in expenditure which will boost overall investment with multiplier effects on growth. Foreign direct investment and foreign portfolio investment to India have surged in recent months, reposing faith in an impressive recovery of the Indian economy. 57. On the global economy front, the International Monetary Fund (IMF), in its January 2021 update, has revised upward its projection of global growth for 2021 which augurs well for our external demand and exports. 58. High frequency indicators suggest that the economic recovery is normalising fast in both rural and urban areas. The agricultural sector has been resilient throughout the pandemic and its prospects appear bright in view of higher rabi sowing and comparatively better reservoir levels. Manufacturing activity is picking up. Although initial revival was propelled by pent-up demand, indications are that growth impulses are now being driven by pick-up in activity across manufacturing and services. Forward looking surveys conducted by the Reserve Bank signal greater optimism from manufacturing with the expectation of an expansion in production volumes and new orders in Q4:2020-21 and the following two quarters. The purchasing managers’ index for manufacturing is in expansionary zone and was above its long-period average in January 2021. 59. Trends in railway freight traffic, toll collection, goods and service tax collections, e-way bills and steel consumption suggest that services sector activity is also recovering. The purchasing managers’ index for services is in the expansion territory. Services and infrastructure sector reported increase in turnover in Q3 and expected further improvement through Q2:2021-22 as reported by firms participating in the Reserve Bank’s services and infrastructure survey. 60. The multiple dimensions of normalisation of economic activity, as reflected in the movement of coincident and proximate high frequency indicators, suggest that in 2021-22 the Indian economy will expand by about 10.5 per cent over 2020-21. These projections are based on the assessment of multispeed recovery which is underway, wherein some sectors are witnessing smart recovery, while consumption in contact intensive sectors, being discretionary in nature, could be postponed in near to medium-term. 61. Inflation which remained above the upper tolerance threshold of 6 per cent consecutively since June 2020, registered a larger than anticipated softening to 4.6 per cent in December, a drop by 2.3 percentage points from the November reading of 6.9 per cent. Around 90 per cent of this fall in headline inflation in December was on account of sharp movement of vegetables into double-digit deflation as prices crashed from highly elevated levels supported by robust winter arrivals and favourable base effect. This trend is likely to be further buttressed by an expected bumper kharif harvest and the rising prospects of a good rabi crop. Further softening in food inflation – both substantial and durable – would, however, be dependent upon the abatement of price pressures that are currently seen in pulses, edible oils, spices, and non-alcoholic beverages. 62. CPI inflation excluding food and fuel remained elevated at 5.5 per cent in December, due to inflationary impact of rising crude oil prices and high indirect tax rates on petrol and diesel, and pick-up in inflation of key goods and services, particularly in transport and health categories. Proactive supply side measures, particularly in enabling a calibrated unwinding of high indirect taxes on petrol and diesel – in a co-ordinated manner by centre and states – are critical to contain further build-up of cost-pressures in the economy. 63. Domestic financial conditions continued to remain accommodative to help nurture the recovery. The liquidity provision of ₹12.9 lakh crore (comprising 6.3 per cent of nominal GDP of 2019-20) since February 6, 2020 has kept systemic liquidity in surplus mode with average daily net absorptions under the liquidity adjustment facility (LAF) at around ₹5.9-6.0 lakh crore in December-January. Reflecting the various liquidity management measures, domestic financial conditions have eased considerably as reflected in the narrowing of term and risk premia in various market segments. Reserve money rose by 14.5 per cent y-o-y (on January 29, 2021), while money supply (M3) grew by only 12.5 per cent as on January 15, 2021. 64. The RBI’s liquidity operations, together with credible communication and explicit forward guidance have been important elements of our strategy during recent times. Explicit forward guidance goes a long way in soothing market apprehensions, particularly when sentiments are frayed during uncertain times. While “state-based” forward guidance or data contingent forward guidance was used occasionally by the MPC in the pre-COVID period, since October 2020 the MPC has started to offer “time-based” forward guidance. The commitment to keep accommodative stance “during the current financial year and into the next financial year” is reflective of a time-based guidance; whereas on the other hand, the expression “to revive growth on a durable basis” characterises a state-based guidance; i.e., guidance contingent on the state of the economy. Going ahead, market participants need to factor in the forward guidance with respect to the two-phase normalisation of the cash reserve ratio (CRR) which opens up space for a variety of market operations to inject additional liquidity through instruments like open market operations (OMOs), among others. 65. Consistent with the accommodative stance of the monetary policy, the Reserve Bank remains committed to ensure the availability of ample liquidity in the system to foster congenial financial conditions for the recovery to gain traction. 66. Growth, although uneven, is recovering and gathering momentum, and the outlook has improved significantly with the rollout of the vaccine programme in the country. The growth momentum, however, needs to strengthen further for a sustained revival of the economy and for a quick return of the level of output to the pre-COVID trajectory. The sharp correction in food inflation has improved the near-term headline inflation outlook, although core inflation pressures persist. Given the sharp moderation in inflation along with a stable near-term outlook, monetary policy needs to continue with the accommodative stance to ensure that the recovery gains greater traction and becomes broad-based. On balance, I vote to keep the policy repo rate unchanged and to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. (Yogesh Dayal) Press Release: 2020-2021/1134 1 See Goyal, Ashima and Bhavya Sharma. 2018. ‘Government Expenditure in India: Composition, Cyclicality and Multipliers’. Journal of Quantitative Economics, 16(1): 1-39. DOI: https://doi.org/10.1007/s40953-018-0122-y. 2 See Goyal, Ashima and Parab Prashant 2020. What Influences Aggregate Inflation Expectations of Households in India? Journal of Asian Economics, Available online November 20, https://www.sciencedirect.com/science/article/abs/pii/S1049007820301408 | ||||||||||||||||

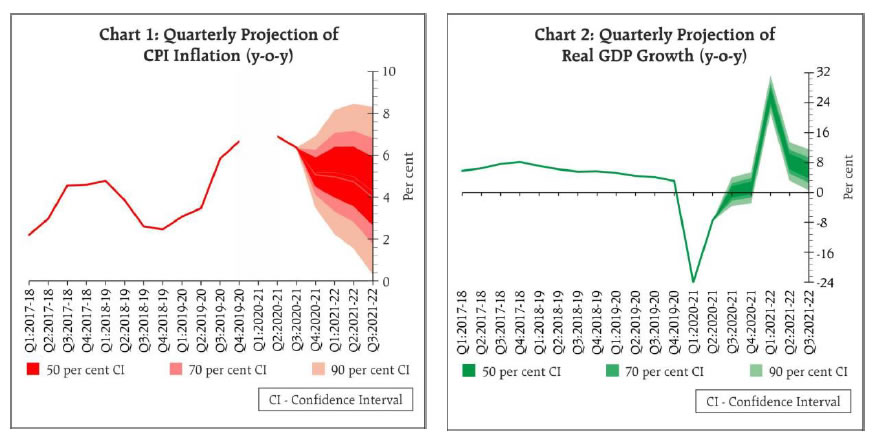

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: