IST,

IST,

Resolution of the Monetary Policy Committee (MPC) April 5-7, 2021

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (April 7, 2021) decided to:

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Since the MPC’s meeting in February, lingering effects of the slowdown in the global economy in Q4 of 2020 have persisted, although recent arrivals of high frequency indicators suggest that a gradual but uneven recovery may be forming. The much anticipated boost to economic activity from the vaccination rollouts is being somewhat held back by new mutations of COVID-19, second and third waves of infections across countries and unequal access to vaccines more generally. World trade activity improved in Q4:2020 and January 2021. There are, however, concerns due to COVID-19-related fresh lockdowns and depressed demand in a few major economies, escalation in shipping charges and container shortages. Inflation remains benign in major advanced economies (AEs), although highly accommodative monetary policies and large fiscal stimuli have added to concerns around market-based indicators of inflation expectations, unsettling bond markets globally. In a few emerging market economies (EMEs), however, inflation is ruling above targets, primarily driven by firming global commodity prices. This has even prompted a few of them to raise policy rates. Equity and currency markets have been turbulent with the increase in long-term bond yields and the steepening of yield curves. More recently, however, calm has returned and major equity markets have scaled new peaks in March, while currencies are trading mixed against a generally firming US dollar. With the bond markets sell-offs, EME assets came under selling pressure and capital outflows imposed depreciating pressures on EME currencies in March. Domestic Economy 3. The second advance estimates for 2020-21 released by the National Statistical Office (NSO) on February 26, 2021 placed India’s real gross domestic product (GDP) contraction at 8.0 per cent during the year. High frequency indicators – vehicle sales; railway freight traffic; toll collections; goods and services tax (GST) revenues; e-way bills; and steel consumption – suggest that gains in manufacturing and services activity in Q3:2020-21 extended into Q4. Purchasing managers’ index (PMI) manufacturing at 55.4 in March 2021 remained in expansion zone, but lower than its level in February. The index of industrial production slipped into marginal contraction in January 2021, dragged down by manufacturing and mining. Core industries also contracted in February. The resilience of agriculture is evident from foodgrains and horticulture production for 2020-21, which are expected to be 2.0 per cent and 1.8 per cent higher respectively than the final estimates of 2019-20. 4. Headline inflation increased to 5.0 per cent in February after having eased to 4.1 per cent in January 2021. Within an overall food inflation print of 4.3 per cent in February, five out of twelve food sub-groups recorded double digit inflation. While fuel inflation pressures eased somewhat in February, core inflation registered a generalised hardening and increased by 50 basis points to touch 6 per cent. 5. System liquidity remained in large surplus in February and March 2021 with average daily net liquidity absorption of ₹5.9 lakh crore. Driven by currency demand, reserve money (RM) increased by 14.2 per cent (y-o-y) as on March 26, 2021. Money supply (M3) grew by 11.8 per cent as on March 26, 2021 with credit growth at 5.6 per cent. Corporate bond issuances at ₹6.8 lakh crore during 2020-21 (up to February 2021) were higher than ₹6.1 lakh crore during the same period last year. Issuances of commercial paper (CPs) turned around since December 2020 and were higher by 10.4 per cent during December 2020 to March 2021 than in the same period of the previous year. India’s foreign exchange reserves increased by US$ 99.2 billion during 2020-21 to US$ 577.0 billion at end-March 2021, providing an import cover of 18.4 months and 102 per cent of India’s external debt. Outlook 