IST,

IST,

Chapter V: Digitilisation - Tackling Emerging Risks and Challenges

|

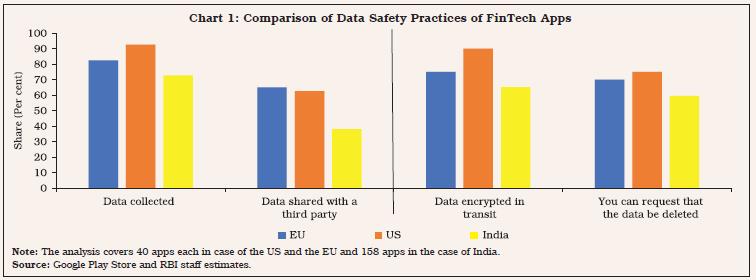

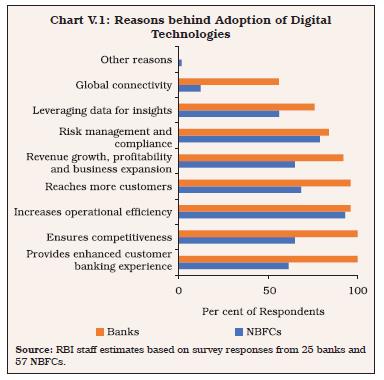

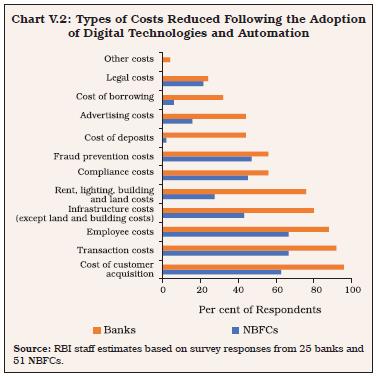

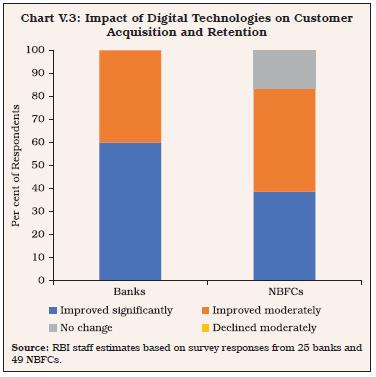

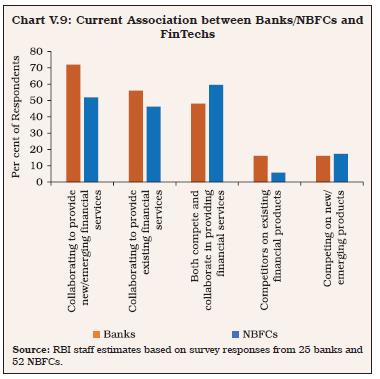

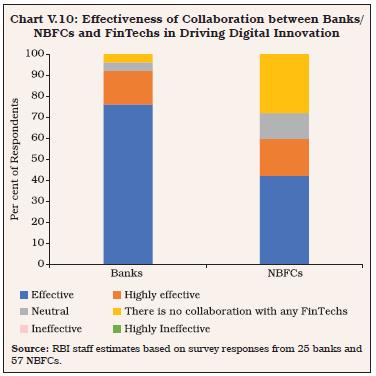

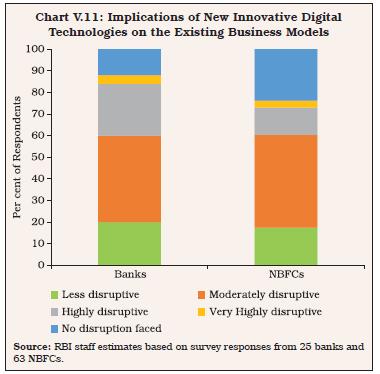

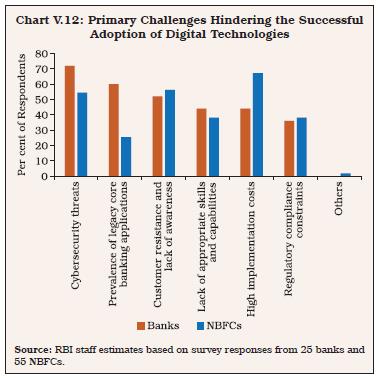

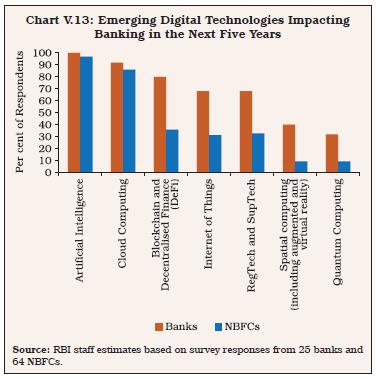

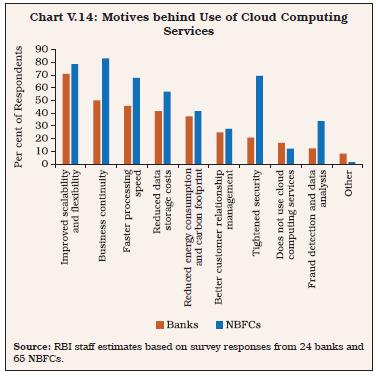

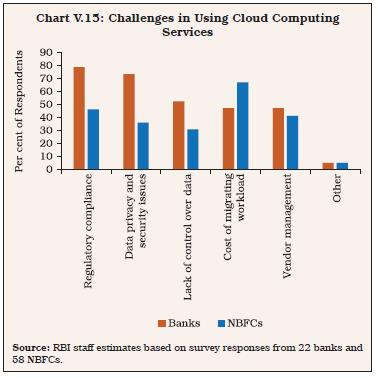

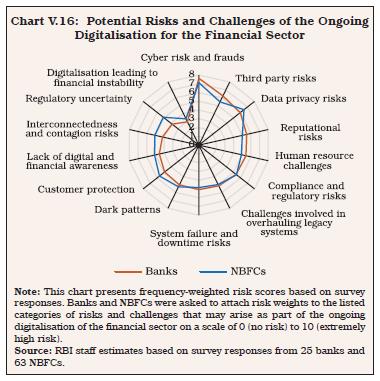

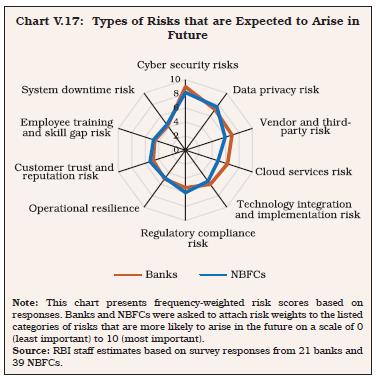

India’s financial sector is experiencing a significant transformation driven by digitalisation. Providing enhanced customer experience, ensuring competitiveness, improving operational efficiency and risk management are key factors influencing digital adoption. Banks and NBFCs view FinTechs as both complementary and competitive to their businesses and they favour regulation of FinTechs. Cybersecurity, data privacy, and vendor and third-party risks are key challenges. While digitalisation improves accessibility and convenience of financial services, it can expose consumers to impulsive spending, herd behaviour and data security concerns. Digitalisation can also create a more complex and interconnected financial system with implications for financial stability. The Reserve Bank has been undertaking proactive policy measures to harness the benefits of digitalisation while mitigating emerging risks to enhance customer protection and ensure financial stability. Digitalisation-induced changes in the behaviour of consumers and financial intermediaries can have implications for monetary policy. 1. Introduction V.1 Digitalisation in the financial sector provides enormous benefits in terms of fostering innovations, expanding access to financial products and services, reducing financial intermediation costs, improving customer experiences and enhancing competition among the service providers, thereby boosting efficiency and inclusivity of the financial sector. These benefits flow from collaborations between traditional players like banks/NBFCs and FinTech firms, enabling both the parties to leverage their strengths and drive innovation in the financial sector. At the same time, digitalisation can bring new risks and challenges through complicated financial products and business models, complex linkages between financial intermediaries and third-party technology/service providers, market concentration, impulsive spending by consumers, cybersecurity risks and financial frauds; all of these could impinge upon macroeconomic and financial stability. V.2 India’s financial sector is undergoing a significant transformation driven by the relentless pace of digitalisation, which is reshaping how financial institutions operate and interact with their customers. New technologies, such as artificial intelligence (AI), big data and blockchain, are fostering innovations that can enhance the efficiency and accessibility of financial services. Yet, the journey towards digitalisation is not without its challenges. As India continues to leverage technology to drive inclusive growth and sustainable development, it becomes imperative to critically examine the opportunities and challenges that accompany this transformative journey. V.3 Against this backdrop, this chapter explores the multifaceted landscape of digitalisation within the financial sector. Section 2 discusses the emerging risks and challenges emanating from digitalisation based on a survey of Indian banks and NBFCs. Section 3 dwells on the effects of digitalisation on customer behaviour. Section 4 discusses the implications of digitalisation for financial stability and monetary policy. Section 5 provides concluding observations. 2. Opportunities and Risks of Digitalisation: Insights from a Survey of Banks and NBFCs V.4 Given the immense benefits and opportunities provided by the digitalisation of finance on the one hand and the evolving risks associated with this process on the other, this section focuses on understanding the perspectives of banks and NBFCs - the key stakeholders – on these critical issues, drawing upon a focused survey conducted in March 2024 covering 25 scheduled commercial banks (SCBs) and 68 NBFCs1. The survey aimed at understanding the factors driving the adoption of digitalisation in banks and NBFCs, the extent of digital adoption in their business operations, the impact of digitalisation on customer acquisition and retention, risk perceptions related to data privacy, cybersecurity, third-party and contagion risks, their preparedness to deal with such risks, and their views on the regulatory approach to FinTech. Factors Driving Digital Adoption by Regulated Entities (REs) V.5 Digitalisation, according to the surveyed banks, is driven by the need to provide enhanced customer banking experience and remain competitive (Chart V.1). Reaching more customers and increasing operational efficiency amidst revenue growth, profitability, and business expansion were seen as other important factors. For NBFCs, increasing operational efficiency, and improving risk management and compliance were the major driving factors behind digitalisation, along with motives like improving customer reach and gaining competitiveness. These motivating factors for the Indian banks and NBFCs align with the findings in the literature (Liu, 2021; PwC, 2023).  V.6 The adoption of digital technologies and automation has helped banks and NBFCs bring down their costs related to customer acquisition, transactions and employees, according to the survey (Chart V.2). A higher proportion of the respondent banks compared to NBFCs noted cost reductions across all the parameters. Large banks may derive greater benefits from digitalisation due to substantial initial investment requirements and increasing returns to scale in the banking industry (Liu, 2021).  V.7 Technological innovations can improve customer experience, lower costs, increase product diversity, and enhance access to financial services (Elekdag et al., 2024). Most of the surveyed REs indicated improvement in customer acquisition and retention due to the adoption of digital technologies (Chart V.3). V.8 Banks, NBFCs and FinTechs employ technology to provide new products and business models that expand credit access to sectors like households and micro, small and medium enterprises (MSMEs) [Ernst & Young, 2023]. Many banks have also introduced digital platforms in the primary intermediation services like bank deposit mobilisation and lending activity. While banks are, at present, mobilising only a small portion of their deposits through digital mode, the importance of this channel is perceived to be increasing rapidly. In the coming five years, 44 per cent of surveyed banks expect to collect more than 50 per cent of deposits through online modes (Chart V.4a).  V.9 On the credit side, about three-fourth of the surveyed banks are extending up to 10 per cent of their total lending through digital modes. Over the next 5 years, 33 per cent of the surveyed banks indicated that they would lend more than 50 per cent digitally (Chart V.4b). These trends can be expected to improve credit deepening in the country going forward. V.10 Digital lending by both banks and NBFCs is primarily in the form of unsecured consumer loans; other major lending categories are secured consumer loans for banks and high value loans for NBFCs (Chart V.5). According to Ernst & Young (2023), the share of NBFCs in total loans disbursed through digital channels by banks and NBFCs has increased from six per cent in 2016-17 to 32 per cent in 2021-22. This is driven by both supply and demand side factors, including efforts to promote financial inclusion, smartphone and internet penetration, improving socio-economic conditions, and supportive regulatory frameworks.  V.11 The evolution of digital banking based on mobile apps and online platforms helps banks to rationalise their branch network to reap efficiency gains (ILO, 2022). India has also witnessed rationalisation in its bank branch network in recent years, reflecting the impact of both digitalisation and mergers in the domestic banking sector (Chart V.6).  V.12 Around a third of the respondent banks and NBFCs expect a decrease in the role of physical branches in the next 5 years, but most respondents see no change in the current importance of bank branches (Chart V.7). A majority of banks and NBFCs see continued importance of the role of physical branches in reaching customers with no/ limited access to digital technology (Chart V.8).   Impact of Digitalisation on Business Models: Complementarity vs. Competition V.13 FinTech players and the growing popularity of their innovative products have challenged the existing financial sector players in maintaining their market share, margins and customer base (Das, 2022). The incumbent banks and NBFCs are responding to these challenges by adopting various strategies, including making investments in FinTech companies, partnering with them, as well as enhancing their in-house capabilities. A higher proportion of banks (84 per cent of banks compared to 35 per cent of NBFCs) provide a range of digital banking services in collaboration with FinTechs as per the survey (See Chapter 2, Chart II.21). Most of the banks highlighted the importance of collaboration with FinTech companies in providing products and services on banking platforms.  V.14 Greater technological complexity involved with FinTech poses potential systemic risks (Cevik, 2023). With the intermingling of FinTech into the financial system, increased competition among banks can, in principle, lead to heightened financial instability (the ‘competition-fragility’ view) or more stability (the ‘competition-stability’ view) [Elekdag et al., 2024]. Therefore, successful collaboration requires careful planning, effective communication, and a shared vision for mutual growth and value creation. In this respect, the survey indicates that majority of respondent banks collaborate with FinTech firms to provide new/emerging services, indicating banks’ willingness to harness FinTech’s potential in developing new products/ services (Chart V.9). FinTechs upend traditional financial services for banks, forcing them to adapt to stay relevant (Pascual and Natalucci, 2022). Nonetheless, most NBFCs compete as well as collaborate with FinTechs in providing financial services.  V.15 Most of the respondent banks and NBFCs viewed their collaboration with FinTech firms as effective or highly effective in driving digital innovation (Chart V.10). V.16 Majority of respondent banks and NBFCs considered digital technology to be less or moderately disruptive2 (Chart V.11). Digital disruption by FinTech and platform-based competitors can impact banks’ profitability and limit credit growth; it can also help in the reduction of various costs (OECD, 2020). V.17 On the factors hindering digital adoption, most respondent banks identified cybersecurity threats, the prevalence of legacy core banking applications and customer unwillingness as key challenges. NBFCs reported implementation costs, customer unwillingness and cybersecurity concerns as the primary reasons hindering the successful adoption of digital technologies (Chart V.12).    V.18 Emerging technologies like AI have the potential to impact the banking industry significantly in the next five years (Chart V.13). AI can benefit the banking sector through operational efficiency and better risk management but can also give rise to challenges such as data privacy, reputational risk and model hallucinations3 (Hernández de Cos, 2024). V.19 Another emerging digital technology being adopted by the REs is cloud computing. Better infrastructure provision through improved flexibility, scalability, and business continuity are the primary motives behind its adoption (Chart V.14). Cloud computing can help improve efficiency through cost reduction, faster processing, and business scalability and flexibility. However, while using cloud services, banks viewed regulatory compliance and data privacy and security issues as prime hurdles, consistent with the study by Cheng et al. (2022). For NBFCs, cost of migrating workload and regulatory compliance were the key concerns (Chart V.15).    Digitalisation and Financial Stability V.20 Digitalisation could pose financial stability concerns owing to cybersecurity threats, data breaches and the speed at which information and rumours can flow through the system. Cyber fraudsters are increasingly targeting financial institutions instead of end users globally. Accordingly, cyber risks and frauds, third-party risks, and data privacy issues were indicated as the most significant risk factors by banks and NBFCs at the current juncture as well as going ahead (Charts V.16 and V.17). Risks associated with cloud services and technology integration and implementation were also highlighted as major concerns going forward. Regulatory and Supervisory Approaches V.21 Regulation of FinTech involves balancing innovation with customer protection, ensuring fair competition, and maintaining financial stability. Although most FinTech companies are relatively small, they can grow faster than traditional lenders across riskier clientele and industry sectors (Pascual and Natalucci, 2022). Regulators may adopt a passive approach to monitor FinTechs through bespoke regulation or adopt test-and-learn policies through institutional arrangements like innovation hubs and sandboxes (Bains and Wu, 2023). Currently, the changes that seem small can grow rapidly endangering the stability of the financial system, which requires regulators to be watchful of all the financial developments that are taking place and respond appropriately (Rao, 2022).   V.22 In India, the regulatory approach has been to strike a balance between mitigating the potential risks without impeding financial innovations through several tools that include research on FinTech developments, proactive engagement with existing and new entrant FinTech firms, clear communication with various stakeholders, risk mitigation strategies, modifications to supervisory processes and issuing guidelines or regulations. As the FinTech ecosystem is a force multiplier, the Reserve Bank has taken several steps to create a nurturing environment to foster innovation, including issuance of guidelines for Account Aggregators (AAs) in 2016 and laying out of regulations for P2P lending in 2017, recognising the sector’s potential in India (Sankar, 2023). In August 2019, the RBI released a regulatory sandbox framework for live testing of innovative products or services in a controlled environment for their effective implementation. V.23 Most of the respondent banks and NBFCs preferred regulation of FinTechs and favoured incentives to collaborate with them (Chart V.18). However, as FinTechs bring innovation, they also raise concerns related to customer protection, data privacy, cybersecurity, grievance handling, internal governance, and financial system integrity. The regulation of this dynamic sector needs to be balanced, nuanced, and reasonably anticipatory. The Reserve Bank’s approach, therefore, has been to encourage self-regulation in the FinTech sector. In this regard, the Reserve Bank released the ‘Framework for Self-Regulatory Organisation(s) for FinTech Sector’ (SRO-FT framework) in May 2024, detailing the processes involved, governance standards, eligibility criteria and expectations.  Preparedness in Dealing with the Risks V.24 The evolving digital landscape requires continuous assessment of preparedness for various risks by the REs as well as the regulators to design suitable policy responses at their end. The qualitative assessment of survey responses indicated that the respondent banks and NBFCs are largely equipped to deal with major risks (Chart V.19). NBFCs also indicated that there is scope for improvement in the case of third-party risk, data privacy risk, cyber risk, and human resource challenges. V.25 To sum up, the survey suggests that banks and NBFCs in India are increasingly leveraging the digital revolution to reduce costs related to customer acquisition, transactions and employees, while favouring collaboration with FinTechs to maximise gains. Cybersecurity threats, implementation costs, legacy core banking applications and customer unwillingness are seen as the primary challenges hindering the adoption of digital technologies. The respondent banks and NBFCs identified cybersecurity, data privacy and third-party risks as key challenges and indicated that they are largely equipped to deal with such risks. The surveyed REs favoured regulation of FinTech firms for harnessing the benefits of digitalisation and securing financial stability in India.  3. Digitalisation and Customer Behaviour V.26 Digitalisation has transformed the way consumers interact with the market while offering convenience, personalised experiences, and unprecedented access to goods and services. Digital financial services through mobile banking apps, online payments, and digital wallets enable consumers to conduct transactions with a few clicks at any time from any location, overcoming the constraints of traditional banking hours or physical branch presence. These advantages, however, come with risks related to impulsive spending, herd behaviour, data security and cyber fraud. V.27 Digital platforms enable quick dissemination of financial trends and choices, allowing information about investments, spending habits, and financial products to spread rapidly across social networks. This viral spread can result in social contagion, as consumers are influenced by the financial actions and recommendations of their peers, influencers, or trending topics (Shrotryia and Kalra, 2022). When customers observe large groups engaging in certain financial activities, such as mass buying or selling of stocks during a market frenzy, they are more likely to follow the crowd. Similarly, driven by herd behaviour, depositors may withdraw their money from banks, leading to potential bank runs/failures. Sentiments in social media amplify the classic bank run risk factors (Cookson et al., 2023). The combination of social contagion and herd behaviour in financial digitalisation can lead to rapid collective shifts in customer actions, often amplifying market trends and contributing to volatility. V.28 Globally, digital platforms offer deferred payment options like Buy Now Pay Later (BNPL), where lenders do not undertake a detailed credit check or rigorous assessment of a consumer’s ability to repay. This can lead to consumers overextending themselves financially, particularly if they use multiple BNPL services concurrently. In India, BNPL is treated as a credit product and requires similar due diligence and credit appraisal standards as for other loans. The global annual BNPL transactions are projected to grow from US$ 309 billion in 2023 to US$ 566 billion in 2026 (Chart V.20). India is among the top five countries in terms of BNPL users. BNPL share in e-commerce was about 3 per cent in India in 2023 as compared to 5 per cent globally. V.29 With the integration of FinTechs and e-commerce platforms, consumers may become more vulnerable to misuse of their personal and confidential information (Box V.1).

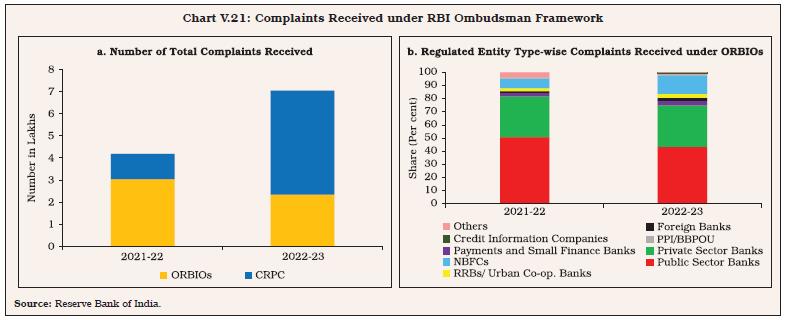

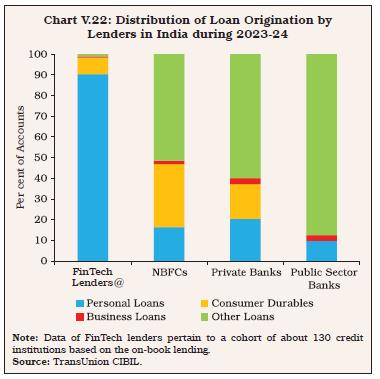

Ensuring the integrity and privacy of user data is, therefore, pivotal. The journey towards a more secure digital FinTech landscape not only involves regulatory compliance but also includes building trust and ensuring the ethical use of technology. V.30 The total number of complaints received by Offices of RBI Ombudsman (ORBIOs) and the Centralised Receipt and Processing Centre (CRPC) increased in 2022-23 due to intense public awareness initiatives and the simplified process for lodging of complaints under the Reserve Bank - Integrated Ombudsman Scheme (RB-IOS), 2021 (Chart V.21) [RBI, 2024a]. Approximately 20 per cent of the complaints received by the ORBIOs in 2022-23 pertained to mobile or electronic banking. As more personal and financial transactions shift to online platforms, the digital footprint of individuals and businesses has expanded, creating a target for cybercriminals. V.31 Population groups with low levels of digital and financial literacy have a higher risk of falling victim to online frauds or scams (OECD, 2021). In a consumer survey conducted by the Committee for Review of Customer Service Standards (Chairman: Shri B. P. Kanungo), 16.3 per cent of respondents considered technology-based services as a major area of concern (RBI, 2023). V.32 The Reserve Bank has taken several customer-centric measures to improve service quality and consumer protection (RBI, 2024b). It has formulated a Charter of Customer Rights, which outlines five basic rights for bank customers: fair treatment; transparency, fair and honest dealing; suitability; privacy; and grievance redress and compensation. The Reserve Bank - Integrated Ombudsman Scheme (RB-IOS) 2021, by adopting a One Nation-One Ombudsman approach, has integrated the erstwhile three Ombudsman Schemes of RBI and brought the Non-Scheduled Primary (Urban) Cooperative Banks with deposit size of and above ₹50 crore, and the Credit Information Companies under its ambit; and simplified the grievance redress process by adoption of ‘deficiency in service’ as a single broad-based ground for filing of complaints. Furthermore, Fair Practices Codes have been instituted for lenders, underscoring the importance of ethical treatment and transparency in their interactions with customers. The Reserve Bank conducted various focused customer awareness programmes including Ombudsman Speak, Talkathon and Nationwide Intensive Awareness Programme to educate customers on safe banking practices; RBI’s Alternate Grievance Redress (AGR) mechanism, and extant regulations for protection of consumer interests. To disseminate information about safe digital banking, the RBI has also been conducting Electronic Banking Awareness and Training (e-BAAT) programmes, actively undertaking digital awareness campaigns in the print and Audio-Visual media, including the Reserve Bank’s flagship programme “RBI Kehta Hai”.  V.33 Furthermore, the RBI launched three booklets viz., ‘Be(A)ware’ in March 2022, ‘Raju and the Forty Thieves’ in April 2022, and ‘The Alert Family’ in March 2024 to create awareness among public about the modus operandi of the frauds, provide guidance on financial frauds and dispel common misconceptions regarding various banking services and facilities, while also providing inputs on precautions to adopt in carrying out financial transactions. In addition, the Reserve Bank has introduced measures to ensure the safety of customer transactions, viz. (a) facility to switch on/switch off card transactions, (b) Card-on-File tokenisation, (c) mandating legal entity identifier (LEI) for high-value transactions in centralised payment systems (CPS), (d) positive pay system for high-value cheques, and (e) mandating additional factor of authentication (RBI, 2022). These measures by the RBI are aimed at fostering a transparent, fair and efficient financial system, and instilling a sense of reassurance and confidence in the stakeholders. 4. Digitalisation: Financial Stability and Macroeconomic Implications 4.1 Digitalisation and Financial Stability V.34 The digitalisation of finance presents significant benefits to the economy and the financial system by promoting efficiency, transparency, accessibility, and convenience of financial services (Table V.1). FinTech lending8 can reduce transaction costs and information asymmetries and increase financial inclusion by alleviating collateral constraints (Sahay et al., 2020). On the other hand, lending by FinTech platforms may involve greater financial risks due to concentration and over-reliance on data-driven algorithms (Cevik, 2023). The interconnectedness among banks, FinTechs, and technology firms complicates risk assessment and management, potentially accelerating financial contagion. Moreover, digitalisation can amplify traditional financial risks like liquidity, pro-cyclicality, and concentration risks, stemming from reliance on specific market infrastructures or third-party service providers (BCBS, 2024). Globally, the growth of non-bank institutions in the lending business also adds a new dimension that could raise regulatory arbitrage between traditional banks and FinTech firms. FinTech firms have complex and less transparent funding structures, making it harder to assess their risk transmission on overall stability. However, in the case of India, non-bank entities in lending are regulated as NBFCs by the RBI, while FinTechs and banks work in partnership in bank-led model subsiding any issue of regulatory arbitrage. Moreover, FinTech entities cannot lend on their own balance sheet; they only act as a loan sourcing agent. V.35 In India, FinTechs are quickly integrating themselves into the financial intermediation chain, offering specialised services and unlocking new business opportunities. In collaboration with banks and NBFCs, they have accelerated lending to new borrower accounts, particularly focusing on the personal loan segment (Chart V.22). This emphasis on low-ticket loans enables access to credit for individuals previously excluded from traditional banking due to factors like lack of credit history or sub-prime status. This strategy, however, could entail credit risk for the lenders due to surge in unsecured personal loans. As per available information, secured lending through digital lending partners has also started.

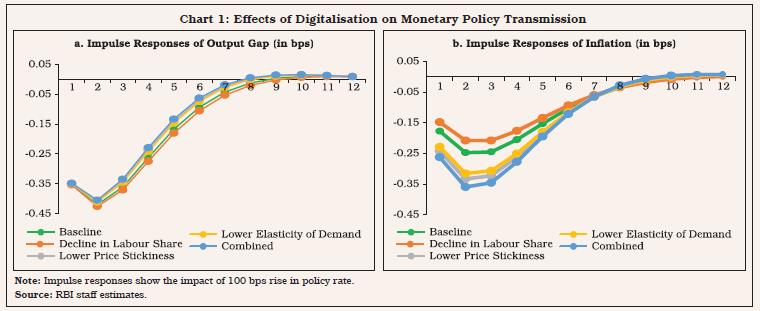

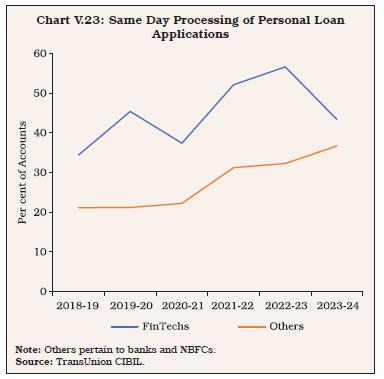

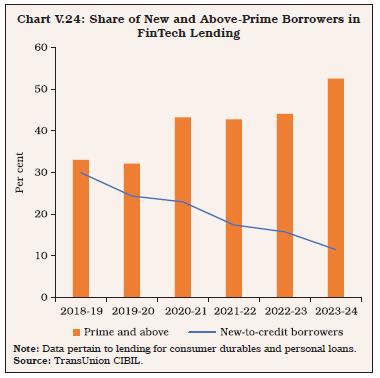

@ The methodology for classifying FinTechs is based on TransUnion CIBIL’s market knowledge that they have a digital first approach for their lending business and/or are members of industry bodies like FACE, DLAI and IAMAI.  V.36 By leveraging on technology in application processing, KYC checks, identity and risk checks with automated scorecards, FinTechs also have a higher proportion of same day loan processing as compared to conventional lenders (Chart V.23). Despite sophisticated lending practices, it is hard to implement true risk-based pricing by using big data and advanced technologies, as compared to the traditional credit rating framework (Johnson et al., 2023). For India, a study on FinTech lending firms suggests that alternate credit scoring using mobile and social footprints can expand credit and reduce the overall default rate (Agarwal et al., 2020). V.37 In India, the share of prime and above-prime borrowers in FinTech lending has been rising since 2018-19, suggesting improvement in their loan portfolio (Chart V.24). The share of new-to-credit borrowers serviced by FinTech lenders has declined, which could be reflective of the caution exercised by lenders due to higher observed delinquencies in small ticket personal loans (RBI, 2024c) as well as proactive measures by the Reserve Bank in terms of issuance of digital lending guidelines in September 2022.  V.38 Notwithstanding the fast penetration of FinTech firms in India, they still face significant challenges in counterparty credit risk assessment. A large portion of the population lacks a formal credit history, making traditional scoring models less reliable. As per the FinTech lending risk barometer study conducted by FACE (2023), issues related to data rank among the top ten risks faced by the Indian FinTech sector. BigTech companies from sectors like e-commerce, social media, and ride-hailing are expanding into finance, leveraging extensive customer data to tailor offerings for those with limited credit history. Even traditional lenders are adopting FinTech platforms for credit assessment. While these developments could have a positive impact in terms of enhancing inclusion and further penetration of financial services, they also raise concerns about concentration risk and potential spillovers. Therefore, potential risks to public policy objectives of maintaining competition, market and business conduct, operational resilience, data privacy, cybersecurity and financial stability need closer attention (Das, 2022). V.39 As per the systemic risk survey conducted by the Reserve Bank among financial sector professionals and academicians, cyber risks have been increasing consistently since 2020 (RBI, 2024c). The dominance of a few technology service providers, outages or cyber incidents could give rise to macro-financial stability risks (IMF, 2024). In India, the incidence of outages, as reflected in banks’ UPI downtime, has been falling (Chart V.25). Policy Initiatives by the Reserve Bank V.40 To harness the benefits of digitalisation in the financial sector while mitigating the emerging risks, the Reserve Bank has been undertaking proactive policy measures. These include (i) issuance of digital lending guidelines in 2022, focusing on credit intermediation, customer protection, data privacy and cybersecurity issues; (ii) issuance of guidelines in 2023 for further strengthening banks’ IT systems as well as employing robust frameworks for fraud prevention and detection measures; (iii) issuance of master directions on outsourcing of IT services in April 2023, which stipulate REs to report cyber incidents within six hours of detection by a third-party service provider; (iv) issuance of Guidance Note in April 2024 for improving and further strengthening banks’ Operational Risk Management Framework to identify, mitigate and recover from cyber incidents and technology failures and enhancing their ability to deliver critical operations, thereby ensuring their Operational Resilience; and (v) releasing the SRO-FT framework in May 2024. Furthermore, to accelerate and widen the reach of digital banking services and lessen the hesitation among customers for availing financial services digitally, the concept of “Digital Banking Units” (DBUs) was introduced by the Reserve Bank in April 2022.  V.41 The Reserve Bank also undertook several initiatives for strengthening the cybersecurity preparedness of supervised entities, including initiating the process of setting up of cyber range for conducting cyber drills, examining the feasibility of implementing the Cyber Sectoral Security Operations Centre (S-SOC), and conducting phishing simulation exercises (RBI, 2024b). It also proposed to set up a Digital Payments Intelligence Platform for network-level intelligence and real-time data sharing across the digital payment ecosystem in June 2024. To enhance the safety and security of digital transactions with a focus on detecting, preventing, and combating financial frauds, the Reserve Bank announced its third edition of the global hackathon, “HaRBInger 2024 – Innovation for Transformation” with two overarching themes viz., ‘Zero Financial Frauds’ and ‘Being Divyang Friendly’ (RBI, 2024d). The Reserve Bank launched initiatives in line with the Payments Vision Document 2025 across anchor goalposts of integrity, inclusion, innovation, institutionalisation and internationalisation during 2023-24 for enhancing the payments ecosystem and fostering a regulatory environment conducive to the growth of payment systems. As part of the agenda for the run-up to RBI@100, the Reserve Bank has taken initiatives to establish a cost-effective cloud facility for the financial sector to enhance the security, integrity and privacy of financial sector data while facilitating scalability and business continuity. 4.2 Digital Transactions and Monetary Policy V.42 The digital transformation of the financial sector is reshaping the landscape in which monetary policy operates. Digitalisation influences various aspects of the economy, from financial intermediation and credit conditions to market dynamics and global integration, reshaping the traditional channels through which monetary policy affects economic variables such as growth and inflation. The widespread adoption of digital payment platforms alters how money circulates in the economy, which can enhance or mitigate the liquidity effects of monetary policy. Financial digitalisation could amplify the effects of monetary policy by loosening credit constraints. The monetary policy impact could be dampened if digitalisation leads to shifting of credit supply from banks to less-regulated / unregulated nonbanks (Buchak et al., 2018; Elliott et al., 2022; Chen et al., 2018), or by offsetting reductions in bank deposits (Xiao, 2020). Financial inclusion can enhance the effectiveness of interest rate based monetary policy by increasing the number of people responsive to interest rate cycles (Patra, 2021). Digital financial system can automatically adjust interest rates on deposits and loans in response to policy rate changes, potentially accelerating the transmission of monetary policy. The impact of policy under the risk-taking channel could be stronger due to digital lending if risk appetite of FinTechs is more sensitive to changes in monetary policy (Stein, 2013; IMF, 2016; Ding and He, 2023). V.43 The overall impact of digitalisation on monetary policy transmission is ambiguous (Hasan et al., 2024). It would depend, inter alia, on whether financial services offered by non-banks complement or substitute those offered by banks. While the complementarity could lead to higher financial intermediation and stronger monetary policy transmission, substitution of bank deposits could enhance financial disintermediation and weaken monetary policy transmission. Against this backdrop, the evolution of monetary policy transmission in India is examined by estimating the response of deposit and lending interest rates to the policy repo rate in a recursive regression framework for the period April 2004 to March 2024. The results suggest an improvement in the degree of interest rate pass-through since 2016-17, reflecting, inter alia, the combined impact of the adoption of flexible inflation targeting (FIT) framework in 2016 and the introduction of mandated external benchmark system for lending rates for select categories starting 2019, even as there has been rapid pace of digitalisation over the same period (Chart V.26). Digitalisation and Inflation V.44 Digitalisation also has implications for the primary monetary policy objective of inflation management. Digitalisation can impact the flexibility of prices, relative prices of online and offline products, market competition, and market concentration, all of which may potentially influence the New Keynesian Phillips Curve (NKPC) – the central element of the workhorse model employed by modern central banks for assessing inflation dynamics and policy evaluation. Digitalisation can increase the degree of flexibility in prices (Anderton et al., 2021; Anderton et al., 2020). It can also reduce menu cost as changing the prices of goods is possible at almost zero cost without reprinting price tags or re-establishing pricing strategies. Information costs have also undergone significant changes under the influence of digitalisation. Digital tools, such as search engines, e-commerce platforms, and social media greatly reduce the time and energy costs for consumers to obtain information, compare prices, and make purchasing decisions, thereby changing the process of price formation and adjustment (Cavallo, 2018; Cavallo, 2017; Jiang and Zou, 2020). Digital technology is key in reducing menu and information costs and reducing price stickiness. A decrease in price stickiness may weaken the effectiveness of monetary policy (Alvarez et al., 2016; Glocker and Piribauer, 2021).  V.45 Algorithmic pricing strategies in the digital realm may lead to collusion, resulting in prices above competitive levels. Additionally, the large initial investment in digital technologies, coupled with lower scaling costs, can lead to a higher level of market concentration and the emergence of natural monopolies or “superstar” firms. The rise in online product competition can lower inflation, while the increase in market concentration of firms, and the resulting higher mark-ups and profit margins, could lead to upward inflation pressures. The net effect of digitalisation on the market power can vary across sectors, depending on changes in market competition, inflation responsiveness, and changes in the structure of the NKPC. Digitalisation forces can, thus, impact inflation by impinging upon all the key components of the NKPC, i.e., the slope, mark-up, slack (output gap), and inflation expectations (Chu et al., 2023):  V.46 The slope channel is dependent on the price stickiness (i.e., the fraction of firms not adjusting the prices), the price elasticity of demand, the elasticity of marginal cost to sales and the elasticity of firms’ mark-up (Anderton et al., 2021). The NKPC could become steeper, making inflation more volatile if the impact of higher price flexibility, induced by digitalisation, outweighs the impact of greater availability of product varieties. By lowering the labour share in aggregate output, the digitalisation-induced higher market concentration may reduce the slope of the NKPC, while the availability of more product varieties can offset the impact of increased market concentration, and lower mark-ups. Technological shocks can impact mark-ups and marginal costs more frequently, which may negatively affect inflation expectations and the stability of the NKPC. Given these diverse channels, a small-scale New Keynesian model, calibrated to Indian macroeconomic conditions, suggests that digitalisation can, on balance, enhance the effectiveness of monetary policy transmission (Box V.2).

Monitoring and Forecasting in the Age of Big Data V.47 An improved understanding of digitalisation induced changes in the behaviour of consumers, firms and financial intermediaries would be necessary for enhancing the effectiveness of data-driven policy making. The availability of large volumes of data enabled by digitalisation has opened up scope for the use of AI/ML techniques for faster processing and analysis of data as well as for macroeconomic forecasting (Chart V.27). In central banks, Big Data and Machine Learning are being used in a variety of areas, including research, monetary policy, and financial stability (Doerr et al., 2021 and Serena et al., 2021). Big data and ML can improve inflation forecasting performance (Chakraborty and Joseph, 2017; Singh and Bhoi, 2022); however, elevated geopolitical tensions, more frequent climate shocks and high volatility in global financial markets and commodity prices continue to pose significant challenges for the assessment and forecasts of output and inflation.  V.48 Digitalisation is transforming India’s financial sector by changing the way financial institutions operate and interact with their customers and provide financial products and services. Amidst several benefits, e.g., fostering innovation, expanding access, enhancing competition, reducing intermediation costs, and improving customer experiences, digitalisation also brings new challenges in terms of complex financial products, greater interconnectedness, cybersecurity risks, financial frauds, and customer protection, with implications for macro-financial stability. These issues need to be addressed to realise the full potential of financial digitalisation. V.49 A survey of select banks and NBFCs in India indicates that providing enhanced customer banking experience, remaining competitive, and improving operational efficiency and risk management are the major drivers of their digitalisation efforts. There is an improvement in customer acquisition and retention due to the adoption of digital technologies. Banks and NBFCs benefit from collaborating with FinTech companies in providing products and services, and they prefer regulation of FinTechs. The respondents view cybersecurity, data privacy, and third-party risks as their prime concerns. V.50 Digitalisation can impact inflation and output dynamics, and monetary policy transmission in diverse manners and the overall impact could vary over time given the fast pace of developments. In this environment, central banks would need to incorporate digitalisation aspects comprehensively into their models for the continued efficacy of monetary policy and the achievement of their price and financial stability goals. Empirical analysis suggests a strengthening of monetary policy effectiveness amidst reforms in policy framework and operating procedures, along with the ongoing digitalisation in India. V.51 Digitalisation can also bring new risks and challenges for customer protection and financial stability. While improving accessibility and convenience of financial services for customers, digitalisation raises concerns related to impulsive spending, herd behaviour and data security. The Reserve Bank has been undertaking proactive policy measures to harness the benefits while mitigating the emerging risks of digitalisation in the financial sector. The regulatory sandbox approach has produced practical and innovative solutions in domains such as retail payments, cross-border payments, MSME lending and prevention of financial frauds (Das, 2023). By integrating digital payment systems and FinTech innovations into its regulatory framework, the Reserve Bank has maintained financial stability while fostering economic growth. The RBI has set out guidelines for banks to implement robust cybersecurity measures, ensuring the safe and secure functioning of digital financial transactions. While encouraging innovation, the Reserve Bank is also proactive in safeguarding customer interests (Patra, 2024). These measures include, inter alia, formulating a charter of customer rights, integrated ombudsman scheme for grievance redressal, laying down of fair practices codes for lenders, and several consumer awareness and educational programmes to reinforce confidence of stakeholders in the financial system. Through these strategic initiatives, the Reserve Bank has been playing a constructive role in creating an innovation-friendly ecosystem in the financial sector consistent with its macro-financial objectives. References Agarwal, S., Alok, S., Ghosh, P., and Gupta, S. (2020). Financial Inclusion and Alternate Credit Scoring for the Millennials: Role of Big Data and Machine Learning in FinTech. Business School, National University of Singapore Working Paper. 3507827. Alvarez, F., Le Bihan, H., and Lippi, F. (2016). The Real Effects of Monetary Shocks in Sticky Price Models: A Sufficient Statistic Approach. American Economic Review, 106(10), 2817-2851. Anderton, R., Cette, G., ... and Jarvis, V. (2021). Digitalisation: Channels, Impacts and Implications for Monetary Policy in the Euro Area. ECB Occasional Paper Series, No. 266, September. Anderton, R., Jarvis, V., Labhard, V., Morgan, J., Petroulakis, F., and Vivian, L. (2020). Virtually Everywhere? Digitalisation and the Euro Area and EU Economies. ECB Occasional Paper Series, No. 244, June. Bains, P., and Wu, C. (2023). Institutional Arrangements for FinTech Regulation: Supervisory Monitoring. IMF FinTech Notes, No 2023/004, June 26. BCBS (2024). Digitalisation of Finance. Bank for International Settlements. Available at https://www.bis.org/bcbs/publ/d575.htm Buchak, G., Matvos, G., Piskorski, T., and Seru, A. (2018). FinTech, Regulatory Arbitrage, and the Rise of Shadow Banks. Journal of Financial Economics, 130(3), 453-483. Cavallo, A. (2017). Are Online and Offline Prices Similar? Evidence from Large Multi-Channel Retailers. American Economic Review, 107(1), 283-303. Cavallo, A. (2018). More Amazon Effects: Online Competition and Pricing Behaviors. National Bureau of Economic Research Working Paper No. 25138. Central Banking (2022). Economics Benchmarks 2022 Report – Evolving Models. Available at https://www.centralbanking.com/benchmarking/economics/7953967/economics-benchmarks-2022-report-evolving-models. Cevik, S. (2023). The Dark Side of the Moon? FinTech and Financial Stability. IMF Working Paper WP/23/253. Chakraborty, C., and Joseph, A. (2017). Machine Learning at Central Banks. Bank of England Staff Working Papers, No. 674. Chen, K., Ren, J., and Zha, T. (2018). The Nexus of Monetary Policy and Shadow Banking in China. American Economic Review, 108(12):3891–3936. Cheng, M., Qu, Y., Jiang, C., and Zhao, C. (2022). Is Cloud Computing the Digital Solution to the Future of Banking? Journal of Financial Stability, 63, 101073. Chu, V., Dahlhaus, T., Hajzler, C., and Yanni, P.Y. (2023). Digitalization: Implications for Monetary Policy. Bank of Canada Staff Discussion Papers, No. 2023-18. Cookson, J. A., Fox, C., Gil-Bazo, J., Imbet, J. F., and Schiller, C. (2023). Social Media as a Bank Run Catalyst. Available at https://www.fdic.gov/analysis/cfr/bank-research-conference/annual-22nd/papers/cookson-paper.pdf Das, S. (2022). FinTech as a Force Multiplier. RBI Bulletin, October. Das, S. (2023). FinTech and the Changing Financial Landscape. Keynote Address at the Global FinTech Festival, Mumbai, September 6. Ding, Q., and He, W. (2023). Digital Transformation, Monetary Policy and Risk-taking of Banks. Finance Research Letters, 55, 103986. Doerr, S., Gambacorta, L., and Serena, J. M. (2021). Big Data and Machine Learning in Central Banking. BIS Working Papers, No. 930. Elekdag, S., Emrullahu, D., and Ben Naceur, S. (2024). Does FinTech Increase Bank Risk Taking? IMF Working Paper, WP/17/24, January. Elliott, D., Meisenzahl, R., Peydró, J.L., and Turner, B. C. (2022). Nonbanks, Banks, and Monetary Policy: US Loan-Level Evidence since the 1990s. Federal Reserve Bank of Chicago Working Paper, No. WP 2022-27, June. Ernst & Young (2023). Unleashing Potential - The Next Phase of Digital Lending in India, September. Available at https://assets.ey.com/content/dam/ey-sites/ey-com/en_in/topics/digital/2023/09/ey-the-next-phase-of-digital-lending-in-india.pdf FACE (2023). FinTech Lending Risk Barometer 2022-2023: Understanding the Perception of Risks in the FinTech Lending Sector in India, January. Available at https://faceofindia.org/wp-content/uploads/2023/12/Fintech-Lending-Risk-Barometer-2022-2023.pdf FSB (2017). Financial Stability Implications from FinTech, Supervisory and Regulatory Issues that Merit Authorities’ Attention. Available at https://www.fsb.org/wp-content/uploads/R270617.pdf Glocker, C., and Piribauer, P. (2021). Digitalization, Retail Trade and Monetary Policy. Journal of International Money and Finance, 112, April, 102340. Hasan, I., Kwak, B., and Li, X. (2024). Financial Technologies and the Effectiveness of Monetary Policy Transmission. European Economic Review, 161, 104650. Hernández de Cos, P. (2024). Managing AI in Banking: Are We Ready to Cooperate? Keynote speech at the Institute of International Finance Global Outlook Forum, Washington DC, April 17. ILO (2022). Digitalization and the Future of Work in the Financial Services Sector. Issues Paper Sectoral Policies Department. Available at https://www.ilo.org/media/225796/download IMF (2016). Monetary Policy and the Rise of Nonbank Finance. Global Financial Stability Report, October, 49–80. IMF (2024). Cyber Risk: A Growing Concern for Macrofinancial Stability. Global Financial Stability Report, April. Jiang, B., and Zou, T. (2020). Consumer Search and Filtering on Online Retail Platforms. Journal of Marketing Research, 57(5), 900-916. Johnson, M. J., Ben-David, I., Lee, J., and Yao, V. (2023). FinTech Lending with Lowtech Pricing. NBER Working Paper No. 31154. Liu, E.X. (2021). Stay Competitive in the Digital Age: The Future of Banks. IMF Working Paper, February. McKinsey and Company (2022). The State of AI in 2022 and a Half Decade in Review. Available at https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2022-and-a-half-decade-in-review. OECD. (2020). Digital Disruption in Banking and its Impact on Competition. OECD Publishing. Available at https://www.oecd-ilibrary.org/docserver/b8d8fcb1-en.pdf?expires=1721046206&id=id&accname=guest&checksum=7B7EAFECF97E6F4E3709F0323F16EF20 OECD (2021). Digitalisation of Consumer Finance and Financial Education in South-East Europe. Policy Brief. Pascual, A.G., and Natalucci, F. (2022). Fast- Moving FinTech Poses Challenge for Regulators. IMF Blogs, April 13. Patra, M. D. (2021). Financial Inclusion Empowers Monetary Policy. Keynote Address at the Indian Institute of Management, Ahmedabad, December 24. Patra, M. D. (2024). Harnessing Digital Technologies in Central Banks: Opportunities and Challenges. Keynote Address at the SAARCFINANCE Seminar, Goa, January. PwC (2023). Breaking New Ground: How Emerging Technologies are Helping NBFCs Evolve. PwC India Industries, FinTech Insights. Rao, M.R. (2022). Reflections on Policy Choices in the Indian Financial System. Speech delivered at the 12th R.K. Talwar Memorial Lecture, Mumbai, October 21. RBI (2022). Benchmarking India’s Payment Systems. July 1. Available at https://rbi.org.in/en/web/rbi/-/publications/reports/benchmarking-india-s-payment-systems-1214 RBI (2023). Report of the Committee for Review of Customer Service Standards in RBI Regulated Entities. April 24. RBI (2024a). Annual Report of Ombudsman Scheme, 2022-23. RBI (2024b). Annual Report, 2023-24. RBI (2024c). Financial Stability Report, June. RBI (2024d). Bi-monthly Monetary Policy Statement. June 07. Sahay, M. R., Von Allmen, M. U. E., Lahreche, M. A., Khera, P., Ogawa, M. S., Bazarbash, M., and Beaton, M. K. (2020). The Promise of FinTech: Financial Inclusion in the Post COVID-19 Era. IMF Working Paper, No. 20/09. Sankar, T. R. (2023). Reserve Bank of India and FinTech - The Road Ahead. Keynote Address at Moneycontrol India Startup Conclave, Bengaluru, July 07. Serena, J. M., Tissot, B., and Gambacorta, L. (2021). Use of Big Data Sources and Applications at Central Banks. Irving Fisher Committee Survey Report No. 13, Bank for International Settlements. Shrotryia, V. K., and Kalra, H. (2022). Herding in the Crypto Market: A Diagnosis of Heavy Distribution Tails. Review of Behavioral Finance, 14(5), 566- 587. Singh, N., and Bhoi, B. B. (2022). Inflation Forecasting in India: Are Machine Learning Techniques Useful? Reserve Bank of India Occasional Papers, 43(2), 46-88. Stein, J. C. (2013). Overheating in Credit Markets: Origins, Measurement, and Policy Responses. Speech at the Symposium on Restoring Household Financial Stability After the Great Recession, Federal Reserve Bank of St. Louis. Xiao, K. (2020). Monetary Transmission Through Shadow Banks. The Review of Financial Studies, 33(6):2379–2420. * This chapter has been prepared by a team comprising Harendra Behera, Binod B. Bhoi, Somnath Sharma, Himani Shekhar, Sambhavi Dhingra, Satyam Kumar, Ashish Khobragade, Nishant Singh, Ranajoy Guha Neogi and Shahbaaz Khan from Department of Economic and Policy Research; Rakesh Kumar from Financial Stability Department; Shesadri Banerjee from Monetary Policy Department; Renu Ajwani from Department of Supervision; and Vinodh Rajkumar from FinTech Department. Valuable insights provided by Shri Suvendu Pati are gratefully acknowledged. 1 The number of respondent banks and NBFCs differs for different survey questions, and the results presented in this chapter are based on actual responses. 2 Disruptive FinTech refers to innovative financial technology solutions that challenge traditional banking and finance models through AI, blockchain, and data analytics advancements to offer financial services. One example of disruptive FinTech is peer-to-peer lending platforms, which connect borrowers directly with lenders, bypassing traditional financial institutions. 3 Model hallucinations occur when an AI model generates information that is not based on input data or real-world context. 4 Mingyu, J. (2019). Google-Play-Scraper. MIT. Available at https://pypi.org/project/google-play-scraper/ 5 FinTechs in the US and EU are identified by using database maintained by Cambridge Centre for Alternative Finance, while Tracxn database is used in case of India. 6 Google Play Store publishes permissions requested (that the developer of the app takes from the user in course of installation/usage of the app) by each app on its platform. Accordingly, information was collected from 339 mobile applications (158 banking apps belonging to 48 banks, and 181 FinTech apps belonging to 172 business-to-consumer FinTech firms identified from the Tracxn database with practice area tags, viz., payments, alternative lending, banking tech, forex tech, remittance tech), identified manually on Google Play Store for each bank/FinTech. 7 Since FinTech apps pertaining to digital lending may also be providing payments services, they may be using permissions which otherwise are not encouraged for digital lending apps. 8 In India, FinTech entities do not lend on their own balance sheets and merely act as loan sourcing agents (defined as Lending Service Provider in Digital Lending Guidelines). In other jurisdictions, FinTech lending can mean multiple things – including lending by FinTechs on their own balance sheets, P2P lending, or simply loan sourcing. |

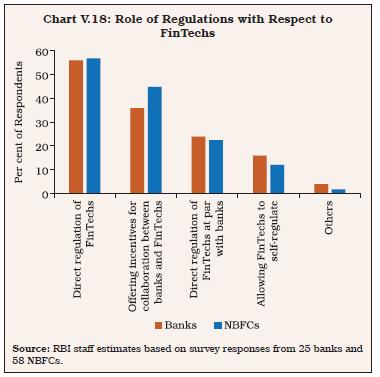

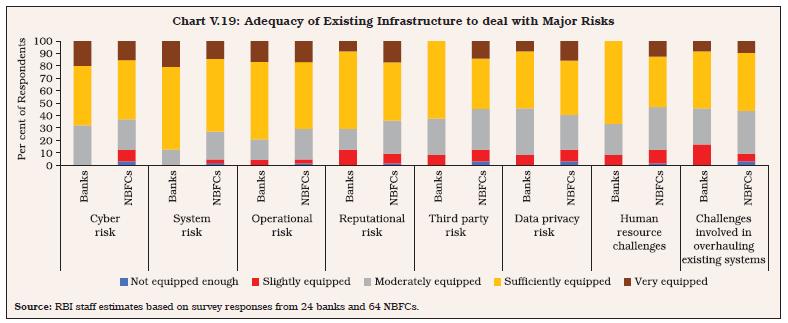

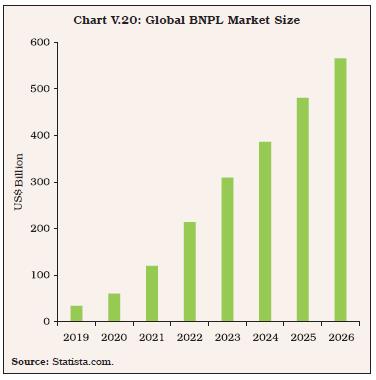

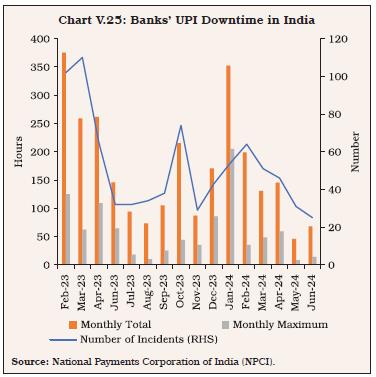

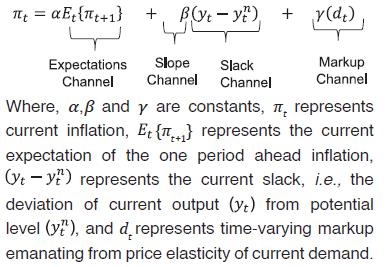

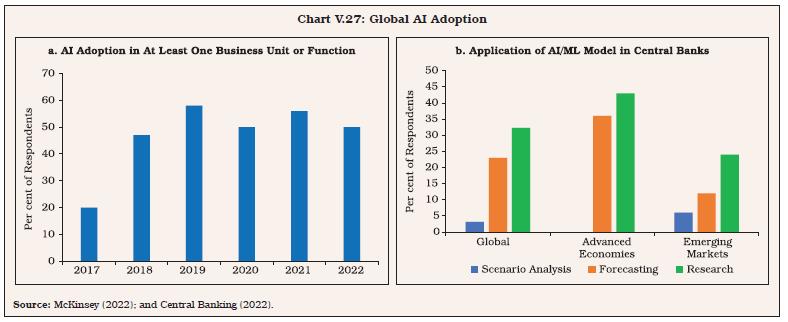

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: