IST,

IST,

Government Securities Market A Primer

The contents of this primer are for general information and guidance purpose only. The Reserve Bank will not be liable for actions and/or decisions taken based on this Primer. Readers are advised to refer to the specific circulars issued by Reserve Bank of India from time to time. While every effort has been made to ensure that the information set out in this document is accurate, the Reserve Bank of India does not accept any liability for any action taken, or reliance placed on, any part, or all, of the information in this document or for any error in or omission from, this document. The G-Secs market has witnessed significant changes during the past decade. Introduction of an electronic screen-based trading system, dematerialized holding, straight through processing, establishment of the Clearing Corporation of India Ltd. (CCIL) as the Central Counter Party (CCP) for guaranteed settlement, new instruments, and changes in the legal environment are some of the major aspects that have contributed to the rapid development of the G-Sec market. Major participants in the G-Secs market historically have been large institutional investors. With the various measures for development, the market has also witnessed the entry of smaller entities such as co-operative banks, small pension, provident and other funds etc. These entities are mandated to invest in G-Secs through respective regulations. However, some of these new entrants have often found it difficult to understand and appreciate various aspects of the G-Secs market. The Reserve Bank of India has, therefore, taken several initiatives to bring awareness about the G-Secs market among small investors. These include workshops on the basic concepts relating to fixed income securities/ bonds like G-Secs, trading and investment practices, the related regulatory aspects and the guidelines. This primer is yet another initiative of the Reserve Bank to disseminate information relating to the G-Secs market to the smaller institutional players as well as the public. An effort has been made in this primer to present a comprehensive account of the market and the various processes and operational aspects related to investing in G-Secs in an easy-to-understand, question-answer format. The primer also has, as annexes, a list of primary dealers (PDs), useful excel functions and glossary of important market terminology. I hope the investors, particularly the smaller institutional investors will find the primer useful in taking decisions on investment in G-Secs. Reserve Bank of India would welcome suggestions in making this primer more user-friendly. Shri B.P. Kanungo Government Securities Market in India – A Primer 1.1 A bond is a debt instrument in which an investor loans money to an entity (typically corporate or government) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by companies, municipalities, states and sovereign governments to raise money to finance a variety of projects and activities. Owners of bonds are debt holders, or creditors, of the issuer. What is a Government Security (G-Sec)? 1.2 A Government Security (G-Sec) is a tradeable instrument issued by the Central Government or the State Governments. It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more). In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs). G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments. a. Treasury Bills (T-bills) 1.3 Treasury bills or T-bills, which are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 day, 182 day and 364 day. Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of ₹100/-. The return to the investors is the difference between the maturity value or the face value (that is ₹100) and the issue price (for calculation of yield on Treasury Bills please see answer to question no. 26). b. Cash Management Bills (CMBs) 1.4 In 2010, Government of India, in consultation with RBI introduced a new short-term instrument, known as Cash Management Bills (CMBs), to meet the temporary mismatches in the cash flow of the Government of India. The CMBs have the generic character of T-bills but are issued for maturities less than 91 days. c. Dated G-Secs 1.5 Dated G-Secs are securities which carry a fixed or floating coupon (interest rate) which is paid on the face value, on half-yearly basis. Generally, the tenor of dated securities ranges from 5 years to 40 years.

The nomenclature of a typical dated fixed coupon G-Sec contains the following features - coupon, name of the issuer, maturity year. For example, - 7.17% GS 2028 would mean:

In case, there are two securities with the same coupon and are maturing in the same year, then one of the securities will have the month attached as suffix in the nomenclature. eg. 6.05% GS 2019 FEB, would mean that G-Sec having coupon 6.05% that mature in February 2019 along with the other similar security having the same coupon. In this case, there is another paper viz. 6.05%GS2019 which bears same coupon rate and is also maturing in 2019 but in the month of June. Each security is assigned a unique number called ISIN (International Security Identification Number) at the time of issuance itself to avoid any misunderstanding among the traders. If the coupon payment date falls on a Sunday or any other holiday, the coupon payment is made on the next working day. However, if the maturity date falls on a Sunday or a holiday, the redemption proceeds are paid on the previous working day. 1.6 Instruments: i) Fixed Rate Bonds – These are bonds on which the coupon rate is fixed for the entire life (i.e. till maturity) of the bond. Most Government bonds in India are issued as fixed rate bonds. For example – 8.24%GS2018 was issued on April 22, 2008 for a tenor of 10 years maturing on April 22, 2018. Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) – FRBs are securities which do not have a fixed coupon rate. Instead it has a variable coupon rate which is re-set at pre-announced intervals (say, every six months or one year). FRBs were first issued in September 1995 in India. For example, a FRB was issued on November 07, 2016 for a tenor of 8 years, thus maturing on November 07, 2024. The variable coupon rate for payment of interest on this FRB 2024 was decided to be the average rate rounded off up to two decimal places, of the implicit yields at the cut-off prices of the last three auctions of 182 day T- Bills, held before the date of notification. The coupon rate for payment of interest on subsequent semi-annual periods was announced to be the average rate (rounded off up to two decimal places) of the implicit yields at the cut-off prices of the last three auctions of 182 day T-Bills held up to the commencement of the respective semi-annual coupon periods. iii) The Floating Rate Bond can also carry the coupon, which will have a base rate plus a fixed spread, to be decided by way of auction mechanism. The spread will be fixed throughout the tenure of the bond. For example, FRB 2031 (auctioned on May 4, 2018) carry the coupon with base rate equivalent to Weighted Average Yield (WAY) of last 3 auctions (from the rate fixing day) of 182 Day T-Bills plus a fixed spread decided by way of auction. Zero Coupon Bonds – Zero coupon bonds are bonds with no coupon payments. However, like T- Bills, they are issued at a discount and redeemed at face value. The Government of India had issued such securities in 1996. It has not issued zero coupon bonds after that. iv) Capital Indexed Bonds – These are bonds, the principal of which is linked to an accepted index of inflation with a view to protecting the Principal amount of the investors from inflation. A 5 year Capital Indexed Bond, was first issued in December 1997 which matured in 2002. v) Inflation Indexed Bonds (IIBs) - IIBs are bonds wherein both coupon flows and Principal amounts are protected against inflation. The inflation index used in IIBs may be Whole Sale Price Index (WPI) or Consumer Price Index (CPI). Globally, IIBs were first issued in 1981 in UK. In India, Government of India through RBI issued IIBs (linked to WPI) in June 2013. Since then, they were issued on monthly basis (on last Tuesday of each month) till December 2013. Based on the success of these IIBs, Government of India in consultation with RBI issued the IIBs (CPI based) exclusively for the retail customers in December 2013. Further details on IIBs are available on RBI website under FAQs. vi) Bonds with Call/ Put Options – Bonds can also be issued with features of optionality wherein the issuer can have the option to buy-back (call option) or the investor can have the option to sell the bond (put option) to the issuer during the currency of the bond. It may be noted that such bond may have put only or call only or both options. The first G-Sec with both call and put option viz. 6.72% GS 2012 was issued on July 18, 2002 for a maturity of 10 years maturing on July 18, 2012. The optionality on the bond could be exercised after completion of five years tenure from the date of issuance on any coupon date falling thereafter. The Government has the right to buy-back the bond (call option) at par value (equal to the face value) while the investor had the right to sell the bond (put option) to the Government at par value on any of the half-yearly coupon dates starting from July 18, 2007. vii) Special Securities - Under the market borrowing program, the Government of India also issues, from time to time, special securities to entities like Oil Marketing Companies, Fertilizer Companies, the Food Corporation of India, etc. (popularly called oil bonds, fertiliser bonds and food bonds respectively) as compensation to these companies in lieu of cash subsidies These securities are usually long dated securities and carry a marginally higher coupon over the yield of the dated securities of comparable maturity. These securities are, however, not eligible as SLR securities but are eligible as collateral for market repo transactions. The beneficiary entities may divest these securities in the secondary market to banks, insurance companies / Primary Dealers, etc., for raising funds. Government of India has also issued Bank Recapitalisation Bonds to specific Public Sector Banks in 2018. These securities are named as Special GoI security and are non-transferable and are not eligible investment in pursuance of any statutory provisions or directions applicable to investing banks. These securities can be held under HTM portfolio without any limit. viii) STRIPS – Separate Trading of Registered Interest and Principal of Securities. - STRIPS are the securities created by way of separating the cash flows associated with a regular G-Sec i.e. each semi-annual coupon payment and the final principal payment to be received from the issuer, into separate securities. They are essentially Zero Coupon Bonds (ZCBs). However, they are created out of existing securities only and unlike other securities, are not issued through auctions. Stripped securities represent future cash flows (periodic interest and principal repayment) of an underlying coupon bearing bond. Being G-Secs, STRIPS are eligible for SLR. All fixed coupon securities issued by Government of India, irrespective of the year of maturity, are eligible for Stripping/Reconstitution, provided that the securities are reckoned as eligible investment for the purpose of Statutory Liquidity Ratio (SLR) and the securities are transferable. The detailed guidelines of stripping/reconstitution of government securities is available in RBI notification IDMD.GBD.2783/08.08.016/2018-19 dated May 3, 2018. For example, when ₹100 of the 8.60% GS 2028 is stripped, each cash flow of coupon (₹ 4.30 each half year) will become a coupon STRIP and the principal payment (₹100 at maturity) will become a principal STRIP. These cash flows are traded separately as independent securities in the secondary market. STRIPS in G-Secs ensure availability of sovereign zero coupon bonds, which facilitate the development of a market determined zero coupon yield curve (ZCYC). STRIPS also provide institutional investors with an additional instrument for their asset liability management (ALM). Further, as STRIPS have zero reinvestment risk, being zero coupon bonds, they can be attractive to retail/non-institutional investors. Market participants, having an SGL account with RBI can place requests directly in e-kuber for stripping/reconstitution of eligible securities (not special securities). Requests for stripping/reconstitution by Gilt Account Holders (GAH) shall be placed with the respective Custodian maintaining the CSGL account, who in turn, will place the requests on behalf of its constituents in e-kuber. ix) Sovereign Gold Bond (SGB): SGBs are unique instruments, prices of which are linked to commodity price viz Gold. SGBs are also budgeted in lieu of market borrowing. The calendar of issuance is published indicating tranche description, date of subscription and date of issuance. The Bonds shall be denominated in units of one gram of gold and multiples thereof. Minimum investment in the Bonds shall be one gram with a maximum limit of subscription per fiscal year of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the Government from time to time, provided that (a) in case of joint holding, the above limits shall be applicable to the first applicant only; (b) annual ceiling will include bonds subscribed under different tranches during initial issuance by Government and those purchased from the secondary market; and (c) the ceiling on investment will not include the holdings as collateral by banks and other Financial Institutions. The Bonds shall be repayable on the expiration of eight years from the date of issue of the Bonds. Pre-mature redemption of the Bond is permitted after fifth year of the date of issue of the Bonds and such repayments shall be made on the next interest payment date. The bonds under SGB Scheme may be held by a person resident in India, being an individual, in his capacity as an individual, or on behalf of minor child, or jointly with any other individual. The bonds may also be held by a Trust, HUFs, Charitable Institution and University. Nominal Value of the bonds shall be fixed in Indian Rupees on the basis of simple average of closing price of gold of 999 purity published by the India Bullion and Jewelers Association Limited for the last three business days of the week preceding the subscription period. The issue price of the Gold Bonds will be ₹ 50 per gram less than the nominal value to those investors applying online and the payment against the application is made through digital mode. The Bonds shall bear interest at the rate of 2.50 percent (fixed rate) per annum on the nominal value. Interest shall be paid in half-yearly rests and the last interest shall be payable on maturity along with the principal. The redemption price shall be fixed in Indian Rupees and the redemption price shall be based on simple average of closing price of gold of 999 purity of previous 3 business days from the date of repayment, published by the India Bullion and Jewelers Association Limited. SGBs acquired by the banks through the process of invoking lien/hypothecation/pledge alone shall be counted towards Statutory Liquidity Ratio. The above subscription limits, interest rate discount etc. are as per the current scheme and are liable to change going forward. x) 7.75% Savings (Taxable) Bonds, 2018: Government of India has decided to issue 7.75% Savings (Taxable) Bonds, 2018 with effect from January 10, 2018 in terms of GoI notification F.No.4(28) - W&M/2017 dated January 03, 2018 and RBI issued notification vide IDMD.CDD.No.1671/13.01.299/2017-18 dated January 3, 2018. These bonds may be held by (i) an individual, not being a Non-Resident Indian-in his or her individual capacity, or in individual capacity on joint basis, or in individual capacity on any one or survivor basis, or on behalf of a minor as father/mother/legal guardian and (ii) a Hindu Undivided Family. There is no maximum limit for investment in these bonds. Interest on these Bonds will be taxable under the Income Tax Act, 1961 as applicable according to the relevant tax status of the Bond holders. These Bonds will be exempt from wealth-tax under the Wealth Tax Act, 1957. These Bonds will be issued at par for a minimum amount of ₹1,000 (face value) and in multiples thereof. RBI vide its notification IDMD.CDD No.21/13.01.299/2018-19 dated July 2, 2018 has issued Master Directions on Relief/Savings Bonds providing details on appointment/delisting of brokers, payment and rates of brokerage for saving bonds and nomination facility etc. d. State Development Loans (SDLs) 1.7 State Governments also raise loans from the market which are called SDLs. SDLs are dated securities issued through normal auction similar to the auctions conducted for dated securities issued by the Central Government (please see question 3). Interest is serviced at half-yearly intervals and the principal is repaid on the maturity date. Like dated securities issued by the Central Government, SDLs issued by the State Governments also qualify for SLR. They are also eligible as collaterals for borrowing through market repo as well as borrowing by eligible entities from the RBI under the Liquidity Adjustment Facility (LAF) and special repo conducted under market repo by CCIL. State Governments have also issued special securities under “Ujjwal Discom Assurance Yojna (UDAY) Scheme for Operational and Financial Turnaround of Power Distribution Companies (DISCOMs)” notified by Ministry of Power vide Office Memorandum (No 06/02/2015-NEF/FRP) dated November 20, 2015. 2. Why should one invest in G-Secs? 2.1 Holding of cash in excess of the day-to-day needs (idle funds) does not give any return. Investment in gold has attendant problems in regard to appraising its purity, valuation, warehousing and safe custody, etc. In comparison, investing in G-Secs has the following advantages:

A. Primary (Urban) Co-operative Banks (UCBs) 2.2 Section 24 (2A) of the Banking Regulation Act 1949, (as applicable to co-operative societies) provides that every primary (urban) cooperative bank shall maintain liquid assets, the value of which shall not be less than such percentage as may be specified by Reserve Bank in the Official Gazette from time to time and not exceeding 40% of its DTL in India as on the last Friday of the second preceding fortnight (in addition to the minimum cash reserve ratio (CRR) requirement). Such liquid assets shall be in the form of cash, gold or unencumbered investment in approved securities. This is referred to as the Statutory Liquidity Ratio (SLR) requirement. It may be noted that balances kept with State Co-operative Banks / District Central Co-operative Banks as also term deposits with public sector banks are now not eligible for being reckoned for SLR purpose w.e.f April 1, 2015. B. Rural Co-operative Banks 2.3 As per Section 24 of the Banking Regulation Act 1949, the State Co-operative Banks (SCBs) and the District Central Co-operative Banks (DCCBs) are required to maintain assets as part of the SLR requirement in cash, gold or unencumbered investment in approved securities the value of which shall not, at the close of business on any day, be less than such per cent, as prescribed by RBI, of its total net demand and time liabilities. DCCBs are allowed to meet their SLR requirement by maintaining cash balances with their respective State Co-operative Bank. C. Regional Rural Banks (RRBs) 2.4 Since April 2002, all the RRBs are required to maintain their entire Statutory Liquidity Ratio (SLR) holdings in Government and other approved securities. D. Provident funds and other entities 2.5 The non- Government provident funds, superannuation funds and gratuity funds are required by the Central Government, effective from January 24, 2005, to invest 40% of their incremental accretions in Central and State G-Secs, and/or units of gilt funds regulated by the Securities and Exchange Board of India (SEBI) and any other negotiable security fully and unconditionally guaranteed by the Central/State Governments. The exposure of a trust to any individual gilt fund, however, should not exceed five per cent of its total portfolio at any point of time. The investment guidelines for non- Government PFs have been recently revised in terms of which minimum 45% and up to 50% of investments are permitted in a basket of instruments consisting of (a) G-Secs, (b) Other securities (not in excess of 10% of total portfolio) the principal whereof and interest whereon is fully and unconditionally guaranteed by the Central Government or any State Government SDLs and (c) units of mutual funds set up as dedicated funds for investment in G-Secs (not more than 5% of the total portfolio at any point of time and fresh investments made in them shall not exceed 5% of the fresh accretions in the year), effective from April 2015. 3.1 G-Secs are issued through auctions conducted by RBI. Auctions are conducted on the electronic platform called the E-Kuber, the Core Banking Solution (CBS) platform of RBI. Commercial banks, scheduled UCBs, Primary Dealers (a list of Primary Dealers with their contact details is given in Annex 2), insurance companies and provident funds, who maintain funds account (current account) and securities accounts (Subsidiary General Ledger (SGL) account) with RBI, are members of this electronic platform. All members of E-Kuber can place their bids in the auction through this electronic platform. The results of the auction are published by RBI at stipulated time (For Treasury bills at 1:30 PM and for GoI dated securities at 2:00 PM or at half hourly intervals thereafter in case of delay). All non-E-Kuber members including non-scheduled UCBs can participate in the primary auction through scheduled commercial banks or PDs (called as Primary Members-PMs). For this purpose, the UCBs need to open a securities account with a bank / PD – such an account is called a Gilt Account. A Gilt Account is a dematerialized account maintained with a scheduled commercial bank or PD. The proprietary transactions in G-Secs undertaken by PMs are settled through SGL account maintained by them with RBI at PDO. The transactions in G-Secs undertaken by Gilt Account Holders (GAHs) through their PMs are settled through Constituent Subsidiary General Ledger (CSGL) account maintained by PMs with RBI at PDO for its constituent (e.g., a non-scheduled UCB). 3.2 The RBI, in consultation with the Government of India, issues an indicative half-yearly auction calendar which contains information about the amount of borrowing, the range of the tenor of securities and the period during which auctions will be held. A Notification and a Press Communique giving exact particulars of the securities, viz., name, amount, type of issue and procedure of auction are issued by the Government of India about a week prior to the actual date of auction. RBI places the notification and a Press Release on its website (www.rbi.org.in) and also issues advertisements in leading English and Hindi newspapers. Auction for dated securities is conducted on Friday for settlement on T+1 basis (i.e. securities are issued on next working day i.e. Monday). The investors are thus given adequate time to plan for the purchase of G-Secs through such auctions. A specimen of a dated security in physical form is given at Annex 1. The details of all the outstanding dated securities issued by the Government of India are available on the RBI website at http://www.rbi.org.in/Scripts/financialmarketswatch.aspx. A sample of the auction calendar and the auction notification are given in Annex 3 and 4, respectively. 3.3 The Reserve Bank of India conducts auctions usually every Wednesday to issue T-bills of 91day, 182 day and 364 day tenors. Settlement for the T-bills auctioned is made on T+1 day i.e. on the working day following the trade day. The Reserve Bank releases a quarterly calendar of T-bill issuances for the upcoming quarter in the last week of the preceding quarter. e.g. calendar for April-June period is notified in the last week of March. The Reserve Bank of India announces the issue details of T-bills through a press release on its website every week. 3.4 Like T-bills, Cash Management Bills (CMBs) are also issued at a discount and redeemed at face value on maturity. The tenor, notified amount and date of issue of the CMBs depend upon the temporary cash requirement of the Government. The tenors of CMBs is generally less than 91 days. The announcement of their auction is made by Reserve Bank of India through a Press Release on its website. The non-competitive bidding scheme (referred to in paragraph number 4.3 and 4.4 under question No. 4) has not been extended to CMBs. However, these instruments are tradable and qualify for ready forward facility. Investment in CMBs is also reckoned as an eligible investment in G-Secs by banks for SLR purpose under Section 24 of the Banking Regulation Act, 1949. First set of CMB was issued on May 12, 2010. 3.5 Floatation of State Government Loans (State Development Loans) In terms of Sec. 21A (1) (b) of the Reserve Bank of India Act, 1934, the RBI may, by agreement with any State Government undertake the management of the public debt of that State. Accordingly, the RBI has entered into agreements with 29 State Governments and one Union Territory (UT of Puducherry) for management of their public debt. Under Article 293(3) of the Constitution of India (Under section 48A of Union territories Act, in case of Union Territory), a State Government has to obtain the permission of the Central Government for any borrowing as long as there is any outstanding loan that the State Government may have from the Centre. Market borrowings are raised by the RBI on behalf of the State Governments to the extent of the allocations under the Market Borrowing Program as approved by the Ministry of Finance in consultation with the Planning Commission. RBI, in consultation with State Governments announces, the indicative quantum of borrowing on a quarterly basis. All State Governments have issued General notifications which specify the terms and conditions for issue of SDL. Before every auction, respective state governments issue specific notifications indicating details of the securities being issued in the particular auction. RBI places a press release on its website and also issues advertisements in leading English and vernacular newspapers of the respective states. Currently, SDL auctions are held generally on Tuesdays every week. As in case of Central Government securities, auction is held on the E-Kuber Platform. 10% of the notified amount is reserved for the retail investors under the non-competitive bidding. 4. What are the different types of auctions used for issue of securities? What is switch/conversion of Government Securities through auction? Prior to introduction of auctions as the method of issuance, the interest rates were administratively fixed by the Government. With the introduction of auctions, the rate of interest (coupon rate) gets fixed through a market-based price discovery process. 4.1 An auction may either be yield based or price based. i. Yield Based Auction: A yield-based auction is generally conducted when a new G-Sec is issued. Investors bid in yield terms up to two decimal places (e.g., 8.19%, 8.20%, etc.). Bids are arranged in ascending order and the cut-off yield is arrived at the yield corresponding to the notified amount of the auction. The cut-off yield is then fixed as the coupon rate for the security. Successful bidders are those who have bid at or below the cut-off yield. Bids which are higher than the cut-off yield are rejected. An illustrative example of the yield-based auction is given below:

ii. Price Based Auction: A price based auction is conducted when Government of India re-issues securities which have already been issued earlier. Bidders quote in terms of price per ₹100 of face value of the security (e.g., ₹102.00, ₹101.00, ₹100.00, ₹ 99.00, etc., per ₹100/-). Bids are arranged in descending order of price offered and the successful bidders are those who have bid at or above the cut-off price. Bids which are below the cut-off price are rejected. An illustrative example of price based auction is given below:

4.2 Depending upon the method of allocation to successful bidders, auction may be conducted on Uniform Price basis or Multiple Price basis. In a Uniform Price auction, all the successful bidders are required to pay for the allotted quantity of securities at the same rate, i.e., at the auction cut-off rate, irrespective of the rate quoted by them. On the other hand, in a Multiple Price auction, the successful bidders are required to pay for the allotted quantity of securities at the respective price / yield at which they have bid. In the example under (ii) above, if the auction was Uniform Price based, all bidders would get allotment at the cut-off price, i.e., ₹100.00. On the other hand, if the auction was Multiple Price based, each bidder would get the allotment at the price he/ she has bid, i.e., bidder 1 at ₹100.19, bidder 2 at ₹100.14 and so on. 4.3 An investor, depending upon his eligibility, may bid in an auction under either of the following categories: Competitive Bidding: In a competitive bidding, an investor bids at a specific price / yield and is allotted securities if the price / yield quoted is within the cut-off price / yield. Competitive bids are made by well-informed institutional investors such as banks, financial institutions, PDs, mutual funds, and insurance companies. The minimum bid amount is ₹10,000 and in multiples of ₹10,000 in dated securities and minimum ₹ 10,000 in case of T-Bills and in multiples of ₹ 10,000 thereafter. Multiple bidding is also allowed, i.e., an investor may put in multiple bids at various prices/ yield levels. Non-Competitive Bidding (NCB): With a view to encouraging wider participation and retail holding of Government securities, retail investors are allowed participation on “non-competitive” basis in select auctions of dated Government of India (GoI) securities and Treasury Bills. Participation on a non-competitive basis in the auctions will be open to a retail investor who (a) does not maintain current account (CA) or Subsidiary General Ledger (SGL) account with the Reserve Bank of India; and (b) submits the bid indirectly through an Aggregator/Facilitator permitted under the scheme. Retail investor, for the purpose of scheme of NCB, is any person, including individuals, firms, companies, corporate bodies, institutions, provident funds, trusts, and any other entity as may be prescribed by RBI. Regional Rural Banks (RRBs) and Cooperative Banks shall be covered under this Scheme only in the auctions of dated securities in view of their statutory obligations and shall be eligible to submit their non-competitive bids directly. State Governments, eligible provident funds in India, the Nepal Rashtra Bank, Royal Monetary Authority of Bhutan and any Person or Institution, specified by the Bank, with the approval of Government, shall be covered under this scheme only in the auctions of Treasury Bills without any restriction on the maximum amount of bid for these entities and their bids will be outside the notified amount. Under the Scheme, an investor can make only a single bid in an auction. Allocation of non-competitive bids from retail investors except as specified above will be restricted to a maximum of five percent of the aggregate nominal amount of the issue within the notified amount as specified by the Government of India, or any other percentage determined by Reserve Bank of India. The minimum amount for bidding will be ₹10,000 (face value) and thereafter in multiples in ₹10,000 as hitherto. In the auctions of GoI dated securities, the retail investors can make a single bid for an amount not more than Rupees Two crore (face value) per security per auction. In addition to scheduled banks and primary dealers, specified stock exchanges are also permitted to act as aggregators/facilitators. These stock exchanges submit a single consolidated non-competitive bid in the auction process and will have to put in place necessary processes to transfer the securities so allotted in the primary auction to their members/clients. Allotment under the non-competitive segment will be at the weighted average rate of yield/price that will emerge in the auction on the basis of the competitive bidding. The Aggregator/Facilitator can recover up to six paise per ₹100 as brokerage/commission/service charges for rendering this service to their clients. Such costs may be built into the sale price or recovered separately from the clients. It may be noted that no other costs, such as funding costs, should be built into the price or recovered from the client. In case the aggregate amount of bid is more than the reserved amount (5% of notified amount), pro rata allotment would be made. In case of partial allotments, it will be the responsibility of the Aggregator/Facilitator to appropriately allocate securities to their clients in a transparent manner. In case the aggregate amount of bids is less than the reserved amount, the shortfall will be taken to competitive portion. The updated Scheme for Non-Competitive Bidding Facility in the auctions of Government Securities and Treasury Bills is issued by RBI vide IDMD.1080/08.01.001/2017-18 dated November 23, 2017. 4.4 NCB scheme has been introduced in SDLs from August 2009. The aggregate amount reserved for the purpose in the case of SDLs is 10% of the notified amount (e.g. ₹100 Crore for a notified amount of ₹1000 Crore) subject to a maximum limit of 1% of notified amount for a single bid per stock. The bidding and allotment procedure is similar to that of G-Secs. Conversion (Switch) of Government of India Securities through auction RBI has from April 22, 2019 started conducting the auction for conversion of Government of India securities on third Monday of every month. Bidding in the auction implies that the market participants agree to sell the source security/ies to the Government of India (GoI) and simultaneously agree to buy the destination security from the GoI at their respective quoted prices. The source securities along with notified amount and corresponding destination securities are provided in the press release issued before the auction. The market participants are required to place their bids in e-kuber giving the amount of the source security and the price of the source and destination security expressed up to two decimal places. The price of the source security quoted must be equal to the FBIL closing price of the source security as on the previous working day. 5. What are Open Market Operations (OMOs)? OMOs are the market operations conducted by the RBI by way of sale/ purchase of G-Secs to/ from the market with an objective to adjust the rupee liquidity conditions in the market on a durable basis. When the RBI feels that there is excess liquidity in the market, it resorts to sale of securities thereby sucking out the rupee liquidity. Similarly, when the liquidity conditions are tight, RBI may buy securities from the market, thereby releasing liquidity into the market. 5 (b) What is meant by repurchase (buyback) of G-Secs? Repurchase (buyback) of G-Secs is a process whereby the Government of India and State Governments buy back their existing securities, by redeeming them prematurely, from the holders. The objectives of buyback can be reduction of cost (by buying back high coupon securities), reduction in the number of outstanding securities and improving liquidity in the G-Secs market (by buying back illiquid securities) and infusion of liquidity in the system. The repurchase by the Government of India is also undertaken for effective cash management by utilising the surplus cash balances. For e.g. Repurchase of four securities (7.49 GS 2017 worth ₹1385 cr, 8.07 GS 2017 worth ₹50 cr, 7.99 GS 2017 worth ₹1401.417 cr and 7.46 GS 2017 worth ₹125 cr) was done through reverse auction on March 17, 2017. State Governments can also buy-back their high coupon (high cost debt) bearing securities to reduce their interest outflows in the times when interest rates show a falling trend. States can also retire their high cost debt pre-maturely in order to fulfill some of the conditions put by international lenders like Asian Development Bank, World Bank etc. to grant them low cost loans. For e.g. Repurchase of seven securities of Government of Maharashtra was done through reverse auction on March 29, 2017. RBI vide DBR.No.BP.BC.46/21.04.141/2018-19 dated June 10, 2019 notified that apart from transactions that are already exempted from inclusion in the 5 per cent cap, it has been decided that repurchase of State Development Loans (SDLs) by the concerned state government shall also be exempted. Governments make provisions in their budget for buying back of existing securities. Buyback can be done through an auction process (generally if amount is large) or through the secondary market route, i.e. NDS-OM (if amount is not large). 6. What is Liquidity Adjustment Facility (LAF) and whether Re-repo in Government Securities Market is allowed? LAF is a facility extended by RBI to the scheduled commercial banks (excluding RRBs) and PDs to avail of liquidity in case of requirement or park excess funds with RBI in case of excess liquidity on an overnight basis against the collateral of G-Secs including SDLs. Basically, LAF enables liquidity management on a day to day basis. The operations of LAF are conducted by way of repurchase agreements (repos and reverse repos – please refer to paragraph numbers 30.4 to 30.8 under question no. 30 for more details) with RBI being the counter-party to all the transactions. The interest rate in LAF is fixed by RBI from time to time. LAF is an important tool of monetary policy and liquidity management. The substitution of collateral (security) by the market participants during the tenor of the term repo is allowed from April 17, 2017 subject to various conditions and guidelines prescribed by RBI from time to time. The accounting norms to be followed by market participants for repo/reverse repo transactions under LAF and MSF (Marginal Standing Facility) of RBI are aligned with the accounting guidelines prescribed for market repo transactions. In order to distinguish repo/reverse repo transactions with RBI from market repo transactions, a parallel set of accounts similar to those maintained for market repo transactions but prefixed with ‘RBI’ may be maintained. Further market value of collateral securities (instead of face value) will be reckoned for calculating haircut and securities acquired by banks under reverse repo with RBI will be bestowed SLR status. RBI vide its notification FMRD.DIRD.01/14.03.038/2018-19 dated July 24, 2018 has issued Repurchase Transactions (Repo) (Reserve Bank) Directions, 2018 applicable to all the persons eligible to participate or transact business in market repurchase transactions (repos). Scheduled commercial banks, Primary Dealers along with Mutual Funds and Insurance Companies (subject to the approval of the regulators concerned) maintaining Subsidiary General Ledger account with RBI are permitted to re-repo the government securities, including SDLs and Treasury Bills, acquired under reverse repo, subject to various conditions and guidelines prescribed by RBI time to time. 7. How and in what form can G-Secs be held? 7.1 The Public Debt Office (PDO) of RBI, acts as the registry and central depository for G-Secs. They may be held by investors either as physical stock or in dematerialized (demat/electronic) form. From May 20, 2002, it is mandatory for all the RBI regulated entities to hold and transact in G-Secs only in dematerialized (SGL) form. a. Physical form: G-Secs may be held in the form of stock certificates. A stock certificate is registered in the books of PDO. Ownership in stock certificates cannot be transferred by way of endorsement and delivery. They are transferred by executing a transfer form as the ownership and transfer details are recorded in the books of PDO. The transfer of a stock certificate is final and valid only when the same is registered in the books of PDO. b. Demat form: Holding G-Secs in the electronic or scripless form is the safest and the most convenient alternative as it eliminates the problems relating to their custody, viz., loss of security. Besides, transfers and servicing of securities in electronic form is hassle free. The holders can maintain their securities in dematerialsed form in either of the two ways:

7.2 Investors also have the option of holding G-Secs in a dematerialized account with a depository (NSDL / CDSL, etc.). This facilitates trading of G-Secs on the stock exchanges. 8. How does the trading in G-Secs take place and what regulations are applicable to prevent abuse? Whether value free transfer of G-Secs is allowed? 8.1 There is an active secondary market in G-Secs. The securities can be bought / sold in the secondary market either through (i) Negotiated Dealing System-Order Matching (NDS-OM) (anonymous online trading) or through (ii) Over the Counter (OTC) and reported on NDS-OM or (iii) NDS-OM-Web (para 8.5) and (iv) Stock exchanges (para 8.6) i. NDS-OM In August 2005, RBI introduced an anonymous screen-based order matching module called NDS-OM. This is an order driven electronic system, where the participants can trade anonymously by placing their orders on the system or accepting the orders already placed by other participants. Anonymity ensures a level playing field for various categories of participants. NDS-OM is operated by the CCIL on behalf of the RBI (Please see answer to the question no.19 about CCIL). Direct access to the NDS-OM system is currently available only to select financial institutions like Commercial Banks, Primary Dealers, well managed and financially sound UCBs and NBFCs, etc. Other participants can access this system through their custodians i.e. with whom they maintain Gilt Accounts. The custodians place the orders on behalf of their customers. The advantages of NDS-OM are price transparency and better price discovery. 8.2 Gilt Account holders have been given indirect access to the reporting module of NDS-OM through custodian institutions. 8.3 Access to NDS-OM by the retail segment, comprising of individual investors having demat account with depositories viz. NSDL and/or CDSL, desirous of participating in the G-Sec market is facilitated by allowing them to use their demat accounts for their transactions and holdings in G-Sec. This access would be facilitated through any of the existing NDS-OM primary members, who also act as Depository Participants for NSDL and/or CDSL. The scheme seeks to facilitate efficient access to retail individual investor to the same G-Sec market being used by the large institutional investor in a seamless manner. ii. Over the Counter (OTC)/ Telephone Market 8.4 In the G-Sec market, a participant, who wants to buy or sell a G-Sec, may contact a bank / PD/financial institution either directly or through a broker registered with SEBI and negotiate price and quantity of security. Such negotiations are usually done on telephone and a deal may be struck if both counterparties agree on the amount and rate. In the case of a buyer, like an UCB wishing to buy a security, the bank's dealer (who is authorized by the bank to undertake transactions in G-Secs) may get in touch with other market participants over telephone and obtain quotes. Should a deal be struck, the bank should record the details of the trade in a deal slip (specimen given at Annex 5). The dealer must exercise due diligence with regard to the price quoted by verifying with available sources (See question number 14 for information on ascertaining the price of G-Secs). All trades undertaken in OTC market are reported on the Reported segment of NDS-OM within 15 minutes, the details of which are given under the question number 15. iii. NDS-OM-Web 8.5 RBI has launched NDS-OM-Web on June 29, 2012 for facilitating direct participation of gilt account holders (GAH) on NDS-OM through their primary members (PM) (as risk controller only and not having any role in pricing of trade). The GAH have access to the same order book of NDS-OM as the PM. GAH are in a better position to control their orders (place/modify/cancel/hold/release) and have access to real time live quotes in the market. Since notifications of orders executed as well as various queries are available online to the GAH, they are better placed to manage their positions. Web based interface that leverages on the gilt accounts already maintained with the custodian Banks/PDs provides an operationally efficient system to retail participants. NDS OM Web is provided at no additional cost to its users. PMs, however, may recover the actual charges paid by them to CCIL for settlement of trades or any other charges like transaction cost, annual maintenance charges (AMC) etc. It has been made obligatory for the Primary Members to offer the NDS-OM-Web module to their constituent GAHs (excluding individual) for online trading in G-sec in the secondary market. Constituents not desirous of availing this facility may do so by opting out in writing. On the other hand, individual GAHs desirous of the NDS-OM-Web facility may be provided the web access only on specific request. iv. Stock Exchanges 8.6 As advised by SEBI, the stock exchanges (like NSE, BSE, MCX) have been asked to create dedicated debt segment in their trading platforms. In compliance to this, stock exchanges have launched debt trading (G-Secs as also corporate bonds) segment which generally cater to the needs of retail investors. The process involved in trading of G-Secs in Demat form in stock exchanges is as follows: a. The Gilt Account Holder (GAH), say XYZ provident fund, approaches his custodian bank, (say ABC), to convert its holding held by custodian bank in their CSGL account (to the extent he wishes to trade, say ₹ 10,000), into Demat form. b. ABC reduces the GAH’s security balance by ₹ 10,000 and advises the depository of stock exchange (NSDL/CSDL) to increase XYZ’s Demat account by ₹ 10,000. ABC also advises to PDO, Mumbai to reduce its CSGL balance by ₹ 10,000 and increase the CSGL balance of NSDL/CSDL by ₹ 10,000. c. NSDL/CSDL increases the Demat balance of XYZ by ₹ 10,000. d. XYZ can now trade in G-Sec on stock exchange. v. Regulations applicable to prevent abuse 8.7 RBI vide FMRD.FMSD.11/11.01.012/2018-19 dated March 15, 2019 issued directions to prevent abuse in markets regulated by RBI. The directions are applicable to all persons dealing in securities, money market instruments, foreign exchange instruments, derivatives or other instruments of like nature as specified from time to time. vi. Guidelines for Value free transfer (VFT) of Government Securities 8.8 VFT of the government securities shall mean transfer of securities from one SGL/CSGL to another SGL/CSGL account, without consideration. Such transfers could be on account of posting of margins, inter-depository transfers of government securities arising from trades in exchanges between demat account holders of different depositories, gift/inheritance and change of custodians etc. VFT would also be required in the case of distribution of securities to the beneficiary demat/gilt accounts on allotment after participation in the non-competitive segment of the primary auction. RBI vide notification IDMD.CDD.No.1241/11.02.001/2018-19 dated November 16, 2018 issued separate guidelines for VFT to enable more efficient operations in the Government securities market. Value Free Transfers between SGL/CSGL accounts not covered by these guidelines will require specific approval of the Reserve Bank. The guidelines prescribes list of permitted transactions for VFT and application for permission for VFT for any other purpose may be submitted to Public Debt Office, Mumbai Regional Office, RBI, Fort, Mumbai 9. Who are the major players in the G-Secs market? Major players in the G-Secs market include commercial banks and PDs besides institutional investors like insurance companies. PDs play an important role as market makers in G-Secs market. A market maker provides firm two way quotes in the market i.e. both buy and sell executable quotes for the concerned securities. Other participants include co-operative banks, regional rural banks, mutual funds, provident and pension funds. Foreign Portfolio Investors (FPIs) are allowed to participate in the G-Secs market within the quantitative limits prescribed from time to time. Corporates also buy/ sell the G-Secs to manage their overall portfolio. 10. What are the Do's and Don’ts prescribed by RBI for the Co-operative banks dealing in G-Secs? While undertaking transactions in securities, UCBs should adhere to the instructions issued by the RBI. The guidelines on transactions in G-Secs by the UCBs have been codified in the master circular DCBR. BPD (PCB).MC.No. 4/16.20.000/2015-16 dated July 1, 2015 which is updated from time to time. This circular can also be accessed from the RBI website under the Notifications – Master circulars section. The important guidelines to be kept in view by the UCBs relate to formulation of an investment policy duly approved by their Board of Directors, defining objectives of the policy, authorities and procedures to put through deals, dealings through brokers, preparing panel of brokers and review thereof at annual intervals, and adherence to the prudential ceilings fixed for transacting through each of the brokers, etc. The important Do’s & Don’ts are summarized in the Box I below.

11. How are the dealing transactions recorded by the dealing desk? 11.1 For every transaction entered into by the trading desk, a deal slip should be generated which should contain data relating to nature of the deal, name of the counter-party, whether it is a direct deal or through a broker (if it is through a broker, name of the broker), details of security, amount, price, contract date and time and settlement date. The deal slips should be serially numbered and verified separately to ensure that each deal slip has been properly accounted for. Once the deal is concluded, the deal slip should be immediately passed on to the back office (it should be separate and distinct from the front office) for recording and processing. For each deal, there must be a system of issue of confirmation to the counter-party. The timely receipt of requisite written confirmation from the counter-party, which must include all essential details of the contract, should be monitored by the back office. The need for counterparty confirmation of deals matched on NDS-OM will not arise, as NDS-OM is an anonymous automated order matching system. In case of trades finalized in the OTC market and reported on NDS-OM reported segment, both the buying and selling counter parties report the trade particulars separately on the reporting platform which should match for the trade to be settled. 11.2 Once a deal has been concluded through a broker, there should not be any substitution of the counterparty by the broker. Similarly, the security sold / purchased in a deal should not be substituted by another security under any circumstances. 11.3 On the basis of vouchers passed by the back office (which should be done after verification of actual contract notes received from the broker / counter party and confirmation of the deal by the counter party), the books of account should be independently prepared. 12. What are the important considerations while undertaking security transactions? The following steps should be followed in purchase of a security:

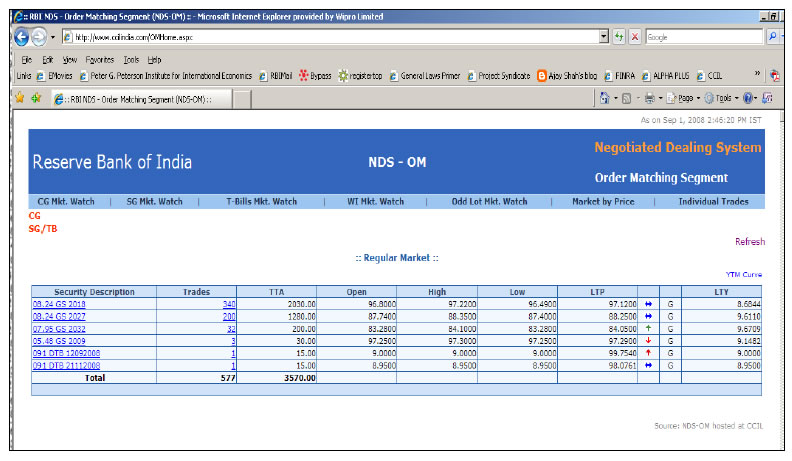

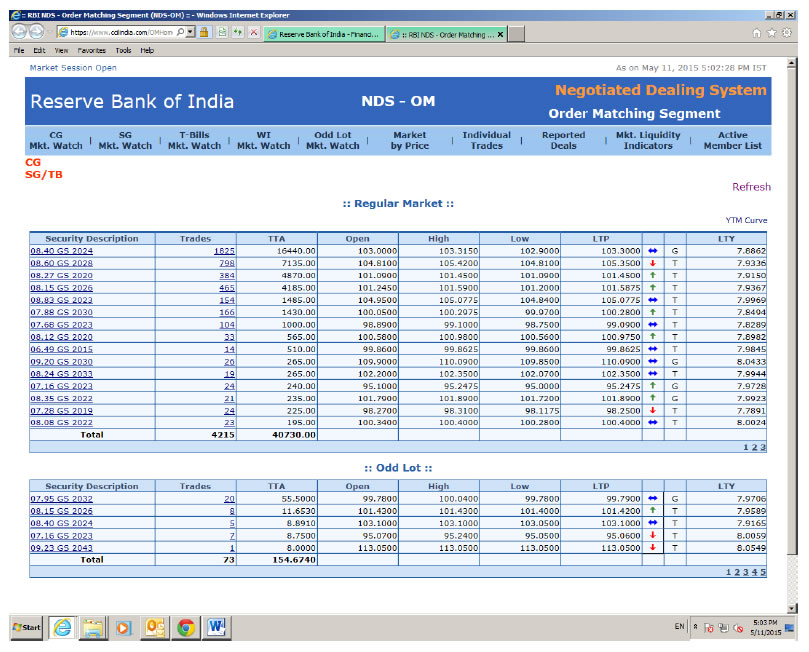

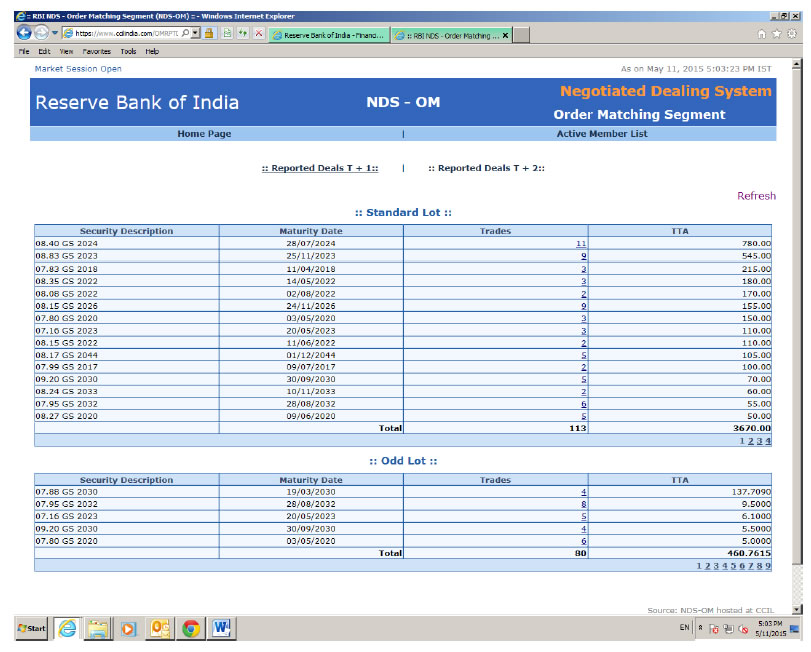

13. Why does the price of G-Sec change? The price of a G-Sec, like other financial instruments, keeps fluctuating in the secondary market. The price is determined by demand and supply of the securities. Specifically, the prices of G-Secs are influenced by the level and changes in interest rates in the economy and other macro-economic factors, such as, expected rate of inflation, liquidity in the market, etc. Developments in other markets like money, foreign exchange, credit, commodity and capital markets also affect the price of the G-Secs. Further, developments in international bond markets, specifically the US Treasuries affect prices of G-Secs in India. Policy actions by RBI (e.g., announcements regarding changes in policy interest rates like Repo Rate, Cash Reserve Ratio, Open Market Operations, etc.) also affect the prices of G-Secs. 14. How does one get information about the price of a G-Sec? 14.1 The return on a security is a combination of two elements (i) coupon income – that is, interest earned on the security and (ii) the gain / loss on the security due to price changes and reinvestment gains or losses. 14.2 Price information is vital to any investor intending to either buy or sell G-Secs. Information on traded prices of securities is available on the RBI website http://www.rbi.org.in under the path Home → Financial Markets → Financial Markets Watch → Order Matching Segment of Negotiated Dealing System. This will show a screen containing the details of the latest trades undertaken in the market along with the prices. Additionally, trade information can also be seen on CCIL website http://www.ccilindia.com/OMHome.aspx. On this page, the list of securities and the summary of trades is displayed. The total traded amount (TTA) on that day is shown against each security. Typically, liquid securities are those with the largest amount of TTA. Pricing in these securities is efficient and hence UCBs can choose these securities for their transactions. Since the prices are available on the screen they can invest in these securities at the current prices through their custodians. Participants can thus get near real-time information on traded prices and take informed decisions while buying / selling G-Secs. The screenshots of the above webpage are given below: NDS-OM Market  The website of the Financial Benchmarks India Private Limited (FBIL), (www.fbil.org.in) is also a right source of price information, especially on securities that are not traded frequently. 15. How are the G-Secs transactions reported? 15.1 Transactions undertaken between market participants in the OTC / telephone market are expected to be reported on the NDS-OM platform within 15 minutes after the deal is put through over telephone. All OTC trades are required to be mandatorily reported on the NDS-OM reported segment for settlement. Reporting on NDS-OM is a two stage process wherein both the seller and buyer of the security have to report their leg of the trade. System validates all the parameters like reporting time, price, security etc. and when all the criterias of both the reporting parties match, the deals get matched and trade details are sent by NDS-OM system to CCIL for settlement. 15.2 Reporting on behalf of entities maintaining gilt accounts with the custodians is done by the respective custodians in the same manner as they do in case of their own trades i.e., proprietary trades. The securities leg of these trades settles in the CSGL account of the custodian. Funds leg settle in the current account of the PM with RBI. 15.3 In the case of NDS-OM, participants place orders (amount and price) in the desired security on the system. Participants can modify / cancel their orders. Order could be a ‘bid’ (for purchase) or ‘offer’ (for sale) or a two way quote (both buy and sell) of securities. The system, in turn, will match the orders based on price and time priority. That is, it matches bids and offers of the same prices with time priority. It may be noted that bid and offer of the same entity do not match i.e. only inter-entity orders are matched by NDS-OM and not intra-entity. The NDS-OM system has separate screen for trading of the Central Government papers, State Government securities (SDLs) and Treasury bills (including Cash Management Bills). In addition, there is a screen for odd lot trading also essentially for facilitating trading by small participants in smaller lots of less than ₹ 5 crore. The minimum amount that can be traded in odd lot is ₹ 10,000 in dated securities, T-Bills and CMBs. The NDS-OM platform is an anonymous platform wherein the participants will not know the counterparty to the trade. Once an order is matched, the deal ticket gets generated automatically and the trade details flow to the CCIL. Due to anonymity offered by the system, the pricing is not influenced by the participants’ size and standing. 16. How do the G-Sec transactions settle? Primary Market 16.1 Once the allotment process in the primary auction is finalized, the successful participants are advised of the consideration amounts that they need to pay to the Government on settlement day. The settlement cycle for auctions of all kind of G-Secs i.e. dated securities, T-Bills, CMBs or SDLs, is T+1, i.e. funds and securities are settled on next working day from the conclusion of the trade. On the settlement date, the fund accounts of the participants are debited by their respective consideration amounts and their securities accounts (SGL accounts) are credited with the amount of securities allotted to them. Secondary Market 16.2 The transactions relating to G-Secs are settled through the member’s securities / current accounts maintained with the RBI. The securities and funds are settled on a net basis i.e. Delivery versus Payment System-III (DvP-III). CCIL guarantees settlement of trades on the settlement date by becoming a central counter-party (CCP) to every trade through the process of novation, i.e., it becomes seller to the buyer and buyer to the seller. 16.3 All outright secondary market transactions in G-Secs are settled on a T+1 basis. However, in case of repo transactions in G-Secs, the market participants have the choice of settling the first leg on either T+0 basis or T+1 basis as per their requirement. RBI vide FMRD.DIRD.05/14.03.007/2017-18 dated November 16, 2017 had permitted FPIs to settle OTC secondary market transactions in Government Securities either on T+1 or on T+2 basis and in such cases, It may be ensured that all trades are reported on the trade date itself. ‘Shut period’ means the period for which the securities cannot be traded. During the period under shut, no trading of the security which is under shut is allowed. The main purpose of having a shut period is to facilitate finalizing of the payment of maturity redemption proceeds and to avoid any change in ownership of securities during this process. Currently, the shut period for the securities held in SGL accounts is one day. 18. What is Delivery versus Payment (DvP) Settlement? Delivery versus Payment (DvP) is the mode of settlement of securities wherein the transfer of securities and funds happen simultaneously. This ensures that unless the funds are paid, the securities are not delivered and vice versa. DvP settlement eliminates the settlement risk in transactions. There are three types of DvP settlements, viz., DvP I, II and III which are explained below: i. DvP I – The securities and funds legs of the transactions are settled on a gross basis, that is, the settlements occur transaction by transaction without netting the payables and receivables of the participant. ii. DvP II – In this method, the securities are settled on gross basis whereas the funds are settled on a net basis, that is, the funds payable and receivable of all transactions of a party are netted to arrive at the final payable or receivable position which is settled. iii. DvP III – In this method, both the securities and the funds legs are settled on a net basis and only the final net position of all transactions undertaken by a participant is settled. Liquidity requirement in a gross mode is higher than that of a net mode since the payables and receivables are set off against each other in the net mode. 19. What is the role of the Clearing Corporation of India Limited (CCIL)? The CCIL is the clearing agency for G-Secs. It acts as a Central Counter Party (CCP) for all transactions in G-Secs by interposing itself between two counterparties. In effect, during settlement, the CCP becomes the seller to the buyer and buyer to the seller of the actual transaction. All outright trades undertaken in the OTC market and on the NDS-OM platform are cleared through the CCIL. Once CCIL receives the trade information, it works out participant-wise net obligations on both the securities and the funds leg. The payable / receivable position of the constituents (gilt account holders) is reflected against their respective custodians. CCIL forwards the settlement file containing net position of participants to the RBI where settlement takes place by simultaneous transfer of funds and securities under the ‘Delivery versus Payment’ system. CCIL also guarantees settlement of all trades in G-Secs. That means, during the settlement process, if any participant fails to provide funds/ securities, CCIL will make the same available from its own means. For this purpose, CCIL collects margins from all participants and maintains ‘Settlement Guarantee Fund’. 20. What is the ‘When Issued’ market and “Short Sale”? "When, as and if issued" (commonly known as ‘When Issued’) security refers to a security that has been authorized for issuance but not yet actually issued. When Issued trading takes place between the time a Government Security is announced for issuance and the time it is actually issued. All 'When Issued' transactions are on an 'if' basis, to be settled if and when the actual security is issued. RBI vide its notification FMRD.DIRD.03/14.03.007/2018-19 dated July 24, 2018 has issued When Issued Transactions (Reserve Bank) Directions, 2018 applicable to ‘When Issued’ transactions in Central Government securities. Both new and reissued Government securities issued by the Central Government are eligible for ‘When Issued’ transactions. Eligibility of an issue for ‘When Issue’ trades would be indicated in the respective specific auction notification. Participants eligible to undertake both net long and short position in ‘When Issued’ market are (a) All entities which are eligible to participate in the primary auction of Central Government securities,(b) However, resident individuals, Hindu Undivided Families (HUF), Non-Resident Indians (NRI) and Overseas Citizens of India (OCI) are eligible to undertake only long position in ‘When Issued’ securities. (c) Entities other than scheduled commercial banks and Primary Dealers (PDs), shall close their short positions, if any, by the close of trading on the date of auction of the underlying Central Government security. When Issued transactions would commence after the issue of a security is notified by the Central Government and it would cease at the close of trading on the date of auction. All ‘When Issued’ transactions for all trade dates shall be contracted for settlement on the date of issue. When Issued’ transactions shall be undertaken only on the Negotiated Dealing System-Order Matching (NDS-OM) platform. However, an existing position in a ‘When Issued’ security may be closed either on the NDS-OM platform or outside the NDS-OM platform, i.e., through Over-the-Counter (OTC) market. The open position limits are prescribed in the directions. All NDS-OM members participating in the ‘When Issued’ market are required to have in place a written policy on ‘When Issued’ trading which should be approved by the Board of Directors or equivalent body. "Short sale" means sale of a security one does not own. RBI vide its notification FMRD.DIRD.05/14.03.007/2018-19 dated July 25, 2018 has issued Short Sale (Reserve Bank) Directions, 2018 applicable to ‘Short Sale’ transactions in Central Government dated securities. Banks may treat sale of a security held in the investment portfolio as a short sale and follow the process laid down in these directions. These transactions shall be referred to as ‘notional’ short sales. For the purpose of these guidelines, short sale would include 'notional' short sale. Entities eligible to undertake short sales are (a) Scheduled commercial banks, (b) Primary Dealers, (c) Urban Cooperative Banks as permitted under circular UBD.BPD (PCB). Circular No.9/09.29.000/2013-14 dated September 4, 2013 and (d) Any other regulated entity which has the approval of the concerned regulator (SEBI, IRDA, PFRDA, NABARD, NHB). The maximum amount of a security (face value) that can be short sold is (a) for Liquid securities: 2% of the total outstanding stock of each security, or, ₹ 500 crore, whichever is higher; (b) for other securities: 1% of the total outstanding stock of each security, or, ₹ 250 crore, whichever is higher. The list of liquid securities shall be disseminated by FIMMDA/FBIL from time to time. Short sales shall be covered within a period of three months from the date of transaction (inclusive of the date). Banks undertaking ‘notional’ short sales shall ordinarily borrow securities from the repo market to meet delivery obligations, but in exceptional situations of market stress (e.g., short squeeze), it may deliver securities from its own investment portfolio. If securities are delivered out of its own portfolio, it must be accounted for appropriately and reflect the transactions as internal borrowing. It shall be ensured that the securities so borrowed are brought back to the same portfolio, without any change in book value. 21. What are the basic mathematical concepts one should know for calculations involved in bond prices and yields? The time value of money functions related to calculation of Present Value (PV), Future Value (FV), etc. are important mathematical concepts related to bond market. An outline of the same with illustrations is provided in Box II below.

22. How is the Price of a bond calculated? What is the total consideration amount of a trade and what is accrued interest? The price of a bond is nothing but the sum of present value of all future cash flows of the bond. The interest rate used for discounting the cash flows is the Yield to Maturity (YTM) (explained in detail in question no. 24) of the bond. Price can be calculated using the excel function ‘Price’ (please refer to Annex 6). Accrued interest is the interest calculated for the broken period from the last coupon day till a day prior to the settlement date of the trade. Since the seller of the security is holding the security for the period up to the day prior to the settlement date of the trade, he is entitled to receive the coupon for the period held. During settlement of the trade, the buyer of security will pay the accrued interest in addition to the agreed price and pays the ‘consideration amount’. An illustration is given below; For a trade of ₹ 5 crore (face value) of security 8.83% 2023 for settlement date Jan 30, 2014 at a price of ₹100.50, the consideration amount payable to the seller of the security is worked out below: Here the price quoted is called ‘clean price’ as the ‘accrued interest’ component is not added to it. Accrued interest: The last coupon date being Nov 25, 2013, the number of days in broken period till Jan 29, 2014 (one day prior to settlement date i.e. on trade day) are 65.

When we add the accrued interest component to the ‘clean price’, the resultant price is called the ‘dirty price’. In the instant case, it is 100.50+1.5943 = ₹102.0943

23. What is the relationship between yield and price of a bond? If market interest rate levels rise, the price of a bond falls. Conversely, if interest rates or market yields decline, the price of the bond rises. In other words, the yield of a bond is inversely related to its price. The relationship between yield to maturity and coupon rate of bond may be stated as follows:

24. How is the yield of a bond calculated? 24.1 An investor who purchases a bond can expect to receive a return from one or more of the following sources:

The three yield measures commonly used by investors to measure the potential return from investing in a bond are briefly described below: i) Coupon Yield 24.2 The coupon yield is simply the coupon payment as a percentage of the face value. Coupon yield refers to nominal interest payable on a fixed income security like G-Sec. This is the fixed return the Government (i.e., the issuer) commits to pay to the investor. Coupon yield thus does not reflect the impact of interest rate movement and inflation on the nominal interest that the Government pays. Coupon yield = Coupon Payment / Face Value Illustration: Coupon: 8.24 ii) Current Yield 24.3 The current yield is simply the coupon payment as a percentage of the bond’s purchase price; in other words, it is the return a holder of the bond gets against its purchase price which may be more or less than the face value or the par value. The current yield does not take into account the reinvestment of the interest income received periodically. Current yield = (Annual coupon rate / Purchase price) X100 Illustration: The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below: Annual coupon interest = 8.24% x ₹100 = ₹8.24 Current yield = (8.24/103) X 100 = 8.00% The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return. iii) Yield to Maturity 24.4 Yield to Maturity (YTM) is the expected rate of return on a bond if it is held until its maturity. The price of a bond is simply the sum of the present values of all its remaining cash flows. Present value is calculated by discounting each cash flow at a rate; this rate is the YTM. Thus, YTM is the discount rate which equates the present value of the future cash flows from a bond to its current market price. In other words, it is the internal rate of return on the bond. The calculation of YTM involves a trial-and-error procedure. A calculator or software can be used to obtain a bond’s YTM easily (please see the Box III).

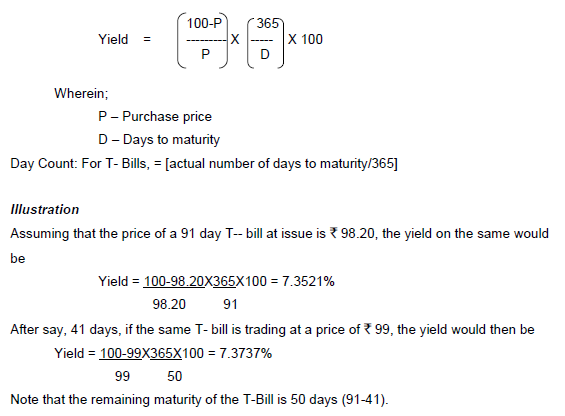

25. What are the day count conventions used in calculating bond yields? Day count convention refers to the method used for arriving at the holding period (number of days) of a bond to calculate the accrued interest. As the use of different day count conventions can result in different accrued interest amounts, it is appropriate that all the participants in the market follow a uniform day count convention. For example, the conventions followed in Indian market are given below. Bond market: The day count convention followed is 30/360, which means that irrespective of the actual number of days in a month, the number of days in a month is taken as 30 and the number of days in a year is taken as 360. Money market: The day count convention followed is actual/365, which means that the actual number of days in a month is taken for number of days (numerator) whereas the number of days in a year is taken as 365 days. Hence, in the case of T-Bills, which are essentially money market instruments, money market convention is followed. In some countries, participants use actual/actual, some countries use actual/360 while some use 30/actual. Hence the convention changes in different countries and in different markets within the same country (eg. Money market convention is different than the bond market convention in India). 26. How is the yield of a T- Bill calculated? It is calculated as per the following formula  27.1 Duration (also known as Macaulay Duration) of a bond is a measure of the time taken to recover the initial investment in present value terms. In simplest form, duration refers to the payback period of a bond to break even, i.e., the time taken for a bond to repay its own purchase price. Duration is expressed in number of years. A step by step approach for working out duration is given in the Box IV below.

More formally, duration refers to:

What is Modified Duration? 27.2 Modified duration (MD) is a modified version of Macaulay Duration. It refers to the change in value of the security to one per cent change in interest rates (Yield). The formula is Illustration In the above example given in Box IV, MD = 1.86/(1+0.09/2) = 1.78 Duration is useful primarily as a measure of the sensitivity of a bond's market price to interest rate (i.e., yield) movements. It is approximately equal to the percentage change in price for one percent change in yield. For example the duration is the approximate percentage by which the value of the bond will fall for a 1% per annum increase in market interest rate. So, a 15-year bond with a duration of 7 years would fall approximately 7% in value if the interest rate increased by 1% per annum. In other words, duration is the elasticity of the bond's price with respect to interest rates. This ignores convexity explained in para 24.7 What is PV 01? 27.3 PV01 describes the actual change in price of a bond if the yield changes by one basis point (equal to one hundredth of a percentage point). It is the present value impact of 1 basis point (0.01%) (1%=100 bps) movement in interest rate. It is often used as a price alternative to duration (a time measure). Higher the PV01, the higher would be the volatility (sensitivity of price to change in yield). Illustration From the modified duration (given in the illustration under 27.2), we know that the security value will change by 1.78% for a change of 100 basis point (1%) change in the yield. In value terms that is equal to 1.78*(101.79/100) = ₹ 1.81. Hence the PV01 = 1.81/100 = ₹0.018, which is 1.8 paise. Thus, if the yield of a bond with a Modified Duration of 1.78 years moves from say 9% to 9.05% (5 basis points), the price of the bond moves from ₹101.79 to ₹101.70 (reduction of 9 paise, i.e., 5x1.8 paise). What is Convexity? 27.4 Calculation of change in price for change in yields based on duration works only for small changes in yields. This is because the relationship between bond price and yield is not strictly linear. Over large variations in yields, the relationship is curvilinear i.e., the reduction in option free bond price is less than the change calculated based only on duration for yield increase, and increase in option free bond price will be more than the change calculated based only on duration for yield decrease. This is measured by a concept called convexity, which is the change in duration of a bond due to change in the yield of the bond. 28. What are the important guidelines for valuation of securities? 28.1 For Cooperative banks, investments classified under 'Held to Maturity' (HTM) category need not be marked to market and will be carried at acquisition cost unless it is more than the face value, in which case the premium should be amortized over the period remaining to maturity. The individual scrip in the ‘Available for Sale’ (AFS) category in the books of the cooperative banks will be marked to market at the year-end or at more frequent intervals. The individual scrip in the ‘Held for Trading’ (HFT) category will be marked to market at monthly or at more frequent intervals. The book value of individual securities in AFS and HFT categories would not undergo any change after marking to market. 28.2 RBI vide FMRD.DIRD.7/14.03.025/2017-18 dated March 31, 2018 has notified that Financial Benchmark India Pvt. Ltd (FBIL) has been advised to assume the responsibility for administering valuation of Government securities with effect from March 31, 2018. From this date, FIMMDA has ceased to publish prices/yield of Government securities and this role has been taken over by FBIL. FBIL had commenced publication of the G-Sec and SDL valuation benchmarks based on the extant methodology. Going forward, FBIL will undertake a comprehensive review of the valuation methodology. RBI regulated entities, including banks, non-bank financial companies, Primary Dealers, Co-Operative banks and All India Financial Institutions who are required to value Government securities using prices published by FIMMDA as per previous directions may use FBIL prices with effect from March 31, 2018. Other market participants who have been using Govt. securities prices/yields published by FIMMDA may use the prices/yields published by FBIL for valuation of their investment portfolio. 28.3 State Development Loans were previously valued by applying YTM method by marking it up by a spread of 25 basis points on the Central G-Sec yield of the corresponding residual maturity, whereas for corporate bonds the spreads given by the FIMMDA need to be added. RBI vide its notification DBR.BP.BC.No.002 /21.04.141/2018-19 dated July 27, 2018 decided that securities issued by each state government, i.e., State Development Loans (SDLs), shall be valued in a manner which would objectively reflect their fair value based on observed prices/yields and Financial Benchmarks India Pvt. Ltd. (FBIL) shall make available prices for valuation of SDLs based on the above principles. Brief details of valuation methodology is provided in Box V.