6. The evolving CPI inflation trajectory is likely to be subjected to both upside and downside pressures. The bumper foodgrains production in 2020-21 should sustain softening of cereal prices going forward. While the prices of pulses, particularly tur and urad, remain elevated, the incoming rabi harvest arrivals in the markets and the overall increase in domestic production in 2020-21 should augment supply which, along with imports, should enable some softening of these prices going forward. While edible oils inflation has been ruling at heightened levels with international prices remaining firm, reduction of import duties and appropriate incentives to enhance productivity domestically could work towards a better demand-supply balance over the medium-term. Pump prices of petroleum products have remained high. Reduction of excise duties and cesses and state level taxes could provide some relief to consumers on top of the recent easing of international crude prices. This could slow down the propagation of second-round effects. The impact of high international commodity prices and increased logistics costs are being felt across manufacturing and services. Finally, inflation expectations of urban households one year ahead showed a marginal increase than over the three months ahead horizon according to the Reserve Bank’s March 2021 survey. Taking into consideration all these factors, CPI inflation is now projected as 5.0 per cent in Q4:2020-21; 5.2 per cent in Q1:2021-22, 5.2 per cent in Q2, 4.4 per cent in Q3 and 5.1 per cent in Q4, with risks broadly balanced (Chart 1). 7. Turning to the growth outlook, rural demand remains buoyant and record agriculture production for 2020-21 bodes well for its resilience. Urban demand has been gaining strength on the back of normalisation of economic activity and should get a fillip with the ongoing vaccination drive. The fiscal stimulus from increased allocation for capital expenditure under the Union Budget 2021-22, expanded production-linked incentives (PLI) scheme and rising capacity utilisation (from 63.3 per cent in Q2 to 66.6 per cent in Q3:2020-21) should provide strong support to investment demand and exports. Firms engaged in manufacturing, services and infrastructure polled by the Reserve Bank in March 2021 were optimistic about a pick-up in demand and expansion in business activity into 2021-22. Consumer confidence, on the other hand, has dipped with the recent surge in COVID infections in some states imparting uncertainty to the outlook. Taking these factors into consideration, the projection of real GDP growth for 2021-22 is retained at 10.5 per cent consisting of 26.2 per cent in Q1, 8.3 per cent in Q2, 5.4 per cent in Q3 and 6.2 per cent in Q4 (Chart 2).   8. The MPC notes that the supply side pressures on inflation could persist. It also notes that demand-side pull remains moderate. While cost-push pressures have risen, they could be partially offset with the normalisation of global supply chains. On imported inflation from global commodity prices, urgent concerted and coordinated policy actions by Centre and States can mitigate domestic input costs such as taxes on petrol and diesel and high retail margins. The renewed jump in COVID-19 infections in certain parts of the country and the associated localised lockdowns could dampen the demand for contact-intensive services, restrain growth impulses and prolong the return to normalcy. In such an environment, continued policy support remains necessary. Taking these developments into consideration, the MPC decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 9. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged. Furthermore, all members of the MPC voted to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 10. The minutes of the MPC’s meeting will be published on April 22, 2021. 11. The next meeting of the MPC is scheduled during June 2 to 4, 2021. (Yogesh Dayal) Press Release: 2021-2022/16 |

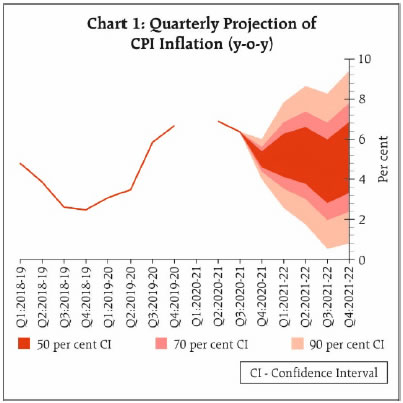

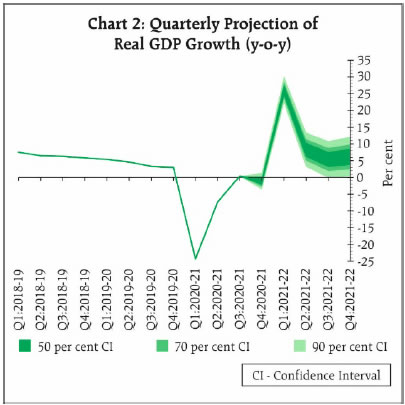

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: